CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Ever heard the phrase ‘patience is a virtue’? In the world of used car buying, it’s more than just a virtue – it’s a strategy. With recent fluctuations in used car prices, knowing when to dive into the market can be the difference between an okay deal and a fantastic bargain. But when will car prices drop? As it turns out, the answer lies in understanding the data behind the trends. We’ll unpack the latest used car market update to reveal why the smartest buyers might want to play the waiting game.

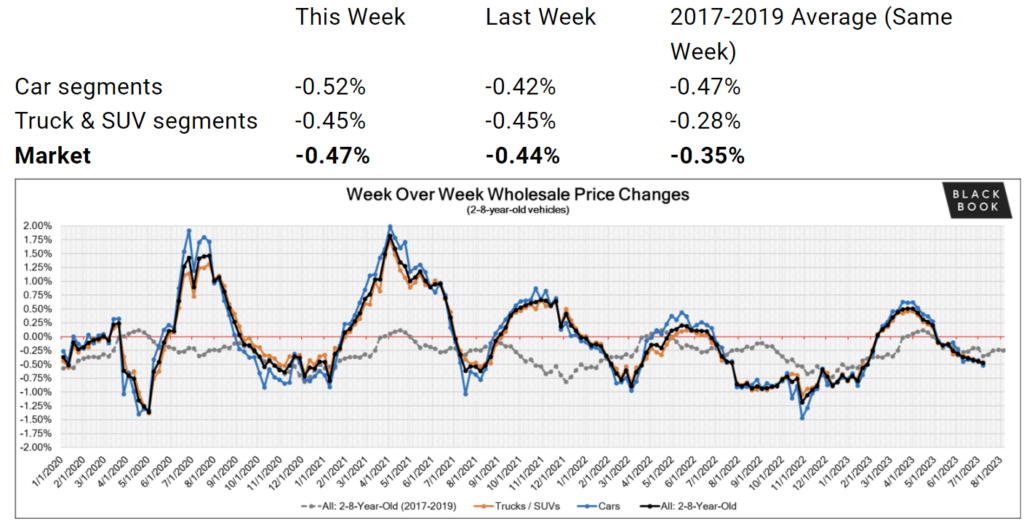

The latest numbers from Cox Automotive are making headlines. In June, wholesale used car prices dropped by -4.2%, with an overall decrease of -10.3% compared to the previous year. June’s decrease was an all-time record for the month, and is second only to the pandemic plunge in car prices during April of 2020.

Here’s where some of the headlines are missing the point: the sharpest declines are being seen at wholesale auctions. These are the auctions that the dealers themselves buy from, not where the average consumer will find their next ride. Surely wholesale price trends will be mirrored in retail prices quickly, right? Not so fast.

On the retail side, the used car price decreases have been more modest. Retail used car prices fell by just -0.5% over the last month, revealing an unsurprising mismatch between wholesale and retail trends. Let’s dig a bit deeper into that…

But why does this gap between wholesale and retail used car prices exist? Simply put, retail prices typically lag behind wholesale trends. This is due to the time it takes for changes in the wholesale market to trickle down and affect retail prices. Dealers want to squeeze every possible dollar out of their inventory, so it takes a while for market trends to finally be reflected in sticker prices (and negotiability).

Therefore, if you’re planning to buy a used car, it’s likely worth waiting 30, 60, or even 90 days. The drastic declines in wholesale auctions seen today will likely translate to better retail prices in the coming months.

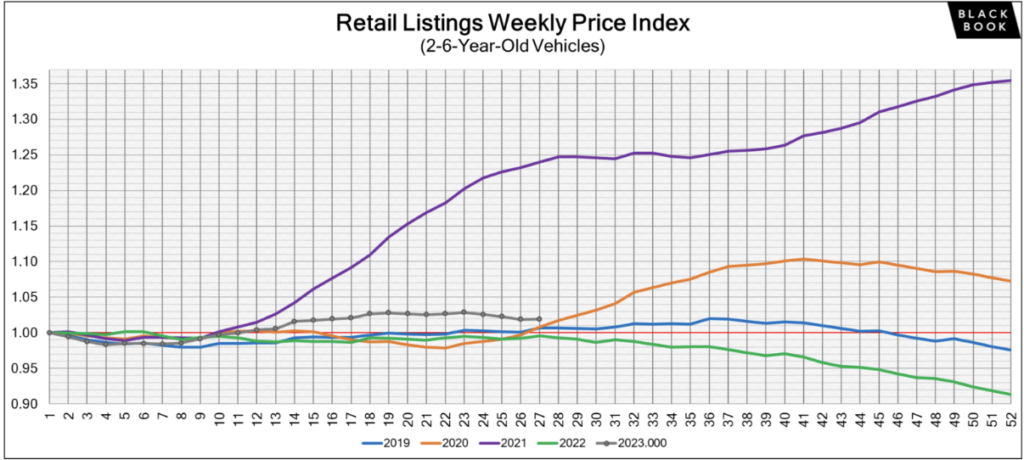

Why not now? Consider the following: We track used car prices weekly here with the help of Black Book. In the graph below, you can clearly see the marginal price movement on the retail side of the market. Retail used car prices in fact remain above where they started 2023.

In this next graph from Black Book, we see the more noteworthy price declines on the wholesale side.

Before you head to the dealership, know this: retail car prices typically lag behind wholesale price trends by one to three months. To save the most on your used car, we recommend waiting 30, 60 or 90 days for retail prices to really come down.

Rushing out to dealer lots today could cost you, as dealers today are very likely to ‘play dumb’ and hold off on lowering prices for as long as they can.

These changes don’t just affect buyers; they also have significant implications for those looking to sell or trade in their vehicle. The most immediate impact of falling used car prices is a decrease in trade-in values. If you’re certain about selling or trading in your car, it’s wise to complete the sale as soon as possible to get the best value.

Compare offers from trusted online buyers with CarEdge today before used car values plummet…

These price trends come alongside a decrease in retail sales for June and a continued rise in used car inventory. ‘Days supply,’ a common industry metric used to compare inventory while also factoring in the daily sales rate, continues to climb for most used vehicle segments. This means that more cars are available, but they are also staying on the lot longer.

Interestingly, the major vehicle market segments saw their seasonally adjusted prices remain lower year over year in June. Compared to June 2022, pickups and vans have fared better than most, losing 6.6% and 8.5% respectively. Sports cars took the hardest hit at 14.8% year-over-year, while compact cars lost 12.6%, and midsize cars dropped by 12.2%. When compared to last month, all segments were down, with compact and midsize cars experiencing the most significant declines.

The rapid fall in used car prices has put car dealerships in a tough spot. Dealers (and their lenders) are under a significant cash crunch. You’re not the only one borrowing money for your next car. Dealers themselves have to pay interest for every day a car sits unsold on their lot, creating a time-is-money dilemma. Car dealerships typically take out loans to purchase inventory at auction, and then pay interest on that loan until the car is sold. This hidden expense is called ‘floorplanning costs’, and they’re rising for dealers in a time of interest rate hikes.

They desperately want to make the most money possible from the sale of each car on their lot. This is their path to profits. However, quickly-changing market dynamics are throwing a wrench in their plans. As used car values fall quickly, dealers are finding themselves in a precarious situation.

Using the market analysis tools available through CarEdge Data, we identified the ten mainstream used cars with the MOST inventory today. These are the used cars that you’re more likely to negotiate a better deal with today.

| Make | Model | Days Supply | Total For Sale | Sold (45 Days) |

|---|---|---|---|---|

| Jeep | Grand Cherokee WK | 155 | 947 | 275 |

| Ford | F-350 | 123 | 1188 | 436 |

| Chevrolet | Impala Limited | 119 | 658 | 248 |

| Chevrolet | Bolt EV | 114 | 1913 | 753 |

| Jeep | Grand Cherokee L | 113 | 3653 | 1451 |

| Jeep | Grand Wagoneer | 110 | 556 | 227 |

| Audi | A8 | 106 | 692 | 294 |

| Ram | 1500 | 106 | 3535 | 1501 |

| Volkswagen | ID.4 | 105 | 675 | 289 |

| Audi | e-tron | 104 | 882 | 382 |

Are there really any surprises here? Trucks can’t sell right now, and just the other day we did a deep-dive into Jeep’s unprecedented glut of inventory.

In the weeks and months ahead, we fully expect to see more models reaching over 100 days supply on the used car market. Electric vehicles and trucks are piling up on dealer lots as we speak!

Negotiating will be tougher with these models in short supply. Note that this list is full of vans and SUVs. These family haulers remain in demand, but the good news is that van and SUV prices have fallen more than the overall market average in recent months. Follow our weekly used car price updates here.

| Make | Model | Days Supply | Total For Sale | Sold (45 Days) |

|---|---|---|---|---|

| Tesla | Model 3 | 55 | 4439 | 3635 |

| Toyota | Sequoia | 55 | 833 | 685 |

| Toyota | Sienna | 55 | 5938 | 4881 |

| Honda | Fit | 54 | 1961 | 1635 |

| Subaru | Ascent | 54 | 3567 | 2946 |

| Ford | Transit | 52 | 961 | 826 |

| Lexus | RX Hybrid | 52 | 804 | 692 |

| Chrysler | Voyager | 50 | 1555 | 1408 |

| Honda | Odyssey | 49 | 6272 | 5791 |

| Porsche | 718 | 49 | 505 | 464 |

There’s more money-saving data where that came from! Try CarEdge Data today to unlock the auto market insights dealers don’t want you to see.

While the current market might seem chaotic, let’s not forget that “patience is a virtue”. As we’ve seen, smart car buyers will benefit significantly from holding off for the next 30 to 90 days. This brief period of waiting will yield better deals and greatly increased negotiability as dealers become eager to offload their inventory. It’s not about being lucky – it’s about being patient and strategic.

To navigate the changing used car market, consider getting expert help from CarEdge. Our CarEdge Data plan provides you with up-to-date, behind-the-scenes market insights that can help you seize the best opportunities. Featuring the latest Black Book vehicle valuations, CarEdge Fair Price and official recommendation for every listing, and three CarEdge Reports per month, you’ll have the tools you need to secure a great deal.

Likewise, a CarEdge Coach can guide you through the process, ensuring you’re equipped with the knowledge and confidence to make the most out of your car buying experience.

Remember, the savviest of car buyers follow the data, not the headlines. Stay patient, stay informed, and get ready to snag that excellent deal on your dream used car soon!

In 2023, the automotive market continues to navigate the unpredictable seas of supply and demand. A lingering used car shortage from previous years is causing 2-3-year-old in-demand models to skyrocket in price, while new car inventories are bloating due to overproduction. What does this mean for you, the savvy car shopper? Let’s dive in.

The latest data from Cox Automotive shows that in many cases, there’s a shortage of 2-3 year old used cars. For in-demand models that are just a few years old, demand far exceeds supply. Dealers are using this to their advantage (to the surprise of no one…) and are marking them up severely. For the brands we’ll talk about below, 2-3 year-old used cars often cost nearly the same as a brand-new car. There’s a totally opposite situation for NEW cars. For many makes and models, there’s now an oversupply of new cars in 2023, just two years after the car shortages of 2021.

New car available supply (total vehicles on the lot) is up 71% since last year, and dealerships are finding their lots chock-full of shiny new cars.

In terms of days’ supply, today’s market is up 47% since spring 2022. Days’ supply is a common auto industry metric that is calculated by dividing the total number of available vehicles by the average daily sales number from the last 45 days. It’s one of many available insights for every new and used listing with CarEdge Data.

790,000 more vehicles on sale today compared to May 2022 means dealers are more motivated than ever to cut deals and move inventory. However, despite this surge in supply, the average listing price for a new car is still 5% higher than last year.

On the flip side, used car inventory is 13% lower compared to last year. High prices have led buyers to say NO to used cars, resulting in a 4% drop in sales rates and listing prices. However, these prices remain stubbornly above 2021 levels.

With brands like Toyota, Lexus, Kia, Honda, Subaru, Hyundai, BMW, and Land Rover, new car supply shortages are making used models a more attractive option than their new counterparts. How so? Dealers continue to markup these cars in many markets.

On the other hand, brands like Ford, Lincoln, Dodge, Ram, Chrysler, Jeep, and Buick are dealing with a glut of new cars, making new vehicles especially negotiable today, and offering more value than used inventory at nearly the same price AFTER negotiation.

Based on the latest new car inventory, these brands are most negotiable in 2023:

Nationally, these automakers all have current new car inventory well above the historical norm of 60 days’ supply. See local days’ supply for models you’re interested in with CarEdge Data on Car Search.

Using the tools available through CarEdge Data, we analyzed new car inventory by brand in the three largest markets across the nation. Some notable differences are seen across California, Texas, and Florida.

| Brand | Days' Supply (CA) | Days' Supply (TX) | Days' Supply (FL) |

|---|---|---|---|

| Toyota | 39 | 43 | 38 |

| Kia | 44 | 46 | 41 |

| Honda | 46 | 47 | 43 |

| Lexus | 45 | 50 | 45 |

| BMW | 53 | 67 | 57 |

| Land Rover | 70 | 65 | 64 |

| Subaru | 59 | 53 | 55 |

| Hyundai | 66 | 53 | 56 |

| Volkswagen | 63 | 63 | 56 |

| Cadillac | 60 | 57 | 63 |

| Chevrolet | 68 | 64 | 68 |

| Nissan | 65 | 59 | 54 |

| Mercedes | 73 | 68 | 69 |

| Porsche | 82 | 61 | 72 |

| Mazda | 62 | 68 | 68 |

| GMC | 77 | 72 | 73 |

| Audi | 89 | 72 | 62 |

| Acura | 72 | 81 | 60 |

| Genesis | 96 | 95 | 87 |

| Mitsubishi | 91 | 65 | 65 |

| Mini | 81 | 94 | 92 |

| Ford | 80 | 71 | 67 |

| Dodge | 101 | 84 | 92 |

| Lincoln | 104 | 72 | 72 |

| Ram | 147 | 116 | 132 |

| Infiniti | 94 | 88 | 73 |

| Chrysler | 106 | 86 | 87 |

| Jeep | 126 | 103 | 119 |

| Jaguar | 101 | 90 | 81 |

| Buick | 100 | 106 | 84 |

Hyundai, Nissan, Mitsubishi and Audi have much higher inventory on the West Coast, while Toyota, Kia and Honda have higher new car inventory in Texas. Be sure to check local market supply in your area to get the best sense of negotiability.

In terms of segments, compact cars, midsize cars, subcompact cars, compact crossover/SUVs, minivans, and full-size crossover/SUVs are experiencing a supply shortage.

Conversely, full-size pickup trucks, high-end luxury cars, electric vehicles, full-size cars, and uber luxury vehicles are enjoying a much higher days’ supply than average.

New car segments like vans, mid-size SUVs, most luxury cars and traditional hybrids have roughly average inventory right now.

Right now is a great time to be in the market for a new EV. Across all brands, there’s a nearly 90-day supply of new electric vehicles. This can be seen in models such as the Ford Mustang Mach-E, which now has over 150 days’ supply. That’s up over 100% since last year.

Tesla keeps lowering prices, and with the Model Y, has severely undercut prices for the following popular competitors:

In other words, there’s finally serious competition in the EV landscape. Is it a price war? So far, Tesla’s competitors have not fired back with steep price cuts of their own. We’ll see if that changes this summer. However, used Tesla prices have fallen drastically this year.

Remember, the EV tax credit landscape has changed in the past several months. Popular EVs from Hyundai, Kia, Audi and others no longer qualify due to made-in-America requirements. However the most popular electric vehicles in America, which are of course those bearing the Tesla badge, once again do qualify for the first time since 2019. Here’s an updated summary of where things stand with the EV tax credits.

Whether it’s better to buy new or used in 2023 largely depends on the brand and type of car you’re interested in. Industry-wide, new cars are looking better than they have in years. Popular brands are facing an oversupply, and with that comes greater negotiation power.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

With fluctuating inventories and prices, it’s crucial to stay informed and flexible. Use CarEdge Car Search to check the local days’ supply of the makes and models you’re interested in, and make sure to stay updated with the latest market trends to snag the best deal.

Dealer lot inventory is on the rise, but where are the deals at?! As we move further into 2023, many potential car buyers are wondering, “is now a good time to buy a car?” and “will car prices go down in 2023?” The good news is that recent market trends indicate that the tide is starting to turn, with car prices slowly beginning to decrease and negotiability on the rise. However, there are big differences between the new and used car markets today. Let’s take a closer look at the details.

According to CarEdge’s Ray Shefska, recent trends suggest that there’s good news for car buyers, with prices gradually decreasing and more room for negotiation on the horizon.

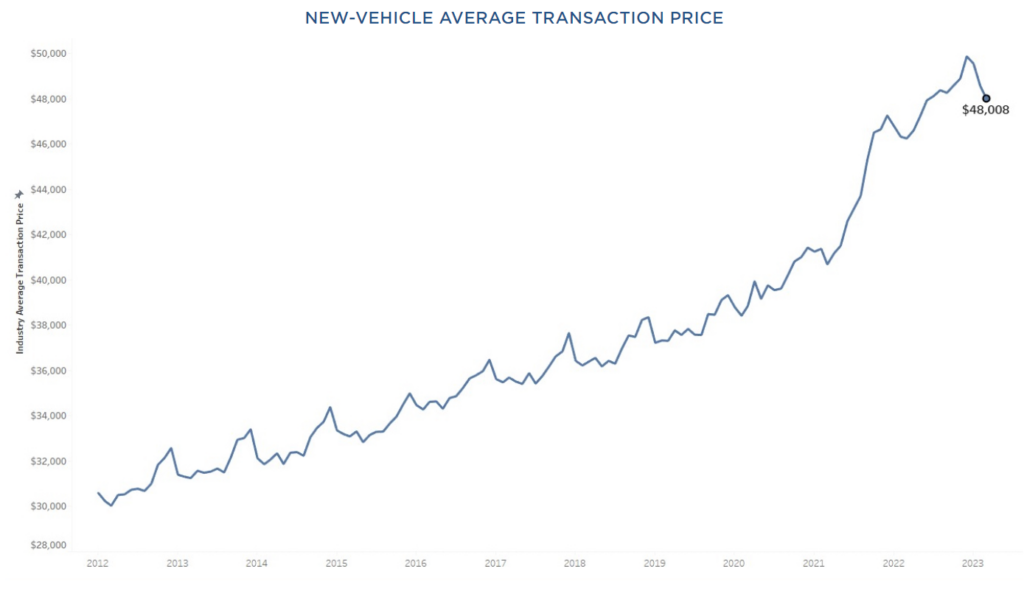

Ray notes that “March broke a string of 20 straight months where the average new car prices transacted at above MSRP, in March the average price paid was $171 below MSRP.”

“Although this drop might not seem significant, it’s a noteworthy development, indicating that dealerships are becoming more open to selling cars at lower prices,” he explained. Car manufacturers are increasing incentives to attract more buyers to the market, ultimately benefiting car shoppers.

CarEdge’s Car Coaches note that patience will be rewarded as we head into the summer 2023 car buying season. “Consumers who are patient will find themselves in a much better position as negotiability should increase as we get into the summer months.”

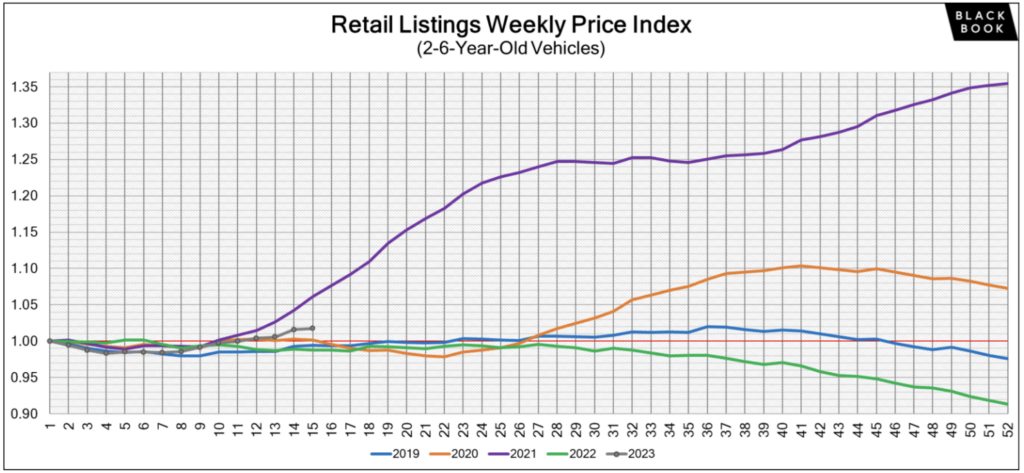

It’s important to note that there are considerable differences between the new and used car markets. New car transaction prices are steadily dropping as dealers try to move more inventory after years of nearly vacant lots. On the other hand, used car prices are increasing as of spring 2023. The latest used car price data from Black Book shows that after 30 weeks of wholesale price declines, used car prices have actually increased for the past several weeks. In April, used car prices increased at the retail level too.

CarEdge’s Car Coaches don’t expect rising used car prices to become a new long-term trend like we saw in 2021 and early 2022. However, there could be a month or two of additional slight price hikes.

We track used car prices weekly here.

How do rising interest rates affect car buying? Of course, buyers who finance are going to pay more in interest, no matter their credit score. But other things change too. Despite higher APRs, there can be benefits for buyers. Car dealers pay interest on lot inventory until it is sold. Think of dealer floor plan financing almost like a credit card made solely for purchasing vehicle inventory. When the federal reserve raises the cost of borrowing money, all kinds of credit will become more expensive, and that includes car lot floor-planning.

With higher floor plan costs, rising lot inventories and incentive spending on the rise, dealers will be motivated to negotiate. Therefore, the longer you can wait to buy a car in 2023, the more likely you’ll be able to negotiate thousands off of your deal.

See the best manufacturer incentives this month (updated)

Furthermore, Ray predicts that it will be a lot easier to secure a deal below MSRP as we get deeper into summer. In fact, the latest data from Kelly Blue Book shows that for the first time in two years, new-vehicle transaction prices fell below MSRP in March. The CarEdge Coaches expect that trend to continue.

Sadly, you and I are well aware that cars are far from cheap these days. The average price paid for a new car is still around $48,000. If you’re looking to go electric, expect to pay 20% more. Even in this market, our Coaches have proven even the toughest new and used cars are negotiable. Check out these success stories from happy drivers around the nation. CarEdge Coaches have even negotiated thousands of dollars off of EV prices in 2023.

We’re real people empowering you to save real money on your next auto. How can we help? Check out hundreds of 100% free resources, great YouTube videos, and the fastest-growing online auto forum today, the CarEdge Community. We just launched Dealer Reviews, where you can see nearly 3,000 crowdsourced car dealer and deal reviews.

Looking for behind-the-scenes auto market data to inform your buying decisions? That’s exactly why we created CarEdge Data. Unlock the Black Book car valuations that dealers use, CarEdge negotiation scores, official recommendations, and local market data for every car on CarEdge Car Search with CarEdge Data.

Ready for expert 1:1 help with your deal? Our Car Coaches are ready to work with you to secure the best deal on out-the-door prices, financing, and more. Learn more about our CarEdge Coach unlimited access plan. We look forward to meeting you.

Buying a new car is no simple task. Stepping foot into a dealership can sometimes feel like you’re entering a new world. The lingo, the slang, the terminology. It’s all intimidating. Not to mention the fact that engaging with many car dealers is like pulling teeth to begin with. Throw in foreign words, phrases, and jargon, and it can be even more challenging to feel comfortable and confident when buying a car. This is why we created The Car Buyer’s Glossary of Terms.

We took the time to compile a glossary of terms, acronyms, and jargon you should know before going into a dealership. Click on any of the links below to jump to a specific section in The Car Buyer’s Glossary of Terms. If you think we missed a word, phrase, or acronym that belongs on this list, please let us know in the comments below.

Without further ado, here is The Car Buyer’s Glossary of Terms.

An acquisition fee, also commonly referred to as a bank fee, only comes into play when you lease a car. This fee is charged by the leasing company to initiate the customers lease and is required on all leases. The lease acquisition fee usually includes GAP insurance to protect both the lessor and the lessee in case of vehicle damage resulting in a total loss. The acquisition fee can range from a few hundred dollars, to more than a thousand dollars. This depends on the leasing company and the car being leased.

Additional dealer markup, or market adjusted pricing, is a tool that dealerships use to increase the asking price for a particular vehicle. This is typically listed on the addendum sticker that is placed next to the Monroney sticker to reflect any dealer installed items and adjustments. This usually occurs on vehicles that are in high demand and short supply.

Annual percentage rate is as common a term in a car dealership as it is at your local bank. Commonly referred to as APR, the annual percentage rate represents the annualized interest rate on a loan (or credit) of any sort. Instead of getting an auto loan at 0.0000110 per day interest, you get a loan at 4% APR. The annualized interest rate is simply easier to understand and reference.

Car auctions represent the underpinnings of the retail car market. Registered car dealers can sell and buy cars at used car auctions across the world. Manheim is the largest used car auctioneer. Dealers have access to manufacturer sponsored auctions where dealers franchised to sell those brands can buy retired company cars and captive lender lease returns.

Blue book value refers to the often referenced price sourced by Kelley Blue Book (kbb.com). Kelley Blue Book is well regarded in the automotive industry, having their used-car pricing guide in publication since 1926.

Most car leases are of the “closed-end” variety. A closed end lease means that the customer is not obligated to purchase the vehicle, or guarantee the lease end residual value of the vehicle at the end of the term. This means the customer does not have to buy out the car at the end of the lease. With an open end lease the customer is obligated to guarantee the lease end residual value of the vehicle.

Dealer incentives and factory incentives are one and the same. They are the incentives that the manufacturer pays to the dealership, and dealership personnel in order to encourage the sale of certain vehicles. These incentives can also take the form of monthly and quarterly sales goals as determined by the manufacturer.

Customer incentives, such as rebates, special financing options, and discounted lease rates are what the manufacturer will advertise and underwrite. These are put in place to encourage the sale of certain cars.

A car’s Monroney sticker provides an overview of relevant information about a new vehicle. Not included on this window sticker are any dealer added accessories. For example, dealers may add aftermarket wheels, undercoating and other features that can raise the asking price above the MSRP. These modifications will appear on a secondary window sticker known as the dealer addendum sticker. This ensures that you, the buyer, have full clarity into what the car includes, and what came from the manufacturer as well as what the dealer added.

A dealership markup may refer to the difference between the price a dealer pays to acquire a vehicle (often the wholesale or invoice price) and the price at which they sell it to the end consumer. In some contexts, it can also refer to the markup added to MSRP by the dealership. See Market Adjustment.

The destination charge is part and parcel of a car’s MSRP, and is listed on the window sticker as a separate line item that makes up the total manufacturer’s suggested retail price. The destination charge is not something that dealers pass on to the customer. It is a charge that the manufacturer imposes.

The disposition fee is non-negotiable, and only charged to a customer when they return their lease car and do not lease or finance another car through that lender or leasing company. This fee is charged in addition to any excess wear and tear items that might be discovered at lease end. The disposition fee helps to mitigate the lenders cost to recondition, transport and register the car for sale at the auction.

This is a fee that the dealerships charge to help offset the costs of non-revenue producing dealership personnel such as accounting staff, title clerks etc. Most states cap the dealers as to how much they can charge for the documentation fee, and this amount varies from state to state.

As with any loan, the down payment represents the cash paid upfront to reduce the total size of a loan.

Another charge only applicable to leases, an early-termination fee is exactly what it sounds like, it is an additional charge for cancelling your lease before the term is over.

Yet another lease specific charge, excess wear charges are incurred on leased vehicles that (upon their return) contain dings, dents, scratches, tears, etc. At the lease-end inspection (click here to jump to lease-end inspection), you will be notified if there are any excess wear charges. This also includes if you exceed your allotted mileage for the term.

An additional product sold by the dealership, that is sometimes referred to as a service contract. It covers service and repair costs that may be incurred beyond the vehicle’s factory warranty.

One of three revenue generating sections of a car dealership, the finance and insurance department is where you’ll sign your paperwork for your new car. The F&I manager will walk you through all of the documentation of your purchase, as well as give you the opportunity to purchase additional products (extended warranties, tire and wheel protection, etc.)

The cost incurred by a dealer to purchase inventory in their dealership. More on dealership floorplanning can be found here, on the NADA website.

Exactly as it sounds, gap insurance provides supplemental coverage for the difference between the cash value of your car and the amount you owe your lender or leasing company at the time of a claim. For vehicles with steep depreciation, gap insurance can be an attractive option.

The proportion of a loan that you are charged for the privilege of being lent money.

The price a dealership pays the manufacturer for a vehicle they have purchased.

This is dealer slang for a customer who accepts the first offer during negotiations, or chooses to not negotiate at all.

Manufacturers offer limited (in terms of scope and term) warranties on their new cars. Terms can be as few as a year or two, and scope frequently does not include general wear and tear items like tires and wiper blades.

The lease end inspection is mandated by the leasing company. The inspection includes recording the miles on the odometer, inspecting the vehicle for excess wear and tear, including such items as tire wear, scratches, dents, dings and windshield damage, and confirming that no aftermarket accessories were added to the vehicle. Oftentimes the lease end inspection is done by dealership personnel on the lender’s behalf, or if a customer prefers, a third party inspection can be requested.

A car dealership market adjustment refers to an additional charge or discount applied to the manufacturer’s suggested retail price (MSRP) of a new vehicle. This adjustment is determined by the dealership and is based on various factors, primarily local demand and availability of a particular vehicle model. The market adjustment is always negotiable.

Market Day Supply (MDS) in the auto industry represents the number of days it would take to sell current vehicle inventory at the existing sales rate. It helps dealerships and manufacturers gauge demand and adjust production and pricing strategies. A lower MDS often indicates high demand, potentially leading to higher prices, while a higher MDS may result in discounts and promotions to accelerate sales. In a healthy market, you can expect MDS for mainstream models to be between 45 and 65 days of supply.

The money factor is utilized by the leasing company to establish the interest portion of a lease payment.

Also commonly referred to as a window sticker, the Monroney sticker is a federally mandated label on all new cars in the United States. Named for Almer Stillwell “Mike” Monroney, a U.S. senator from Oklahoma who sponsored the legislation in 1958, the Monroney sticker contains information on the MSRP, fuel mileage, country of origin and more. Ray wrote this guide to understand how to read a Monroney sticker.

The Manufacturer’s Suggested Retail Price is the factory’s recommended selling price for a vehicle. Nine times out of ten, a dealership does not sell a car for it’s MSRP. Most are negotiated below that amount, since the dealer can still make money.

The total cost to purchase a vehicle. Also sometimes referred to as the “on-the-road” price. This includes all taxes, fees, and the selling price of the vehicle.

A rebate is cash that is advanced to the customer by the manufacturer as an inducement for the customer to buy the car. In the vast majority of cases the customer opts to use the rebate amount as additional cash down on the purchase. The other option for the customer is to request that the manufacturer actually mail them a check for the rebate amount after the sale. This probably happens less than one percent of the time.

The residual value represents the expected value of a vehicle at the end of a lease term. Cars depreciate, and lease rates are determined based off of the expected residual value of a vehicle at the end of a term. Residual values differ for every car.

Generally synonymous with extended warranty (click here to go to extended warranty), a service contract is a dealer sold product that covers repairs or service beyond the manufacturer’s warranty.

Loans granted to individuals who have less than stellar credit scores. Typical subprime credit scores fall below 600. More on the credit scores car dealers use can be found here.

The duration of a loan or lease as agreed to in your contract. Typically anywhere from 24 to 84 months.

Issued by the Department of Motor Vehicle in each state, a title represents a vehicles proof of ownership. Note that if you finance your car the bank will hold the title (known as a lien) until the loan is paid off. Similarly, if you lease a vehicle, the leasing company will hold the title.

When you sell your vehicle to a dealership during the process of purchasing another car. The “traded-in” car’s value is put towards the sale price of the next vehicle.

Cars, trucks, and SUVs come with a dizzying array of options. Trim levels are manufacturer created tiers of standard equipment and options. For example a BMW 3 series comes in four trim levels; 330i, 330i xDrive, M340i, and M340i xDrive. The model is a 3 series, the manufacturer is BMW, and the trim level is the 330i, 330i xDrive, M340i, and M340i xDrive.

Also referred to as “being under water,” or “negative equity,” this term refers to when you owe the bank more money than the vehicle’s current value. A high percentage of people find themselves in this position when they go to trade their existing car in towards a new one, especially if they took out a lengthy loan.

A 17 digit identification number that is unique to each vehicle. A vehicle’s identification number will include codes for year, make, body style and engine. VINs are typically found under the windshield or along the door jambs of a vehicle.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!