Is all the talk of inflation giving car dealers and automakers an excuse to raise car prices even further? While that would be pure speculation, we do know that a new vehicle now costs more than ever before. New data from Cox Automotive/Moody’s Analytics reveals that just a few weeks after a previous record high was reached, new car prices have forced monthly auto payments to new heights. How high will new car prices climb? Is this simply a new normal that we have to accept? Here’s what the data tell us.

New Vehicle Affordability Declines on Low Inventory

The new report from Cox Automotive and Moody’s Analytics is disheartening to say the least. Today’s out-of-control car prices can be summarized by one statistic: In June, the estimated number of weeks of median income needed to purchase the average new vehicle was up 17% from last year. Median incomes have risen slightly, but rising new car prices have far outpaced income.

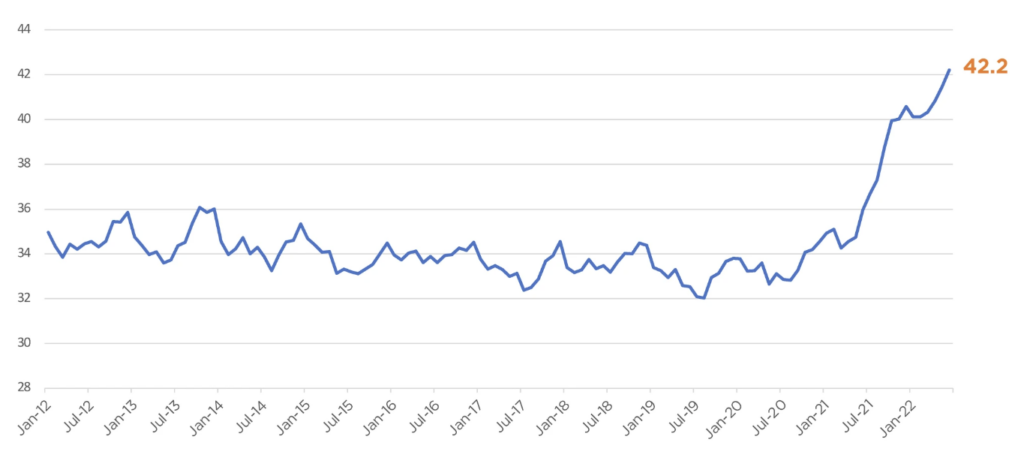

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is driven by the consumer’s vehicle transaction prices, the income of the consumer, amount financed by the consumer, and the interest rate provided by the lender. The result is a value that represents the number of weeks of the median household income in America that would be needed to buy the average new vehicle.

The number of median weeks of income needed to purchase the average new vehicle in June increased to 42.2 weeks from 41.5 weeks in May. This is an all-time high that reflects the predicament that consumers needing a car find themselves in. From May to June 2022, median income grew 0.3% at the same time that new car transaction prices increased 1.6%.

The estimated average monthly payment increased 2.2% to $730, which is a new record high. A new car monthly payment now costs as much as rent in many parts of the country. We’re seeing more and more car payments over $1,000 a month.

Rising Interest Rates Worsen Vehicle Affordability

Gone are the days of zero percent financing. As the Federal Reserve continues to raise interest rates to combat inflation, borrowing money becomes more expensive for everyone from the banks to the consumer. From May to June of 2022, the average auto interest rate increased another 8 basis points.

Higher interest rates affect luxury car buyers and those who put little money down the most. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term. Interest rates are a big part of car buying, and they remain dynamic as our economy traverses ups and downs.

Manufacturer Incentives Decline to Record Lows When Buyers Need Them Most

Why would automakers offer new car incentives when demand far exceeds supply? To be nice to the consumer? We could only hope for such benevolence from OEMs, but we know that’s not how big business works.

New car incentives are down 59% in just 12 months as supply chain problems squeeze new vehicle inventory to record lows that have struggled to climb back. In the second quarter of 2022, incentives averaged $1,228 industry-wide. That’s a 59% drop year-over-year.

| Q2 2022* | Q1 2022 | QoQ change | Q2 2021 | YoY change | |

|---|---|---|---|---|---|

| BMW | $1,206 | $2,358 | -49% | $4,713 | -74% |

| Daimler | $1,257 | $2,012 | -38% | $3,574 | -65% |

| Ford | $1,193 | $1,824 | -35% | $2,567 | -54% |

| General Motors | $1,847 | $1,974 | -6.40% | $4,399 | -58% |

| Honda | $818 | $1,163 | -30% | $2,167 | -62% |

| Hyundai | $620 | $890 | -30% | $2,102 | -71% |

| Kia | $650 | $1,260 | -48% | $2,549 | -75% |

| Nissan | $1,501 | $1,848 | -19% | $3,502 | -57% |

| Stellantis | $1,893 | $2,413 | -22% | $3,522 | -46% |

| Subaru | $753 | $901 | -17% | $1,339 | -44% |

| Toyota | $803 | $1,025 | -22% | $2,219 | -64% |

| Volkswagen Group | $1,169 | $1,769 | -34% | $3,730 | -69% |

| Industry | $1,228 | $1,631 | -25% | $3,003 | -59% |

Until more cars are sitting on dealer lots, there simply won’t be any reason for manufacturers to offer more new car incentives to buyers. Here’s more of our coverage on manufacturer incentives.

New Car Inventory Remains Low, and That Needs to Change

In January of 2020, the industry’s average was 82 days’ supply. By early 2021, that figure had fallen to 66, but it would soon plummet as the chip shortage lasted longer than most expected. In July of 2022, new car inventory is slim with just 21 days’ supply.

Subaru, Mazda, Volvo, Kia and Hyundai have had the lowest new car inventory, and therefore have had the least incentives for buyers. See the latest new car inventory numbers.

A Silver Lining: Used Car Prices Are Going Down

For three consecutive weeks, used car prices have declined at wholesale auctions. This leading indicator suggests that relief may be on the way for consumers in desperate need of a more affordable option. In fact, only full-size vans appreciated last week. All other vehicle segments have seen prices decline at the used wholesale level.

Will used car prices continue to decline? It all depends on new car inventory. When there are more cars on dealer lots, used cars will lose value, and may ultimately come back down to Earth from record highs. This is something to bear in mind if you’re thinking about buying a used car at today’s inflated prices.

CarEdge tracks used car prices with weekly updates. See used car price updates here.

The FTC’s Comment Period Is NOW OPEN. Make Your Voice Heard!

The U.S. Federal Trade Commission is proposing new regulations that would ban anti-consumer sales tactics notoriously common in the auto industry. These shady practices include..

- Bait-and-switch pricing

- Forced add-ons

- Poor F&I disclosures

- Discrimination against cash buyers

Car dealer lobbyists are NOT HAPPY about this set of proposed regulations! We the consumers have until September 12, 2022 to leave a comment in support of these common sense regulations. Find out how YOU can make your voice heard here. We must fight back against powerful dealers!

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments