CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In 2026, getting top dollar for your trade-in requires more preparation and strategy than in previous years.

Here’s why: 7-year-old vehicles traded in during 2025 had an average value of $14,400, a 72% increase from 2019, when they were valued at $8,400, according to a recent report. That’s usually great news for sellers, but there’s a catch.

Despite rising used-car values, many drivers still get less than expected when trading in. The gap between projected and actual resale values is widening as new and used car prices converge. Without knowledge and preparation, you’re likely to leave money on the table.

We consulted CarEdge’s consumer advocates to find out how to get the best trade-in value in 2026. The common theme? Prepared, informed buyers get the best deals. Let’s take a look at how you can top-dollar for your trade-in this year.

Many drivers aren’t aware that some parts of a car trade-in contract are negotiable, primarily because dealers present the agreement as a package.

The number one rule for getting the most for your trade-in is to always treat it as a separate transaction. The car salesperson WILL do their best to tie your trade-in to your purchase. That’s a recipe for a low-ball offer. Negotiating your car purchase and trade-in together gives the dealer more opportunities to profit at your expense. Handle them separately to maximize your trade-in value.

In most cases, the appraisal of your trade-in value isn’t the final offer. Before you arrive at the dealership, get several online offers and values for your car, so you know what it should be worth. Be honest with yourself about the condition of your car when getting these values.

Having several online offers from CarEdge’s free tool, CarFax, Carvana, and others (as well as the KBB Value) not only gives you an up-to-date assessment of your vehicle’s trade-in value, it is your source of leverage against dealer offers.

Go one step further and get trade-in offers in writing from at least two dealerships, ideally three or more. They’ll need to see your vehicle in person to do this, but it’s worth the hassle. You’re likely to get hundreds of dollars more (or thousands, in some cases) by not skipping this step. It’s work on your end, but work that pays.

Having service records on hand can help your trade-in value, too. However, with the widespread use of CarFax and online service records, this is less crucial in 2026. It merely helps to show that the car has been taken care of.

Getting your car detailed can also help you achieve a higher trade-in value, but don’t spend hundreds of dollars on this. A good interior and exterior cleaning at home is usually best for your wallet, and for getting a fair offer for your trade-in.

This is an important one. You’d be shocked to see how effective the following questions are at getting more for your trade-in: “Is that your best offer? Do you mind checking the numbers again? I believe it’s worth more than that.”

In many cases, they’ll ‘check with their manager’ and come back with at least $100 more in value, often more. And that’s all just from showing that you’re not going to just accept the bare minimum for your vehicle.

Knowing what your vehicle offers is crucial when negotiating trade-in offers, as its specific trim level may raise its value. The original window sticker can help you identify these features. It’s likely sitting in your glove compartment.

For example, mid-to-upper level trims of a specific model tend to offer features that include but aren’t limited to:

Anything that’s not standard equipment on your model’s base trim is fair game. Did you get work done recently? Noting new parts and repairs can increase offers for any trim level.

While 2026 is set to offer higher average trade-in offers, some periods are more ideal for maximizing value. Edmunds data shows that Q1 and Q2 are the best times for trade-ins, as used car values tend to trend higher.

Additionally, since a car loses more value the longer you have it in your driveway, it’s more appealing during Q1 and Q2 compared to the end of the year when it’s about to become another model year older.

What kind of vehicle are you trading-in? If you’re trading-in an all-wheel drive SUV, winter can be an opportune time to get top dollar. Softer-selling segments like a convertible may benefit from a trade-in during the warmer months.

Is the air conditioning out on your trade-in? You won’t get top dollar for it during the heat of summer!

Are your tire tread getting low? If so, the icy winter months aren’t the best time to sell. It all matters if you’re aiming to get top dollar for your car!

When considering trade-in timing, mileage often comes to mind. Luckily, there’s no major drop-off after certain milestones, as long as your vehicle has been well-kept, which you can help prove with documents like timely service records.

In comparison, model years matter more. It may be obvious to some, but many sellers are surprised to learn that like-for-like, a five year-old car with just 30,000 miles on the odometer is still going to be worth significantly less than a two-year old car with 50,000 miles. Model year matters to buyers, especially if there’s a chance your trade-in will go to auction.

Where a vehicle was built used to be a non-factor; however, a car’s manufacturing location can now play a significant role in resale value due to tariffs.

Depending on the country, automakers exporting vehicles to the U.S. face tariff rates roughly ranging from 10% to 27.5% on a car’s declared value, increasing dealer replacement costs for impacted new models. When these replacement prices increase, dealers have more incentive to lean on already-imported used models, giving you added leverage if you have an imported brand with limited U.S. production.

Examples of these brands can include:

If you follow the news in 2026, you know that the tariff situation seems to change weekly. Even so, sharing this bit of information can still give you more negotiation power, as it shows you’re an informed buyer (and seller).

What if you didn’t have to go back and forth to dealerships, negotiating with pushy salespeople all along the way? Wouldn’t it be nice to have an experiences automotive professional do it all for you? That’s what we offer with CarEdge’s car buying service. From finding the perfect trim and paint color to negotiating every aspect of your deal (including your trade-in), we make car-buying easy.

Learn more about CarEdge Concierge, and take the stress out of your big purchase!

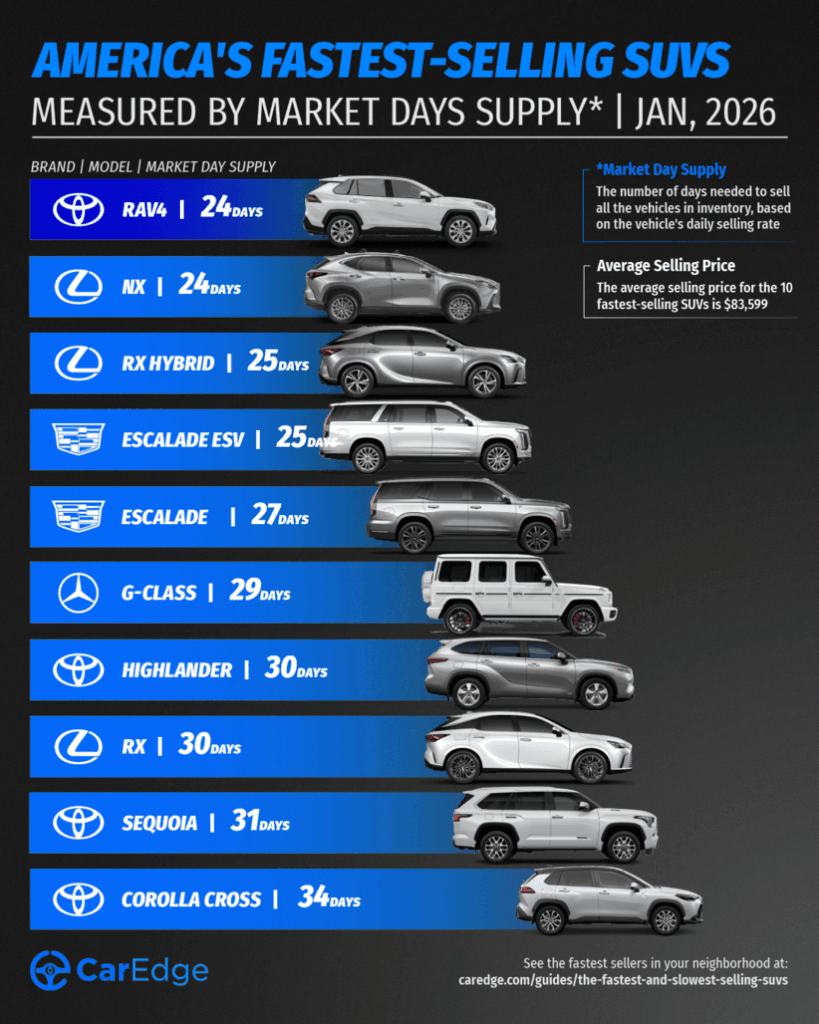

Out with the old, and in with the new seems to be the theme in this month’s rankings of the fastest and slowest-selling SUVs and crossovers. In early 2026, the glory days of EV sales are gone, and reliable namesakes from Toyota are back at the top. Right now, some SUVs are being scooped up as soon as they hit the lot, while others are sitting unsold for nearly a year on average.

We analyzed January 2026 auto market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers so far in 2026’s SUV market.

These are the SUVs and crossovers with the lowest market day supply in January 2026. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | RAV4 | 24 | 38,923 | 73,186 | $37,389 |

| Lexus | NX | 24 | 3,008 | 5,713 | $51,475 |

| Lexus | RX Hybrid | 25 | 5,027 | 9,227 | $64,200 |

| Cadillac | Escalade ESV | 25 | 1,149 | 2,057 | $127,519 |

| Cadillac | Escalade | 27 | 2,381 | 3,919 | $125,506 |

| Mercedes-Benz | G-Class | 29 | 1,062 | 1,643 | $201,631 |

| Toyota | Highlander | 30 | 5,480 | 8,100 | $52,703 |

| Lexus | RX | 30 | 5,954 | 8,828 | $59,760 |

| Toyota | Sequoia | 31 | 3,644 | 5,254 | $84,101 |

| Toyota | Corolla Cross | 34 | 15,087 | 20,040 | $31,703 |

Source: CarEdge Pro

Toyota is back on top yet again in January. Seven of the 10 fastest-selling SUVs are Toyota or Lexus models. If you’ve been following along for a while, this isn’t unusual. Toyota’s reputation for reliability, affordability, and overall value continues to be a hit with buyers. Consumer Reports named Toyota as the most-reliable brand yet again last year.

If you haven’t noticed, SUVs are no longer budget-friendly vehicles for the most part. No one wants a $50,000 crossover that lacks in reliability. Buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

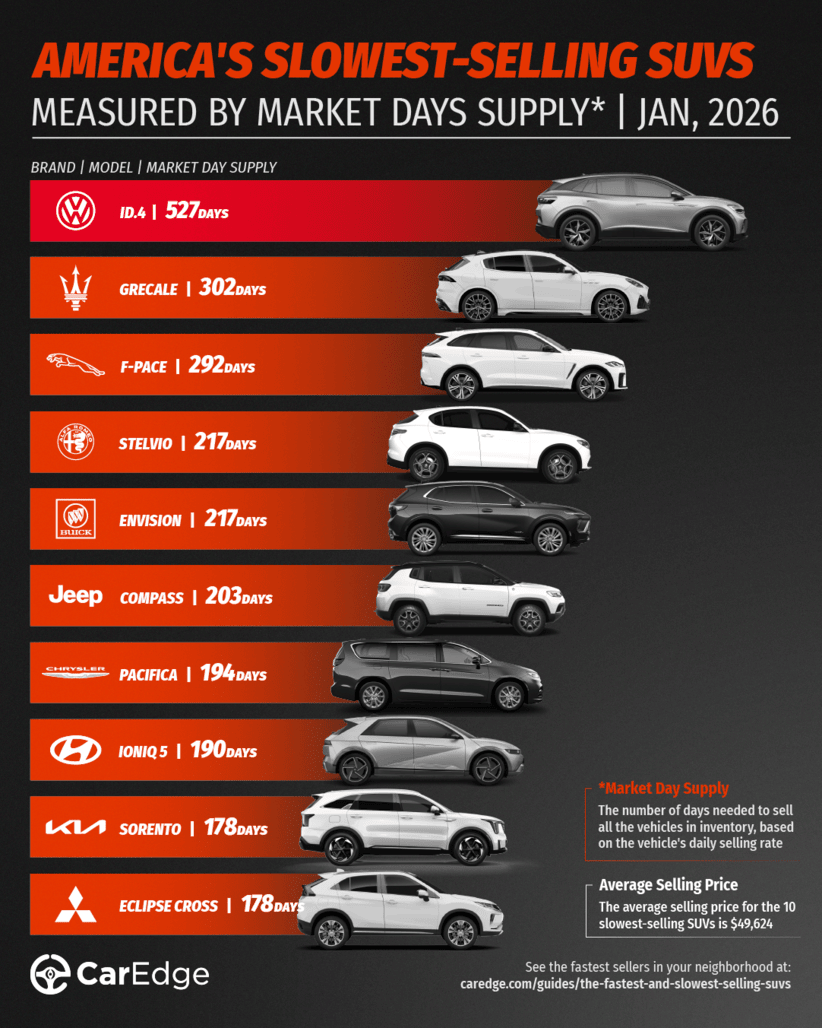

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in January 2026, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 527 | 1,500 | 128 | $49,534 |

| Maserati | Grecale | 302 | 638 | 95 | $84,448 |

| Jaguar | F-PACE | 292 | 2,148 | 331 | $69,503 |

| Alfa Romeo | Stelvio | 217 | 887 | 184 | $55,467 |

| Buick | Envision | 217 | 8,352 | 1,735 | $40,150 |

| Jeep | Compass | 203 | 27,375 | 6,063 | $32,392 |

| Chysler | Pacifica | 194 | 16,442 | 3,815 | $46,694 |

| Hyundai | IONIQ 5 | 190 | 10,693 | 2,536 | $47,865 |

| Kia | Sorento | 178 | 35,349 | 8,955 | $40,126 |

| Mitsubishi | Eclipse Cross | 178 | 2,715 | 685 | $30,058 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 is the slowest-selling car in America for the second month in a row. There’s a year and a half of market supply right now, meaning that an ID.4 on a dealer’s lot today may see 2027 before finding a buyer.

Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2026.

Four Stellantis models are in the bottom 10 this month. Jaguar’s F-PACE has been a slow-selling model for all of the past year, despite being the top model by volume for the British automaker.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a SUV deal in 2026, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation unless market dynamics shift dramatically. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2026.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

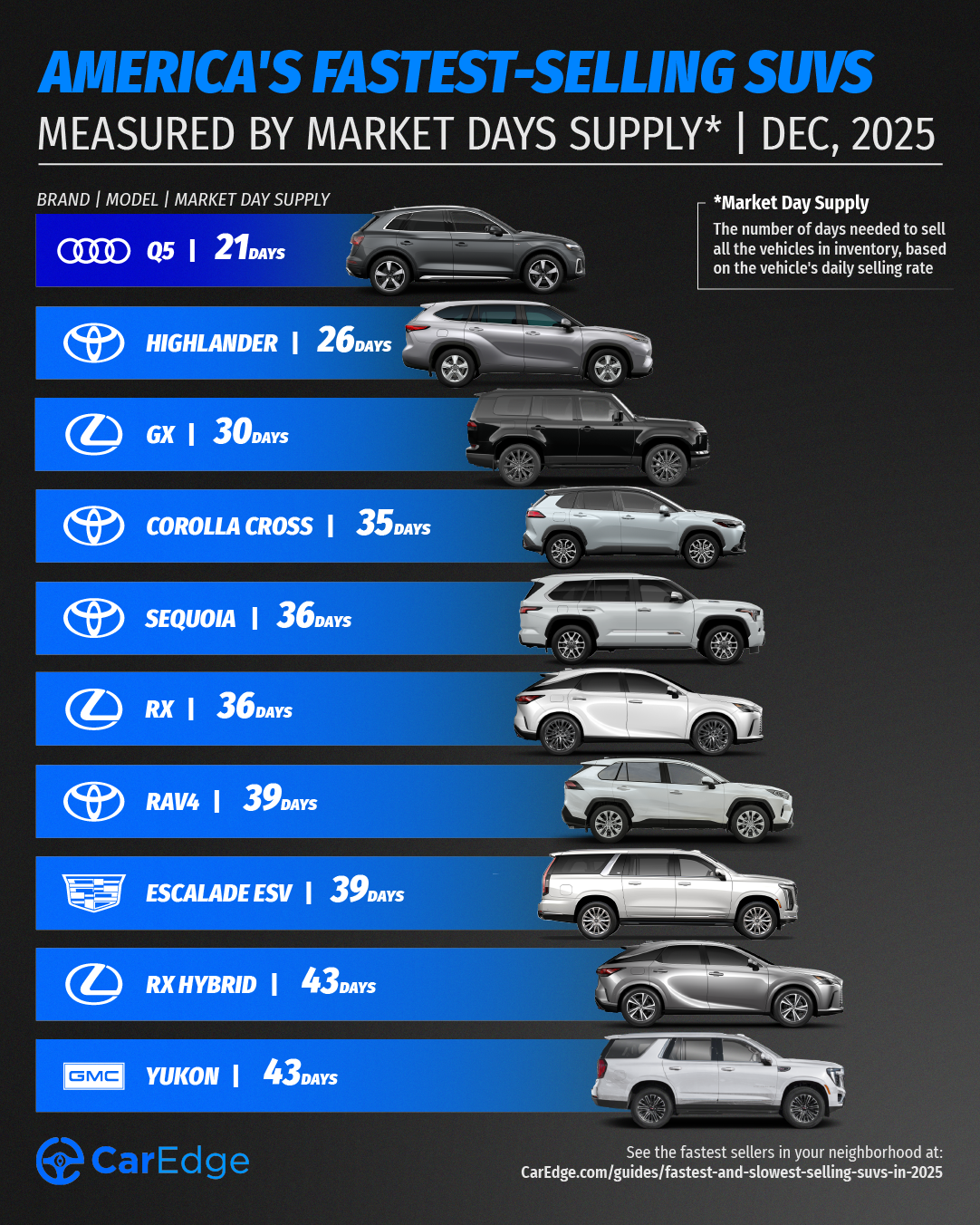

In 2025, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than six months. Whether you’re a buyer looking for a deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed December car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2025’s SUV market.

These are the SUVs and crossovers with the lowest market day supply as of December 2025. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Audi | Q5 | 21 | 546 | 1,198 | $59,913 |

| Toyota | Highlander | 26 | 5,408 | 9,238 | $52,294 |

| Lexus | GX | 30 | 2,505 | 3,708 | $80,358 |

| Toyota | Corolla Cross | 35 | 15,932 | 20,331 | $31,303 |

| Toyota | Sequoia | 36 | 4,269 | 5,375 | $83,585 |

| Lexus | RX | 36 | 7,307 | 9,189 | $59,257 |

| Toyota | RAV4 | 39 | 69,716 | 80,310 | $37,424 |

| Cadillac | Escalade ESV | 39 | 1,713 | 1,987 | $126,778 |

| Lexus | RX Hybrid | 43 | 6,381 | 6,725 | $63,418 |

| GMC | Yukon | 43 | 5,393 | 6,118 | $88,398 |

Source: CarEdge Pro

In an unusual hiccup, the Audi Q5 is the fastest-selling SUV this month. Audi is selling down the 2025 Q5 with compelling incentives as dealers prepare for incoming 2026 models. We don’t expect the Q5 to be on this list much longer.

Seven of the top 10 fastest-selling SUVs in 2025 are Toyota or Lexus models. With Consumer Reports naming Toyota as the most-reliable brand (again), more shoppers are flocking to their lineup. No one wants a $50,000 car that lacks in reliability. Car buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

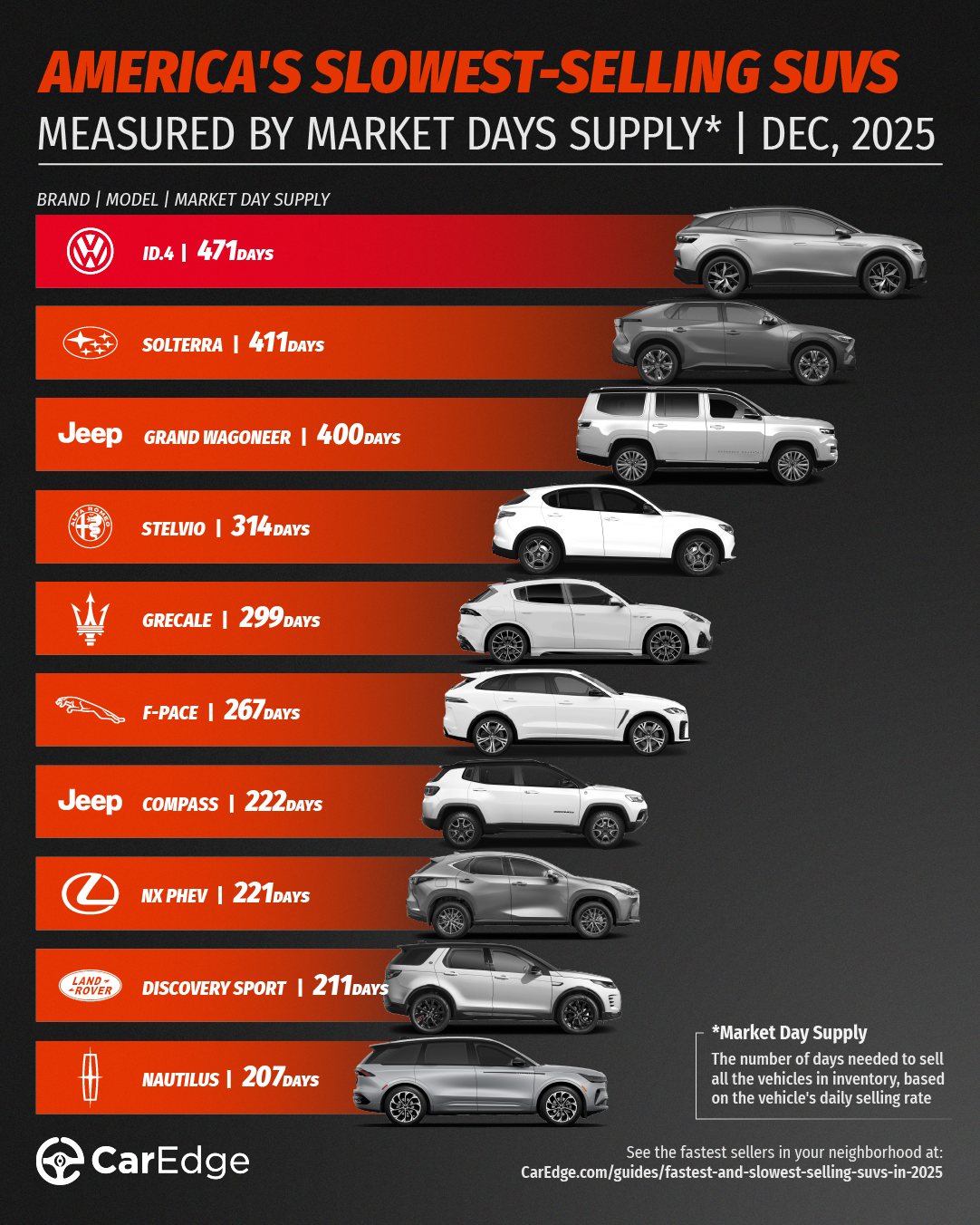

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in December, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 471 | 1,371 | 131 | $48,036 |

| Subaru | Solterra | 411 | 868 | 95 | $41,463 |

| Jeep | Grand Wagoneer | 400 | 1,254 | 141 | $96,557 |

| Alfa Romeo | Stelvio | 314 | 886 | 127 | $57,297 |

| Maserati | Grecale | 299 | 672 | 101 | $82,381 |

| Jaguar | F-PACE | 267 | 2,136 | 360 | $70,204 |

| Jeep | Compass | 222 | 26,303 | 5,320 | $31,805 |

| Lexus | NX PHEV | 221 | 2,112 | 430 | $67,380 |

| Land Rover | Discovery Sport | 211 | 641 | 137 | $53,008 |

| Lincoln | Nautilus | 207 | 13,629 | 2,963 | $62,969 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 and Subaru Solterra have jumped to the top of the list, with well over one year of supply. Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2025.

Four Stellantis models are in the bottom 10 this month. Jaguar’s F-PACE has been a slow-selling model for all of 2025, despite being the top model by volume for the British automaker.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2025.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

After a year of limited inventory, rising prices, and dealerships holding all the cards, the car market has finally shifted in favor of consumers. If you’ve been waiting for the right time to buy or lease a car, that moment may have arrived. Here are three clear signs that we’re in a buyer’s market, and why December will bring even bigger opportunities to save.

The days of empty dealer lots and stiff competition are over. According to Cox Automotive, both new and used car inventory levels are climbing, giving buyers more options and significantly more negotiating power.

Used Car Inventory Hits 2025 High

Used car inventory has reached a new high for 2025, hitting 48 days of market supply. There are now 2.26 million used cars for sale across the U.S., with an average listing price of $25,825. This increase in available vehicles means dealers are more motivated than ever to move inventory off their lots. It also means that those who trade-in and sell are getting less for their vehicles than in months prior. For used car buyers, all signs point towards a buyer’s market.

New Car Inventory Climbs to Highest Level Since Q1

On the new car side, inventory is also rising as buyers strategically wait for December’s year-end incentives. As of the latest data from Cox Automotive, new car inventory has climbed to 84 days, with 2.87 million new cars for sale—a 4.8% increase month over month. New car inventory is now at the highest level since the first quarter of this year.

Why This Matters for Buyers

Higher inventory levels translate directly to greater negotiating power at the dealership. When dealer lots are filling up, the leverage shifts from seller to buyer. Dealers need to move vehicles to make room for incoming inventory, and that pressure works in your favor. It’s officially a buyer’s market.

Nothing signals a buyer’s market quite like aggressive incentives, and November’s deals are some of the best we’ve seen all year. December will be even better. “There’s a reason we always tell the CarEdge Community to wait until December for the best deals,” noted CarEdge co-founder Ray Shefska. “But if you see a deal you like in November, don’t stress yourself out about it. Now is a great time to buy, and many of this month’s sales will simply be carried over to December.”

0% APR Financing Spreads to Luxury and Popular Models

Zero-percent financing is creeping into the luxury car market and appearing on models that aren’t accustomed to receiving big discounts. In November, there are 29 offers of zero-percent financing available—and it’s not just slow-sellers and EVs benefiting from these deals.

Popular, high-demand models like the Chevy Silverado 1500, Ram 1500, and Hyundai Tucson now feature interest-free financing. This is a big shift from the seller’s market of recent years, when even modest incentives were rare.

Lease Deals Are Getting Better Too

If you’re considering leasing, the deals are equally compelling. Ford is offering a number of lease specials with just the first month’s payment due at signing. Dozens of new cars are now available for under $250 per month with under $3,500 due at signing.

With depreciation being the #1 hidden cost of car ownership, leasing is a smart way to protect your wallet. You avoid the steep depreciation hit that comes with owning a new car, while still enjoying the latest models with full warranty coverage.

The calendar doesn’t lie, and dealers know it. When 2026 arrives, any 2025 model still sitting on the lot instantly becomes “last year’s model”, and takes a significant depreciation hit.

900,000 Reasons to Negotiate

There are currently 900,000 2025 model year vehicles sitting on dealer lots across the country. That means dealers have just weeks left to sell these cars before they face growing losses. No dealer wants to be stuck with dozens of last year’s models when the new year begins.

Model Year Changeover Has to Happen One Way or Another

This creates a powerful incentive for dealers to negotiate. They need to clear out 2025 inventory to make room for 2026 models, and they’re willing to offer aggressive discounts to do it. For informed buyers, this represents one of the best opportunities of the year to score a deal.

If you’ve been on the fence about buying or leasing a car, the conditions are aligned in your favor. It’s officially a buyer’s market after many months of stagnation. Take advantage of higher inventory to negotiate confidently, explore the best financing and lease deals we’ve seen in years, and use the pressure of model year changeover to secure additional discounts.

Don’t go it alone when shopping for year-end car deals. Use your personal AI agent to negotiate car prices with ease, or have a human Concierge give you the complete white-glove experience. CarEdge always works for consumers, and never dealers or automakers.

How do we do it? Our team brings decades of experience in the business to the table. We simply keep the lights on by providing expert car buying services to the everyday driver!

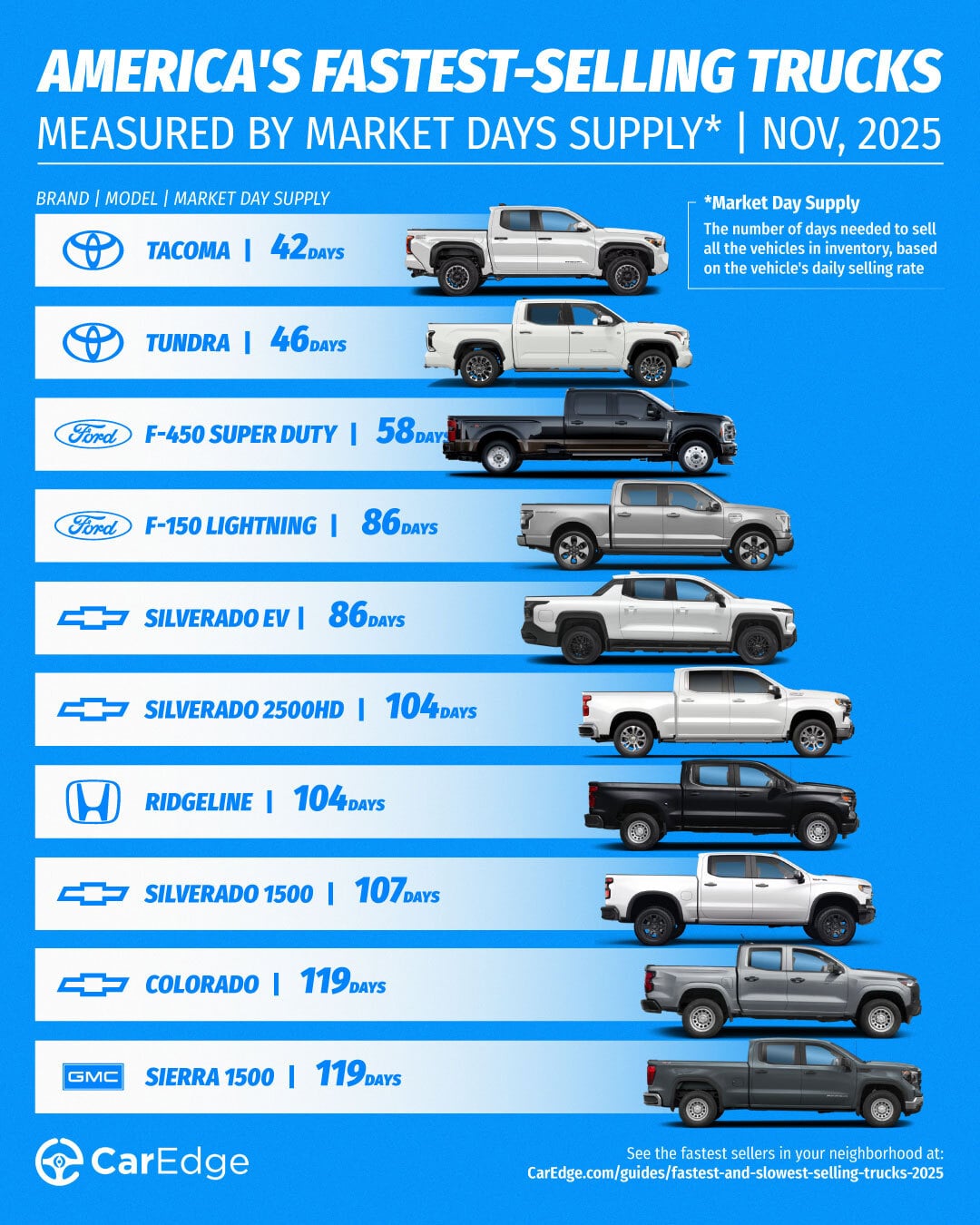

The gap between the fastest and slowest-selling pickups is wider than ever in 2025. With some trucks selling in just over a month, and others sitting unsold for over six months, knowing what’s hot (and what’s not) can make or break your next deal.

That’s why understanding Market Day Supply (MDS) is more important than ever for anyone buying or selling a truck in 2025. At CarEdge, we used real-time inventory and sales data to identify the fastest- and slowest-selling trucks in November.

MDS tells us how long it would take to sell all the current inventory of a particular model at the current sales pace, assuming no new units are added. A low MDS means a truck is selling quickly. A high MDS, on the other hand, signals oversupply, and that can mean buyers have more leverage at the dealership.

Whether you’re buying new or considering a trade-in, here’s what the latest market data from CarEdge Pro reveals about the best-selling and worst-selling trucks in America.

These trucks are in high demand and selling quickly. But if you’re hoping to negotiate a deal on one of these, don’t count on much wiggle room unless you work with a pro.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Tacoma | 42 | 51,245 | 54,331 | $45,723 |

| Toyota | Tundra | 46 | 30,621 | 30,099 | $63,206 |

| Ford | F-450 Super Duty | 58 | 1,578 | 1,233 | $96,354 |

| Ford | F-150 Lightning | 86 | 6,843 | 3,563 | $69,161 |

| Chevrolet | Silverado EV | 86 | 2,946 | 1,541 | $60,307 |

| Chevrolet | Silverado 2500HD | 104 | 30,611 | 13,288 | $40,224 |

| Honda | Ridgeline | 104 | 11,913 | 5,167 | $26,414 |

| Chevrolet | Silverado 1500 | 107 | 77,799 | 32,621 | $29,978 |

| Chevrolet | Colorado | 119 | 27,949 | 10,527 | $25,301 |

| GMC | Sierra 1500 | 119 | 56,676 | 21,350 | $35,094 |

Source: CarEdge Pro

The Toyota Tacoma is the fastest-selling pickup truck in November 2025. On average, this heavy duty pickup truck sits on the lot for a little under two months before finding a buyer. Toyota’s Tundra is in second place at 46 days of supply, with trucks from GM far behind.

We didn’t expect to see two electric trucks on the list of fastest-selling pickups this month. Now that federal EV incentives have expired, the F-150 Lightning and Silverado EV are not likely to return to this list anytime soon.

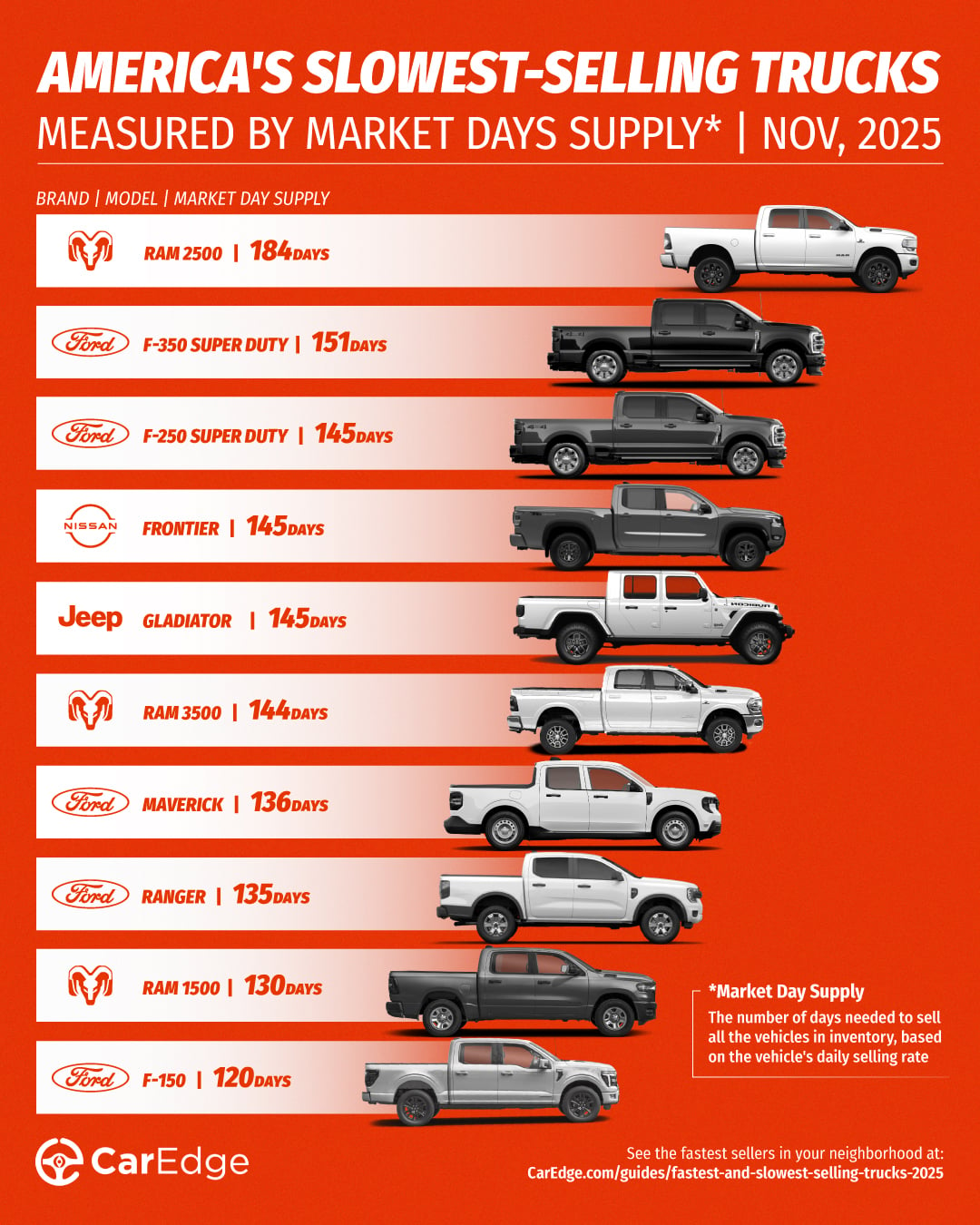

On the flip side, these trucks are struggling to move. Some of these trucks are taking more than six months to sell on average. If you’re in the market, these pickup trucks offer room for negotiation, especially with DIY market insights.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Ram | Ram 2500 | 184 | 39,136 | 9,577 | $67,626 |

| Ford | F-350 Super Duty | 151 | 31,071 | 9,252 | $76,907 |

| Ford | F-250 Super Duty | 145 | 46,275 | 14,321 | $71,249 |

| Nissan | Frontier | 145 | 21,605 | 6,687 | $22,513 |

| Jeep | Gladiator | 145 | 19,516 | 6,039 | $34,416 |

| Ram | Ram 3500 | 144 | 11,652 | 3,636 | $48,755 |

| Ford | Maverick | 136 | 37,269 | 12,313 | $33,733 |

| Ford | Ranger | 135 | 22,105 | 7,358 | $43,481 |

| Ram | Ram 1500 | 130 | 52,201 | 18,037 | $30,467 |

| Ford | F-150 | 120 | 114,338 | 42,806 | $59,535 |

Source: CarEdge Pro

The Ram 2500 is the slowest-selling truck in America right now. Trucks from Stellantis brands (Ram and Jeep) take up four of the bottom 10 spots in November. Sellers can expect these slow-selling trucks to sit on the lot for at least four months, but this creates great chances to negotiate savings for buyers.

As the truck market ebbs and flows, it’s easy to become overwhelmed. Luckily, there are new tools and services available that take the hassle out of buying a truck entirely. Here’s how CarEdge can help.

👉 Negotiate anonymously with CarEdge AI (NEW!)

👉 Have a pro negotiate your deal with CarEdge’s Car Buying Service

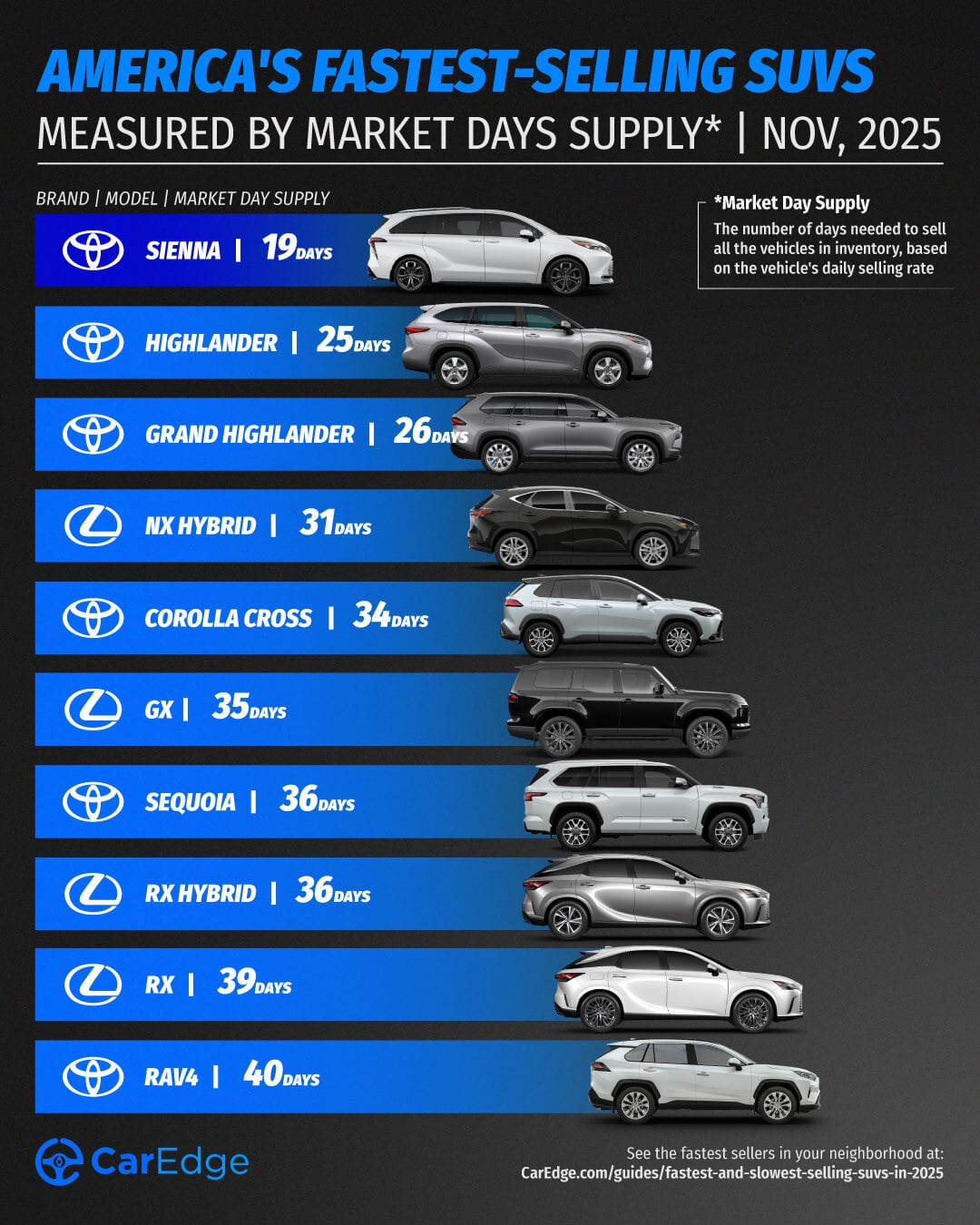

It’s true that SUVs have taken over the car market in recent years, but not all are hot sellers. In fact, the gap between the fastest and slowest-selling models is growing. In 2025, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than six months. Whether you’re a buyer looking for a great deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed November car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2025’s SUV market.

These are the SUVs and crossovers with the lowest market day supply as of November 2025. That means they’re in high demand right now, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Toyota | Sienna | 19 | 7,704 | 18,358 | $51,910 |

| Toyota | Highlander | 25 | 5,928 | 10,765 | $52,072 |

| Toyota | Grand Highlander | 26 | 13,733 | 27,573 | $55,573 |

| Lexus | NX Hybrid | 31 | 2,182 | 3,189 | $54,595 |

| Toyota | Corolla Cross | 34 | 14,739 | 19,477 | $31,303 |

| Lexus | GX | 35 | 2,858 | 3,659 | $80,224 |

| Toyota | Sequoia | 36 | 4,408 | 5,483 | $83,585 |

| Lexus | RX Hybrid | 36 | 4,465 | 5,526 | $63,418 |

| Lexus | RX | 39 | 8,315 | 9,702 | $59,010 |

| Toyota | RAV4 | 40 | 70,764 | 80,355 | $37,313 |

Source: CarEdge Pro

All of the top 10 fastest-selling SUVs in 2025 are Toyota or Lexus models. Car buyers are valuing reliability and affordability above all else right now, and the latest data reflects that.

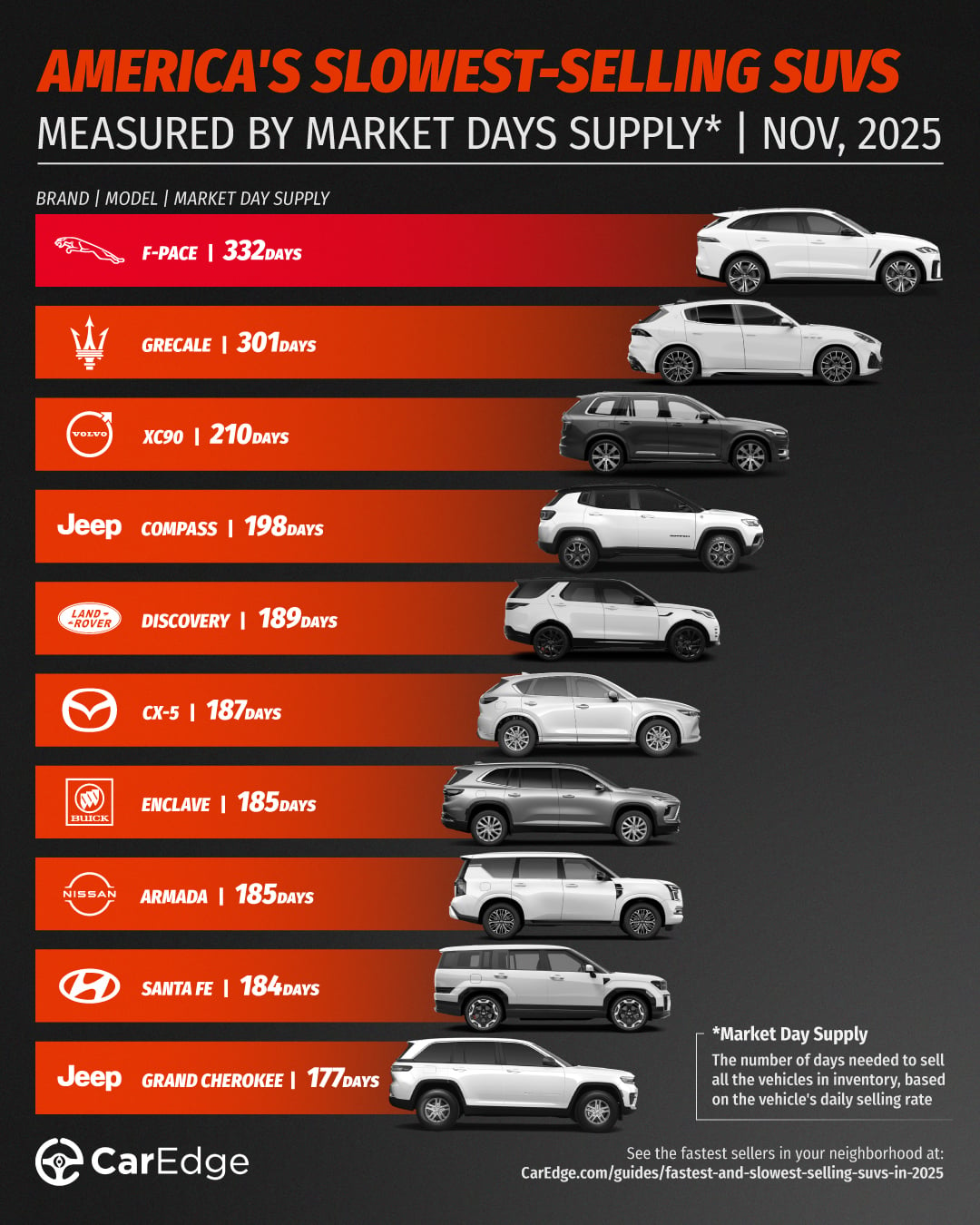

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in October, especially with this new AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Jaguar | F-PACE | 332 | 2,299 | 312 | $70,966 |

| Maserati | Grecale | 301 | 675 | 101 | $82,255 |

| Volvo | XC90 | 210 | 15,642 | 3,349 | $71,761 |

| Jeep | Compass | 198 | 21,358 | 4,843 | $31,924 |

| Land Rover | Discovery | 189 | 1,145 | 272 | $73,959 |

| Mazda | CX-5 | 187 | 43,567 | 10,487 | $34,343 |

| Buick | Enclave | 185 | 13,912 | 3,377 | $52,747 |

| Nissan | Armada | 185 | 6,756 | 1,641 | $71,331 |

| Hyundai | Santa Fe | 184 | 42,768 | 10,438 | $42,928 |

| Jeep | Grand Cherokee | 177 | 47,730 | 12,137 | $46,865 |

Source: CarEdge Pro

Many of these models fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles in 2025. Jaguar’s F-PACE is the slowest-selling SUV today. Surprisingly, just one Stellantis model is in the bottom 10. Land Rover has quickly filled the list, with three slow-selling models this month. Many luxury buyers are waiting for interest rates to fall further as year-end sales approach.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

Thinking about EVs? If it qualifies for the $7,500 federal tax credit, you’ve only got until the end of this month to make a purchase (or get a binding order in writing with a down payment). Although incentives abound, be wary of steep depreciation if you buy any EV. Unless you’ll be keeping your EV for several years, leasing is the smarter choice for your wallet.

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2025!

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.