Spring car buying season is here, and many shoppers are heading to dealerships with their tax refunds in hand, ready to make a down payment on a used car. According to a recent survey by Talker Research, Americans expect to receive an average refund of $1,700 this year. With the average price of a used car sitting at $25,128 in March 2025, a solid down payment can help offset high borrowing costs.

However, used car shoppers are facing an unpleasant reality: the highest used car loan rates in over 40 years. Rising interest rates are making monthly payments significantly more expensive in 2025, tightening budgets for many buyers. Before financing a used car this spring, it’s crucial to understand how today’s high APRs will impact your loan – and what steps you can take to minimize costs. Here’s what to expect and how to protect your wallet.

Used Car Loan Rates Haven’t Been This High Since the 1980s

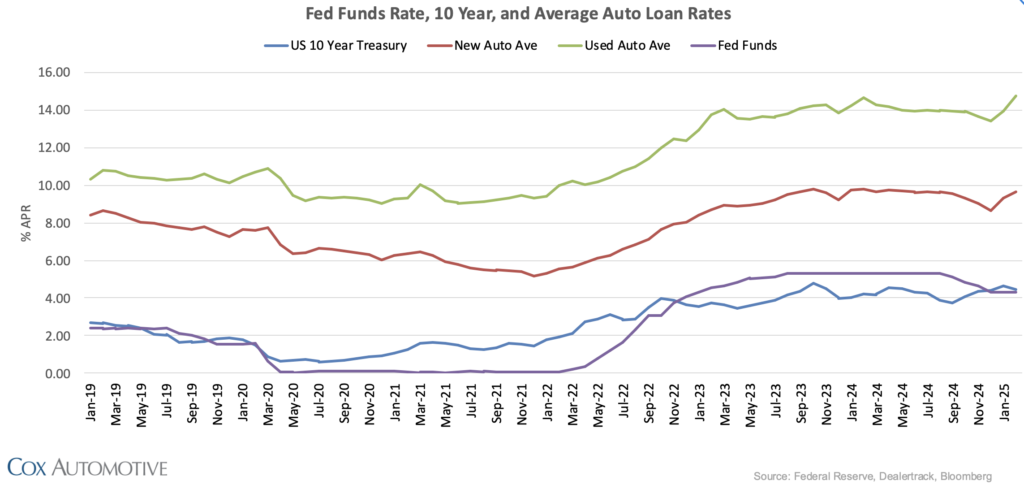

Over the past year, used car prices have fluctuated but have generally trended lower. While this is good news for buyers, the cost of financing remains a major hurdle. Used car loan rates have surged to levels not seen since the early 1980s.

After a brief dip in December, interest rates jumped sharply in January and February. According to Cox Automotive, the average used car loan rate in March 2025 is now 14.73% APR. For comparison, new car rates sit at 9.69% APR on average.

For buyers with lower credit scores, the situation is even worse. Many subprime borrowers are being offered rates close to 20% APR – adding thousands of dollars in interest over the life of a loan.

It’s hard to fathom just how much high interest rates can quickly add up, adding thousands of dollars to the total cost of owning a car. Consider the following real-world example: A $25,000 used car loan financed for 72 months at a 15% APR interest rate will accumulate $13,000 in total loan interest over 72 months. For buyers with bad credit, a 20% APR loan rate would push the interest paid above $18,000 for the same loan amount. Buying a car at all starts to lose its appeal with rates at these levels.

What’s Driving Used Car Loan Rates Higher?

Several factors are keeping borrowing costs elevated in 2025:

- Federal Reserve Policy: Although the Fed paused rate hikes, persistent inflation has delayed any meaningful rate cuts. This means auto loan rates remain high.

- Lender Risk: Banks and credit unions are tightening lending standards, particularly for borrowers with lower credit scores. As a result, lenders charge higher interest rates to offset perceived risk.

- Vehicle Depreciation Concerns: With used car values still above pre-pandemic levels, lenders are wary of financing older cars that could lose value faster than expected.

How to Qualify for the Best Used Car Loan Rates

While the overall rate environment isn’t favorable, car buyers can take steps to secure the best financing possible. Here’s how:

Check Your Credit Score Before Shopping: Your credit score plays a major role in determining your interest rate. Scores above 700 typically secure the best rates, while subprime borrowers (below 600) face the steepest costs. Your debt-to-income ratio is also a key consideration.

Get Pre-Approved by a Credit Union or Local Bank: Credit unions often offer lower rates than dealership financing. Getting pre-approved also gives you negotiating power when discussing financing options with dealers.

Make a Larger Down Payment: The more cash you put down, the less you have to borrow – reducing your interest charges over time. With tax refunds arriving, consider using that money to increase your down payment.

Choose a Shorter Loan Term: A 36- or 48-month loan will come with a lower interest rate than a 72- or 84-month loan. While monthly payments will be higher, you’ll save money on interest in the long run.

Avoid Add-Ons That Increase Loan Costs: Extended warranties, service contracts, and dealer add-ons can be financed into your loan, but this increases the total amount borrowed – and the interest you’ll pay.

👉 Before you commit to a used car with a high APR, drivers with good credit should check out the Best New Car Financing Incentives This Month. For well-qualified buyers, there are plenty of low-APR and even zero percent APR deals out there!

Take our free car buyer’s guide with you to save more and buy with confidence.

For Some Drivers, Repairs Make More Sense Than Financing

With used car loan rates at historic highs, some drivers may be better off repairing their current vehicle rather than financing a new one.

If your car is paid off or close to being paid off, investing in repairs can be far cheaper than taking on a high-interest loan. Consider getting a repair estimate before deciding whether to trade in or keep your car.

Always consider the total cost of ownership before buying any car. Use these free cost of ownership tools to see the numbers – you might be shocked at what you find!

👉 The Best Used Cars Under $10,000

Final Thoughts

Used car prices are coming down slowly, but financing costs remain a major challenge in 2025. With average used car loan rates nearing 15% APR for the first time in 40 years, shoppers need to be strategic about where they finance and how much they borrow.

If you’re planning to buy a used car this spring, use tools like CarEdge’s Free Car Buying Guide to compare financing options and find the most negotiable deals. Knowledge is your best tool to fight back against high borrowing costs. Don’t head to the dealership without a plan!

0 Comments