What’s the motivating force that keeps you showing up to work day after day, year after year? Is it your desire to own a home, the need to provide for your family, or simply to cover the bills? In 2022, more Americans are seeing their hard-earned money go straight to their monthly car payment. The latest numbers tell a worrisome tale of the economic reality that seems to be worsening.

The average transaction price reached a May record of $45,502, according to number crunchers at J.D. Power. Add in the cost of financing, taxes and fees, and the average TOTAL cost of buying a car is ten grand higher at $55,821, according to Cox Automotive and Moody’s Analytics. Considering that the U.S. median household income is $70,284, inflation is at 40-year highs and gas prices mean $100 fill-ups, how much worse can it get?

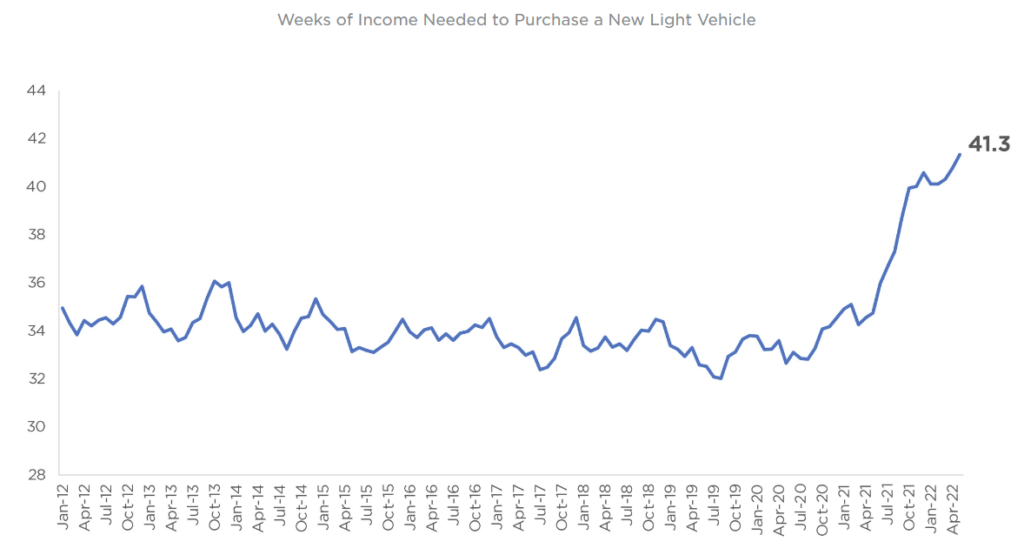

It now takes 41 weeks of the average American’s household income to purchase a new vehicle

It can get worse, but will it? Rising interest rates mean that an auto loan will cost more over time. The average amount financed on a new car purchase is now $39,721. We’re all friends here, so let’s call it $40,000. The data show that most car buyers opt for a 72 month loan (even I did for my recent electric vehicle purchase), so let’s do the math to see how rising interest rates cost buyers.

In May, the average auto loan interest rate reached 4.07%. The Federal Reserve is openly stating that they plan additional interest rate increases as they flex their muscle in last-ditch efforts to put a damper on inflation. In all likelihood, the average auto loan rate will reach 5% at some point in the next year. Over a 72-month loan term for the average $45,502 transaction, the difference between 4% and 5% auto loan rates totals $1,400 more in interest paid over the life of the loan. At a 5% interest rate, today’s average auto loan will cost $6,813 in interest over 72 months.

Demand Remains Strong Despite Outrageous Prices and Rising Rates

Why are automakers and car dealers keeping prices inflated despite the economic downturn deepening? Simply put, it’s because consumers continue to pay the higher prices. From the perspective of the American consumer, lack of widespread public transportation and our deeply ingrained ‘car culture’ means that for many, a car is a necessity, not a want. Americans are paying higher prices because in many cases they have to. Cars get us to work, to school and to the grocery store.

AutoNation CEO Mike Manley said in April that the nation’s largest dealer group had “not seen any reduction in the demand for new vehicles or really any perceivable segment-shifting as a result of current economic conditions.”

“We, frankly, have customers for basically everything that’s coming,” Manley told Automotive News.

Evidence for their bold claims? Kelley Blue Book says that the average vehicle sold went for $1,000 over MSRP. That’s not how it used to be.

Used Cars Are Cheaper, But At Record Highs Too

We’ve been tracking the volatility of the used car market. The pre-pandemic ups and downs gave way to prices in freefall at the height of the pandemic, followed by an unprecedented turnaround that culminated in skyrocketing used car prices as new car inventory was squeezed by the chip shortage.

What a wild ride it’s been. As of June 2022, overall used car prices have increased more than 30% year-over-year. In some vehicle segments, prices are 60% higher than they were in 2021.

See used car price trends here, updated weekly

The Case For Maintaining and Keeping Older Vehicles Gets Stronger

More often than not, it makes a lot of financial sense to repair an older vehicle than to shell out record amounts of cash (and financing) for a new car. Only those who drive A LOT (over 15,000 miles per year) might see the benefits of buying a newer, more fuel efficient vehicle. We recently did the math, and the break-even point when purchasing an EV over a combustion-powered competitor can take from four years to sometimes nearly a decade, depending on out-the-door cost, incentives and annual miles driven.

Maintenance isn’t cheap, but with the average monthly car payment over $600/month, more drivers are cornered into picking the lesser of two evils.

Great Video, yes they need to make a new car for the income levels!

I would like to know how the profit is split up.

Afraid when the market price falls there will be many repos for sale IMO