CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

When it comes to the end of a car lease, you have a few different options for what you can do. To make the best choice possible, it’s important to understand a few factors that go into your options at the end of your car lease.

Deciding what to do at the end of a car lease depends mostly on how you feel about the car. Of course, your financial situation and inclinations also come into play. We’re about to explore each of the options available to you as your lease ends.

When you return your leased car, it will be thoroughly inspected, this is called the “lease-end inspection,” and it’s important to understand that you may be charged fees for excessive wear and tear to the vehicle. When you take your vehicle to the dealership they’ll be looking for:

Before you head for the dealership, you should ensure you have everything that came with the car to avoid additional fees. This means you’ll want to bring both sets of keys, make sure the spare tire is in the trunk, have the original floor mats in the vehicle, etc, etc.

If you plan to simply return the vehicle, you should also be prepared to pay the lease disposition fee, which is often around $400 (although the exact amount is on your lease contract). This fee is to cover the costs of reselling your leased car, and if you plan to return your vehicle (and not lease another vehicle from the same manufacturer) you cannot get out of paying this fee. If you went over your mileage allotment expect to get a bill sent to you, and if you’re terminating your lease before it’s over, expect even more fees (as well as the reality that you’ll still need to make your remaining lease payments).

Let’s say you want to return your car and then get a new lease. That is of course also an option, and one the dealership will be excited to help with. It’s likely that the dealership has contacted you in the months leading up to your lease-end to try and get you into a new lease already, and so by the time you show up to return your vehicle you may have already put together your new lease deal.

When you return a vehicle and then lease another from the same manufacturer they will waive the lease disposition fee. The vehicle you are returning will still need to go through a lease-end inspection, and you’ll face fees if you don’t have the second set of keys, or went over the allotted mileage.

You may be able to roll any lease equity over into a new lease as well. Lease equity is the positive equity created when your car is worth more than the residual value stated in your lease terms. Equity typically only occurs when you have severely under-driven the mileage stated on your lease, or when you simply get lucky because of an increased demand for your specific car.

For example, let’s say you lease a Honda Accord, and the stated residual value at the end of the term is $15,000. You lease it and barely drive it during the 36 month lease. You head to the dealership to return your current lease and move into a new Accord. When you arrive the dealership lets you know that the vehicle’s “book value” (how much they’re willing to buy it for) is $16,000. Rather than return the vehicle, you work with the dealer to buy it, trade it in, and roll over the equity ($1,000) into the new lease.

When leasing a car, many people decide to move into a new lease with the same dealership. While reasonable, you should shop around before jumping into another lease. Like we always preach, you should negotiate the largest dealer discount from MSRP before committing to a car deal. Learn how CarEdge can make negotiating your lease easy.

If you’ve enjoyed your leased car you always have the option of buying it outright at the end of your lease. You know exactly how much you’re going to pay for the car (the residual value set when you signed the lease contract), and you know everything about the vehicle (since you’ve been driving it for the past few years).

The residual price is in your leasing contract and was determined based on their estimation of what your car would be worth at the end of the lease. Comparing the residual value against the current market value is often the deciding factor for people considering buying their leased car.

For example, John leases a Toyota Prius, and at the time the contracts are drawn up, the manufacturer calculates that the Prius will be worth 58% (residual values are always represented as percentages) of its original MSRP. That means John can buy his Prius outright, at the end of the lease for $17,000 (remember, this is a hypothetical). Because of market conditions, and the fact that John only put 18,000 miles on the Prius, he knows the vehicle is worth $20,000 if he sold it to a private party, or $18,500 if he sold it to the dealer. These figures mean John should almost certainly buy the car since it’s $1,500 cheaper than the market rate.

However, if John’s lease comes to an end and the book value on his Prius is actually $15,000, John would be paying an extra $2,000 over his Prius’ market value if he bought it outright at the end of the lease. In this case John would be better off turning in the leased Prius and buying one elsewhere for $15,000.

Learn how to understand your lease contract [free guide]

One of the most challenging decisions people face when considering what to do at the end of a car lease is often the same decision that originally led them to their lease: should you lease it or buy it?

There are pros and cons to both options. Objectively considering both will ultimately help you decide what to do at the end of a car lease.

People decide to buy cars at the end of their leases all the time. There are many good reasons why. However, there are also a few notable drawbacks.

Pro:

Cons:

Buying a car usually makes more financial sense than leasing a car. One benefit of purchasing the vehicle that you’ve been leasing is that you know exactly how it’s been driven and maintained, as compared to buying a used car off the lot.

Some people are serial car leasers. They’d never want to commit to owning the same car for longer than a lease. Let’s take a look at some reasons why.

Pro:

Cons:

You may notice that these pros and cons lists are quite similar to the lists you might make before you first got into a lease. That’s because deciding what to do at the end of a car lease is similar to deciding to start a lease in the first place: lease a new car or buy the one you’ve been driving.

Deciding between the three lease end options detailed above can often be tricky. It typically comes down to how you feel about the car. If you love the way it drives and you want to keep driving it, buying it is usually the best option, even if the numbers say you should turn it in. Conversely, if you dislike driving it and you’ve been counting down the days, it’s probably best to turn it in and walk away.

Now you know what to do at the end of a car lease, but you still have homework to do. You need to determine the car’s current market value and compare it against the residual price. The difference between these numbers will help you decide what to do at the end of a car lease.

One thing you learn as you get older is that there’s no such things as an “easy way out.” Although, when it comes to ending your car lease early, you may have a few options. Depending on your circumstances, there are a few creative ways you can end your car lease early without hurting your bank account.

Car dealers, and their manufacturers are always looking for two things: ways to make money, and how to sell more cars.

If your lease isn’t due for another few months, but you really want to get into a new car, the odds are that a dealer is going to put their best foot forward to help you make that a reality. Why? Because they’ll make money selling the new lease, and they’ll sell another car. Both of those things benefit the dealer.

Although, this positive attitude needs to be taken with a grain of salt. Your current lease agreement is a legally binding document.

Getting a good deal on a car is all about leverage. If your lease isn’t due for 3 months, and you have a legally binding contract that says you’ll make the remaining payments, you don’t have too much leverage. With all this being said, there are some creative ways you can approach this situation. Let’s get into the weeds of how you can end your car lease early.

The short answer is “no.” The long answer is “probably.” Why do I say that? Because a lot of factors are in play.

First, how many monthly payments do you have left on your current lease? If you have less than three, the odds are high that the dealer and the leasing company will work with you to forgive your remaining lease obligations in exchange for getting into a new car (although there are caveats to this that we’ll cover below). On the other end of the spectrum, if you have six, eight, or twelve payments left on your lease, it is less likely that the dealer will have any interest in helping you out. Why would they? You’ve got a whole year’s worth of payments to continue making, and with each check you write, they make money.

Take a look at your original lease agreement and locate the termination date of the lease (the date you would return the car if you completed the lease). You can typically also find this information in your online payment portal. This date is the most important thing for you to keep in mind, and it’s the date that the dealership and the leasing company will be referring to when they consider how “friendly” they’ll be in forgiving your remaining lease payments.

To end your car lease early without penalty, you’ll want to research lease pull-ahead programs. Car lease pull-ahead programs are specific incentive programs that leasing companies create to entice prospective customers to lease a new vehicle. A lease pull-ahead program is your best option for ending a car lease early.

Leasing companies generally do not readily provide this information. Instead, each month the captive finance company (Toyota Financial Services, for example) will send it’s dealerships a list of new and ongoing incentive programs for customers.

These lists are huge, complex, and not particularly easy to understand. Within these monthly guidelines, dealers may find pull-ahead programs that are intended to incentivize customers to buy new cars. Keep in mind that incentive programs are different for each region within the United States. Two dealerships may have two very different incentive programs in any given month. This is partly why you don’t see lease pull-ahead programs advertised nationwide.

You can try and find this information online, although your best bet is to call your local dealership, or the leasing company itself.

At the end of the day, if you’re looking to end your car lease early you need to recognize that you have a legal obligation to fulfill the contract you signed. With that being said, you know that dealers and leasing companies want to lease you a new car, and you can use that to your advantage to ask for incentives and programs to help offset the remaining payments you have on your current lease.

In need of some assistance from auto lease experts? Learn how The CarEdge Team can help!

By Zach Shefska, Co-Founder & CEO of CarEdge

Spending $50,000 should be fun, exciting, and rewarding. Sadly, for both consumers and car dealers, the car buying process is typically the opposite. Riddled with inefficiencies and frustrations, the age of AI presents an opportunity to redefine retail automotive sales.

Trust between buyers and sellers is at an all-time low. In Gallup’s annual trustworthiness of profession survey, car salespeople consistently rank at the very bottom. In the most recent poll, only 7% of Americans reported that they trust car salespeople to have high honesty and ethics. It’s no surprise then that many shoppers dread stepping into a showroom. Lack of transparency on pricing, confusing add-ons, and high-pressure tactics have made the process feel adversarial.

Not only does this broken status quo tarnish dealers’ reputations, it also hurts their bottom line. Consider the fact that the turnover rate for dealership sales consultants is nearly 72% (double that of other roles at the dealership). Dealerships are unable to retain their sales staff. Why? The quality of life for a sales consultant in a dealership can be poor, and while the pay can make up for it for a while, it is untenable for many long-term.

Ask any dealership sales team about their pain points, and they’ll inevitably mention lead bloat – a flood of online leads and inquiries, most of which go nowhere. Third-party listing websites and lead generators grew quickly as retail auto sales transitioned online in the mid to late 2000s. These websites often blast the same customer inquiry out to multiple dealerships, creating a frenzy where five stores chase one lukewarm prospect.

The result is wasted time and money: the average dealership converts only about 2% of its third-party leads into sales, however third-party leads make up a significant amount of total lead volume. That means salespeople must sift through countless inquiries to sell just one car (or dealerships invest in expensive business development centers, adding to their already high cost infrastructure).

The incentives in today’s system are misaligned – many third-party platforms profit from quantity of leads, not quality of outcomes. Dealers and OEMs end up paying for lots of noise and very little signal. This traditional model leaves everyone dissatisfied. Consumers feel pestered and distrusted, and dealers waste resources chasing ghosts.

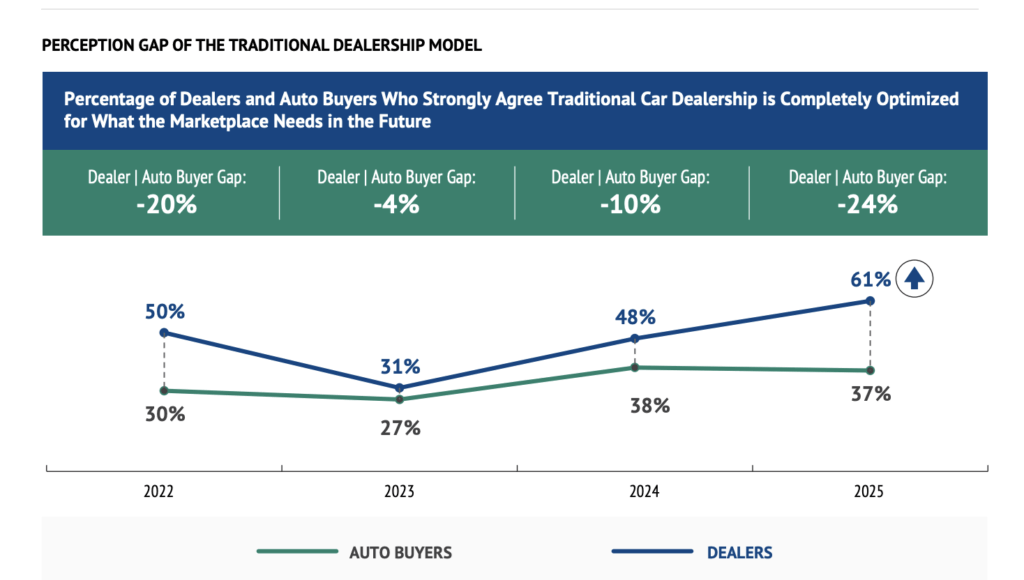

It’s no wonder then that this paradigm has led to the largest gap between dealer and consumer expectations, ever. In 2025, 61% of dealers believe buying a car from a dealership is “completely optimized,” whereas only 37% of consumers agree. There is a lot of work to be done to close this gap, and improve the overall experience for the entire marketplace.

Is there a better way? I believe so, and AI will usher in change at an unprecedented rate.

A recent survey found that 25% of consumers are already using tools like ChatGPT to assist them in purchasing a vehicle, and that 40% of consumers say they will use AI tools to support them in their future vehicle purchases. AI adoption at dealerships is significantly higher (albeit nascent in scope), with nearly 90% of dealerships reporting that they have already deployed AI at their store.

Let’s start with third-party shopping websites. These platforms are incentivized to keep users scrolling through thousands of listings, with dealers and OEMs paying fees for sponsored placements and advertisements. Their user experiences are optimized for form fills and lead submissions with dark UX patterns encouraging users to submit more and more leads – quantity over quality.

Think of your own search behavior for a moment. Before LLMs, you likely scrolled through the first page of results on Google to find the blue link you wanted to click on. How do you search now? You use AI Mode, or type a question into ChatGPT. There’s a reason why Google search traffic is falling for publishers, and it’s because there is a fundamental shift in how consumers access information.

The same is true for retail automotive. Third-party car shopping websites will evolve to look more like ChatGPT. Imagine an intuitive interface where you can ask questions, share input, and ultimately be presented with options that work for you. AI will change how consumers research and ultimately decide on the vehicle they want to purchase.

Dealerships will spend less time explaining features and capabilities – customers will have vetted that information with their AI shopping agent first. Sales consultants won’t waste time chasing leads that aren’t in the market to shop – instead they’ll get notifications from buyer’s AI shopping agents that the customer is ready to purchase. Because consumers will be more educated and empowered before contacting a dealership, we will see a fundamental shift in the leads business away from quantity and towards quality. This is good.

Agentic AI presents a compelling use case for consumers and dealers to hand off even more of the rudimentary grunt work of car buying as well. Why would I go to the dealership and haggle with the salesperson when my AI shopping agent can do it for me? As a dealership operator, why would I employ a sales consultant and sales manager to negotiate with an AI agent? I wouldn’t. For these customers, AI agents will handle it instead.

Agentic commerce means agentic commerce. Agents representing both consumers and dealers will engage with each other. Cost infrastructure will come down and time will be given back to the humans previously in the loop.

Buying a car is one of the few purchases consumers engage in that requires negotiation. Salespeople and sales managers negotiate every day, but customers do it once every three to five years. Negotiations are a dreaded (and time consuming) part of the buying process and a perfect example of where agentic AI can level the playing field, increase efficiency, and drive positive outcomes.

At CarEdge we’re already seeing the beneficial impacts of agentic AI for both sellers and buyers. Consider the story of Thomas. He came to CarEdge in June looking to purchase a Honda Accord. Thomas’ AI agent contacted numerous dealerships in his area that all had the vehicle he was interested in, right down to the specific trim and options.

While Thomas was at work, his AI agent engaged with the dealerships and ultimately, after 13 messages back and forth with one dealer in particular, achieved an out the door price of $36,900. The initial out the door price quote was $38,180.

Thomas went in that afternoon and purchased the vehicle. Thomas saved time, and $1,280 thanks to his AI agent. This is how agentic commerce is already influencing retail automotive.

How does the entire automotive ecosystem win with agentic AI? It’s simple. Data.

Car prices are notoriously opaque. The only way to really know what you are going to pay for a car is to contact a dealer and get an out the door price quote. The FTC and states’ attorney generals have gone after myriad dealerships over the years for bait and switch pricing and forced add-ons. However the practice is still prevalent, and in many cases, it’s a cost of doing business.

Take for example this Nissan Rogue for sale in Florida.

The online advertisement is hard to decipher, however it appears the price is $32,415.

Upon contacting the dealership, the price is actually:

$34,239 (plus tax/title/fees & payoff – whatever that is in this case). How and why did the price increase by nearly $2,000? Who knows. But this is all too common in retail automotive.

These practices obviously frustrate and confuse customers, however they also harm dealers who are reputable and don’t play games. Andrew Wright, Managing Partner at Vinart Dealerships shared his frustrations on X:

“I inquired about what this major 3rd party classified listings company was doing to police their platform for dealers engaging in deceptive pricing practices. The answer in short: NOTHING… All of the major classified listings platforms (Cars Commerce, Autotrader, CarGurus, Carfax, etc.) know that this is going on and they are doing NOTHING to stop it. In fact, they are REWARDING this behavior by affixing “great deal” badges on cars with deceptively low pricing.”

How do AI agents solve this problem? It’s simple. They collect, organize, and retain complete pricing data to bring unparalleled transparency. Currently, there is no third-party collecting accurate data on vehicle pricing (including dealer fees and add-ons). There have been some nascent attempts to flag bad actors (i.e. Markups.org and online review websites), however their scope and efficacy is limited, and we all know that consumers and dealers are equally capable of leaving bad reviews that stretch the truth. Pricing transparency isn’t just good for customers, it’s a competitive edge for honest dealers. AI helps surface trustworthy dealers in a crowded market and rewards them with more sales.

AI agents flip the script. Instead of relying on human beings to get out the door pricing and then manually enter that information into some sort of crowd-sourced database, AI agents are able to automate this process, removing any potential biases.

At CarEdge, our car shopping agents have been deployed 10,000 times since launch in late July, and we have collected data on thousands of dealerships. Want to know which dealer is adding “mandatory” nitrogen tire fill for $399 to all of their vehicles? We know it. Want to know which dealers are not playing games and leading with transparency? We have it.

AI agents level the playing field for consumers and dealers. Publishing and sharing this data will bring transparency unlike ever before, and will challenge the industry to operate more efficiently and fairly for everyone involved. Again, this is only possible thanks to agentic AI.

Artificial intelligence’s impact on retail auto will be profound (and it already is). From vehicle research and selection, to negotiation and pricing, agentic AI brings much needed transparency and efficiency to an industry that desperately needs it.

For consumers, the car buying experience is about to get radically easier. For dealers and OEMs, the ones who embrace this new model won’t just survive, they’ll lead. The age of agentic AI is here, and it’s time we start building with it.

“I’m so lost on what to do now.”

Those should never be the first words out of a customer’s mouth after leasing a brand-new $36,000 vehicle. But for Adrianne, confusion and anxiety replaced what should have been joy and excitement after leasing her 2025 Kia K5 from Mark Kia in Scottsdale, Arizona.

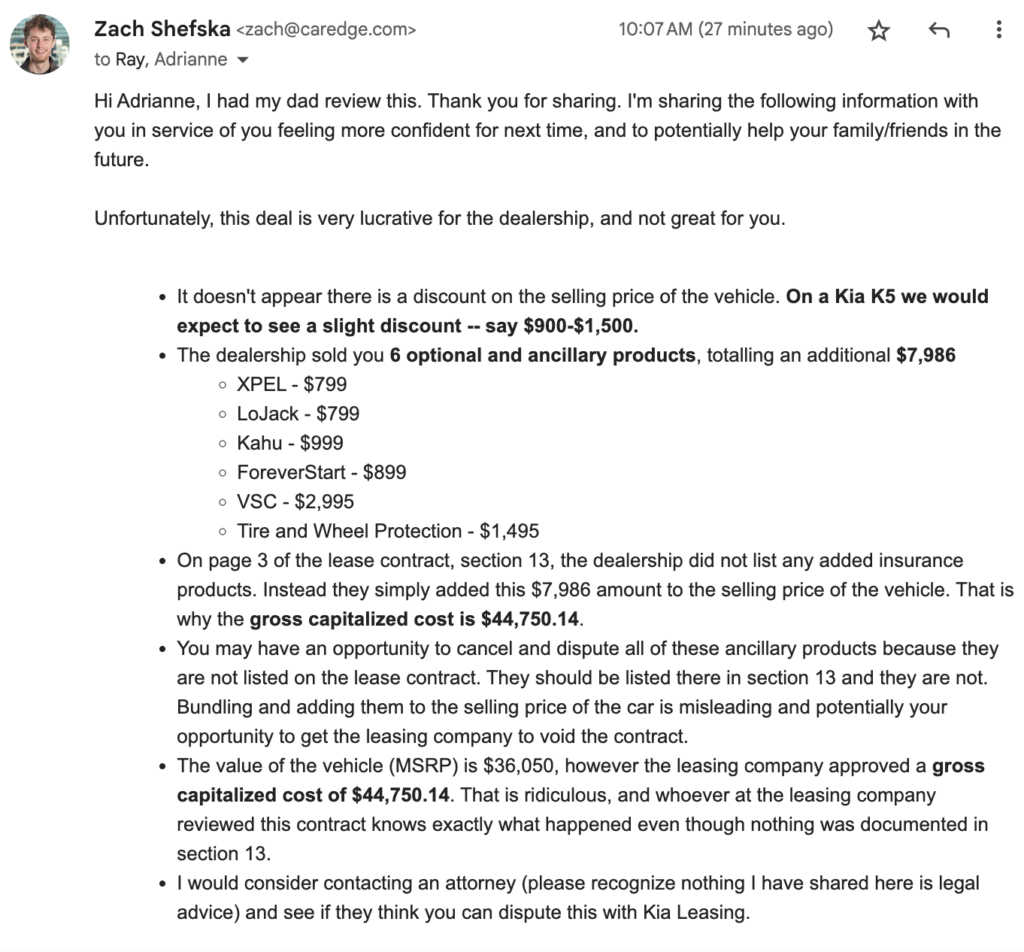

On Sunday, June 1st, I received an email from Adrianne. She found CarEdge through our YouTube channel and reached out for help.

Followed by my reply…

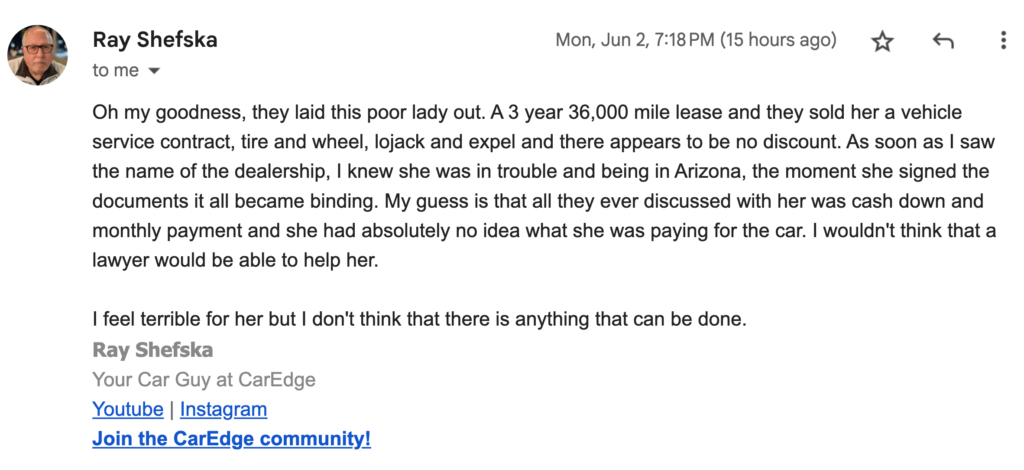

“Dad, I think this customer may have been taken advantage of,” I said, as I forwarded her paperwork to my dad, Ray.

My dad spent 43 years in the car business. In 2019, we launched CarEdge together with one mission: to protect consumers and bring transparency to the car buying process. We’ve evolved since then, but our mission remains the same: make buying a car more fair, transparent, and efficient.

“Oh my goodness, they laid this poor lady out.”

That was my dad’s reaction. Not exactly what I hoped to hear, but it confirmed what I feared. “Laid out” is old-school car dealer slang for taking a customer to the cleaners. This dealership saw an opportunity and took full advantage of Adrianne. “I feel terrible for her,” he said. “But I don’t think there’s anything that can be done.”

That hit hard.

I felt deflated. “How do I reply to her? What should I say?”

About three years ago I got into running and endurance sports. Since then I’ve run five 70.3 IronMan races and myriad marathons. I’ve become a bit addicted to feeling “deflated.” There’s something human and inspiring about feeling beat up, feeling down, and then persevering and pushing through. I think this is why I find myself signing up for more races. I like hitting the low point and proving to myself that I can push through.

My feeling of being “deflated” quickly began to diminish. I started to feel inspired and excited.

“Time to go to battle for Adrianne I thought.” I thought back to my mom’s meaning in life, to repair the world. She raised me through the lens of “whoever saves a life, it is considered as if he saved an entire world,” a quote from the Talmud.

“Time to do a Mitzvah project and repair the world today!”

Kia Leasing and Mark Kia of Scottsdale, AZ, you should be ashamed of yourselves. Is this what you want your brand to be known for?

Let’s break down Adrianne’s “deal.”

The dealership did 3 things that allowed them to make a lot of money and set Adrianne up for failure.

Here is the window sticker of the vehicle she leased. Note the dealer is adding XPEL and LoJack for $1,598. However, there’s much more to the story, as you’ll see below.

First, for transparency’s sake, here is the window sticker:

And below is Section 13, showing optional insurance products:

And here’s how we get to Adrianne’s final monthly payment:

Where do we start? It’s easy to feel defeated after seeing all that was piled on to Adrianne’s deal. Here’s what truly makes this the Kia lease deal from hell, that NO customer should ever have to put up with:

Here is the exact email I sent Adrianne:

Adrianne trusted this Kia dealership, and they outright took advantage of her trust by adding $8,000 in optional products to her contract.

At CarEdge, we’re fired up. We’re prepared to do all that we can to help make this right for Adrianne if at all possible, and at the very least, to ensure that these deceptive practices stop. Far too many drivers have left the dealership lot feeling confused and taken advantage of. It’s long past due for that to change.

The extra $8,000 of protection products added approximately $240 to her monthly payment. We have encouraged Adrianne to file a consumer affairs complaint with the Arizona Attorney General’s office. In the meantime …

Please share this article on social media. Please tag Kia, Mark Auto Group, and CarEdge. Let’s get some money back in Adrianne’s pockets and force this industry to wake up and operate more fairly and transparently.

I’ll keep this section short and sweet:

Do not fall for these 3 car dealership traps! When we founded CarEdge five years ago, our mission was simple: empower customers to navigate car buying with confidence. While we’ve come a long way, car dealerships continue to use tactics that make negotiations challenging. Recently, I tested our CarEdge negotiation templates by interacting with dealerships firsthand, and the results were eye-opening. Here are three common car dealer tactics and, more importantly, how you can play it smart.

The number one piece of advice we always give to DIY car buyers is to insist on negotiating the out-the-door price. The out-the-door price (OTD price) includes taxes and fees, giving you a true picture of the total cost of the car. We have a free OTD price calculator that can be a valuable tool while you shop.

Unfortunately, it’s often a challenge to get an OTD price from car salespeople. They will tell you that you need to stop by in-person to get an accurate quote. It’s simply not true. As long as you’ve shared the exact vehicle you’re interested in and your zip code, nothing is keeping them from sending you the car’s OTD price. This is a problem I ran into multiple times as I interacted with dealerships. In fact, it’s a common car dealership tactic.

Take the following exchange with a Florida Honda dealership, for example. Our messages started off as expected…

Soon, our texting turned into a back-and-forth about one thing: my insistence on seeing the out-the-door price for a Honda CR-V I was interested in.

Notice that as a confident car buyer, I didn’t back down. If you keep asking, the salesperson will eventually share their out-the-door price quote with you. And in the rare event that they don’t, you definitely don’t want to give them your business anyway. Here’s how this conversation ultimately played out.

See, that wasn’t too much to ask, was it?

Let’s take a look at other car dealership tactics that buyers face when inquiring about cars online or via text.

You may have caught it in the messages shared above, but car salespeople always want to know how much is in it for them. And by that, I simply mean how much money they will be making. And with that, comes the question of whether or not you have a trade-in that they can expect to resell either on their lot or at the auction.

Here’s how quickly the representative from Honda of Aventura brought up the question of a trade-in.

The story was the same at other dealerships. All too often, the salesperson insists on knowing if you have a trade-in. There’s a simple way to handle that – don’t give them an answer. As we talk about in the trade-in tactics for success guide, you should always treat your trade-in and the vehicle you are purchasing as two separate transactions. A polite way to work around their question is to kindly say that you may have a trade, but you’re not sure right now. Then follow that up with a reminder that you really just want to know the out-the-door price after all.

Why shouldn’t you share if you have a trade-in? Car dealers like to treat your trade-in and new purchase as one transaction, allowing them to play with the numbers to make them more favorable for them. Getting a car deal that’s almost too good to be true? Expect them to offer less for your trade-in. If you insist on keeping your new car purchase and trade-in as separate transactions, they won’t be able to use your trade-in against you.

If you’ve purchased a new or used car in the past decade, you’ve almost certainly encountered cars with unnecessary and sometimes downright odd add-ons. The story from the car salesperson is always the same: the car has this great product, and since it’s already on the car, it’s added to the vehicle’s price.

These car dealer fees add little value despite potentially costing hundreds or thousands of dollars. If you don’t want the product, these fees or ‘add-ons’ are always negotiable:

These are just some of the many ‘almost fake’ fees that car dealerships charge in the form of forced add-ons. See the complete list of car dealership add-ons here.

As you can see from my outreach, one dealer added $999 in accessories. What are these accessories? Do I want them? Did I ask for them? When you negotiate the out the door price, be prepared to negotiate these accessories off the price of the vehicle.

All car buyers should remember this: you don’t have to accept markups for forced add-ons. If anyone tells you that you do, then remind them of pending lawsuits about this deceptive practice. Here’s how we negotiate dealer add-ons effectively:

See exactly how we negotiate dealer add-ons with this free guide

As I just experienced firsthand, the key to successful car buying is staying in control of the negotiation process. Car dealership tactics will often try to steer the conversation toward their advantage, but by being persistent and informed, you can avoid common traps like hidden fees, unnecessary add-ons, and unclear pricing.

Don’t hesitate to push back when necessary, and remember: you can always walk away from a deal if it doesn’t meet your expectations. You hold the power in these transactions, so use the free car buying resources at your disposal to secure the best possible outcome.