CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’re asking yourself this question, you’re not alone. It’s probably the single most common question our CarEdge team gets right now. The car market has been unpredictable for years, from rising MSRPs and interest rates to the ups and downs of tariffs. No wonder shoppers are stuck on whether to buy now or sit tight for a few more months.

To make this simple, we turned to CarEdge co-founder Ray Shefska. With 43 years in the auto industry, Ray’s advice is grounded in decades of watching manufacturers, dealers, and markets cycle through ups and downs. Here’s how to use the market to your advantage in the months ahead.

For most shoppers eyeing a new car, the timing of your purchase could make thousands of dollars’ worth of difference. Ray’s take? The smart move for most new car shoppers is to wait until year-end sales from Black Friday through December 2025.

“I think that we will see manufacturers increase their incentive spends in the last two months of this year and they will increase their advertising spends dramatically in December.”

Automakers are sitting on a lot of 2025 inventory, and they’ll need to make space for the 2026 models arriving weekly. Expect 0% APR financing, cash discounts over 10% of MSRP, and the best lease deals of the year come December.

This year, there’s another factor at play, and it’s one that actually helps buyers for a change. The next Federal Reserve meetings in September, late October, and early December are likely to bring about rate cuts for the first time since late 2024.

Ray thinks that falling rates will play a big role in year-end deals in 2025:

“With the anticipated Fed rate cuts, I would expect to see more low-APR incentives as well since the cost of doing that will be less than it has been.”

If you are, you’re in for a real treat when shopping for a car. By treat, we mean serious savings. There are still over 90,000 new 2024 models sitting on dealer lots as of September 2025, including aging vehicles from Ford, Dodge, Jeep, and others. These will be the most negotiable cars in the market until they’re gone. If you’re open to driving last year’s model, dealers are going to be far more flexible on price just to move them off their lots.

On the other hand, waiting until 2026 is unlikely to save you money. Automakers have been steadily announcing higher prices for 2026 models, whether through MSRP hikes or padded fees. Incentives also tend to dry up when a new model year launches, which means buyers holding out could end up paying more for less. The deepest discounts will be on 2025 models during late 2025, not on fresh 2026 arrivals.

Here’s the bottom line: Unless you’re in urgent need of a new car or you’re considering EVs, waiting until year-end sales in November and December is the smart play. If you wait until 2026, higher MSRPs are likely to cost you.

This is where timing matters most. The federal tax credit is set to expire for qualifying vehicles on September 30, 2025, with a catch. New federal guidance from the IRS has clarified that buyers have until that date to get a signed binding contract with a down payment, even if the car isn’t delivered yet. That’s welcome news as electric models are several of the fastest-selling cars right now.

“Obviously EV shoppers should take advantage of the federal tax credits before they expire on September 30th, so if you are looking for an EV do it now not later.”

That’s about as clear as it gets. EV buyers have a ticking clock that runs out at month’s end. Right now, EV leases are especially appealing. Before you rush out to purchase anything with a battery, understand that depreciation hits hard with EVs.

Here’s the bottom line: If a new EV is on your radar, buy or lease before September 30, 2025. The credit for used EVs under $25,000 will also expire on that date.

The used car market doesn’t feature manufacturer incentives, but it does move with interest rates and seasonal demand.

Ray notes that if the economy weakens, it’ll ripple into both new and used prices:

“If the economy struggles, that will add pressure on both the manufacturers and dealers to be even more aggressive at year-end.”

That’s good news for buyers, since cheaper new car financing usually pulls used prices down too.

The exception? You guessed it – used EV buyers should be aware of the expiring $4,000 federal incentive. Most electric models under $25,000 will qualify. The federal used EV incentive will be gone for good when September concludes.

Here’s the bottom line: Don’t feel rushed to buy a used car in 2025, unless you’re shopping for used EVs under $25,000. But if you’re financing, waiting a few months could save you money.

For shoppers on the fence, here’s the big picture: waiting until 2026 could mean paying more. Some automakers are announcing price hikes for the 2026 model year, and others are being sneaky with higher ‘mandatory destination charges’ and other fees. That makes the final months of 2025 one of the best windows to grab a deal on a 2025 model.

Year-end sales will be especially aggressive. Manufacturers will crank up incentives like 0% APR financing and cash offers in November and December. Each year, this manufacturer push lines up perfectly with dealer pressure to clear out remaining inventory. Take note: this level of new car sales won’t be seen again until late 2026. In the auto industry, it’s common knowledge that the end of the year is always the best time to buy a car.

With expiring EV incentives, MSRPs rising, and interest rate cuts looming, car buyers have some decisions to make. However, the good news is that timing can work in your favor. If you’re shopping for a new car (non-EV), November and December are shaping up to be the best months to take advantage of sales and savings. If you’re shopping for an EV, the clock is ticking. Federal incentives vanish after September 30, 2025, making this the time to act.

And if you’re open to considering a leftover 2024 model, you’re in luck: these are the most negotiable cars on the market right now. After all, they’re almost two years old!

Used car shoppers have a bit more flexibility, though late-year sales and falling rates could give you an edge. Retail used car prices have been relatively flat over the past year, and that’s unlikely to change substantially in 2026. What IS likely to shift in buyer’s favor is falling interest rates. For used car shoppers with a bit of flexibility, December is likely to be your best month to purchase with most shoppers focusing on year-end new car deals, and the likelihood of falling interest rates.

Ray summed it up best: wait until December if you can, unless it’s an EV. The manufacturers and dealers will be more aggressive than ever at the end of this year, and that’s when you’ll find the deals worth waiting for.

No matter your timeline, you don’t have to navigate this market alone. CarEdge can handle the negotiations for you, from our white-glove Concierge service to the world’s first AI car price negotiator. Either way, the best way to buy a car in 2025 is with the facts on your side.

Buying a used car can be a smart financial decision — if you ask the right questions. Pre-owned vehicles come with unique risks, from hidden damage to unclear pricing. That’s why it’s crucial to go into the process prepared and confident.

Use this guide to make sure the dealership (or private seller) is giving you the full picture. If they dodge any of these questions, consider it a red flag.

Used car prices often vary by dealership, but the OTD price reveals the real cost, including taxes, fees, and dealer-installed accessories.

👉 Use our free Out-the-Door Price Calculator to compare offers.

The longer a used car sits, the more room there is to negotiate. A vehicle that’s been on the lot for 45–60+ days may come with bigger discounts.

📊 Use CarEdge Pro to check days on lot, supply, and local market pricing.

A Carfax or AutoCheck report should be free and readily available. It reveals accidents, maintenance, and ownership history.

🚨 No history report = red flag. Walk away if they won’t provide one.

It’s important to note that if you’re buying a used car from a private seller, you may need to purchase your own vehicle history report. All you’ll need is the car’s VIN.

A Pre-Purchase Inspection (PPI) can uncover hidden mechanical issues that a dealer won’t mention. This step alone can save you thousands.

Pro tip: Always choose an independent mechanic who’s not affiliated with the seller.

Used cars can vary greatly, even within the same make, model, and year. A test drive helps you catch mechanical concerns and ensure comfort. Drive on a variety of road surfaces at low and high speeds.

Take note: A test drive doesn’t replace the need for a pre-purchase inspection by an independent mechanic.

Used cars may still have factory warranty remaining or include a dealer-backed warranty. Ask for details, and if they’re selling you an extended warranty:

Compare to CarEdge Extended Warranty plans for full transparency. No markups, just clear coverage.

Buying from a private seller can sometimes get you a better deal. However, it comes with more risk and fewer protections than buying from a dealership. That’s why it’s critical to ask the right questions up front.

Here are some additional questions you should ask a private party seller before agreeing to buy a car:

💡 Pro Tip: Bring a printed bill of sale template and ensure both parties sign it. Also, double-check your local DMV requirements for title transfers and taxes before finalizing anything. See some examples here, but always ensure that all required fields are on your form.

Buying used doesn’t mean buying blind. Let CarEdge’s car buying service do the legwork:

✅ We find the best pre-owned vehicles

✅ We negotiate pricing and review contracts

✅ We coordinate inspections, delivery, and paperwork

Learn more about how CarEdge can help.

CarEdge is your trusted partner for smarter used car shopping. We provide expert tools, unbiased insights, and negotiation support — so you never overpay. Start your car search at CarEdge.com and take control of your next purchase.

Understanding what’s on a new car’s window can save you from overpaying or falling for dealer tricks. If you’ve ever heard the terms Monroney sticker or window sticker and felt confused — you’re not alone. These labels are crucial for transparency when buying a car, and every buyer should know what to look for.

In this guide, we’ll break down what a Monroney sticker is, why it exists, and how to read it. You’ll leave feeling more confident and equipped to understand what a car really includes — no matter what a salesperson might tell you.

Before car buyers had access to standardized pricing, buying a car was like walking into the Wild West. Salespeople could pick and choose what to tell you — and what to charge.

That all changed with the creation of the Monroney sticker, a federally mandated label that must be displayed on every new car for sale in the U.S. You’ll also hear it referred to as the window sticker — they’re the same thing.

This label lists everything a shopper needs to know about the car’s equipment, price, and origin. It was designed to protect buyers and level the playing field.

Only 9% of Americans say car salespeople have high ethical standards — the lowest of any profession according to Gallup. That’s why federal law stepped in.

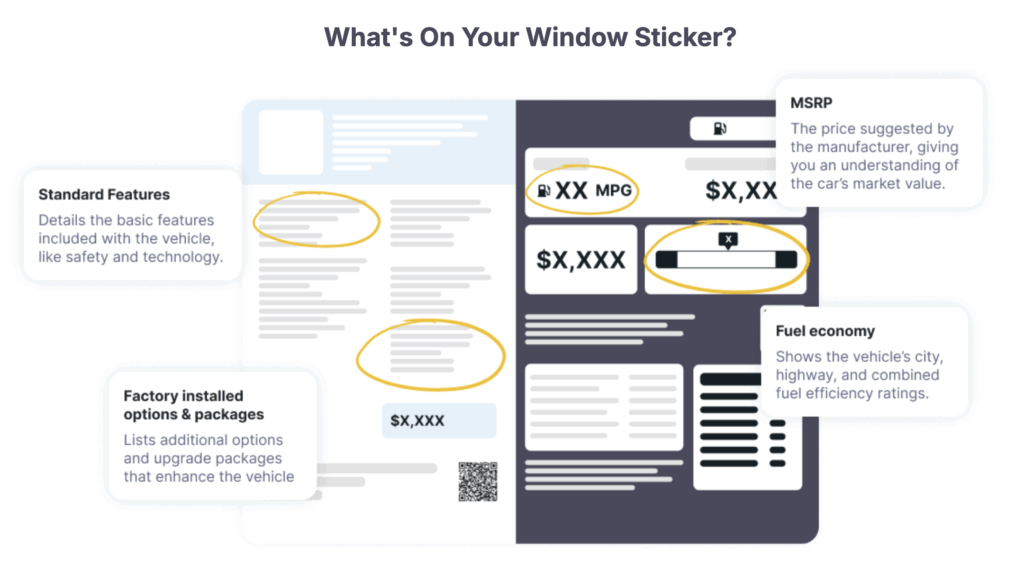

Here’s what’s included on every Monroney sticker:

Check out an example of where you’ll find this important information:

📌 Important: Dealer-installed accessories (like pinstripes, floor mats, or nitrogen tires) are not listed on the Monroney sticker. They appear on a separate dealer addendum sticker, which is not federally regulated.

The name comes from Senator Almer “Mike” Monroney, who sponsored the Automobile Information Disclosure Act of 1958. Signed into law by President Dwight Eisenhower, the act required automakers to include standardized labels on all new cars.

Before this law, car buyers had no way to verify what was included in a vehicle or whether the price was fair.

Monroney was a leader in consumer protection and also played a role in creating the Federal Aviation Administration (FAA). His legacy lives on every time you look at a new car’s window sticker.

Want to learn more about the law? Visit the Consumer protection Branch at the U.S. Department of Justice.

Let’s recap what you’ll find on a new car’s Monroney (window) sticker. This information is required by law and cannot be altered or removed by dealers:

💡 Tip: If you don’t see this sticker on a new car, ask why — and consider walking away.

So you’re standing on a dealership lot — where should your eyes go first?

The Edmunds guide to reading a window sticker is an excellent visual breakdown. You can view it here, but here’s a quick summary:

In today’s car market, dealer markups and confusing add-ons are everywhere. But the Monroney sticker keeps it real — it’s the one label they can’t legally change.

When you’re comparing similar vehicles across different dealerships, the window sticker helps you:

Whether you’re shopping used or just want to do your research from home, you no longer have to visit the lot to see the original window sticker. CarEdge now offers access to digital Monroney stickers on most vehicles — giving you instant insight into the car’s features, options, and MSRP breakdown.

✅ Great for used cars that originally included premium options

✅ Helps compare trim levels and original pricing

✅ Saves time and reveals red flags before you visit the dealership

View the original window sticker — and shop smarter from the start.

Q: Is a Monroney sticker required by law?

A: Yes. Every new car for sale in the U.S. must display a Monroney sticker — it’s federal law.

Q: Are Monroney and window stickers the same thing?

A: Yes. These two terms refer to the same federally required label.

Q: Can dealers alter or remove the Monroney sticker?

A: No. It’s illegal for dealers to modify or remove the sticker prior to sale.

Q: Does the window sticker include dealer add-ons?

A: No. Only manufacturer-installed options are listed. Dealer-installed accessories appear on a separate sticker.

Q: Do used cars have a Monroney sticker?

A: No. The law only applies to brand-new vehicles. However, used vehicles may have copies of the original sticker or digital replicas provided by the dealer.

Founded by industry veterans, CarEdge is your trusted resource for transparent car buying. From understanding pricing to negotiating deals and avoiding scams, we provide data-backed insights, expert tools, and concierge services to help you buy with confidence.Want help with your next car purchase? Let us find and negotiate the best deal for you! Explore CarEdge’s car buying help today.

Timing your car purchase just right can save you thousands of dollars. Knowing when to shop (and when not to) can make all the difference. Dealership routines, monthly sales targets, and inventory cycles reveal some clear strategies that smart car buyers use to their advantage. Here’s how auto industry experts break down the best times to buy by day, month, and season.

Timing can make or break your car deal. If you’re wondering when the best time to buy a car is, you’re not alone. The answer depends on when you walk into the dealership just as much as what you’re shopping for.

Whether you’re buying new or used, here’s what you need to know:

The best time to buy a car is late in the day, late in the month, and especially in December.

Let’s get into why these times benefit buyers the most, and offer real opportunities for savings.

Most car shoppers hit the dealership on the weekend, and that’s exactly what you should avoid. We asked CarEdge Co-Founder and 44-year industry veteran Ray Shefska what he recommends to shoppers looking to time their purchase right. After decades in the business, this wasn’t a tough question to answer.

“The best day to buy? Wednesday. Traffic is light, and if you show you’re serious about buying that day, you’re more likely to find a motivated salesperson ready to make a deal. Try going late in the day, near closing time. That’s when some staff just want to wrap up the day—and a quick deal might be just what they’re looking for.”

— Ray Shefska, CarEdge Co-Founder

Key Tip: Shopping midweek (especially Wednesday afternoons) gives you a better shot at undivided attention and more aggressive pricing.

Salespeople and managers live by monthly quotas. That’s why the last few days of the month are when deals start to heat up.

Why? Dealers need to hit targets to earn bonuses from the manufacturer. If they’re a few cars away from their goal, they’ll often offer steep discounts just to get a deal done.

All-around best time: The final 2–3 days of the month, especially if they fall midweek.

End-of-quarter sales goals are even bigger than monthly goals. That means the last days of March, June, September, and December are the most negotiable of all. If you can time your car purchase to line up with the end of the quarter, you’re setting yourself up for success when negotiating the out-the-door price.

Here’s the overall best-case scenario: Walk into a dealership late on a Wednesday afternoon that also happens to be the last day of the month and the end of a quarter, and you’ve hit the sweet spot.

Hands down, the best month to buy a car is December. Why?

Look for:

Want to stack the odds even more in your favor? These extra strategies go beyond timing to help you land the best possible deal.

Take these free car buying cheat sheets with you to the dealership! Trust me, it’s worth dusting off that printer to have expert insights in your hands. Download them for free!

You’ve got questions, and we’ve got answers. Here’s all you need to know about the best time to buy a car.

Q: What day is best to buy a car?

A: Wednesday, especially in the afternoon when foot traffic is light and staff is more focused.

Q: Why is the end of the month better for buying a car?

A: Dealers and sales staff are trying to hit monthly sales goals, so they’re more motivated to cut deals.

Q: Why is December the best month to buy a car?

A: In December, dealerships offer major year-end discounts to move inventory, especially on last year’s models.

Q: Should I avoid buying early in the month?

A: Usually, yes. Salespeople feel less pressure early in the month, so you’re less likely to get the best offer. The exception is when holiday car sales fall early in the month, like Independence Day for example.

Q: What if I’m buying used?

A: The same timing rules apply, at least when shopping at used car dealerships. If you’re buying from private sellers, timing is less important. However, be sure to get a pre-purchase inspection to protect your wallet, and see the original window sticker.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn more at CarEdge.com.

Purchasing a new or used car can be an exciting experience. It can also be miserable. When you set out to secure a great deal on your next car, it’s essential to be well-informed about the auto financing process to avoid costly mistakes. To help you navigate the often complex world of car loans and financing, we have compiled a comprehensive guide to auto financing that covers ten essential steps and tips for success, including:

2. Considering down payment options

3. Shopping around for financing

4. Determining the right loan term

5. Understanding manufacturer incentives

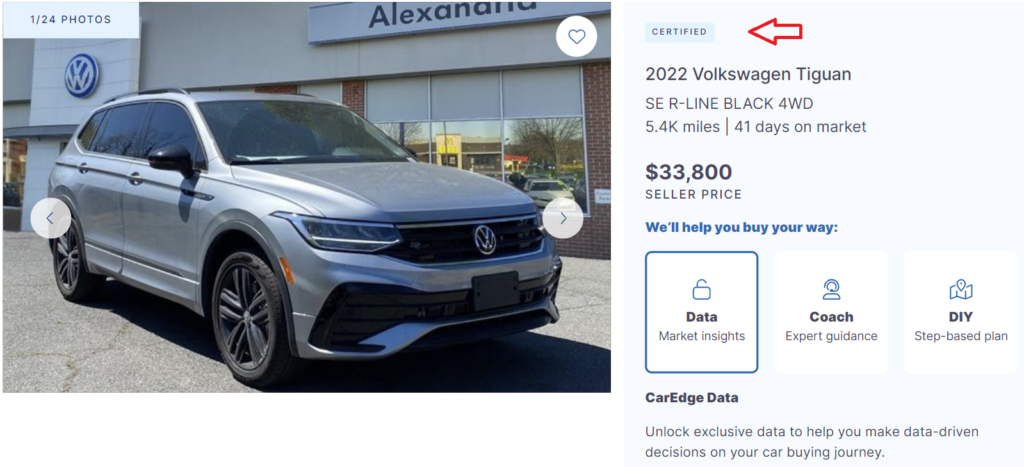

6. Exploring Certified Pre-Owned Vehicles

To illustrate how to effectively employ these strategies, we have also created an example conversation between an empowered car buyer and a car dealership Finance Manager. This detailed script guides you through the entire financing process, from the initial introduction to signing the paperwork. By following this example and implementing the advice provided, you’ll be better equipped to secure a favorable loan, save money, and drive away in the car of your dreams.

Your Path to Auto Loan Savings: Credit Scores, Down Payments, and Savvy Financing Strategies

Let’s dive into valuable tips and expert advice from myself, CarEdge Finance and Insurance Specialist Kimberly Kline, and automotive industry veteran and CarEdge co-founder Ray Shefska. We’ll explore the key factors that influence your loan costs, such as credit score, down payment, and loan term, as well as some lesser known considerations that can save you big bucks at the finance office. Study this auto finance cheat sheet before you head to the dealership!

👉 The basics of auto lending: There are three things that lenders look at when determining whether to approve a customer for a loan. Those three things are 1) ability, 2) stability and 3) willingness.

Ability: do you have the ability to actually make the payments? Will your income support the payment? Based on your debt-to-income ratio, do you fall into the guidelines that the banks use to make this determination?

Stability: how long have you been doing what you do? How long have you been on your job, at your address? Do you job hop or move frequently? Have you shown the requisite stability within your field to satisfy the bank’s lending policies?

Willingness: how have you handled your past credit obligations? Have you handled them in a timely manner or have you sometimes fallen behind? In other words, have you shown a willingness to pay your bills in a timely fashion?

If you can satisfy those three criteria, then you should be approved for a loan at a good interest rate.

Now, we’ll walk you through the key factors you need to consider when applying for a car loan (with the goal of securing a great rate).

Your credit score plays a significant role in determining your auto loan interest rate. Before shopping for a car, check your credit score and work on improving it. For example, pay off outstanding debts, make timely payments, and keep your credit utilization low. Be cautious of applying for multiple credit cards or loans in a short period, as this may negatively impact your score. Monitor your credit report for errors and dispute them promptly.

👉 Pro Tip: Always let the dealership Finance Manager know that YOU know your credit well! This puts you in a more controlling position.

Aim for a down payment of at least 20% of the car’s purchase price to minimize interest costs and potentially qualify for a lower rate. For instance, on a $30,000 car, a 20% down payment would be $6,000. By saving more for your down payment, you can reduce the loan amount, lower monthly payments, and decrease the likelihood of being upside down on your loan.

👉 Pro Tip: Banks and credit unions like to see a healthy loan-to-value ratio. This means that a higher down payment is always a good thing.

Don’t limit yourself to dealership financing. Once you know your credit score, search online for reputable credit unions that operate in your state (start here with CarEdge). Most credit unions publish their new and used auto loan rates on their website. This gives you an excellent idea of what the best current interest rates are. This arms you with knowledge when it comes to speaking with the Finance Manager. If you find a great deal, speak to the loan officer, and consider applying for a car loan. Even if you decide to finance with the dealership, this pre-approval will come in handy in the dealership finance office. Consider working with CarEdge-approved credit unions for excellent rates, and top-tier customer service.

👉 Pro Tip: protect your credit. Don’t aimlessly apply to credit unions online but if you find one with great rates, always speak with a loan officer first, get all your questions answered on their process and then apply.

While longer loan terms may have lower monthly payments, they also mean you’ll pay more interest over the life of the loan. Opt for a shorter loan term if it fits your budget to save on interest costs. For example, choosing a 48-month loan term instead of a 72-month term on a $25,000 loan at a 5% interest rate can save you over $1,500 in interest payments.

Automakers often offer special financing deals or cash rebates to encourage new car sales. Keep an eye out for these incentives, such as low or 0% APR financing, which can significantly reduce your overall interest costs. Be sure to read the fine print and weigh the pros and cons of these offers before deciding. We keep track of the best manufacturer incentives here.

👉 Pro Tip: Don’t expect the dealership finance manager to advertise the manufacturer promotion. Do your research online before shopping.

If you’re buying a used car, consider a manufacturer-certified Certified Pre-Owned (CPO) vehicle. Manufacturer CPO programs have stricter guidelines and typically offer enhanced warranty coverage. Stay away from third-party CPOs, at least if you’re looking for better rates. Browse certified pre-owned (CPO) car listings at CarEdge Car Search to find the perfect vehicle with local market data.

👉 Pro Tip: Let the dealership Finance Manager know that YOU know there are often APR Incentive rates for manufacturer CPO’s. So speak their language and ask them to “check their rate sheet for subvented rates on the CPO”.

If you are stuck with a higher-than-ideal rate, consider refinancing to save on interest costs and potentially lower your monthly payment. Refinancing involves taking out a new loan to pay off your existing loan, ideally with a lower interest rate. Refinancing matters more today than it has in the recent past. With rates being so high right now, even half of a point could save you big money over the life of the loan! This can be a smart move if your credit score has improved since you initially took out the loan or if you discovered in hindsight that the dealership put you in a higher interest loan.

👉 Pro Tip: When refinancing, check to see if the bank or credit union has any incentives (such as for automatic withdrawals, or career-based incentives for teachers, first responders, military and more).

Dealerships may add a markup to the interest rate they offer on car loans, pocketing the difference as profit. Be aware of this practice and ask for the ‘Buy Rate’ to see how much the dealership is marking up the loan. If you have a pre-approval from a credit union, use it as leverage to negotiate the best rate with the dealer. It’s smart to understand how dealers make money before negotiating.

We’ll explain exactly how to negotiate marked-up interest rates in the next section. Stay tuned!

If your car loan allows for early repayment without penalties, consider making extra payments towards “principal only” to pay the loan off ahead of schedule.

👉 Pro Tip: Use an amortization schedule to see how fast you’ll pay down your loan!

This can save you a significant amount of money on interest charges over the life of the loan. Just be sure to double-check your loan agreement for any prepayment penalties before proceeding.

Now, let’s go over a real-world scenario that will be VERY similar to what you’ll encounter at the dealership. It’s time to apply your knowledge!

Check out our series of car buying roleplay videos for unbeatable insights into what it’s like to make a deal!

The best way to learn how to effectively negotiate in the finance office is to prepare for the situations and conversations you’re likely to encounter. What better way to do that than creating a real-world script with the help of dealership professionals who’ve been through this hundreds of times? The following is an example conversation between an empowered, prepared car buyer and a car dealership auto Finance Manager. Don’t forget to check out the original CarEdge Cheat Sheet to Car Buying for more word-for-word car buying help!

Finance Manager: Hi, I’m the finance manager here at the dealership. I understand you’re interested in purchasing a car today. Is that correct?

You: Yes, that’s correct. I’ve already chosen the car I want, and now I’m looking to finalize the financing.

Finance Manager: Great, let’s start by filling out a credit application.

(Note: The dealership is going to need to run a credit report and will insist on doing so in order to determine what interest rates you may qualify for. People usually only know their overall credit score and not their auto credit score which by its nature is what banks need.)

You: I know my credit well and I have Tier One credit.

👉 Pro Tip: If you have a lower credit score, you can ask for a ‘tier bump’ at this point. A tier bump is essentially when the dealership finance manager would call the lender to ask for a higher rate, despite the buyer’s lower credit.

Finance Manager: That’s a decent score. Now let’s discuss financing options. We have some deals available through our dealership.

You: Thanks, but I’ve already shopped around for financing and have already spoken with my credit union loan officer and I will qualify for their best rate. I’d like to see how your dealership’s rates compare before making a decision. Also, I’ve been approved for a lower rate with a credit union. Can you beat that rate?

👉 Pro Tip: If you’re borrowing over $30,000, consider asking about a ‘large loan discount’, which is sometimes an option for higher borrowing amounts. See the video we shared in Scene One for more information!

Finance Manager: We’ll certainly do our best to match or beat the rate you’ve received from the credit union. Let me check our current offers. Based on your credit score, we can offer you a 60-month loan at an interest rate of 4.5%.

You: I appreciate the offer, but I’d prefer a shorter loan term of 48 months to save on interest costs over the life of the loan. Can you provide a quote for that term and see if you can match or beat the rate I received from the credit union?

Finance Manager: Sure, let me recalculate the rates for a 48-month term and see if we can match or beat your credit union’s rate. Give me a moment.

Alright, I’ve looked into our current offers for a 48-month loan term. We can offer you a 48-month loan at an interest rate of 0.5% lower than the offer from your credit union.

