It’s a new year, but car buyers are still facing some of the same challenges. In 2024, the dilemma of choosing between a new or used car is influenced by several factors, including depreciation rates, interest rates, price trends, and the lingering effects of the pandemic. Let’s break down what you need to know to make the best decision in 2024.

Key Takeaways:

- For most buyers in 2024, new car deals are more sensible due to lower financing costs and attractive incentives.

- Used car prices are declining but remain high, affected by the pandemic’s long-term impact on production.

- New cars offer appealing financial advantages with low APR offers and manufacturer incentives, despite their higher initial cost.

- The choice between new and used cars depends on individual financial situations and long-term vehicle ownership plans.

- Free resources are available to guide money-conscious drivers through car buying decisions.

Buy New in 2024, But Risk Depreciation

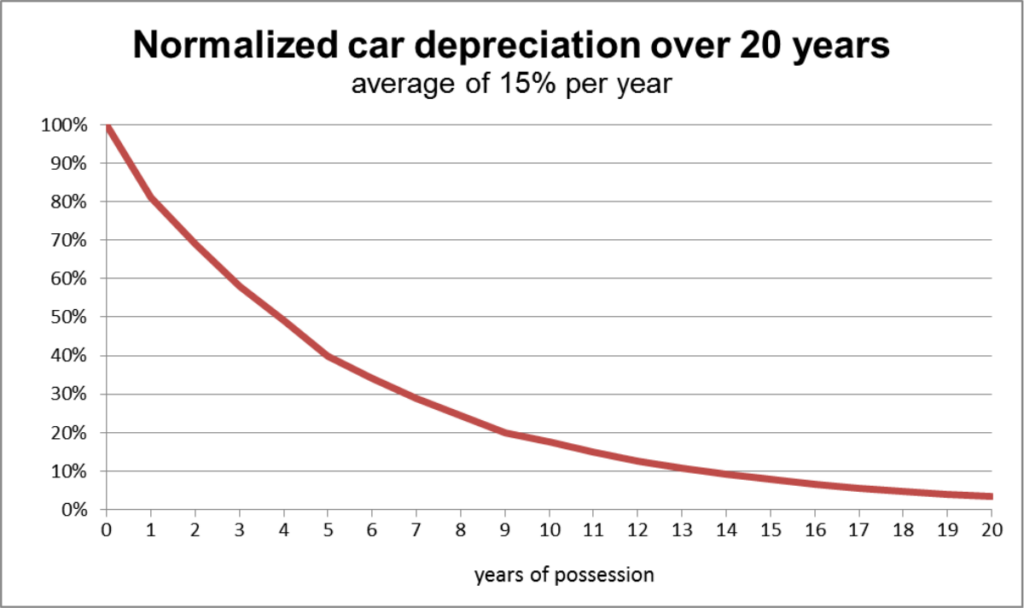

The automotive landscape has seen dramatic shifts in trade-in and resale values over the past few years. In 2024, a trend that began last year is continuing: used car prices are declining in wholesale markets, impacting trade-in values significantly. The era of purchasing a new car and flipping it for profit is over. Instead, we’re returning to the traditional pattern where new cars lose a substantial portion of their value as soon as they leave the dealership.

Interest Rates Matter – New Cars Have Much Lower APRs

This year, expect to see an uptick in subvented rates from captive lenders, as new car sales decelerate. Low APR offers are here to stay in 2024. Manufacturers are increasingly offering incentives to clear inventory, including surprising zero percent financing deals available in January. Despite stable interest rates, the high cost of loans remains a critical factor in the car market. Consequently, we anticipate a larger share of new car loans will be sourced through captive lenders like Hyundai Motor Finance, Ford Credit, and Toyota Financial Services.

Towards the end of 2023, data from Cox Automotive showed an uptick in 0% APR offers. We expect this trend to continue into 2024.

With the average used car loan rate now north of 13% APR, plenty of used car shoppers are checking out new car offerings to simply pay less interest.

Check out the best APR offers this month

Finally, Fair Prices Are Within Reach For New Cars

Don’t pay dealer markups for any vehicle in 2024. No matter what the salesperson might tell you, we’re firmly in a buyer’s market. This isn’t 2022’s car market anymore.

After consecutive years of rising MSRPs, the tide is turning in 2024. Although prices for the latest models have increased for the 2024 model year, we don’t foresee this trend continuing once 2025 model pricing is announced.

Resistance to high prices is growing among consumers, evident in slowing sales and increasing inventory, particularly for expensive cars, SUVs, and trucks. This resistance is gradually influencing the used car market as well.

These 2023 models have the most remaining inventory, and high negotiability

Used Car Prices Trending Downward, But Remain High

Used-car wholesale prices have given up 53% of their pandemic gains. However, wholesale markets are largely off limits to the average car buyer. Unfortunately, this drop is less pronounced in retail prices. According to the Consumer Price Index, retail used car prices have given up just 36% of the pandemic price spike two years later. Retail used car prices are down 12.6% from the July 2022 highs.

Why are used car prices still high in 2024?

The auto market is still feeling the lasting effects of the pandemic-induced semiconductor chip shortage. Pandemic-related factory shutdowns resulted in 16 million vehicles never being produced. These missing vehicles contribute to a global shortage of used cars, expected to last until at least the late 2020s. Ray Shefska of CarEdge predicts a return to normalcy in the used car market might not occur until 2030.

In 2024, used car prices will continue their gradual decline, influenced by high interest rates deterring potential buyers. With new car loan rates exceeding 13% APR, a 20-year high, many buyers are turning away from used cars in favor of new vehicles with more attractive financing options. Indeed, new car deals make more sense for many buyers in 2024.

In 2024, the Details Matter For Car Buyers

2024 presents a nuanced picture for car buyers. While new cars offer more favorable financing options and the appeal of owning a brand-new vehicle, they also come with the risk of rapid depreciation and of course, higher prices.

On the other hand, used cars, although more affordable, are still priced relatively high due to market shortages years ago. Ultimately, the decision depends on individual priorities, financial situations, and long-term plans for vehicle ownership.

Free Car Buying Help Is Here

Ready to outsmart the dealerships? We have FREE resources for new and used car buyers alike. Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments