CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you own a Ford or Lincoln truck or SUV from the last few years, there’s a decent chance you’re caught up in one of the largest vehicle recalls in recent memory. In February 2026, Ford filed paperwork with the National Highway Traffic Safety Administration (NHTSA) covering 4,380,609 vehicles over a software flaw that can kill your trailer’s brakes and lights while you’re towing.

Here’s what the recall is about, which Ford models are impacted, and how the latest Ford recall is a sign of a much larger problem for the automaker.

The defect lives inside the Integrated Trailer Module (ITRM), a software-driven component that manages communication between your truck and whatever you’re towing. When the vehicle wakes up from sleep mode — essentially every time you start it — there’s a chance the ITRM loses its connection to the rest of the truck’s computer system.

Ford and NHTSA describe it as a “race condition” bug, meaning the software is sensitive to the timing and sequence of events during startup. Most of the time it works fine. But when it doesn’t, the consequences can be serious: your trailer’s stop lamps go out, its turn signals stop working, and on trucks equipped with the high-series ITRM, the trailer’s electric brakes can fail entirely.

Think about what that means in practice. You’re on the highway pulling a 10,000-pound boat or a loaded work trailer. The driver behind you has no warning you’re slowing down. You apply the brakes, but only your truck is stopping — the trailer isn’t. That’s a crash waiting to happen.

Ford says it’s aware of 405 warranty claims potentially connected to the defect, along with two formal complaints filed directly with the NHTSA. The company has not identified any crashes or injuries tied to the issue.

Your dashboard will usually tip you off before things get dangerous. If you see a “Trailer Brake Module Fault” message pop up on your instrument cluster — possibly accompanied by a fast-flashing turn signal indicator or a “Blind Spot Assist System fault” warning — that’s the ITRM telling you it lost communication. Stop towing if you see either of these messages and get the software update as soon as possible.

The recall (NHTSA ID: 26V104000; Ford’s internal number: 26C10) covers the following vehicles:

The F-150 and Super Duty alone account for more than 3.4 million of the 4.38 million affected vehicles. These are America’s most popular trucks, which is part of why this recall is so significant.

Ford estimates that only about 1% of the affected vehicles actually have the defect — roughly 44,000 trucks and SUVs. But with numbers this large, even 1% is a lot of vehicles on the road.

The good news is that this is a software problem, and software problems tend to have clean fixes. Ford plans to push an updated ITRM software patch that eliminates the race condition bug entirely. Better still, most owners won’t need to make a dealer appointment.

Here’s the timeline:

Starting March 17, 2026: Ford will begin mailing recall notices to affected owners. On that same date, you’ll be able to search your VIN on the NHTSA website (nhtsa.gov/recalls) or Ford’s recall page to confirm whether your vehicle is included.

March 17–23, 2026: Owners can also take their vehicle to any Ford or Lincoln dealer at no charge to have the software update applied. No appointment necessary — walk-ins are welcome for recall repairs.

May 2026: Ford plans to begin rolling out the fix as an over-the-air (OTA) update for vehicles that support it. If your truck can receive OTA updates, you may not have to do anything at all beyond accepting the update when it arrives.

Either way — dealer visit or OTA — the repair is completely free.

If you don’t want to wait for a letter in the mail, you can check today. Go to nhtsa.gov/recalls and enter your 17-digit VIN to see if your vehicle is impacted by any open recalls. Your VIN is printed on a sticker inside the driver’s door jamb, on your registration, or on the lower left corner of your windshield.

Ford’s own recall lookup is available at ford.com/support/recalls.

Note that Ford expects all affected VINs to be searchable in the NHTSA system starting March 17. If you check today and your VIN doesn’t surface any results for this specific recall, give it until mid-March before concluding you’re in the clear.

It would be easy to treat this as an isolated incident, but it’s hard to ignore the context. In 2025, Ford issued 153 recalls covering more than 12.9 million vehicles — the most recalls any automaker has issued in a single calendar year, by a wide margin. The previous record was 77, set by General Motors in 2014. Second place in 2025 wasn’t even close: Chrysler finished with 53.

2026 hasn’t started much better. Before this trailer module recall even dropped, Ford had already issued eight recalls in the first 50 days of the year. That’s enough to put Ford ahead of every other automaker before February is out.

What makes all of this particularly hard to square is that Ford handed out company-wide bonuses just weeks ago — tied specifically to quality improvements. According to Reuters, CEO Jim Farley told employees in a February town hall that bonuses would be set at 130%, citing meaningful gains in “initial quality,” a metric that measures how often owners bring vehicles in for repairs within the first 90 days of ownership. Farley reportedly described current initial quality as the best it’s been in a decade.

Ford and Farley aren’t wrong that initial quality and recall counts measure different things. A recall can be triggered by a defect that only appears years into ownership, or — as Ford has argued — by a more aggressive internal strategy to find and fix issues before regulators force the issue.

Ford also paid a $165 million NHTSA fine in 2024 for being too slow to recall vehicles with defective rearview cameras, which likely explains some of the heightened urgency to act quickly now.

But from where a car buyer sits, the optics are tough. A record-breaking recall year followed by bonuses for quality, followed by one of the largest single recalls in recent memory — all before March — is a lot to process. Both things can be true simultaneously: initial quality may genuinely be improving while older software and hardware issues continue to surface in the field. The question for buyers is which metric they weight more heavily when deciding whether to pull the trigger on a new F-150 or pick up a used Super Duty.

If you regularly tow with your truck, the most practical step is to pay attention to those dashboard warnings. A “Trailer Brake Module Fault” message is your signal to stop towing and get the update applied. If your truck is sitting in the driveway and not connected to a trailer, the defect poses no safety risk — the problem only becomes dangerous when you’re actually towing something.

If you’re shopping for a used F-150, Maverick, Super Duty, Ranger, Expedition, or Navigator right now, don’t let this recall alone steer you away from an otherwise solid truck. An open recall is a known, fixable problem. What you want to confirm is that the recall has already been repaired before you purchase. Ask the dealer to confirm recall status before you sign, or check the VIN yourself.

Have a Ford or Lincoln truck caught in this recall? Check your VIN at nhtsa.gov/recalls, and reach out to CarEdge if you have questions about how open recalls affect your negotiating position.

The car-buying game has fundamentally changed. According to a Cox Automotive study from January 2026, 66% of buyers now cross-shop new AND used vehicles. That’s up from 57% one year ago. Even more striking: 29% of new car buyers are actively comparing leasing versus buying before they sign anything. Both numbers are all-time highs, and they represent a massive shift in how consumers approach the market.

Dealers? They absolutely hate it. And for good reason: when you cross-shop, you hold all the leverage.

A few years ago, the playbook was simple. You walked into a dealership knowing whether you wanted new or used, and salespeople could steer you toward whatever had the best margin. But three major forces have flipped the script:

1. Inventory normalization: New car supply has recovered from pandemic lows, while used prices have cooled from their 2021-2022 peaks. The gap between new and used isn’t as predictable anymore.

2. Rate volatility: Interest rates have swung wildly. A lightly used car with a 6% rate might cost more per month than a new model with manufacturer financing at 2.9%.

3. Information access: Tools like CarEdge, ChatGPT, and even TikTok have made it trivial to compare a 2024 CPO model against a brand-new 2026 with incentives—all before you ever talk to a salesperson.

The result? Buyers are making smarter, more flexible decisions. And dealers are losing control of the narrative.

Let’s break down what this means in practice. If you walk into a Honda dealership looking at a new Accord, there’s a two-in-three chance you’ve also priced out:

This isn’t indecision, it’s responsible car shopping. Buyers are treating the car market like any other major purchase: they’re comparison shopping.

Why does this frustrate dealers? Because it kills the anchor. Salespeople rely on anchoring your expectations to a single category. If you’re “a new car buyer,” they can upsell trim levels and warranties. If you’re “a used car buyer,” they can push certification fees and extended coverage. But when you’re both, they can’t box you in.

This one’s even more telling. Nearly three in ten buyers who do choose new are also running lease vs. finance calculations. That’s a massive behavioral shift.

Why? Because the math has gotten weird. In 2026, you might find:

Smart buyers are asking: “Do I even want to own this, or should I just lock in a low payment and reassess in three years?” Dealers hate this because leases require transparent residual calculations, and they can’t bury profit in interest rate markup as easily.

Cross-shopping breaks the dealership playbook. Ray’s seen this firsthand over decades in dealerships. Here’s the traditional sales process:

1. Qualify the buyer: Are they trading in? What’s their budget? New or used?

2. Isolate the vehicle: Get them emotionally attached to one car.

3. Control the numbers: Structure the deal so monthly payment feels reasonable, even if the total cost is inflated.

Cross-shopping destroys step two. When a buyer says, “I’m also looking at a CPO model across town and a new one with 0% financing,” the salesperson can’t anchor you to their inventory. You’re signaling that you’ll walk if the math doesn’t work.

Dealers make money in a few key places:

When you cross-shop new and used, you’re implicitly comparing all three. A CPO car might have a lower sticker but a higher rate. A new car might have incentives that make financing cheaper. Suddenly, the dealer can’t hide profit in one bucket because you’re scrutinizing the whole package.

Ray’s advice? This is your power move. Don’t let them silo the conversation. If they’re pushing a used car, ask about new incentives. If they’re pushing new, ask about CPO inventory. Force them to compete against themselves.

Don’t walk in with your mind made up. Even if you think you want a new 2026 RAV4, spend 20 minutes researching:

Use tools like CarEdge Pro to pull real market data. When shopping new cars, always have the invoice price. You want to walk into the dealership knowing the range of good deals, not just one target.

Here’s a real example from a CarEdge member in early 2026:

The new car was $2/month more expensive. Guess which one the dealer wanted to sell? The used one—because they owned it outright and had more margin.

The buyer? She went with the new car. Better warranty, lower rate, and she leveraged the CPO quote to get an extra $500 off.

Even if you plan to own the car long-term, get a lease quote. Why?

Leasing has quickly become a popular option as rising MSRPs have put buying out of reach for many. For drivers who want something fresh and different every two or three years, leasing lets you avoid repeated depreciation hits.

Here’s the script:

“I’m comparing this 2026 Accord at $32,000 to a 2024 CPO at $28,500 and a leftover 2025 at another dealer for $30,000. I like your car, but I need you at $31,000 to make the numbers work.”

You’re not being rude—you’re being transparent. And transparency terrifies dealers because it means you’ve done your homework.

Ray’s tip: Don’t bluff. If you say you have another offer, you better actually have it. Dealers can smell BS, and it kills your credibility.

Buyers Have the Upper Hand

The 66% cross-shopping stat isn’t just a data point—it’s a power shift. For the first time in years, buyers are forcing dealers to compete on value, not just availability. Inventory is up, prices are negotiable again, and information asymmetry is shrinking.

But this won’t last forever. If demand spikes or rates drop sharply, dealers will regain leverage. The time to cross-shop is now.

Dealers Are Adapting (And You Should Too)

Smart dealers are already adjusting. They’re pricing CPO cars more competitively, offering transparent online quotes, and training salespeople to handle cross-shoppers without the hard sell. The dinosaurs who refuse to adapt? They’re losing deals left and right.

As a buyer, your job is to reward the good dealers and walk away from the bad ones. If a salesperson dismisses your cross-shopping research or pressures you to “decide today,” that’s a red flag. There are plenty of dealers who will work with you.

The fact that two-thirds of car buyers now cross-shop new and used isn’t a trend—it’s the new normal. And the 29% who compare leasing vs. buying? That’s a sign that buyers are getting smarter, not just more cautious.

Dealers hate it because it makes their jobs harder. But for you, it’s the best leverage you’ve had in years.

Here’s your action plan:

1. Cross-shop ruthlessly: New, used, CPO, leftover models—get quotes on all of it.

2. Compare leasing and buying: Even if you think you’ll buy, the lease quote reveals hidden value.

3. Negotiate with data: Walk in with real numbers from real competitors. No bluffing.

4. Don’t rush: The market is soft right now. Dealers need your business more than you need their car.

The power is in your hands. Use it. Learn how CarEdge can get you the best deal.

It’s a new year, yet the car market is presenting drivers with the same classic dilemma: should you buy new or used in 2026? This year, several factors are reshaping the debate, including depreciation trends, interest rates, and price shifts in both new and used car markets. Making the right choice requires a close look at your financial situation and ownership goals. We spoke to CarEdge Co-Founder and auto industry veteran Ray Shefska about how car buyers can make smart, financially-sound decisions in 2026’s market.

Here are some key considerations to help you determine whether buying new, buying used, or leasing makes the most sense for you.

New cars are known for their steep depreciation, and in 2026, depreciation rates have returned to pre-pandemic levels. That means a new car can lose 20-30% of its value within the first two to three years of ownership. If you’re buying an EV or PHEV, depreciation can be even higher.

However, buying new has its advantages, too. Manufacturer incentives are sweetening the deal for buyers with attractive lease offers, low APR financing, and cash incentives that simply aren’t available for used car buyers.

Here’s a look at the pros and cons of buying a new car in 2026.

Why Buy New in 2026?

Drawbacks of Buying New:

If you’re considering a new car but worry about depreciation, leasing may be a better option for you in 2026. It allows you to enjoy the benefits of driving new without the financial impact of resale value losses. Otherwise, buying used is the better option for many drivers. More on that below.

Interest rates are a defining factor in the new versus used car debate. While borrowing costs remain high in 2026, automakers are making it easier to finance new cars by offering low APR financing. Used car loans, on the other hand, often come with higher interest rates from banks and credit unions. It’s important to keep in mind that low-APR financing is reserved for what the industry calls ‘well-qualified buyers‘.

Why New Cars Win on Interest Rates:

In 2026, the average used car loan rate is about 12% APR, while new car loan rates average 7% APR. Used car loans typically come with interest rates about 5% higher than those for new vehicles. Over a five-year loan term, this can significantly increase the total cost of financing a used car. If monthly payments are a concern, financing a new car with low APR may actually make more financial sense.

👉 However, NEVER negotiate monthly payments – always negotiate the Out-the-Door Price to avoid add-ons and ripoffs.

See Every 0% APR Offer This Month

The days of guessing what to pay for a new car are over. In 2026, buyers have access to tools that provide insight into dealer pricing, invoice costs, and manufacturer incentives.

How to Save Big When Buying New:

These tools make it easier than ever to negotiate confidently and secure the best deal on a new car in 2025.

After years of record-breaking price hikes, used car prices are finally starting to decline. However, they remain elevated compared to historical norms, and deals can still be hard to come by without the right negotiating tools.

Why Consider Buying Used in 2026?

Challenges of Buying Used:

Despite these challenges, buying used is still the go-to option for many drivers who prioritize affordability and don’t mind sacrificing the latest features.

For many car buyers, a 3-5 year-old used car strikes the perfect balance between affordability, reliability, and long-term value. This “sweet spot” in the used car market offers significant benefits that make it a smart choice for budget-conscious drivers who don’t want to sacrifice quality or performance.

Here’s why a 3-5 year-old used car could be the ideal option for you:

New cars typically lose 30-40% of their value within the first three years, making depreciation one of the biggest hidden costs of buying new.

Compared to buying new, 3-5 year-old used cars are significantly more affordable. The average used car price in 2026 is $26,000, nearly 50% lower than today’s average new car price of $50,000.

A car that’s 3-5 years old still comes equipped with many of the features found in today’s new models, such as advanced safety systems and driver assistance.

A 3-5 year-old car is typically well within its prime and often covered by a portion of the manufacturer’s original powertrain warranty. If coverage is about to run out, get an Extended Warranty quote for peace of mind.

While interest rates for used car loans are higher than those for new cars, lenders generally offer better rates for late-model used cars compared to older vehicles. This makes financing a 3-5 year-old car more manageable and less risky.

By choosing a 3-5 year-old used car, you get the best of both worlds: modern features at a lower price, and the ability to avoid the financial pitfalls of buying new. It’s a smart compromise for 2026 car buyers looking for value and reliability. To ensure you’re making a wise investment, always research market trends, request vehicle history reports, and schedule a pre-purchase inspection before buying any used car.

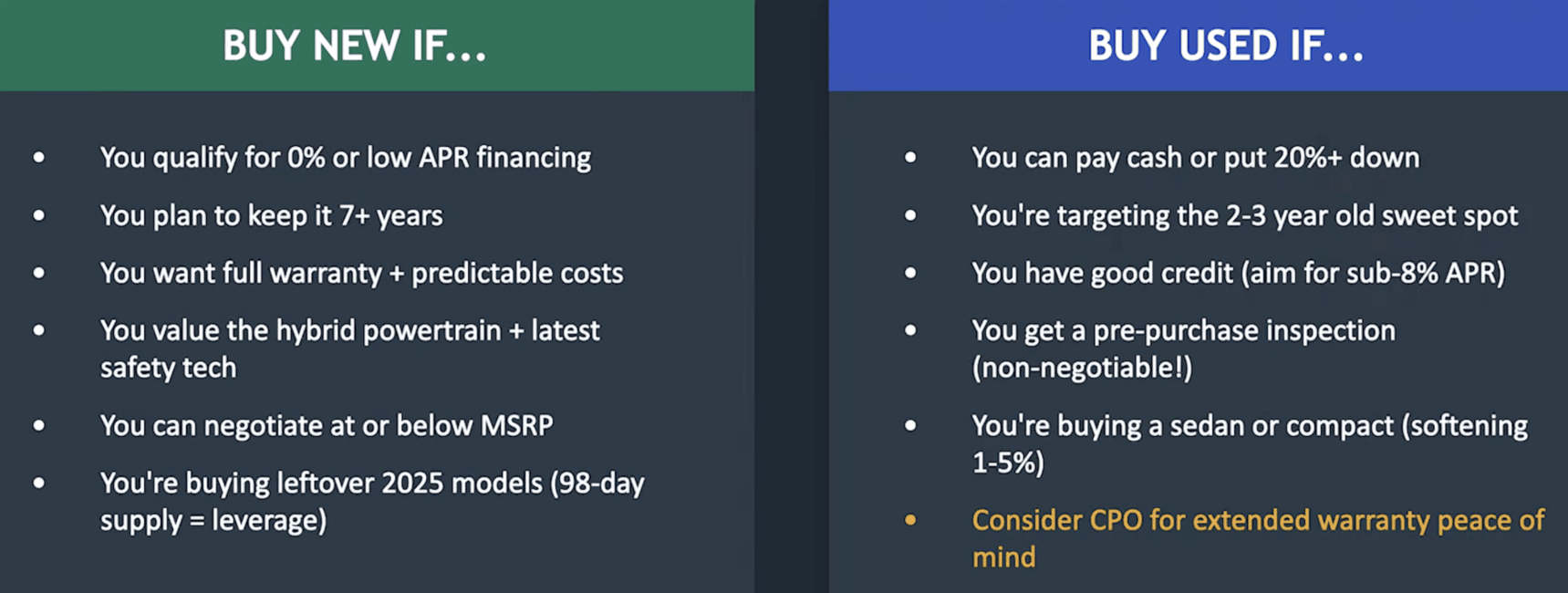

In 2026, the decision between buying new or used depends largely on your financial situation and long-term ownership goals.

When to Buy New:

When to Buy Used:

No matter which option you choose, doing your homework is key. Research market trends, compare deals, and always negotiate to get the best price possible.

Navigating today’s car market doesn’t have to be stressful. With tools like the Research Hub, Free Dealer Invoice Pricing, and CarEdge Pro, you’ll have all the information you need to negotiate like a pro. Whether you’re shopping for new or used cars, we’ve got the resources to help you save thousands.

Ready for an expert to negotiate on your behalf? CarEdge Concierge is your perfect fit!

Start your car buying journey with confidence at CarEdge, where transparency meets savings.

The car buying game has fundamentally changed. In 2026, the smartest shoppers walk into dealerships with the same information dealers once kept behind closed doors—and it’s completely free. This shift in power dynamics is forcing a new kind of negotiation, one where informed buyers set the terms instead of reacting to sales tactics.

Let’s break down exactly how educated car shoppers are winning deals in 2026, using real negotiation strategies that work.

The first question most dealerships ask is: “What’s your monthly payment goal?” It sounds helpful, but it’s actually a negotiation tactic designed to shift your focus away from the vehicle’s actual price.

When you anchor a negotiation around monthly payments, dealers gain enormous flexibility to adjust loan terms, interest rates, and hidden fees while keeping your payment within your stated range. You might hit your $500/month target, but you could be paying thousands more over the life of the loan than necessary.

Smart buyers in 2026 shut this down immediately. Instead of discussing payments, they focus on one number:

This approach forces transparency and keeps the negotiation focused on value rather than affordability theater.

Here’s what changed everything: pricing intelligence that was once dealer-exclusive is now available to anyone with an internet connection. Tools like CarEdge provide:

In our example negotiation, the buyer came prepared with specific numbers: MSRP of $63,435, invoice of $59,311, and the knowledge that the F-150 had been on the lot for 84 days. This intel completely reframes the conversation.

When a vehicle has been sitting for nearly three months, the dealer is carrying floor plan costs and wants to move it. An informed buyer can leverage this without being aggressive—simply acknowledging the reality shifts negotiating power.

The key is having this data before you contact the dealer. Once you’re in the negotiation, having specific numbers on hand signals that you’re serious and informed.

Modern car buying starts with research, not test drives. Here’s the smart sequence:

Step 1: Do Your Homework

Step 2: Make Initial Contact

Step 3: Frame the Negotiation

Step 4: Negotiate with Data

Salespeople are trained to steer you toward payment discussions. Here’s how to redirect:

Dealer: “What monthly payment are you looking for?”

You: “I’m not focused on the monthly payment right now. I want to make sure we agree on a fair selling price first. Once we settle on the out-the-door number, we can structure financing however makes sense.”

This response is firm but not adversarial. It signals experience without creating tension.

Every day a vehicle sits on a dealer lot costs money. Most dealerships pay floor plan interest to finance their inventory—typically $20-50 per day per vehicle depending on its value.

An F-150 that’s been sitting for 84 days has cost the dealer roughly $1,680-$4,200 in carrying costs alone. That’s before accounting for lost opportunity (that lot space could hold faster-moving inventory) and depreciation risk.

This context doesn’t mean you strong-arm the dealer, but it does mean they’re motivated to move aged inventory. A reasonable offer on a vehicle with high days-on-lot is likely to get serious consideration, especially if you’re a qualified buyer ready to close quickly.

When negotiating a car deal, it’s helpful to know exactly how much profit for the dealership is built into each sale. No matter what the salesperson tells you, you do have plenty of room to negotiate savings! Here’s a quick breakdown of the pricing hierarchy:

Your goal is to negotiate a selling price between invoice and MSRP, closer to invoice especially on aged inventory, then verify the out-the-door price includes only legitimate fees.

In the example negotiation, the buyer:

This approach immediately shifts the dynamic. The salesperson recognizes they’re dealing with someone who’s done research, which tends to accelerate the negotiation process and reduce back-and-forth games.

Buying a car in 2026 isn’t about being the toughest negotiator or playing games—it’s about being informed. When you walk in with invoice pricing, inventory age, and market data, you’re negotiating from a position of knowledge rather than reacting to sales tactics.

The dealers who adapt to this new reality focus on service, transparency, and efficiency. The ones who don’t quickly find themselves losing deals to competitors who respect informed buyers.

Your goal isn’t to squeeze every last dollar out of a dealer. It’s to pay a fair price based on actual market conditions and vehicle cost structure. With the right information and approach, that’s exactly what you’ll accomplish.

The power shift in car buying is real, and it’s permanent. Smart shoppers in 2026 are leveraging it to save thousands while making the process faster and less stressful for everyone involved.

The 2026 Hyundai Venue has officially claimed the title of the cheapest new car you can buy in America, with a base MSRP of $20,550. With the Nissan Versa and Mitsubishi Mirage both gone from the U.S. market, the Venue stands alone at the bottom of the price ladder.

That’s a remarkable feat in a market where the average new car now costs close to $50,000. But here’s the thing: cheap isn’t the same as good value. And when you dig into the numbers, the Venue’s low sticker price starts to look less like a deal and more like a trap.

Spend roughly $4,000 more, and you can drive home in a 2026 Toyota Corolla Hatchback — a car that beats the Venue in nearly every category. Here’s why that extra investment is worth it.

Yes, the 2026 Hyundai Venue starts at $20,550. But that number doesn’t tell the whole story.

Once you add the mandatory destination fee, the base price is $22,150. Want heated front seats and wireless phone charging in your Venue? The SEL trim will run you $24,200.

The Toyota Corolla sedan starts at $24,120 with destination fees included. For an apples-to-apples comparison, we’ll be comparing the 2026 Toyota Corolla Hatchback to the Venue. The popular Corolla Hatchback SE starts at $26,560.

So the real-world price difference between base models is about $4,410. Over a five-year loan, that’s roughly $75 to $90 more per month depending on your interest rate. For most buyers, that’s a manageable gap.

And as we’ll soon show, you get a lot in return.

Here’s the part that tends to surprise people: the cheaper car actually costs more to own in the long run.

CarEdge’s 5-year total cost of ownership tells the story clearly:

That’s nearly $1,900 in savings with the Corolla over five years, despite its higher sticker price. The primary drivers? Depreciation and maintenance.

The Hyundai Venue is projected to lose 36% of its value over five years. The Corolla Hatchback? Just 23%. That 13-point difference means the Corolla holds significantly more resale value — money that stays in your pocket when it’s time to sell or trade in.

All things considered, CarEdge rates the two cars accordingly: the Corolla Hatchback earns an A+ value rating, while the Hyundai Venue gets a B. Neither is bad, but the Corolla Hatchback is the clear winner.

Reliability is one of the biggest factors in total cost of ownership, and it’s one of the clearest wins for the Corolla.

Consumer Reports rates the 2026 Corolla Hatchback 73 out of 100 for reliability. The Venue scores just 55 out of 100. That 18-point gap is significant — it reflects a meaningful difference in how often you’re likely to deal with unexpected repairs and maintenance headaches over time.

The overall Consumer Reports scores tell a similar story:

On safety, the gap is even sharper. NHTSA awarded the 2026 Corolla Hatchback a perfect 5 out of 5 stars. The Venue earned 4 out of 5 stars. For buyers who prioritize keeping themselves and their passengers safe, that difference matters.

The Venue is powered by a 121-hp four-cylinder engine. It’s adequate for city driving, but Car and Driver testing showed it takes 8.5 seconds to reach 60 mph, and reviewers consistently note a near-complete lack of passing power on the highway. The CVT doesn’t help matters.

The Corolla Hatchback packs a 2.0-liter four-cylinder making 169 horsepower — a full 48 more than the Venue. It reaches 60 mph in 8.3 seconds, edging out the Venue despite moving a larger, better-equipped car.

Fuel economy is another win for the Corolla. The EPA rates it at 32 mpg city and 41 mpg highway, compared to the Venue’s 29 mpg city and 33 mpg highway. The Corolla’s 8 mpg highway advantage can add up to real savings at the pump, especially for drivers who commute longer distances

This is one area where the Hyundai Venue has a genuine edge. Hyundai’s warranty coverage is among the best in the industry:

Hyundai Venue:

Toyota Corolla Hatchback:

Hyundai’s 10-year/100,000-mile powertrain warranty is legitimately impressive and provides real peace of mind. If warranty coverage is your top priority, the Venue deserves credit here.

That said, it’s worth asking why Hyundai offers such an extensive warranty. In part, it’s because the Venue’s reliability scores aren’t as strong as Toyota’s. The Corolla Hatchback scores 18 points higher on Consumer Reports’ reliability scale. Toyota rarely shows up in recall notices, but we can’t say the same for Hyundai.

The 2026 Hyundai Venue isn’t a bad option for drivers with tight budgets who need new-car warranty coverage above all else. We’re not here to dismiss it.

But if you can stretch your budget by roughly $4,400 at the base level, the 2026 Toyota Corolla Hatchback is the smarter buy in almost every dimension: lower 5-year cost of ownership, better resale value, superior reliability, a perfect NHTSA safety rating, more horsepower, and much better fuel economy.

The cheapest price tag at the dealership isn’t always the cheapest car to own. Sometimes, spending a little more upfront is exactly how you save money in the long run.