CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Every month, analysts and journalists report on the “average new car price in America.” It sounds useful, but to the average American car buyer, it rarely is.

That number includes every new vehicle sold, from a heavily discounted Mitsubishi Mirage to a $200,000 Porsche 911. Low-volume luxury models and niche vehicles skew that average in ways that have nothing to do with the cars most Americans are actually buying. When the average new car price goes up, is it because your next car costs more, or because a handful of wealthy buyers picked up more exotics last month? You can’t tell.

At CarEdge, we think car buyers deserve a more accurate measure of car price trends. So we built one.

Each month, we track the average transaction prices and inventory levels of the 20 best-selling vehicles in America. These are the trucks, SUVs, and cars that mainstream car buyers are actually shopping for: the Ford F-150, the Toyota RAV4, the Honda CR-V, and the like. These are vehicles that move in massive volumes and reflect the market the way most Americans experience it.

By focusing on the Popular 20, we filter out the noise and outliers. What remains is a clear, honest signal of where new car prices and inventory are actually heading for mainstream buyers.

We track two things for each model every month.

Average Transaction Price is what cars are actually selling for, not the MSRP.

Market Day Supply (MDS) is how many days of inventory dealers have on hand at the current sales pace. This is the single best indicator of where prices are heading. Low supply means dealer leverage. High supply means shopper leverage. Learn more about this market metric here.

We’ll update this data every month. Over time, we hope this becomes a useful tool, providing a ground-level view of the market that journalists, analysts, and car shoppers can actually rely on.

| January 2026 | February 2026 | Percent Change | |

|---|---|---|---|

| Ford F-150 | $61,109 | $61,217 | 0.18% |

| Chevrolet Silverado 1500 | $53,286 | $52,911 | -0.70% |

| Toyota RAV4 | $37,379 | $37,432 | 0.14% |

| Honda CR-V | $38,667 | $38,709 | 0.11% |

| Ram 1500 | $59,331 | $60,056 | 1.22% |

| GMC Sierra 1500 | $62,583 | $62,347 | -0.38% |

| Toyota Camry | $35,209 | $35,202 | -0.02% |

| Toyota Tacoma | $46,103 | $46,088 | -0.03% |

| Toyota Corolla | $25,666 | $25,710 | 0.17% |

| Honda Civic | $29,210 | $29,277 | 0.23% |

| Hyundai Tucson | $35,321 | $35,444 | 0.35% |

| Ford Explorer | $50,078 | $49,953 | -0.25% |

| Nissan Rogue | $33,191 | $32,764 | -1.29% |

| Jeep Grand Cherokee | $45,370 | $45,348 | -0.05% |

| Chevrolet Trax | $25,565 | $25,652 | 0.34% |

| Subaru Crosstrek | $32,690 | $32,896 | 0.63% |

| Kia Sportage | $35,508 | $35,492 | -0.05% |

| Subaru Forester | $39,344 | $39,466 | 0.31% |

| Jeep Wrangler | $53,454 | $53,477 | 0.04% |

| Subaru Outback | $40,225 | $40,876 | 1.62% |

| Top 20 Average Selling Price | $41,964 | $42,016 | 0.12% |

| January 2026 | February 2026 | Percent Change | |

|---|---|---|---|

| Ford F-150 | 81 | 129 | 59% |

| Chevrolet Silverado 1500 | 65 | 92 | 42% |

| Toyota RAV4 | 22 | 37 | 68% |

| Honda CR-V | 53 | 67 | 26% |

| Ram 1500 | 149 | 163 | 9% |

| GMC Sierra 1500 | 78 | 115 | 47% |

| Toyota Camry | 33 | 45 | 36% |

| Toyota Tacoma | 58 | 58 | 0% |

| Toyota Corolla | 37 | 44 | 19% |

| Honda Civic | 57 | 67 | 18% |

| Hyundai Tucson | 95 | 132 | 39% |

| Ford Explorer | 117 | 141 | 21% |

| Nissan Rogue | 101 | 93 | -8% |

| Jeep Grand Cherokee | 133 | 156 | 17% |

| Chevrolet Trax | 88 | 109 | 24% |

| Subaru Crosstrek | 73 | 90 | 23% |

| Kia Sportage | 100 | 121 | 21% |

| Subaru Forester | 103 | 77 | -25% |

| Jeep Wrangler 4-Door | 151 | 180 | 19% |

| Subaru Outback | 74 | 117 | 58% |

| Top 20 Average MDS | 83 | 102 | 22% |

Of the 20 models we track, 18 saw market day supply increase from January to February. Inventory is building across the mainstream market, and that matters enormously for buyers. More supply means more negotiating leverage, less pressure to pay over sticker, and more time to make a smart decision.

The biggest jumps came from some of the market’s highest-volume trucks and SUVs. The Ford F-150 saw its MDS leap from 81 to 129 days, a 59% increase in a single month. The Subaru Outback surged from 74 to 117 days, and both the GMC Sierra 1500 and Hyundai Tucson climbed 37 days each. These are significant moves.

