Here’s a powerful and sobering statistic: In 2023, 30% of used cars have a price tag of under $20,000. Five years ago, 60% of used cars were below that price point. Where have all of the affordable used cars gone, and will they ever return to the market? We’ll take a look at the latest analysis from Edmunds, as well as the latest used car market data from CarEdge. Used car deals can still be had, if you know where to look, and how to negotiate.

Unprecedented Trends in the Used Car Market

The impact of the infamous chip shortage of 2021 and 2022 continues to be felt in the used car market. An astonishing 18 million new cars were never produced during this period, essentially erased from production schedules and not replaced. This production gap has created a ripple effect that will continue to influence the used car market for years to come, and this shift is just one of the significant changes the industry is undergoing.

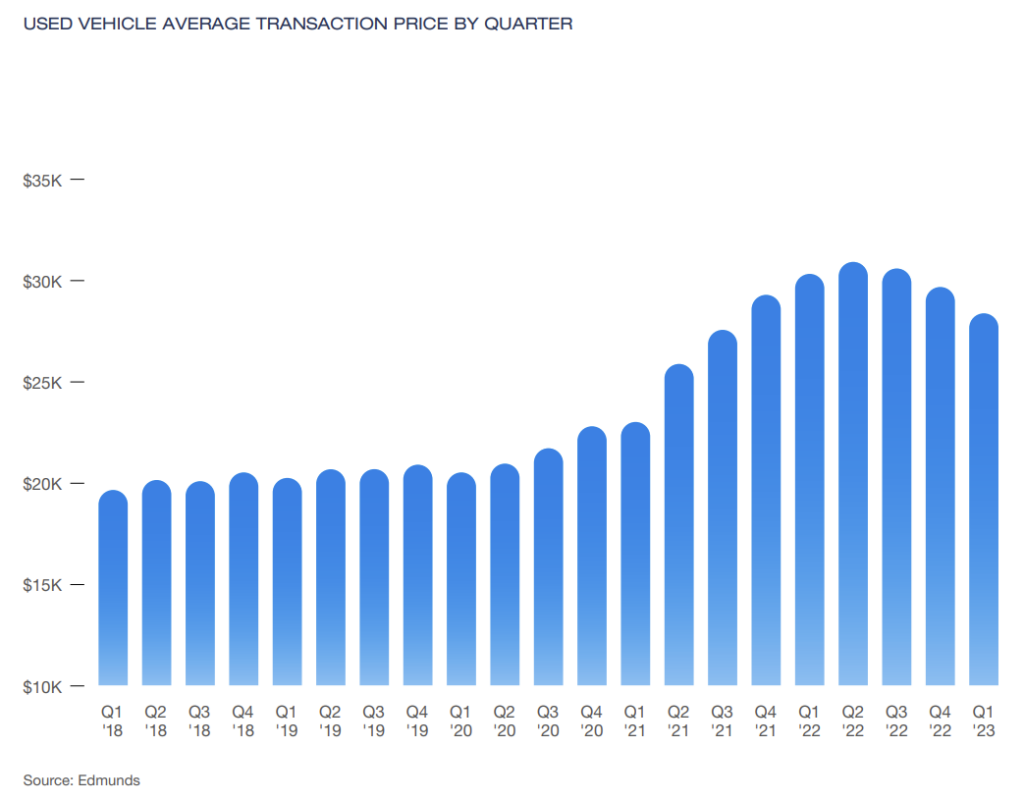

The latest data from Edmunds suggests that we might be facing a new normal rather than a temporary aberration. In terms of pricing, the average used car transaction price fell by 6.4% in the first quarter of 2023 compared to the same period last year. Sounds great, right? Not so fast. Used car prices are still a staggering 44% higher than the average back in 2018. To put it in perspective, the average selling price for a used car in America in Q1 2023 was $28,381, a far cry from the $19,657 average seen five years ago.

Cheap Cars Are Vanishing

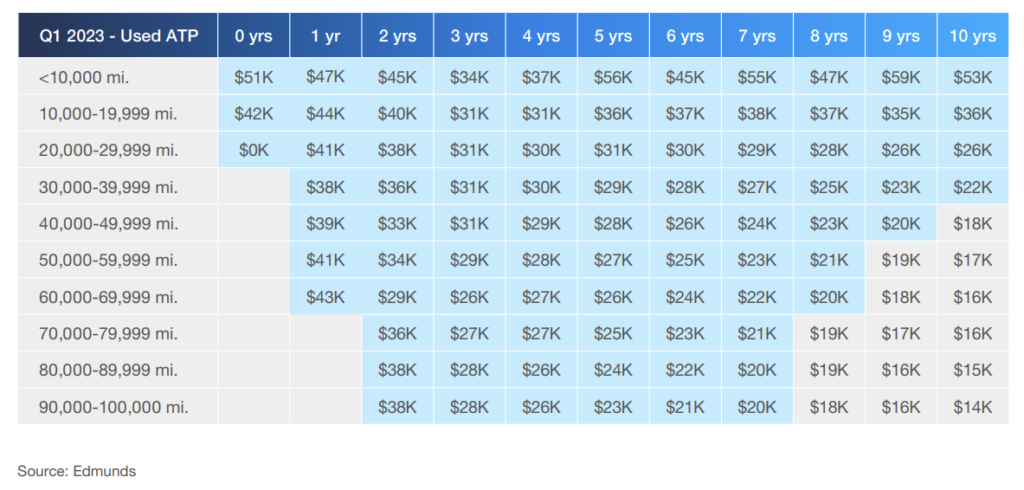

Used cars with a price tag of under $20,000 are hard to come by. The Edmunds data suggests that consumers have to look towards used cars that are at least 8 years old and have over 70,000 miles on the clock before they can find sub-$20,000 prices.

If you’re hoping for a used car that costs $15,000 or less, you’ll likely be considering vehicles that are a decade old or more. On top of that, there’s a huge mismatch in demand versus supply of cheap used cars. People want affordable transportation, but the new car market simply doesn’t offer it. The result is more competition for cheap used cars.

Older vehicles are seeing a surge in popularity despite their age. The reason is simple: they’re the only affordable cars around. Nearly half of all used cars sold today are older models priced under $25,000. In the new car market, a mere 5% of cars are sold for less than that price.

It’s more important than ever for consumers to understand car market trends and adjust their expectations (and budget) when setting out to purchase a used vehicle.

New Data Shows a Tough Market For Affordable Car Buyers

Our team recently launched a new 100% free tool, CarEdge Data Explorer. For the first time ever, local market data is available for every used car model, all in one spot. Using CarEdge Data Explorer, we analyzed used car listings in the five biggest used car markets in the nation: California, Texas, Florida, New York and Pennsylvania. By comparing market days’ supply, an important car market negotiability factor, our team of Car Coaches identified a troubling trend among the most popular age class, used cars that are three years old.

Measure Market Health with Days’ Supply

Why should you care about the days’ supply of used cars? Days supply in the car market is calculated by dividing the current unsold inventory of a specific car model by its average daily sale rate, which indicates how many days it would take to sell all the existing inventory at the current sales pace. For example, if there’s a 200 day supply of the 2019 Toyota Camry, that means it would take over six months to sell the existing inventory at current buying rates.

On the other hand, if you’re looking at a car with a 10, 20 or 30 day supply, all existing inventory is likely to be sold within the month. In other words, it’s in high demand. For reference, a typical days’ supply is about 60 days.

Here’s a subset of what we found in Data Explorer:

| Make | Model | Model Year | Days' Supply | Average Price |

|---|---|---|---|---|

| Toyota | Camry | 2020 | 49 | $26,043 |

| Toyota | Corolla | 2020 | 49 | $21,948 |

| Tesla | Model 3 | 2020 | 42 | $37,156 |

| Honda | Accord | 2020 | 53 | $27,103 |

| Nissan | Altima | 2020 | 65 | $22,436 |

| Toyota | RAV4 | 2020 | 56 | $31,471 |

| Honda | CR-V | 2020 | 64 | $29,453 |

| Tesla | Model Y | 2020 | 91 | $46,295 |

| Jeep | Grand Cherokee | 2020 | 86 | $34,133 |

| Toyota | Highlander | 2020 | 48 | $38,263 |

| Ford | F-150 | 2020 | 74 | $42,096 |

| Chevrolet | Silverado | 2020 | 70 | $41,349 |

| Ram | 1500 | 2020 | 83 | $42,181 |

| GMC | Sierra | 2020 | 74 | $46,486 |

| Toyota | Tacoma | 2020 | 68 | $36,680 |

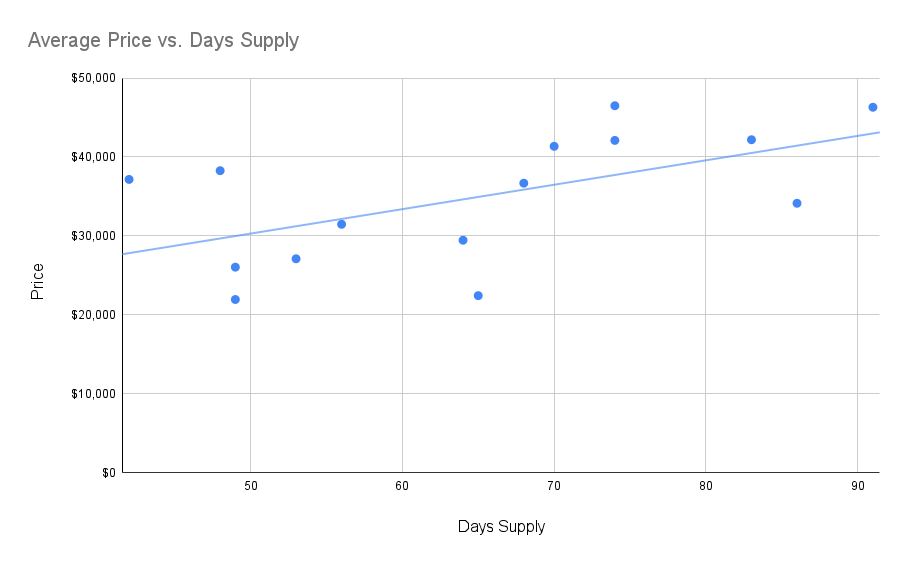

The shortage of affordable used cars on the market is a severe issue that is negatively impacting consumers. High-demand vehicles in the lower price range have far less inventory available, making it increasingly difficult to find a reasonably priced used car, let alone negotiate for a better deal. This situation is the consequence of several economic and industry factors we’ve highlighted, with no quick fix in sight.

In contrast, the market for larger SUVs, and full-size trucks is relatively robust, but these come with a hefty price tag. Although this disparity in the market may provide a wider choice for those who can afford these more expensive models, it leaves budget-conscious consumers with limited options.

Lower Prices = Lower Inventory

A graph of data from Data Explorer of the five top-selling cars, trucks and SUVs shows that lower prices mean less inventory:

Affordable models are harder to come by today. While this reality poses a challenge for buyers, it also emphasizes the need for prospective car owners to be savvy, strategic, and armed with the best information possible to navigate this changing landscape.

We’re on a mission to bring car buyers everywhere more resources and tools to level the playing field when negotiating car deals. Do your own research using the same tools our team uses with CarEdge Data Explorer. See used car inventory in your area, average prices, average mileage and more in all 50 states. Data Explorer is your jumping off point for understanding current market trends. In the face of a challenging market, knowledge and strategy are your best allies in the hunt for an affordable used car.

Dealers Send the Cheapest Cars Overseas

You know what’s infuriating? The fact that dealers are increasingly shipping their most affordable used cars overseas. Yes, everyone should have access to transportation that’s at an attainable price point. That includes countries in Africa, Central America, and other regions where American used cars are heading. But let’s remember that supply is not meeting the demand for cheap used cars right here at home.

The global market for used light-duty vehicles grew by almost 20% between 2015 and 2019, resulting in over 4.8 million units being exported from the United States to developing countries. Following a slowdown during the pandemic, exports are skyrocketing in 2023.

Interestingly, the growing popularity of electric vehicles is contributing to an affordability crisis in the used car market. Dealers in states such as New York and Florida, where consumers are increasingly purchasing EVs, are turning to international markets to sell their older gas-powered models. Check out this intriguing piece by CNN to learn more about the lucrative international trade of used cars.

Here’s What It Will Take to Bring Back Used Car Deals

1. More Lease Returns

Firstly, a significant increase in the number of returned lease vehicles could lead to more affordable used cars. The volume of lease returns dropped from 6.2 million vehicles in 2018 to 5.5 million in 2022. Further, leasing has plummeted from 33% of the new car market in 2020 to only 17% today. This decline in leasing is starting to trickle down into the wider auto market, which affects the used car supply. For those nearing the end of their car lease, our guide spells out your options at the end of a lease.

2. More Trade-Ins

Secondly, encouraging more trade-ins could help make used cars more affordable. Drivers nowadays are holding on to their cars for longer and being more judicious when it’s time to sell, often opting to sell to private buyers instead of dealerships. Increasing the number of trade-ins could pump more used vehicles into the market, potentially helping to stabilize prices.

Always be sure to compare quotes from online car buyers here before trading in! You could get thousands more for your car.

3. Quicker Rental Fleet Turnover

Lastly, increasing turnover in rental car fleets could also contribute to a more balanced used car market. The average age of rental car fleets has risen from 1.9 years in 2019 to 3 years today. While older rental cars can provide a boost to used car inventory, exercise caution when considering these vehicles due to the potential for heavy use and lack of maintenance during their rental life. For a deeper dive into this topic, check out our guide to buying a rental vehicle.

Steering Through the Challenges, Guided by Data

In summary, the used car market is presenting unprecedented challenges for budget-minded buyers. Today’s market conditions are driven by a confluence of factors. These include a shortage of new vehicles due to a chip crisis, a decline in leased vehicles and trade-ins, and an older rental car fleet. These changes have led to a significant increase in the average price of used cars. Affordable options under $20,000 are increasingly rare and more challenging to negotiate.

Before you kick off car shopping, be sure to explore used car deals and inventory in your area with our newest free tool, CarEdge Data Explorer. We’ve also just launched our ultimate deal analysis tool, CarEdge Report, included with every Data and Coach plan. This tool equips you with comprehensive, up-to-date market insights to give you the upper hand in finding and negotiating the best deals on used cars. At CarEdge, we believe in demystifying car buying, once and for all. Knowledge is power!

![Ford Models With the Best Resale Value [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Ford-Ranger-400x250.png)

0 Comments