Toyota inventory levels have never been lower than they are right now. Go for a drive to your local Toyota dealer and you’ll see few new cars on the lot. We’ve noticed fewer Toyota listings on CarEdge Car Search. Production challenges have plagued Toyota for the entirety of 2022, and their dealer body currently has a 36 hour supply of on hand inventory. For perspective, in 2019 Toyota had a 60 day supply of inventory. To say Toyota’s production challenges are severe is an understatement.

After weathering the initial chip-shortage in 2021 better than their peers, the world’s largest automaker has officially fallen behind. Toyota is struggling to supply their dealer body with inventory, and as a result their sales are down 23% for the first quarter of their fiscal year (April-to-June), while average transaction prices have reached all-time highs; $37,336.

It’s easy to forget just how far the automotive industry has fallen from pre-pandemic normals. In July, automakers had a 38 days’ supply of on hand and in-transit new vehicles. That may not sound too bad compared to the recent past, but consider this: In 2019, automakers had 86 days’ supply.

Toyota Inventory Levels Tumble, Wait Times Drag On

| Inventory Units - December 2023 | Days Supply - December 2023 | |

|---|---|---|

| Toyota car | 54,100 | 27 |

| Toyota truck | 144,700 | 31 |

| Total Toyota | 198,800 | 30 |

This week, Toyota Motor North America executive vice president of sales, Jack Hollis spilled the beans on what Toyota expects the coming year to look like. In short, Toyota doesn’t see inventory ever returning to pre-pandemic levels. This is the new normal. Crystal ball aside, Hollis did provide key insights into what car buyers should expect going into 2023.

Jack Hollis, who happens to have an extensive working history with Ford’s Jim Farley, was sharing his candid outlook at an event hosted by the Automotive Press Association. For what could very well have been a bland interview full of scripted answers, the world learned surprising new details about just how bad the inventory shortage has become at times for Toyota.

Hollis said that Toyota’s demand continues to outpace automakers’ production capacity. We’ve heard that before. However, it’s the details that made headlines. Hollis said that Toyota dealerships recently sunk down to a 36-hour supply of new vehicles. This has led to extensive dealer markups, accessories, and add-ons. If a consumer wants to buy a new Toyota off a dealer’s lot, they are likely going to pay above MSRP.

To find Toyota dealers who aren’t charging above MSRP, head to the community forum or markups.org.

We know from our research that wait times to order a new Toyota extend upwards of a year for Toyota’s electrified lineup. For Toyota hybrids and plug-in hybrids, factory order wait times are commonly around one year. For the Toyota RAV4 Prime and Prius Prime, wait times are now 18 months to two years in the worst cases. Keep this in mind if you’re in the market for a Toyota plug-in hybrid.

Why has Toyota struggled so much while other automakers seem to be weathering the storm better? It appears as if Toyota’s domestic production in Japan is where the company has taken the biggest hit. Japan has faced its own struggles (COVID and an earthquake to name a few), however the entire Japanese automotive industry is closely tied to suppliers and factories in China.

Toyota is heavily reliant on Chinese parts suppliers, and the latest round of COVID shutdowns didn’t do them any favors. In August, a new round of Chinese factory shutdowns, this time weather-related, are disrupting Toyota’s Asian supply chains.

This week, Automotive News reports that Toyota’s biggest domestic competitor is looking for a way out of reliance on China’s supply chains. According to Japanese publication Sankei, Honda Motor Co. is looking for ways to decouple their supply chains from reliance on China. Last year, nearly 40 percent of Honda’s production capacity was in China.

With the latest heat wave causing the third major supply disruption in two years for Toyota, we would bet that Toyota is looking at its options moving ahead.

Inventory Will Never Return to “Normal”

During the first half of 2022, even the lauded analysts at AutoForecast Solutions seem to have underestimated just how severe and prolonged the chip shortage and subsequent car shortages are. Now, one of Toyota’s top executives is forecasting a similarly poor situation for 2023.

“We’re going to be dealing with this for one more year,” said Hollis. “I do not believe we’re going to see growing dealer stock for one more year.”

He also shared doubts that any automaker would return to pre-pandemic inventory levels. “They just won’t,” Hollis asserted. There was also a relevant point to be made regarding how car buyers’ behavior has changed. Hollis noted that customers now trust online car buying, and that’s going to impact lot inventory moving forward. Dealers don’t have to hold inventory to make sales these days.

Consumers are partly to blame for the continued high prices at dealerships. Hollis remarked that people don’t seem to mind going without the manufacturer incentives and holiday discounts of years past. “Some of the highest customer satisfaction scores in the entire industry are occurring right now, and everyone’s buying a vehicle at MSRP,” he said.

Toyota Slashes Incentives

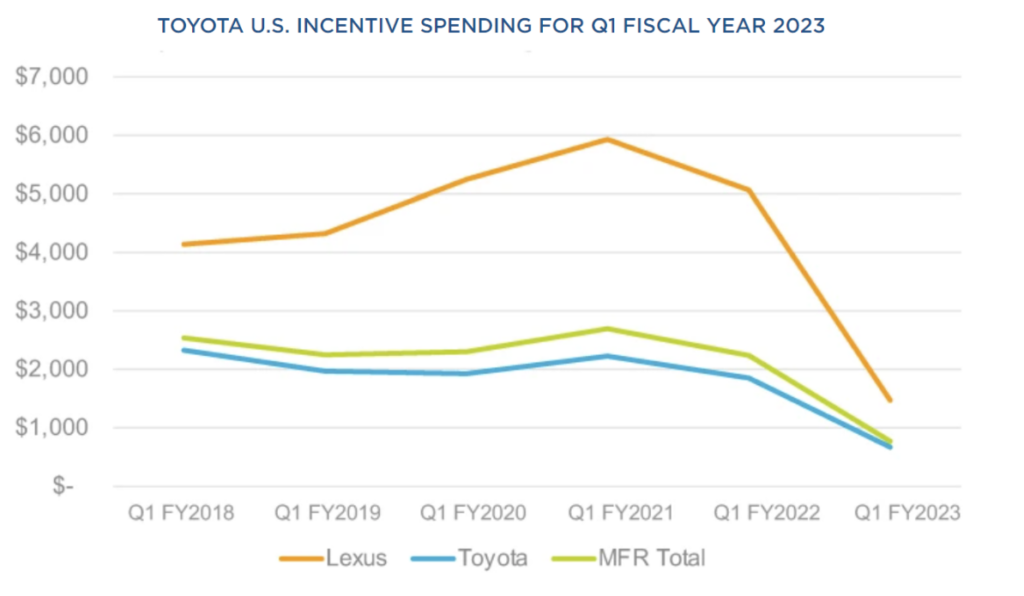

As a result of decreased supply, Toyota has drastically reduced incentives for consumers. For the first time since 2017, Toyota incentives are below $1,000. For the April-to-June quarter, Toyota’s average incentive per vehicle was $772, down 66% year-over-year.

Toyota brand incentives were even lower at just $672 per vehicle. Lexus incentives were down 71% to an average of $1,474 per vehicle. From 2019 to 2021, Lexus incentives averaged more than $5,000 per vehicle.

This means that buyers are more likely to pay MSRP or higher. As Hollis candidly pointed out, car buyers are not balking at the idea of paying higher prices. Toyota dealers are having no problem selling every vehicle they receive from the factory. Simply, there’s no reason to incentivize buying.

In the first quarter of the fiscal year, Toyota’s (Toyota + Lexus) average transaction price approached $40,000. Just two years ago, this figure was under $35,000.

Hollis Defends Toyota’s EV Strategy

At the Automotive Press Association’s event, Hollis also touched on the long-term outlook for Toyota’s delayed entry into fully-electric vehicles. Hollis reiterated Toyota’s belief in offering a wide range of electrified vehicles, not just BEVs, as the best way to reduce overall carbon emissions. He is unabashedly skeptical that American drivers will adopt EVs at anywhere near the pace that government goals have suggested.

Considering that the average electric vehicle transaction is $10,000 more than the overall industry average, I think Hollis is onto something. Throw in battery and raw material shortages, poor charging infrastructure and a simple lack of inventory, and Toyota’s roadmap starts to look a lot more wise.

0 Comments