CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Navigating the 2026 car market can be a daunting task, especially for the unprepared. Knowing which cars are most negotiable, and which command the highest price premiums, is a valuable piece of information. When buying a car, knowledge truly is power. A critical piece of this knowledge is understanding the Market Day Supply (MDS).

MDS is a measure of the number of days it would take to sell all of a particular model of car, based on the current sales rate, assuming no additional inventory is added. A high MDS suggests an oversupply, potentially giving buyers leverage for negotiation, while a low MDS might indicate a seller’s market, where negotiating could prove tougher.

Using CarEdge Pro, we identified which new cars have the most and least inventory available in February 2026.

Why does inventory matter to car buyers?

Inventory influences negotiability. When there’s a glut of cars, dealers will be more inclined to negotiate with you. Slim pickings? Not so much. This valuable insight can give you an edge in your car buying journey, helping you save money and avoid the hassle.

Here are the fastest and slowest-selling cars and trucks in America right now.

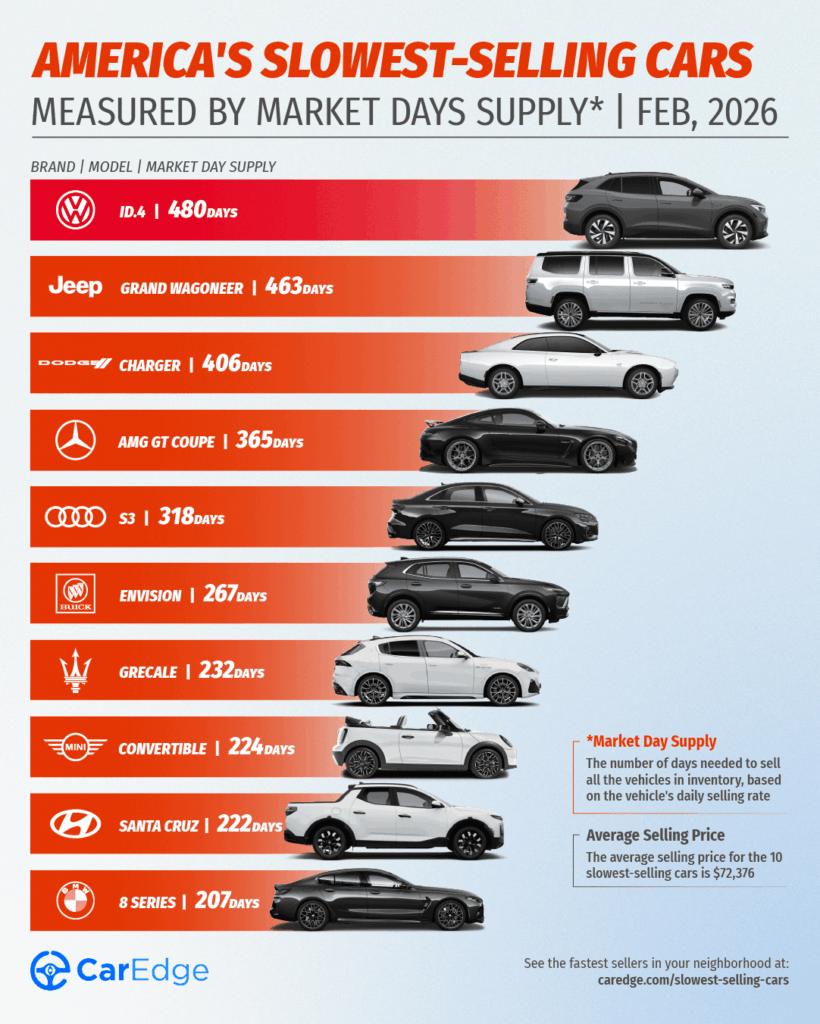

These are the slowest-selling cars in the U.S. right now. At the top of the list, the Volkswagen ID.4 is the slowest-selling car in America in February. Three Stellantis models are the top 10, including the Jeep Grand Wagoneer in second place with nearly eight months of inventory at current selling rates.

The average selling price for the 10 slowest-selling cars is $83,240 in February 2026, an increase largely due to the presence of the AMG GT and BMW 8 Series in the top 10 this month.

Here are the 10 slowest-selling new cars, in other words, the models with the most inventory today.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 480 | 1,482 | 139 | $49,534 |

| Jeep | Grand Wagoneer | 463 | 4,510 | 438 | $85,252 |

| Dodge | Charger | 406 | 5,721 | 634 | $56,595 |

| Mercedes-Benz | AMG GT Coupe | 365 | 778 | 96 | $153,666 |

| Audi | S3 | 318 | 552 | 78 | $58,862 |

| Buick | Envision | 267 | 11,337 | 1,910 | $40,994 |

| Maserati | Grecale | 232 | 583 | 113 | $85,649 |

| MINI | Convertible | 224 | 1,979 | 398 | $44,871 |

| Hyundai | Santa Cruz | 222 | 10,474 | 2,120 | $36,439 |

| BMW | 8 Series | 207 | 1,990 | 432 | $111,895 |

There’s BIG potential for deals on any of these cars, but only with negotiation know-how.

👉 See local fastest and slowest sellers [free tool]

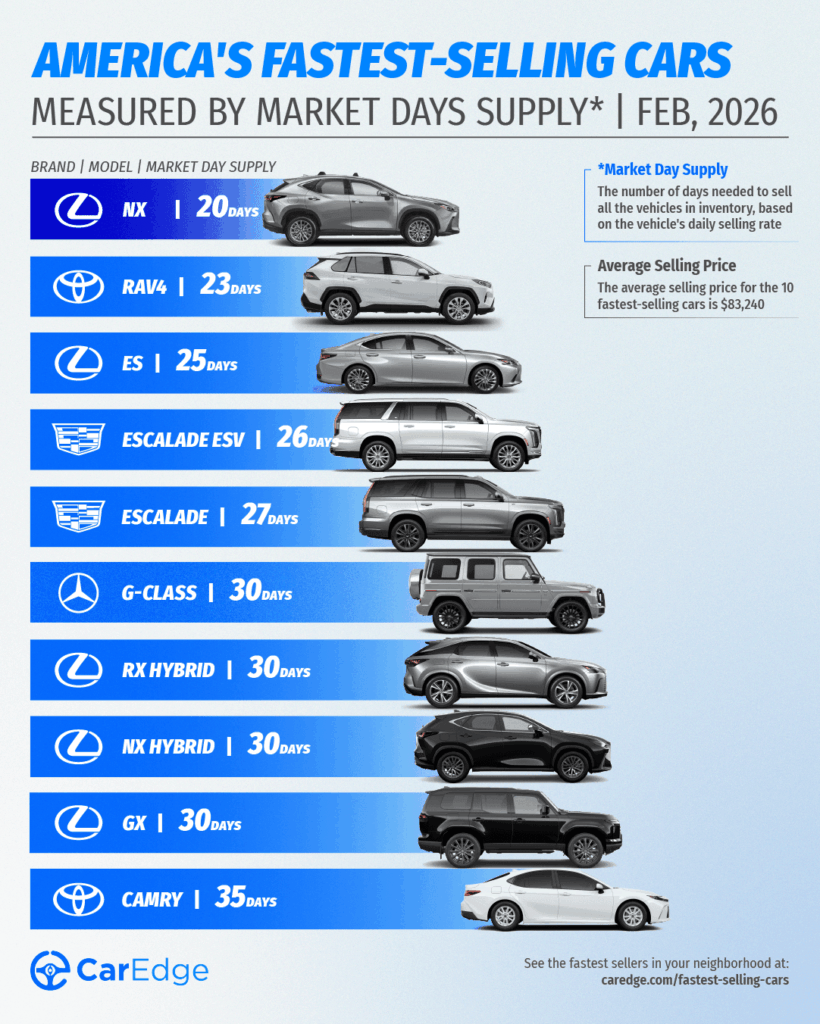

On the other side of the coin, these are the fastest-selling cars today. This month, seven of the fastest-selling cars are Toyota models. The Lexus NX is in the top spot, with just 20 days of market supply. The revamped RAV4 is in second place, and the Lexus ES very close behind.

The average selling price for the 10 fastest-selling cars is $72,376, the highest average on record. The sudden spike is due to the quick-selling Mercedes-Benz G-Class, Cadillac Escalade, and Escalade ESV on the list this month.

Here are the fastest-selling cars in America in February:

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Lexus | NX | 20 | 1,618 | 3,650 | $51,503 |

| Toyota | RAV4 | 23 | 23,903 | 46,640 | $37,389 |

| Lexus | ES | 25 | 1,838 | 3,278 | $50,380 |

| Cadillac | Escalade ESV | 26 | 994 | 1,695 | $127,407 |

| Cadillac | Escalade | 27 | 1,795 | 3,026 | $125,746 |

| Mercedes-Benz | G-Class | 30 | 937 | 1,417 | $204,981 |

| Lexus | RX Hybrid | 30 | 4,914 | 7,420 | $64,374 |

| Lexus | NX Hybrid | 30 | 2,511 | 3,796 | $54,465 |

| Lexus | GX | 30 | 2,378 | 3,593 | $80,947 |

| Toyota | Camry | 35 | 31,472 | 40,991 | $35,209 |

👉 See local fastest and slowest sellers [free tool]

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download.

👉 Know before you buy! Estimate your future insurance costs with our free car insurance calculator. We’re here to help!

By Zach Shefska, Co-Founder & CEO of CarEdge

Spending $50,000 should be fun, exciting, and rewarding. Sadly, for both consumers and car dealers, the car buying process is typically the opposite. Riddled with inefficiencies and frustrations, the age of AI presents an opportunity to redefine retail automotive sales.

Trust between buyers and sellers is at an all-time low. In Gallup’s annual trustworthiness of profession survey, car salespeople consistently rank at the very bottom. In the most recent poll, only 7% of Americans reported that they trust car salespeople to have high honesty and ethics. It’s no surprise then that many shoppers dread stepping into a showroom. Lack of transparency on pricing, confusing add-ons, and high-pressure tactics have made the process feel adversarial.

Not only does this broken status quo tarnish dealers’ reputations, it also hurts their bottom line. Consider the fact that the turnover rate for dealership sales consultants is nearly 72% (double that of other roles at the dealership). Dealerships are unable to retain their sales staff. Why? The quality of life for a sales consultant in a dealership can be poor, and while the pay can make up for it for a while, it is untenable for many long-term.

Ask any dealership sales team about their pain points, and they’ll inevitably mention lead bloat – a flood of online leads and inquiries, most of which go nowhere. Third-party listing websites and lead generators grew quickly as retail auto sales transitioned online in the mid to late 2000s. These websites often blast the same customer inquiry out to multiple dealerships, creating a frenzy where five stores chase one lukewarm prospect.

The result is wasted time and money: the average dealership converts only about 2% of its third-party leads into sales, however third-party leads make up a significant amount of total lead volume. That means salespeople must sift through countless inquiries to sell just one car (or dealerships invest in expensive business development centers, adding to their already high cost infrastructure).

The incentives in today’s system are misaligned – many third-party platforms profit from quantity of leads, not quality of outcomes. Dealers and OEMs end up paying for lots of noise and very little signal. This traditional model leaves everyone dissatisfied. Consumers feel pestered and distrusted, and dealers waste resources chasing ghosts.

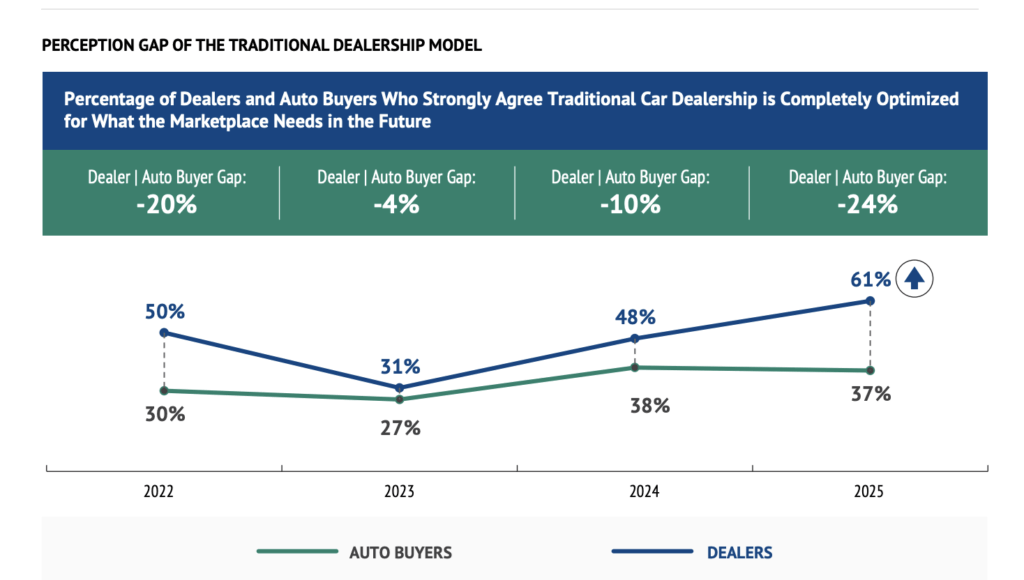

It’s no wonder then that this paradigm has led to the largest gap between dealer and consumer expectations, ever. In 2025, 61% of dealers believe buying a car from a dealership is “completely optimized,” whereas only 37% of consumers agree. There is a lot of work to be done to close this gap, and improve the overall experience for the entire marketplace.

Is there a better way? I believe so, and AI will usher in change at an unprecedented rate.

A recent survey found that 25% of consumers are already using tools like ChatGPT to assist them in purchasing a vehicle, and that 40% of consumers say they will use AI tools to support them in their future vehicle purchases. AI adoption at dealerships is significantly higher (albeit nascent in scope), with nearly 90% of dealerships reporting that they have already deployed AI at their store.

Let’s start with third-party shopping websites. These platforms are incentivized to keep users scrolling through thousands of listings, with dealers and OEMs paying fees for sponsored placements and advertisements. Their user experiences are optimized for form fills and lead submissions with dark UX patterns encouraging users to submit more and more leads – quantity over quality.

Think of your own search behavior for a moment. Before LLMs, you likely scrolled through the first page of results on Google to find the blue link you wanted to click on. How do you search now? You use AI Mode, or type a question into ChatGPT. There’s a reason why Google search traffic is falling for publishers, and it’s because there is a fundamental shift in how consumers access information.

The same is true for retail automotive. Third-party car shopping websites will evolve to look more like ChatGPT. Imagine an intuitive interface where you can ask questions, share input, and ultimately be presented with options that work for you. AI will change how consumers research and ultimately decide on the vehicle they want to purchase.

Dealerships will spend less time explaining features and capabilities – customers will have vetted that information with their AI shopping agent first. Sales consultants won’t waste time chasing leads that aren’t in the market to shop – instead they’ll get notifications from buyer’s AI shopping agents that the customer is ready to purchase. Because consumers will be more educated and empowered before contacting a dealership, we will see a fundamental shift in the leads business away from quantity and towards quality. This is good.

Agentic AI presents a compelling use case for consumers and dealers to hand off even more of the rudimentary grunt work of car buying as well. Why would I go to the dealership and haggle with the salesperson when my AI shopping agent can do it for me? As a dealership operator, why would I employ a sales consultant and sales manager to negotiate with an AI agent? I wouldn’t. For these customers, AI agents will handle it instead.

Agentic commerce means agentic commerce. Agents representing both consumers and dealers will engage with each other. Cost infrastructure will come down and time will be given back to the humans previously in the loop.

Buying a car is one of the few purchases consumers engage in that requires negotiation. Salespeople and sales managers negotiate every day, but customers do it once every three to five years. Negotiations are a dreaded (and time consuming) part of the buying process and a perfect example of where agentic AI can level the playing field, increase efficiency, and drive positive outcomes.

At CarEdge we’re already seeing the beneficial impacts of agentic AI for both sellers and buyers. Consider the story of Thomas. He came to CarEdge in June looking to purchase a Honda Accord. Thomas’ AI agent contacted numerous dealerships in his area that all had the vehicle he was interested in, right down to the specific trim and options.

While Thomas was at work, his AI agent engaged with the dealerships and ultimately, after 13 messages back and forth with one dealer in particular, achieved an out the door price of $36,900. The initial out the door price quote was $38,180.

Thomas went in that afternoon and purchased the vehicle. Thomas saved time, and $1,280 thanks to his AI agent. This is how agentic commerce is already influencing retail automotive.

How does the entire automotive ecosystem win with agentic AI? It’s simple. Data.

Car prices are notoriously opaque. The only way to really know what you are going to pay for a car is to contact a dealer and get an out the door price quote. The FTC and states’ attorney generals have gone after myriad dealerships over the years for bait and switch pricing and forced add-ons. However the practice is still prevalent, and in many cases, it’s a cost of doing business.

Take for example this Nissan Rogue for sale in Florida.

The online advertisement is hard to decipher, however it appears the price is $32,415.

Upon contacting the dealership, the price is actually:

$34,239 (plus tax/title/fees & payoff – whatever that is in this case). How and why did the price increase by nearly $2,000? Who knows. But this is all too common in retail automotive.

These practices obviously frustrate and confuse customers, however they also harm dealers who are reputable and don’t play games. Andrew Wright, Managing Partner at Vinart Dealerships shared his frustrations on X:

“I inquired about what this major 3rd party classified listings company was doing to police their platform for dealers engaging in deceptive pricing practices. The answer in short: NOTHING… All of the major classified listings platforms (Cars Commerce, Autotrader, CarGurus, Carfax, etc.) know that this is going on and they are doing NOTHING to stop it. In fact, they are REWARDING this behavior by affixing “great deal” badges on cars with deceptively low pricing.”

How do AI agents solve this problem? It’s simple. They collect, organize, and retain complete pricing data to bring unparalleled transparency. Currently, there is no third-party collecting accurate data on vehicle pricing (including dealer fees and add-ons). There have been some nascent attempts to flag bad actors (i.e. Markups.org and online review websites), however their scope and efficacy is limited, and we all know that consumers and dealers are equally capable of leaving bad reviews that stretch the truth. Pricing transparency isn’t just good for customers, it’s a competitive edge for honest dealers. AI helps surface trustworthy dealers in a crowded market and rewards them with more sales.

AI agents flip the script. Instead of relying on human beings to get out the door pricing and then manually enter that information into some sort of crowd-sourced database, AI agents are able to automate this process, removing any potential biases.

At CarEdge, our car shopping agents have been deployed 10,000 times since launch in late July, and we have collected data on thousands of dealerships. Want to know which dealer is adding “mandatory” nitrogen tire fill for $399 to all of their vehicles? We know it. Want to know which dealers are not playing games and leading with transparency? We have it.

AI agents level the playing field for consumers and dealers. Publishing and sharing this data will bring transparency unlike ever before, and will challenge the industry to operate more efficiently and fairly for everyone involved. Again, this is only possible thanks to agentic AI.

Artificial intelligence’s impact on retail auto will be profound (and it already is). From vehicle research and selection, to negotiation and pricing, agentic AI brings much needed transparency and efficiency to an industry that desperately needs it.

For consumers, the car buying experience is about to get radically easier. For dealers and OEMs, the ones who embrace this new model won’t just survive, they’ll lead. The age of agentic AI is here, and it’s time we start building with it.

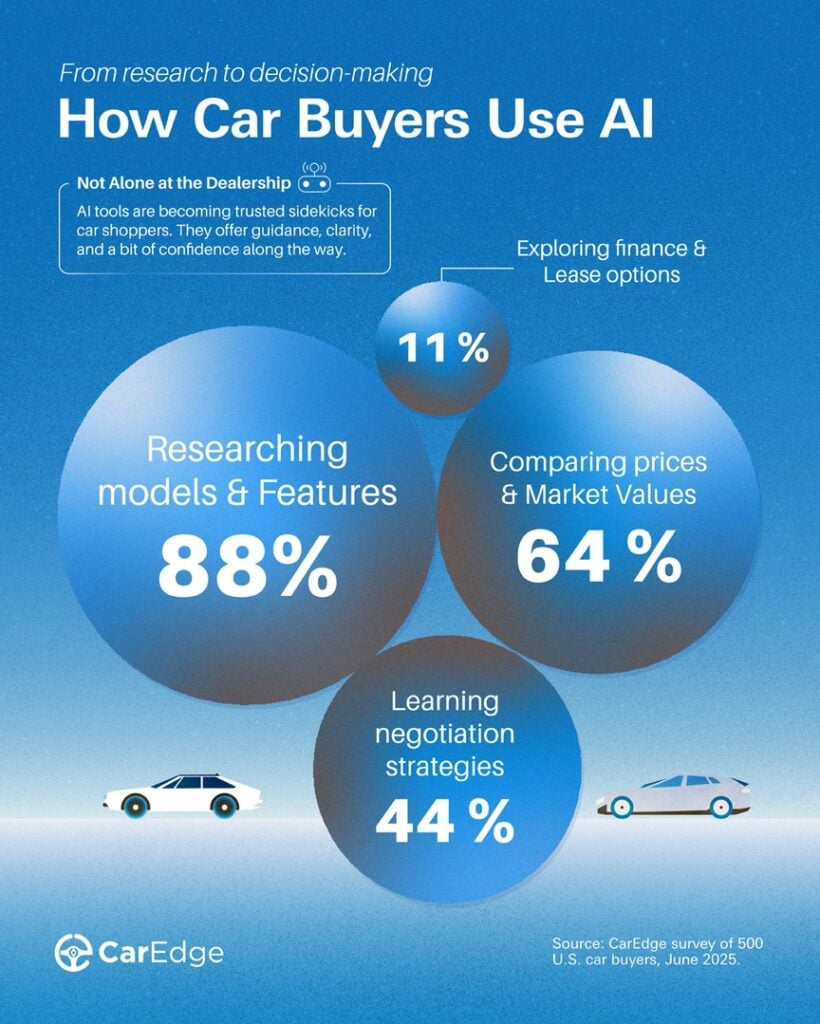

Artificial intelligence is changing the way Americans buy cars, and it’s a transition that is happening quickly. In the first-ever survey of its kind, CarEdge asked 500 car shoppers if they’re using AI tools like ChatGPT to research, compare, and negotiate during the car buying process.

The results confirm a major shift is underway. One in four car buyers in 2025 is already using AI tools to gain an edge, and future buyers are even more likely to embrace these technologies.

Car buyers are finding AI to be a valuable tool. Among those who used tools like ChatGPT, Perplexity, Google Gemini, and others, 88% said it was helpful. AI is quickly becoming a trusted co-pilot for car buyers.

This report offers the first data-backed look at how AI tools are reshaping the car buying experience. For the automotive industry, the message is clear: buyers are more empowered than ever — and they’re bringing AI to the dealership.

The 2025 CarEdge AI & Car Buying Survey reveals a clear and growing trend: AI tools are quickly becoming part of the car buying process for a significant portion of consumers. Here are the standout findings:

25% of car buyers in 2025 say they used or plan to use AI tools like ChatGPT during the shopping or buying process. This contrasts with a recent survey by Elon University that found 52% of Americans now use AI large language models. While signs point towards increased adoption of AI tools, the CarEdge survey found that most car buyers are still in the early stages of integrating these tools into high-stakes decisions like vehicle purchases. This suggests there’s still significant room for growth in AI adoption amongst car buyers.

Among those who haven’t bought a car yet this year, 40% say they are using or plan to use AI tools during their search or deal-making. This is nearly 3x higher than the 14% seen among those who already bought a car earlier in the year.

Among those who used AI:

Of the respondents who had already leased a car in 2025, none reported using any AI tools.

AI adoption among car buyers is still in its early stages, but clear trends are beginning to emerge.

Just 14% of those who already bought a vehicle this year used AI tools during the process. Adoption rates were nearly identical across new and used buyers, with 14% in each group saying they used AI tools.

The numbers jump significantly when looking at those who haven’t yet bought in 2025. Among this group — who represent 39% of total respondents — 40% say they either already use or plan to use AI tools during their car search and buying process.

That’s more than triple the current usage rate among recent buyers, suggesting AI adoption is accelerating as awareness grows and tools become easier to use.

This group also appears to be more proactive: 60% of those who used AI tools during their buying journey said they used them “a lot,” while 40% used them only occasionally.

AI tools are quickly becoming essential research companions for car shoppers looking to make more informed, confident decisions. After all, why go it alone when a wealth of automotive knowledge powered by large language models (LLMs) is right in your pocket?

Among buyers who used AI tools during their car purchase or lease process, here’s how they put them to work:

The most common use by far, AI tools helped buyers learn about different models, trims, features, and reliability. For many, it was like having an always-available expert to explain the pros and cons of their options.

Buyers used AI to better understand fair pricing, from invoice pricing to out-the-door.

Nearly half of AI users leaned on these tools to prepare for conversations with salespeople. Whether role-playing negotiation scenarios or asking how to spot add-on fees, this group used AI to level the playing field at the dealership.

A much smaller portion of buyers used these tools to become familiar with leasing vs. financing, how to calculate payments, and similar queries.

Car buying has always been tilted in favor of the dealership. Information asymmetry — what the dealer knows versus what the customer knows — has long been the source of consumer frustration, confusion, and overpayment.

That dynamic is beginning to shift.

This survey confirms what many in the industry are only starting to realize: AI is giving car buyers the upper hand. Tools like ChatGPT are helping consumers cut through the noise, ask smarter questions, and avoid common dealership traps. Instead of relying on guesswork or scattered advice, buyers are turning to AI for fast, personalized guidance at every step.

But one auto industry veteran has words of caution for buyers relying heavily on AI tools.

“It’s both surprising and a little scary to see how quickly people are turning to AI to guide such a major financial decision,” said Ray Shefska, Co-Founder of CarEdge. “While tools like ChatGPT can be powerful, they’re only as good as the data behind them. AI should complement your research, not replace your own critical thinking.”

That perspective underscores the real takeaway of this report: AI works best when it’s used thoughtfully as a tool, not as a crutch. In an age where automation raises fears of job loss or decision-making without human oversight, this survey offers a more optimistic view — one where technology helps everyday consumers make smarter choices. Used wisely, AI can help level the playing field and bring more transparency and fairness to the car buying experience.

This survey was conducted by CarEdge between June 19 and June 24, 2025. A total of 500 U.S. respondents participated, recruited through the CarEdge email newsletter and social media channels. Questions were tailored based on buying status to better understand how and when AI tools were used in the car shopping process.

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence.

With trusted resources like the CarEdge Research Center, fair pricing tools, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry.

Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights. Join the CarEdge Community to connect with car buyers and sellers nationwide.

Contact for Media Inquiries:

[email protected] | www.CarEdge.com

CarEdge, the best place to buy, sell, and own a car with confidence, recently surveyed 408 U.S. drivers to better understand how consumers are navigating the car market in 2025. The survey, conducted from May 16 to May 19, comes at a pivotal time. Following the implementation of U.S. auto tariffs on April 3, car prices, interest rates, and inventory levels have all been in flux. With uncertainty growing, CarEdge sought to answer a critical question: how are real drivers adapting their car buying behavior?

Survey participants represent a broad cross-section of car shoppers and owners, from those who’ve recently purchased to those holding off for the foreseeable future. The full survey is available at CarEdge.com. Below, we break down the most important findings from this May 2025 snapshot.

The survey responses paint a picture of a divided car market, shaped by mixed economic signals and widespread caution. Among all respondents, 16% reported purchasing a car after the April 3 tariff announcement, while another 12% said they had bought a vehicle shortly before the tariffs went into effect. A much larger share (52%) said they are still actively shopping for a car, while 20% said they have not purchased a vehicle in the past six months and do not plan to buy one in 2025.

Tariffs have clearly impacted perceptions. Interestingly, among those who bought their car before April 3, 38% acknowledged they made the purchase early specifically to avoid the risk of higher prices. Among those who purchased after April 3, 16% said they believe they paid more due to the tariffs, with the vast majority of post-tariff buyers (84%) saying they believe they did not pay more.

Looking ahead, half of respondents are still planning to buy a car before the end of 2025. Of those future buyers, about a third plan to purchase new, another third are shopping used, and the remaining 30% are still undecided.

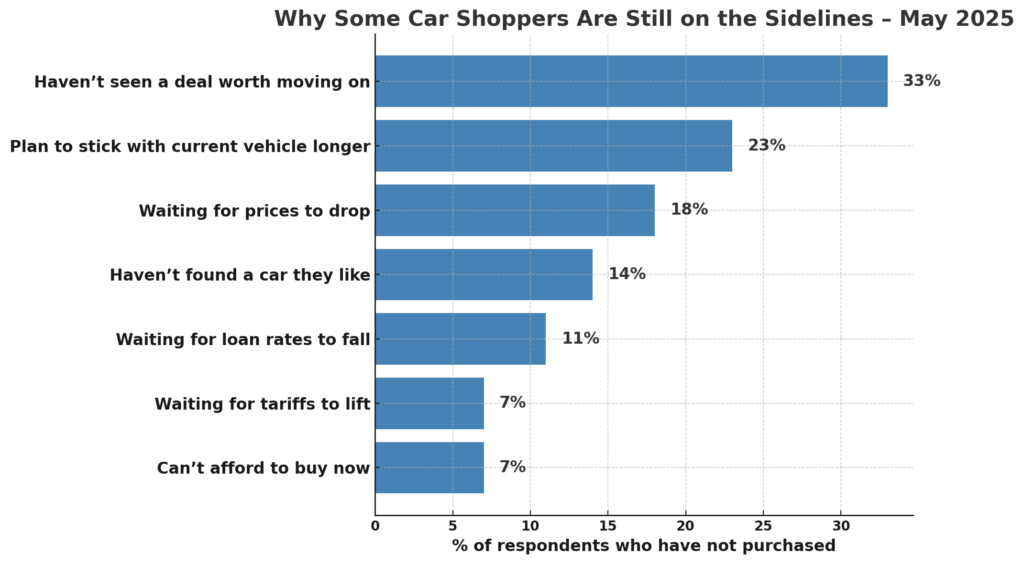

When it comes to what’s keeping people on the sidelines, affordability challenges and a lack of compelling deals top the list.

These are the barriers to buying (as a percent of all respondents who have not purchased):

With these top-line insights in mind, we next explore specific groups within the survey to uncover how recent and future car buyers are thinking about today’s market.

Survey respondents who purchased a car in the six months leading up to April 3 offer another layer of insight. Among these buyers, 61% purchased new and 39% purchased used.

What stands out most in this group is that more than a third (38%) said they intentionally bought their car early to avoid potential price hikes from tariffs. For the remaining 62%, tariffs didn’t factor into the timing of their purchase.

Income again played a role in how buyers approached the market. Among households earning $200K or more, just 22% said they made their purchase early in response to the looming tariffs. Nearly half (48%) of buyers earning between $100K and $199K did the same. In contrast, 39% of buyers earning under $100K said they bought early to avoid tariff-related price hikes.

This suggests that low- to middle-income consumers were more likely to act on policy changes and proactively adjust their buying timeline. Higher-income households, on the other hand, may not have been as concerned about the possible impact of tariffs on car prices this spring.

For respondents who bought a car after the April 3 tariff rollout, the data reveals a blend of resilience and skepticism. Among this group, 81% purchased a new vehicle, while 19% opted for a used one.

Despite the added costs associated with the new tariffs on imported vehicles, most post-April 3 buyers didn’t feel the sting. A strong majority—84%—said they don’t believe they paid more as a result of the tariffs. Still, 16% acknowledged they believe they did.

Among buyers who purchased after the April 3 tariff implementation, a different pattern emerged. Higher-income households were more likely to believe tariffs increased the price they paid. Specifically, 27% of households earning over $200,000 said they believed they paid more because of tariffs. In contrast, only 11% of households earning between $100,000 and $199,999 felt the same. Meanwhile, 17% of buyers with incomes under $100,000 said they believed tariffs had raised their purchase price.

These results suggest that while tariffs haven’t universally discouraged buyers, those with tighter budgets and those with a keen eye on policy changes are the most attuned to their potential impact.

Among those still planning to buy a car in 2025, the data reveals a thoughtful and strategic group of shoppers. Less than half (44%) of active shoppers expect to make their purchase within the next three months, while a majority (56%) plan to buy later this year.

When it comes to what they’re looking for, 54% say they’re in the market for a new car. About 19% are shopping for used vehicles, while just over a quarter are still unsure.

As for why these shoppers haven’t yet moved forward, deal quality remains the leading barrier. Respondents were asked to select all reasons why they have yet to purchase in 2025. 50% say they haven’t seen an offer worth acting on, while 30% are waiting for prices to come down. Another 21% say they haven’t found a car or truck they like. A smaller group is holding out for lower loan rates (18%), while tariffs were cited by just 11% of active shoppers.

One-fifth of active shoppers said that their decision to keep their current vehicle for longer was a factor in delaying their purchase.

Looking at the income distribution of active shoppers, the data continues to reflect a largely middle-income profile. The majority fall between $50K and $149K in household income, suggesting that many of these buyers are financially capable, but remain cautious in an uncertain economy.

Among drivers who have neither purchased a car in the past six months nor plan to buy one in 2025, a few clear themes emerge. This group is not driven by fear of rising costs or policy uncertainty, but rather by satisfaction with their current vehicle, and a lack of appealing options in today’s market.

The majority of these respondents (71%) say they’re sticking with their current vehicle longer, a sign that many Americans are adopting a “wait and see” approach to the market. Beyond that, 23% haven’t seen a deal worth moving on, while 9% say they haven’t found a car or truck they like. Price sensitivity remains a factor, with 20% waiting for prices to drop and 14% holding out for lower loan rates.

Concerns about tariffs are present, but not widespread. Among those on the sidelines right now, the reasons cited are roughly the same for all income segments. About one quarter say that they’re keeping their current vehicle for longer, while roughly 20% say they haven’t seen any deals worth acting on yet. The third most common reason for sitting out today’s car market is waiting for prices to come down. Only 7% cited tariffs as one of their reasons for not planning to buy a car in 2025.

The 2025 CarEdge Consumer Survey shows that the American car market remains fractured and cautious in the wake of economic headwinds and new policy shifts like auto tariffs. While some shoppers are moving forward with confidence, many are hesitant, skeptical, or simply waiting for conditions to improve.

The overarching takeaway? The car market in 2025 is no longer defined by pent-up pandemic demand or rapid inflation. Instead, it is being shaped by deal quality, interest rates, and policy awareness. For automakers, dealers, and car buyers alike, understanding these shifting motivations is key to navigating what’s shaping up to be one of the most complex car buying environments in recent history.

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.

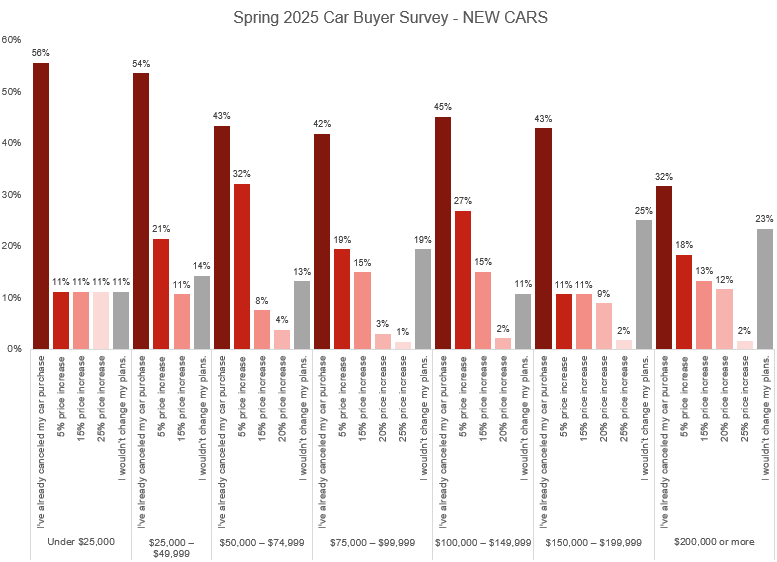

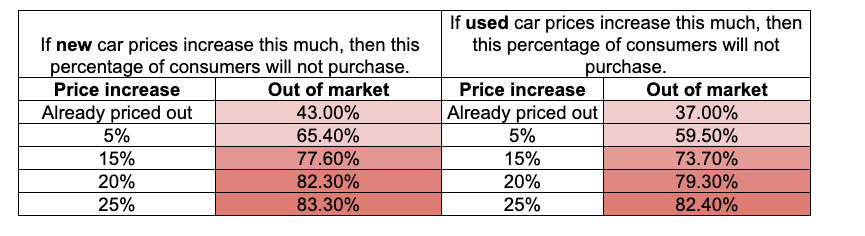

Amid a volatile market and looming auto tariffs, a new consumer survey conducted by CarEdge reveals that most Americans are unwilling—or unable—to tolerate further increases in car prices and monthly payments. The Spring 2025 Car Buyer Survey, which gathered over 400 responses from prospective new and used car shoppers, shows just how sensitive demand is to monthly payment hikes.

“These numbers make it clear: new car affordability is reaching a breaking point,” said Zach Shefska, Co-Founder and CEO of CarEdge. “If monthly payments increase even slightly, automakers are going to lose a huge chunk of their customer base.

From 2022 to 2024, incentives were increasing. Now, that trend is reversed, with incentives making up just 7% of the average transaction price. With auto loan rates averaging 9% APR for new cars, any decline in manufacturer incentives could spell trouble for buyers and sellers alike.”

The latest CarEdge Car Buyer Survey highlights a striking reality: car buyers at all income levels are reaching their breaking point.

Even middle-income households are feeling the pressure:

And while some might assume high earners are unaffected by today’s car prices, the data says otherwise:

“Car affordability impacts all households,” said Shefska. “Even six-figure earners are pushing back. That should be a wake-up call to automakers who have spent years increasing MSRPs and abandoning affordable (sub $25,000) vehicles.”

