Purchasing a new or used car can be an exciting experience. It can also be miserable. When you set out to secure a great deal on your next car, it’s essential to be well-informed about the auto financing process to avoid costly mistakes. To help you navigate the often complex world of car loans and financing, we have compiled a comprehensive guide to auto financing that covers ten essential steps and tips for success, including:

2. Considering down payment options

3. Shopping around for financing

4. Determining the right loan term

5. Understanding manufacturer incentives

6. Exploring Certified Pre-Owned Vehicles

To illustrate how to effectively employ these strategies, we have also created an example conversation between an empowered car buyer and a car dealership Finance Manager. This detailed script guides you through the entire financing process, from the initial introduction to signing the paperwork. By following this example and implementing the advice provided, you’ll be better equipped to secure a favorable loan, save money, and drive away in the car of your dreams.

Part One: Knowledge

Your Path to Auto Loan Savings: Credit Scores, Down Payments, and Savvy Financing Strategies

Let’s dive into valuable tips and expert advice from myself, CarEdge Finance and Insurance Specialist Kimberly Kline, and automotive industry veteran and CarEdge co-founder Ray Shefska. We’ll explore the key factors that influence your loan costs, such as credit score, down payment, and loan term, as well as some lesser known considerations that can save you big bucks at the finance office. Study this auto finance cheat sheet before you head to the dealership!

👉 The basics of auto lending: There are three things that lenders look at when determining whether to approve a customer for a loan. Those three things are 1) ability, 2) stability and 3) willingness.

Ability: do you have the ability to actually make the payments? Will your income support the payment? Based on your debt-to-income ratio, do you fall into the guidelines that the banks use to make this determination?

Stability: how long have you been doing what you do? How long have you been on your job, at your address? Do you job hop or move frequently? Have you shown the requisite stability within your field to satisfy the bank’s lending policies?

Willingness: how have you handled your past credit obligations? Have you handled them in a timely manner or have you sometimes fallen behind? In other words, have you shown a willingness to pay your bills in a timely fashion?

If you can satisfy those three criteria, then you should be approved for a loan at a good interest rate.

Now, we’ll walk you through the key factors you need to consider when applying for a car loan (with the goal of securing a great rate).

Check your credit score

Your credit score plays a significant role in determining your auto loan interest rate. Before shopping for a car, check your credit score and work on improving it. For example, pay off outstanding debts, make timely payments, and keep your credit utilization low. Be cautious of applying for multiple credit cards or loans in a short period, as this may negatively impact your score. Monitor your credit report for errors and dispute them promptly.

👉 Pro Tip: Always let the dealership Finance Manager know that YOU know your credit well! This puts you in a more controlling position.

Save for a down payment

Aim for a down payment of at least 20% of the car’s purchase price to minimize interest costs and potentially qualify for a lower rate. For instance, on a $30,000 car, a 20% down payment would be $6,000. By saving more for your down payment, you can reduce the loan amount, lower monthly payments, and decrease the likelihood of being upside down on your loan.

👉 Pro Tip: Banks and credit unions like to see a healthy loan-to-value ratio. This means that a higher down payment is always a good thing.

Shop around for financing

Don’t limit yourself to dealership financing. Once you know your credit score, search online for reputable credit unions that operate in your state (start here with CarEdge). Most credit unions publish their new and used auto loan rates on their website. This gives you an excellent idea of what the best current interest rates are. This arms you with knowledge when it comes to speaking with the Finance Manager. If you find a great deal, speak to the loan officer, and consider applying for a car loan. Even if you decide to finance with the dealership, this pre-approval will come in handy in the dealership finance office. Consider working with CarEdge-approved credit unions for excellent rates, and top-tier customer service.

👉 Pro Tip: protect your credit. Don’t aimlessly apply to credit unions online but if you find one with great rates, always speak with a loan officer first, get all your questions answered on their process and then apply.

Consider loan terms

While longer loan terms may have lower monthly payments, they also mean you’ll pay more interest over the life of the loan. Opt for a shorter loan term if it fits your budget to save on interest costs. For example, choosing a 48-month loan term instead of a 72-month term on a $25,000 loan at a 5% interest rate can save you over $1,500 in interest payments.

Look for manufacturer incentives

Automakers often offer special financing deals or cash rebates to encourage new car sales. Keep an eye out for these incentives, such as low or 0% APR financing, which can significantly reduce your overall interest costs. Be sure to read the fine print and weigh the pros and cons of these offers before deciding. We keep track of the best manufacturer incentives here.

👉 Pro Tip: Don’t expect the dealership finance manager to advertise the manufacturer promotion. Do your research online before shopping.

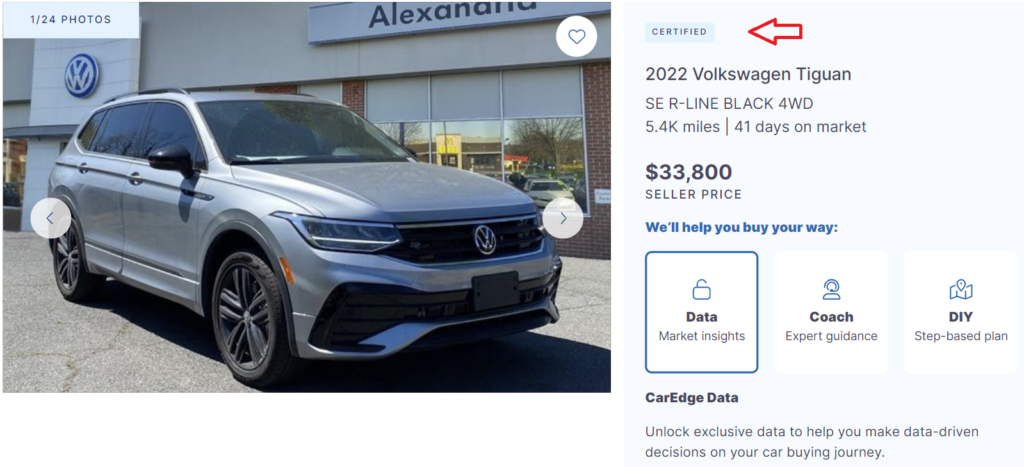

Choose a Certified Pre-Owned vehicle

If you’re buying a used car, consider a manufacturer-certified Certified Pre-Owned (CPO) vehicle. Manufacturer CPO programs have stricter guidelines and typically offer enhanced warranty coverage. Stay away from third-party CPOs, at least if you’re looking for better rates. Browse certified pre-owned (CPO) car listings at CarEdge Car Search to find the perfect vehicle with local market data.

👉 Pro Tip: Let the dealership Finance Manager know that YOU know there are often APR Incentive rates for manufacturer CPO’s. So speak their language and ask them to “check their rate sheet for subvented rates on the CPO”.

Refinance existing loans

If you are stuck with a higher-than-ideal rate, consider refinancing to save on interest costs and potentially lower your monthly payment. Refinancing involves taking out a new loan to pay off your existing loan, ideally with a lower interest rate. Refinancing matters more today than it has in the recent past. With rates being so high right now, even half of a point could save you big money over the life of the loan! This can be a smart move if your credit score has improved since you initially took out the loan or if you discovered in hindsight that the dealership put you in a higher interest loan.

👉 Pro Tip: When refinancing, check to see if the bank or credit union has any incentives (such as for automatic withdrawals, or career-based incentives for teachers, first responders, military and more).

Avoid dealer finance markups

Dealerships may add a markup to the interest rate they offer on car loans, pocketing the difference as profit. Be aware of this practice and ask for the ‘Buy Rate’ to see how much the dealership is marking up the loan. If you have a pre-approval from a credit union, use it as leverage to negotiate the best rate with the dealer. It’s smart to understand how dealers make money before negotiating.

We’ll explain exactly how to negotiate marked-up interest rates in the next section. Stay tuned!

Pay off the loan early

If your car loan allows for early repayment without penalties, consider making extra payments towards “principal only” to pay the loan off ahead of schedule.

👉 Pro Tip: Use an amortization schedule to see how fast you’ll pay down your loan!

This can save you a significant amount of money on interest charges over the life of the loan. Just be sure to double-check your loan agreement for any prepayment penalties before proceeding.

Now, let’s go over a real-world scenario that will be VERY similar to what you’ll encounter at the dealership. It’s time to apply your knowledge!

Part Two: Apply What You Learned

Check out our series of car buying roleplay videos for unbeatable insights into what it’s like to make a deal!

The best way to learn how to effectively negotiate in the finance office is to prepare for the situations and conversations you’re likely to encounter. What better way to do that than creating a real-world script with the help of dealership professionals who’ve been through this hundreds of times? The following is an example conversation between an empowered, prepared car buyer and a car dealership auto Finance Manager. Don’t forget to check out the original CarEdge Cheat Sheet to Car Buying for more word-for-word car buying help!

Finance Manager: Hi, I’m the finance manager here at the dealership. I understand you’re interested in purchasing a car today. Is that correct?

You: Yes, that’s correct. I’ve already chosen the car I want, and now I’m looking to finalize the financing.

Scene 1: Credit Score

Finance Manager: Great, let’s start by filling out a credit application.

(Note: The dealership is going to need to run a credit report and will insist on doing so in order to determine what interest rates you may qualify for. People usually only know their overall credit score and not their auto credit score which by its nature is what banks need.)

You: I know my credit well and I have Tier One credit.

👉 Pro Tip: If you have a lower credit score, you can ask for a ‘tier bump’ at this point. A tier bump is essentially when the dealership finance manager would call the lender to ask for a higher rate, despite the buyer’s lower credit.

Scene 2: Financing Options

Finance Manager: That’s a decent score. Now let’s discuss financing options. We have some deals available through our dealership.

You: Thanks, but I’ve already shopped around for financing and have already spoken with my credit union loan officer and I will qualify for their best rate. I’d like to see how your dealership’s rates compare before making a decision. Also, I’ve been approved for a lower rate with a credit union. Can you beat that rate?

👉 Pro Tip: If you’re borrowing over $30,000, consider asking about a ‘large loan discount’, which is sometimes an option for higher borrowing amounts. See the video we shared in Scene One for more information!

Finance Manager: We’ll certainly do our best to match or beat the rate you’ve received from the credit union. Let me check our current offers. Based on your credit score, we can offer you a 60-month loan at an interest rate of 4.5%.

You: I appreciate the offer, but I’d prefer a shorter loan term of 48 months to save on interest costs over the life of the loan. Can you provide a quote for that term and see if you can match or beat the rate I received from the credit union?

Finance Manager: Sure, let me recalculate the rates for a 48-month term and see if we can match or beat your credit union’s rate. Give me a moment.

Alright, I’ve looked into our current offers for a 48-month loan term. We can offer you a 48-month loan at an interest rate of 0.5% lower than the offer from your credit union.

You: That’s great! I appreciate you working with me to secure a better rate. I think I’ll go with this financing option from the dealership. Interest adds up!

Scene 3: Down Payment

Finance Manager: How much do you plan on putting down as a down payment?

You: I’m prepared to make a down payment of 20% of the car’s purchase price to minimize interest costs and avoid the need for GAP insurance. Can you double check if there are any additional manufacturer incentives or offers available that could get me an even lower rate?

Scene 4: Certified Pre-Owned (CPO)

You: I noticed that the car I’m interested in is a Certified Pre-Owned (CPO) vehicle. Please check your “rate sheet” for subvented rates on the CPO. Does that qualify me for a lower interest rate?

👉 Pro Tip: It will go a long way to show that you’re familiar with dealership terms like the ones we’ve included here. Don’t miss this FREE resource: The Car Buyer’s Glossary of Terms

Finance Manager: Yes, CPO vehicles typically do qualify for lower rates due to their lower risk. With that in mind, I can offer you a 3.9% interest rate for a 48-month loan with the manufacturer incentive.

Scene 5: Avoiding Dealer Finance Rate Markups

You: I appreciate the offer, but what is the rate on my approval that you received? I’d like to see a direct quote from the lender.

(Note: You can ask to see the direct quote from the lender, but know that since this is indirect lending with the dealership acting as an intermediary, they are not required to share that information with you. Their answer simply may be, “this is the rate that I can offer you”.)

Finance Manager: You received a subvented rate of 3.9%.

You: Is that the Buy Rate?

Finance Manager: No, we mark it up by a point.

You: I would really love that Buy Rate. I know my credit union offered 4.0%, but if you can give me 3.5%, I won’t refinance the loan immediately.

Finance Manager: Okay, I can do that.

👉 Pro Tip: The Finance Manager always wants to avoid the charge-back on the refinance. Basically, if you refinance right away, they’re not making any money from selling you the loan.

Scene 6: Add-ons and Extended Warranty

Finance Manager: Before we finalize the paperwork, I’d like to go over a few additional products we offer that could save you money in the long run. First, we have a Theft protection Package that will reimburse you in case your car is stolen.

You: Thanks for mentioning it, but I’ve already researched that option and I don’t think it’s necessary for my situation. I’ll pass on the Theft protection Package.

Finance Manager: Alright, that’s fine. Another package I’d recommend is our Tire Care Package. It covers tire replacements and rotations, ensuring your tires are always in great condition.

You: I appreciate the suggestion, but I’ve budgeted for tire maintenance separately and will handle it on my own. I won’t be needing the Tire Care Package.

Finance Manager: No problem, I understand. Lastly, we offer an Extended Warranty that covers any unexpected repairs or breakdowns after the manufacturer’s warranty expires. It’s a great way to protect your investment. I can offer this coverage to you for $30/month.

👉 Pro Tip: Finance Managers will not give you the actual price unless you ask for it. They prefer to tell you the monthly payment to downplay the cost.

You: I’ve actually already looked into extended warranties, and I found the same exact coverage through CarEdge for hundreds of dollars less. I’ll be purchasing their warranty instead.

Finance Manager: Alright, I respect your decision. Let’s move forward and finalize the paperwork for your new car!

(Note: If the finance manager attempts to force you to purchase any of their add-on products, demand to see the contract. Every product includes a contract, and on there, it will clearly state that the product is not required to secure financing.)

👉 Pro Tip: The purchase of products in the finance office cannot be tied to your interest rate. For example, a Finance Manager cannot say “if you get the extended warranty, you’ll get a lower interest rate”.

You can say “No” to everything if you want and sign a Declination Disclosure. However, it is part of Compliance that the Finance Manager lets you know the additional products that are available to 100% of the buyers, 100% of the time.

The Complete List: Never Pay These Fake Dealership Fees

Scene 7: Signing the Paperwork

Finance Manager: Here’s your base payment at 3.5% for 48 months. Are you ready to proceed with this offer?

You: Yes, that sounds great. Let’s finalize the paperwork and complete the purchase.

By employing the expert advice provided in the previous responses, the car buyer in this example has successfully navigated the auto financing process, and secured a great deal. Despite the initial offer from the dealership being substantially higher interest rate, the buyer used their knowledge of auto financing to get a better rate. By showing that they understand the process through questioning every aspect of the deal and speaking dealership language, the buyer stayed in control, ultimately saving hundreds to thousands of dollars over the life of the loan.

You’ve Got This! We’re Available to Help Anytime

Check out CarEdge Dealer Reviews to see what deals are near you!

With these car loan tips in hand, you’re well on your way to making the best possible auto financing decisions. But don’t stop there! Join the 100% FREE CarEdge Community to connect with our Car Coaches and thousands of drivers like yourself. Looking for expert tools and assistance? CarEdge Data and CarEdge Coach offer expert guidance and personalized support throughout the car buying process. Our experienced professionals will help you save money, avoid costly mistakes, and achieve your car buying goals.

Don’t go through the car buying process alone – let CarEdge empower you with industry-leading tools and expert coaching. Try CarEdge Data and CarEdge Coach today and drive away with confidence.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

This article thanks for taking the time to write and thank you for being an all. I think I’m ready for the F&I office.

Thank you for your kind words! I’m glad you found the article helpful. If you feel ready for the F&I office, that’s great to hear.