New monthly sentiment measure shows car-buying confidence plunging below neutral, signaling consumer fatigue and affordability pressures.

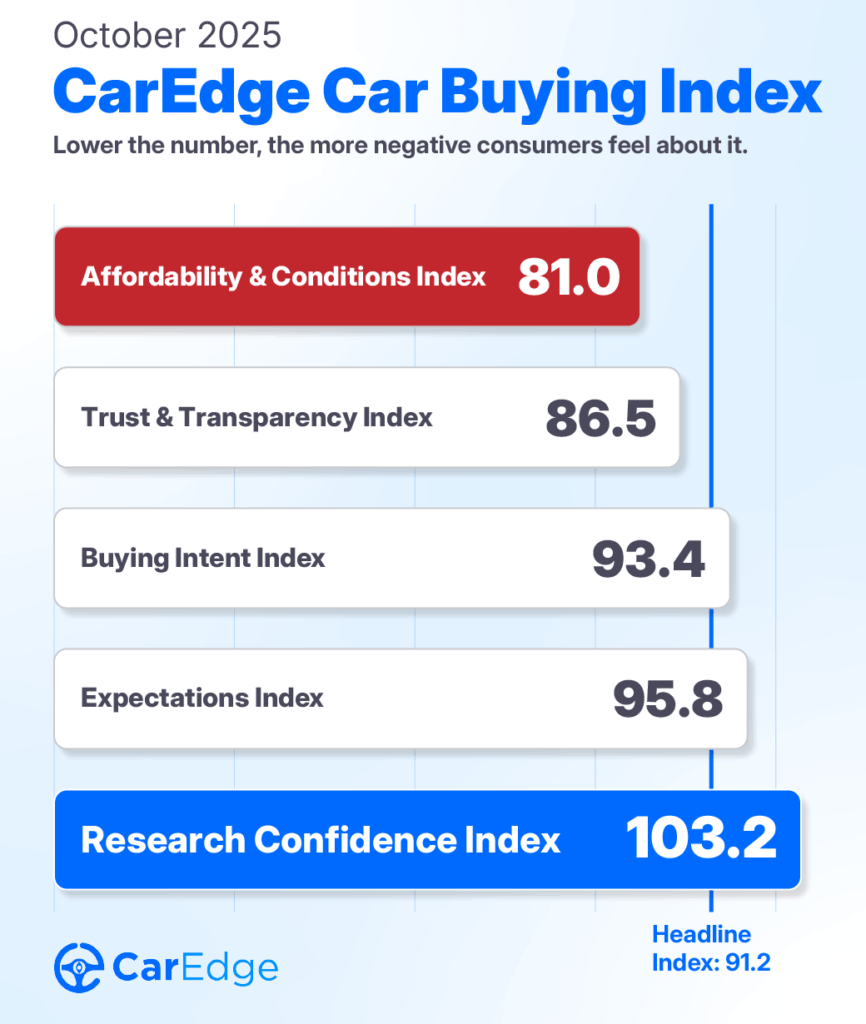

U.S. car buyers are losing faith in both the market and the middlemen. According to the inaugural CarEdge Car Buying Index (CCBI), a new monthly gauge of consumer sentiment, confidence among car shoppers has fallen to 91.2, below the neutral baseline of 100, reflecting pessimism about affordability and trust across the auto market.

Affordability Pressures Dominate

The Affordability & Conditions sub-index scored 81.0, the lowest of all measured categories and the primary driver of negative sentiment. Stubbornly high financing rates, insurance costs, and negative equity are converging to squeeze household budgets in addition to already increasing car prices.

Key findings include:

- Only 20% believe the next 12 months will be a good time to buy a vehicle

- 74% of buyers say vehicles are less affordable than a year ago

- 49% are not satisfied with vehicle availability in their price range

“Most respondents believe that their financial situation will continue to be about the same as it is now, yet 74% believe that vehicles are less affordable today. This indicates to me that something has got to change or the pool of customers will continue to get shallower and shallower,” said Ray Shefska, Co-Founder of CarEdge and auto industry veteran.

Trust Has Evaporated

The Trust & Transparency sub-index scored 86.5, revealing deep skepticism toward both dealers and manufacturers:

- 82% report low trust in dealerships to treat consumers fairly (only 1% express high trust)

- 59% report low trust in automakers (only 2% express high trust)

- Just 66% of car buyers feel confident they can avoid unwanted fees and add-ons

“The thing that stands out the most to me is how 82% of respondents don’t trust the dealership to treat them fairly. That represents just how poorly dealerships have operated for decades,” said Ray. “That number should scream ‘we need to change how we operate’ to both dealers and manufacturers.“

Pent-Up Demand Persists Despite Pessimism

Despite widespread dissatisfaction, 58% of respondents plan to purchase or lease a vehicle within the next six months, with 51% targeting new vehicles. This reflects need-based demand. Buyers often require vehicles even when market conditions are unfavorable.

Research Confidence Brings a Silver Lining

The Research Confidence sub-index scored 103.2, the only measure above neutral. Key findings include:

- 86% feel confident the information they find when researching is accurate and unbiased

- 78% trust independent sites like CarEdge most for transparent information

- Only 2% trust dealer websites most

Additional Findings:

- Expectations sub-index: 95.8 (near neutral, reflecting cautious optimism about personal finances but pessimism about car market conditions)

- EV skepticism: 69% would not consider an electric vehicle or plug-in hybrid in the next 12 months

- Stable personal finances: 63% say their household financial situation is about the same as a year ago

About the CarEdge Car Buying Index

The CCBI tracks consumer sentiment toward affordability, availability, trust, research confidence, and purchase intent. Modeled after the University of Michigan Consumer Sentiment Index, it uses a 50-150 scale where 100 represents neutral sentiment. The index will be published monthly to track shifting sentiment in the automotive market.

The October 2025 survey of 1,048 respondents was conducted among CarEdge’s audience of 370,000 weekly newsletter subscribers.

Access detailed index data and methodology with the full CCBI report PDF, and interview CarEdge analysts at Caredge.com/press.

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and AI-powered tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry.

Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.