Across the board, households making over $100,000 per year are more price-sensitive than expected, with many drawing firm lines as affordability concerns mount. It’s not just new car shoppers who are reconsidering making a vehicle purchase. We see similar trends among used car buyers:

Shockingly, among households earning over $200,000 per year considering a used vehicle, one quarter say they’ve already canceled their purchasing plans. That’s the same percentage as those in the same income bracket who say they wouldn’t change their plans even if used car prices rose by 25%.

These findings come at a time when tariffs are threatening to push car prices even higher. The Trump administration’s recent pause on some trade duties does not include the automotive sector, where tariffs on imported vehicles remain in place.

“Any further price increases—whether from tariffs, panic buying, or other pressures—are likely to trigger a significant drop in demand,” noted Ray Shefska, CarEdge Co-Founder and used car sales veteran with 43 years of experience. “Automakers should think twice before pushing through further price hikes without offering offsetting incentives.”

The average new car transaction price is $47,962, according to Cox Automotive. A 5% increase in new car prices would send average transaction prices above $50,000 for the first time. Our data suggests that if that were to happen, 65% of would-be new car buyers would be out of the market.

Used Car Prices Are Not Immune

While the average used car is more affordable than a new one, used car prices are not insulated from the effects of rising new car prices. If tariffs or production constraints push new car prices even higher, many buyers will inevitably turn to the used car market—increasing demand and potentially driving up prices for pre-owned vehicles.

As of April 2025, the average used vehicle listing price stands at $25,180, well below the 2022 peak of over $28,000—but still high by historical standards.

“As demand shifts into the used market, we will see a second wave of price inflation,” Zach Shefska warned. “That could squeeze budget-conscious buyers even further and delay car ownership for many. We have already seen material price increases at dealer wholesale auctions, and we anticipate price increases to show up on the showroom floor quickly.”

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.Contact for Media Inquiries:

[email protected] | www.CarEdge.com

Negative equity, or owing more on a car loan than the vehicle’s market value, continues to rise as inflationary pressures and long loan terms take their toll on car buyers. CarEdge, in partnership with Black Book, surveyed 474 drivers in Q4 2024 to uncover the state of vehicle equity. Here are the highlights and the broader implications for drivers, car buyers, and the automotive industry.

👉 Download the complete report

In Q4 2024, 39% of drivers who financed their vehicles were underwater—up from 31% in Q3, a 25% jump. For cars purchased since 2022, the situation is even worse: 44% of these buyers owe more than their car is worth. As depreciation accelerates and long-term loans become the norm, the risk of negative equity continues to grow. This trend highlights a troubling financial burden on drivers and poses risks for the broader auto market.

Our survey reveals that 60% of drivers believe their car is worth more than its actual trade-in value. Of these, 18% overestimate by $5,000 or more, and 7% by over $10,000. This disconnect leads many to carry negative equity into their next car purchase, perpetuating financial strain.

When drivers attempt to trade in or sell their vehicles, they often face the harsh reality of lower-than-expected offers, which can derail their car-buying plans. Unfortunately, many choose to roll over the remaining debt into their next loan. This practice, while common, leads to higher monthly payments and extended loan terms, keeping buyers in a cycle of financial vulnerability.

Loan terms significantly impact vehicle equity. Borrowers with 84-month loans face a median negative equity of -$8,485, while those with shorter 36-month terms have a positive median equity of $7,783. While longer loans make monthly payments more affordable, they also leave buyers trapped in equity-negative positions for years.

For many buyers, the appeal of lower monthly payments outweighs the long-term risks. However, as loan balances decrease more slowly with longer terms, these borrowers are more likely to face financial strain when attempting to sell or trade in their vehicles. Buyers who opt for shorter terms and make larger down payments tend to build equity more quickly, putting them in stronger financial positions.

Electric vehicle owners face the highest negative equity rates, with 54% underwater and a median equity of -$2,345. This makes EVs particularly vulnerable compared to gas and hybrid vehicles, which are more likely to have positive equity.

The rapid depreciation of EVs is a key driver of this trend. EV technology can become outdated quickly as newer models with improved range, charging speeds, and driver assistance features enter the market. Additionally, concerns about costly battery replacements and limited resale demand have led many buyers to prefer new EVs with warranties and a known history, further impacting the resale value of used EVs.

For EV buyers, understanding depreciation trends and factoring in long-term costs is critical to avoiding significant negative equity. Opting for shorter loan terms and considering potential incentives or tax credits can help offset some of the financial risks. Buyers who plan to hold on to their EVs for longer than just a few years are less likely to be impacted by negative equity with their auto loans.

As we head into 2025, the issue of negative equity looms large for both consumers and the auto industry. For car buyers, rolling over negative equity into new loans can lead to long-term financial stress, reducing their purchasing power and limiting options. For the auto industry, high levels of negative equity could dampen trade-ins and slow new car sales, forcing automakers and dealerships to adjust their strategies.

Car dealers also face challenges when appraising trade-ins with negative equity. To close deals, dealers may need to discount new vehicles more aggressively or offer creative financing solutions, which can erode profit margins. Over time, high levels of negative equity in the market can disrupt the typical sales cycle

The Q4 2024 Negative Equity Report paints a clear picture of a growing issue in the car market. Drivers, car buyers, and the auto industry alike must address the challenges posed by rising negative equity.

CarEdge remains committed to empowering consumers with tools and insights to navigate today’s challenging car market. To avoid falling into the negative equity trap, car buyers should prioritize shorter loan terms, be familiar with expected car depreciation, and monitor used car values with tools like Black Book. Overcoming negative equity is possible when drivers make informed car buying and ownership decisions.