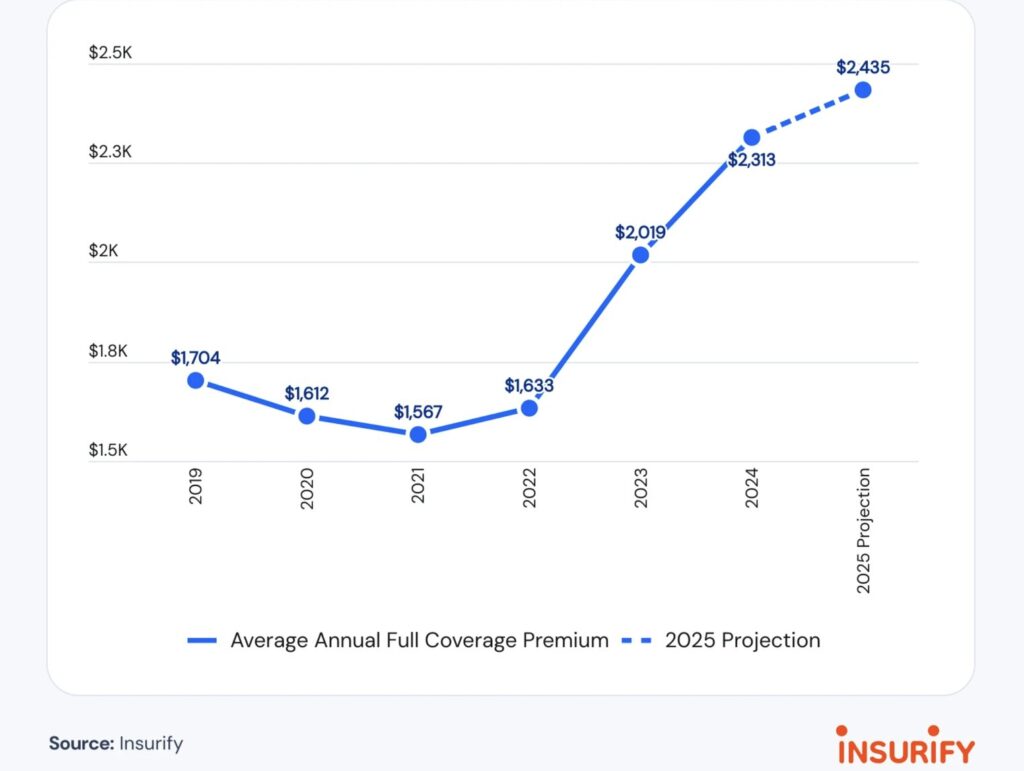

Auto insurance rates are climbing in 2025, and while that’s no surprise to most drivers, what might shock some is which states have the highest accident rates. Car accidents are a major factor driving insurance premiums higher, but they aren’t the only culprit. Rising car prices, increased repair costs, and even tariffs map push rates higher this year.

Using Insurify’s latest insurance data, we’ve identified the states with the most at-fault accidents in 2025 — and the states where drivers are least likely to be involved in a crash.

The States with the Highest Accident Rates

Insurify, a digital insurance marketplace licensed in all 50 states, connects drivers with quotes from over 100 providers. Thanks to this expansive data set, Insurify is able to track national trends, offering a unique look at which states have the highest accident rates.

Nationally, 5.3% of drivers have an at-fault accident on their record. But in some states, that number is significantly higher.

New England stands out as the region with the most accident-prone drivers. Massachusetts takes the top spot, with 8.1% of drivers having an at-fault accident on their record. New Hampshire follows closely behind at 7.7%, while Maine rounds out the top three at 7.6%. Rhode Island also ranks in the top five, with 7.1% of drivers reporting accidents.

North Carolina is the only non-New England state in the top five, with 6.6% of drivers having an at-fault accident on record.

Here’s a look at the 10 states with the highest accident rates in 2025:

| State | Drivers with At-Fault Accidents |

|---|---|

| Massachusetts | 8.05% |

| New Hampshire | 7.67% |

| Maine | 7.59% |

| Rhode Island | 7.12% |

| North Carolina | 6.61% |

| Utah | 6.56% |

| Idaho | 6.49% |

| Nebraska | 6.36% |

| Maryland | 6.26% |

| Ohio | 6.23% |

Source: Insurify data

The States with the Lowest Accident Rates

On the other end of the spectrum, some states report far fewer accidents. Whether due to lower population density, better infrastructure, or safer driving habits, these states see fewer crashes than the national average.

Michigan has the lowest rate of at-fault accidents in the country, with just 2.6% of drivers having one on their record. Mississippi follows at 3.6%, while Illinois and New Mexico also rank among the least accident-prone states.

Interestingly, Florida, often criticized for aggressive driving, high insurance costs, and outrageous dealership fees, is also among the states with lower accident rates, at just 4.5%. This suggests that while Florida has unique insurance challenges, at-fault accidents aren’t the primary issue.

Here’s how all 50 states and the District of Columbia rank in terms of drivers with at-fault accidents on their record, as of 2025:

The visualization above was produced by CarEdge using Insurify data.

How Accident Rates Impact Insurance Costs

Having an at-fault accident on your record can significantly increase your car insurance premiums. On average, drivers who cause an accident see their rates rise by $800 or more per year, depending on the severity of the crash and their insurance provider. These rate hikes typically last three to five years before gradually returning to normal—assuming no additional accidents occur.

But even drivers with clean records aren’t immune to rising premiums. Insurance companies set rates based on the overall risk in a given area. If a state or city experiences high accident rates, insurers adjust their pricing accordingly to offset increased claim payouts. That means even if you’ve never been in an accident, living in a high-risk state could mean paying more for coverage.

If your rates have gone up, it may be time to compare insurance quotes and explore ways to lower your premium. Shopping around, maintaining a clean driving record, and improving your credit score can all help keep costs down in 2025. Stay safe out there!

0 Comments