If you’ve ever been anxious about car buying, you’re not alone. Vehicle ownership is a major financial commitment. With this in mind, how much of your monthly budget should you spend on a car? Today, we’re going to answer that question with the 10% rule.

You’re likely to find many different opinions on how much you should spend on a car. Truthfully, there is no perfect answer. At the end of the day, you have to make a decision that you feel comfortable with.

That being said, we do have some advice we’d recommend you follow. We’re here to help you learn about the 10% rule, and how it helps you determine how much you should spend on your next car.

Assess your financial situation

First things first, to determine how much you should spend on a car, you need to assess your financial situation. This means auditing your monthly gross income. How much gross (before taxes) income do you make each month?

I say monthly income on purpose, because most car buyers are shopping for a monthly payment that meets their budget. This is as good a time as ever to mention that if you can afford to buy a car in cash, and you intend to keep it for decades, please do that. However, make sure to do it the right way (we go over the details here). Paying cash is the most financially responsible car buying decision you can make.

Having said that, most of us aren’t in a position to pay for a car in cash upfront. If that’s you, then start this exercise by analyzing your monthly gross income.

Write that number down, we’re going to come back to it.

First, ask yourself “why” you need a car

Are you buying a car because you need transport from point “a” to point “b,” or are you getting a car to make a statement?

When I worked at an Acura dealership in the early 2000’s, a customer came in and purchased an Acura RL in the top trim. This was an expensive and luxurious car. The same day this customer took home his new car he came back. Why? Because his wife wanted him to buy a Lexus instead. To her, the Acura didn’t portray the image she wanted to her neighbors.

In this case, the “why” behind purchasing a car was to make a material statement, not to simply get from point “a” to point “b.”

If you’re trying to make a statement, it’s my strong recommendation you figure out a cheaper, more fiscally responsible way to make that statement. Consider buying a watch, a house, a painting … literally anything other than a car. Cars simply lose value too quickly.

Factor in all cost of ownership expenses

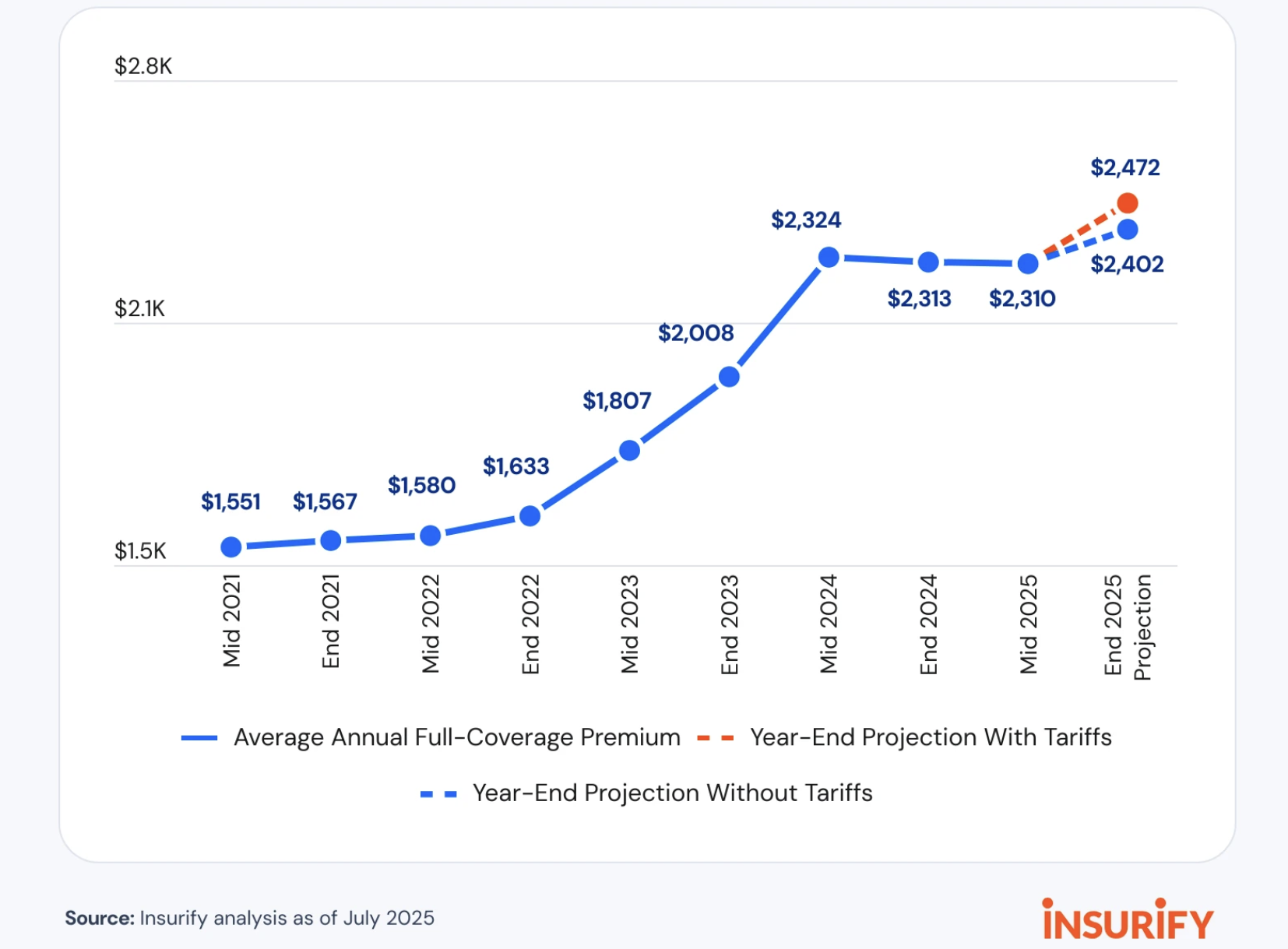

Buying a car entails a lot more than making a monthly car payment. Insurance, gas, maintenance, depreciation, the list goes on and on. If you’ve ever owned a car before, you know just how expensive it is. Plus, insurance costs are rising quickly.

That being said, it’s critically important to consider the total cost of ownership when thinking, “How much should I spend on a car?” Your monthly car payment should include:

- The lease or loan payment

- Insurance

- Maintenance

- Wear and tear

When you factor each of these items into your monthly car payment you see that a $500/mo car payment is actually $1,000/mo. And this is where the 10% comes in. I’ve always advised all of my customers to spend no more than 10% of their gross income on their car.

That means that if you make $60,000 per year ($5,000 per month), you can aim for up to $500 per month to go towards your car payment. That doesn’t mean you can afford any car that has a monthly payment of $500, it means the combined cost of the payment, the insurance, and maintenance all needs to be under 10% of your gross income, or in this example, under $500.

Some personal finance gurus suggest that you can afford to spend much more than 10% of your gross income on a car, and banks will even loan you the money you need to purchase a car so long as your debt to income ratio is below 40%.

The 10% rule isn’t a commandment, it’s simply a suggestion. Spending more than 10% of your monthly gross income on a depreciating asset is a tough pill to swallow, but for some it’s worth it.

Consider leasing instead

If you drive less than the average driver each year, I highly recommend you consider leasing a car instead of buying. This is especially advised for those who prefer to upgrade to a new car every few years or so.

Leasing has some distinct advantages compared to purchasing; mainly, you know exactly what you are signing up for. The cost of depreciation and maintenance are built into the lease, whereas when you buy a car outright neither of those factors are known.

The 10% rule also applies to leasing. For example, if my monthly income is $4,000, then my next Mini Cooper lease should be under $400/month since I’ll have to factor in insurance and gas costs.

Leasing allows for a certain level of cost certainty since most lease terms are in the 24 to 36 month range, and cars are under warranty for most (or all) of that time. Some brands even include free scheduled maintenance during your lease term, essentially making the monthly payment and the cost of fuel and your insurance premium your total car expenses.

Trust me, cost certainty is a huge advantage for drivers. Once you experience it, you’ll wonder how you ever lived without it.

A car is NOT an investment!

Ultimately, how much you spend on a car comes down to how much money you are willing to set aside on a monthly basis. Additionally, always remember that when you buy a car, it will lose value. Vehicles are not investments.

How do you play it smart then? My recommendation is that you follow the 10% rule. It’s fair, it’s reasonable, and it’s not overly constrictive. Plus, when you drive somewhere in your new car, if you follow the 10% rule, you’ll still have some money in your pocket to pay for things when you get there!

Ready for a car-buying expert to get YOU the best deal?

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments