General Motors reported net income that was 40% lower than the same period last year. Ford’s net income was off 24%, and Volkswagen’s fell 12%. As you know by now, no automaker has been able to sidestep the effects of the ongoing chip crisis. Every automaker has faced production challenges, with many OEMs shutting down their manufacturing plants for weeks at a time.

Which automakers have been hit the hardest from the chip shortage? With Q3 results in hand, and a myriad of other data sources to draw from, it becomes clear who is faring the best and who is faring the worst. Since GM, Ford, and Volkswagen all reported their third quarter earnings this week, we’ll focus our attention on them.

Let’s dive in.

GM is really struggling

General Motors’ Q3 results were disappointing. Compared to their peers, net income fell more than expected (down 40% year-over-year). That’s not what is most concerning for the company. It appears as if GM is having an identity crisis. The brand, once known and revered for its American made qualities, is now struggling with how to become an electric vehicle manufacturer.

CEO Mary Barra is demonstrating a masterclass is projecting confidence, however when you take a peek “under the hood” it becomes clear that GM is struggling. First and foremost they were hit the hardest and caught most off guard by the chip shortage.

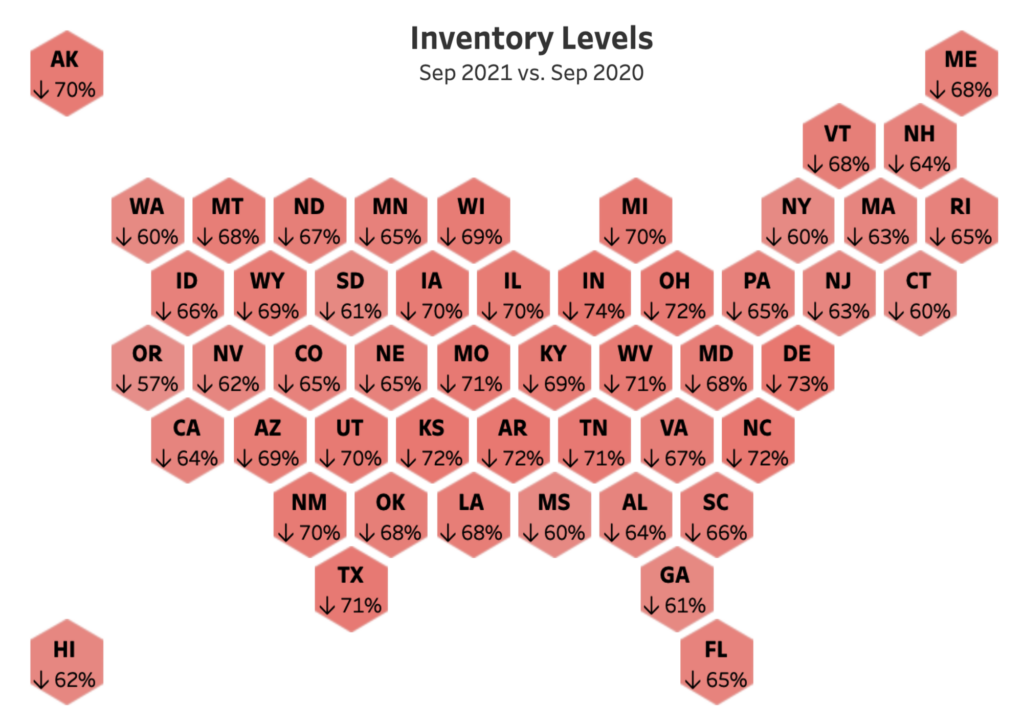

Inventory of GM products (Chevrolet, Buick, GMC, and Cadillac) has suffered more than their peers so far in 2021. For example, in Texas Chevy inventories are down 80% year-over-year, whereas Ford is (only) down 66%. You can explore and drill down on state-by-state inventory levels by brand here.

General Motor’s plant utilization was just 60 percent in the third quarter. This is down from 112 percent a year earlier. At that time, multiple plants were running on overtime to make up for the shutdowns at the start the global pandemic. For the year, GM’s capacity utilization rate is 81 percent, down from 85 percent through three quarters of 2020.

GM recently reported that they have received enough chips to finish production of their partially built 2021 model year inventory. This is a good thing, however one challenge the automaker (and their dealer network) may face is “lot rot” associated with those vehicles that had been siting for 6+ months waiting for their final modules to be installed. GM has plenty of challenges in front of them.

Thinking about buying an extended warranty? Get a free quote from CarEdge first!

Recently GM announced a massive investment in electric charging stations. The automaker appears to be going all in on electric vehicles. With this announcement, plus bringing back the Hummer in electric form, GM is certainly in a period of transformation. Will they come out on the other side as a better and stronger company? Only time will tell, however, if their recent performance is any indicator of what the future holds, I wouldn’t be holding my breathe.

Ford’s struggles continue

If there is an automaker who is trying to make GM feel better, it would be Ford. Their struggles have been well documented so far in 2021. They too were caught off guard by the chip shortage, and their response was not much better. Couple this with a slew of quality control issues, and you have a recipe for poor earnings!

Ford’s Q3 net income dropped 24% year-over-year. We can again look at our state-by-state dataset to see that their inventory levels nationwide are down considerably. We also have access to market days supply data from Ford.

Nationally, inventory levels are off ~66% from where they typically would be.

There is light at the end of the tunnel for Ford though. At the beginning of Q3, Ford had approximately 70,000 unfinished vehicles waiting for chips. Ford CFO, John Lawler said they ended the quarter with 27,000 partially-built vehicles, and that the number should drop below 5,000 at the end of the year.

Ford, just like GM is investing mightily in becoming an electric vehicle company.

Volkswagen struggles, but does better than their peers

VW Group’s net income dropped 12% in Q3 year-over-year, a much more modest decline than their American peers. VW, just like GM and Ford has struggled to produce enough vehicles to meet consumer demand. To preserve profit margin, VW has allocated resources towards the production of higher profit vehicles (Audi and Porsche).

What does that mean in practice? Well, at VW’s main factory in Wolfsburg, Germany they currently have an order backlog of more than 130,000 Golf models. That equals roughly four months of production and comes on top of 110,000 orders for the brand’s best-selling Tiguan SUV that are also on backorder.

VW Groups global deliveries were down 24%, and inventory levels of their more affordable brands have seen the biggest declines.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments