Carvana Stock Price: The Case Against CVNA

An in-depth analysis of why Carvana is overvalued

Published on May 11th, 2021. Last Updated on .

In 1999, I worked for Goldman Sachs, and each morning we would sit at our desks to learn how last night's IPOs were going to do on their first day of trading. While every company at that time would price at the high end of its range, or above, everyone knew that when the trading started, the shares would rise above their IPO price. In 1999, just about every IPO would trade at a premium, especially if the company had anything to do with technology broadly, or the internet specifically. In 1999, if a company had an "e" at the beginning of its name, it was assured passioned investor interest, and the shares would almost be guaranteed of a doubling or tripling of its IPO price by the time the trading bell rang at 4:00 PM that first day.

Back then, one company came to mind as memorable. The online retailer, eToys, seeing the magic of IPOs, went public in 1999, after just two years in operation. At the time, eToys management, its bankers, and the marketplace in general, thought that eToys was going to put every bricks-and-mortar toy-seller out of business. The market was so confident that this was going to happen, that on its first day of trading, eToys shares went from $20 to $76, giving the company a market cap of $7.7 billion.

It didn't take long for the tide to turn on eToys, however, as the dot.com bubble burst soon thereafter, and took the air of enthusiasm out of eToys as well. As a result, the shares did an abrupt U-turn, and investors headed for the exits. From their peak of $76, the shares sank lower, and lower, and lower. Finally, with the stock trading at less than $1, the eToys board agreed to sell the company to KB Toys for $5 million less than two years after its IPO-a spectacular and truly epic crash to be noted by all investors.

Carvana is not eToys, but...

Fast-forwarding 20 years later, we see the same froth and exuberance being bestowed on the markets' current raptured darlings. Today, instead of the mania being cast upon all web-based firms, today's fad is on those companies who have business models where virtual commerce is expected to replace (or significantly encroach upon) their bricks-and-mortar brethren-enter the virtual used car dealer, Carvana.

Unlike eToys, Carvana has physical assets, a unique business model, and is executing its plan-all qualities that eToys lacked. However, Carvana does share a notable commonality with eToys in that its market value significantly exceeds what can rationally be supported by its current, and even forecasted, financial results. This is so much so, that Carvana's market capitalization has reached $44 billion, roughly 10X what it expects to achieve this year in revenues-not earnings, but total annual revenues. While not quite the irrational hype associated with eToys, financial analysts have utilized some very aggressive assumptions to rationalize Carvana's shares as being anything but the subject of a mania.

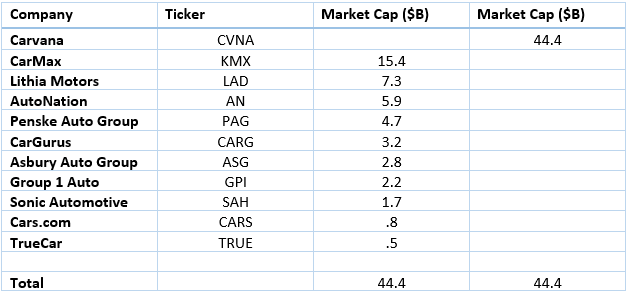

While Carvana's business model is unique, and pure comparables are difficult to identify, it is notable (and very coincidental) how Carvana's equity value stacks up against others involved in the retailing of automobiles. As if it were divined from above, the numbers just happen to work out this way-exactly...

With the market capitalizations providing such a dichotomy between Carvana and its rivals, investors must ask themselves whether Carvana is worth the entirety of all ten public companies listed above. Given the choice, would a rational investor choose to invest in the one upstart with a tailwind, or the collective assets and P&Ls of all those other firms--many of which are very profitable, have significant tangible assets, and enjoy a very diverse mix of revenue streams?

Why Carvana's Shares Will Stall

Carvana management has very successfully found a market niche on which they have been able to execute deftly. Moreover, commercial constraints brought about by Covid-19 have played perfectly into Carvana's business model, as they represent a virtual alternative to shopping for a product in person-something which many industries are trying to replicate right now. Through skill or good luck, the timing of Carvana's expansion has been fortuitous, and they find themselves with the right busines model at the right time. However, there are many reasons that Carvana's meteoric share price rise is not sustainable, and we will outline them here...

The significant commercial constraints of Covid-19 will likely diminish meaningfully in 2021.

While Covid currently has a tight grip on all retailers' ability to transact with customers in-person, it is widely expected that these impediments will ease in the coming months. Most anticipate that remote car-buying is here to stay, and the likelihood that this business model will continue to exist, is high. However, the seismic, enduring shift that is believed by some, where remote purchasing makes up a meaningful portion of vehicle purchases, is surely to be challenged as we exit our Covid lockdowns and consumers return in earnest to dealerships, malls, and all other public shopping venues.

Used car buyers want to sit in the seat and listen to the radio before purchasing.

Some within the auto industry have suggested that the online purchase of a used car is no different than the purchase of a new iPhone or packaged household goods, but such an argument is folly. Used cars, as juxtaposed to new cars-or new anything-have in fact, been owned by someone else, are not wrapped in plastic, have likely been on the road for years, and have logged thousands of miles before they show up in Carvana customers' driveways. Crucially, vehicles are tactile purchases, where vehicle shoppers want to sit behind the wheel, adjust the seats, play with the infotainment system, and generally take in their surroundings, before making a decision on something that represents a major purchase, which they will spend a lot of time within, and which will be with them for several years. Even the finest of used vehicles have flaws, where the paint isn't perfect, the seats are a little worn, and that new-car smell has long faded. In reality, most, if not all, would prefer to experience what that car is like, prior to purchasing it-even if given the option of changing their mind in the near-term. While no one truly "kicks the tires", the adage is well-founded in suggesting that consumers want to check things out, prior to putting cash on the barrel head.

Most auto dealers make their biggest profits in the parts and service departments.

A not-so-well-kept secret within the auto industry, is that most auto dealers make the majority of their profits, not in the sale of new and used vehicles, but instead on selling parts and performing service (under warranty and otherwise) and body work on the vehicles that they sold previously. The sale of vehicles generally serves a utilitarian function, and represents a future pipeline for these high-margin areas of the dealership. These "back-end" departments also provide dealerships with a much more stable flow of business, as the parts and service departments in particular, are considered counter-cyclical, in that motorists are more apt to have their vehicles repaired when times are tough, versus just buying something shiny and new.

As we know, relative to most auto dealerships with five principal areas of revenues (new cars, used cars, parts, service, and body shop), Carvana has one (used cars), and is subject to the highs and lows in the used car marketplace. This lack of diversity in revenue streams brings additional risk to the Carvana business model vis-a-vis traditional dealerships, and excludes those business areas that dealers rely upon to weather the inevitable cyclical and seasonal downturns in vehicle sales.

Franchised dealers have a natural source of used car inventory.

Whereas Carvana only sells used cars, and has no franchise rights to sell new cars, the company generally doesn't have access to the approximately 15-17 million people annually that purchase new vehicles. These new car buyers represent a robust and consistent inflow of trade-in vehicles, as almost half of new vehicle purchasers have a trade that is included in the transaction. With such, franchised dealers receive roughly 8 million vehicles a year in trade, which they can either sell directly, and profitably to another consumer, or wholesale to others. Moreover, new car dealers have first dibs on vehicles coming off of lease, which provides another significant supply of late-model, high-quality used vehicles. When used vehicle inventory becomes scarce, or prices at the auctions rise significantly, Carvana is at a significant disadvantage vis-a-vis franchise dealers, in that they cannot directly tap into this enormous, and continual supply of trade-in and off-lease vehicles.

Significant opportunity draws significant competition

Carvana has done an excellent job at introducing to the public a new way of purchasing used vehicles. While many may have tried and failed in the past, Carvana has established itself as the company to beat in today's virtual car-shopping marketplace. The company has blanketed the airwaves with their well-choreographed advertisements and visions of their novel vehicle vending machine, and done terrifically well in the areas of marketing and branding. This, coupled with a favorable backdrop of a Covid-induced shop-at-home paradigm, has allowed Carvana's equity value to reach astronomic heights (as discussed above), and with such, this has drawn the attention of many others who sell vehicles, or support those who do.

As the adage goes, "imitation is the best form of flattery", and Carvana's competitors are getting ready to flatter Carvana's management team en masse. A significant majority of those companies listed above, as well as numerous others, are currently strategizing on their own virtual car-shopping business models, with regional and national distributions networks being organized right now. Many of these firms, with the availability of significant capital, have the ability to replicate a Carvana-like business model in a matter of months, and on a national level. So, whereas Carvana today sits upon the top, seemingly without significant competition (Vroom acknowledged), this situation is getting ready to change quickly, as new entrants will swiftly enter the same arena, offering a service that mirrors that of Carvana-but also has all of the other dealership advantages as outlined above. Within a year, look for several more national firms to be participating heavily in the virtual, home-delivery of used (and new) vehicles.

Q3 of 2020 was a once-in-a-generation event in automotive retailing.

The third quarter of 2020 ended up being the best of all worlds for automotive retailers-at least those who had any inventory to sell. With the overnight shift away from mass transportation and to self-sufficient motoring, consumers needed their own vehicles, and they needed them right away. Concurrently, new vehicle factories, were shutting down to stem the spread of Covid, causing vehicle production to stop in its tracks.

For those dealers who had adequate inventory, it was money-making time, and the cash registers were ringing loudly and often. Frenetic panic-purchasing came about, all while fear spread that there wouldn't be enough cars to satiate the needs of our new (but temporary) transportation reality. Consumers were literally willing to do whatever it took to find a vehicle, and price was not a concern. With such, the profitability of vehicles sales shot through the proverbial roof, as the demand/supply imbalance became overwhelming. As a result, most dealers literally sold out of inventory, and had their best sales quarter in their lifetimes. Even well-known auto veterans, in business for decades, couldn't remember a time when things were as good as they were (profit-wise) in the third quarter of 2020. Most also agree, that they are unlikely to experience such again anytime in the foreseeable future.

Carvana is a great company; it's just overvalued

The Carvana management team should be commended on the execution of a solid business model. While the Covid environment has provided a tailwind for their style of auto retailing, they have clearly demonstrated that they can market, build a brand, and deliver upon their business plan. Everything that they have done has worked out at or above expectations, and their Board should be pleased with such.

If you are investor in Carvana, it has been a great ride, and you have been rewarded handsomely. However, the marketplace, and individual investors specifically, must recognize that Carvana is not worth $44 billion, or is it worth as much as ten of its competitors combined. Look to 2021 to be a turning point for Carvana's share price, as share value and share price will eventually converge, causing the shares to fall back meaningfully, in line with the company's fundamentals.

About CarEdge.com and the author: CarEdge.com is a consumer-focused automotive site that provides data and analytics for car shoppers, so that they can make more-informed vehicle purchase decisions. Scott Baker is a 30+ year veteran of the financial services and automotive industries.

Disclosures: CarEdge does not compete directly with Carvana, or does it receive revenues from automotive dealers. The opinions in this article are those of myself only, and should not be interpreted as financial advice, or a solicitation to buy or sell a security. Neither I nor CarEdge.com has a business relationship with any company mentioned in this article, or were we paid for writing this article.