As you’re well aware, used cars aren’t supposed to appreciate, however in 2021, used car prices have increased by nearly 50% across the industry. That has led many of us consumers to utter a question we never thought we’d have to say, “When will used car prices drop?”

In “normal” times, used car prices are always dropping (they’re depreciating assets after all), however as the chip shortage and supply chain challenges have reared their ugly heads, we’ve seen some used cars appreciate to levels that were once incomprehensible. Many one to two year old used cars have sold for more than their original MSRP — it’s truly insane!

Get the most when you sell your car.

Compare and choose multiple offers in minutes:

In this article we present to you our best bet as to when used car prices will drop in 2022. And yes, we do think there will be some sort of price drop in 2022. This article is based on many data sources, such as this report from Boston Consulting Group on the chip shortage, a recent white paper from KPMG, and ongoing data analysis from the team at Black Book.

If you find this content valuable and helpful, please consider sharing it with a friend or family member. Let’s dive in.

Used car prices will go down in 2022

Let’s start here; our prediction is that used car prices will begin to drop in 2022. The natural next question is “when?” To answer that, let’s look at what the “experts” are saying:

- Cox Automotive thinks wholesale used car prices will peak between January and April of 2022

- KPMG says a “20 to 30 percent plunge in used-vehicle prices” could happen before October of 2022

- Data from Black Book shows a “softening trend” in wholesale prices as we reach the end of 2021, a potential indicator of prices declining in 2022

It’s important to understand that there are two prices for each used car that is sold in the United States; the wholesale price, and the retail price. Wholesale used car prices are the prices dealers have to pay for inventory, and retail used car prices are what us consumers pay at the dealership.

Wholesale used car prices

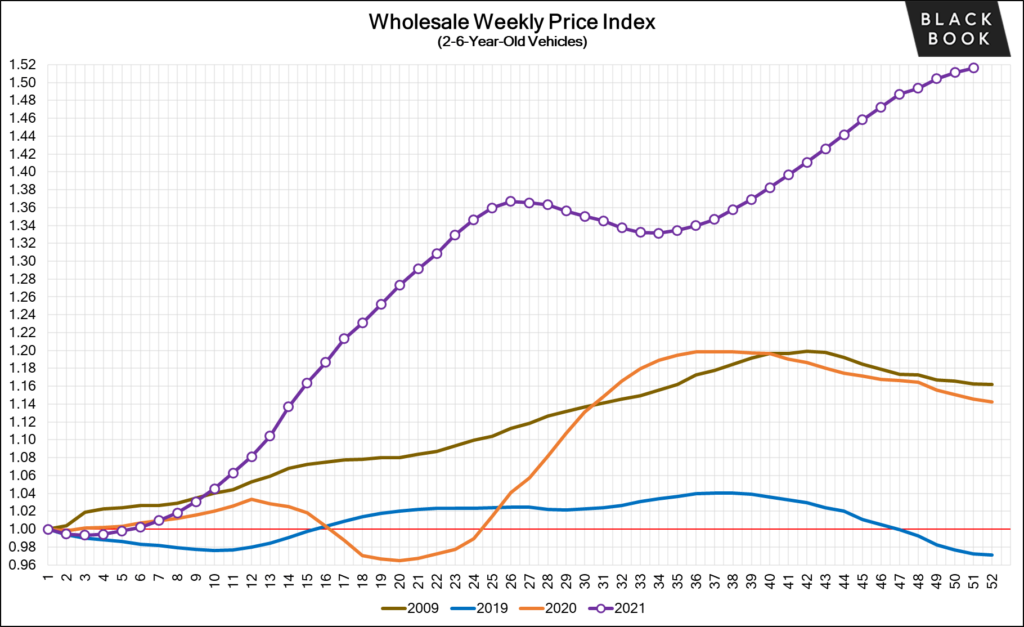

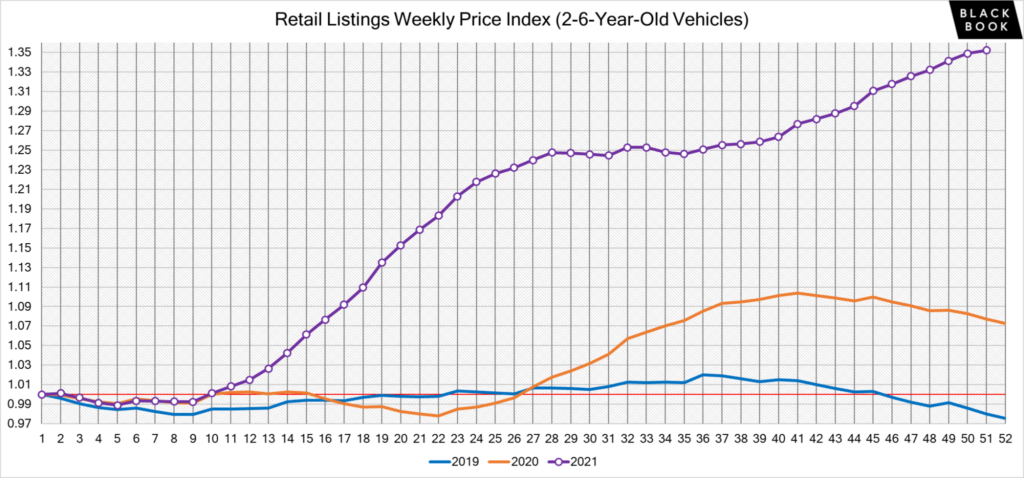

Black Book’s data shows us that wholesale used car prices have increased upwards of 50% in 2021, while retail prices have only increased by 35%. There is an inherent and obvious relationship between wholesale and retail prices, and retail prices typically trail the movement of the wholesale market.

Recently, we have begun to see softening on wholesale used car prices. From Black Book:

The softening trend continued this past week, with the overall market slowing the rate of increase, sales rates declining, and more segments reporting decreases in prices compared to the week prior.

It appears as if the wholesale used car market is plateauing. This is a good sign, however retail prices will likely continue to rise for months to come. This is in part because dealers who bought used cars at inflated wholesale prices will hold on to them until they can find a retail customer to purchase. In prior years, dealers would be more interested in “turning” their inventory so that they could mitigate interest costs on the vehicle, however since interest rates are very low right now that likely won’t be a driving factor.

Retail used car prices

While wholesale car prices soften, we expect retail used car prices to continue to increase through the first quarter of 2022, especially amidst tax season. We also expect wholesale prices to increase (although less rapidly) in the first quarter.

Consumer availability to credit is high. A recent survey from the Federal Reserve showed that some financial institutions loosened their lending standards. As a result we expect consumers to continue to have relatively easy availability to financing for their vehicles purchases. This will also keep retail used car prices high, since dealers will be able to find financing options for their customers that get them to a comfortable monthly payment.

During the “spring selling season” we will continue to see increases in used car prices. It is by the summer that we anticipate some signs of price declines in wholesale and retail used car prices. The KPMG white paper proposes that used car prices could drop significantly as early as October of 2022, and we agree with them. Prices may continue to stay inflated if new car production continues to be hampered in 2022, however signs are pointing to automakers getting through the worst of their production issues.

Fall of 2022 is when used car prices will drop

As we survey the landscape of the automotive industry, it seems clear that the fall of 2022 represents the most likely time for used car prices to drop in 2022. Traditionally the fall and winter months are when used car depreciate the most. This seasonality, paired with increases in new car production, and likely increases in interest rates, should ultimately drive some downward pressure on used car prices.

One factor that we cannot account for is the potential for government tax incentives on electric vehicles. While Congress has yet to pass a bill that contains EV tax credits for 2022, there is a lot of speculation that they will. proposed credits would significantly increase consumer demand in new and used vehicles, and if this were to happen, it may very well offset the downward pressures on used car prices.

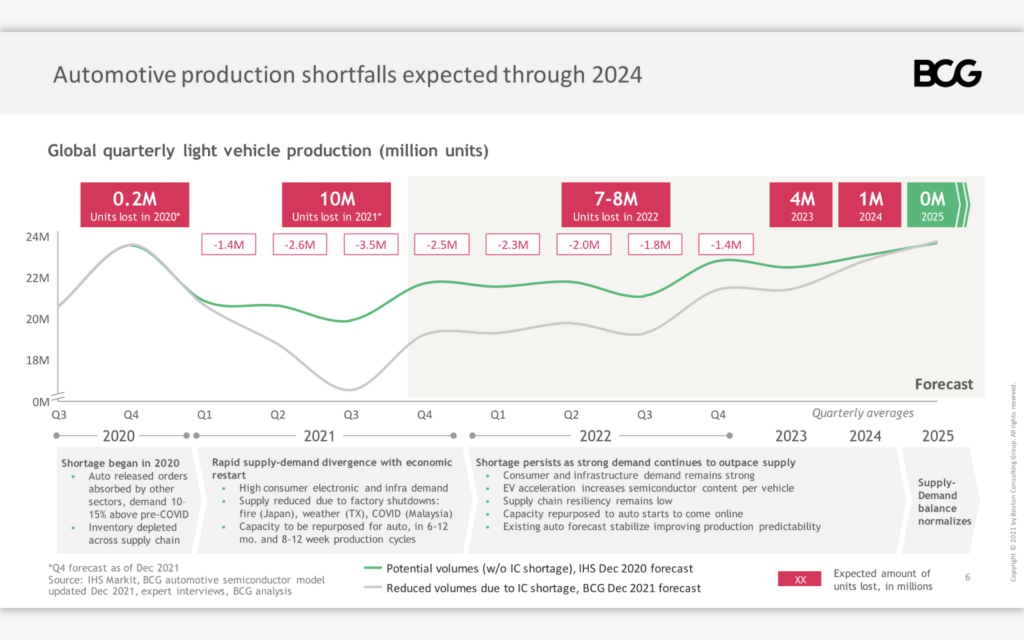

There are also a lot of questions surrounding new car production. While manufacturer’s such as Toyota have published press releases signaling they’re through the worst of their manufacturing woes, only time will tell if that’s actually true. Boston Consulting Group thinks it will be 2025 when new car production meets demand, so questions still remain about how much new car inventory will be available in 2022.

If manufacturers are unable to improve new car supply in 2022 we could see used car prices continue to increase. Our best guess is that automakers will be able to incrementally improve their new car supply throughout the year. We are already seeing signs of this in 2021 as AutoForecast Solutions has begun to revise their worst-case chip shortage estimations downward instead of upwards.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

This issue is on Kelley blue book used car guide not being revised. If a used car price now is higher now a trade-in value should be higher. Is it too much money to revise the software? Let me guess there is no backup? or Let me guess it’s too damaging for an interchange? Or at least put it in the news that Kelley blue book should address new trade-in values in their software. I went to a dealer and I said that trade in value is based upon prior pandemic prices. If a car is blue Don wholesale the same for an wholesale issue.