Q4 2025 survey shows trust in dealerships hitting new lows, with 74% of buyers reporting low confidence—up from 82% who reported distrust in October

American car buyers are facing deteriorating market conditions heading into 2026, according to the latest CarEdge Car Buying Index (CCBI). The Q4 2025 reading dropped to 82.5, nearly nine points below October’s reading of 91.2. This marks a sharp decline in consumer sentiment across affordability, trust, and market expectations.

The quarterly survey of 453 car shoppers reveals that 82% now say vehicles are less affordable than a year ago (up from 74% in October), while trust in dealerships continues to erode. Most striking: only 2% of consumers express high trust in car dealers to treat them fairly.

Affordability Crisis Worsens

The Affordability & Conditions sub-index fell to 73.4, with buyers reporting:

- 82% say vehicles are less affordable than a year ago (up 8 points from October)

- Only 13% feel affordability has stayed the same (down from 22% in October)

- 66% are dissatisfied with vehicle availability in their price range (up from 49%)

- Only 24% believe the next 12 months will be a good time to buy (down from 20%)

“The affordability problem isn’t just stagnant, it’s actively getting worse,” said Ray Shefska, Co-Founder of CarEdge and automotive industry veteran with over 40 years of experience.

“When the percentage of buyers who think conditions are stable gets cut in half in just three months, that tells you the market is deteriorating for everyday consumers.”

Trust Has Evaporated

The Trust & Transparency sub-index posted the steepest decline of any category, dropping 12.6 points to 73.9:

- 2% of car buyers report trust in dealerships

- Just 2% of car buyers report trust in automakers

- Only 2% have high trust in dealers to treat them fairly

71% feel confident avoiding unwanted fees, suggesting buyers trust their own research, not sellers.

“Just 2% of car buyers trusting dealerships and automakers is staggering because it shows the problem that the industry faces with the consumers they are supposed to serve,” Shefska added.

“Dealers and manufacturers keep talking about improving the customer experience, but the data shows consumers are becoming even more skeptical. That’s a fundamental breakdown in the relationship that drives this industry.”

Electric Vehicle Adoption Stalls

Despite billions in manufacturer investments and the end of federal EV tax credits in September 2025, consumer interest in electric vehicles remains flat:

- 71% say they won’t consider an EV or plug-in hybrid in the next 12 months (virtually unchanged from October’s 69%)

- Only 9% are very likely to consider an EV

- 20% say “possibly”, indicating weak intent

The data suggests that removing federal tax incentives has done nothing to change consumer behavior, and that underlying barriers to EV adoption, things like range anxiety, charging infrastructure concerns, and affordability, remain significant obstacles.

Buyer Intent Holds Steady Despite Pessimism

In contrast to declining sentiment across all other measures, the Buying Intent sub-index remained remarkably stable at 93.3 (down just 0.1 from October):

- 59% plan to purchase or lease within six months (unchanged from October)

- 47% prefer new vehicles (down slightly from 51%)

- 29% prefer used vehicles (stable)

- 24% are shopping both options (up from 20%)

This resilience reflects need-based demand: Americans require vehicles for daily transportation regardless of market conditions, forcing many buyers to purchase even when timing and affordability are unfavorable.

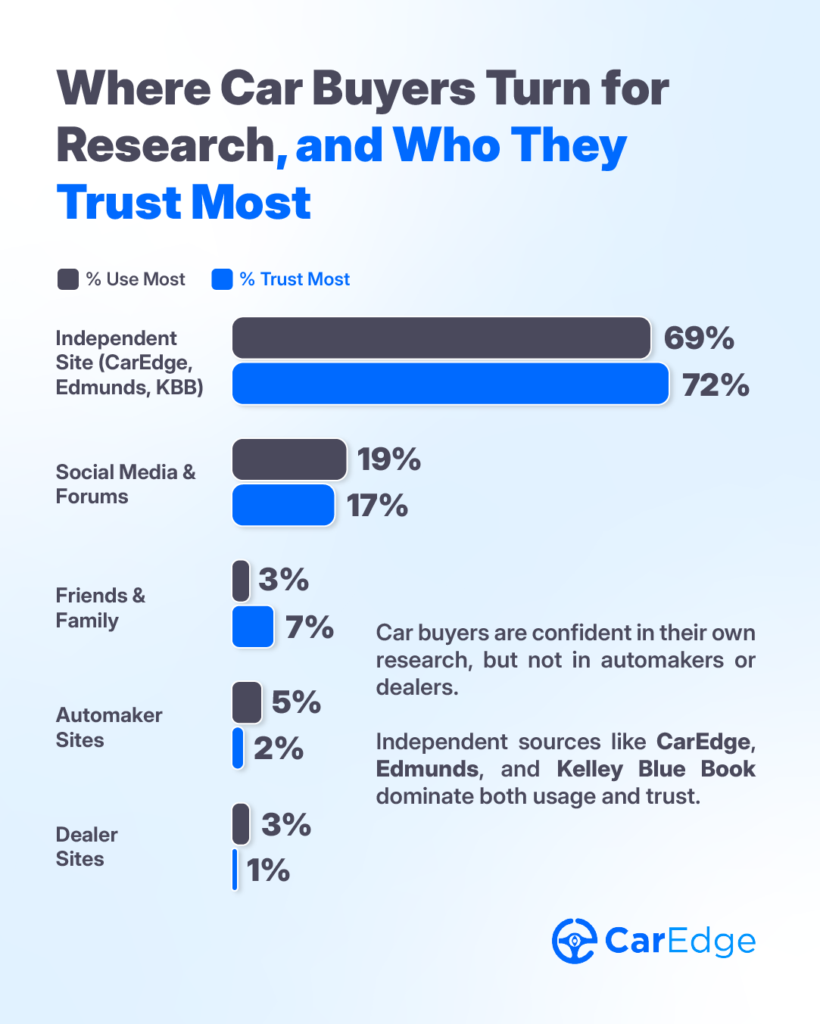

Research Confidence Brings a Silver Lining

The Research Confidence sub-index scored 93.9—the only measure approaching neutral and the highest of all categories:

- 80% feel confident their research is accurate and unbiased. Knowing where to find unbiased, trusted car market information is a major pain point for American drivers. Transparency is often lacking, even on platforms that at first appear consumer-focused.

- 72% trust independent sites most (CarEdge, Edmunds, KBB). The growing variety of consumer-focused car buying websites and research tools has empowered drivers to take a DIY approach to car shopping.

- Only 1% trust dealer websites most. Consumers are wary of dishonest pricing practices and a lack of transparency on dealer websites.

- Trust in family and friends jumped to 8% (up from 1%), surpassing automaker sites (2%)

The shift toward family and friends as trusted sources signals growing reliance on personal networks over manufacturer and dealer information.

Key Takeaways

- Market conditions are deteriorating: Every sentiment measure except buying intent declined from October, with trust posting the steepest drop.

- Affordability is the primary barrier: 82% say vehicles are less affordable, and dissatisfaction with available options jumped 17 points.

- Car buyers don’t trust dealers: Just 2% of car buyers surveyed say they trust car dealerships.

- EV adoption remains stuck: Federal incentive removal had no impact on consumer interest.

Demand persists out of necessity: 59% still plan to buy within six months despite worsening conditions.

About the CarEdge Car Buying Index

The CCBI tracks consumer sentiment toward affordability, availability, trust, research confidence, and purchase intent. Modeled after the University of Michigan Consumer Sentiment Index, it uses a 50-150 scale where 100 represents neutral sentiment. The index will be published monthly to track shifting sentiment in the automotive market.

The Q4 2025 CCBI surveyed 453 respondents from CarEdge’s audience of 370,000 weekly newsletter subscribers between November 20 and December 10, 2025. The index uses a 50-150 scale where 100 represents neutral sentiment. Scores below 100 indicate pessimism; scores above indicate optimism.

Access detailed index data and methodology with the full CCBI report PDF, and interview CarEdge analysts at Caredge.com/press.

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and AI-powered tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry.

Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.