CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’ve ever been anxious about car buying, you’re not alone. Vehicle ownership is a major financial commitment. With this in mind, how much of your monthly budget should you spend on a car? Today, we’re going to answer that question with the 10% rule.

You’re likely to find many different opinions on how much you should spend on a car. Truthfully, there is no perfect answer. At the end of the day, you have to make a decision that you feel comfortable with.

That being said, we do have some advice we’d recommend you follow. We’re here to help you learn about the 10% rule, and how it helps you determine how much you should spend on your next car.

First things first, to determine how much you should spend on a car, you need to assess your financial situation. This means auditing your monthly gross income. How much gross (before taxes) income do you make each month?

I say monthly income on purpose, because most car buyers are shopping for a monthly payment that meets their budget. This is as good a time as ever to mention that if you can afford to buy a car in cash, and you intend to keep it for decades, please do that. However, make sure to do it the right way (we go over the details here). Paying cash is the most financially responsible car buying decision you can make.

Having said that, most of us aren’t in a position to pay for a car in cash upfront. If that’s you, then start this exercise by analyzing your monthly gross income.

Write that number down, we’re going to come back to it.

Are you buying a car because you need transport from point “a” to point “b,” or are you getting a car to make a statement?

When I worked at an Acura dealership in the early 2000’s, a customer came in and purchased an Acura RL in the top trim. This was an expensive and luxurious car. The same day this customer took home his new car he came back. Why? Because his wife wanted him to buy a Lexus instead. To her, the Acura didn’t portray the image she wanted to her neighbors.

In this case, the “why” behind purchasing a car was to make a material statement, not to simply get from point “a” to point “b.”

If you’re trying to make a statement, it’s my strong recommendation you figure out a cheaper, more fiscally responsible way to make that statement. Consider buying a watch, a house, a painting … literally anything other than a car. Cars simply lose value too quickly.

