CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Electric car prices have fallen off of a cliff. Depending on your stance in the market, this could be great news, or far from it. Since September 2022, the average used electric car price has tumbled from $63,069 to $33,645. That is a 47% loss of value in a little over a year and a half.

At the same time, used internal combustion engine vehicles have seen their prices decline too. Since September of 2022, used cars powered by internal combustion engines have seen their average price decline from $34,000 to $32,000. This 6% loss in value over 18 months is more like what we would expect.

A closer look at some EVs for sale today reveals that a 47% drop in value would actually be a better scenario, believe it or not. Should EV buyers consider this drastic drop in value to be a good or bad sign? We’ll get into that too.

The actual value of new electric cars is significantly lower than their starting MSRPs. Take for example this BMW i4 that is currently for sale. The manufacturers suggested retail price is $64,740. The CarEdge Target Discount from the dealer is 8% off of MSRP which is a price of $59,561.

What happens when you plug this vehicle into CarEdge.com/sell and receive instant cash offers? With just 500 miles entered on the odometer, the highest cash offer is $28,370 from CarGurus.

That is an astounding 56% loss of value the moment you drive the car off the lot!

Things get even worse when you look at the Mercedes-Benz EQS. This 2023 Mercedes-Benz EQS has a manufacturers suggested retail price of $156,170. The CarEdge Target Discount is 15% off of MSRP, leading to a selling price of $132,745. 15% off of a Mercedes seems like an excellent deal! Until …

When you plug this vehicle into CarEdge.com/Sell with 500 miles you get an instant cash offer of $67,000. Again, a 57% loss in value.

When Ford launched their flagship ‘Tesla-killer’ EV in 2021, nearly infinite demand was expected by Ford’s leadership. “It’s hard to produce Mustang Mach-Es fast enough to meet the incredible demand, but we are sure going to try,” said Ford CEO Jim Farley at the time.

How times have changed. From boasting production targets of 200,000 copies by 2023, to struggling to sell last year’s inventory even today, Ford EV sales have not lived up to their corporate expectations.

The good news for buyers is that great deals can be had on a new Mustang Mach-E. But is it enough to lift buyers out of negative equity from day one?

Let’s take a look at an example from the CarEdge Community.

This new 2022 Mustang Mach-E was STILL on the dealer lot in early 2024. In fact, about 100 new 2022s remain across the nation. With a $27,000 discount, surely it’s a steal, right? Not so fast…

Here’s how much online car buyers would pay for that exact car, the moment it is driven off of the lot…

That’s right, a 48% drop in market value from day one. Although this was a 2022 model, roughly two-thirds of all new Mustang Mach-Es on dealer lots today are leftovers from 2023. No one should be paying MSRP for last year’s cars in spring or summer of 2024. See how low prices are near you.

Lower selling prices is welcome news for EV buyers, but with a few VERY important caveats.

The only folks who should be buying new EVs right now are those who plan to keep them for a long time. Otherwise, buying an EV is a very risky financial decision if there’s a chance you’ll be looking to sell anytime soon.

Unless a hefty down payment or trade-in is made, buying a new EV in 2024 puts buyers at significant risk of becoming ‘underwater’ on their car loan. This means that your car is worth less than you owe on the loan (learn more here). It’s a situation you want to avoid, no matter what.

Leasing an EV is another great option, and there are some great EV lease offers out there today. Plus, leasing is a low-stress way of trying out the EV lifestyle for the first time.

This is where the EV depreciation crisis turns into good news for some. If you’re open to buying a used electric car, the shocking depreciation of today’s new models is in your favor. Previously, EV buyers had to decide between the benefit of the federal EV tax credit (available only on select models), or somewhat lower prices on the used market. Today, that’s no longer the case.

In 2024, the price gap between new and used EVs couldn’t be more clear. The savings that come along with a used EV are no match for even the most generous of new EV incentives. With new tools like Recurrent Auto, you can even check a used electric car’s battery health before buying.

Used EV buyers can take advantage of rapid depreciation to score a sweet deal on any used EV, from Tesla to Ford and everything in between.

👉 See for yourself with these Local Used EV Listings

In 2024’s changing EV market, there are more reasons than ever to equip yourself with car buying know-how. The good news is that we have 100% FREE resources to get you there!

Ready to outsmart the dealerships? Enroll in Deal School now—CarEdge’s online, completely free car-buying course. Gain the insider knowledge to take charge of your purchase. Start mastering your deal today!

Understanding used car dealership profit margins can make buying a car at a fair price easier than you’d think. Thanks to fresh industry data we have insight into the profitability of eight publicly traded dealership groups. And while most used car dealers experienced a decrease in gross profits per used vehicle sold in Q1 2023, there were exceptions — Carmax (+3%), AutoNation (+35%), and Carvana (+52%).

Here’s the breakdown:

So, how does understanding dealership profit margins empower you, the consumer to get a better deal? Let’s dive in.

Fluctuating profit margins in the market hint at competitive dynamics, potentially paving the way for better deals for consumers. This could be an excellent time to consider buying a used car, especially from dealerships that are currently facing profit contractions.

With the knowledge of dealership profit margins, you could have an edge in price negotiations. If a dealership enjoys high-profit margins, there may be more room for negotiation. On the flip side, those with tighter margins might not offer as much price flexibility, but they could be keener on making a sale.

Interestingly the used car dealers with the greatest profit margins are Carvana and CarMax, the two dealer groups that do not allow negotiations. This means that if you are considering purchasing from one of these dealers you need to understand that you are paying a premium, and you likely could save money on a comparable vehicle from another dealer.

Don’t restrict your search to one dealership or group. The disparity in profit margins among dealership groups underscores the value of shopping around. Independent dealerships could also provide attractive deals.

It’s also paramount to research the fair market value of the vehicle you’re interested in. Resources like CarEdge can provide an extensive array of data to help you make an informed decision.

Understanding the days supply of inventory is another valuable piece of information. It indicates how long a dealer’s current stock of used vehicles would last given the current sales rate. The longer a vehicle stays on the lot, the more it costs the dealership in the form of floorplanning costs, which can encourage them to negotiate on price.

Current used inventory days supply for the six groups are:

Unfortunately we do not have a reliable source for days supply for Carvana or CarMax.

This information could influence your buying strategy. Dealerships with a high inventory supply might be more willing to negotiate on price. Timing your purchase when the inventory supply is high could lead to better deals. A high supply might suggest overpricing or less popular models, whereas a low supply could indicate competitive pricing or high-demand models.

Try using the new FREE CarEdge Data Explorer to get a sense for days supply of inventory in your area.

With this knowledge of dealership profit margins and days supply of inventory, you’re well-equipped for your next car buying journey. It may not look like the good old days, but you’re setting the stage for a win-win negotiation. After all, in this new era of car buying, information is your strongest asset.

In June, the Federal Trade Commission proposed a new set of rules that would ban unscrupulous sales practices that are commonly employed at car dealerships. Among the notoriously anti-consumer practices targeted are the sale of products without benefit, bait-and-switch pricing, forced add-ons, and discriminatory practices for cash buyers.

There’s a reason the annual trustworthiness of profession poll from Gallup ranks car salespeople at the bottom; it’s not because every salesperson is bad, it’s because a few bad apples ruin the bunch. Over the years I have heard countless stories from our community of these aforementioned practices. Still, powerful dealer lobbies are combating the FTC proposal, and it’s become clear that they’re determined to defeat the proposal at all costs.

Fortunately, consumers have a real opportunity to have their voices heard. A public comment period is now open until September 2022, and we’re calling on you to share your opinion with the FTC. It’s clear that auto dealers are already amassing a unified position, and we need to do the same. If consumers show up in numbers, car buying may be transformed for the benefit of we, the people. Time is of the essence, as this narrow window leaves less than two months for the public to share their support.

On June 27th, The Federal Trade Commission proposed a new set of rules that would ban specific auto sales tactics commonly used by car dealers to take advantage of consumers. In an FTC proposal titled Motor Vehicle Dealers Trade Regulation Rule No. P204800, the following auto dealer practices are targeted:

FTC Bureau of Consumer protection Director Samuel Levine explained the reasoning behind the proposed rules. “As auto prices surge, the commission is taking comprehensive action to prohibit junk fees, bait-and-switch advertising and other practices that hit consumers’ pocketbooks. Our proposed rule would save consumers time and money and help ensure a level playing field for honest dealers.”

The average new car transaction is now $47,202, or 72% of the median household income in the United States. Bait-and-switch pricing, forced add-ons and dishonest financing tactics have all contributed to the average monthly car payment soaring to $730, 40% higher than the average payment just five years prior. With car prices at record highs, consumers are fed up with anti-consumer sales tactics that proliferate at many dealerships nationwide.

This is our chance as consumers to unite behind a proposed rule that could change car buying for the better unlike ever before. However, this battle is far from won.

The National Automobile Dealers Association, or NADA, is a nationally-recognized industry and political force that represents over 16,000 auto dealers nationwide. Every year, the NADA and its counterpart for independent dealers spend millions of dollars lobbying politicians to advance legislation that is pro-dealer, too often at the expense of the consumers the auto industry relies on. The power and influence of today’s car dealers can be traced directly to the NADA and NIADA.

Needless to say, the dealer lobby isn’t happy about the FTC’s proposed rules. In a letter to the FTC, the NADA characterized the proposal as unsupported, sloppy and inconsistent. How so? NADA senior vice president Paul Metrey dismissed the proposal as “woefully inadequate” because the regulation is unnecessary in his view, because it would address “things they can go after” already. It’s as if dealers and their powerful lobbies are fully aware of the anti-consumer sales tactics flourishing in the industry, but are content with pushing the limits of regulation until enforcement encroaches on their bottom lines.

Read the full NADA response here.

Another flawed argument promoted by the NADA is that complaints are few and far between. The FTC said it received more than 100,000 auto-related complaints in 2021. To counter that startling statistic, the NADA says there were 42 million new- and used-car sales last year. We all know that car buyers rarely have the time to seek out the procedures to submit a formal FTC complaint. Consumers have jobs, families, and other financial obligations on their minds. Imagine if one out of twenty dishonest car sales resulted in a formal complaint. In reality, reporting is likely even lower.

There’s no way of knowing just how widespread this problem is, yet every day our community of CarEdge members shares tales of shady dealership practices, and dishonest, anti-consumer tactics that cost them time and money. Whether it be comments on YouTube, or essays we receive via email; our millions of monthly viewers are fed up with the status quo, and demand change.

Industry media outlets are picking sides, and some heavyweights are clearly siding with dealer lobbies. Industry news outlet Automotive News published an editorial promoting the talking points disseminated by the NADA and NIADA. They too are calling for interested parties to submit comments during the narrow public comment period.

The FTC’s open commenting period is now open, and it will remain open until September 12, 2022. Anyone can submit a comment to voice support or displeasure with the proposal. In a classic David versus Goliath scenario, dealer lobbyists are facing off against consumers like you and I. With massive auto dealer lobbies and even media outlets calling for dealers to submit comments opposing the proposed rules, it’s up to all of us to make our voices heard. Submit a comment today on Regulations.gov. This should be a priority for all Americans who are sick and tired of car buying being synonymous with deception and dishonesty. We’ll keep you posted on the latest developments.

View Ray’s comment here, or read it below:

As someone who spent 43 years managing automobile dealerships and advocating for better enforcement of rules and regulations regarding dealer advertising and F&I practices, I strongly support your efforts to finally rid America of the unethical practices that many dealerships employ. Business decisions are made by dealerships everyday as to how to advertise the price of a vehicle online. Should we include the destination charge that is part of the MSRP in the price or should we disclose that in the small print? Should we disclose any dealer installed accessories or packages that the customer is expected to pay for in the advertised price or should we only disclose that once they have come into the dealership? Should we disclose all dealer and state fees or again wait until the customer has agreed to buy the car? How should we disclose our F&I offerings, or our rate markups for placing indirect loans? These are all business decisions that truthfully should not have to be made, full disclosure and transparency is not only what consumers want, it is what they are entitled to. You can read many consumer complaints in regards to this issue on our YouTube channel: https://www.youtube.com/c/CarEdge/ videos, just click on just about any video and read what consumers are saying on a daily basis.

One must question what is wrong with a society as a whole when everyone knows that consumers are taken advantage of everyday when purchasing a car or truck and everyone turns a blind eye to it. Law enforcement, consumer protection agencies, State Attorney Generals, the Federal Trade Commission and many other “consumer” protection organizations all know what is going on yet do next to nothing to correct it. The essence of commerce should not be “who can we take advantage of today” but rather how can we operate in a consumer respectful and honest manner. I believe the enactment of these proposals would bring us closer to the later and finally rid our society of the former.

Average monthly car payments have been increasing ever since the beginning of the chip shortage in 2020. Today, the average monthly car payment for a new car exceeds $700 for the first time ever, while the average monthly car payment for a used vehicle is more than $500.

Over the last 18+ months we’ve covered the tenuis rise of car prices. It’s shocking to think that the average car payment is now closing in on the average mortgage payment in America. Data from Edmunds shows that 12% of new car buyers in June are paying more than $1,000 a month. In 2021 the average home mortgage payment was roughly $1,000 a month. Let that sink in.

Here’s the latest data on new and used car payments, affordability, and which vehicles you should consider if you are looking for a relative “bargain” in today’s market.

Let’s dive in.

Data from J.D. Power/LMC Automotive suggests that the average new car transaction price was $45,844 in June. As compared to data from Cox Automotive, this average transaction price is actually down considerably when compared to prices from the end of 2021 and earlier in 2022.

For example, at the end of 2021 the average transaction for a new vehicle was $47,077 according to Cox Automotive, however the average monthly payment was only $688. This was a function of cheaper interest rates.

Today, the average monthly payment for a new car stands at $712 dollars. That is more than rent for a one bedroom apartment in some cities.

| City | Rent |

|---|---|

| Akron, OH | $640 |

| Wichita, KS | $710 |

| Lubbock, TX | $720 |

| Shreveport, LA | $740 |

| Lexington, KY | $800 |

| El Paso, TX | $860 |

| Baton Rouge, LA | $860 |

| Tallahassee, FL | $860 |

| Oklahoma City, OK | $870 |

| Des Moines, IA | $890 |

Average loan terms for a new car sit at 70 months, with most consumers opting for 6 year financing terms at an average interest rate of just over 5%. Back in December of 2021 the average new car interest rate was under 4%, accounting for the uptick in monthly payment amounts.

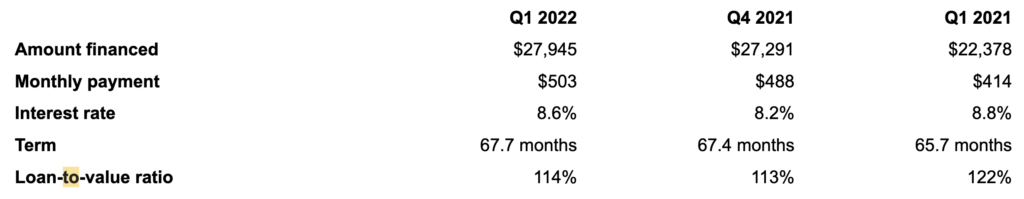

As you very well know, used car prices have skyrocketed ever since the beginning of the chip shortage. For the first time ever, the average used car monthly payment sits above $500. Data for Q1 of 2022 shows an average interest rate of 8.6% and an average loan term of 68 months. We expect data for Q2 to show a significant increase in the interest rate and monthly payment. We would not be surprised to see 9%+ as the average interest rate on a used car loan, and monthly payments in excess of $525 for the first time ever.

Used hybrids and electric vehicles are especially expensive in today’s market, with monthly payments on more fuel efficient vehicles in excess of $700.

Cox Automotive tells us that the average transaction price for a new car was $47,148 in May 2022. Where are the new car values?

Sadly, non luxury vehicles are seeing their prices increase rapidly as more consumers look for “value”. The average price paid for a new non-luxury vehicle in May was $43,338; on average a customer paid $1,000 over MSRP for a new non-luxury vehicle. We are seeing some below MSRP deals on Stellantis brands; Jeep, Ram, Alfa Romeo, Chrysler.

The average luxury car buyer paid $65,379 in May. They also spent about $1,000 over MSRP to get their new car.

The average electric vehicle buyer paid $64,000 in May. The Chevrolet Bolt represents the only real “bargain” in the EV space.

The average truck buyer paid $56,216 in May, while the average van buyer paid $48,671, and the average SUV buyer paid $46,073. The only “value” segment on the list are cars, where the average sedan buyer paid $41,902 in May.

Automakers such as Nissan have average transaction prices of $34,681. Compared to other automakers such as Toyota ($40,036) and Hyundai ($35,988) they represent a relative “steal”.

Ford, Stellantis, and GM have seen their average transaction prices increase significantly. Ford’s average transaction price stands at $49,528. Stellantis is at $53,212, and GM is at $50,854.

Update: The public comment period is NOW OPEN. The deadline is September 12, 2022! Here’s how you can submit a comment. Share with your friends and family!

On June 27th, The Federal Trade Commission proposed a new set of rules that would make many commonplace car dealer sales tactics illegal. Let’s break down the proposal and discuss what tactics dealers use to take advantage of customers.

FTC Bureau of Consumer protection Director Samuel Levine explained the reasoning behind the proposed rules. “As auto prices surge, the commission is taking comprehensive action to prohibit junk fees, bait-and-switch advertising and other practices that hit consumers’ pocketbooks. Our proposed rule would save consumers time and money and help ensure a level playing field for honest dealers.”

From time to time, consumer’s voices are actually heard by those who have the power to make a change. The FTC explained the role of consumer complaints in the drafting of this proposal.

“Consumer complaints suggest that some dealers have added thousands of dollars in unauthorized charges, including for add-ons that consumers had already rejected. These issues are exacerbated when pre-printed consumer contracts automatically include charges for optional add-ons, when consumers are rushed through stacks of paperwork, or when they are asked to sign blank documents.”

Perhaps you’ve experienced this firsthand. We help CarEdge members cancel unwanted products all the time. It’s just another unnecessary obstacle to buying a car in 2022.

Without further ado, these are the four anti-consumer dealer practices targeted by the FTC’s proposed rules.

The new FTC rule would ban all add-ons that do not add any benefit to the product. Examples of included products are nitrogen-filled tires that contain no more nitrogen than is normally found in the air, duplicate warranty coverage and unnecessary GAP insurance, a product that not every car buyer will benefit from.

How many times have you inquired about a specific car that was advertised, only to learn of a ‘market adjustment’ or slew of dealer add-ons? Transparent pricing is a novelty in today’s auto sales, however the FTC’s proposed rule would require that dealers advertise the true price of the car online.

Why should any car buyer be penalized for paying cash? The new FTC rule would require auto dealers to advertise the cash price of the vehicle without add-ons. The customer would have to be told the price of the car, with and without financing. Notably, this mandatory price disclosure would have to be without optional add-ons from the get-go. No more teasing it out of the salesperson.

If the customer agrees to pay something different, both they and a dealership manager must sign a document saying so.

How to Challenge Forced Front-End Add-Ons At a Dealership

“Express, informed consent” would be required for add-ons commonly pushed on buyers in the financing and insurance (F&I) office when buying a car. What would be different? Disclosures and consent options must go beyond “a signed or initialed document, by itself” or “prechecked boxes,” the FTC said. I’m wondering, why wasn’t it always like this?

Here’s 5 things you need to know before stepping into the dealership F&I office.

As this is breaking news, it’s too soon to know what dealership lobbies like the National Automobile Dealers Association think of it. I think we can all assume they won’t be fans of the proposal. The NADA spends $3 million a YEAR on lobbying efforts in Washington, and their influence is strong at the state level, too.

How did car dealerships become so powerful in America? It’s a story of power, money and influence.

Opposition to the new FTC proposal came from one of the panel’s own members. FTC Commissioner Christine Wilson felt “unlawful practices persist” within the auto retail industry, but said the proposal courted “unintended but negative consequences.” Commissioner Wilson cited prior regulations which had hurt competition and proved difficult to keep current. Interestingly, she also cited the rise of direct-to-consumer sales and Carvana’s online sales model as reasons for opposing the rule.

One state where the auto dealer lobby has enormous power is Florida. Over 1,000 car dealers belong to the Florida Automobile Dealers Association. Dissenting FTC Commissioner Wilson happens to be from Florida. Coincidence? Maybe.

Can the dealership model save itself from the rise of direct-to-consumer sales? Transparent pricing would be a step in the right direction. With the dealer markups and bait-and-switch tactics all too common in today’s car buying experience, wouldn’t you opt for honest pricing given the chance?

Leave your comment in support of this proposal! We hope you’ll share this important opportunity with your friends and family.