The latest on used car prices:

Used car prices typically follow seasonal patterns. Winter, and the fourth quarter are traditionally when the used car market experiences most of its yearly depreciation. So far, in this fourth quarter of 2021 used car prices have appreciated 5%.

We all know that used car prices have been increasing this year, and the latest data from Black Book suggests we’re going to continue to see used car values appreciate through the end of this year. That being said, we are starting to see some mixed signals from other data providers. Cox Automotive recently shared data that used car inventory levels have increased in November. Although used car prices have continued to increase, we could potentially be seeing a softening in the market if inventory levels continue to rise.

In this post we’ll run through the latest data on used vehicle values. We will update this page weekly as we get new data and information to share. If you have specific questions about used car prices please ask them on the CarEdge Community Forum.

To get the Black Book value of your vehicle you can do that here: https://app.CarEdgemember.com/trade-in

Let’s dive in.

Overall Used Car Market Update

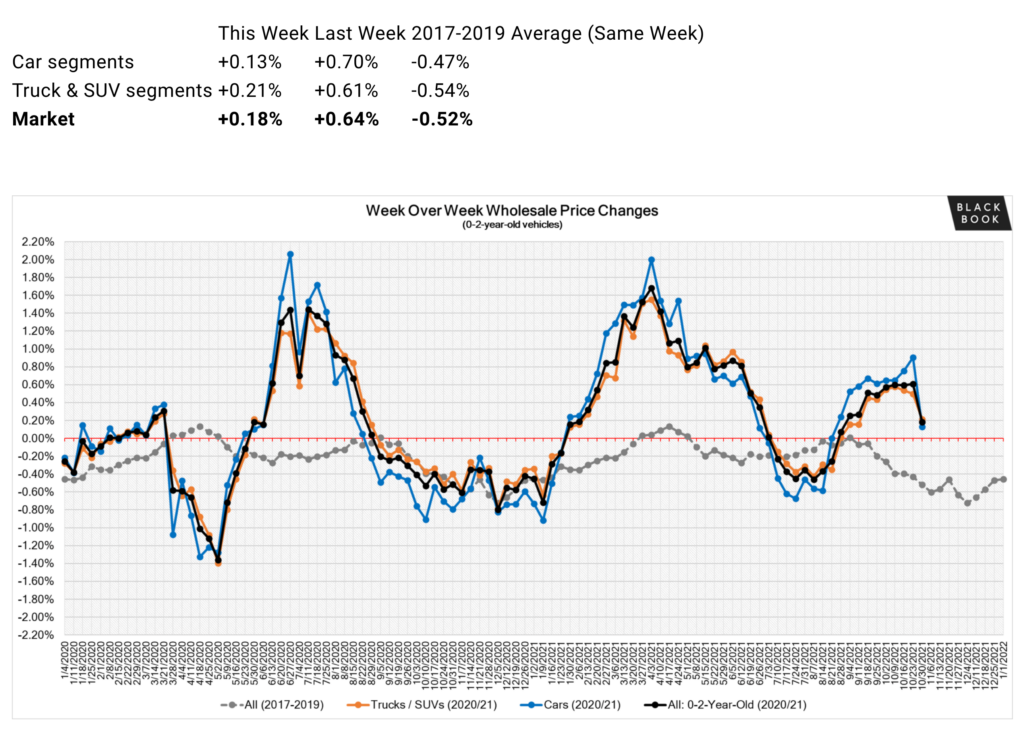

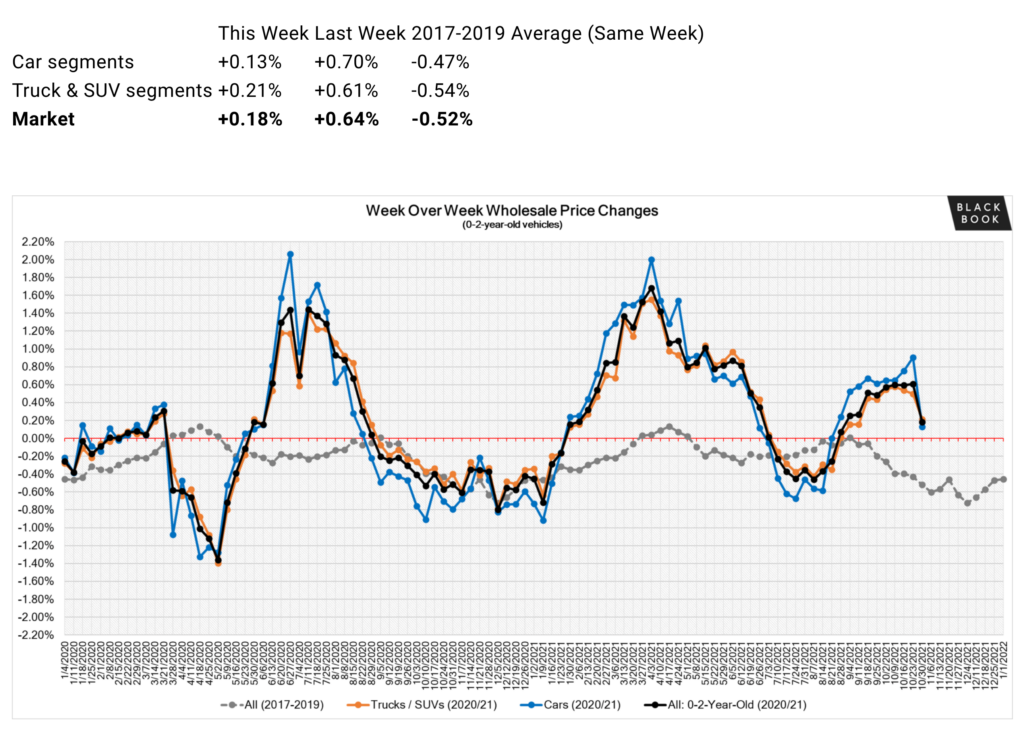

Wholesale used car prices have continued to increase. Data from Black Book shows that wholesale used vehicle prices have appreciated 48% in 2021 alone. The purple line represents 2021 wholesale weekly price changes. The blue line represents 2019 (the last “normal” year) of data we have. You can see drastic differences between the two lines.

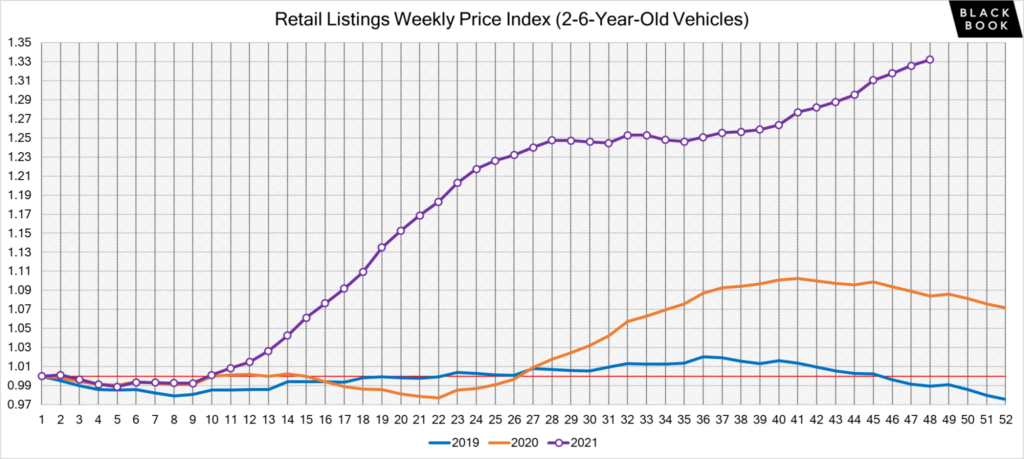

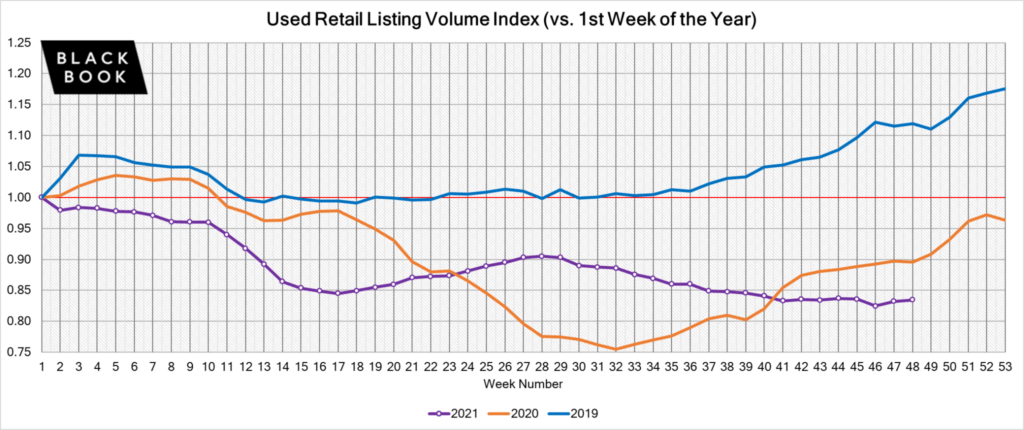

As wholesale prices have continued their ascent, retail used car prices have followed suit. Retail used car prices are up more than 33% since the beginning of this year. Again, look at the purple (this year) and blue (2019) lines in the graph below. It’s incredible to see the stark difference between the two.

As you are likely well aware, used car prices have skyrocketed because of the ongoing chip shortage and lack of new vehicles. We have updated data on new car inventory levels for the month of November, and they are not pretty.

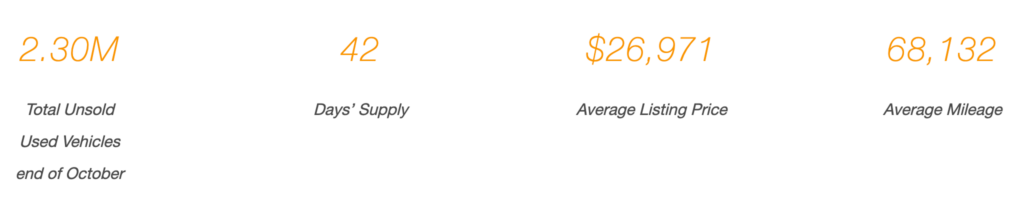

That being said, wholesale used car inventory levels have ticked up so far in November. Data from Cox Automotive showed positive signs in terms of inventory with October inventory levels up 200,000 units from September. September ended with 2.28 million used vehicles in inventory, while October ended with 2.30 million. October’s supply was still about 8% lower than 2020.

Cox also estimates the days supply of used car inventory. It is at 42 for the month of October, the same as September. Their data suggests that about 1.65 million used vehicles were sold in October 2021, up 400,000 units from the 1.61 million sold in September. October sales ran about 7% below the same year-ago period.

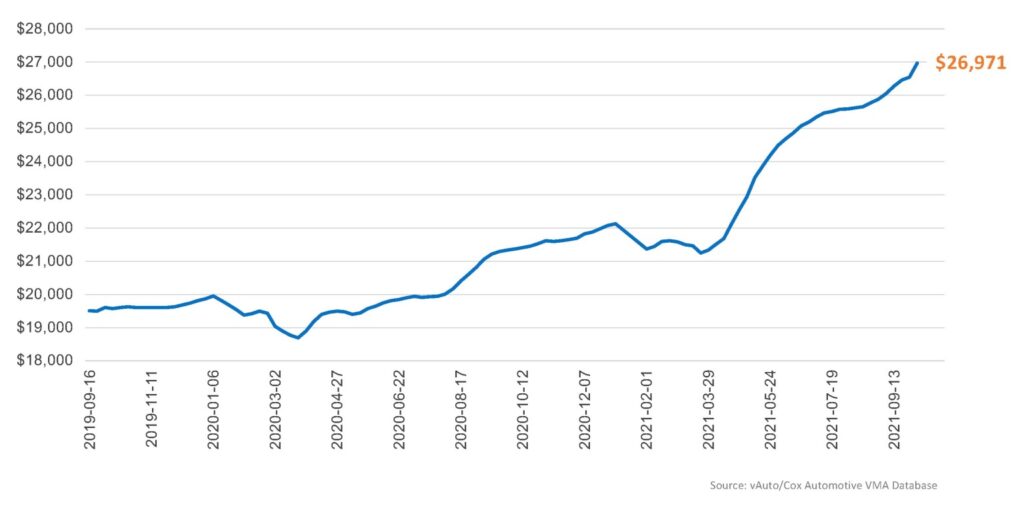

Both Cox and Black Book show retail used car prices hitting all-time highs. Cox has the average listing price for used vehicles at a new record of $26,971. That’s a $400 increase from September ($26,548).

One of the most interesting data points Black Book tracks is used vehicle retail listings volume. This means how many used vehicles are listed for sale in the United States each week. Data from Cox suggests inventory levels are edging higher, and Black Books data shows the same thing. We see a slight week-over-week increase in retail listing volume.

Again, the purple line represents this year, and the blue line shows 2019. Typically we would see an increase in retail listing volume at this time of year, however right now the volume is still low and not increasing. This simply means there are less used vehicles for sale than earlier in the year, and the lowest level we’ve seen so far this year.

That being said, we did see another week of wholesale price increases, our 13th straight week of appreciation. Last week cars appreciated .70%. This week that sunk down to .13%. Trucks and SUVs increased .61% last week, and increased modestly by .21% this week. The used car market as a whole was up .18%, considerably lower than last week.

Toyota’s new car sales volume was down 29% in October. Toyota’s biggest sellers posted double digit declines in sales volume in October: Camry down 40 percent; RAV4 down 39 percent; Tacoma sales declined 38 percent; Highlander off 19 percent and Corolla sales off a staggering 61 percent.

It wasn’t just Toyota. Honda sales volume dropped 24% in the month too.

Used car prices will continue to appreciate as long as automakers are struggling to produce enough new vehicles. These recent earnings reports highlight how much the major manufacturers are struggling to stock their dealer’s lots.

What types of cars are increasing in value the most?

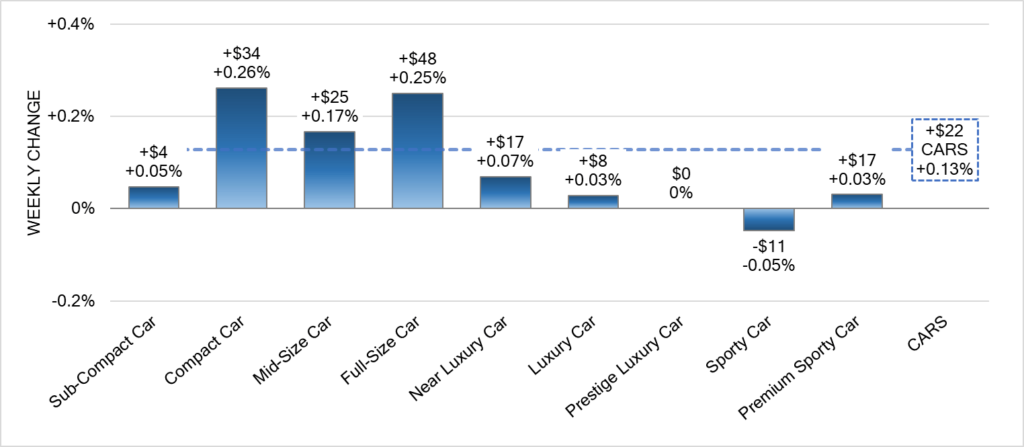

Black Book supplies us with compelling data on the change in used car prices broken down by segment of vehicle. This past week compact cars appreciated in value the most. These are your Subaru Imprezas, Ford Fiestas, Nissan Versas, Mazda Mazda3s, Ford Focus, etc.

Sporty cars are finally depreciating! This time of year is seasonally when sports cars depreciate the most.

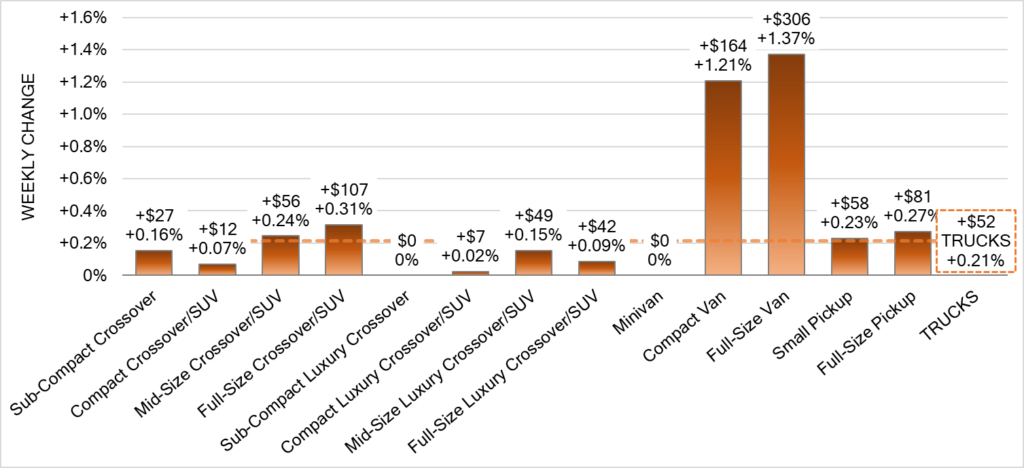

Compact vans and full-size vans continue to increase in value rapidly. Their value increased well over 1% week-over-week. Full-size vans have increased in price 42 out of the past 43 weeks.

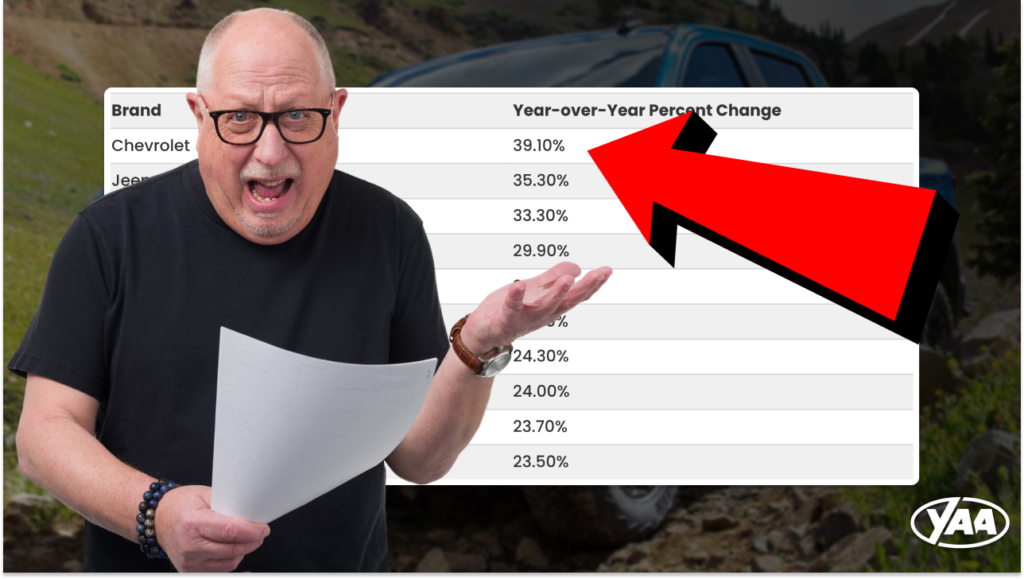

We recently published data on which brands have seen their new and used prices increase the most (and least) year-over-year: https://caredge.com/guides/which-brands-prices-have-increased-the-most-least-in-2021/

What’s going on at the auction?

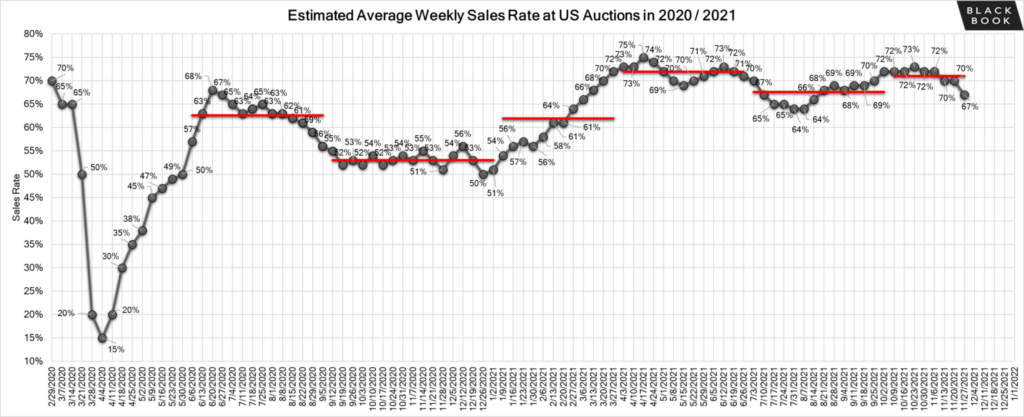

Black Book provides “sales rate” data from the wholesale used car auctions.