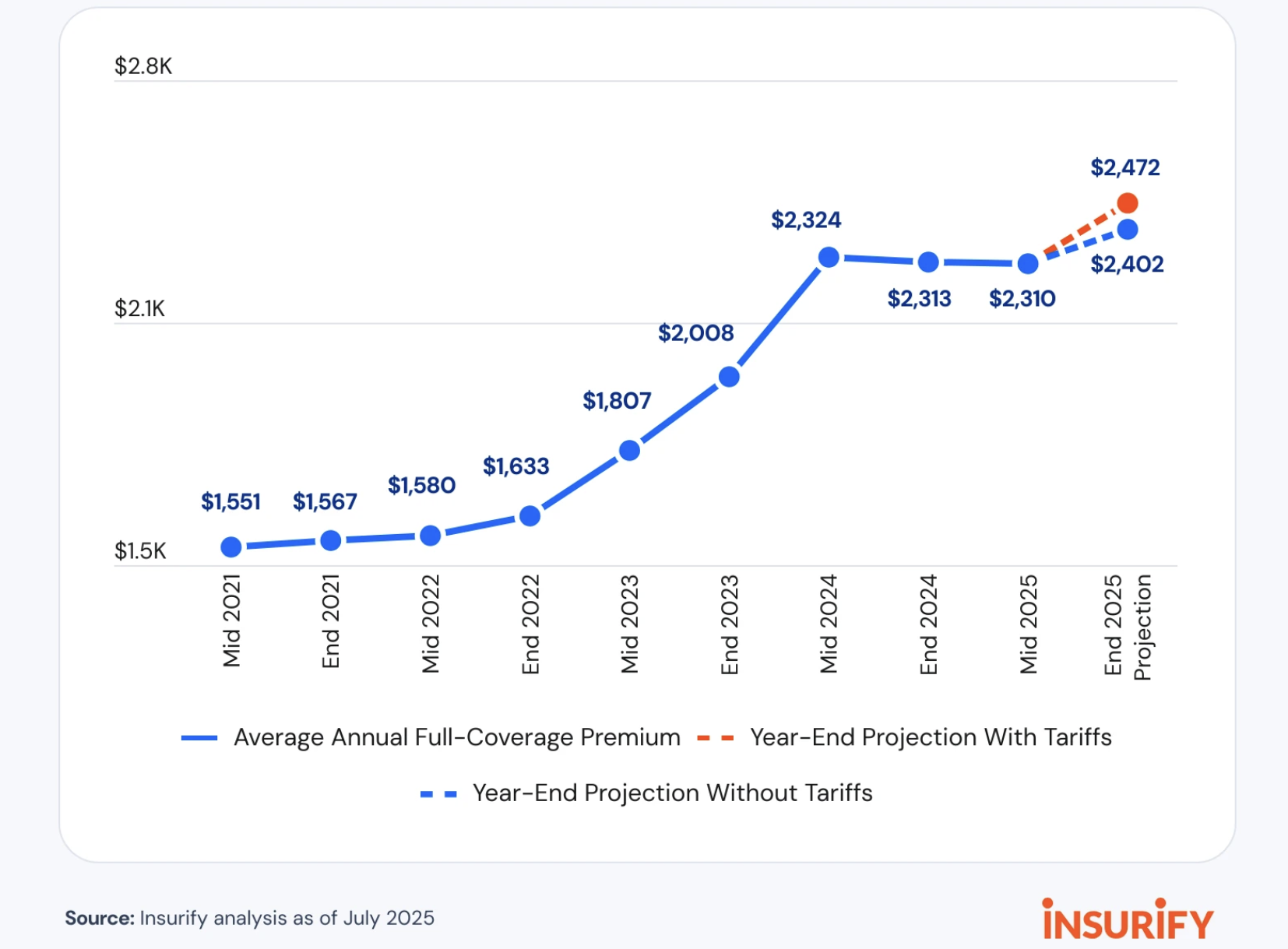

Buying a car entails a lot more than making a monthly car payment. Insurance, gas, maintenance, depreciation, the list goes on and on. If you’ve ever owned a car before, you know just how expensive it is. Plus, insurance costs are rising quickly.

That being said, it’s critically important to consider the total cost of ownership when thinking, “How much should I spend on a car?” Your monthly car payment should include:

When you factor each of these items into your monthly car payment you see that a $500/mo car payment is actually $1,000/mo. And this is where the 10% comes in. I’ve always advised all of my customers to spend no more than 10% of their gross income on their car.

That means that if you make $60,000 per year ($5,000 per month), you can aim for up to $500 per month to go towards your car payment. That doesn’t mean you can afford any car that has a monthly payment of $500, it means the combined cost of the payment, the insurance, and maintenance all needs to be under 10% of your gross income, or in this example, under $500.

Some personal finance gurus suggest that you can afford to spend much more than 10% of your gross income on a car, and banks will even loan you the money you need to purchase a car so long as your debt to income ratio is below 40%.

The 10% rule isn’t a commandment, it’s simply a suggestion. Spending more than 10% of your monthly gross income on a depreciating asset is a tough pill to swallow, but for some it’s worth it.

If you drive less than the average driver each year, I highly recommend you consider leasing a car instead of buying. This is especially advised for those who prefer to upgrade to a new car every few years or so.

Leasing has some distinct advantages compared to purchasing; mainly, you know exactly what you are signing up for. The cost of depreciation and maintenance are built into the lease, whereas when you buy a car outright neither of those factors are known.

The 10% rule also applies to leasing. For example, if my monthly income is $4,000, then my next Mini Cooper lease should be under $400/month since I’ll have to factor in insurance and gas costs.

Leasing allows for a certain level of cost certainty since most lease terms are in the 24 to 36 month range, and cars are under warranty for most (or all) of that time. Some brands even include free scheduled maintenance during your lease term, essentially making the monthly payment and the cost of fuel and your insurance premium your total car expenses.

Trust me, cost certainty is a huge advantage for drivers. Once you experience it, you’ll wonder how you ever lived without it.

Ultimately, how much you spend on a car comes down to how much money you are willing to set aside on a monthly basis. Additionally, always remember that when you buy a car, it will lose value. Vehicles are not investments.

How do you play it smart then? My recommendation is that you follow the 10% rule. It’s fair, it’s reasonable, and it’s not overly constrictive. Plus, when you drive somewhere in your new car, if you follow the 10% rule, you’ll still have some money in your pocket to pay for things when you get there!

Ready for a car-buying expert to get YOU the best deal?

Buying a used car can be a smart financial decision — if you ask the right questions. Pre-owned vehicles come with unique risks, from hidden damage to unclear pricing. That’s why it’s crucial to go into the process prepared and confident.

Use this guide to make sure the dealership (or private seller) is giving you the full picture. If they dodge any of these questions, consider it a red flag.

Used car prices often vary by dealership, but the OTD price reveals the real cost, including taxes, fees, and dealer-installed accessories.

👉 Use our free Out-the-Door Price Calculator to compare offers.

The longer a used car sits, the more room there is to negotiate. A vehicle that’s been on the lot for 45–60+ days may come with bigger discounts.

📊 Use CarEdge Pro to check days on lot, supply, and local market pricing.

A Carfax or AutoCheck report should be free and readily available. It reveals accidents, maintenance, and ownership history.

🚨 No history report = red flag. Walk away if they won’t provide one.

It’s important to note that if you’re buying a used car from a private seller, you may need to purchase your own vehicle history report. All you’ll need is the car’s VIN.

A Pre-Purchase Inspection (PPI) can uncover hidden mechanical issues that a dealer won’t mention. This step alone can save you thousands.

Pro tip: Always choose an independent mechanic who’s not affiliated with the seller.

Used cars can vary greatly, even within the same make, model, and year. A test drive helps you catch mechanical concerns and ensure comfort. Drive on a variety of road surfaces at low and high speeds.

Take note: A test drive doesn’t replace the need for a pre-purchase inspection by an independent mechanic.

Used cars may still have factory warranty remaining or include a dealer-backed warranty. Ask for details, and if they’re selling you an extended warranty:

Compare to CarEdge Extended Warranty plans for full transparency. No markups, just clear coverage.

Buying from a private seller can sometimes get you a better deal. However, it comes with more risk and fewer protections than buying from a dealership. That’s why it’s critical to ask the right questions up front.

Here are some additional questions you should ask a private party seller before agreeing to buy a car:

💡 Pro Tip: Bring a printed bill of sale template and ensure both parties sign it. Also, double-check your local DMV requirements for title transfers and taxes before finalizing anything. See some examples here, but always ensure that all required fields are on your form.

Buying used doesn’t mean buying blind. Let CarEdge’s car buying service do the legwork:

✅ We find the best pre-owned vehicles

✅ We negotiate pricing and review contracts

✅ We coordinate inspections, delivery, and paperwork

Learn more about how CarEdge can help.

CarEdge is your trusted partner for smarter used car shopping. We provide expert tools, unbiased insights, and negotiation support — so you never overpay. Start your car search at CarEdge.com and take control of your next purchase.

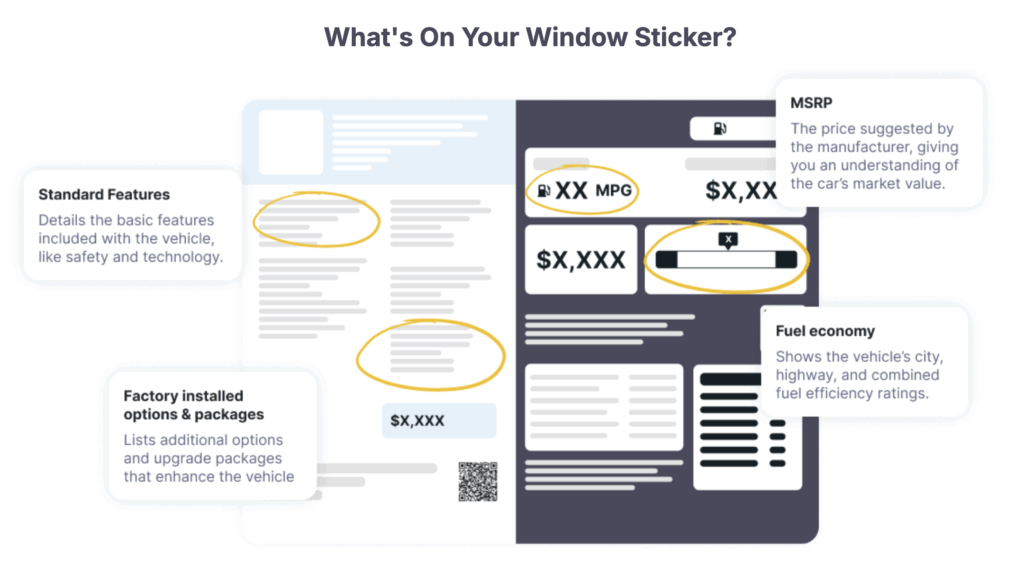

Understanding what’s on a new car’s window can save you from overpaying or falling for dealer tricks. If you’ve ever heard the terms Monroney sticker or window sticker and felt confused — you’re not alone. These labels are crucial for transparency when buying a car, and every buyer should know what to look for.

In this guide, we’ll break down what a Monroney sticker is, why it exists, and how to read it. You’ll leave feeling more confident and equipped to understand what a car really includes — no matter what a salesperson might tell you.

Before car buyers had access to standardized pricing, buying a car was like walking into the Wild West. Salespeople could pick and choose what to tell you — and what to charge.

That all changed with the creation of the Monroney sticker, a federally mandated label that must be displayed on every new car for sale in the U.S. You’ll also hear it referred to as the window sticker — they’re the same thing.

This label lists everything a shopper needs to know about the car’s equipment, price, and origin. It was designed to protect buyers and level the playing field.

Only 9% of Americans say car salespeople have high ethical standards — the lowest of any profession according to Gallup. That’s why federal law stepped in.

Here’s what’s included on every Monroney sticker:

Check out an example of where you’ll find this important information:

📌 Important: Dealer-installed accessories (like pinstripes, floor mats, or nitrogen tires) are not listed on the Monroney sticker. They appear on a separate dealer addendum sticker, which is not federally regulated.

The name comes from Senator Almer “Mike” Monroney, who sponsored the Automobile Information Disclosure Act of 1958. Signed into law by President Dwight Eisenhower, the act required automakers to include standardized labels on all new cars.

Before this law, car buyers had no way to verify what was included in a vehicle or whether the price was fair.

Monroney was a leader in consumer protection and also played a role in creating the Federal Aviation Administration (FAA). His legacy lives on every time you look at a new car’s window sticker.

Want to learn more about the law? Visit the Consumer protection Branch at the U.S. Department of Justice.

Let’s recap what you’ll find on a new car’s Monroney (window) sticker. This information is required by law and cannot be altered or removed by dealers:

💡 Tip: If you don’t see this sticker on a new car, ask why — and consider walking away.

So you’re standing on a dealership lot — where should your eyes go first?

The Edmunds guide to reading a window sticker is an excellent visual breakdown. You can view it here, but here’s a quick summary:

In today’s car market, dealer markups and confusing add-ons are everywhere. But the Monroney sticker keeps it real — it’s the one label they can’t legally change.

When you’re comparing similar vehicles across different dealerships, the window sticker helps you:

Whether you’re shopping used or just want to do your research from home, you no longer have to visit the lot to see the original window sticker. CarEdge now offers access to digital Monroney stickers on most vehicles — giving you instant insight into the car’s features, options, and MSRP breakdown.

✅ Great for used cars that originally included premium options

✅ Helps compare trim levels and original pricing

✅ Saves time and reveals red flags before you visit the dealership

View the original window sticker — and shop smarter from the start.

Q: Is a Monroney sticker required by law?

A: Yes. Every new car for sale in the U.S. must display a Monroney sticker — it’s federal law.

Q: Are Monroney and window stickers the same thing?

A: Yes. These two terms refer to the same federally required label.

Q: Can dealers alter or remove the Monroney sticker?

A: No. It’s illegal for dealers to modify or remove the sticker prior to sale.

Q: Does the window sticker include dealer add-ons?

A: No. Only manufacturer-installed options are listed. Dealer-installed accessories appear on a separate sticker.

Q: Do used cars have a Monroney sticker?

A: No. The law only applies to brand-new vehicles. However, used vehicles may have copies of the original sticker or digital replicas provided by the dealer.

Founded by industry veterans, CarEdge is your trusted resource for transparent car buying. From understanding pricing to negotiating deals and avoiding scams, we provide data-backed insights, expert tools, and concierge services to help you buy with confidence.Want help with your next car purchase? Let us find and negotiate the best deal for you! Explore CarEdge’s car buying help today.

A few years ago, a typical car deal would include thousands of dollars of “incentives” to help a dealership seal the deal with a customer. Nowadays, new car incentives are few and far between. As the ongoing chip shortage (and new magnesium shortage) have hampered automakers, we’ve seen a drastic decline in new car incentives.

Incentives traditionally take the form of either cash rebates or special financing programs. Cash rebates are going by the wayside as vehicle supply cannot keep up with consumer demand. Because of this imbalance automakers do not need to subsidize the purchase of their vehicles. Many consumers are perfectly content buying at MSRP (or above).

Special finance programs still exist, however most industry analysts expect them to fad away as well as interest rates inevitably increase due to inflationary pressures.

TrueCar tracks incentives for most major OEMs. We’ve compiled that data here for you.

The table below makes it very clear; new car incentives are being cut left and right.

| Manufacturer | Q3 2021 | Q3 2020 | Q2 2021 | YoY % Change | QoQ % Change |

| BMW | $3,929 | $5,340 | $4,713 | -26.4% | -16.6% |

| Daimler | $3,135 | $5,621 | $3,574 | -44.2% | -12.3% |

| Ford | $2,569 | $4,241 | $2,564 | -39.4% | 0.2% |

| GM | $3,062 | $5,515 | $4,399 | -44.5% | -30.4% |

| Honda | $2,013 | $2,580 | $2,167 | -22.0% | -7.1% |

| Hyundai | $1,560 | $2,547 | $2,102 | -38.7% | -25.8% |

| Kia | $2,336 | $3,428 | $2,549 | -31.9% | -8.4% |

| Nissan | $2,661 | $4,519 | $3,502 | -41.1% | -24.0% |

| Stellantis | $2,892 | $4,903 | $3,522 | -41.0% | -17.9% |

| Subaru | $1,382 | $1,851 | $1,339 | -25.3% | 3.2% |

| Toyota | $1,992 | $2,726 | $2,219 | -26.9% | -10.3% |

| Volkswagen Group | $2,939 | $4,421 | $3,730 | -33.5% | -21.2% |

| Industry | $2,478 | $3,997 | $3,003 | -38.0% | -17.5% |

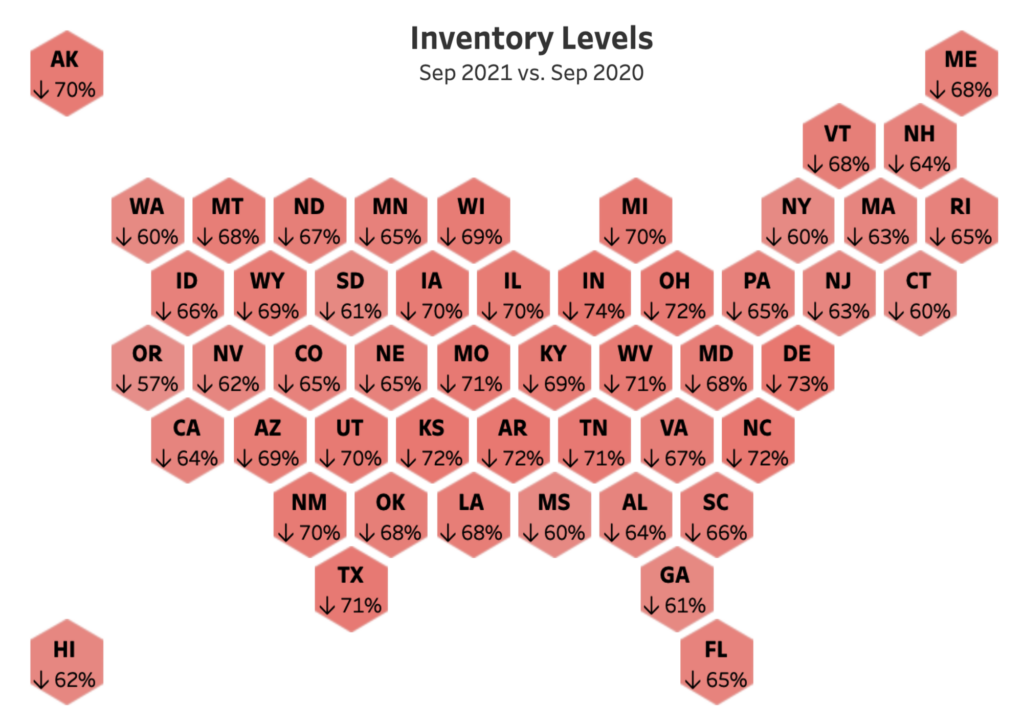

GM, who lost their US sales crown to Toyota is cutting back most heavily when it comes to incentives. This makes sense, because GM inventory levels are down 80%+ in most states right now. With no new vehicles to sell, it makes sense why GM would cut back on incentives.

Hyundai and Nissan have also cut their incentives aggressively quarter-over-quarter. This indicates that they may be struggling more than their peers when it comes to production of vehicles.

As a whole, the industry has experienced a 38% reduction in new car incentives year-over-year for the third quarter.

Digging into the data on a month-to-month level is fascinating. We can actually see that the month-over-month changes are more drastic, indicating that the reduction in new car incentives is more aggressive today than it was at the beginning of Q3.

| Manufacturer | Sep 2021 Forecast | Sep 2020 Actual | Aug 2021 Actual | YOY | MOM |

| BMW | $3,246 | $5,120 | $4,142 | -36.6% | -21.6% |

| Daimler | $3,039 | $5,715 | $3,086 | -46.8% | -1.5% |

| Ford | $2,850 | $4,539 | $2,381 | -37.2% | 19.7% |

| GM | $2,314 | $5,438 | $2,894 | -57.4% | -20.0% |

| Honda | $1,940 | $2,468 | $1,987 | -21.4% | -2.4% |

| Hyundai | $1,310 | $2,708 | $1,481 | -51.6% | -11.5% |

| Kia | $2,169 | $2,991 | $2,236 | -27.5% | -3.0% |

| Nissan | $2,500 | $4,491 | $2,474 | -44.3% | 1.1% |

| Stellantis | $2,987 | $5,079 | $2,970 | -41.2% | 0.6% |

| Subaru | $1,420 | $1,844 | $1,329 | -23.0% | 6.8% |

| Toyota | $1,883 | $2,705 | $2,145 | -30.4% | -12.2% |

| Volkswagen Group | $2,690 | $4,311 | $2,763 | -37.6% | -2.6% |

| Industry | $2,326 | $4,028 | $2,422 | -42.3% | -4.0% |

BMW and GM have decreased their new car incentives the most, followed by Toyota. Ford and Subaru have both increased their new car incentives. This is surprising, because Subaru has a very limited supply of inventory, and Ford isn’t fairing too much better.

The industry as a whole has slashed new car incentives 42% year-over-year for the month of September. There is no indication that this will get “better” before the end of the year, and many automakers are excited to get rid of incentives because it allows them to save money.

We can also see a decline in incentives as a percentage of the average transaction price (ATP) of a new vehicle.

| Manufacturer | Sep 2021 Forecast | Sep 2020 Actual | Aug 2021 Actual | YOY | MOM |

| BMW | 5.3% | 8.5% | 6.9% | -38.1% | -23.8% |

| Daimler | 4.7% | 9.8% | 4.7% | -52.1% | 0.7% |

| Ford | 6.0% | 10.5% | 5.0% | -43.0% | 19.1% |

| GM | 5.0% | 13.0% | 6.5% | -61.9% | -23.6% |

| Honda | 6.0% | 8.2% | 6.3% | -26.2% | -4.3% |

| Hyundai | 3.9% | 9.1% | 4.6% | -57.2% | -14.4% |

| Kia | 7.6% | 11.1% | 8.0% | -31.9% | -6.0% |

| Nissan | 7.9% | 15.8% | 7.9% | -50.0% | 0.2% |

| Stellantis | 6.2% | 11.7% | 6.3% | -47.1% | -1.3% |

| Subaru | 4.7% | 6.2% | 4.3% | -24.1% | 9.8% |

| Toyota | 5.1% | 8.0% | 6.0% | -35.6% | -15.3% |

| Volkswagen Group | 6.8% | 10.7% | 6.8% | -37.0% | -0.3% |

| Industry | 5.9% | 11.0% | 6.3% | -46.4% | -6.3% |

To understand this table, simply look at BMW. In September of 2020 incentives accounted for 8.5% of the average transaction price of a BMW. That means that if you were buying a $100,000 BMW you would expect $8,500 in incentives. Today the expectation should be $5,300 in incentives. As new car incentives decline, and average transaction prices increase, incentives as a percent of average transaction price is also falling.

“Deal” is relative in this market. The short answer is “yes,” the long answer is, “it depends.” We have seen many CarEdge members secure new cars at MSRP with no additional dealer markup. In this market, that’s a GOOD deal. A lot of your dealmaking ability will have to do with the amount of inventory the dealership has available for sale. Some automakers are also still offering incentives on factory orders, so if you are okay with waiting for your new car, placing an order might make sense for you.

Here at CarEdge, we’re focused on one thing: making car buying more transparent, more fair, and less of a hassle. As most drivers know from experience, buying a car is already a complex process, and purchasing a vehicle in another state can make it even more overwhelming. With inventory levels fluctuating, many car buyers are expanding their search beyond to find the right vehicle at the best price. We’ll walk you through the entire process, from understanding the steps involved to figuring out tax requirements and transportation logistics.

Buying a vehicle in another state is eerily similar to buying a car at your local dealership with a few exceptions. The steps to the sale are:

At a high level, that’s how you buy a car in another state. Let’s break each step down a bit further.

As with any car deal, the first step is to negotiate the OTD price with the salesperson or sales manager. Never be a monthly payment shopper. That’s a recipe for severely overpaying. When buying a vehicle in another state you’ll likely be unfamiliar with their taxes and fees.

It is incredibly important that you tell the dealership what your zip code is so that they can calculate your taxes and fees based on your location. We’ll touch on this more below, but taxes are paid where you register your vehicle, not where you purchase it. If the dealership doesn’t know your zip code, they won’t be able to provide you with an accurate out the door price quote.

We strongly recommend that you reference the CarEdge OTD Price Calculator to verify that the dealership’s OTD price matches up with the correct tax, title, and registration rates in your state.

Do you know what happens if you arrive at the dealership without a competitive financing pre-approval in hand? The finance office will be THRILLED because to the dealership, they instantly realize they have the upper hand.

Dealers routinely mark up finance offers before presenting them to customers. It’s one way they make money. Be sure to bring a competitive financing offer from a credit union!

Ideally, get offers from more than one credit union or small bank. Why not the “giant monster mega banks”, as money guru Clark Howard puts it? They don’t usually offer the best rates. They have name recognition, so perhaps they don’t feel that they need to be competitive.

Note: It’s ok to finance with the dealership, but only if they can beat your best offer from a credit union. Sometimes, this will make the sales manager more likely to ‘work with you’ on the out-the-door price of the car, since they receive compensation from the banks they work with when you finance with them. As long as it’s the best deal for you, there’s nothing wrong with it.

If you’re purchasing a used vehicle from another state, there are a few extra considerations you should be aware of. First, you should absolutely consider arranging for a pre-purchase inspection to make sure the vehicle is in good working condition. Second, you’ll need to ensure the vehicle can pass your state’s inspection and emissions testing. By conducting a pre-purchase inspection (PPI) you’ll likely become aware of any issues that would preclude the vehicle you’re thinking of buying from passing your state’s inspection.

To arrange for a pre-purchase inspection from out of state, you have a few options:

Check out our complete guide to PPIs for more information.

Before you sign anything, review the written out-the-door price and official buyer’s order to insure that there are NO dealer markups, and no unwanted add-ons. Nitrogen-inflated tires, ‘theft protection’, VIN etching, and even pinstripes are common add-ons. Just because the dealer pre-installed it, does NOT mean you have to pay for it.

👉 Remember: If it’s taxable, it’s negotiable.

After an inspection report has been received and you’ve agreed to an OTD price that you’ve carefully reviewed, you’ll want to place a deposit down on the vehicle. When buying a vehicle in another state, the last thing you want to do is fly there, or arrange shipping, only to see the price change at the eleventh hour. To protect yourself from last minute changes, place a deposit on the vehicle, and also request to sign a copy of the buyer’s order. Request that the sales manager at the dealership does the same too.

The final step in the out of state purchase process is to take delivery of the vehicle. This is when you will meet with the Finance and Insurance Manager to review loan options and insurance products. As with buying a vehicle locally, you can (and should) come in pre-approved with outside financing and extended warranty coverage quotes.

Depending on what state you are purchasing the vehicle from, you may be able to “take delivery” remotely (sign all the paperwork electronically) and have the vehicle shipped to you. More on that below.

Yes, if you buy a car in another state you can drive it back home to where you live. Unless of course you decide to buy a car in the state of Massachusetts …

In every state except Massachusetts you will receive a temporary license plate from the state where you purchased the vehicle. This temporary tag (also referred to as “drive off tags”) will allow you to legally operate the vehicle after purchasing it.

When you arrive back in your home state you will then go to your local department of motor vehicle and register the vehicle. This is when you will receive your permanent plates for the vehicle.

Why is Massachusetts different from all the other states? That’s a great question. Their laws around vehicle registration are infuriatingly complex and cumbersome. Auto Influence wrote a great article on the Massachusetts Problem.

When you purchase a vehicle out of state, you pay taxes in the state where you register the vehicle, not where you purchased it. The actual process of calculating the correct tax amount and remitting it to your home state can be handled differently.

For example, if it’s a neighboring state, the dealership where you purchase the vehicle will collect and remit the taxes and fees for you. You’ll then receive your permanent plates and registration in the mail. Many dealerships have software that allows them to calculate the proper sales tax and registration fees for different states, and in neighboring states they may feel comfortable handling that for you.

If you’re buying from a further away state, or if the dealership doesn’t offer to handle tax and registration for you, you should contact the dealership’s title department to see if they can walk you through the steps you’ll need to take back in your home state. At this point it is also helpful to consider contacting a local dealership and asking them for assistance too. You can of course also refer to your state and local tax laws and remit payment on your own.

Let’s say you purchase out of state and you pay for sales tax, but it is the wrong amount. What happens then? When you go to register your vehicle at your local department of motor vehicle you will either receive a credit from them, or you will owe them additional money.

Yes, absolutely. This is a very common practice and could financially make a lot of sense for you. The dealership where you purchase the vehicle may recommend a particular shipping company and you should see what their quote is. You should also shop the quote and get bids from other providers as well.

Shipping options will range from open air freight to closed container shipping.

When you buy with CarEdge, we can ship your vehicle to you. Learn more about the benefits of buying with CarEdge.

Yes. The registration process is different in each state, however you can buy a vehicle in one state and register it in your home state. You’ll need to make sure the vehicle can pass your state’s emissions test and road worthiness inspection.

You’ll also need to confirm that the vehicle title is clear of any liens.

If you’re buying a vehicle in another state and you have a trade-in, you should always treat your trade-in as a separate transaction from your purchase. When negotiating the out-the-door price, don’t let the dealership tie your trade-in offer to your purchase. If you do, you will get a low-ball offer.

👉 Take this trade-in checklist with you to play it smart.

Yes, you can lease a vehicle from another state, however some dealership’s will not allow you to. The complexity of out-of state leases is high, and some dealerships do not want the burden of mistakenly calculating the wrong taxes and fees on a lease.

Before negotiating an OTD price with an out of state dealership, we would encourage you to ask them if they’re willing to lease you the vehicle with you being from another state. Be prepared to give them your zip code since each state treats leases differently.

In conclusion, buying a vehicle in another state can seem like a daunting task, but with the right knowledge and guidance, it can actually be a smart move that saves you money. By taking the time to research the laws and regulations in the state you plan to buy from, and working with a reputable dealer or private seller, you can find the car of your dreams without breaking the bank.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download.