Stepping into a car dealership can feel like entering a high-stakes poker game, but with the right guidance, you can confidently call their bluff. CarEdge’s Ray Shefska lifts the veil on dealership tactics with secrets from his impressive 40+ year tenure in the industry. While maximizing profits is part of their playbook, you don’t have to be an unwitting participant. Here’s how you can outsmart the car dealership sales team

Part One: Negotiating with the Salesperson

- “Do you have a monthly budget in mind?“

Correct answer: I have a total out-the-door price in mind. I’d like to stay focused on that.

Wrong answer: Yes, I don’t want my monthly payment to be more than $700 per month.

Why: Once the dealer knows what your monthly payment goal is, they immediately start thinking about how much wiggle room they have for add-on products, incentives and other odds and ends of the deal. Once you share your desired monthly payment, you’ll be negotiating that number for the rest of the deal. This makes it alarmingly easy to lose sight of how much you’re actually paying for the car.

- “How much cash do you plan to put down?“

Correct answer: I just want to know what the out-the-door number is, can we stay focused on that for now?

Wrong answer: I think I could put between $5,000 and $10,000 down. It depends on what the price of the car is, and how much you give me for the trade-in.

Why: This question is another tactic the salesperson uses to turn you into a ‘payment buyer’. Yes, you’ll eventually have to tell them what your down payment is, but do NOT volunteer that information too early in the negotiation! Car dealership salespeople are going to.

Note: Often, the salesperson will phrase this question as if it’s coming from the bank. For example, “The bank typically wants you to put 20% cash down or more. Were you planning on doing that?” You can still refuse to answer this question early on in the conversation. Remember, you’re still trying to get the out-the-door price from them. That’s the number that matters.

- “I see you drove a nice car here today. Will you have a trade in?“

Correct answer: I haven’t decided yet. Once we’ve established an out-the-door number, we can discuss things like that.

Wrong answer: Yes of course, how much can you give me for it?

Why: You should always treat buying a car and trading in as TWO separate transactions, because they truly are. See what your car is worth with offers from multiple online buyers here.

Part Two: The Finance Office

These are the questions you’re most likely to encounter at the finance office. For even more tips, examples and advice, see our Finance Office Cheat Sheet. It’s one of our many free resources!

- “Have you thought about what loan term you’d be happy with?“

Correct answer: I have thought about this and I’ve even been pre-approved with competitive credit unions, so I do understand what my loan terms should be in order to keep my payment affordable.

Wrong answer: No, I haven’t thought about it yet. Can you help me lower my payment even further?

Why: When you express uncertainty about your desired loan term, finance managers spot an opportunity to manipulate the loan term to make a deal appear more attractive. By extending the loan term, they can “lower” your monthly payments, even if it ends up costing you more in the long run due to interest.

- “Would you consider financing with us?“

Correct answer: Yes, if you can beat the rate I have on my pre-approval from the credit union, I’d consider it. The rate and the payment would need to come down enough to justify it.

Wrong answer: Sure! That sounds easier.

Why: Be sure to mention that your payment would need to come down in addition to getting a lower interest rate. Why? All too often, the finance manager can offer you a slightly lower interest rate, only to trick you into add-on products later, meaning that your monthly payment ends up the same or even higher than it was originally.

- “Here’s our menu of products. Let’s talk monthly payments!”

Are you interested in our tire care package for just $6 per month? Or theft protection for just $10 per month?

Correct answer: Thanks, but for each of these products, I need to see the total cost of the product, not just the monthly payment.

Wrong answer: Awesome, wow I see that this theft protection only adds $10 per month!

Why: Expect them to show you the monthly payment, not the total price of the products on their menu. You’ll have to ask for them to point out the total price. Remember this: A product that adds ‘just’ $10 to your monthly car payment over a 60-month loan term will actually cost you $600.

Would you pay $600 for something like tire protection or theft protection? Or, could you buy these products elsewhere for half the price? This is how you should think about the menu products.

The finance office is not the time to lose sight of the number that matters: the out-the-door price!

Your Guide to Car Dealer Fees: What’s legit, and what’s not?

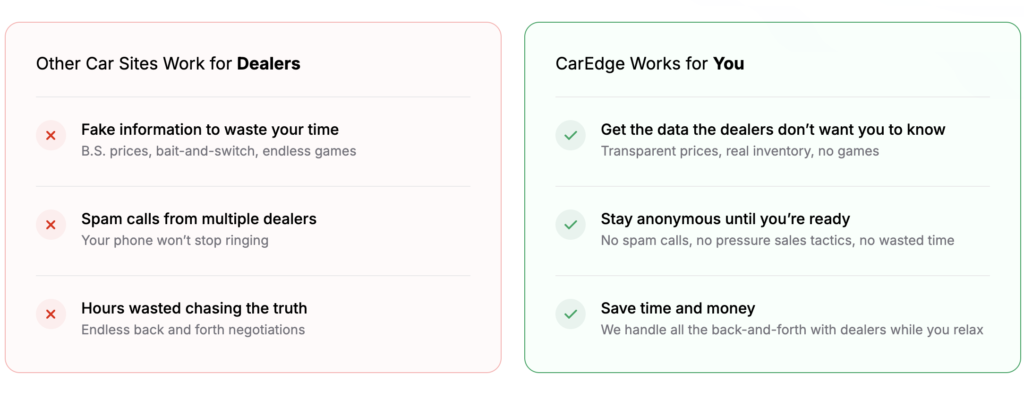

No-Hassle Car Buying Is Here!

Ready to outsmart the dealerships? Our seasoned experts will 1) find the car you’re looking for, 2) negotiate your deal, from start to finish, 3) arrange the paperwork so you just sign on the dotted line. Want home delivery? We can do that too!

Here’s how CarEdge Concierge works.

Remember that when buying or leasing a car, knowledge is power!

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

0 Comments