CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’ve been watching the car market, you know something’s broken. But here’s what most people don’t realize: car repossessions in 2026 are tracking at levels we haven’t seen since the 2008 financial crisis. For owners at risk of losing their vehicle, this is a statistic that hits close to home. And if you’re a used car buyer, this could be a little-known opportunity to snag a deal.

CarEdge co-founder Ray Shefska here has spent decades in dealerships, and he’s seeing something alarming on the lots right now. Let me break down exactly what’s happening, what dealers aren’t telling you about these repo cars flooding the market, and how you can navigate this situation whether you’re buying or currently at risk of losing your vehicle.

Let’s start with the numbers. According to recent data from Cox Automotive, auto loan delinquencies (60+ days past due) have climbed to 4.8% in early 2026—the highest rate since 2010. Here’s why:

1. Pandemic-Era Loans Coming Due

Remember 2021-2022 when everyone bought cars at inflated prices with six or seven month loans? Those buyers are now 3-4 years into loans, and many are deeply underwater. Their $45,000 electric vehicle or luxury crossover is worth $25,000, but they still owe $38,000. Many are looking for a way out of negative equity, but few are finding an easy solution.

2. Payment Shock Is Real

The average new car payment in 2026 is $748/month. Used cars? $563/month. That’s not a car payment—that’s a second mortgage. When you combine that with inflation in groceries, rent, and insurance, something has to give.

3. Subprime Lending Came Roaring Back

From 2021-2024, lenders loosened standards dramatically. People with 580 credit scores were getting approved at 18-22% APR. Now those loans are imploding. Subprime auto loan delinquencies are above 6.5%. As banks and automaker captive financing companies lose money on more loans, it become tougher for all borrowers to secure a good rate.

If it gets any worse, the entire auto lending system will be under threat.

4. The Trade-In Trap

Industry veteran Ray Shefska sees it all the time: “People come in already $8,000 upside down on their current loan, roll that negative equity into a new $50,000 purchase, and suddenly they’re financing $58,000 at 9% interest. When life happens—job loss, medical bills, divorce—that payment becomes impossible.“

Repossession isn’t just losing your car. For many, having a car repossessed is a financial chain reaction that can follow you for years. Understanding the sequence of events and the full scope of the damage is the first step to avoiding it, or dealing with it if you’re already there.

The Repossession Timeline:

The Financial Damage:

If you know repossession is inevitable, you don’t have to wait for the tow truck to show up in the middle of the night. Voluntary repossession—where you call your lender and arrange to drop the car off yourself—puts you in control of the timing and lets you clear out your belongings on your own terms.

The financial damage is nearly the same either way. Voluntary repo still hits your credit report just like an involuntary one, and you’re still on the hook for any deficiency balance if the car sells at auction for less than you owe. The one practical upside is that you may avoid the repo agent fee ($400–800), which slightly reduces what you’ll owe in the end.

Think of it less as a financial solution and more as a way to manage a bad situation with a little more dignity. If you’ve exhausted your other options—negotiating with the lender, refinancing, or selling the car yourself—voluntary surrender at least lets you exit on your own terms rather than waking up to an empty driveway.

Car dealers have good reasons for not advertising repossessed cars. Many shoppers would be turned off by this revelation. Few drivers want their “new” car to remind them of the financial hardships others have endured. So, how can you find out if a car was repossessed? Let’s get into it.

Ray’s seen thousands of repos come through dealerships, and here’s how they get there:

Route 1: Wholesale Auction (Most Common)

“When a bank repos a car, they want it gone fast,” Ray explains. “It goes to Manheim, ADESA, or another wholesale auction. Dealers bid on these, usually getting them for $3,000-7,000 below clean retail because repos often have issues like missed maintenance, interior damage, sometimes even mechanical sabotage from angry former owners.”

Route 2: Direct Sales to Franchise Dealers

Captive finance arms (Ford Credit, GM Financial, Toyota Financial) often send repos directly to their franchise dealers. “A Ford repo might come straight to a Ford dealership’s used lot,” Ray notes. “These are usually in better shape because they were newer when repossessed.”

Route 3: Buy-Here-Pay-Here Lots

Higher-mileage repos with issues often end up at BHPH dealers who do in-house financing. These lots target the same subprime buyers who lost their cars to repo, creating a dangerous cycle.

Here’s what dealers won’t voluntarily disclose:

1. They’re Not Required to Tell You It’s a Repo

Unlike flood damage or salvage titles, repossession history doesn’t show up on a Carfax or vehicle title. A dealer can legally sell you a former repo without disclosure.

2. Repo Cars Often Have Hidden Issues

“I’ve seen repos come in with 15,000 miles past due for an oil change, bald tires, and check engine lights,” Ray says. “The previous owner knew it was getting taken back—they stopped maintaining it months ago.”

3. The “Auction Fresh” Red Flag

On a Carfax, look for “sold at auction” within the last 30-60 days, especially if there’s only one previous owner. That’s often a repo that got wholesaled.

4. Dealers Mark Them Up Anyway

Just because a dealer bought it cheap at auction doesn’t mean you get a deal. They’ll still mark it up to market rate or higher. Your job is to negotiate knowing they have less money in it.

Research red flags

Check the Carfax or AutoCheck report. A Repossession may show:

At the Dealership, keep an eye out for these signs:

Questions to ask the salesperson

1. “Where did you acquire this vehicle?” (If it came from an auction, that’s normal. Inquire further by asking if it was a bank return. In dealership lingo, repos are often called “bank returns”)

2. “Can you show me the last service records?” (Gaps of 12+ months are a warning sign)

3. “Has this vehicle had a pre-purchase inspection by your service department?” (Many repos don’t get proper reconditioning)

4. “What’s your best out-the-door price?” (Repos have more negotiating room since dealers bought them cheap)

The opportunity is real, but be careful. Here’s Ray’s advice: “The repo surge means there’s legitimate opportunity for educated buyers. Banks are motivated, dealers have inventory they want to move, and you can get a good car for the right price—but you MUST do your homework.”

Some banks sell repos directly to consumers through their websites:

Pros: Skip the dealer markup, often better condition disclosure

Cons: Sold as-is, limited negotiation, you handle all paperwork

Manheim and ADESA occasionally have public auction days. You can inspect vehicles beforehand and bid directly.

What to Bring:

If you play it smart, it’s possible to buy a repossessed car at auction for 20-25% below retail pricing.

If you’ve identified a likely repo at a dealership:

1. Get a Pre-Purchase Inspection: Non-negotiable. Pay $150-200 for an independent mechanic to inspect it thoroughly

2. Use Auction Data: Check recent auction results on sites like Manheim Market Report to see wholesale values

3. Negotiate Based on Condition: “I see this needs new tires ($800), brakes ($400), and hasn’t been serviced in a year. Here’s my offer based on these deferred costs.”

4. Get an Extended Warranty: If you’re buying a higher-mileage repo, negotiate for a dealer warranty or purchase a reputable third-party plan

If you’re not comfortable evaluating a repo, just wait for off-lease inventory. These are vehicles coming back from 2-3 year leases, typically well-maintained, and dealers are motivated to move them too. You get a known history without the repo risk. For many, it’s worth the patience and higher price tag for a known vehicle history.

The good news is that you have more options than you think. If you’re behind on payments and worried about repo, here’s Ray’s advice from someone who’s worked with hundreds of struggling buyers:

Don’t hide. Most lenders would rather work with you than repo your car. Call and ask about:

“The absolute worst thing you can do is ghost your lender,” Ray emphasizes. “Once they assign a repo agent, your options disappear.”

If you’re underwater but not too deep:

1. Get instant offers from Carvana, CarMax, and Vroom

2. Compare to private party value on Facebook Marketplace or Craigslist

3. If you can cover the difference between the offer and your payoff, sell immediately

4. If possible, use the proceeds to buy a $5,000-8,000 reliable used car that you own outright. If that’s not an option, start saving up.

If you can’t make payments and can’t sell, voluntary surrender is better than repossession:

“Voluntary surrender is better than hiding the car and playing games with the repo man,” Ray says. “It shows some responsibility and might make the lender more willing to negotiate on the deficiency.”

If you’re 30-60 days behind but your credit hasn’t tanked yet:

“I’ve helped people who were 60 days behind get into a different vehicle with a $200/month lower payment,” Ray notes. “It’s not ideal—you’re still buried—but it keeps you mobile and out of repo status.”

Used Car Prices Will Stabilize or Decline. Repo inventory flooding wholesale auctions puts downward pressure on used car prices. Good news if you’re buying, bad news if you’re trying to trade in.

Lending Will Tighten (Again). Expect stricter credit requirements, higher down payment demands, and shorter loan terms as lenders react to losses. The 84-month loan at 6.99% for 620 credit scores? That’s disappearing.

Subprime Buyers Will Struggle. If you have damaged credit and need a car, expect to pay 15-22% APR or resort to buy-here-pay-here dealers with even worse terms. Breaking this cycle requires saving for a cheap, reliable car you can own outright.

Opportunity for Cash Buyers. 2026-2027 could be the best time in years to buy a used car with cash or strong credit. Dealers need to move inventory, repos are plentiful, and negotiating leverage is shifting back to buyers.

If You’re Buying:

If You’re Struggling With Payments:

The bigger lesson according to Ray

“The repo crisis of 2026 is a direct result of over-leveraged buyers financing depreciating assets at high interest rates. If you take away one thing, let it be this: just because a bank will approve you for $60,000 doesn’t mean you should borrow it. Buy less car than you can afford, keep the loan term short, and always have an emergency fund. That’s how you avoid becoming a repo statistic, and having a car you no longer drive follow you for years.”

What’s your experience with the current auto loan market? Have you seen repos on dealer lots, or are you navigating a difficult payment situation yourself? Join the conversation at the CarEdge Community.

On Friday, February 20, 2026, the U.S. Supreme Court ruled that President Trump exceeded his authority when imposing sweeping global tariffs under the International Emergency Economic Powers Act (IEEPA). The 6-3 ruling puts an end to tariffs imposed under the IEEPA, but it leaves other tariff options on the table for the administration.

That decision immediately reshapes U.S. trade policy, and it has real consequences for automakers, dealerships, and car buyers. It’s important to note that this remains a developing situation, and President Trump has already committed to imposing a new 10% global tariff in coming days.

To understand what happens next, we first need to look at what the tariff environment actually looked like just before the ruling.

Before the Supreme Court decision, vehicle imports into the United States were operating under meaningfully elevated effective tariff rates. Across all imported vehicles, the blended effective tariff rate averaged approximately 15.3%. That reflects the real-world duties being paid at the border after negotiations and adjustments, not just the original headline tariff proposals.

Rates varied by country:

In practice, most North American-built vehicles retained duty-free status, preserving a major supply chain advantage for USMCA-compliant production.

It is important to clarify that these figures represent effective rates, not just headline announcements. Although initial tariff proposals were often higher, negotiations had already reduced many of them to approximately 15% for key allies.

The Supreme Court ruling invalidated tariffs imposed under IEEPA authority. As a result, those specific duties are no longer legally in force unless re-established under a different statutory mechanism. Some have estimated that more than half of the existing tariffs imposed by the U.S. were issued under the IEEPA.

Other trade authorities — such as Section 301 or Section 232 — could be used in the near future to bring back tariffs. At a press announcement on Friday, President Trump said that he will be launching a new 10% tariff using a different legal backing that the overturned IEEPA tariffs. While the Court removed the existing tariff structure, it did not permanently eliminate the possibility of future tariffs on auto imports.

This remains an evolving situation, and the auto industry is certainly following developments closely.

Removing a roughly 15% effective tariff from imported vehicles changes the cost equation meaningfully.

When a vehicle carried a 15% duty at the port of entry, that cost had to be absorbed somewhere. In many cases, it was passed through to consumers in the form of higher MSRPs. In other cases, automakers absorbed reduced incentive spending to offset it. This meant fewer low-APR incentives and cheap lease deals for consumers.

With that layer removed, automakers gain flexibility.

While vehicle prices are not going to fall 15% overnight, eliminating tariff pressure reduces upward pricing momentum. For now, the ruling gives manufacturers room to increase incentives, protect margins, or compete more aggressively on price.

This is welcome news as the industry is expecting sales to stagnate through 2026. With more competitive pricing and incentives now on the table, automakers will have new options to compete for your business.

Parts costs could also ease. Even vehicles assembled in the United States often rely on globally sourced components. If imported parts were previously facing 10–15% duties, removing those costs lowers production expenses and improves manufacturing economics. In a market where affordability remains strained in 2026, even incremental cost relief can matter.

Even the cars and trucks made in America could benefit from the Supreme Court ruling.

Competitive dynamics may also shift. Prior to the ruling, Japanese, Korean, and European vehicles were competing under approximately 15% tariff pressure, while Chinese imports faced even steeper effective burdens. With tariffs invalidated, those imported vehicles regain structural cost competitiveness. That increases pricing pressure on domestic manufacturers and could lead to stronger cross-brand competition. This typically benefits consumers.

There is also the potential for financial adjustments. Companies that paid tariffs may seek refunds, which could improve short-term profitability and potentially support future incentive programs. However, refund processes are often complex and could take time to resolve.

Before the February 20 Supreme Court ruling on President Trump’s global tariff strategy, most major vehicle-exporting countries were operating under an effective tariff environment of roughly 15%. China faced much higher blended rates, and USMCA-compliant vehicles from Canada and Mexico remained duty-free.

With those tariffs now overturned under IEEPA authority, imported vehicles and parts regain cost relief. Production inputs become less expensive, competitive pressure increases, and one of the largest recent cost drivers in the auto market has been removed.

If new car prices come down (even modestly), used car prices could also decline. That would be a win for all car shoppers in 2026. Those looking to sell or trade-in could see their trade-in values drop, however.

Vehicle prices are not going to collapse overnight. But structurally, this ruling removes a major upward force on pricing. For car buyers navigating a still-expensive market in 2026, that represents a meaningful shift — and potentially the first real affordability tailwind the industry has seen in quite some time.

If you’re thinking about trading in your car, when you do it matters almost as much as what you’re trading in. We’re talking about a difference of several hundred dollars based purely on timing. For high-dollar luxury models, large SUVs, and trucks, the difference can reach into the thousands.

Spring 2026 is almost here, and it happens to be the best time of year to get the most for your trade-in. There are some interesting reasons why dealerships pay more for trade-ins during the spring.

In this guide, we’ll break down exactly why spring is your best window, what makes dealers more generous during this season, and how you can position yourself to get every dollar your car is worth.

Here’s what happens every spring: millions of Americans get their tax refunds, and a significant chunk of that money goes toward buying a car. Usually, tax refunds tend to have a more pronounced impact on the used car market compared to the new car market as budget shoppers head out in droves. This is great news for sellers.

Dealers know this, and they start scrambling for inventory in March to meet the surge in demand.

When dealers need inventory, your trade-in becomes more valuable to them. During tax refund season, the prospect of a buyer walking in to buy your trade-in makes dealers more willing to pay you a fair trade-in value. They’d rather buy your car than have to haul more inventory from dealer auctions to their lot.

Dealers are forward-thinking. By April and May, they’re already preparing for summer, which is traditionally one of the busiest car-buying seasons. Families plan road trips, and people simply feel more optimistic when the weather improves. Most of us are more likely to spend money when we’re in a good mood.

Your trade-in in April isn’t just inventory for today—it’s inventory they’re confident they can move quickly over the next few months. That confidence translates into better offers for you.

👉 Review these trade-in tactics for success, no matter when you’re in the market.

Here’s a reality of the car business: every day your trade-in sits on their lot costs them money. Interest on their floor plan financing, depreciation, and opportunity cost all add up. In the business, we call this ‘floorplanning costs’. In spring, dealers know they can turn your trade-in faster, which means less risk. Less risk means they can afford to pay you more.

Compare that to trading in your car in November when their lot might be full and sales are slowing down. Same car, different value, purely based on how quickly they think they can sell it.

This one’s practical: spring weather makes used cars look better and sell faster. Your car is cleaner, buyers can actually inspect it without freezing or getting soaked, and test drives are more pleasant.

Convertibles and sports cars particularly benefit from spring timing—nobody’s excited about a convertible in January, but in April? That’s a different story. Even for regular sedans and SUVs, warmer weather means more foot traffic at dealerships and more impulse purchases.

The spring selling season doesn’t end on June 1st. Early summer continues to be a strong time for trade-ins, though you start to see the window closing as July progresses.

Come June, many families realize that their current vehicle isn’t going to cut it for that big road trip they’ve been planning. SUVs and minivans move quickly during this period. If your vehicle fits that profile, June can be just as good as April.

High school and college graduations create a wave of first-time car buyers in May and June. Parents who promised their kid a car after graduation are shopping, and young adults entering the workforce need transportation. This is definitely more noticeable on the used car market.

By late July, dealers start shifting their focus beyond the summer rush. They’re less interested in taking on trade-ins because they’re trying to clear space for incoming vehicles for the next model year. After all, those typically arrive around autumn. Your trade-in value starts dropping not because your car got worse, but because dealer priorities changed.

If you’re considering a summer trade-in, get it done before the Fourth of July for best results.

These are the worst months for trade-in value. Dealer lots are quieter, buyers are focused on holiday expenses, and bad weather keeps people home. Dealers also know that anyone trading in during these months probably needs to, which weakens your negotiating position.

Winter weather also works against you. Road salt, dirty conditions, and gray skies make every used car look worse than it actually is. It’s silly, but it’s true (especially if you live in a cold climate).

During this period, dealers are laser-focused on moving current-year new inventory before next year’s models arrive. They’re already drowning in cars and the last thing they want is your trade-in adding to the pile. You’ll get lowball offers simply because they don’t have room or attention for your vehicle.

Post-holiday periods are tough because buyers have tapped out their budgets on gifts, travel, and celebrations. Fewer buyers means dealers need less inventory, which means lower trade-in offers for you.

1. Get your car in good shape

Don’t wait until April to think about this. Take February and early March to get your car in the best possible condition:

2. Get multiple offers online

This should be done when you’re finally ready to trade-in. Before you accept any offer, be sure to compare offers from multiple buyers, such as:

Spring timing works in your favor because all of these buyers are competing for the same limited inventory. Use that competition.

3. Time it right

The sweet spot is mid-March through May. Early enough that you’re ahead of the summer rush, but late enough that tax refunds are flowing and dealers are in a mood to buy.

Memorial Day weekend can still work, but you’re cutting it close. After that, you’re into the gradual decline of summer.

4. Consider your vehicle type

Some vehicles have their own timing:

Getting the most for your trade-in is about understanding basic supply and demand. When dealers need inventory and have confidence they can sell it quickly, they pay more for trade-ins. Spring offers that perfect combination of tax refund money, optimistic buyers, good weather, and dealer demand.

If you’re planning to trade this year, start preparing your vehicle now. Get it cleaned up, gather your paperwork, and plan to gather some official offers soon. The difference between trading in during the best month versus the worst month can easily be $1,000–$2,000 on a typical vehicle.

Your car isn’t getting any younger, but at least you can control when you trade it in. Make spring 2026 work for you.

👉 Use this trade-in checklist to avoid mistakes and get the best deal

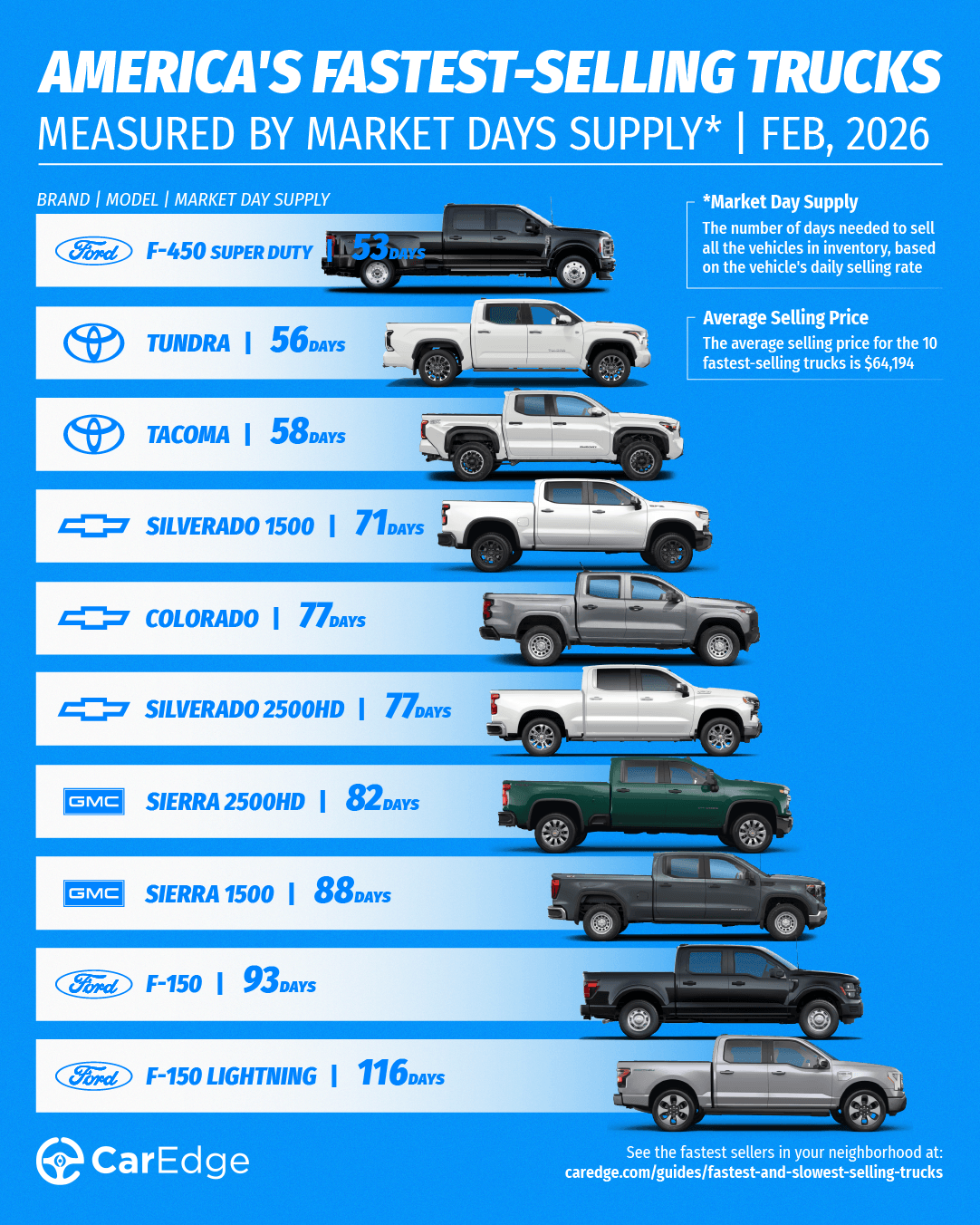

The gap between the fastest and slowest-selling pickups is widening in 2026. With some trucks selling in just over a month, and others sitting unsold for over six months, knowing what’s hot (and what’s not) can make or break your next deal.

That’s why understanding Market Day Supply (MDS) is more important than ever for anyone buying or selling a truck in 2026. At CarEdge, we used real-time inventory and sales data to identify the fastest- and slowest-selling trucks each month.

MDS tells us how long it would take to sell all the current inventory of a particular model at the current sales pace, assuming no new units are added. A low MDS means a truck is selling quickly. A high MDS, on the other hand, signals oversupply, and that can mean buyers have more leverage at the dealership.

Whether you’re buying new or considering a trade-in, here’s what the latest market data from CarEdge Pro reveals about the best-selling and worst-selling trucks in America.

These trucks are in high demand and selling quickly. But if you’re hoping to negotiate a deal on one of these, don’t count on much wiggle room unless you work with a pro.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Ford | F-450 Super Duty | 53 | 1,555 | 1,318 | $98,065 |

| Toyota | Tundra | 56 | 29,870 | 24,081 | $63,936 |

| Toyota | Tacoma | 58 | 55,275 | 42,861 | $46,088 |

| Chevrolet | Silverado 1500 | 71 | 56,709 | 35,709 | $52,911 |

| Chevrolet | Colorado | 77 | 19,009 | 11,146 | $41,844 |

| Chevrolet | Silverado 2500HD | 77 | 22,335 | 13,120 | $66,488 |

| GMC | Sierra 2500HD | 82 | 17107 | 9420 | $81,410 |

| GMC | Sierra 1500 | 88 | 46,625 | 23,731 | $62,347 |

| Ford | F-150 | 93 | 87,124 | 42,293 | $61,217 |

| Ford | F-150 Lightning | 116 | 4,315 | 1,677 | $67,631 |

Source: CarEdge Pro

The Ford F-450 Super Duty is the fastest-selling pickup truck in February 2026. On average, this heavy duty pickup truck sits on the lot for a little under two months before finding a buyer. Toyota’s Tundra and Tacoma are in second and third place, with trucks from GM far behind.

These trucks will be less negotiable as demand exceeds what’s typical for the truck market. Still, never agree to dealership markups or forced add-ons. Remember, informed shoppers always get the best deals.

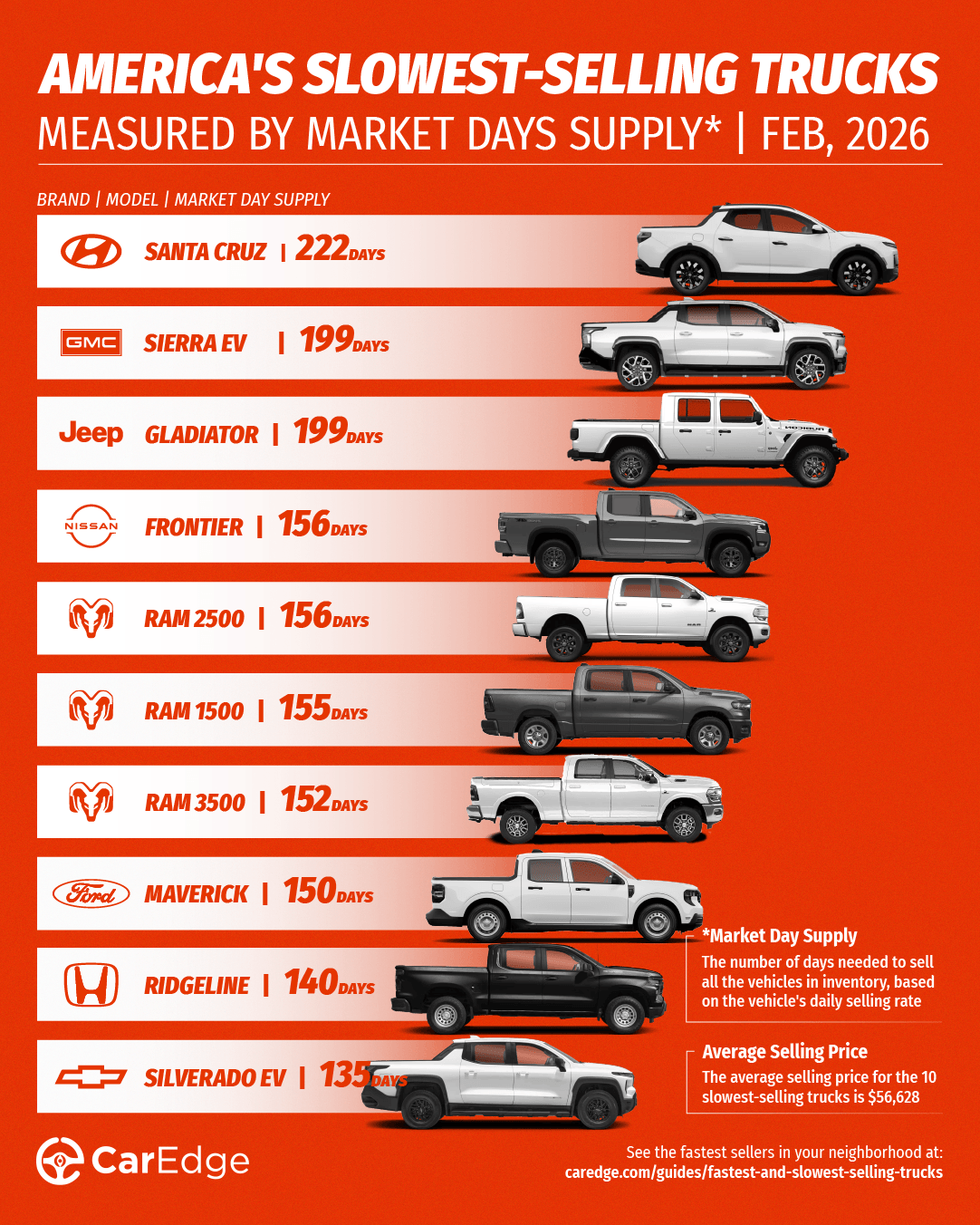

On the flip side, these trucks are struggling to move. Some of these trucks are taking more than six months to sell on average. If you’re in the market, these pickup trucks offer room for negotiation, especially with DIY market insights.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Hyundai | Santa Cruz | 222 | 10,474 | 2,120 | $36,439 |

| GMC | Sierra EV | 199 | 2,709 | 614 | $81,439 |

| Jeep | Gladiator | 199 | 19,162 | 4,332 | $48,732 |

| Nissan | Frontier | 156 | 21,527 | 6,214 | $39,957 |

| Ram | Ram 2500 | 156 | 31,388 | 9,047 | $68,554 |

| Ram | Ram 1500 | 155 | 66,988 | 19,429 | $60,056 |

| Ram | Ram 3500 | 152 | 10993 | 3263 | $77,020 |

| Ford | Maverick | 150 | 43,224 | 12,933 | $33,930 |

| Honda | Ridgeline | 140 | 11,513 | 3,711 | $45,292 |

| Chevrolet | Silverado EV | 135 | 1,855 | 615 | $74,864 |

Source: CarEdge Pro

The Hyundai Santa Cruz, a truck that was recently sent to the graveyard. Trucks from Stellantis brands (Ram and Jeep) take up four of the bottom 10 spots in February. Sellers can expect these slow-selling trucks to sit on the lot for at least four months, but this creates great chances to negotiate savings for buyers.

As the truck market ebbs and flows, it’s easy to become overwhelmed. Luckily, there are new tools and services available that take the hassle out of buying a truck entirely. Here’s how CarEdge can help.

👉 Negotiate anonymously with CarEdge AI (NEW!)

👉 Have a pro negotiate your deal with CarEdge’s Car Buying Service

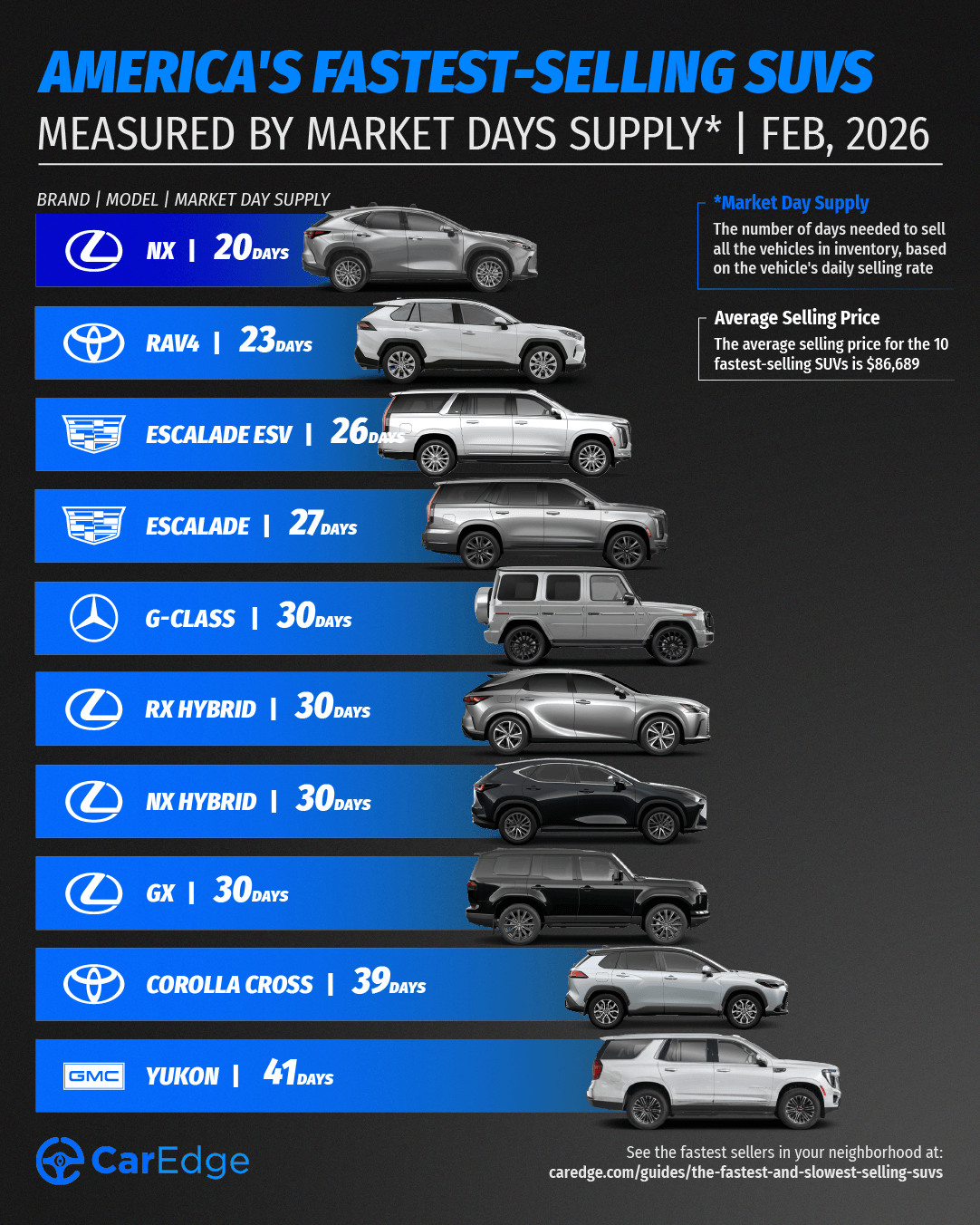

In 2026, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than a year on average. Whether you’re a buyer looking for a deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed February car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2026’s SUV market.

These are the fastest-selling SUVs and crossovers this month. These models have the lowest market day supply, which means they’re in high demand, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Lexus | NX | 20 | 1,618 | 3,650 | $51,503 |

| Toyota | RAV4 | 23 | 23,903 | 46,640 | $37,389 |

| Cadillac | Escalade ESV | 26 | 994 | 1,695 | $127,407 |

| Cadillac | Escalade | 27 | 1,795 | 3,026 | $125,746 |

| Mercedes-Benz | G-Class | 30 | 937 | 1,417 | $204,981 |

| Lexus | RX Hybrid | 30 | 4,914 | 7,420 | $64,374 |

| Lexus | NX Hybrid | 30 | 2,511 | 3,796 | $54,465 |

| Lexus | GX | 30 | 2,378 | 3,593 | $80,947 |

| Toyota | Corolla Cross | 39 | 16,797 | 19,195 | $31,709 |

| GMC | Yukon | 41 | 4,643 | 5,139 | $88,369 |

Source: CarEdge Pro

Besides the surprise visit of four GM models on the list, February is yet another month dominated by Toyota and Lexus. The 2026 Lexus NX is the fastest-selling SUV right now, with inventory sitting on the lot for just 20 days on average. The newly-redesigned RAV4 is close behind. Cadillac’s Escalade and larger Escalade ESV are also quick sellers, marking a bright spot for otherwise slow-selling GM models.

What does it all mean? If you plan to buy or lease any of the above SUVs, especially those from Toyota and Lexus, expect to have less negotiating power than if you were to shop one of the slower-selling cars on the market. That doesn’t justify paying for dealer markups or unwanted add-ons. Stay away from those traps. But for these fast-selling SUVs and crossovers, paying MSRP would be a fair deal in 2026’s SUV market.

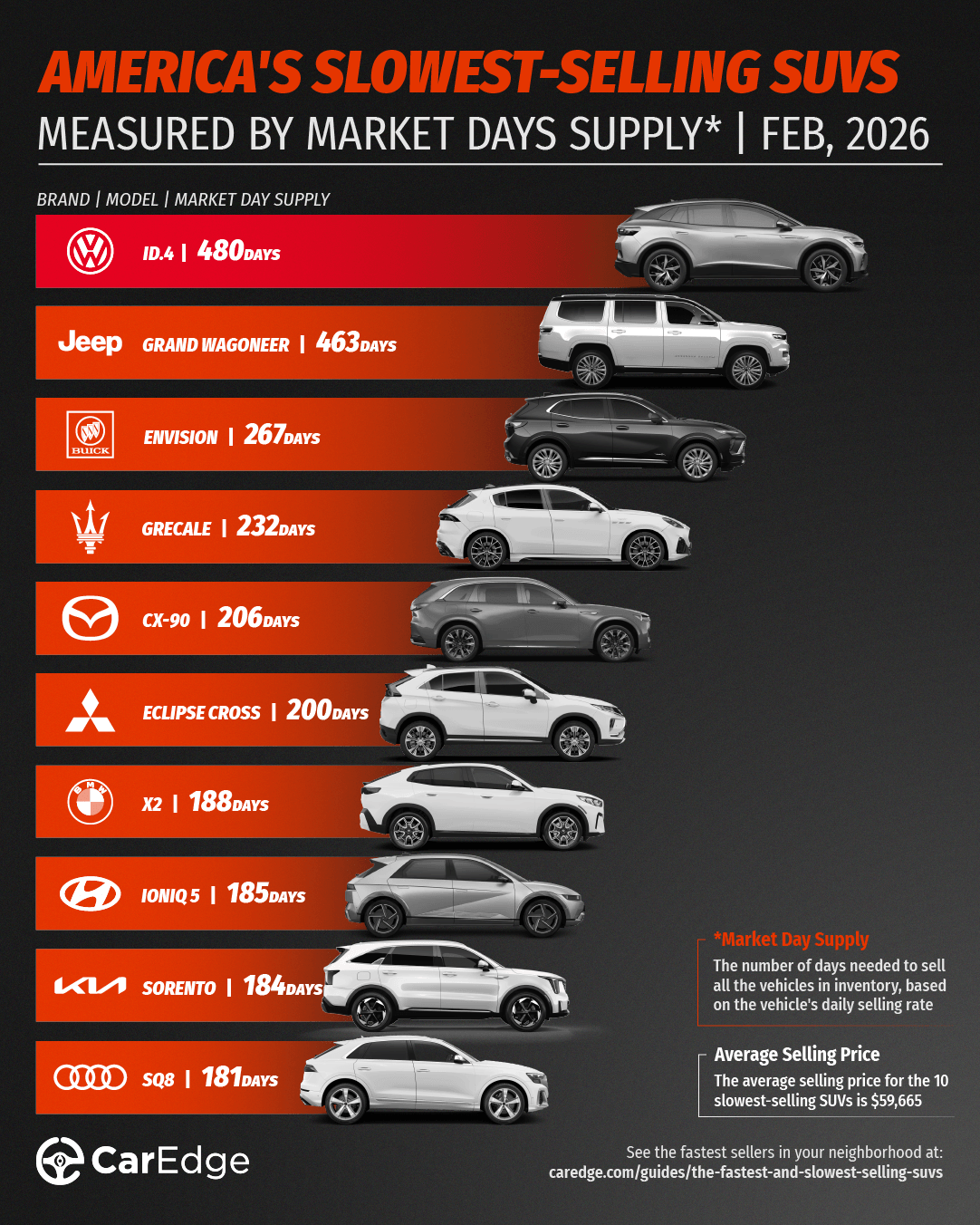

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in February, especially with this AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 480 | 1,482 | 139 | $49,534 |

| Jeep | Grand Wagoneer | 463 | 4,510 | 438 | $85,252 |

| Buick | Envision | 267 | 11,337 | 1,910 | $40,994 |

| Maserati | Grecale | 232 | 583 | 113 | $85,649 |

| Mazda | CX-90 | 206 | 15,991 | 3,486 | $48,214 |

| Mitsubishi | Eclipse Cross | 200 | 2,658 | 597 | $30,111 |

| BMW | X2 | 188 | 1,392 | 333 | $52,698 |

| Hyundai | IONIQ 5 | 185 | 10,276 | 2,506 | $45,901 |

| Kia | Sorento | 184 | 36,137 | 8,845 | $40,047 |

| Audi | SQ8 | 181 | 518 | 129 | $118,251 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 is at the top of the list for the second month in a row, with well over one year of supply. The IONIQ 5, one of the fastest-charging EVs on the market, is also taking half a year to sell. Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles.

Just two Stellantis models are in the bottom 10 this month. That’s a big improvement after dominating the slowest-sellers last year. However, Jeep’s Grand Wagoneer is still in second place. It has been a slow-selling model for most of the past year, despite seeing major price cuts several months ago.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2026.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

Trading in your car doesn’t have to mean leaving money on the table. With the right preparation and knowledge, you can get the best trade-in value and walk into the dealership with confidence. The key is treating your trade-in as what it really is: a separate transaction that deserves your full attention.

Too many car buyers let dealers bundle their trade-in into the new car purchase, which makes it nearly impossible to know if you’re getting a fair deal on either transaction. This CarEdge guide will show you the smart way to approach your trade-in.

Before you even think about walking into a dealership, do your homework.

Check online valuation tools: Use Kelley Blue Book (KBB), Edmunds, and online buyers like CarMax and Carvana to get an estimated value for your car. This gives you a range of what you might expect.

Check local listings: See what similar cars in your area are selling for. Be sure to compare make/model, mileage, condition, year, and location (local market influences price). See local listings with Car Search.

Get multiple appraisals: Take your car to different dealerships and get online offers. More options = better deal.

Having your paperwork in order makes the process smoother and shows you’re serious about the trade-in.

Title: If you own the car outright, bring the title. If you still owe, bring the payoff statement from your lender.

Registration: Ensure the car is registered and that you have the up-to-date documents.

Insurance: Show proof of insurance to prove the car has been properly maintained.

Maintenance records: If you’ve kept up with regular maintenance (oil changes, brakes, etc.), having these documents can increase the value. For cars routinely serviced at a dealership, these records may already be available online.

Any accessories or extra parts: Include anything you’ve added (new tires, roof racks, custom wheels, etc.).

Loan payoff balance: If there’s still a loan balance, bring the details about what’s left to pay off. You have two options if you still owe money on the car: (1) Pay off the remaining balance directly, or (2) Roll the negative equity into your next car loan (though this will increase your payments, often by a lot).

First impressions count, and a well-maintained vehicle often gets a higher offer.

Exterior: Wash the car. This makes it easy to see the condition of the exterior.

Interior: Clean out trash, vacuum the floors, and wipe down surfaces.

Odor: Neutralize any lingering smells (smoke, pets, etc.) with air fresheners or fabric sprays.

Tires: If they’re worn, don’t worry: it’s not worth it to replace your tires before trading in. You’d be unlikely to receive the value of new tires in added trade-in value. Why? Many trade-ins are sent to dealership auctions, where they are sold to the highest bidder.

Engine bay: Clean it (just don’t use anything too harsh). A clean engine bay makes the car look well-maintained. Here’s a quick guide.

Take care of minor repairs that might be turning off buyers.

Address safety issues: Make sure things like brakes, lights, and other critical systems work properly.

Mechanical problems: If the car has engine, transmission, or suspension issues, it may be worth fixing small things that can raise the car’s value.

Check fluid levels: Top off the oil, coolant, brake fluid, and transmission fluid—this shows the car’s been taken care of. Even the windshield washing fluid should be checked.

Before walking in, know your car’s trade-in value and be prepared to negotiate. Have your offers from online buyers written down on paper, or better yet, printed out for leverage at the dealership.

Have a firm minimum in mind: Know what bottom price you’re willing to accept. This should be based on the online offers you will have received, and the KBB or Edmunds value. Having a minimum in mind will help you avoid emotional or hasty decisions.

Know what similar cars are selling for in the area: The dealer will want some room for profit, but you can still use nearby listings to show that you know what your car is worth.

Bring printed online offers and valuation estimates: Show the dealer that you’ve done your homework.

Be ready to walk away: Don’t let the first offer sway you. If they lowball, you can take it elsewhere.

When the dealer makes an offer, get it in writing so that you have a reference point.

If they try to adjust or lower the price, you’ll have the original offer to fall back on. Getting offers in writing can also serve as a tool for negotiating with other dealers.

Remember, the number one rule of trading in your car is to always treat your trade-in as a separate transaction. Don’t let the dealer tie your trade-in value to your purchase of a new car. That’s a recipe for getting a lowball offer.

Following this checklist will put you in a strong position to get top dollar for your trade-in. But what if you could let the experts handle it? CarEdge’s car buying service doesn’t just help you maximize your trade-in value—we negotiate your entire deal from start to finish.

Your personal CarEdge Concierge negotiates with dealers on your behalf to ensure you’re getting the best possible price on your new vehicle while getting you the most for your trade-in.

We keep these transactions separate (just like you should), and we have the market data and dealer relationships to get you a deal you can feel confident about.

Ready to make your trade-in easy? Let CarEdge do the negotiating for you.