Following a strong December fueled by luxury sales and holiday promotions, the new year kicked off with a sharp decline in vehicle transactions. According to new data from Cox Automotive, new car sales dropped 25% month-over-month in January, leading to a notable increase in inventory levels. With year-end buying season over and interest rates still high, new car inventory is up 26% since the start of January.

For car buyers, this means increasing negotiability for February’s Presidents’ Day deals. Let’s take a closer look at how new car inventory, pricing, and incentives are shaping up for 2025.

New Car Inventory Builds, But Some Brands Face Bigger Challenges

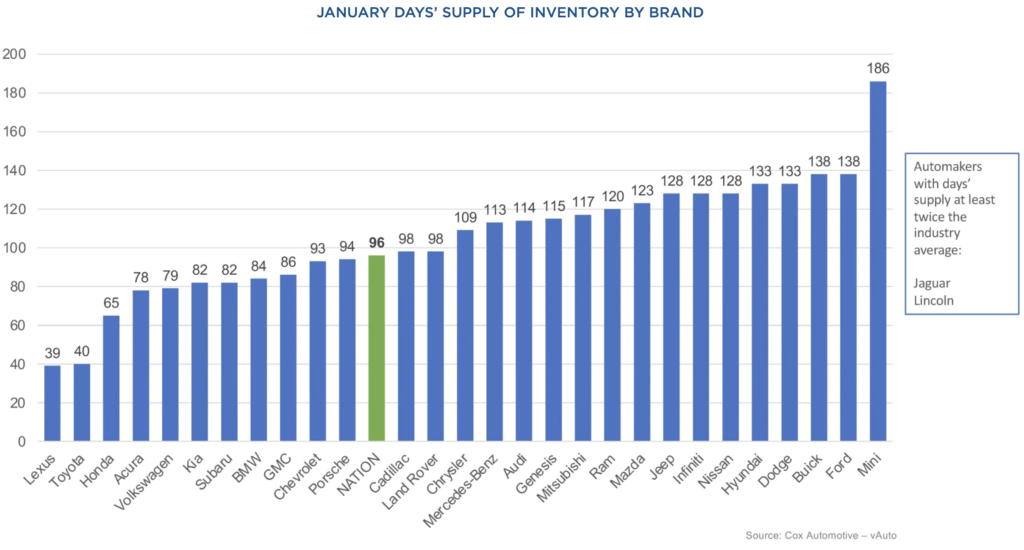

As sales cooled off in January, total new vehicle inventory rose to 2.92 million units at the start of February, marking a 14.2% increase year-over-year. However, the biggest change is the sharp rise in days’ supply, which surged to 96 days, far above the industry norm.

Ford and Chevrolet have the largest share of new car inventory, accounting for 17% and 11% of available stock, respectively. Meanwhile, Toyota, Honda, Kia, and Hyundai continue to dominate overall sales, with strong retail demand keeping their days’ supply lower than competitors.

Some brands are carrying particularly high levels of unsold inventory, creating opportunities for buyers to negotiate better deals. Stellantis—home to Jeep, Dodge, Ram, and Chrysler—has seen a dramatic shift in its supply situation. After struggling with excessive inventory last year, aggressive discounting has helped normalize Stellantis’ stock levels, though some models still linger well above industry averages:

- Dodge – 133 days’ supply

- Jeep – 128 days’ supply

- Ram – 120 days’ supply

- Chrysler – 109 days’ supply

However, Ford and Lincoln now top the charts for the highest inventory buildup, with many 2024 models still sitting unsold. Ford’s lineup is particularly weighted down by last year’s models, with 63% of their inventory still 2024 models.

SUVs and Trucks Still Dominate Sales

Despite the slowdown in overall sales, compact SUVs and full-size pickup trucks continue to be America’s best-selling vehicles.

The Toyota RAV4 remains the best-selling SUV, making it one of the least negotiable vehicles on the market. With an average listing price of $38,403, buyers can expect strong demand and limited discounts on this popular model.

On the other hand, full-size trucks have significantly more inventory, leading to higher negotiability. The Ford F-150, America’s best-selling truck, has a staggering 141 days’ supply—far above the industry average. Buyers looking for a full-size truck may find bigger discounts and more dealer incentives as brands work to move inventory.

New Car Prices Are Falling

With demand cooling off, new car prices took a step back in January.

The average listing price for a new vehicle dropped to $48,637, a 2.5% decrease from December. While this still represents a 2.5% increase year-over-year, the decline is a welcome relief for shoppers who faced record-high prices in 2023 and 2024.

For budget-conscious buyers, more affordable new cars are still available:

- 81 models are priced under $40,000

- 27 models are priced under $30,000

- Only one new car remains under $20,000: the Mitsubishi Mirage, priced at $19,526, with the Mirage G4 sedan variant at a similar price point.

Incentives Drop in January, But February Brings Big Sales

One of the biggest drivers of December’s strong sales was higher manufacturer incentives, but those deals dropped in January. In January 2025, new car incentives fell to 7.2% of the average transaction price, or approximately $3,486 per vehicle.

February’s rising inventory has automakers bringing back BIG incentives for Presidents’ Day, especially on leftover 2024 models.

See the best deals in your ZIP code (free tool)

What This Means for Car Buyers in 2025

January’s slowdown has set the stage for some of the best Presidents’ Day car deals in years. With inventory climbing, buyers shopping for EVs, full-size trucks and slower-selling SUVs will have more leverage to negotiate. While incentives dipped slightly in January, they remain well above 2024 levels, and Presidents’ Day sales events are expected to bring even deeper discounts as dealers work through excess inventory.

For the best deals, focus on models with high days’ supply, especially these slowest-selling cars and trucks.

Shop smart in 2025! Use CarEdge’s free tools to compare local inventory levels, dealer pricing, and market trends before heading to the dealership.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments