CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

The average car payment has been on an upward trajectory for some time, and 2023 is no exception. Today, we’re dissecting what the average car payment looks like and why it’s been rising. We’ll explore how average monthly car payments crossed the $1,000 threshold, and how you can navigate this landscape to spend less.

| (New Cars) | 2023 Q3 | 2023 Q2 | 2023 Q1 |

| Average Term | 68.4 | 68.5 | 68.8 |

| Monthly Payment | $736 | $733 | $730 |

| Amount Financed | $40,149 | $40,356 | $40,468 |

| Average APR | 7.4% | 7.1% | 7.0% |

| Down Payment | $6,907 | $6,823 | $6,956 |

According to Edmunds’ latest data, the share of $1,000+ monthly car payments has hit an all-time high. The rise is attributed to various factors: high interest rates, increased automaker prices, and dealer practices.

Reaching a new record, 17.5% of new car loans in Q3 2023 required a monthly payment of $1,000 or more. That’s up from 17.1% in Q2 2023 and a massive increase from the meager 4.3% back in 2019.

The average car payment in Q3 2023 reached a record high of $736 per month for new cars, up 4.5% since Q3 2022, and a 32% increase from 2019. Meanwhile, the average monthly car payment for used cars is $567, marking a 46% rise from 2019, but up less than 1% from Q3 2022.

Take a look a the average new car payment over time:

Data source: Edmunds. Graph by CarEdge.

The average monthly payment for used cars has followed a similar path upward, as we can see here:

Data source: Edmunds. Graph by CarEdge.

In pre-pandemic times, there was a slow but steady rise in car payment amounts. As the auto industry came out of the pandemic recession and the following chip shortage, car prices went through the roof, bringing average monthly payments along with them.

Let’s talk about why car payments are so high right now, and what you can do about it.

So, how much have car prices gone up? The average transaction price for a new car is $48,451 in 2023, a 25% increase since 2019. For used cars, it stands at $28,381, still 37% higher than in 2019, despite a slight decrease from the previous year. To make matters worse, interest rates for used car loans are commonly over 10% these days.

We track used car prices weekly. See the latest data!

Why are average monthly car payments and overall prices rising so fast? The auto industry can’t simply blame it on inflation, as we’ll get into below. But first, let’s talk about financing.

Car buyers are making larger down payments as the cost of borrowing money increases. The average auto loan rate is now 7.4% APR for a new car loan, and 11.2% APR for a used car loan. These are the highest auto loan rates the market has seen since 2007.

When will car loan rates go down? Simply put, it’s up to the Fed. The Federal Reserve sets the ‘Federal Funds Rate’, which largely determines how much it costs for banks to borrow money from each other, ultimately driving consumer loan rates.

Raising interest rates is a tool used to combat inflation. The thinking goes that when borrowing gets too expensive, excessive spending will be discouraged, and in turn demand for goods and services will cool down to the point that inflation slows.

Car loan rates will remain high until The Federal Reserve begins to lower interest rates at their Board meetings. Inflation needs to cool down for that to happen. Things are headed in the right direction, but we’re not there yet.

FREE Resource: How to Finance a Car Like a Pro: The Ultimate Auto Financing Cheat Sheet

Even with auto loan rates at 20-year highs, there ARE ways you can lock in big savings on loan interest. Here are the most effective ways to save on interest, according to our CarEdge team of experts:

Check out our deep dive into the many ways you can spend less on auto loan interest. With today’s interest rates, these tips could save you hundreds of dollars! Don’t forget to print this auto finance cheat sheet and bring it with you!

Our team of Car Coaches is made up of professionals who have decades of experience in the auto industry. Rather than squeeze more money out of every sale at the dealership, these car pros help drivers SAVE money with their auto. We spoke to our team of Coaches to learn how much money today’s car buyers should aim to spend on their monthly car payment.

The consensus was broad: the CarEdge team advises keeping your monthly car payment below 10% of your monthly take-home pay. With gas, insurance, and maintenance, it should ideally be well below 20% of your monthly income. It’s worth noting that negotiation can play a pivotal role in ensuring you spend less on your car.

Here are a few essential FREE resources to help you budget for your car purchase:

Browse cars with expert help just a click away with CarEdge Car search.

Use this Free Out-the-Door Price Calculator to more accurately estimate how much your car will cost once taxes and fees are included.

Here’s a Free Car Payment Calculator that will help you understand what price range you can afford with your down payment. It’s most useful if you have an idea of what loan rates you might qualify for.

Most automakers have an oversupply of new cars right now. Over the past year, we’ve seen dealer lot inventory climb above and beyond what we typically see in a healthy, stable car market. Automakers and dealers like to have roughly a 60 day supply of new cars on their lots. Today, we see more and more models well above a 100 day supply. For some, like the Ford Mustang Mach-E, Jeep Renegade and Ram 1500 truck, inventory exceeds 200 days.

Something has to give. Floorplanning costs mean that the car dealers themselves pay interest for every day that a car sits on their lot. Plus, no one wants a two-year old ‘new’ car. With each passing day, dealers are incentivized to move their inventory off the lot.

We’re seeing used car prices fall rather quickly, yet new car prices are more complicated. Listing prices remain high (and in some cases outrageous), but our team of CarEdge Coaches is seeing greater negotiability on the new car market.

Dealers are more willing to lower their prices and remove add-ons and markups. However, in most cases, this is only true when the buyer is prepared to put some work into the deal with negotiation know-how. Don’t expect softball deals in today’s new car market. But don’t fret: we’re here to help.

Our team of Car Coaches created this 100% free guide to negotiating a car purchase with one goal: to save you time and money. Print it and bring it with you to the dealership!

Negotiate Car Prices With This Cheat Sheet

Looking for more car buying help? Search our free guides, and join the CarEdge Community today! We’re here to help you negotiate car prices confidently. When it comes to car buying, knowledge certainly is power.

Ready to work 1:1 with your own car buying coach? Learn more about CarEdge Coach, your path to ultimate savings! Looking for more of a DIY route to savings? We created CarEdge Data just for you. For the first time ever, behind-the-scenes market data is at your fingertips, empowering car buyers everywhere to negotiate with confidence.

Remember, the secret to smart car buying isn’t solely about discovering the car that captures your heart. It also involves understanding the market you’re shopping in. Despite escalating prices, opportunities remain for those willing to undertake comprehensive research and exhibit patience.

Stay informed, be patient, and you might find that the perfect deal is just a stone’s throw away. We’re here to help!

As 2023 model year lineups were announced last year, a sizable portion of the automotive industry faced widespread criticism for eliminating their most affordable vehicles from the lineup. At a time when new car prices were running away from the middle class, the most affordable versions of popular cars were sacked.

Now, in 2024, car manufacturers are reversing course. Are we about to see the resurrection of affordable cars? Or are we getting our hopes up too soon? Let’s take a look at where we’ve been, where things stand today, and where we’re headed as new car sales continue through yet another volatile year.

You could say Tesla started it all when they axed the much-hyped $35,000 version of the Model 3 years ago. However, legacy automakers are a different animal entirely, so we’ll fast forward to 2022. Late last year, Honda led the charge with changes to their product lineup, and were soon followed by Kia and Jeep. Within months, multiple base models were discontinued in the United States, sending entry-level prices through the roof overnight for some of the most popular cars in America.

This was no small move. Together, these manufacturers account for 30% of new car sales in the U.S. The effects were swift and significant, leading to an outcry among car buyers, and as one Kia representative put it, ‘unprecedented demand’ for what had previously been seen as unwanted, unpopular base trims.

Automakers cited lower sales numbers and the supply chain woes of 2021-2022 when explaining the abrupt decision. However, in doing so, they overlooked the crucial role these base models play in catering to the needs of lower-income and budget-conscious drivers. Without affordable base models, a large chunk of the market would be priced out, and would simply take their business to used car lots.

Fast forward to 2024, and some of these same automakers are now making a U-turn, resurrecting their affordable vehicles. The most shocking reversal comes from none other than…. Honda.

Honda ruffled feathers when it eliminated the most affordable Honda Civic, the LX base model, in late 2022. This decision followed an earlier price hike between $1,000 – $2,000 for the 2023 model year. Consequently, budget-conscious commuters, the heart of Honda’s fanbase, were left reeling just as interest rates climbed higher. Further compounding the issue, the CR-V, America’s #2 best-selling SUV, also lost its base trim.

As the base trims were dropped, the entry-level price for the Civic increased from $22,350 to just north of $25,000 for the EX. For the CR-V, the base price jumped by almost $5,000 overnight to $31,610.

The rationale behind these decisions might have been an attempt to boost profits amidst supply chain issues that had plagued Honda since 2021. However, by mid-2022, the automaker’s US sales had plummeted 50% year-over-year.

Now, Honda seems to be having a change of heart. In response to decreasing new car prices and slowed sales, the company has announced the return of the more affordable CR-V in 2024. The CR-V LX, without a sunroof, power-adjustable driver’s seat, and with just a single climate control zone, now lists for $28,410 plus a $1,295 destination fee.

Around the same time as Honda’s controversial move, Kia also announced the cancellation of the most affordable version of its popular electric car, the Kia EV6. This caused the base price of the EV6 to soar by $7,300, or 18%, to nearly $49,000. Furthermore, the beloved gas-powered Kia K5 also lost its LX base trim, pushing the entry price to $26,195.

Kia, once known for affordability, seemed to be pushing further into premium territory.

However, 2023 and 2024 have seen Kia backtrack somewhat, albeit with certain conditions. The automaker is now offering the EV6 Light in select western US states. The EV6 Light has even returned to Kia’s online configurator.

We call this a win for consumers, especially considering that Kia’s EVs lost the federal EV tax credit this year due to the Made in (North) America requirement.

As far as the Kia K5, the entry-level LX trim has yet to return. The K5 now starts at $26,515 with destination fees. For reference, the 2019 Kia Optima started at $23,915, or 11 percent less than today’s K5.

There’s a 399 day supply of Jeep Renegades nationwide, according to the car buying tools available through CarEdge Pro. This didn’t happen overnight. Jeep’s inventory has been building for months. In fact, every Jeep model has over 100 day’s supply, far above the industry’s healthy standard of 60 days.

You would have thought that Jeep’s parent company Stellantis would have seen the writing on the wall, and perhaps even would have considered lowering prices or introducing incentives.

What we got was the complete opposite. The boxy, poor-selling and unreliable Jeep Renegade lost its Sport base trim for the 2023 and 2024 model years. What happened next? Jeep’s inventory just kept on climbing, and now leads the industry for number of cars on the lot.

Here’s a full breakdown of Jeep inventory today, and where the best deals could be negotiated.

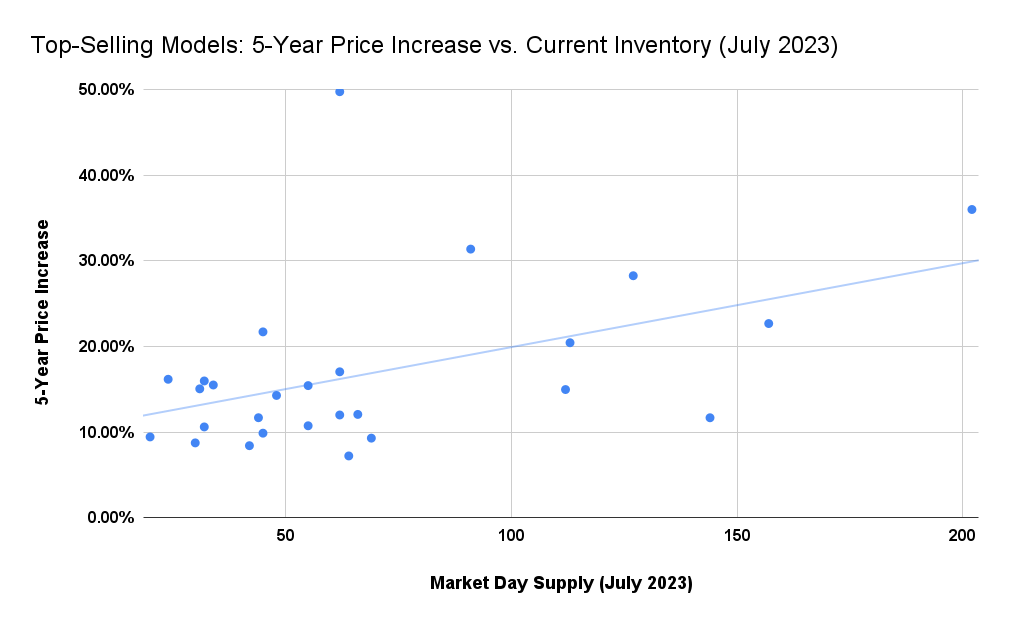

In the past five years, new car prices have risen by a staggering 37%. However, there seems to be a light at the end of the tunnel. Our own analysis reveals that automakers who have hiked prices the most are paying the price in the form of WAY too much inventory. See for yourself in the graph below showing how much inventory is on the lot for top-selling models that received price hikes this year.

Buyers are pushing back against runaway new car prices. Dealers are loaded with inventory that won’t sell. See which automakers are suffering the consequences right now, and how YOU can use this as negotiation leverage.

When it comes to the car market, we’re no stranger to the ups and downs. Get ready for yet another market adjustment, according to at least one group of experts.

A report by industry analysts at AlixPartners forecasts a steady decline in new car transaction prices over the next few years.

By 2025, the analysts expect the average transaction price to decline to around $42,000, down from where it stands today near $46,000.

What do they expect to drive this downward trend in prices? The dynamics don’t “mean the price of the same vehicle comes down,” Mark Wakefield, global co-leader of the automotive & industrial practice at AlixPartners, said at a press conference. “The predominant driver of that is mix shift and trim shift within a product to reduce the higher, more profitable vehicles and get more volume out.”

In other words, it looks like automakers are coming to their senses (at least somewhat) and are planning to make higher numbers of lower-trim vehicles at more accessible price points.

What if there was a way to guarantee you never overpay for a car again? We’re here to make that a reality for you. Don’t let the journey to your dream car be a bumpy one. Our CarEdge Coaches are ready to guide you every step of the way, ensuring you find the perfect vehicle at an unbeatable price.

Or, if you’re a do-it-yourself enthusiast, use CarEdge Pro to get the industry insights you need to negotiate like a pro.

Let CarEdge steer you towards your perfect ride. We’re here to help!

In 2023, the automotive market continues to navigate the unpredictable seas of supply and demand. A lingering used car shortage from previous years is causing 2-3-year-old in-demand models to skyrocket in price, while new car inventories are bloating due to overproduction. What does this mean for you, the savvy car shopper? Let’s dive in.

The latest data from Cox Automotive shows that in many cases, there’s a shortage of 2-3 year old used cars. For in-demand models that are just a few years old, demand far exceeds supply. Dealers are using this to their advantage (to the surprise of no one…) and are marking them up severely. For the brands we’ll talk about below, 2-3 year-old used cars often cost nearly the same as a brand-new car. There’s a totally opposite situation for NEW cars. For many makes and models, there’s now an oversupply of new cars in 2023, just two years after the car shortages of 2021.

New car available supply (total vehicles on the lot) is up 71% since last year, and dealerships are finding their lots chock-full of shiny new cars.

In terms of days’ supply, today’s market is up 47% since spring 2022. Days’ supply is a common auto industry metric that is calculated by dividing the total number of available vehicles by the average daily sales number from the last 45 days. It’s one of many available insights for every new and used listing with CarEdge Data.

790,000 more vehicles on sale today compared to May 2022 means dealers are more motivated than ever to cut deals and move inventory. However, despite this surge in supply, the average listing price for a new car is still 5% higher than last year.

On the flip side, used car inventory is 13% lower compared to last year. High prices have led buyers to say NO to used cars, resulting in a 4% drop in sales rates and listing prices. However, these prices remain stubbornly above 2021 levels.

With brands like Toyota, Lexus, Kia, Honda, Subaru, Hyundai, BMW, and Land Rover, new car supply shortages are making used models a more attractive option than their new counterparts. How so? Dealers continue to markup these cars in many markets.

On the other hand, brands like Ford, Lincoln, Dodge, Ram, Chrysler, Jeep, and Buick are dealing with a glut of new cars, making new vehicles especially negotiable today, and offering more value than used inventory at nearly the same price AFTER negotiation.

Based on the latest new car inventory, these brands are most negotiable in 2023:

Nationally, these automakers all have current new car inventory well above the historical norm of 60 days’ supply. See local days’ supply for models you’re interested in with CarEdge Data on Car Search.

Using the tools available through CarEdge Data, we analyzed new car inventory by brand in the three largest markets across the nation. Some notable differences are seen across California, Texas, and Florida.

| Brand | Days' Supply (CA) | Days' Supply (TX) | Days' Supply (FL) |

|---|---|---|---|

| Toyota | 39 | 43 | 38 |

| Kia | 44 | 46 | 41 |

| Honda | 46 | 47 | 43 |

| Lexus | 45 | 50 | 45 |

| BMW | 53 | 67 | 57 |

| Land Rover | 70 | 65 | 64 |

| Subaru | 59 | 53 | 55 |

| Hyundai | 66 | 53 | 56 |

| Volkswagen | 63 | 63 | 56 |

| Cadillac | 60 | 57 | 63 |

| Chevrolet | 68 | 64 | 68 |

| Nissan | 65 | 59 | 54 |

| Mercedes | 73 | 68 | 69 |

| Porsche | 82 | 61 | 72 |

| Mazda | 62 | 68 | 68 |

| GMC | 77 | 72 | 73 |

| Audi | 89 | 72 | 62 |

| Acura | 72 | 81 | 60 |

| Genesis | 96 | 95 | 87 |

| Mitsubishi | 91 | 65 | 65 |

| Mini | 81 | 94 | 92 |

| Ford | 80 | 71 | 67 |

| Dodge | 101 | 84 | 92 |

| Lincoln | 104 | 72 | 72 |

| Ram | 147 | 116 | 132 |

| Infiniti | 94 | 88 | 73 |

| Chrysler | 106 | 86 | 87 |

| Jeep | 126 | 103 | 119 |

| Jaguar | 101 | 90 | 81 |

| Buick | 100 | 106 | 84 |

Hyundai, Nissan, Mitsubishi and Audi have much higher inventory on the West Coast, while Toyota, Kia and Honda have higher new car inventory in Texas. Be sure to check local market supply in your area to get the best sense of negotiability.

In terms of segments, compact cars, midsize cars, subcompact cars, compact crossover/SUVs, minivans, and full-size crossover/SUVs are experiencing a supply shortage.

Conversely, full-size pickup trucks, high-end luxury cars, electric vehicles, full-size cars, and uber luxury vehicles are enjoying a much higher days’ supply than average.

New car segments like vans, mid-size SUVs, most luxury cars and traditional hybrids have roughly average inventory right now.

Right now is a great time to be in the market for a new EV. Across all brands, there’s a nearly 90-day supply of new electric vehicles. This can be seen in models such as the Ford Mustang Mach-E, which now has over 150 days’ supply. That’s up over 100% since last year.

Tesla keeps lowering prices, and with the Model Y, has severely undercut prices for the following popular competitors:

In other words, there’s finally serious competition in the EV landscape. Is it a price war? So far, Tesla’s competitors have not fired back with steep price cuts of their own. We’ll see if that changes this summer. However, used Tesla prices have fallen drastically this year.

Remember, the EV tax credit landscape has changed in the past several months. Popular EVs from Hyundai, Kia, Audi and others no longer qualify due to made-in-America requirements. However the most popular electric vehicles in America, which are of course those bearing the Tesla badge, once again do qualify for the first time since 2019. Here’s an updated summary of where things stand with the EV tax credits.

Whether it’s better to buy new or used in 2023 largely depends on the brand and type of car you’re interested in. Industry-wide, new cars are looking better than they have in years. Popular brands are facing an oversupply, and with that comes greater negotiation power.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

With fluctuating inventories and prices, it’s crucial to stay informed and flexible. Use CarEdge Car Search to check the local days’ supply of the makes and models you’re interested in, and make sure to stay updated with the latest market trends to snag the best deal.