CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’re in the market for a family vehicle, March is a great time to shop deals on three-row SUVs and minivans. Spring car deals have arrived, and dealers are sitting on rising inventory. Automakers are offering APRs as low as zero percent and lease specials to clear out 2025 inventory. We’re also beginning to see incentives on brand-new 2026 models, too.

Let’s dive into the top 3-row SUV and minivan deals available in March 2026.

MSRP: $33,885 – $49,245

Financing Offer: 0% APR for 60 months. See details at Kia.com

Lease Offer: Lease the 2025 Sorento LX for $329/month for 24 months with $3,999 due

Safety Rating: Top Safety Pick +

Consumer Reports Overall Score: 68/100. See the full review.

Browse Sorento listings with the power of local market data

MSRP: $39,220 – $57,325

Financing Offer: 2.9% APR for 60 months for the 2026 CX-90, or 0.9% APR for 60 months for the CX-90 PHEV. Learn more at MazdaUSA.com

Safety Rating: Top Safety Pick Plus

Consumer Reports Overall Score: 63/100. See the full review.

Browse Mazda CX-90 listings with the power of local market data

MSRP: $62,040 – $82,535

Lease Offer: The 2025 Wagoneer is available from $829/month for 39 months with just $3,999 due at signing.

Safety Rating: See the latest IIHS crash test results

Consumer Reports Overall Score: 54/100. See the full review.

Browse Jeep Wagoneer listings with the power of local market data

MSRP: $62,485 – $81,184

Financing Offer: The 2025 Grand Cherokee L is eligible for 0% APR for 60 months. The 2026 model gets zero percent financing for 36 months.

Safety Rating: Top Safety Pick

Consumer Reports Overall Score: 53/100. See the complete rating.

See Jeep Grand Cherokee listings with the power of local market insights

MSRP: $40,785 – $56,105

Financing Offer: 0% APR for 60 months. Learn more at VW.com

Lease Offer: Lease the 2026 Atlas SE Tech for $439/month for 36 months with $3,999 due at signing.

Safety Rating: Top Safety Pick +

Consumer Reports Overall Score: 71/100. See the full review.

Browse VW Atlas listings with the power of local market data

MSRP: $37,585 – $54,780

Financing Offer: 0% APR for 48 months. See details at Kia.com

Lease Offer: Lease the 2025 Telluride S for $379/month for 24 months with $3,999 due

Safety Rating: Top Safety Pick Plus

Consumer Reports Overall Score: 76/100. See the full review.

Browse Telluride listings with the power of local market data

MSRP: $39,495 – $55,595

Lease Offer: Lease the 2026 Traverse LT from $499/month for 24 months with $5,209 due for eligible lessees.

Financing Offer: None advertised this month. See details at Chevrolet.com

Safety Rating: Top Safety Pick

Consumer Reports Overall Score: 74/100

Browse Traverse listings with the power of local market data

MSRP: $58,195 – $81,895

Financing Offer: Check with your local dealer. See details at Chevrolet.com

Lease Offer: No lease specials are advertised.

Safety Rating: 4-Stars

Consumer Reports Overall Score: 59/100. See the full review.

Browse Tahoe listings with the power of local market data

MSRP: $37,895 – $51,995

Financing Offer: 1.9% APR for 48 months. See details at Kia.com

Lease Offer: Lease the 2025 Carnival MPV LX for $399/month for 36 months with $3,999 due.

Safety Rating: Not awarded. See safety test details.

Consumer Reports Overall Score: 82/100. See the full review.

Browse Kia Carnival listings with the power of local market data

MSRP: $41,340–$61,480

Financing and Cash Offer: 0% APR financing for 60 months. See details at Chrysler.com

Lease Offer: Lease the 2026 Chrysler Pacifica Select for $389/month for 36 months with $3,999 due.

Safety Rating: Top Safety Pick

Consumer Reports Overall Score: 63/100. See the full review.

Browse Pacifica listings with the power of local market data

MSRP: $41,915–$59,305

Lease Offer: Lease the Sienna LE from $499/month for 36 months with $4,498 due at signing. See Toyota details.

Safety Rating: Top Safety Pick

Consumer Reports Overall Score: 80/100. See the full review.

Browse Sienna listings with the power of local market data

👉 Ready to find your perfect 3-row SUV? Let CarEdge help you navigate the car buying process. Your CarEdge Concierge can find the best vehicle for your needs, negotiate the best price, and handle all the details.

Or, have AI handle your negotiation for you. Yes, you read that right. CarEdge’s new AI Negotiator makes getting a fair price easier than ever before. Here’s how it works.

March new car deals are here, and it’s clear that automakers are eager to move inventory. With 400,000 leftover 2025 models and dealership lots filling up as we head into spring, it’s still a buyer’s market. We dug through all of the March manufacturer incentives to find the 10 best offers available right now. All offers expire March 31, 2026 unless noted, and some may be regional in nature.

Tired of the car buying hassles? Learn how CarEdge makes it easy.

Best Deal in March: 0% APR for 72 months for the Rear-Wheel Drive and All-Wheel Drive variants

The Model Y is still America’s best-selling EV, and Tesla is bringing back their best-ever financing offer. Zero percent APR for six full years means absolutely no interest on the easiest EV to own, considering the vast Supercharger network. Just keep in mind that Tesla depreciation can be steep — it’s always worth checking used Model Y listings before committing to new.

Best Deal in March: 0% APR for 72 months

Six years of free financing on a full-size truck? That’s an amazing deal. At today’s prices, most Ram buyers are financing $45,000 or more, and at 0% APR, that’s a lot of money staying in your pocket instead of going to a lender.

The 2026 Ram 1500 also qualifies for 0% APR, just capped at 60 months. But with 3,000 new 2025 models still on the lot, the 72-month offer is where the real value is. See Ram offer details.

Browse Ram 1500 listings with local market data

Best Deal in March: 0% APR for 60 payments, plus no payments for 90 days.

Gas prices are on the rise, and a hybrid 3-row SUV is looking better than ever. Consumer Reports gives the Santa Fe Hybrid an overall score of 84 out of 100 due to a stellar road test and high predicted owner satisfaction.

The 2026 Hyundai Hybrid Santa Fe is rated by the EPA at 36 miles per gallon in the city, and 35 MPG on the highway. That’s on par with the similarly-sized Toyota Highlander, but you won’t be finding zero-percent financing for that model. See offer details.

Browse Hyundai Santa Fe listings with local market data

Best Deal in March: 0% APR for 60 months, OR approximately $10,000 off MSRP (20% conquest discount for buyers switching from another brand)

This is one of the most flexible incentive packages in the March market. Shoppers can either lock in five years of interest-free financing or take roughly 20% off the sticker — one of the steepest discounts on any new vehicle this month. If you’re coming from a competitor’s brand and open to an affordable EV crossover, it’s worth a serious look. Owners and reviewers say the Equinox EV makes for a great ride around town. See Chevrolet offer details.

Browse Chevrolet Equinox EV listings with local market data

Best Deal in March: 0% APR for 60 months + $1,000 Truck Month Cash + no payments for 90 days (no money down required)

Ford has been knocking it out of the park with zero percent financing and zero-down lease deals. In March, the best-selling truck in America, the F-150, is truly priced to sell. Note that this zero percent financing offer is for the 28,000 remaining 2025 models left unsold. See Ford F-150 offer details.

Browse Ford F-150 listings with local market data

Best Deal in March: $399/month for 36 months with just $399 due at signing

Ford is taking the zero-down lease formula and applying it across much of their lineup this month. The Bronco Sport Big Bend 4×4 is available with just the first month’s payment due at signing — that’s it. The off-road-capable compact SUV segment has gotten crowded, but at $399 down and $399 a month, the Bronco Sport makes a pretty compelling case for itself. See Ford Bronco Sport offer details.

Browse Ford Bronco Sport listings with local market data

Best Deal in March: $299/month for 24 months with $4,239 due at signing

Under $300 per month on a full-size four-wheel-drive truck is a steal. GMC is clearly trying to work down a bloated full-size truck inventory right now, and buyers are the ones benefiting. As of last check, there’s 121 days of supply for the Sierra 1500, nearly twice the market average.

If the Sierra has been on your radar, this is about as cheap as leasing a 4WD full-sizer gets. See GMC offer details.

Browse GMC Sierra 1500 listings with local market data

Best Deal in March: 0% APR for 60 months + $1,000 Bonus Cash

VW is offering one of the best three-row family SUV deals this month. The Atlas is one of the more spacious and value-oriented family haulers on the market. Worth noting: VW’s offer runs through April 30, giving buyers a little extra time compared to most deals on this list. See Volkswagen offer details.

Browse Volkswagen Atlas listings with local market data

Best Deal in March: $269/month for 36 months with only $2,254 due at signing

This is the best hybrid lease deal in March. Low monthly payments, just a few grand due at signing, and Subaru’s symmetrical all-wheel drive makes this a standout deal. If you’re aiming for fuel savings without the need to charge, the Forester Hybrid is due for a test drive. See Subaru offer details.

Browse Subaru Forester listings with local market data

Best Deal in March: 0% APR for 72 months, OR $7,500 cash offer

Volvo’s flagship three-row luxury EV SUV rarely shows up on a deals list, but here we are for the second month in a row. At an MSRP north of $80,000, six years of zero-percent financing saves buyers a serious amount of money. The $7,500 cash option is there too if you’d rather take the discount upfront. See Volvo offer details.

Browse Volvo EX90 listings with local market data

With inventory rising heading into spring, manufacturers don’t have much choice but to offer aggressive incentives. From full-size trucks to crossovers, just about everything is sitting on the lot longer than dealers would like. Add new economic uncertainties driven by geopolitics to the mix and what you end up with is a strong buyer’s market.

Tired of the car buying hassle? CarEdge Concierge handles the entire process for you, from finding the right vehicle to negotiating the best price. Or, if you prefer a DIY approach with professional tools, CarEdge Pro gives you insider data and an AI agent to negotiate on your behalf.We’re here to help! Schedule your free consultation today.

Spring car sales are here, but not every automaker got the memo. While March brings some genuinely great deals, a handful of brands are sitting on bloated inventory with weak incentives to match. We dug through the March manufacturer offers to find the five deals worth skipping — and what to consider instead.

Don’t miss our guide to the best car deals in March 2026. As always, some manufacturer incentives are regional in nature.

If a third of your March inventory was last year’s model, you’d probably run some big incentives to sell them, right? Lincoln and parent company Ford didn’t do the obvious for the roughly 2,500 remaining 2025 Navigators sitting unsold. The best financing deal in March is 3.9% APR for 48 months. The lease isn’t much better: the Navigator Reserve comes in at $1,579/month for 36 months with $5,604 due at signing.

For a full-size luxury SUV that’s been on the lot for months, those numbers are hard to justify. Competing three-row luxury SUVs are offering much more compelling terms right now. The 2026 Infiniti QX80, for example, is available at 0% APR for 60 months — on a vehicle that starts at a similar price point. If a large luxury SUV is on your list, the Navigator is not where the value is this month.

Why is 3.75% APR for 36 months one of the worst car deals in March? Because this offer is for the outgoing 2025 RAV4, not the latest-and-greatest, better-equipped 2026 model that’s now arriving on dealership lots.

The brand-new 2026 RAV4 is already being advertised at 4.99% APR for 60 months in most markets, and lease deals for both model years are virtually identical at the base LE trim. We’re not sure why any Toyota shopper would choose last year’s RAV4 given this lack of incentives. The 2026 model is genuinely that much better — standard hybrid powertrain, improved infotainment, and updated styling. If you’re in the market for a RAV4, hold out for the new one.

Toyota’s offers are especially regional, so it’s important to see local Toyota offer details.

Mazda just reported its seventh straight monthly decline in U.S. sales as rivals Toyota, Honda, Kia, and Hyundai continue to gain ground. Despite the sales slide, incentives for some of Mazda’s top sellers remain underwhelming in March.

There’s currently a 155-day supply of the CX-50 sitting on dealer lots — more than twice the market average. With 16,000 unsold CX-50s and stagnant demand, you’d expect something more compelling than the best offer of 1.9% APR for just 36 months. That’s a short term that is unlikely to move the needle for Mazda.

If you’re set on buying or leasing the CX-50, we’d recommend waiting to see what April brings. Given the inventory pressure, more compelling incentives are likely on the way.

Jeep is offering some good APR and lease deals across most of its lineup in March. The Compass is the exception. With 170 days of supply, it’s one of the slower-moving vehicles in the entire Stellantis portfolio, and the best financing available is 6.9% APR — a rate more appropriate for buyers with fair credit than a manufacturer trying to clear excess stock.

The lease is a bit more reasonable: the Compass Limited 4×4 is available from $379/month for 36 months with $3,999 due before taxes and fees. If you’re aiming to drive home a new Compass this month, the lease is the better path. But given the inventory levels, there’s a case to be made for negotiating harder on price before committing to either option.

The 2026 Crown Signia is the slowest-selling Toyota model in March, roughly tied with the bZ electric crossover at about 72 days of supply. For context, the Toyota brand average is around six weeks of supply, and the most popular models typically sell in less than three weeks.

So why isn’t Toyota advertising a single incentive for the Crown Signia in most U.S. markets? That’s a fair question. Toyota’s U.S. market share continues to grow while many competitors struggle, so perhaps they feel little pressure to discount. Whatever the reason, buyers will find slim pickings here.

In most markets, leasing a 2026 Crown Signia XLE starts at $712/month for 36 months with $5,000 due at signing. Parts of the West Coast and Midwest are the exception, where Toyota is advertising lease deals from $529/month for 36 months with $3,999 due — a much more reasonable entry point.

There are no financing offers as of early March. The Crown Signia is a genuinely attractive vehicle, but at these terms and without any meaningful incentives, it’s hard to recommend pulling the trigger right now. Check your local Toyota deals, as Toyota’s incentives are notoriously regional.

When shopping for any of the vehicles above, remember to check manufacturer websites for your specific region before heading to a dealership, as offers can vary significantly by market.

Don’t forget to check out the BEST offers of the month, featuring 10 new car deals handpicked by our team of experts.

If you want the easiest path to a good deal, CarEdge Concierge handles your entire transaction from start to finish. You can also tap into our CarEdge Community forum and YouTube channel for market news, negotiation tips, and real buyer experiences.

Did you find a deal we missed? Let us know in the comments below.

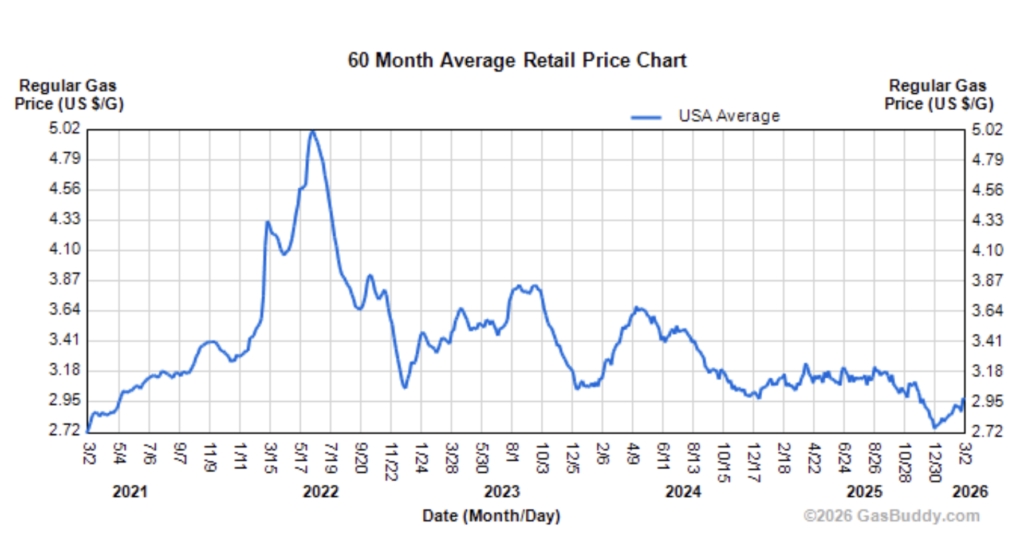

Oil prices are climbing again as tensions escalate overseas, and as the latest nationwide data shows, gas prices are already climbing. For an American electric vehicle market that has been losing momentum, that may be exactly the catalyst it needs to survive.

EV sales have fallen dramatically since the expiration of federal incentives last year. Rising fuel prices could be what gets them moving again. Here’s where things stand now, and where the EV market could be headed in the weeks ahead.

U.S. EV sales totaled roughly 66,000 units in January 2026, down nearly 30% year-over-year and about 20% lower than December. EVs made up just 6.0% of all new vehicle sales for the month. That’s a substantial decline from the 10.5% peak seen in Q3 2025.

Zooming out, 2025 still finished as the second-best year on record for EV volume. But market share slipped from 8.1% in 2024 to about 7.8%, growth clearly plateaued, and several automakers have since moderated production targets in response.

Hybrids told a different story. Electrified vehicles overall gained market share in 2025, but most of that growth came from hybrids rather than fully electric vehicles. Consumers didn’t abandon fuel efficiency — they shifted toward options that felt more practical and less risky. Changing federal incentives, reliability concerns, and lingering charging anxiety all contributed to softer EV demand, and even Tesla saw monthly volatility as category growth cooled.

The EV market isn’t in freefall. But with market share slipping and automakers pulling back on targets, rising oil prices arrive at a critical moment.

When oil prices rise, gasoline prices follow, and the math on vehicle ownership shifts quickly.

Consider a straightforward example: a 25 MPG vehicle driven 15,000 miles per year costs about $1,950 annually in fuel at $3.25 per gallon. Push that to $4.50 per gallon, and the number climbs to roughly $2,700 — a $750 annual increase. Most EV drivers, by comparison, spend somewhere between $500 and $800 per year on electricity.

Gas prices are also uniquely visible. They’re posted in large numbers on every corner, and when they rise, they shift how drivers think about affordability in a way that abstract ownership calculations rarely do. That’s why drivers and politicians alike keep close tabs on gas prices.

Hybrids Move First, Then EVs

When gas prices spike, hybrid demand usually tightens first. Brands like Toyota, Lexus and Honda benefit immediately with their heavily-electrified lineups.

But when elevated oil prices persist for months rather than weeks, buyer behavior shifts further. That’s when full EV sales tend to accelerate, as longer time horizons make the ownership math increasingly compelling. Automakers like Ford, GM, Rivian, and Tesla could see renewed momentum in that scenario.

If demand strengthens meaningfully, expect incentives to shrink along with it. In March, zero-percent financing is commonplace for slow-selling EVs. Lease deals are also stellar. If we see a steady climb in EV interest, the best incentives could vanish.

In the previous oil price spike in 2022, EV sales were limited by a smaller model lineup, thinner charging infrastructure, and a buyer pool that was largely first-adopters. That’s no longer the case. There are now more than 70 fully-electric models available in the U.S. across a wide range of price points. The public charging network has expanded significantly with newcomers like IONNA and expansions from players like Tesla, EVgo, and Electrify America. Used EV inventory is deeper and more affordable than ever.

If gas prices stay elevated this time, the EV market is better positioned to absorb and sustain a demand surge than it has been at any prior point. Whether that translates into a structural shift or a temporary bump comes down to one variable: duration.

A short spike will likely produce a temporary lift in EV and hybrid shopping — enough to move inventory, but not enough to change the market’s trajectory. Sustained high prices over 6 months or could produce something different: stronger used EV demand, accelerated investment in charging infrastructure, and automakers leaning harder into electrification timelines they might otherwise delay.

If oil prices are rising and you’re thinking about your next vehicle, here’s how to approach it without letting the news cycle make the decision for you.

Run the full ownership math. A lower monthly payment on a gas vehicle can look attractive until you factor in fuel costs over five years. Compare total cost of ownership, not just sticker prices.

Consider EV leases. When buying any EV, depreciation hits hard. A two-to-three year lease keeps your options open and protects you from depreciation risk in a segment where resale values are still finding their footing. See the best leases right now.

Consider the used EV market. Prefer to own rather than lease? The used EV market is where some of the strongest value currently exists for buyers who want to reduce fuel costs without absorbing the full cost of a new vehiclea.

Of course, this is an evolving situation. Stay tuned to CarEdge for the latest industry trends, buyer tips, and the best deals of the month.

Truck demand remains strong heading into spring, but sky-high prices haven’t stopped manufacturers from fighting for your business. Truck prices remain near all-time highs with an average of $66,241 — yet automakers are rolling out incentives worth thousands of dollars to clear crowded dealership lots.

Tens of thousands of leftover 2025 models remain unsold in March. That’s the perfect recipe for a buyer’s truck market. Don’t pay MSRP when March truck deals like these are on the table.

Whether you’re in the market for a mid-size hauler or a full-size workhorse, we’ve done the legwork so you don’t have to. Here are the best truck deals available in March.

NOTE: New manufacturer incentives will arrive on Tuesday, March 3. Check back for new deals!

Through March 2, current lessees of 2021 or newer Chevrolet vehicles can lease the 2026 Silverado 1500’s Crew Cab 4WD LT trim with a TurboMax engine at $379/month for 36 months, with $1,709 due at signing.

If you’re interested in financing, you can get a 2025 or 2026 Silverado 1500 with a TurboMax engine at 1.9% APR for 36 months through March 2.

See Chevrolet Silverado 1500 listings near you.

Is a mid-size Chevrolet pickup more your speed? Current lessees of any 2021 or newer Chevrolet can lease the Colorado Custom Crew Cab 2WD at $279/month for 36 months, with $1,929 due at signing through March 2.

Or, finance a 2026 Colorado at 3.9% APR for 60 months, complemented by a $2,000 Chevrolet mid-pickup competitive cash allowance. See Chevrolet offer details.

Some key advantages you’ll get with the Colorado over the full-size Silverado 1500 are:

See Chevrolet Colorado listings near you.

Nearly half of the new F-150s for sale in March are 2025 models, and dealers are desperate to sell them soon. Right now, you can lease the 2025 F-150 STX 4×4 2.7L at $479/month for 36 months, with just $479 due at signing.

Or, finance the F-150 STX 4×4 2.7L at 2.9% APR for 60 months. These Ford deals are good through March 2. See Ford offer details.

See 2026 Ford F-150 listings near you.

Ford is offering an attractive mid-size truck lease this month. Through March 2, 2026, you can lease the 2025 Ford Ranger XLT 4×4 from $471/month for 36 months, with $471 due at signing. See Ford offer details.

See 2026 Ford Ranger listings near you.

GMC is offering some big truck sales in March. With a trade-in, you can receive a maximum $8,350 cash discount on 2026 GMC Sierra 1500 models with a TurboMax engine.

Current lessees of 2021 or newer GM models can lease the 2026 Sierra 1500 Short Box Crew Cab 4WD Elevation w/TurboMax trim for $299/month for 24 months, with $3,709 due at signing. See GMC offer details.

See 2026 GMC Sierra 1500 listings near you.

Ram is offering 0% APR for 60 months on the 2026 Ram 1500 through March 2. Remaining 2025 inventory is eligible for an even more impressive 0% APR for 72 months. See Ram offer details.

See 2026 Ram 1500 listings near you.

The best electric truck deal in March is 0% APR for 60 months on its Chevrolet’s 2025 Silverado EV, which features faster charging and more range than competitors like the Ford F-150 Lightning or Tesla Cybertruck.

Unlike the F-150 Lightning, the Silverado EV hasn’t been discontinued. With specs that firmly place it in the top of its segment, it would be a shock to the industry if it ever is.