The end of the year is the best time to buy a new car. Each year, from Black Friday through New Years Day, automakers and dealerships alike bring out their biggest sales. Automakers are looking to prop up year-end sales numbers, while dealerships want to clear out any remaining inventory from the previous model year. For car shoppers, this is the ultimate buyer’s market. During this time, a bit of preparation can save you a lot of time and money. These are our top tips for what to do before you head to the dealership this December.

Prequalify For Your Best Rate

Dealerships have financing options, but it’s often best to shop around first. Some of the best places to look are small local banks and credit unions. They’re more likely to tailor car loan options to fit your needs. Credit unions in particular often have lower interest rates, since they are nonprofit organizations that don’t have to answer to shareholders. However, they also have eligibility requirements, such as a certain residence or employer.

Both banks and credit unions also offer prequalification—a loan offer that’s good within a certain window—so you’ll know how much you can borrow before heading to the dealership. Prequalifying gives you leverage at the dealership. When the dealership finance manager brings out their “best rate”, you’ll likely have a better offer already in your pocket that you can ask them to match or beat.

Check Your Credit Score

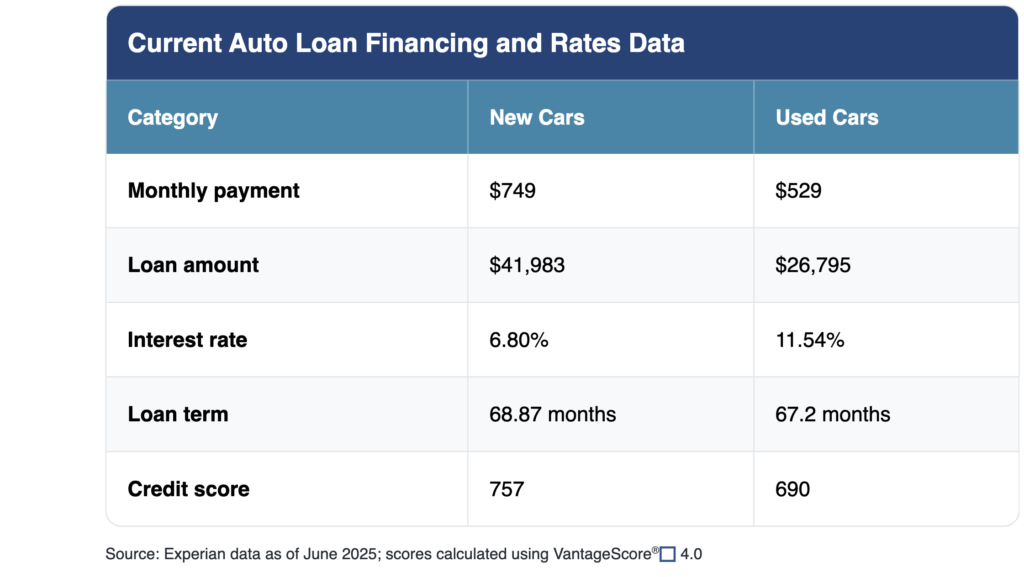

It’s always a good idea to check your credit score before car shopping. Your credit score is a major factor in what loan offers you will receive. Credit scores can be easily checked through services like Experian and CreditKarma, and while dealerships will also do this during the sales process, it’s best to verify for yourself rather than rely on what a salesperson is telling you.

Higher scores in the 700 to 800 range generally qualify for the best loan terms. For example, automakers frequently advertise 0% APR financing, but that’s usually linked to a high credit score. A lower credit score could mean a higher interest rate. If you’re in that category, paying down debt can help boost your score before you buy.

Get Your Trade-In Ready

If you’re trading in a car, it’s also a good idea to get a sense of its market value before sitting down with a salesperson. Like any business, dealers are looking to maximize profits, and when it comes to accepting trade-ins, that means buying low and selling high. Luckily, there are plenty of online tools like CarEdge, Kelley Blue Book, and Edmunds for finding the value of your used car. A dealer isn’t going to offer you market value—again, they need to leave room for profit when they resell—but it’s important to know how close their offer is.

To get the most for your trade-in, make sure your car looks and runs its best. A thorough cleaning, both inside and out, and taking care of small maintenance issues can go a long way. Dealers often deduct the cost of reconditioning from their offers, so a well-kept car helps you keep more value. Just don’t overspend — major repairs rarely add enough to the trade-in price to pay for themselves. Focus on affordable improvements that make your car look cared for and ready to drive.

Compare the Best Deals

Once you have your financing and trade-in sorted, it’s time to actually start shopping. It’s best to be proactive and look for deals rather than wait for a salesperson to tell you. Now is the perfect time to start thinking about a car purchase for December, as many automakers’ year-end deals are already in place as Black Friday specials. CarEdge’s Best Deals Hub is the perfect place to compare this month’s new car incentives.

As of this writing, we’re already seeing 42 offers of 0% financing and a few dozen leases under $250 a month. Although December is the best month to buy, if you see something you like and your finances are in order, there’s no reason to wait until next month.

When it comes time to negotiate, why not have AI do the hard part for you? CarEdge Pro is your ticket to empowered car buying. Rather have an expert handle it all? Learn more about our Car Buying Service.

The Best Time to Buy a Car Is Here

Now is the best time to score a deal on a new car or truck. Year-end deals are already being rolled out. But as with any other time of the year, a bit of preparation can go a long way. If your finances and trade-in are sorted before heading to the dealership, you’ll get better deals and a smoother buying process. When buying a car, a little bit of preparation can go a long way.

CarEdge can help. Learn how CarEdge’s team of auto experts can drive home your best deal ever with your personal Concierge, or equip yourself with the ultimate DIY car buying toolkit, CarEdge Pro.

And of course, we’ve got you covered with FREE car buying help over on YouTube, and on the CarEdge Community forum. We hope to see you there!

0 Comments