On April 9, President Trump announced a 90-day pause on most reciprocal tariffs, marking a temporary shift in U.S. trade strategy. However, there was one glaring exception: automotive tariffs remain firmly in place.

At a White House press conference, Treasury Secretary Scott Bessent confirmed that the pause does not apply to sectoral tariffs like those affecting the auto industry. That means the 25% duty on imported vehicles that took effect on April 3, along with steel and aluminum levies, are still being enforced.

What If Auto Tariffs Are Paused? It’s Complicated

With the pause on reciprocal tariffs, many consumers and analysts are wondering what would happen if auto tariffs were next on the chopping block. Let’s be clear: as of April 9, auto tariffs are NOT paused. But as trade negotiations continue, it’s worth exploring how a change in that policy might impact car prices, inventory, and the broader market.

Automakers Are Thinking Ahead

Despite the current uncertainty, automakers are preparing for the 2026 model year. Some, like Honda (with the new 2026 Passport) and Porsche (with the upcoming 911), have already announced higher prices for 2026 models.

Why does that matter? Because automakers plan MSRPs months—even years—in advance. And tariff policy plays a big role in those decisions. Even American brands are affected. The higher the tariff burden on imported components or vehicles, the higher the MSRP is likely to be, even for U.S.-assembled cars that rely on global supply chains.

The continued enforcement of auto tariffs through this summer and beyond means automakers will build 2026 pricing with the uncertain trade environment in mind. Simply put, consumers should expect higher prices as automakers set prices for next year’s models.

See Every Car and Truck Manufactured in the U.S.

Jaguar Land Rover and Audi Pause Shipments to U.S.

A few European automakers have already reacted decisively: Audi and Jaguar Land Rover have paused all shipments of new vehicles from its European factories to the United States. Neither automaker has any production in the United States. Both Audi and JLR import 100% of their U.S. lineup from overseas plants.

If auto tariffs continue without a pause or significant reduction, we can expect to see additional overseas auto brands pausing shipments to the U.S. market.

What if auto tariffs are paused?

It hasn’t happened yet. Despite the big news on April 9, 2025 that most reciprocal tariffs are paused for 90 days, it’s important for car buyers to understand that these developments do not impact tariffs on new car imports. But, what if trade negotiations do result in a pause in the weeks or months ahead?

If the U.S. were to pause auto tariffs, we’d likely see a rush of vehicles into the American market from automakers looking to take advantage of the window before tariffs return. Luxury car brands would scramble to send inventory to the U.S. market as quickly as possible.

European automakers would move fastest: brands like BMW, Mercedes-Benz, and Volkswagen Group (including Audi and Porsche) would likely prioritize North American shipments.

For example, neither Audi nor Porsche produce any of their models in North America. Every vehicle sold here is shipped in from Europe. If tariffs were lifted, even temporarily, these brands would scramble to flood the market with inventory. Cargo ships full of luxury SUVs and sports cars could hit American shores within weeks.

Asian automakers have a large manufacturing presence in the U.S. these days, but we’d see plenty of imported models arrive at ports as quickly as a cargo ship can cross 5,000 miles of the Pacific Ocean. Automakers with manufacturing facilities in Canada and Mexico have been partly shielded by the USMCA agreement, but we’d likely see a rush of those vehicles into the United States, too.

With so many vehicles arriving on U.S. shores, it’s possible that new car prices may soften due to a temporary buildup of imported cars. Whether or not prices would meaningfully fall would depend on the scale and duration of a future tariff pause.

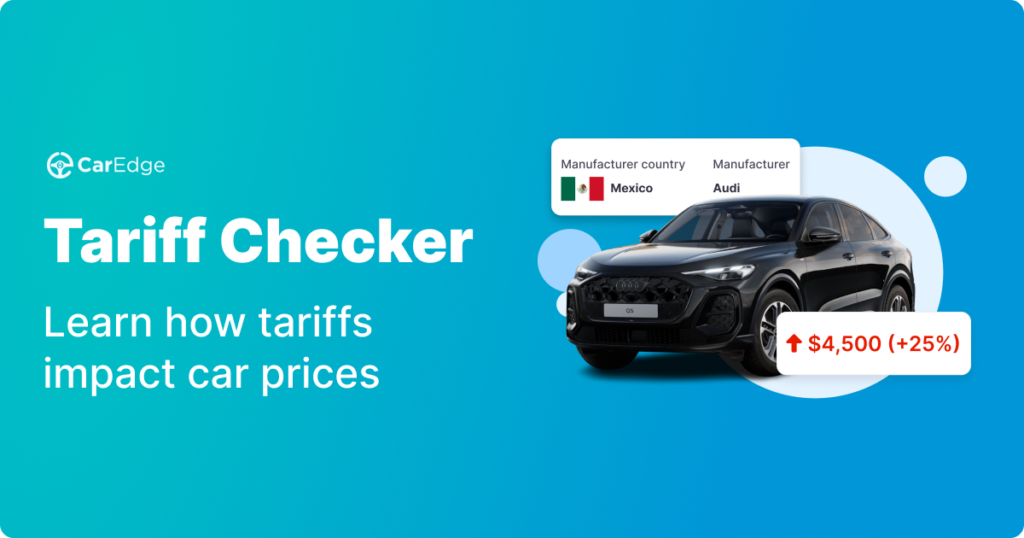

👉 Free Auto Tariff Checker: See if your next car is impacted

What a Tariff Pause Would Mean for the Global Auto Market

A temporary pause in U.S. auto tariffs would send ripples across the global car market. Here’s what we might see:

– Short-term inventory surge: European and Asian automakers could ship in as many vehicles as possible during the pause. This could temporarily ease tight inventory for luxury models in the U.S.

– Price volatility: If OEMs believe tariffs might return soon, they may still keep MSRPs high to account for risk. However, dealers may offer temporary discounts to move sudden surpluses.

– Trade policy whiplash: Repeated changes to tariff policy make long-term planning difficult for both automakers and car buyers. This uncertainty trickles down to prices, supply chain strategies, and even where vehicles are manufactured.

– Pressure on U.S. brands: If imports flood the market, U.S. automakers might respond with better deals or financing to stay competitive.

The Bottom Line for Car Shoppers

While most reciprocal tariffs have been paused, auto tariffs remain fully in effect as of April 9. This has real implications for car pricing and availability, especially for luxury imports.

If you’re in the market for a car, especially a European model, pay close attention to trade news. A sudden policy shift could bring a wave of new inventory — or trigger another round of price hikes.

For now, the best thing you can do is stay informed and shop smart. Use tools like CarEdge’s Free Car Buyer’s Guide and local car market insights to track local inventory and get the best deal, no matter what direction trade winds blow.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments