Auto insurance rates are climbing once again in 2025, and the latest data suggests that relief is nowhere in sight. According to the February 2025 Consumer Price Index, the motor vehicle insurance index rose 2.0% in January, pushing the 12-month increase to nearly 12%. Car insurance costs have been rising steadily for the past three years, and new factors – including tariff’s impacts on car prices and auto parts – threaten to send rates even higher. Here’s what’s driving up auto insurance costs in 2025, and what it means for drivers.

Insurance Rates Continue to Rise

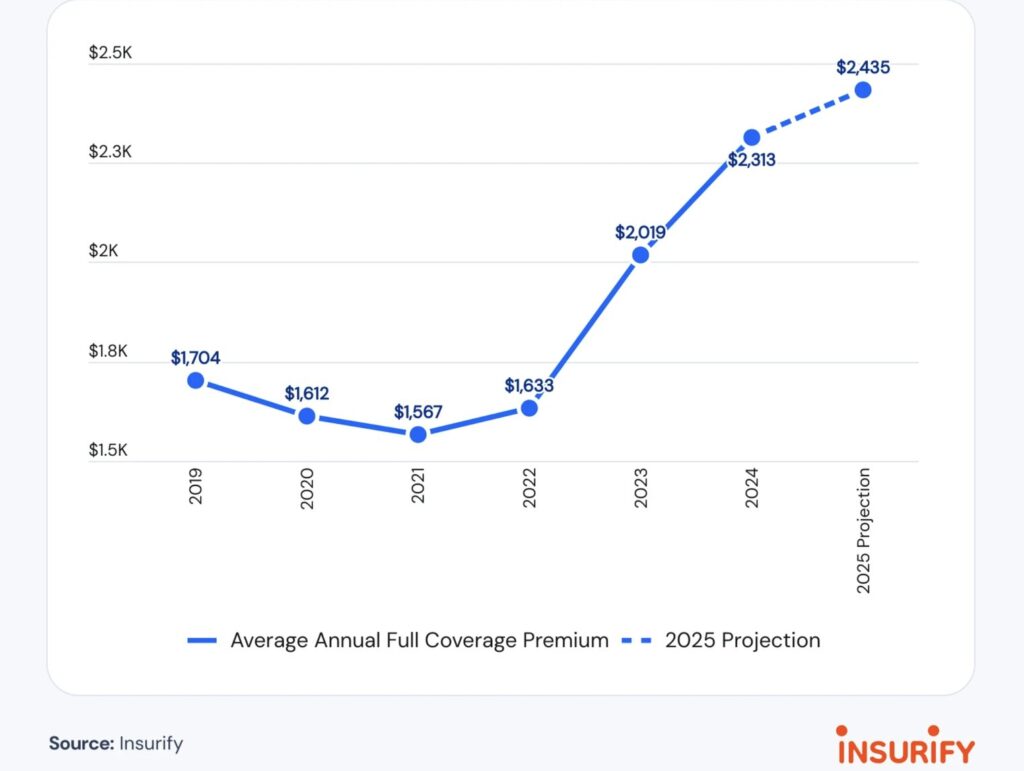

Auto insurance rates have been on a steady upward trajectory since 2022, and new projections suggest that costs will increase another 5% in 2025. According to Insurify, auto insurance rates soared 15% in 2024, while EV insurance costs for nine popular models jumped 28% over the same period.

Today, the average cost of full-coverage auto insurance is $2,313 per year, but for many drivers, it’s far worse. In six states, annual premiums exceed $3,000, making car ownership even more expensive. Many drivers fail to plan for insurance costs prior to purchasing a vehicle, making insurance expenses one of the hidden costs of vehicle ownership, alongside depreciation.

Why Are Auto Insurance Rates Rising in 2025?

Several factors are driving the increase in car insurance costs, including:

- Rising Vehicle Repair Costs: As cars become more technologically advanced, repairs are more expensive. This is especially true for EVs, which tend to have higher repair costs than gas-powered vehicles. Even ICE vehicles have costly electronic components these days, making it more difficult to avoid the risks of costly repairs.

- Climate Risk Adjustments: Insurance companies are increasingly factoring climate risks into their rates. More frequent hurricanes, wildfires, and severe weather events are leading to higher claims payouts, which results in rising premiums for all drivers.

- Previous Insurance Industry Losses: In 2022, insurers faced a record $33.1 billion in underwriting losses, prompting a 24% increase in full-coverage policy costs in 2023. While the market is stabilizing, insurers are still adjusting their pricing models.

Some states are seeing a bit of relief. In the second half of 2024, average premiums decreased in 21 states. However, Insurify projects that drivers in Florida, New York, Georgia, Nevada, and Delaware will see the biggest rate hikes in 2025, with full-coverage rates expected to rise another 10% in these high-cost states. Nationwide, the average auto insurance premium is forecast to reach $2,435 in 2025.

How Tariffs Will Push Car Insurance Even Higher

New tariffs on cars, auto parts, and manufacturing materials are poised to make vehicle ownership even more expensive in 2025.

According to a Wall Street Journal report, auto insurance rates are particularly sensitive to tariff’s impacts because higher car prices lead to higher repair costs – which in turn drives up insurance premiums.

While tariffs on Canadian and Mexican imports have been delayed, the Trump administration has announced new tariffs on steel, aluminum, and imported semiconductors – all of which will increase manufacturing costs for automakers. Additionally, auto repair costs will rise as imported components become more expensive. As both car prices and repair costs rise, auto insurance rates will follow suit.

Even before these tariffs take effect, vehicle repair costs are already rising. The February 2025 CPI report showed that vehicle repair costs increased by 7.4% year-over-year, reflecting higher parts costs and labor shortages. With 40% of imported car parts coming from Mexico and Canada, many automotive repairs will become more expensive in 2025.

Car Prices Are Set to Climb to New Records

Tariffs are also expected to drive new car prices to record highs in 2025. As of February, the average new car sells for $49,740, or just a hair below 2022’s record high. Later this year, average new car prices are likely to surpass $50,000 for the first time.

One prominent industry analyst predicts that if the Trump administration’s proposed 25% tariffs on Mexico and Canada go into effect, the cost of a new car could rise by nearly $6,000. A Benchmark analysis estimates that these tariffs would push the average new car price above $54,500, a 12% increase compared to 2024.

The auto industry is among the most vulnerable to these tariff increases due to its heavy reliance on global supply chains. Benchmark found that:

- More than 22% of finished cars and 40% of auto parts imported into the U.S. come from Mexico and Canada.

- Tariffs on these imports will increase production costs, forcing automakers to raise prices.

- Consumers will ultimately bear the brunt of these added costs—not just in vehicle prices, but in higher insurance rates, registration fees, and financing costs.

What Drivers Can Expect in 2025

Between rising repair costs, climbing insurance rates, and looming auto tariffs, the cost of car ownership is headed even higher in 2025. Auto insurance rates are up 12% over the past year, and experts predict another 5% increase this year, with drivers in high-cost states facing the biggest hikes.

At the same time, tariffs on vehicles and auto parts could add thousands of dollars to the cost of new cars, leading to even steeper increases in insurance premiums. The combined impact of these factors means that car buyers and owners need to be more strategic than ever when shopping for a new vehicle or renewing their insurance policy.

💡 How can you save?

- Compare insurance quotes before purchasing a vehicle. Rates vary widely based on car model and state.

- Consider cars with lower repair costs and strong safety ratings to help keep insurance premiums down.

- Stay informed about the total cost of ownership before you buy.

At CarEdge, we provide free tools and expert insights to help you navigate rising car costs in 2025. From comparing insurance rates to finding the best car deals, we’re here to help you make smarter car-buying decisions.

👉 Lock in a Low Rate BEFORE Insurance Premiums Rise – Compare Offers in Minutes

0 Comments