Directly from Black Book:

The weekly estimated average sales rate has remained stable at the 70% mark for the 2nd week in a row. This time last year, the estimated average weekly sales rate was around 51%, so while floor prices continue to rise, buyers continue to purchase vehicles at auction at a higher rate.

Typically the holiday season signals an increase in newer used vehicles. This is because of lease returns and rental vehicles coming to the auction. This year that is not happening to previously expected levels. While there was a slight uptick in newer model year vehicles rolling across the lane this past week, a significant portion of vehicles are arriving damaged.

Franchise car dealers are grounding lease returns and not sending them to auction. Fierce competition at the auctions can be mostly attributed to large independent dealerships and rental companies. Because of inventory scarcity, we have seen bidding wars across the country. Wholesale values and floors continue to increase and give no indication of slowing down.

We’ve heard stories from our community of similar experiences at the auction, and it appears that rougher and rougher vehicles are crossing the auction block at this time.

Are any used cars depreciating?

No. From all of the data we’ve been able to get our hands on, it looks like there isn’t a single style of vehicle or particular nameplate that is not increasing in value right now. We know that certain vehicles are appreciating less than others, however all vehicles are increasing in value right now.

Luxury vehicles, and in particular luxury SUVs are appreciating much less rapidly than other vehicles. Take for example the Mercedes-Benz GLC, it has only appreciated 8% year over year. This further reinforces the theory for why the Mirage has increased in value nearly 50%; consumers need affordable and attainable used cars, not expensive and luxurious ones.

How long will used car prices keep going up?

Although our crystal ball has been notoriously cloudy here at CarEdge, we feel confident in saying that used car prices will continue to increase well into 2022. Even when automakers get production back up to speed for new vehicles, there will be lingering effects from this period of time where they have not been able to produce at expected capacity.

Also, the price to produce new vehicles has gone up. As a result of the chip shortage (and other supply chain issues), we expect MSRP on new vehicles to be considerably higher than before. Why? Because the manufacturers costs are increasing, and they will likely pass that along to the consumer. As a result, the demand for used cars will continue to be high because used cars (especially vehicles like the Mitsubishi Mirage) will be the only “attainable” price point vehicles for many people.

For these reasons, we think week over week, and month over month used car price increases will continue for at least another 12 months.

When should I sell my used car?

If used car prices are likely going to continue to appreciate, it would make sense to hold onto your used vehicle and wait to sell it. That being said, our best recommendation is to track the value of your used vehicle weekly. To do this we encourage you to use the “value my vehicle” section of your CarEdge account. You should also get quotes from Carvana, Vroom, CarMax, etc.

There may be small fluctuations in price from week to week, but we expect the price of your vehicle to gradually increase overtime. The indicator for when to sell will be when you see week over week declines in the value of your vehicle.

If You’re Buying a Used Car …

Our recommendation has been, and will continue to be to stop buying cars! We’re so passionate about this that we even made a website: http://stopbuyingcars.com/

However, if you need to buy a used car right now, here’s what you need to remember.

How to value if it’s a fair deal

The only way to know if you’re getting a fair deal is to get the out-the-door price from the seller and then compare that to the vehicle’s value. To get the out-the-door price follow this guide:

To know if the vehicle’s price is fair, we encourage you to run the VIN through the CarEdge vehicle valuation page and to also get a quote from Carvana to see what they would pay to buy the car right now. If the Carvana quote is close to what you are paying for the vehicle, then it’s likely a pretty fair deal.

Get a pre-purchase inspection

In today’s market, with “rougher” used cars for sale it is critically important that you get a pre-purchase inspection done on the vehicle you are thinking of purchasing. We have heard too many horror stories of people buying used cars “as-is” and then getting stuck with a piece of junk. Avoid that, and get a PPI!

Consider an extended warranty from CarEdge

Last but not least, consider getting an extended warranty on your used vehicle. CarEdge partnered with AUL Corporation to sell extended warranties with a flat markup, transparent pricing, and free consultations with an Auto Advocate. If we can help you protect your use car, we want to. More on that here: https://caredge.com/extended-warranty/ and request a free quote here: https://app.CarEdgemember.com/service-contract

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments