As we enter autumn, retail and wholesale used car prices are falling. In October 2025, the average used car listing price sits at $25,512. The car market is changing as year-end sales approach. This combination of seasonality and economic uncertainty means that used car prices will be difficult to forecast in the weeks ahead. With the continuing market volatility, it’s never been more important to track the value of your car.

👉 We also track new car prices. See the latest monthly update here.

Used Car Prices – October 2025 Update

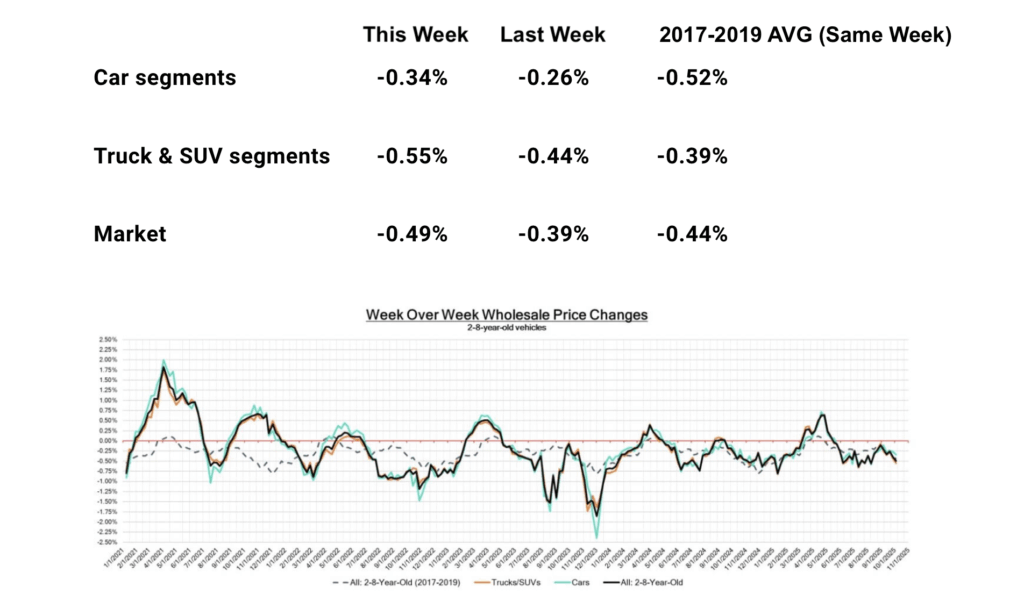

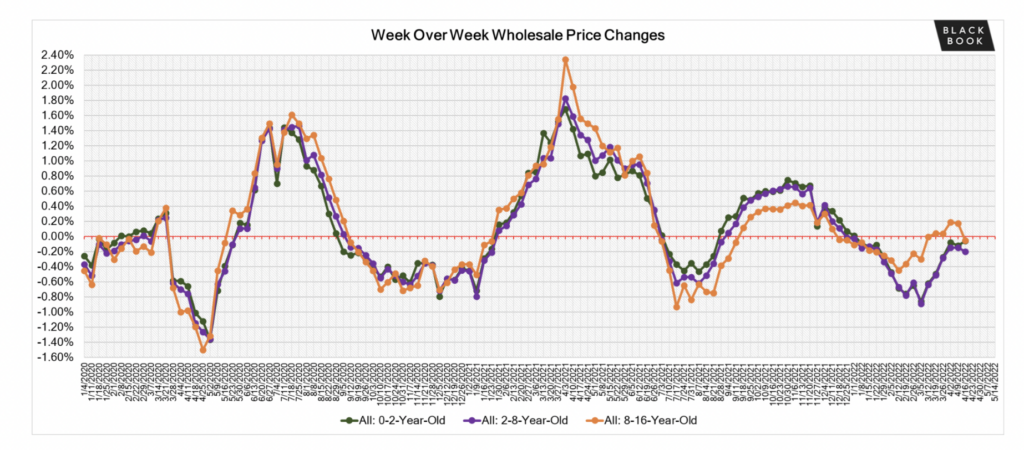

As of October, used car prices have fallen for 25 consecutive weeks. According to the latest used car market data from Black Book, the used car prices are slowly but steadily falling at wholesale markets. These are the markets that most car dealerships buy and sell preowned inventory from. Will retail used car prices continue dropping? We’ll get into that below. First, let’s take a closer look at wholesale prices last week.

Where are used car prices headed? Let’s look at the data.

This week, wholesale used car prices continue a steady decline as the year-end car buying season appears on the horizon. That’s a great sign for buyers looking for lower prices in the weeks ahead.

In the first week of October, wholesale used car prices fell – 0.26% according to Black Book data. This drop is on par with the historical average for this time of year, following several week of larger declines.

Which used car prices are falling most? Let’s take a look at the latest data from Black Book. We’ll break it down by vehicle segment below.

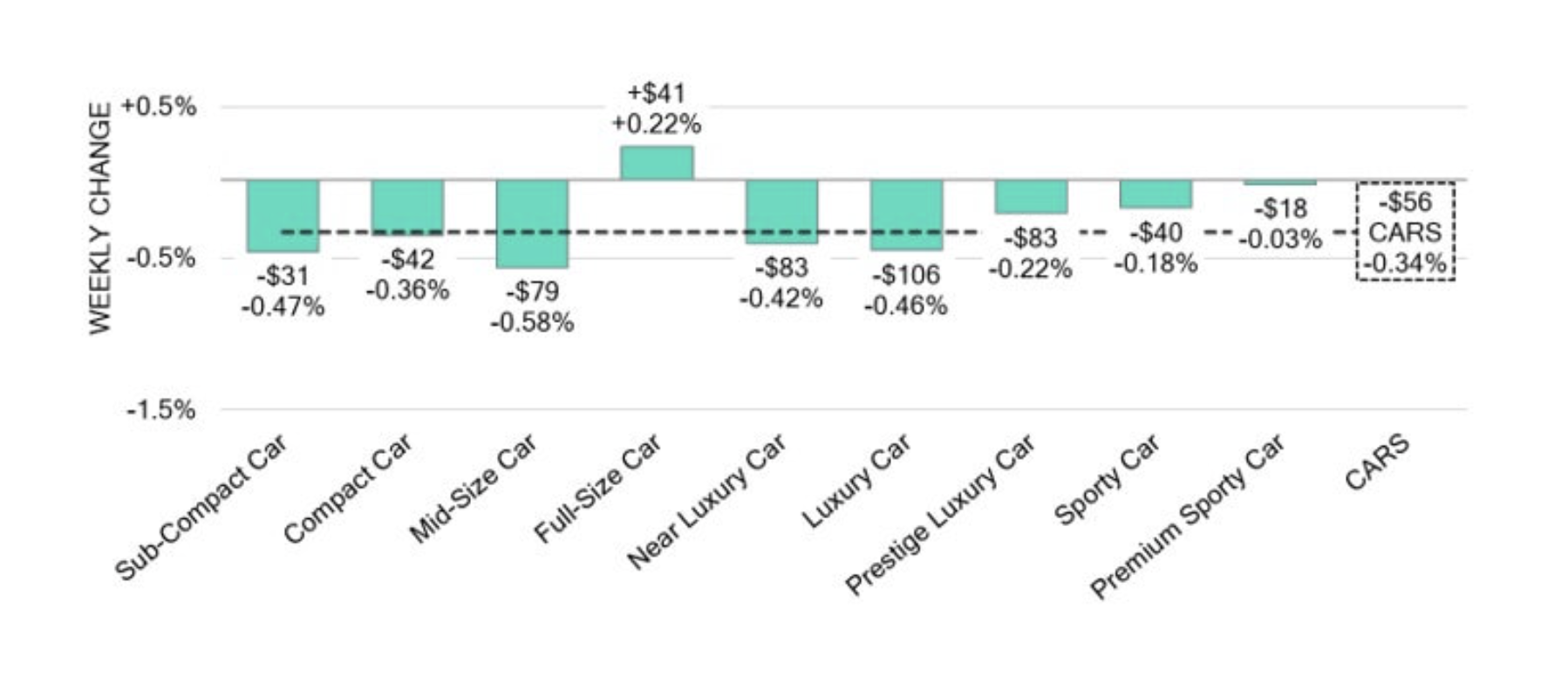

Used car prices (wholesale sedans)

The overall car segment saw prices fall -0.34% this week. Most segments of sedans, from luxury to compact, saw falling prices. Midsize and luxury car prices fell the most, while full-size cars actually increased. Here’s how used car prices changed over the past week:

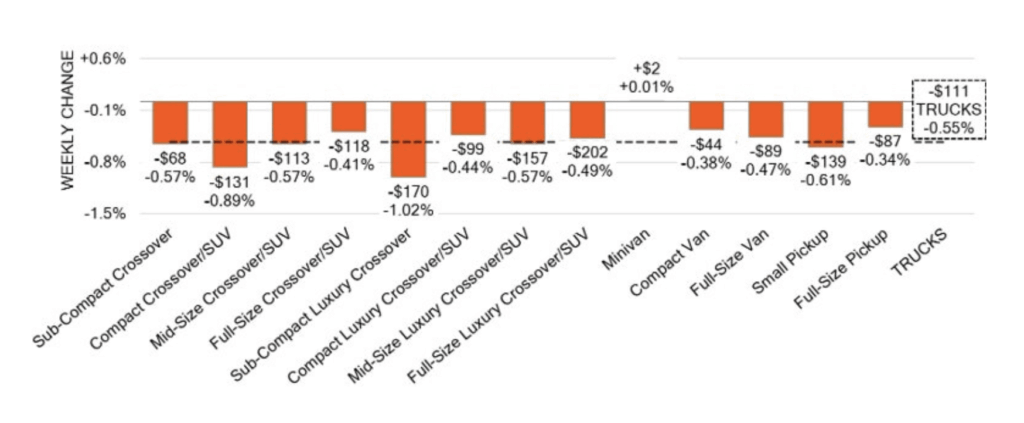

Used Truck Prices (Wholesale)

Used truck and SUV prices are falling in October 2025. No segments are falling sharply, but all are seeing moderate declines. Across the segment, wholesale prices fell by -0.55% last week. Buyers should expect better negotiability for used truck and crossover models as the year-end car buying season gets started. How so? Car buyers tend to focus on new car incentives during this time, lowering the demand for used cars. Buyers can use this to their advantage.

Retail used car prices are flat in October

As the data above shows, retail used car prices are basically unchanged in early October. Historically, used car prices fall during the autumn and winter months. We’ll be watching to see if that trend continues in 2025.

Lower interest may drive the demand for used cars higher in the coming months. This is something that both buyers and sellers should be aware of. Sellers are likely to have an easier time selling come December and beyond, while buyers will face increased competition.

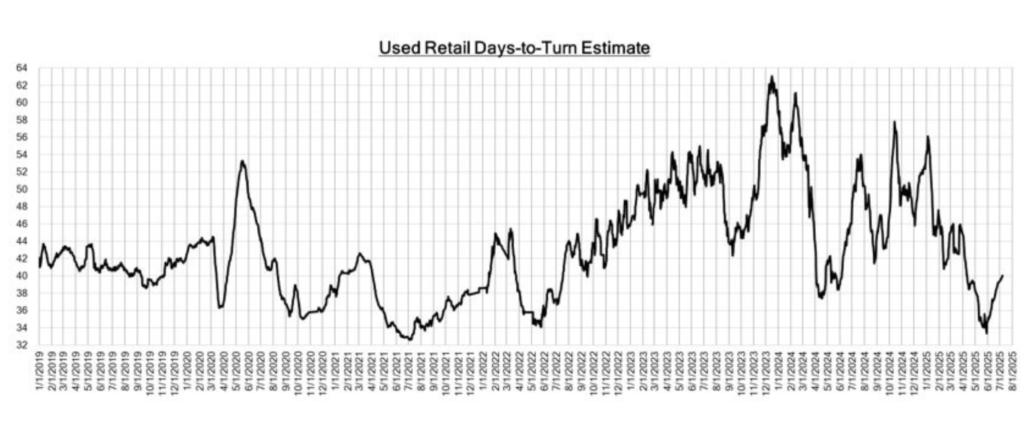

How long does it take to sell a car in 2025?

Used cars are selling faster than they have in recent years. In the graph below, you can see how the retail days-to-sell metric has been falling over the past few months.

According to Black Book, the estimated Used Retail Days-to-Turn is now at 36 days. In other words, it take 36 days to sell a used car on average in 2025. Late last year, this number was north of 55 days. It’s interesting to note that used car prices are falling as the time to sell has fallen sharply. Usually, we’d expect to see the time to sell increase as prices fall. Of course, cars in higher demand will sell quicker, and those with less demand can take considerably longer.

New Car Price Trends (Monthly Updates)

Free Car Buying Help Is Here!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Older used cars have appreciated most

A new phenomenon we have begun tracking is that older used cars are appreciating more rapidly than younger used cars.

This is primarily a function of consumer demand. Retail customers that want to purchase a car at a sub $20,000 price-point are being forced to look at older used vehicles because the new ones have increased in value beyond their budget. This is scary, crazy, and a whole host of other words.

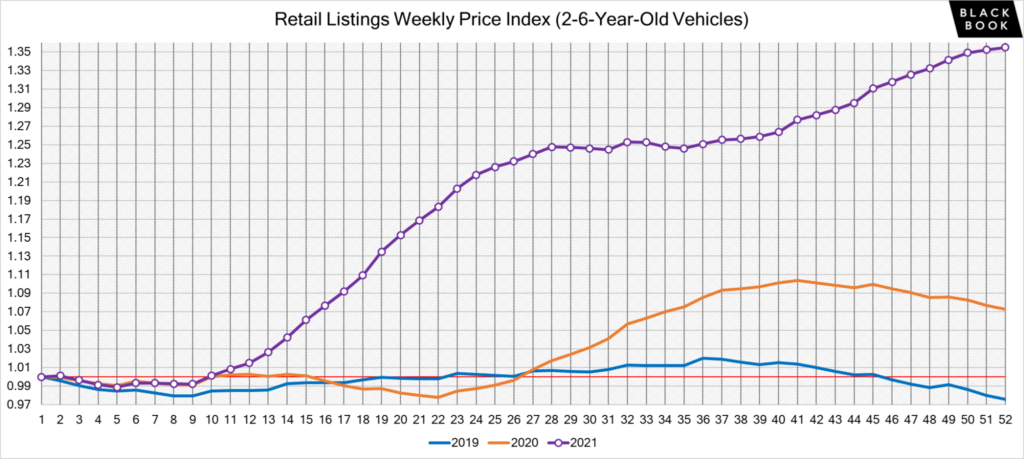

How much did used car prices increase back in 2021?

How did used car prices get so high? To find the answer, we simply need to remind ourselves of the car shortages of 2021. Depending on who you ask (Cox Automotive, Edmunds, CarGurus, or Black Book), retail used car prices increased anywhere from 32% to 36% in 2021.

Black Book shows a 35% increase in retail used car prices for 2021 (the purple line). For comparison, the orange line shows a 7% appreciation for used car prices in 2020, and the blue line shows a 3% depreciation of used car values for 2019.

Here’s a month-over-month table showing used car price trends for 2021:

| Month | Average Used Car Price |

| January | $22,112 |

| February | $21,573 |

| March | $21,343 |

| April | $22,568 |

| May | $24,414 |

| June | $25,101 |

| July | $25,500 |

| August | $25,890 |

| September | $26,548 |

| October | $27,067 |

| November | $27,569 |

| December | $29,000 |

This data, supplied by Cox Automotive, shows the incredible ascent used car prices took in 2021.

Wholesale used car price trends are even crazier

Every used car has two prices; the wholesale price, and the retail price. As consumers we typically concern ourselves with the retail price, and with good reason, unless you have a dealer’s license you can’t buy a car wholesale at an auction.

That being said, wholesale used car prices are the lifeblood of car dealers, and the used car price trends we saw on the wholesale side in 2021 were truly unfathomable. While retail used car prices increased ~36% in 2021, wholesale used car prices rose 52%.

There is an obvious interplay between wholesale and retail prices. As wholesale prices increase, we can expect retail to prices to do the same.

Interactive data

Thanks to our friends at foureyes, we can share with you this real-time updating data set on used and new car prices.

How will the recent hurricane be affecting auto prices on the used car market. Will there be concerns over cars that may have been declared a total loss on the used car market?

My vote is definitely team Pops/reality

I like to be an optimist but these are most extraordinary times and the economy being the way it is and God knows getting worse I don’t see the used car market (far more affordable than new cars) going anywhere but up.

No

Great insights in this post! It’s really helpful to see the data on used car price trends, especially with the fluctuations we’ve been experiencing. I’ll definitely be checking back weekly for updates as I’m in the market for a used vehicle soon. Thanks for keeping us informed!

Every single vehicle (used $35k-42k range) that I have been watching as a potential purchase just increased by $1000-$2000. Deep South. Very discouraging and not at all indicative of what I read/see on CarEdge. Then when you see the listing include “$500 price drop” ….from the new price?!!! Sickening and ready to give up and buy a piece of junk for $1500