You: That’s great! I appreciate you working with me to secure a better rate. I think I’ll go with this financing option from the dealership. Interest adds up!

Finance Manager: How much do you plan on putting down as a down payment?

You: I’m prepared to make a down payment of 20% of the car’s purchase price to minimize interest costs and avoid the need for GAP insurance. Can you double check if there are any additional manufacturer incentives or offers available that could get me an even lower rate?

You: I noticed that the car I’m interested in is a Certified Pre-Owned (CPO) vehicle. Please check your “rate sheet” for subvented rates on the CPO. Does that qualify me for a lower interest rate?

👉 Pro Tip: It will go a long way to show that you’re familiar with dealership terms like the ones we’ve included here. Don’t miss this FREE resource: The Car Buyer’s Glossary of Terms

Finance Manager: Yes, CPO vehicles typically do qualify for lower rates due to their lower risk. With that in mind, I can offer you a 3.9% interest rate for a 48-month loan with the manufacturer incentive.

You: I appreciate the offer, but what is the rate on my approval that you received? I’d like to see a direct quote from the lender.

(Note: You can ask to see the direct quote from the lender, but know that since this is indirect lending with the dealership acting as an intermediary, they are not required to share that information with you. Their answer simply may be, “this is the rate that I can offer you”.)

Finance Manager: You received a subvented rate of 3.9%.

You: Is that the Buy Rate?

Finance Manager: No, we mark it up by a point.

You: I would really love that Buy Rate. I know my credit union offered 4.0%, but if you can give me 3.5%, I won’t refinance the loan immediately.

Finance Manager: Okay, I can do that.

👉 Pro Tip: The Finance Manager always wants to avoid the charge-back on the refinance. Basically, if you refinance right away, they’re not making any money from selling you the loan.

Finance Manager: Before we finalize the paperwork, I’d like to go over a few additional products we offer that could save you money in the long run. First, we have a Theft protection Package that will reimburse you in case your car is stolen.

You: Thanks for mentioning it, but I’ve already researched that option and I don’t think it’s necessary for my situation. I’ll pass on the Theft protection Package.

Finance Manager: Alright, that’s fine. Another package I’d recommend is our Tire Care Package. It covers tire replacements and rotations, ensuring your tires are always in great condition.

You: I appreciate the suggestion, but I’ve budgeted for tire maintenance separately and will handle it on my own. I won’t be needing the Tire Care Package.

Finance Manager: No problem, I understand. Lastly, we offer an Extended Warranty that covers any unexpected repairs or breakdowns after the manufacturer’s warranty expires. It’s a great way to protect your investment. I can offer this coverage to you for $30/month.

👉 Pro Tip: Finance Managers will not give you the actual price unless you ask for it. They prefer to tell you the monthly payment to downplay the cost.

You: I’ve actually already looked into extended warranties, and I found the same exact coverage through CarEdge for hundreds of dollars less. I’ll be purchasing their warranty instead.

Finance Manager: Alright, I respect your decision. Let’s move forward and finalize the paperwork for your new car!

(Note: If the finance manager attempts to force you to purchase any of their add-on products, demand to see the contract. Every product includes a contract, and on there, it will clearly state that the product is not required to secure financing.)

👉 Pro Tip: The purchase of products in the finance office cannot be tied to your interest rate. For example, a Finance Manager cannot say “if you get the extended warranty, you’ll get a lower interest rate”.

You can say “No” to everything if you want and sign a Declination Disclosure. However, it is part of Compliance that the Finance Manager lets you know the additional products that are available to 100% of the buyers, 100% of the time.

The Complete List: Never Pay These Fake Dealership Fees

Finance Manager: Here’s your base payment at 3.5% for 48 months. Are you ready to proceed with this offer?

You: Yes, that sounds great. Let’s finalize the paperwork and complete the purchase.

By employing the expert advice provided in the previous responses, the car buyer in this example has successfully navigated the auto financing process, and secured a great deal. Despite the initial offer from the dealership being substantially higher interest rate, the buyer used their knowledge of auto financing to get a better rate. By showing that they understand the process through questioning every aspect of the deal and speaking dealership language, the buyer stayed in control, ultimately saving hundreds to thousands of dollars over the life of the loan.

Check out CarEdge Dealer Reviews to see what deals are near you!

With these car loan tips in hand, you’re well on your way to making the best possible auto financing decisions. But don’t stop there! Join the 100% FREE CarEdge Community to connect with our Car Coaches and thousands of drivers like yourself. Looking for expert tools and assistance? CarEdge Data and CarEdge Coach offer expert guidance and personalized support throughout the car buying process. Our experienced professionals will help you save money, avoid costly mistakes, and achieve your car buying goals.

Don’t go through the car buying process alone – let CarEdge empower you with industry-leading tools and expert coaching. Try CarEdge Data and CarEdge Coach today and drive away with confidence.

Our team of Car Coaches combines decades of experience in the automotive industry to help you, the consumer, buy a car without the hassle. That’s why we created this must-have resource for buying a new or used car at a dealership, whether in person or through the internet sales department. This car buying cheat sheet will help you negotiate car prices confidently, so you can drive away feeling proud of what you’ve accomplished.

Thank you to CarEdge’s Ray Shefska (former dealership sales manager) and Kimberly Kline (former dealership finance manager) for putting this together for car buyers everywhere!

Want to download printable versions of all CarEdge cheat sheets? Find them all here.

Use this cheat sheet to negotiate the best auto loan rates on new or used cars!

The best way to learn how to negotiate car prices effectively is to prepare for the situations and conversations you’re likely to encounter with the salesperson and finance manager. Feel free to print off this cheat sheet and bring it with you! Without further ado, here’s how an informed, prepared car buyer can expertly negotiate.

Salesperson: What do you want your monthly payment to be?

You: I’m not concerned with the monthly payment, I am only focused on the total out-the-door price.

Salesperson: So you’re paying cash?

You: I haven’t determined exactly how I plan to pay for it. I am only concerned about the total out-the-door price.

Salesperson: So you have a monthly budget in mind?

You: I have a total out-the-door price in mind, so I would only like to discuss that at the present time.

Salesperson: OK, how much cash will you be putting down?

You: I haven’t decided that yet and I won’t until we establish an acceptable total out-the-door price.

Notice a trend here? You really really want to stay laser-focused on the only number that matters this early in the game: the out-the-door price. Salespeople will try hard to learn more about how much money you’re willing to spend. If that can get you to talk about monthly payments, they immediately have an advantage over you. That gives them leverage to play with higher interest rates, longer loan terms, and lower trade-in offers. None of those are good for you, the buyer.

Salesperson: What are going to do with the car that drove here, will you be trading it?

You: I haven’t decided yet. We can discuss that as a possibility after we agree to an out-the-door price.

Salesperson: Now that we have agreed to the out-the-door price, what about the car you drove here, will you be trading that in?

You: I might, it depends on whether or not you can match or beat these written offers that I have already received.

Salesperson: Now that we have agreed to the out-the-door price and agreed to the value of your trade, what do you want your monthly payment to be?

You: I’ll only discuss that with the Finance Manager.

Salesperson: Will you be putting any cash down?

You: I’ll be more than happy to discuss all of that with the Finance Manager. If you provide me with a credit application I’ll be more than happy to fill that out for the Finance Manager.

Salesperson: The Finance Manager will be with you shortly.

Use this cheat sheet to negotiate the best auto loan rates on new or used cars!

NEW in 2024: Due to popular demand, we created this additional FREE guide: Auto Financing Cheat Sheet

Finance Manager: I assume that you have given some thought to a monthly payment and loan term that will be comfortable to you.

You: I have indeed and I have also secured a pre-approval from my credit union as a possibility for my loan.

Finance Manager: Would you consider financing through us?

You: I would assuming that you can beat the pre-approved rate that I have. Here is the pre-approval terms sheet from my credit union with all the particulars.

Finance Manager: So if I beat the rate you will finance with us?

You: Yes, if you beat it by at least ¼ of a percent. And I promise to at least listen to any finance and protection packages that are available.

Finance Manager: So you are open to some of our programs?

You: Possibly, if we can agree to a reasonable selling price on any items that I think have value. Oh, and if I do buy any products I would at least expect you to give me the buy rate from the bank on my loan. Once again though, you will need to beat my credit union rate by at least ¼ of a percent for me to even consider it.

Finance Manager: Great, let’s get started.

You: I’m all ears.

Finance Manager shares the MENU with additional products.

You: But first, before we go over product benefits, where is my base payment, amount financed, term and interest rate?

Finance Manager shows them to you.

You: Is there a prepayment penalty if I finance with you?

If there is no prepayment penalty, proceed with considering their menu options.

These are products you might see on the menu, and questions to ask:

Finance Manager shows you payments

You: (If you don’t see actual product price) Please write the actual product price next to each one.

Finance Manager: It just changes your payment by this much.

You: I see that, but I want to see the actual price of each product to help me make a good decision.

At this point, negotiate prices down on any products you want.

Finance Manager: OK, sign here and here and here.

You: Please print my Bank Contract and Purchase Order first so I can go over them.

Go over each line of your itemized Purchase Order and make sure the bottom line (amount financed) on both documents match!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Check us out on YouTube at the CarEdge main channel and our daily Ray and Zach LIVE SHOW.