Dealer lot inventory is on the rise, but where are the deals at?! As we move further into 2023, many potential car buyers are wondering, “is now a good time to buy a car?” and “will car prices go down in 2023?” The good news is that recent market trends indicate that the tide is starting to turn, with car prices slowly beginning to decrease and negotiability on the rise. However, there are big differences between the new and used car markets today. Let’s take a closer look at the details.

Patience, Fellow Car Buyers

According to CarEdge’s Ray Shefska, recent trends suggest that there’s good news for car buyers, with prices gradually decreasing and more room for negotiation on the horizon.

Ray notes that “March broke a string of 20 straight months where the average new car prices transacted at above MSRP, in March the average price paid was $171 below MSRP.”

“Although this drop might not seem significant, it’s a noteworthy development, indicating that dealerships are becoming more open to selling cars at lower prices,” he explained. Car manufacturers are increasing incentives to attract more buyers to the market, ultimately benefiting car shoppers.

CarEdge’s Car Coaches note that patience will be rewarded as we head into the summer 2023 car buying season. “Consumers who are patient will find themselves in a much better position as negotiability should increase as we get into the summer months.”

Used Car Prices Are a Different Story

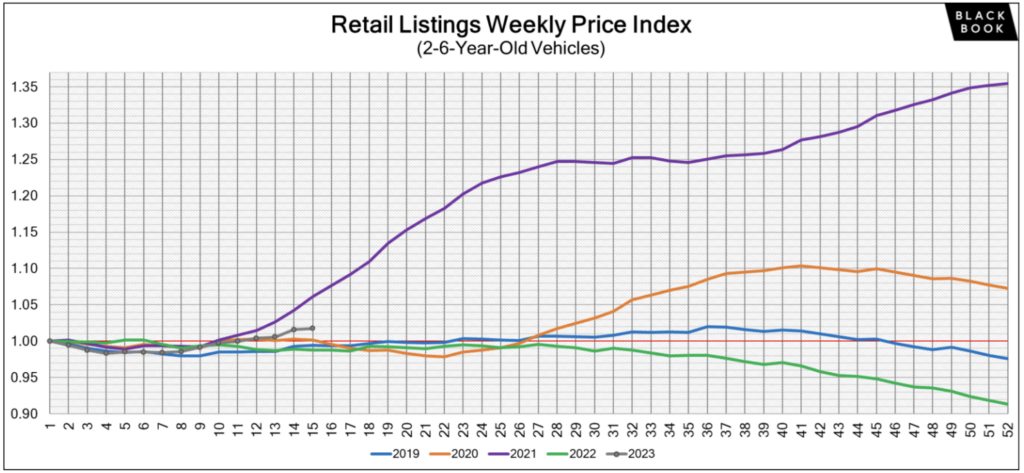

It’s important to note that there are considerable differences between the new and used car markets. New car transaction prices are steadily dropping as dealers try to move more inventory after years of nearly vacant lots. On the other hand, used car prices are increasing as of spring 2023. The latest used car price data from Black Book shows that after 30 weeks of wholesale price declines, used car prices have actually increased for the past several weeks. In April, used car prices increased at the retail level too.

CarEdge’s Car Coaches don’t expect rising used car prices to become a new long-term trend like we saw in 2021 and early 2022. However, there could be a month or two of additional slight price hikes.

We track used car prices weekly here.

High Interest Rates Motivate Dealers

How do rising interest rates affect car buying? Of course, buyers who finance are going to pay more in interest, no matter their credit score. But other things change too. Despite higher APRs, there can be benefits for buyers. Car dealers pay interest on lot inventory until it is sold. Think of dealer floor plan financing almost like a credit card made solely for purchasing vehicle inventory. When the federal reserve raises the cost of borrowing money, all kinds of credit will become more expensive, and that includes car lot floor-planning.

With higher floor plan costs, rising lot inventories and incentive spending on the rise, dealers will be motivated to negotiate. Therefore, the longer you can wait to buy a car in 2023, the more likely you’ll be able to negotiate thousands off of your deal.

See the best manufacturer incentives this month (updated)

Furthermore, Ray predicts that it will be a lot easier to secure a deal below MSRP as we get deeper into summer. In fact, the latest data from Kelly Blue Book shows that for the first time in two years, new-vehicle transaction prices fell below MSRP in March. The CarEdge Coaches expect that trend to continue.

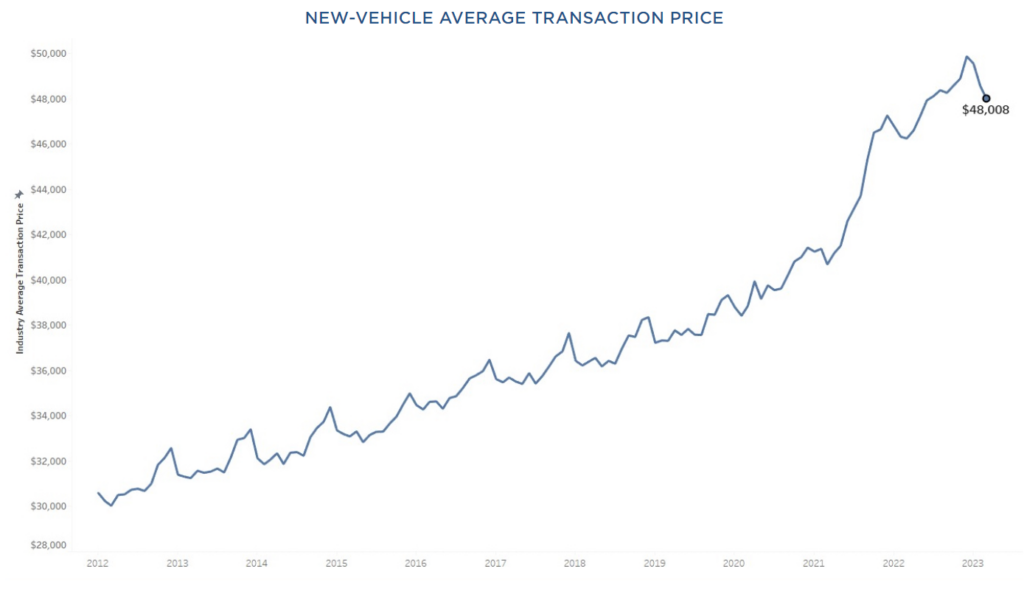

Sadly, you and I are well aware that cars are far from cheap these days. The average price paid for a new car is still around $48,000. If you’re looking to go electric, expect to pay 20% more. Even in this market, our Coaches have proven even the toughest new and used cars are negotiable. Check out these success stories from happy drivers around the nation. CarEdge Coaches have even negotiated thousands of dollars off of EV prices in 2023.

Expert Car Buying Help Is Here!

We’re real people empowering you to save real money on your next auto. How can we help? Check out hundreds of 100% free resources, great YouTube videos, and the fastest-growing online auto forum today, the CarEdge Community. We just launched Dealer Reviews, where you can see nearly 3,000 crowdsourced car dealer and deal reviews.

Looking for behind-the-scenes auto market data to inform your buying decisions? That’s exactly why we created CarEdge Data. Unlock the Black Book car valuations that dealers use, CarEdge negotiation scores, official recommendations, and local market data for every car on CarEdge Car Search with CarEdge Data.

Ready for expert 1:1 help with your deal? Our Car Coaches are ready to work with you to secure the best deal on out-the-door prices, financing, and more. Learn more about our CarEdge Coach unlimited access plan. We look forward to meeting you.

Hello , Everybody is saying wait wait wait the prices will start to drop and banks are doing repo s by the thousands . My question is what happens when the value of the dollar falls with car prices in 2024 ? Nobody really discusses that point and the only valid reasons to wait is to get dealer incentives and pay below msrp when supply exceeds demand . Am I wrong ?