Who can afford a new car in 2022? The latest data from Cox Automotive’s Kelley Blue Book reveals that the wealthy are making up more and more of new vehicle purchases as prices soar out of reach for many. New car prices are at all-time record highs, but could this be the peak? Let’s dive into the details.

New Vehicle Transaction Prices Make a Run for $50,000

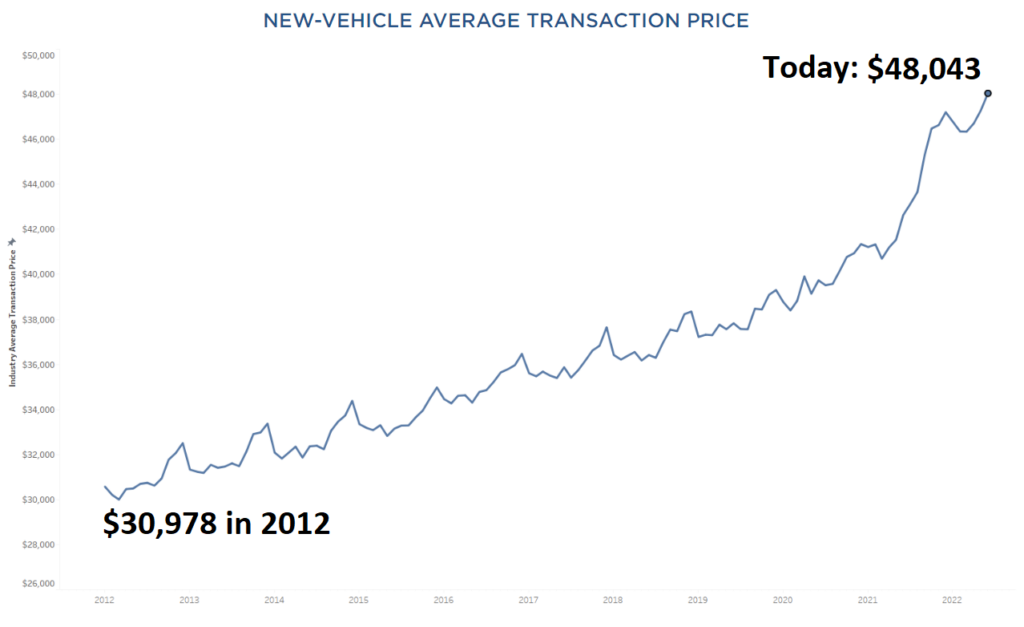

Last December, we reported a new record that everyone saw coming, but no one was thrilled about. Six months ago, the average new vehicle transaction price reached $47,202. In June of 2022, the average transaction price (ATP) soared to $48,043, according to Kelley Blue Book’s data. June prices rose 1.9% ($895) from May and were up 12.7% ($5,410) from June 2021.

A bit of perspective brings to Earth just how high new car prices are right now. Ten years ago, the average transaction price of a new car was just $31,000. The average price of a vehicle purchased in 2022 is 54% higher than it was in 2012. That’s INSANE.

Here’s how new car prices have risen over the last decade:

Luxury Vehicles Are MORE Popular Than Ever, Despite Record Prices

Here we are in the roaring twenties, and it appears that those with the means are going all-out with their vehicle purchases. Today’s data suggests that to many, it’s all about lavish luxury, no matter the price tag. The popularity of luxury autos happens to coincide with America’s total personal debt reaching an all-time high of $14.96 trillion. The average American debt (per U.S. adult) is $58,604, and three-quarters of American households have at least some type of debt.

Incentives Disappear When Buyers Need It Most

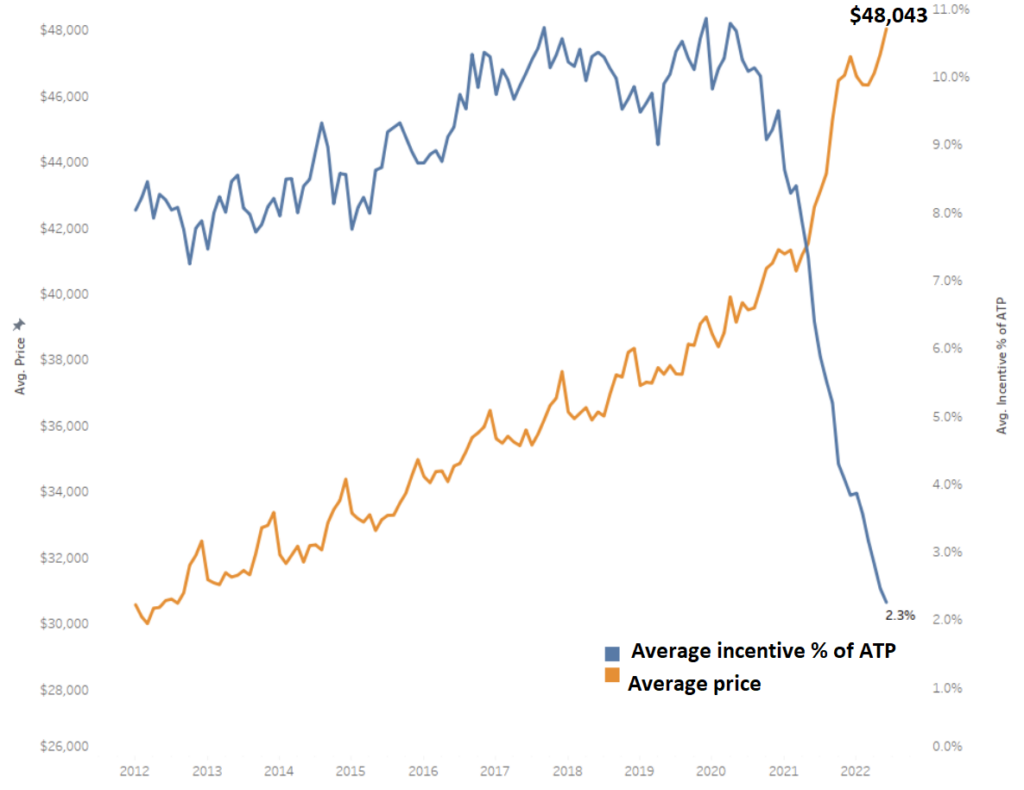

The image below shows the industry average transaction price versus the industry average incentive as $ of ATP. Clearly, manufacturer incentives are evaporating as new cars become more expensive.

Electric vehicles had the lowest incentives (as a percentage of ATP) of 0.4%, and entry-level luxury cars had the highest of 3.4%. Incentives dropped to a record low level in June, averaging only 2.3% of the average transaction price. See the latest new car incentive numbers here.

Hybrid and Electric Vehicle Prices Climb Higher

With an average transaction price of $39,040, hybrid cars saw the largest ATP increase of $3,593. Hybrids have been in the lowest supply lately of any segment. Electric vehicle prices climbed to new records in June, with an ATP of $66,997, an increase of $2,444 since May 2022.

Electric vehicle market share has crept up over the first six months of the year, despite overall vehicle sales sliding. Recently, Bloomberg noted that when other countries attained 5% market share, the floodgates opened to more rapid EV adoption. Will this familiar pattern play out in the United States? With EV transaction prices averaging over $66,000, it’s a bit of a stretch to think EV adoption could happen so quickly. We must not forget that the median household income is around $70,000, just a few thousand dollars more than EVs are selling for today. Electrification is not top of mind for most American households, but the worsening affordability crisis is for many.

Are Car Prices Going Down?

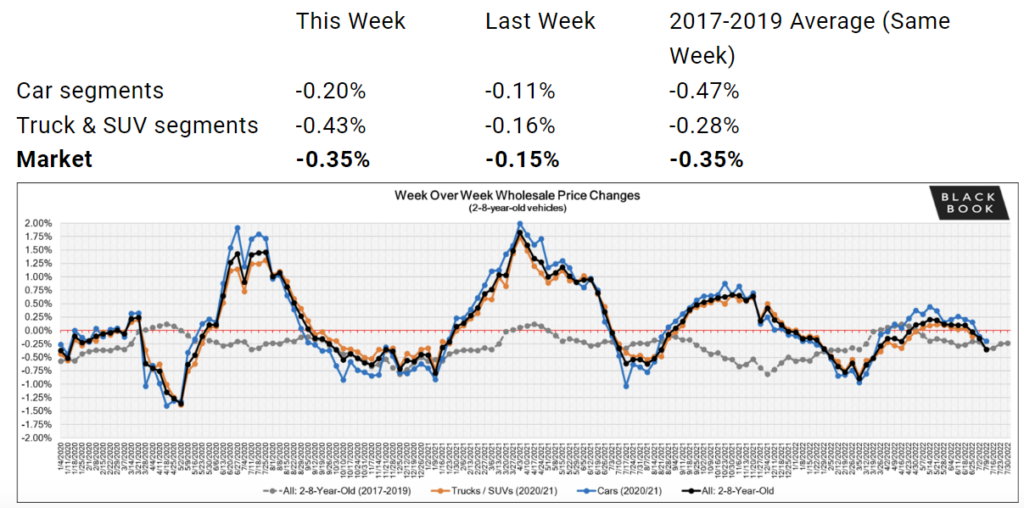

Is the car bubble about to pop? Here’s what the latest data shows. We keep close tabs on the latest automaker inventory numbers, and we’re finally starting to see inventory increase, albeit slowly. Wholesale used car prices are another leading indicator of where the car market is headed, and this week we saw a sharp downturn in prices in almost every vehicle class.

In mid-July, wholesale used car prices dropped 0.35% in just one week, the third week in a row of declines. Trucks and SUV prices declined by nearly half of one percent. While this alone may not sound significant, remember that this is week-over-week, not monthly or yearly data. See the full data on used car numbers, updated weekly.

In conclusion, car prices may drop if both of these trends continue. But they’ll have to continue much longer before we see a substantial decline in used and new car prices. If automakers are finally able to overcome supply chain constraints, new vehicle inventory will continue to rise, and dealer lots will have more vehicles. Until that happens, used car prices will remain high. Check back for the latest updates at caredge.kinsta.cloud/guides.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments