Amid a volatile market and looming auto tariffs, a new consumer survey conducted by CarEdge reveals that most Americans are unwilling—or unable—to tolerate further increases in car prices and monthly payments. The Spring 2025 Car Buyer Survey, which gathered over 400 responses from prospective new and used car shoppers, shows just how sensitive demand is to monthly payment hikes.

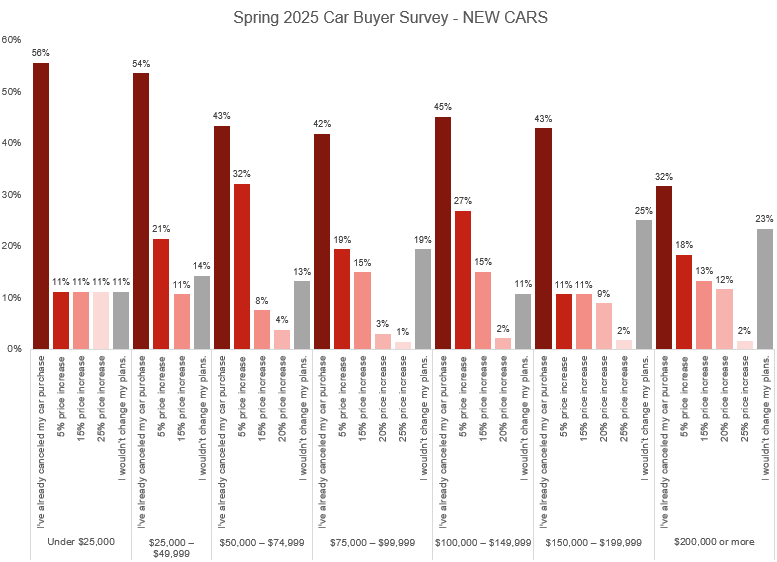

Key Findings: New Car Buyers

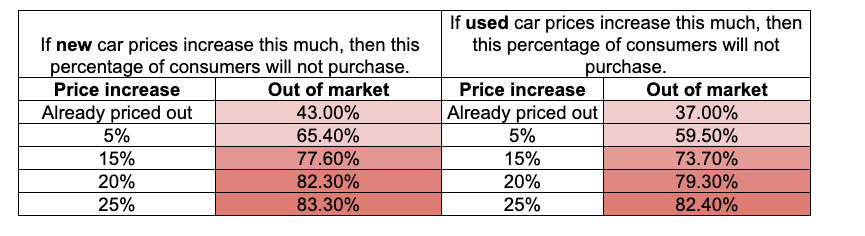

- Even without any additional price increase, 42% say they’ve already canceled their car purchase plans due to high prices.

- 65% of new car buyers say they would exit the market entirely if monthly payments rose by just 5%.

- 78% would be out if payments rose by 15%, and more than 83% would stop shopping entirely if payments climb 25%.

“These numbers make it clear: new car affordability is reaching a breaking point,” said Zach Shefska, Co-Founder and CEO of CarEdge. “If monthly payments increase even slightly, automakers are going to lose a huge chunk of their customer base.

From 2022 to 2024, incentives were increasing. Now, that trend is reversed, with incentives making up just 7% of the average transaction price. With auto loan rates averaging 9% APR for new cars, any decline in manufacturer incentives could spell trouble for buyers and sellers alike.”

Key Findings: Used Car Buyers

- 37% of used car shoppers report they’ve already given up on buying due to high prices.

- Used car shoppers show similar price sensitivity, with 60% saying they’d be out of the market if prices rose 5%.

- That figure climbs to 74% at a 15% price increase, and 82% of buyers say they’d walk away if payments rose 25%.

Income Breakdown: Even High Earners Are Walking Away

The latest CarEdge Car Buyer Survey highlights a striking reality: car buyers at all income levels are reaching their breaking point.

- Lower income buyers are hit hardest: Among new car buyers with household incomes below $50,000, a staggering 51% have already canceled their purchase plans due to high prices.

- For used car shoppers in the same income bracket, the figure is nearly identical at 49%.

Even middle-income households are feeling the pressure:

- 43% of new car shoppers earning $50,000–$100,000 have also exited the market.

- 37% of used car shoppers in this income range say they’ve given up their purchase plans.

And while some might assume high earners are unaffected by today’s car prices, the data says otherwise:

- Higher-income households are slightly more resilient in the used market, but even among those earning $150,000 or more, 44% say they would be out of the market if used car prices rise by 5%.

- Among households earning over $200,000 annually, 32% of prospective new car buyers say they’ve already walked away. In the used market, 25% of shoppers in this high-income bracket report the same.

- While only 9% of all new car buyers said they wouldn’t change their plans regardless of price, that number jumps to 24% among households earning $150,000 or more.

“Car affordability impacts all households,” said Shefska. “Even six-figure earners are pushing back. That should be a wake-up call to automakers who have spent years increasing MSRPs and abandoning affordable (sub $25,000) vehicles.”

Across the board, households making over $100,000 per year are more price-sensitive than expected, with many drawing firm lines as affordability concerns mount. It’s not just new car shoppers who are reconsidering making a vehicle purchase. We see similar trends among used car buyers:

Shockingly, among households earning over $200,000 per year considering a used vehicle, one quarter say they’ve already canceled their purchasing plans. That’s the same percentage as those in the same income bracket who say they wouldn’t change their plans even if used car prices rose by 25%.

Market Implications

These findings come at a time when tariffs are threatening to push car prices even higher. The Trump administration’s recent pause on some trade duties does not include the automotive sector, where tariffs on imported vehicles remain in place.

“Any further price increases—whether from tariffs, panic buying, or other pressures—are likely to trigger a significant drop in demand,” noted Ray Shefska, CarEdge Co-Founder and used car sales veteran with 43 years of experience. “Automakers should think twice before pushing through further price hikes without offering offsetting incentives.”

The average new car transaction price is $47,962, according to Cox Automotive. A 5% increase in new car prices would send average transaction prices above $50,000 for the first time. Our data suggests that if that were to happen, 65% of would-be new car buyers would be out of the market.

Used Car Prices Are Not Immune

While the average used car is more affordable than a new one, used car prices are not insulated from the effects of rising new car prices. If tariffs or production constraints push new car prices even higher, many buyers will inevitably turn to the used car market—increasing demand and potentially driving up prices for pre-owned vehicles.

As of April 2025, the average used vehicle listing price stands at $25,180, well below the 2022 peak of over $28,000—but still high by historical standards.

“As demand shifts into the used market, we will see a second wave of price inflation,” Zach Shefska warned. “That could squeeze budget-conscious buyers even further and delay car ownership for many. We have already seen material price increases at dealer wholesale auctions, and we anticipate price increases to show up on the showroom floor quickly.”

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.Contact for Media Inquiries:

[email protected] | www.CarEdge.com

0 Comments