Can a car dealer charge you more than the manufactures suggested retail price (MSRP)? If you live in the United States, the answer is yes.

W,e’ll walk you through the laws that allow car dealers to sell their inventory priced over MSRP. We’ve included a bonus “craziest markups” section at the bottom of this post to give you some context as to how out of control new car pricing currently is.

In this post we’ll also give you some suggestions for how you can find dealers that are not marking their new cars over MSRP, as well as the “word tracks” you can use when trying to negotiate with a salesperson or sales manager.

Let’s dive in!

How can a car dealer charge more than MSRP?

Many goods are sold by manufacturers through their network of dealers or agents. Think about insurance as an example. Many insurance products are sold by an agent, who is simply a licensed producer that represents an insurer. Could you buy insurance directly from the insurer? Sure, some companies allow for that, but not all. Many insurance companies don’t want to have to deal with selling their own product. As strange as that sounds, it’s pretty common, and instead of selling directly to consumers they employ agents to do that for them.

The same dynamic applies in retail automotive. Can you buy a car directly from a manufacturer? Yes. Do most manufacturers not sell directly to consumers because they don’t want to deal with all that it entails? YES. The hassle of dealing with customers, plus franchise dealer laws in all 50 states make it an easy decision for automakers to leverage their dealer partners to sell cars. The exception in 2025 and beyond is with direct-to-consumer automakers like Tesla, Rivian, and Lucid.

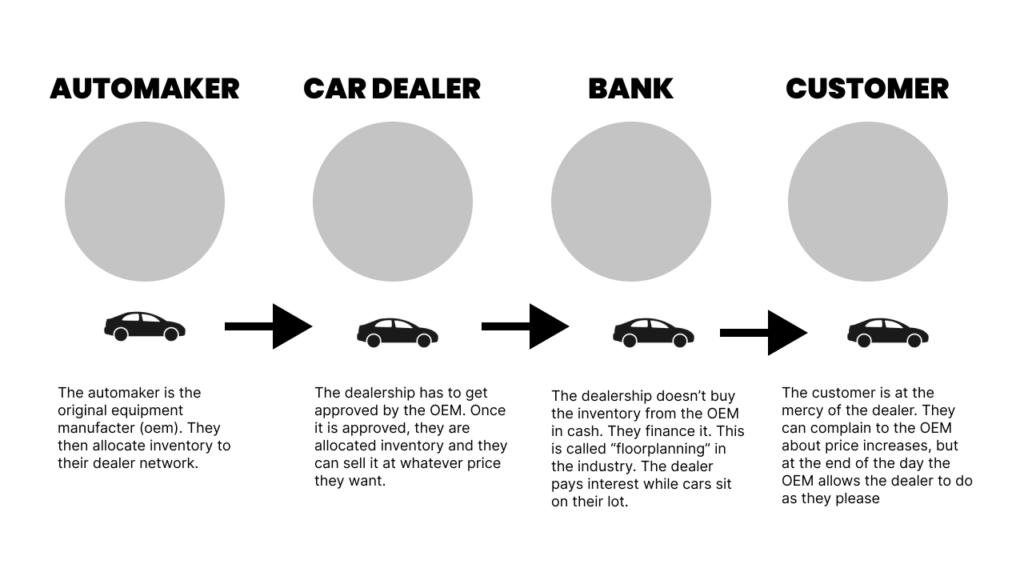

So long as most new cars are sold through dealers, the dealers will have their discretion to price their inventory however they’d like. MSRP does stand for manufacturers suggested retail price after all. At the end of the day, the franchise dealer model is simple:

The automaker is responsible for producing the vehicle. The dealer is responsible for selling the vehicle. The bank is responsible for financing the purchase of inventory for the dealer. The customer is responsible for negotiating and purchasing the vehicle.

Within the franchise agreements that dealers sign with their OEMs they do not have rules that prevent them from marking up vehicles beyond the suggested retail price. If automakers wanted to be consumer advocates and cap the price of their vehicles, they could do this by simply adding and enforcing a price cap rule with their dealer body.

This will likely never happen. Why? Because gross profit on new cars has never been higher, and automakers and dealers alike are enjoying this new reality. If automakers attempted to stop their dealers from selling above MSRP they would be picking a fight with their best customer (remember, the dealer buys the inventory from them!).

Common Add-ons & Accessories

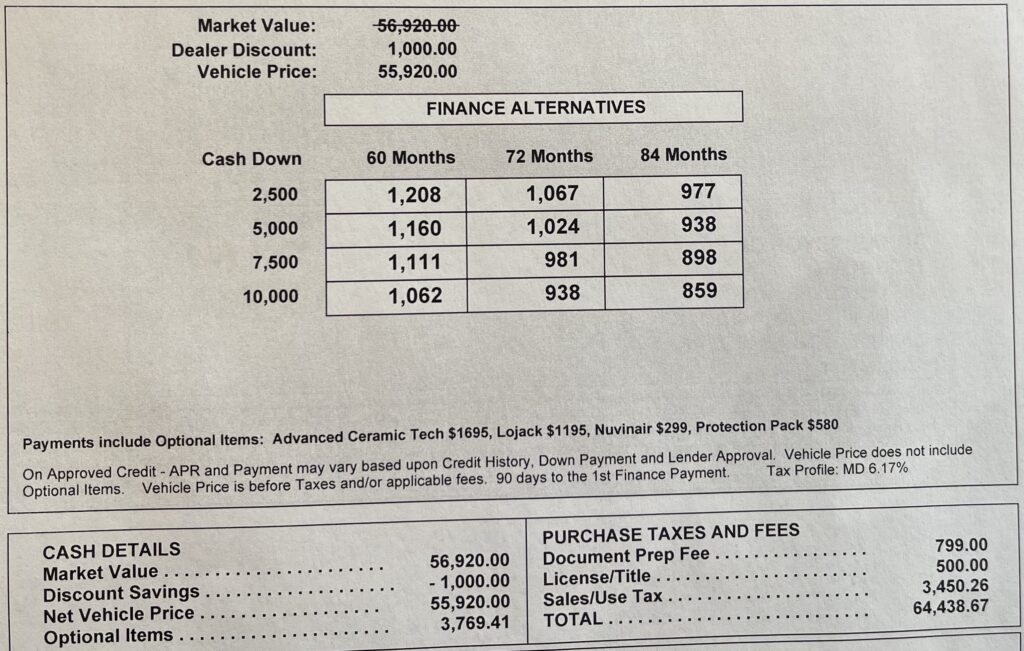

Some dealerships refuse to sell their cars for more than MSRP. That’s great. The issue is that they add all sorts of add-ons and accessories to a vehicle that you didn’t ask for. Here’s a perfect example of that from a Land Rover dealership:

In this case the dealer discounted their price by $1,000. That’s awesome! Then they added $3,769.41 in accessories and add-ons…

The accessories they added are:

- Advanced Ceramic Tech for $1,695

- Lojack for $1,195

- Nuvinair for $299

- protection Pack for $580

Our recommendation in this case (and in the current market) would be to negotiate the cost of the accessories down to the dealer’s cost. The dealership incurs a cost to their service department to install these products. That cost is likely a few hundred dollars (refer to the table below). With that in mind, you’ll want to ask for the RO (repair order) they issued for the installation of the accessories.

| Item | Cost to Dealer | Retail Price | Dealer profit |

| Interior protection | $50 | $500 | $450 |

| Paint protection | $100 | $850 | $750 |

| Undercoating | $200 | $700 | $500 |

| Rustproofing | $50 | $800 | $750 |

| Car alarm | $300 | $800 | $500 |

| VIN etching | $75 | $400 | $325 |

| Lojack | $325 | $1,000 | $675 |

| Nitrogen-filled tires | $35 | $250 | $215 |

| Window tinting | $25 | $300 | $275 |

Additional Dealer Markup

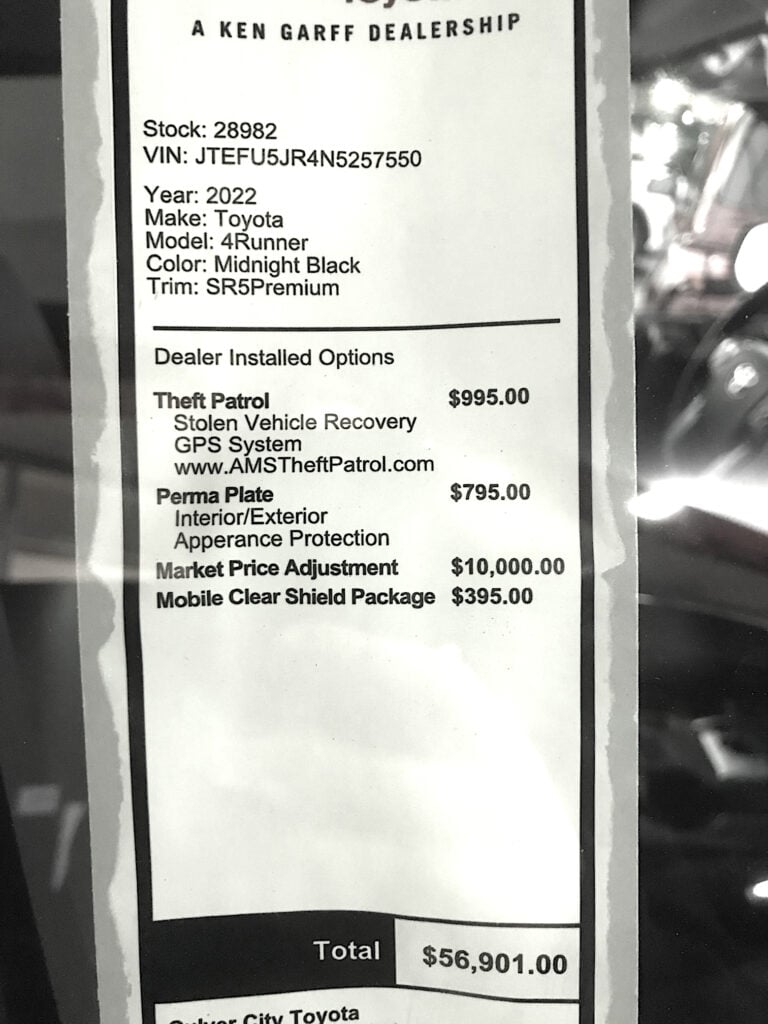

Many car dealerships are selling their new cars above MSRP, and they aren’t shy about it. Every new car comes with a window sticker, also known as a Monroney Label. Many dealers are adding additional stickers to new cars with their additional dealer markup. Here’s an example:

In this case the dealership added both add-ons (Theft Patrol, Perma Plate, and Mobile Clear Shield Package), and a “Market Price Adjustment” of $10,000. The market adjustment is additional dealer markup. You get nothing in exchange for having paid an additional $10,000. It is pure profit for the dealership.

How to negotiate when the car is over MSRP

What can you do when a new car is for sale over MSRP? How can you negotiate a lower price? Well, as always, remember “if it’s taxable, it’s negotiable.” That means if it’s taxed on the bill of sale, you can negotiate its price.

As a refresher, here are the fees that you can and cannot negotiate on.

When it comes to additional dealer markup and add-ons we encourage you to not settle for what the dealer is asking for. Dig your heels in a bit and try and get some money back in your pocket. Just because they are asking for $10,000 in additional markup doesn’t mean they won’t accept $5,000.

If the dealer is adamant about their pricing and won’t budge, consider factory ordering a new vehicle. When you factory order you can get a legally binding signed buyers order for the agreed upon selling price at the time you place the order.

CarEdge Can Help

If you found this article helpful, you’ll love what we have in store for you at CarEdge. From free car buying guides to expert negotiation help, we’re proud to make car buying easy for every shopper. Check us out!

“We’ve included a bonus “craziest markups” section at the bottom of this post to give you some context as to how out of control new car pricing currently is.

In this post we’ll also give you some suggestions for how you can find dealers that are not marking their new cars over MSRP, as well as the “word tracks” you can use when trying to negotiate with a salesperson or sales manager.“

I don’t see these things addressed in this post. Am I just missing it?

Carl, I forgot to copy that section over from my doc to the post! Ah! I will update soon. Thank you, thank you!

Hello gentlemen,

I am in the market to buy the new Lexus IS 500. I am a current owner of the isf and love my car. However, this is the last of the is f sports 500 series and 1 of 500 made for USA and I really would like to own one. I called the dealerships to find out about ordering one and they all are giving me insane markups upwards of 20k. I can afford to pay cash for it the vin is JTHUP1D29N5001347 . But that markup is unbelievable, can I work this out to get in the car I desire or should I make a choice to take the L and go with the base model.

Base model will likely mean less additional dealer mark up …

Good Deal

I don’t have to read this article to tell you, you’re full of it. There’s no bank in the nation that would lend a buyer more than MSRP, unless it was some rare exotic. The bank would at the least want the buyer to, at the least, put down the amount over MSRP. Also good luck finding an insurance company to insure the vehicle above what the current car’s value is at the time of purchase. I understand the concept of supply and demand. But charging 20k over MSRP for regular sedan is ludicrous. In two to three years, when this so called chip shortage is over. I’d like to see what that car would be worth then.

You answered your own question here at least partially. the bank will merely require a larger down payment, just as they do in this crazy housing market when the house does not appraise for the selling price. As far as insurance, that’s an interesting question. I know you can find insurance set at a higher than normal value – I have it on my 1990 Nissan TT which is modified and cherry from top to bottom. Not at all sure how that works with a new car though.

Ok, I have disagree with there logic. First of all, its all up to the judge, not a journalist. One might argue in court. that the practice never was done up until nation pandemic. So there first hand proof of price gauging. this is no different than a hurricane hitting florida and some store owner is charging $10 for a gallon of water. I AJ charging companies all the time. Do never say never. IF that dealer always marked up their cars above MSRP then there is no case. but to take advantage because of national disaster such Covid , pandemic, I say its in the gray area. YOu just got to find the right lawyer that wants to make a name for themself. Ive been calling around trying to get a class action going. You need to have proof that you actually where in the market and the dealer was price gauging. So get copies of sales quote. Never know

sorry for grammar , i didnt proof read.

I’m looking into that as well. It seems to me, if they’re not listing these market adjustments included in the price on their ads, it’s just a bait & switch. The dealership I went to advertises one price on Cars.com, then acts like they had no idea the “wrong” price was there. Told me Cars.com sets the price. I contacted Cars.com, and of course that was complete BS. I’m trying to get some kind of resolution on the add-ons I never authorized, but am likely stuck with the crappy deal.

This is in complete violation of consumer protection laws in most all states. The only way to collect

is to buy the car and sue for the premium, at that point you have damages…. the violation is you are not

allowed to advertise a car for for a price you do not intent on sell it at ! You most disclose the add on up front in advertising not not at the sales table ! ….. I know I sued , I won !

Hello Collins… how & what type of lawyer do you recommend. I just got myself bait & switch.

I was in the market for a Kia EX sportage hybrid with upgrade moonroof package. I called around and MSRP Price is 34-36k. I called a dealer who had the exact car and asked the sell price he said it $34k. When i got there i test drive car and then started the game of what monthly payment, loan rates, down payment etc.

They ran my credit to see if i qualify for the loan (which i knew i do 800 credit score & i had a 10k down payment) then they bring the Sales Manager

He comes up the real sale price $36 plus a 5k adjudtment price. Long story shorter… after going back forth, with me saying i did not want to pay for 5k adjustment price.. he started to pressure or convince me that he could lower the interest rate to offset the 5k ajustment and meet my monthly desire payment, bait & switch complete.

I fell for it , it sounded good at that time. But after going thru the agreement after i got home i realize my big mistake. With the 5k adjustment price and loan rate i will end up paying close to 10k more for same car at other dealers with out the price adjustment.

Total price of car would be 53k.

Buyers remorse 😒😬

I was put into a horrible position by a dealership. But I’m here to talk about price gouging. The dealership Raised the MSRP up 5k. Me not knowing bought it. The next day I told them that they tricked me into a car I didn’t want. I was within the 3 day return policy and they still would not allow me it. But I could trade it in for the car I should got. This dealership is corrupt. They then had the MSRP at the new car price 5k lower. Someone bought it 2 months later and along with my 8k of extras on it. I pulled the history report and they bought it for the new car price. This is price gouging. What they did to me they should be fired!

The sticker on the window is an advertised price and some states like Florida it is illegal to add unlisted charges, other than certain exceptions, to the sticker price. In Fl these Covid mark ups of 30 to 45 percent ARE ILLEGAL.

North Carolina. Renville Nissan charged us -+ $9, 000 more then the list price on winow paper plus said would give us $4,000 for our 2005 Nissan truc for a Nissan 2022 truck..because 2005 Nissan truck it had a crack in radiator which went into transmission not knowing if was in motor cost plus labor be $7,000 to $10,000. We were in a hard spot being with out a vechile. Then we feel like been took advance blaming this is inflation when it’s to me dealership wanting MORE MONEY.

My daughter is buying a car. The Salesmen from South County Lexus in South Orange County, CA, lets her know, after we get to the dealer, that the offer he made her on her phone, now has a $15,000 premium. We leave. I figure I’ll go through my American First Credit Union car buying program and obtain a Member Certificate.

First,I find the Autosafe website and obtain the Member Certificate for all of the 2022 Lexus NX 450h vehicles. They are all around the same price on the website comparatively. I utilize the “Contact Button” to send my information to each dealership that I’m interested in purchasing the Lexus 2022 NX 450h.

Westminster Lexus is the first to call me. I ask Eddie a few questions about the vehicle and that I’m going through the American First Credit Union to obtain the MSRP for the vehicle. Eddie tells me that there is no guarantee of the price, only that I might receive a loan from the American First Credit Union. So I ask Eddie if there is a premium and he says, “Yes, $20,000.” I said, “No, Thank You”.

I then proceeded to notify Autosafe of my experience. I was notified of a Case Number in an Autosafe e-mail and then contacted by an Autosafe representative. The representative asked me if I had information on whom I spoke with and did I have the Member Certificate of the vehicle. I do. I sent him everything.

I then received an e-mail from Eddie saying he might be able to lower the price down $2,500 or $3,500. I responded with an e-mail to he and his assistant, Olivia, basically stating this is a terrible business practice for a dealership to exploit consumers based on demand.

Today I wrote an email, as well, to the GM from this same Westminster Lexus dealership regarding the same sentiment.

Today I contacted a Salesman in El Cajon, San Diego, CA, stating I would like to buy this same vehicle as they have two on the Autosafe Website available. He responded about a different vehicle but no response on the NX. I notified him I would not be paying Premiums. I guess that’s why I haven’t heard back.

Today I also contacted Autoland. They had a salesman contact me from South Bay Lexus. That dealership has a $10,000 premium. He, at least, suggested we wait one to three months.

I went back to the Autosafe website to locate other dealerships that might be interested and all but one, have now removed the MSRP on the Member Certificate and say to Contact Dealer for a Price. Wow, news travels fast.

I read your article regarding this predatory behavior and watched the YouTube video. At least we’re not alone in this but, Wow. My biggest concern is “Buyer Beware.” We weren’t aware of this “premium,” until now, and I am concerned that people will have these premiums buried in those long contracts, with fine print and lots of lines. I’m disgusted.

Sincerely, Therese Cloughen

https://amerfirst.cudlautosmart.com/Vehicle/Details/121210825?itemViewSource=SRP

I ordered a car that finally came in yesterday. I bought a used 2019 c43 mag that was sold as a cpo with 2 accidents that they didn’t disclose the amount of damage just had us initial that we were told and that what I paid for that car they would put towards the car I pre ordered that came in yesterday. To my surprise they not only refused to give me the full purchase price but they also added 15k to the new 2022 c43 amg. I had to put an additional 24k to lower my payments. I was in shock. No one told me about it until I caught it in the agreement. I have my original purchase order for 74k. I’m sick to my stomach. Is this legal? They also refused to finance it with Mercedes Benz which has financed 3 vehicles for me. The interest rate they wanted to also hit me with was 5%.. is this legal? I’ve spent every dollar I had and I told them I couldn’t afford it. They told me someone was buying the car on Monday early in the morning to force me into their terms. I wanted to go through my bank and call Mercedes Benz to see if I could order directly from their site. Is there anything I can do at this point?

Wowza … If you don’t feel comfortable with the amount you spent, then I would encourage you to contact the dealer and see if they’ll let you “unwind” the deal.

Just FYI in the United Kingdom it’s illegal for a dealer to sell new cars for higher than list price. Due to the chip shortage and delivery times sometimes stretching to over a year for even regular family cars the price of pre-owned vehicles is often higher than new!

Hi CarEdge! First off, you guys are great; thank you for what you’re doing!

My question: my factory ordered vehicle just arrived (Ford Transit) and now the dealership is trying to charge me an additional $3k in a Market Adjustment just because the market is so hot. Although the Sales Manager and I signed the Buyers Guide in Nov 2021, they are trying to charge the additional MA anyway. In leu of the MA, they have offered 2 different protection and maintenance packages, but I don’t want either and both add additional cost to the agreed upon Buyers Guide amount. Additionally, the color of the vehicle is wrong, its missing extended side mirrors (came with short), has wiring still needing connected for the added high interface fuse panel (they said its supposed to be left floating for my upfitting later), tow haul wiring isn’t complete, missing hitch and ball, etc.. Furthermore, nor the factory or dealership notified me of it being built or shipped providing me enough time to collect auto loans from my banks, they said the plant was closed and didn’t know when it would re-open, and then boom “its here”. And now they’re telling me I have 48 hours to sign for the vehicle (prior to loan agreements).

What can I do to not be charged the added MA by the dealership? I’m considering taking this to my lawyer, but unsure if that struggle is worth the $3k.

Please help, I’m going back to the dealership today!

Gratefully,

Brett

Brett, this sounds like an instance where you need to contact your states attorney general and file a complaint. That would be the best thing to do at this point, sadly.