When you’re buying a car, one of the biggest decisions you need to make is how much money to put down. The down payment you make can have a significant impact on your monthly car payment, interest rate, and the overall cost of your loan. In this article, we’ll provide expert advice from CarEdge’s Ray Shefska and break down everything you need to know about choosing the right down payment for your budget.

How Much Should You Put Down on a Car?

The down payment is the initial payment you make on a car, and it has a significant impact on the overall cost of your car. In this section, we’ll discuss the reasons why the down payment matters, including how it affects your monthly payments, interest rates, and loan terms.

CarEdge’s Ray Shefska shared this wisdom and advice: “I think that in today’s market the minimum down payment should be 20% of the total out-the-door price and if possible, upwards of 30%. That way, you have at least covered your taxes, tags, and doc fees, with some applied to the principal. Even with 20% down, I think that it still makes sense to look at GAP insurance, especially on a used car or a new car with a market adjustment.”

The credit bureau Experian says a 20% down payment might help shield you from depreciation. Depreciation refers to the ever-shrinking value of your car. The value of a new car declines about 20% in just the first year. Try out our depreciation calculator for the make and model you’re in the market for.

What does that look like in a real world example? It depends on the price of the car you’re thinking about buying. A 20% down payment for a $20,000 car is $4,000, but a 20% payment for a $60,000 car is $12,000. The monthly payments for each of these scenarios would be vastly different, despite having the same down payment percentage. More on that later.

The Average Down Payment on Cars

The average down payment on a car varies depending on whether it’s a new or used car. We’ll look at the latest data to see what the average down payment is today. We’ll also discuss why putting down a larger down payment can help protect you from depreciation.

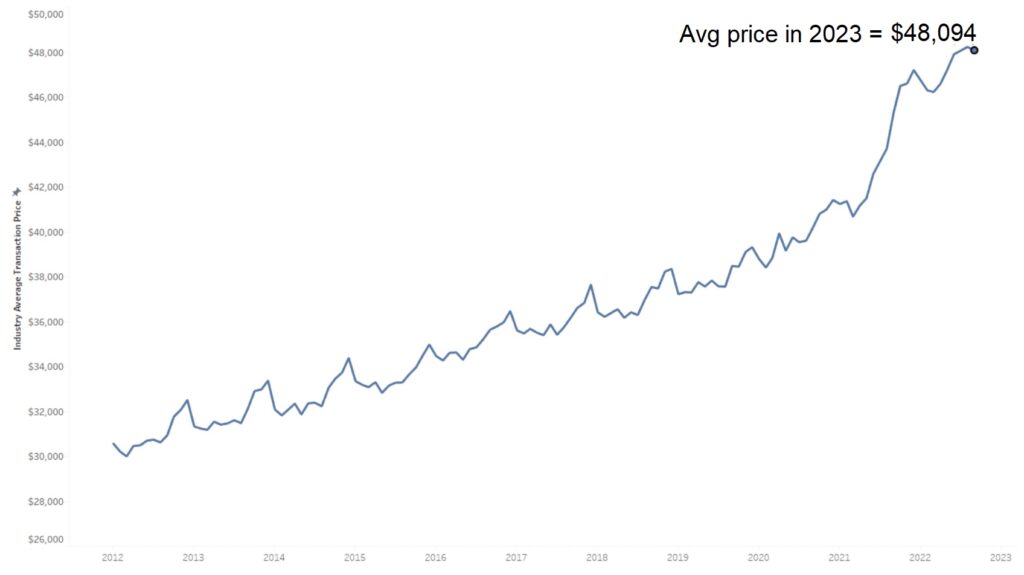

In 2022, the average down payment on a new vehicle was just over $6,000, according to Edmunds. This is an increase of 27 percent from 2021, and is the highest it has ever been. The average down payment on used vehicles was $3,574 in 2022. For both new and used cars, the average down payment in 2022 was far below the recommended 20%. This partly explains why the average monthly payment for a new car is above $700/month in 2023. Over 15% of new car buyers pay over $1,000 a month, not including insurance or fuel.

Financing: Loan Rates and Down Payments

The down payment amount can have a significant impact on financing. A larger down payment lowers the amount financed, which means a lower monthly payment and less interest paid over the life of the loan. It can also reduce the risk of being upside down on the loan. You don’t want to be end up owing more than the car is worth. On the other hand, a smaller down payment may lead to higher monthly payments and more interest paid over the life of the loan. It’s important to find the right balance between a down payment that fits your budget and financing that makes sense for you.

Auto loan rates are at a 14-year high. When your loan has a higher interest rate, you will avoid hundreds or even thousands of dollars in interest payments by making a larger down payment. Another option is to refinance to a lower rate as soon as possible. In many cases, by putting a few hundred more dollars down today, you’re saving much more in interest over the loan term.

According to the latest data from NerdWallet, the average auto loan rate in March 2023 is 6.07% for new cars and 10.26% for used cars. Borrowers with low credit scores qualify for even higher auto loan rates.

Down Payment Example: Monthly Car Payments Based on Down Payment for a $35,000 Car

To better understand how your down payment affects your monthly car payments, we’ve created a table based on a used SUV priced at $35,000. Use this table as a guide to help you make an informed decision when buying a car and choosing a down payment amount.

You can see that with a higher down payment, your loan amount decreases, and your monthly payment drops substantially.

What about interest? If you finance the FULL $35,000 in this example, you’d pay $6,088 in total interest over 60 months. However, if you put $10,000 down, you’re paying $4,300 in interest. The numbers don’t lie: a higher down payment will save you in the long run.

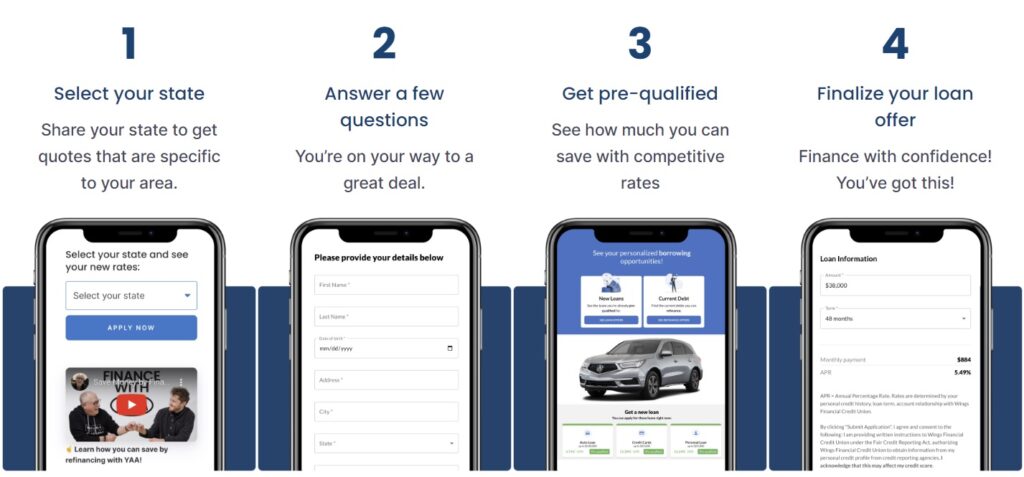

Financing with a Credit Union

Why should you finance with a credit union? Credit unions offer the best rates, helping you save money for years to come. They offer lower rates than banks, have no hidden fees, and are known for their personal approach to customer service. Work with a CarEdge-approved credit union for the best rates. Drive your dream car at a rate you can afford.

We’re Here to Help

We’ve got tools that empower you to make smarter car buying decisions. From the industry’s best car buying data package to CarEdge Concierge, we’ve got options to suit every driver and budget. CarEdge Coaches are here to help guide you through the car buying process. Our team of expert coaches is dedicated to providing personalized advice and support to help you save money and avoid costly mistakes. With CarEdge Coach, you’ll have access to one-on-one guidance from experienced professionals who understand the car buying process inside and out. Prefer a DIY experience? CarEdge Data is the perfect toolkit for you. Whether you have questions about financing options, down payment amounts, or negotiating with a dealership, we’re here to help you make informed decisions and achieve your car buying goals.

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

I have problems with the statement “ In some cases, by putting a few hundred more dollars down today, you’re saving a few thousand dollars in interest over the loan term.”

The overall message of the article remains true but this statement is, as far as I can tell, misleading or false. This statement might be true on the very edge cases of car loans – but those wouldn’t be relevant to 99% of people. I think these kind of statements, which can have an impact on people when they go shopping, need to be backed by the example of loan terms the writer used (if any?). The readers can see if that scenario is even relevant to their expected terms.

Thanks for the feedback Matt. I adjust the text to ensure we’re not misleading anyone. You’re right, for it to be that large of an impact, the interest rate would need to be above average. Still, it’s true that putting hundreds more down when purchasing will save drivers money in the long run. Thanks!