Sometimes, a sudden jump in supply reflects a recent delivery of vehicles from the factory. That is likely the case with the Outback and F-150. To find vehicles sitting on dealership lots the longest, use tools like CarEdge Pro to gain market insights. These are always the most-negotiable new cars.

On the other end of the spectrum, the Toyota RAV4 remains the tightest vehicle in our index at just 37 days supply, up from 22 in January but still firmly in seller’s-market territory. The Toyota Tacoma held perfectly flat at 58 days. The Subaru Forester was the only model to see a meaningful inventory decline, dropping from 103 to 77 days. Subaru is likely selling down 2025 Forester inventory as new 2026 shipments are imminent.

Despite the inventory surge, transaction prices barely moved for most models. The Popular 20 average transaction price in January was $41,979. In February it was $41,994, essentially flat.

That stability is worth noting. Rising inventory doesn’t immediately push prices down — the market doesn’t move that fast. Prices tend to lag inventory by weeks or months. If the supply trend continues into March and beyond, downward pressure should follow, particularly in the truck segment where inventory is growing fastest.

The Ram 1500 was the most notable outlier on the upside, rising $725 to $60,056 despite already carrying 163 days of supply, the second-highest in the index. That’s a disconnect worth watching. The Subaru Outback also climbed $651, coinciding with its inventory nearly doubling. Moving in the opposite direction, the Nissan Rogue fell $427 as its inventory slightly contracted.

The full-size truck segment — F-150, Silverado, Ram, and Sierra — dominates our index both by volume and by price. Their average transaction prices sit well above $60,000, a level that would have seemed extraordinary just a few years ago. At the same time, three of the four now sit at 90-plus days of supply, with the Ram above 160. These are buyers’ market conditions by any historical standard. Shoppers cross-shopping full-size trucks have real leverage right now and should use it.

Pay close attention to the MDS figure for the vehicle you’re considering. Anything above 90 days is a buyer’s market in 2026. With these models, you have room to negotiate. Trucks and large SUVs have higher inventory in general, and are the most negotiable. Thousands of 2025 models remain unsold, and these present the greatest opportunities for saving.

Anything below 45 days means the dealer has the upper hand. Negotiating discounts will be tough for these cars. Right now, the RAV4, Camry, and Corolla are all in high demand and short supply.

If you’re watching the broader market, the February inventory surge is the leading indicator to follow. If inventory (as measured by MDS) continues climbing into the spring, expect transaction prices to soften, especially for slower-selling trucks and three-row SUVs.

Methodology: Average transaction prices reflect what buyers paid at the dealership, aggregated across all trim levels and configurations for each model. Market Day Supply is calculated by dividing current dealer inventory by the average daily sales rate. Data covers the United States. The 20 models included reflect the best-selling vehicles in America by volume as reported in Car and Driver, with direct-to-consumer models from Tesla omitted.

Next update: March 27, 2026

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and AI-powered tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry.

Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.

The workers who buy trucks can no longer afford them. Here’s what the data shows.

The full-size pickup truck has always been more than just a vehicle. For electricians, contractors, factory workers, and drivers, it’s a professional tool — and often the biggest purchase they’ll make outside of a home. For decades, a mid-tier truck was attainable on a blue collar income. That’s no longer the case.

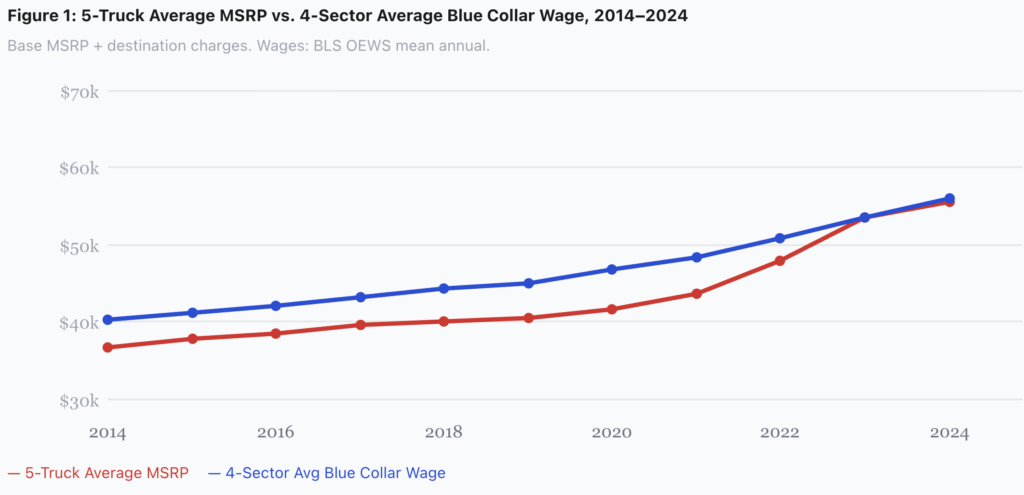

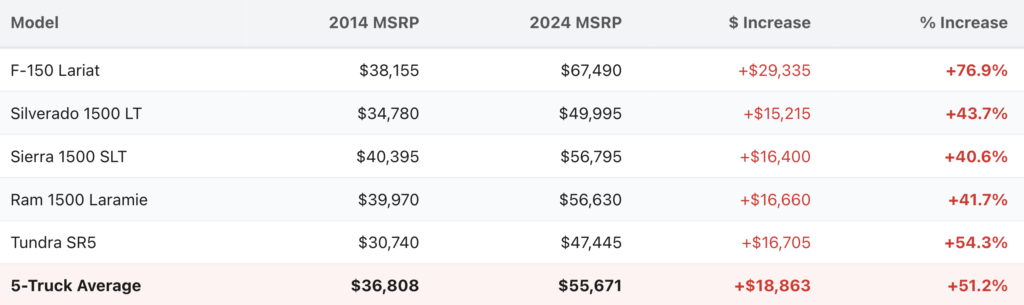

A new CarEdge analysis of truck pricing and the most recent U.S. wage data finds that between 2014 and 2024, the average mid-tier full-size truck climbed 53.1% in price — while the average blue collar wage grew just 38.7%. Truck prices are rising nearly 40% faster than the paychecks of the workers most likely to buy them.

Read the full CarEdge Truck Price Inflation Report →

In 2014, the five trucks in our study averaged $36,808. By 2024, that average had reached $55,671 — an increase of nearly $19,000 in ten years. To put that in perspective: the entire base price of the most affordable truck in the study in 2014 is now less than the price increase on the most expensive model alone.

By 2023, something happened that had never happened before: the average truck price hit 1.00x the average annual blue collar wage. For the first time on record, buying a new truck meant spending an entire year’s gross salary.

Occupational wage statistics for 2025 are expected to be released by the Bureau of Labor Statistics in the summer of 2026. CarEdge will run the numbers again with the latest figures when we have the update.

Not all blue collar workers are in the same position. Construction and extraction workers — among the higher earners in the group at $63,920 annually — now need about 10.5 months of gross pay to afford the average truck, up from 9.5 months in 2014.

Production and transportation workers have it worse. Earning between $48,000 and $50,000 a year, these workers now need more than 13 months of gross income to cover the average truck price — and that’s before taxes, rent, or any other expense.

The pandemic accelerated an affordability crisis that was already underway. Between 2021 and 2023, the five-truck average surged nearly $10,000 in just two years as semiconductor shortages collapsed inventory and manufacturers prioritized their most profitable high-trim models. Prices spiked — and never came back down.

But the pandemic wasn’t the whole story. Automakers had been quietly walking away from the blue collar buyer for years. The number of new vehicle models priced under $25,000 dropped from 36 in 2017 to just 10 five years later. Entry-level truck trims became nearly impossible to find on dealer lots by design.

Then came the EV losses. Ford expects to continue losing billions on EVs for years to come. GM took roughly $6 billion in EV-related write-downs. Those losses were largely offset by charging more for the gas-powered trucks that actually sell. The workers who buy F-150s effectively subsidized a failed industry bet.

New-car prices in 2024 were still 29% higher than in 2019, and CarEdge projects trucks and SUVs will rise another 3–5% in 2026 — before any tariff impact on imported components. Relief isn’t coming soon. But there are ways to fight back.

Shop leftover 2025 models. Ford and Ram are heading into 2026 with tens of thousands of unsold 2025 trucks on dealer lots. That’s leverage. Dealers are motivated to move aging inventory, and buyers who target outgoing model-year trucks can often negotiate well below MSRP — sometimes thousands under sticker. The longer those trucks sit, the more room there is to negotiate.

Know the dealer’s cost before you walk in. CarEdge’s free dealer invoice tool shows you what the dealer actually paid for the truck — not what they’re asking for it. That number is your anchor. Any negotiation should start there, not at MSRP.

Have AI negotiate aging inventory for you. CarEdge Pro gives you access to target discount recommendations, market pricing data, and a step-by-step negotiation guide so you know exactly what to say — and what to push back on — at every stage of the deal.

Consider the used and CPO market. Certified pre-owned trucks from the last two to three years still offer strong capability at a meaningfully lower price point. With new truck prices near historic highs, a lightly used model can represent significant savings without sacrificing much in terms of condition or features.

Look at mid-size alternatives. For buyers whose work doesn’t require a full-size bed or towing capacity, mid-size trucks offer real utility at a significantly lower price point — and are usually easier to negotiate on.

Explore the full CarEdge Truck Price Inflation Report, including all data and methodology →

CarEdge analyzed base MSRP data for five best-selling full-size trucks cross-referenced against Bureau of Labor Statistics wage data for four blue collar occupational sectors, covering 2014–2024. Full methodology available at caredge.com/truck-price-inflation-2026.

If you’re planning to buy a new or used vehicle this spring, understanding the current state of the car market is essential. With average new car prices hovering near $50,000, used car interest rates exceeding 10%, and wildly different inventory levels across brands and regions, the landscape is anything but simple.

Here’s a comprehensive breakdown of the new and used car markets for spring 2026, including where the deals are, which brands give you the most leverage, and whether now is the right time to buy or sell.

The average transaction price for a new car is now almost $50,000. That staggering figure has a ripple effect across the entire market. Fewer consumers can afford to participate, and those who can are increasingly willing to stretch their budgets. In fact, 20% of new car buyers are now taking on monthly payments of $1,000 or more—a number that becomes even more alarming when you factor in insurance costs that can add another $300 to $500 per month.

The result? Automakers are essentially appealing to a shrinking pool of buyers who can actually afford these vehicles, while a growing number of consumers are being priced out of the new car market entirely.

One of the most important metrics to understand before walking into a dealership is market day supply. Currently, the nationwide new car market day supply sits at 98 days, meaning it would take more than three months to sell all available inventory at the current sales pace. Dealers have roughly 2.7 million new cars in stock.

A 98-day supply is relatively high compared to the pandemic era when inventory was severely constrained. Generally speaking, the higher the day supply, the more leverage you have as a buyer.

But there’s a nuance: not all brands are on the same page.

The differences in inventory across brands are dramatic, and they directly impact how much room you have to negotiate:

What constitutes a “great deal” is entirely relative. A great deal on a Lexus might mean paying MSRP with no added fees, while a great deal on a Volkswagen could mean thousands off the sticker price. Especially for the slowest-selling car in America.

Inventory levels also vary significantly by state. For example, Maine has a 114-day supply of new cars, while Utah has just a 43-day supply. Your local market dynamics—including regional demand, weather patterns, and dealer competition—will influence the deals available to you.

There’s a silver lining in the spring 2026 new car market. Industry expectations point toward lower overall sales, which should translate to more deals for consumers. Additionally, there are still 580,000 leftover 2025 model year vehicles sitting on dealer lots.

With the Federal Reserve holding steady on interest rates, manufacturers are stepping in with subvented financing rates—think 0%, 0.9%, and 1.9% APR—to move aging inventory. Keep in mind, however, that these promotional rates typically require top-tier credit. As your credit score drops, the rates climb. Here’s what it means to be a well-qualified buyer.

Leasing is also making a comeback. About a quarter of new car customers are now choosing to lease, drawn by advertised payments of $250–$350 per month as a more affordable alternative to buying. The best lease deals of the month include zero-down lease deals, even for a few luxury models.

Overall, the spring 2026 new car market lands in neutral-to-fair territory. It’s neither a strong buyer’s market nor a seller’s market. However, it tilts decidedly toward a buyer’s market for leftover 2025 vehicles, where dealers and manufacturers are eager to clear inventory. For current model year vehicles from popular brands, you’ll need to work harder to secure a meaningful discount.

The average transaction price for a used car in 2026 is $26,000. Used car prices are up 18% over the past five years and 4% year-over-year. While that’s roughly half the cost of a new car, don’t be fooled into thinking used vehicles are affordable. The average interest rate on a used car loan is over 10% APR, which significantly inflates the total cost of ownership and monthly payments. For used car buyers with bad credit, APRs easily top 15%.

The used car market has a 49-day supply of inventory—considerably tighter than the 98-day supply on the new car side. While that’s 5% higher than last year, it’s still lower than the 2022–2024 period. In short, used car inventory remains tight.

One of the most fascinating dynamics in today’s used car market is the K-shaped divergence in vehicle values:

Why is this happening? Many consumers who are priced out of the new luxury car market are turning to pre-owned luxury vehicles instead, driving up demand and values in that segment.

The composition of available used car inventory should give buyers pause:

The quality of used cars available today may be at its lowest level ever in terms of mileage, vehicle condition, and dealer preparation. This makes getting a pre-purchase inspection before buying any used car absolutely essential.

Spring is historically when used car values appreciate, and 2026 is no exception. Auction data shows that used car values have already started appreciating 2–3 weeks earlier than normal. This trend is driven by dealers stocking up on inventory ahead of tax return season and the warmer weather that brings more buyers to dealerships.

This has two important implications:

Unlike the neutral new car market, the used car market tilts toward a seller’s market for spring 2026. Tight inventory, rising prices, seasonal appreciation, and high financing costs all work against buyers. If you must purchase a used vehicle this spring, do your homework on local pricing, get pre-approved for financing to avoid dealer markup on rates, and always get an independent inspection.

Whether you’re buying new or used this spring, the single most important thing you can do is research your specific market. National averages tell one story, but your local brand inventory, regional pricing, and available incentives tell another. Arm yourself with data before you set foot on a dealer lot, and you’ll be in a far stronger position to negotiate.

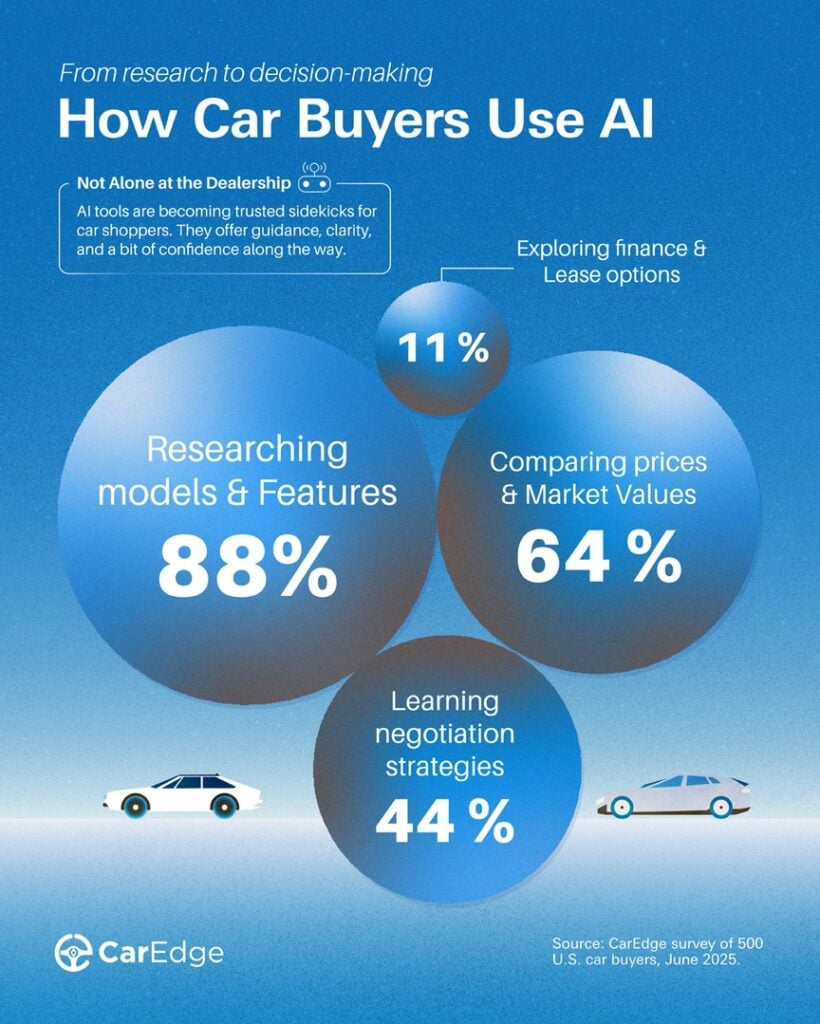

Artificial intelligence is changing the way Americans buy cars, and it’s a transition that is happening quickly. In the first-ever survey of its kind, CarEdge asked 500 car shoppers if they’re using AI tools like ChatGPT to research, compare, and negotiate during the car buying process.

The results confirm a major shift is underway. One in four car buyers in 2025 is already using AI tools to gain an edge, and future buyers are even more likely to embrace these technologies.

Car buyers are finding AI to be a valuable tool. Among those who used tools like ChatGPT, Perplexity, Google Gemini, and others, 88% said it was helpful. AI is quickly becoming a trusted co-pilot for car buyers.

This report offers the first data-backed look at how AI tools are reshaping the car buying experience. For the automotive industry, the message is clear: buyers are more empowered than ever — and they’re bringing AI to the dealership.

The 2025 CarEdge AI & Car Buying Survey reveals a clear and growing trend: AI tools are quickly becoming part of the car buying process for a significant portion of consumers. Here are the standout findings:

25% of car buyers in 2025 say they used or plan to use AI tools like ChatGPT during the shopping or buying process. This contrasts with a recent survey by Elon University that found 52% of Americans now use AI large language models. While signs point towards increased adoption of AI tools, the CarEdge survey found that most car buyers are still in the early stages of integrating these tools into high-stakes decisions like vehicle purchases. This suggests there’s still significant room for growth in AI adoption amongst car buyers.

Among those who haven’t bought a car yet this year, 40% say they are using or plan to use AI tools during their search or deal-making. This is nearly 3x higher than the 14% seen among those who already bought a car earlier in the year.

Among those who used AI:

Of the respondents who had already leased a car in 2025, none reported using any AI tools.

AI adoption among car buyers is still in its early stages, but clear trends are beginning to emerge.

Just 14% of those who already bought a vehicle this year used AI tools during the process. Adoption rates were nearly identical across new and used buyers, with 14% in each group saying they used AI tools.

The numbers jump significantly when looking at those who haven’t yet bought in 2025. Among this group — who represent 39% of total respondents — 40% say they either already use or plan to use AI tools during their car search and buying process.

That’s more than triple the current usage rate among recent buyers, suggesting AI adoption is accelerating as awareness grows and tools become easier to use.

This group also appears to be more proactive: 60% of those who used AI tools during their buying journey said they used them “a lot,” while 40% used them only occasionally.

AI tools are quickly becoming essential research companions for car shoppers looking to make more informed, confident decisions. After all, why go it alone when a wealth of automotive knowledge powered by large language models (LLMs) is right in your pocket?

Among buyers who used AI tools during their car purchase or lease process, here’s how they put them to work:

The most common use by far, AI tools helped buyers learn about different models, trims, features, and reliability. For many, it was like having an always-available expert to explain the pros and cons of their options.

Buyers used AI to better understand fair pricing, from invoice pricing to out-the-door.

Nearly half of AI users leaned on these tools to prepare for conversations with salespeople. Whether role-playing negotiation scenarios or asking how to spot add-on fees, this group used AI to level the playing field at the dealership.

A much smaller portion of buyers used these tools to become familiar with leasing vs. financing, how to calculate payments, and similar queries.

Car buying has always been tilted in favor of the dealership. Information asymmetry — what the dealer knows versus what the customer knows — has long been the source of consumer frustration, confusion, and overpayment.

That dynamic is beginning to shift.

This survey confirms what many in the industry are only starting to realize: AI is giving car buyers the upper hand. Tools like ChatGPT are helping consumers cut through the noise, ask smarter questions, and avoid common dealership traps. Instead of relying on guesswork or scattered advice, buyers are turning to AI for fast, personalized guidance at every step.

But one auto industry veteran has words of caution for buyers relying heavily on AI tools.

“It’s both surprising and a little scary to see how quickly people are turning to AI to guide such a major financial decision,” said Ray Shefska, Co-Founder of CarEdge. “While tools like ChatGPT can be powerful, they’re only as good as the data behind them. AI should complement your research, not replace your own critical thinking.”

That perspective underscores the real takeaway of this report: AI works best when it’s used thoughtfully as a tool, not as a crutch. In an age where automation raises fears of job loss or decision-making without human oversight, this survey offers a more optimistic view — one where technology helps everyday consumers make smarter choices. Used wisely, AI can help level the playing field and bring more transparency and fairness to the car buying experience.

This survey was conducted by CarEdge between June 19 and June 24, 2025. A total of 500 U.S. respondents participated, recruited through the CarEdge email newsletter and social media channels. Questions were tailored based on buying status to better understand how and when AI tools were used in the car shopping process.

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence.

With trusted resources like the CarEdge Research Center, fair pricing tools, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry.

Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights. Join the CarEdge Community to connect with car buyers and sellers nationwide.

Contact for Media Inquiries:

[email protected] | www.CarEdge.com

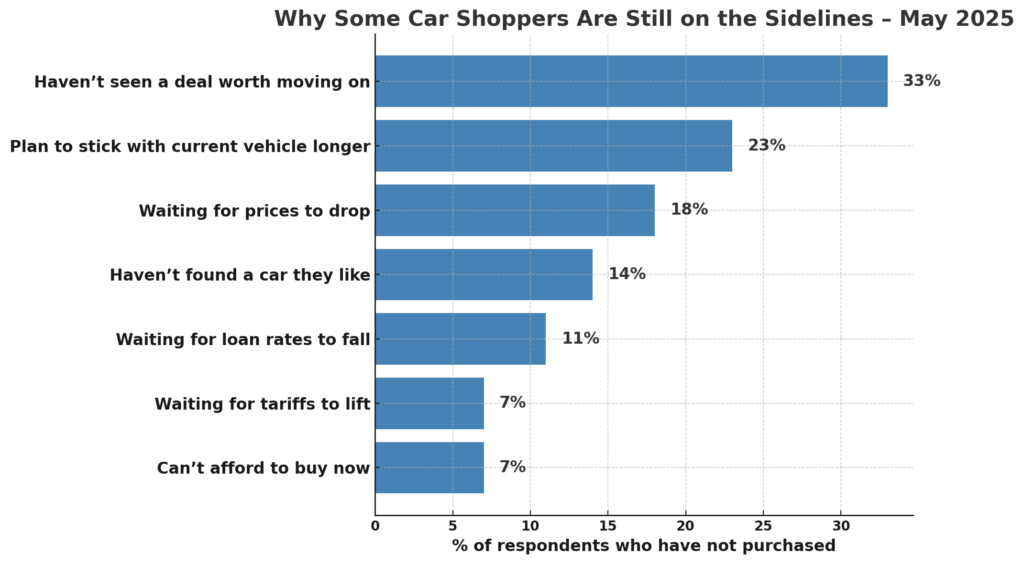

CarEdge, the best place to buy, sell, and own a car with confidence, recently surveyed 408 U.S. drivers to better understand how consumers are navigating the car market in 2025. The survey, conducted from May 16 to May 19, comes at a pivotal time. Following the implementation of U.S. auto tariffs on April 3, car prices, interest rates, and inventory levels have all been in flux. With uncertainty growing, CarEdge sought to answer a critical question: how are real drivers adapting their car buying behavior?

Survey participants represent a broad cross-section of car shoppers and owners, from those who’ve recently purchased to those holding off for the foreseeable future. The full survey is available at CarEdge.com. Below, we break down the most important findings from this May 2025 snapshot.

The survey responses paint a picture of a divided car market, shaped by mixed economic signals and widespread caution. Among all respondents, 16% reported purchasing a car after the April 3 tariff announcement, while another 12% said they had bought a vehicle shortly before the tariffs went into effect. A much larger share (52%) said they are still actively shopping for a car, while 20% said they have not purchased a vehicle in the past six months and do not plan to buy one in 2025.

Tariffs have clearly impacted perceptions. Interestingly, among those who bought their car before April 3, 38% acknowledged they made the purchase early specifically to avoid the risk of higher prices. Among those who purchased after April 3, 16% said they believe they paid more due to the tariffs, with the vast majority of post-tariff buyers (84%) saying they believe they did not pay more.

Looking ahead, half of respondents are still planning to buy a car before the end of 2025. Of those future buyers, about a third plan to purchase new, another third are shopping used, and the remaining 30% are still undecided.

When it comes to what’s keeping people on the sidelines, affordability challenges and a lack of compelling deals top the list.

These are the barriers to buying (as a percent of all respondents who have not purchased):

With these top-line insights in mind, we next explore specific groups within the survey to uncover how recent and future car buyers are thinking about today’s market.

Survey respondents who purchased a car in the six months leading up to April 3 offer another layer of insight. Among these buyers, 61% purchased new and 39% purchased used.

What stands out most in this group is that more than a third (38%) said they intentionally bought their car early to avoid potential price hikes from tariffs. For the remaining 62%, tariffs didn’t factor into the timing of their purchase.

Income again played a role in how buyers approached the market. Among households earning $200K or more, just 22% said they made their purchase early in response to the looming tariffs. Nearly half (48%) of buyers earning between $100K and $199K did the same. In contrast, 39% of buyers earning under $100K said they bought early to avoid tariff-related price hikes.

This suggests that low- to middle-income consumers were more likely to act on policy changes and proactively adjust their buying timeline. Higher-income households, on the other hand, may not have been as concerned about the possible impact of tariffs on car prices this spring.

For respondents who bought a car after the April 3 tariff rollout, the data reveals a blend of resilience and skepticism. Among this group, 81% purchased a new vehicle, while 19% opted for a used one.

Despite the added costs associated with the new tariffs on imported vehicles, most post-April 3 buyers didn’t feel the sting. A strong majority—84%—said they don’t believe they paid more as a result of the tariffs. Still, 16% acknowledged they believe they did.

Among buyers who purchased after the April 3 tariff implementation, a different pattern emerged. Higher-income households were more likely to believe tariffs increased the price they paid. Specifically, 27% of households earning over $200,000 said they believed they paid more because of tariffs. In contrast, only 11% of households earning between $100,000 and $199,999 felt the same. Meanwhile, 17% of buyers with incomes under $100,000 said they believed tariffs had raised their purchase price.

These results suggest that while tariffs haven’t universally discouraged buyers, those with tighter budgets and those with a keen eye on policy changes are the most attuned to their potential impact.

Among those still planning to buy a car in 2025, the data reveals a thoughtful and strategic group of shoppers. Less than half (44%) of active shoppers expect to make their purchase within the next three months, while a majority (56%) plan to buy later this year.

When it comes to what they’re looking for, 54% say they’re in the market for a new car. About 19% are shopping for used vehicles, while just over a quarter are still unsure.

As for why these shoppers haven’t yet moved forward, deal quality remains the leading barrier. Respondents were asked to select all reasons why they have yet to purchase in 2025. 50% say they haven’t seen an offer worth acting on, while 30% are waiting for prices to come down. Another 21% say they haven’t found a car or truck they like. A smaller group is holding out for lower loan rates (18%), while tariffs were cited by just 11% of active shoppers.

One-fifth of active shoppers said that their decision to keep their current vehicle for longer was a factor in delaying their purchase.

Looking at the income distribution of active shoppers, the data continues to reflect a largely middle-income profile. The majority fall between $50K and $149K in household income, suggesting that many of these buyers are financially capable, but remain cautious in an uncertain economy.

Among drivers who have neither purchased a car in the past six months nor plan to buy one in 2025, a few clear themes emerge. This group is not driven by fear of rising costs or policy uncertainty, but rather by satisfaction with their current vehicle, and a lack of appealing options in today’s market.

The majority of these respondents (71%) say they’re sticking with their current vehicle longer, a sign that many Americans are adopting a “wait and see” approach to the market. Beyond that, 23% haven’t seen a deal worth moving on, while 9% say they haven’t found a car or truck they like. Price sensitivity remains a factor, with 20% waiting for prices to drop and 14% holding out for lower loan rates.

Concerns about tariffs are present, but not widespread. Among those on the sidelines right now, the reasons cited are roughly the same for all income segments. About one quarter say that they’re keeping their current vehicle for longer, while roughly 20% say they haven’t seen any deals worth acting on yet. The third most common reason for sitting out today’s car market is waiting for prices to come down. Only 7% cited tariffs as one of their reasons for not planning to buy a car in 2025.

The 2025 CarEdge Consumer Survey shows that the American car market remains fractured and cautious in the wake of economic headwinds and new policy shifts like auto tariffs. While some shoppers are moving forward with confidence, many are hesitant, skeptical, or simply waiting for conditions to improve.

The overarching takeaway? The car market in 2025 is no longer defined by pent-up pandemic demand or rapid inflation. Instead, it is being shaped by deal quality, interest rates, and policy awareness. For automakers, dealers, and car buyers alike, understanding these shifting motivations is key to navigating what’s shaping up to be one of the most complex car buying environments in recent history.

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.

Negative equity, or owing more on a car loan than the vehicle’s market value, continues to rise as inflationary pressures and long loan terms take their toll on car buyers. CarEdge, in partnership with Black Book, surveyed 474 drivers in Q4 2024 to uncover the state of vehicle equity. Here are the highlights and the broader implications for drivers, car buyers, and the automotive industry.

👉 Download the complete report

In Q4 2024, 39% of drivers who financed their vehicles were underwater—up from 31% in Q3, a 25% jump. For cars purchased since 2022, the situation is even worse: 44% of these buyers owe more than their car is worth. As depreciation accelerates and long-term loans become the norm, the risk of negative equity continues to grow. This trend highlights a troubling financial burden on drivers and poses risks for the broader auto market.

Our survey reveals that 60% of drivers believe their car is worth more than its actual trade-in value. Of these, 18% overestimate by $5,000 or more, and 7% by over $10,000. This disconnect leads many to carry negative equity into their next car purchase, perpetuating financial strain.

When drivers attempt to trade in or sell their vehicles, they often face the harsh reality of lower-than-expected offers, which can derail their car-buying plans. Unfortunately, many choose to roll over the remaining debt into their next loan. This practice, while common, leads to higher monthly payments and extended loan terms, keeping buyers in a cycle of financial vulnerability.

Loan terms significantly impact vehicle equity. Borrowers with 84-month loans face a median negative equity of -$8,485, while those with shorter 36-month terms have a positive median equity of $7,783. While longer loans make monthly payments more affordable, they also leave buyers trapped in equity-negative positions for years.

For many buyers, the appeal of lower monthly payments outweighs the long-term risks. However, as loan balances decrease more slowly with longer terms, these borrowers are more likely to face financial strain when attempting to sell or trade in their vehicles. Buyers who opt for shorter terms and make larger down payments tend to build equity more quickly, putting them in stronger financial positions.

Electric vehicle owners face the highest negative equity rates, with 54% underwater and a median equity of -$2,345. This makes EVs particularly vulnerable compared to gas and hybrid vehicles, which are more likely to have positive equity.

The rapid depreciation of EVs is a key driver of this trend. EV technology can become outdated quickly as newer models with improved range, charging speeds, and driver assistance features enter the market. Additionally, concerns about costly battery replacements and limited resale demand have led many buyers to prefer new EVs with warranties and a known history, further impacting the resale value of used EVs.

For EV buyers, understanding depreciation trends and factoring in long-term costs is critical to avoiding significant negative equity. Opting for shorter loan terms and considering potential incentives or tax credits can help offset some of the financial risks. Buyers who plan to hold on to their EVs for longer than just a few years are less likely to be impacted by negative equity with their auto loans.

As we head into 2025, the issue of negative equity looms large for both consumers and the auto industry. For car buyers, rolling over negative equity into new loans can lead to long-term financial stress, reducing their purchasing power and limiting options. For the auto industry, high levels of negative equity could dampen trade-ins and slow new car sales, forcing automakers and dealerships to adjust their strategies.

Car dealers also face challenges when appraising trade-ins with negative equity. To close deals, dealers may need to discount new vehicles more aggressively or offer creative financing solutions, which can erode profit margins. Over time, high levels of negative equity in the market can disrupt the typical sales cycle

The Q4 2024 Negative Equity Report paints a clear picture of a growing issue in the car market. Drivers, car buyers, and the auto industry alike must address the challenges posed by rising negative equity.

CarEdge remains committed to empowering consumers with tools and insights to navigate today’s challenging car market. To avoid falling into the negative equity trap, car buyers should prioritize shorter loan terms, be familiar with expected car depreciation, and monitor used car values with tools like Black Book. Overcoming negative equity is possible when drivers make informed car buying and ownership decisions.