The Consumer Financial protection Bureau (CFPB) is concerned about Americans getting deeper into debt. It’s not credit cards or mortgages that are raising red flags, it’s auto loans. Today, the average car payment is $733 per month. That’s nearly $9,000 a year in car payments alone. Rising car prices are leading to larger loan amounts and record-high monthly payments. The CFPB just released new data that shows auto loan delinquency rates increasing dramatically for deep subprime borrowers.

Just how concerned is the Bureau? The latest auto lending data shows that borrowers with poor credit are struggling to make ends meet, largely due to the surging costs of owning a vehicle.

“We are particularly concerned about the impact of these changes on consumers’ financial health, especially for consumers with near-prime or subprime credit scores,” said the report.

Let’s take a closer look at the most recent auto lending data, why delinquencies are rising, and what lies ahead for tomorrow’s car buyer.

Deep Subprime Borrowers Falling Behind; Delinquencies Up 33%

One in three Americans falls within a subprime lending tier, which includes credit scores under 620. So when the federal bureau tasked with keeping tabs on American spending habits sounds the alarm, lenders listen.

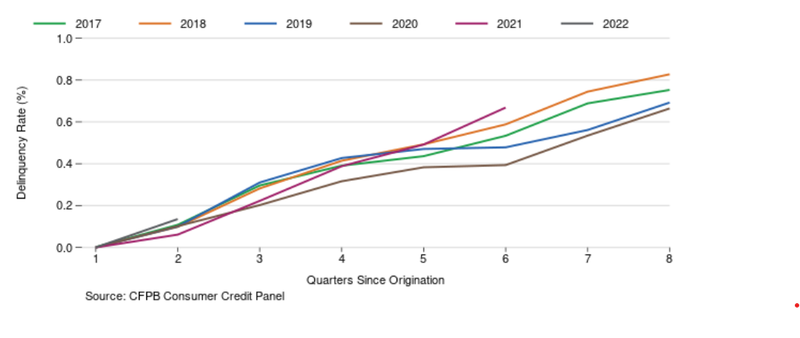

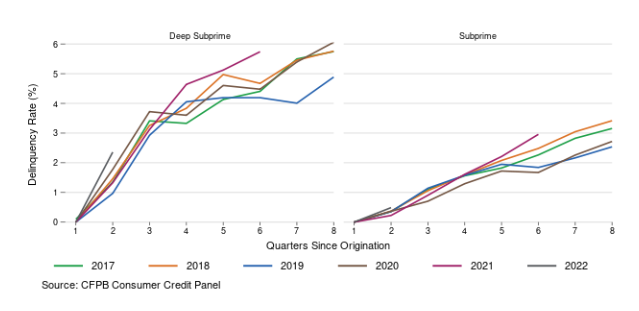

The CFPB measures auto loan delinquency rates by quarter after loan origination. The loan origination year is called the vintage, and delinquency rates are tracked by quarter since the vintage was originated. This is considered the best way to detect when borrowers are taking on more debt than they can handle.

Here’s what the Bureau highlighted in their latest report.

“When looking at delinquency in the first two years after purchase, loans originated in 2021 and 2022 are starting to show higher delinquency rates relative to loans originated in previous years, even when compared to loans unaffected by pandemic-related stimulus payments. For example, auto loans originated in 2021 have a delinquency rate of 0.67 percent in the sixth quarter after origination, which is 13 percent higher than the delinquency rate of auto loans originated in 2018.”

Borrowers with poor credit are faring much worse.

“This trend is even more pronounced for consumers with subprime and deep subprime credit scores. For example, 2022 vintage auto loans for consumers with deep subprime credit scores were 2.4 percent delinquent two quarters after origination, which is a 33 percent increase from the previous five-year high set in 2020.”

Why Are Auto Loan Delinquency Rates Rising?

Cars are more expensive, interest rates are rising quickly, and together that equals record-high monthly auto payments. Over the past year, the average car payment has risen from $623/month to $733/month. Go back further in time, and the average car payment was $502 in 2017. When auto loan payments increase nearly 50% in just five years, lower income borrowers are the first to feel the impacts.

Pandemic stimulus packages are over, and household budgets are struggling to adjust as consumer price indices show inflation at 40-year highs. With stimulus money gone (and student loan forbearance set to end at the end of the year), Americans have less money to spend on car payments. Car prices are up as much as 40% since pre-pandemic times, but there’s less money to go around.

Rising Auto Loan Interest Rates Add to the Pain

The federal reserve has made it clear that it will become more expensive to borrow money. Higher-risk borrowers are footing the bill in the form of MUCH higher interest rates. To get a better sense of just how bad it is for subprime borrowers right now, we crunched the numbers to find out how the average auto loan interest rates are adding well over $10,000 to the total cost of an auto loan.

| Credit score | Average APR, New Car | Average Amount Financed | Total Interest Paid (60 Months) | Total Cost (Principal + Interest) 60 Mo. Loan | Total Interest Paid (72 Months) | Total Cost (Principal + Interest) 72 Mo. Loan |

|---|---|---|---|---|---|---|

| Superprime: 781-850 | 2.96%. | $36,725 | $2,830 | $39,555 | $3,403 | $40,128 |

| Prime: 661-780 | 4.03%. | $41,969 | $4,440 | $46,409 | $5,348 | $47,317 |

| Near Prime: 601-660 | 6.57%. | $42,461 | $7,470 | $49,931 | $9,032 | $51,493 |

| Subprime: 501-600 | 9.75%. | $38,802 | $10,378 | $49,180 | $12,603 | $51,405 |

| Deep subprime: 300-500 | 12.84%. | $33,978 | $12,241 | $46,219 | $14,925 | $48,903 |

Used car buyers with subprime credit have it even worse, with the average deep subprime rates over 20%.

| Credit score | Average APR, Used Car | Average Amount Financed | Total Interest Paid (60 Months) | Total Cost (Principal + Interest) 60 Mo. Loan | Total Interest Paid (72 Months) | Total Cost (Principal + Interest) 72 Mo. Loan |

|---|---|---|---|---|---|---|

| Superprime: 781-850 | 3.68% | $28,639 | $2,759 | $31,398 | $3,322 | $31,961 |

| Prime: 661-780 | 5.53% | $30,473 | $4,477 | $34,950 | $5,404 | $35,877 |

| Near-Prime: 601-660 | 10.33% | $28,598 | $8,139 | $36,737 | $9,891 | $38,489 |

| Subprime: 501-600 | 16.85% | $23,935 | $11,640 | $35,575 | $14,258 | $38,193 |

| Deep subprime: 300-500 | 20.43% | $20,311 | $12,248 | $32,559 | $15,057 | $35,368 |

Borrowing less money at lower interest rates for shorter terms is the only way out of runaway interest debt. It’s easier said than done.

Looking Ahead

The CFPB says it is focused on ensuring a fair, transparent, and competitive auto lending market. The Bureau aims to do this by ensuring affordable credit for auto loans, monitoring practices in auto loan servicing and collections, and fostering competition among subprime lenders.

The first step towards keeping auto loan debt under control is to spend less. But there’s only so much that government oversight can do. New car inventory remains historically low (but improving for some), and OEMs announce more MSRP hikes every week it seems. Automakers have been blatantly stating that they plan to keep inventory low long-term, and that’s going to keep new car prices high. And then there’s inflation.

Get the most when you sell your car.

Compare and choose multiple offers in minutes:

Is there a silver lining? If you’re willing to consider a used car, you have more negotiating power than at any point in the past year. Data from Black Book shows more used cars sitting on dealer lots for longer, and the bubble has officially burst at wholesale auctions. Dealers are eager to sell their inventory to minimize losses in a rapidly softening used car market. The result is more willingness to negotiate.

Don’t settle for the sticker price. In fact, we think you should aim to negotiate between five percent and ten percent off of the sticker price on a used car. Thinking of selling? Selling sooner rather than later will get you more money as the used car market softens.

What do you think about the latest auto lending numbers? It’s hardly a surprise when car payments cost as much as rent in much of the nation.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

Can the public buy these repos? Is it a savings or chase to the unknown quality of the vehicles. Your right if it isn’t a bubble it’s a FLAT!