It is officially safe to declare; used car prices are finally going down. Finally, we’re seeing a clear trend emerge in used car prices. Now is the time to sell a car (as we’ve seen five weeks in a row of used car price declines and trade-in values will likely drop over the coming weeks), and patience is still required if you’re looking to buy a used car (wait a few more weeks, we expect prices to decline even more).

Thanks to data from Black Book, Cox Automotive, financial institutions, and the experiences of our community, we now have enough data to feel confident in saying that used car prices are going down, and that they will continue to fall. For car buyers, patience is more important than ever. If you’re in the market to buy a car, wait a few more weeks for a better deal.

Let’s dig into what’s happening in the market, and how you can time your sale or purchase.

Five Weeks of Declines: Used Car Prices Are Going Down

In 2021 we witnessed the unthinkable; used car values appreciated more than 40%. During the first quarter of 2022, we saw used car prices drop nearly 5% on the wholesale markets. By the time spring rolled around, we experienced another increase in wholesale used car prices, canceling out those previous declines.

While the wholesale market rose and fell, retail used car prices have remained high during the first half of 2022. Consequently, the average monthly car payment is over $700.

As we settle into summer, we’ve now seen five consecutive weeks of overall market softening. For the first time since the pandemic lows of 2020, used car prices are going down across all market segments.

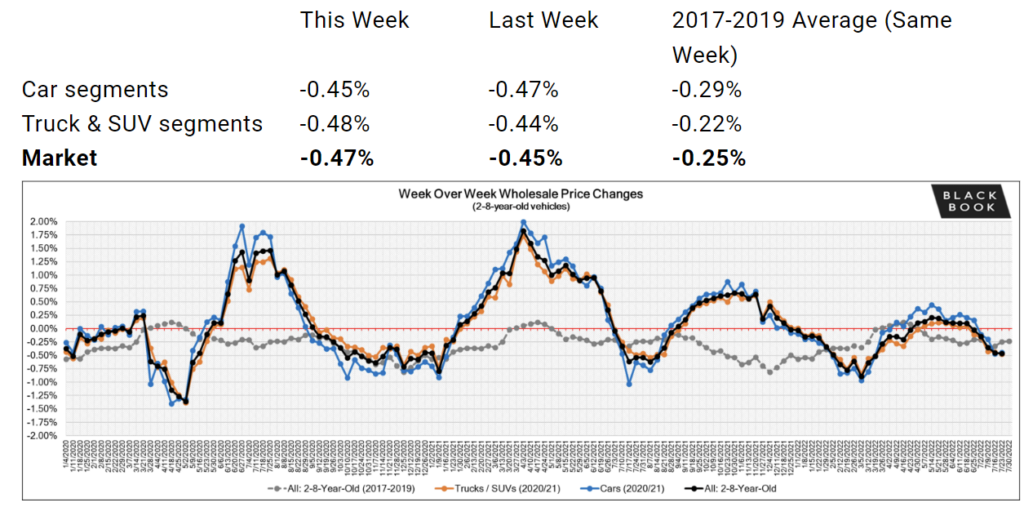

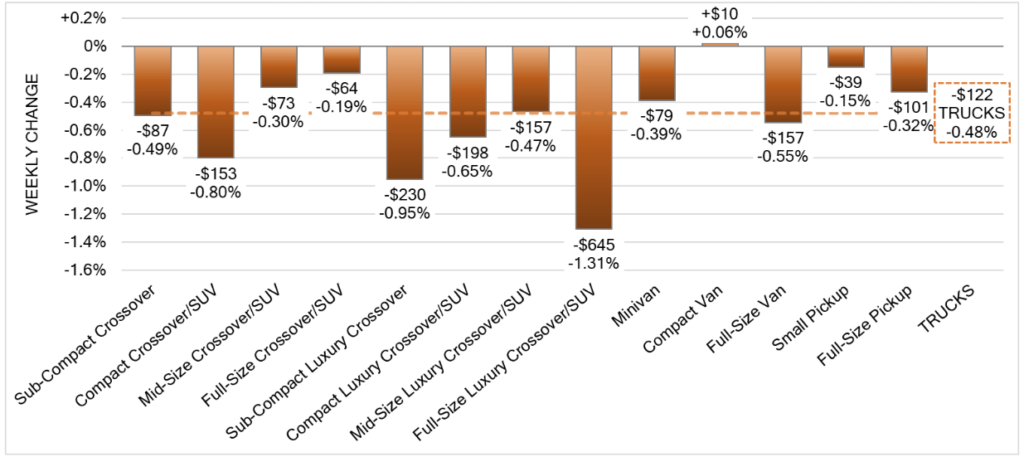

We track weekly wholesale used vehicle prices to provide you with granular market insights that will empower you to make an informed decision if you’re in the market to buy or sell. The past several weeks have brought a much-needed reprieve from month after month of record high used car prices. Notably, wholesale price declines are accelerating. Just last week, used car prices declined by -0.47%. Half of one percent may not cause alarm to some, but remember that this is across just seven days.

When we look at cumulative used car price decreases, the picture becomes more clear. These are the overall used car market price trends from the past five weeks of Black Book’s Market Pro:

-0.02% the week of June 28

-0.15% the week of July 5

-0.35% the week of July 12

-0.45% the week of July 19

-0.47% the week of July 26

That folks, is a trend. Since late June, wholesale used car prices have declined by 1.42% from all-time highs. Now that the trend is clear, our attention turns to how wholesale price declines will translate into lower used car prices for the consumer.

As we’ve heard from members of our community, used car deals can be had. Negotiating on used cars is more feasible now than before because dealers no longer have the option to simply sell a car at the auction for a profit. With wholesale prices dropping and interest rates rising, dealers are once again negotiating on used car prices.

Consumers can leverage this information (plus the likely increase in used car supply thanks to repossessions, and rising interest rates increasing dealer costs) to negotiate a more fair used car deal. Deal School 2.0 is a great free resource if you’re thinking about buying a used car anytime soon and want to save time and money.

Here’s How We Expect Wholesale Price Declines to Impact Retail Prices

Sadly, we don’t expect retail used car prices to plummet tomorrow. There remains a severe shortage of new cars as automakers continue to grapple with the semiconductor chip shortage, the lingering effects of international COVID shutdowns, and now the war in Ukraine. Still, there’s some good news if you’re looking to buy, and a new sense of urgency if you’re considering selling.

Buyers: Patience Will Save You Money

Used car prices are going down on wholesale markets, and now we’re anticipating a decline at the retail level. However, patience will be key. Buyers who are able to wait 60 to 90 days are very likely to save money versus buying today. It would not be out of the question to see used car prices decline 5% to 10% in just a few month’s time. This is because retail prices lag wholesale prices, plus there are a few other factors (covered below) that are impacting our forecast.

Sellers: Time Is of the Essence!

The past 18 months have been the exception to the rule. Normally, vehicles are depreciating assets. They lose value over time, and that keeps used car prices more affordable. We think days are numbered for ‘car flippers’ who buy and sell for a profit weeks or months later. Used car prices are on an accelerating downward trend, and this means that your car is likely to be worth less one month into the future.

Trade-in values are going to decline, too. Dealers have been shelling out surplus cash for trade-ins over the past year. More often than not, when you trade in a vehicle, the dealer will sell it at auction. We’re seeing wholesale auction prices decline in real time, therefore dealers will be trying to stay ahead of the downward trend by offering sellers less for their trade-in.

If you’re considering selling a vehicle, our advice would be to sell it as soon as possible. Those who wait are very likely to sell for substantially less given the current market trends.

Factors That Will Also Impact Pricing

Auto Loan Defaults and Repossessions

America’s $1.3 TRILLION in auto loan debt is on the minds of financial institutions. They are aware that they just spent the past year and a half financing vehicles at greatly inflated prices, and that the bottom may fall out at any time. If this indeed is the bubble bursting, the looming threat of auto repossessions will make banks and credit unions very nervous.

If a consumer stops making payments and the repo man pays a visit, the bank will be left with an asset that is depreciating rapidly. Auto loan defaults are increasing, but remain below pre-pandemic levels. As of Q1 2022, about 4% of auto loans were 90 days past due. However, subprime borrowers are more likely to default according to the latest data. In March, 8.5% of subprime borrowers defaulted on their car loans, according to Equifax. We have heard from our community members that upcoming Q2 data from financial institutions will show 10%+ delinquency rates for subprime borrowers. We’re watching this closely.

As more repo vehicles make it to the retail market we expect used car prices to continue to soften.

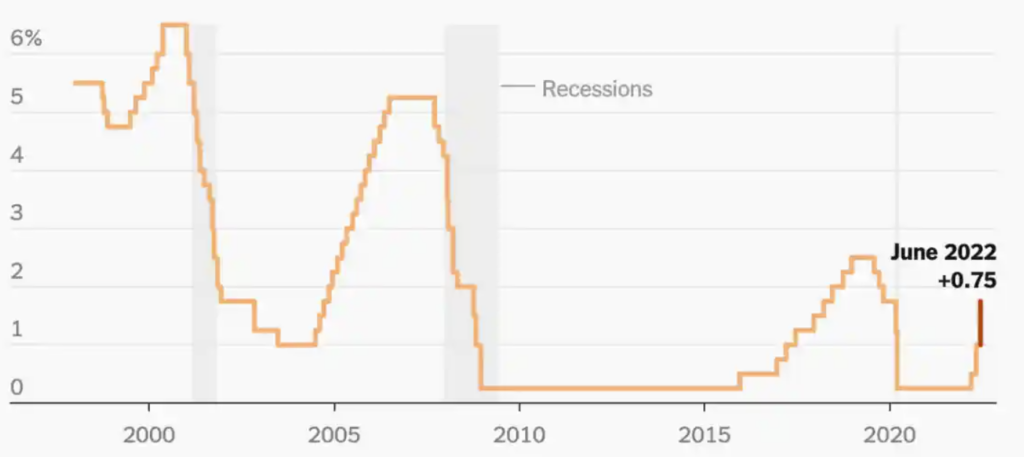

Interest Rates

The Federal Reserve has publicly stated that it intends to continue hiking interest rates until inflation is under control. The cost of borrowing money will increase in 2022, and possibly into 2023. Car buyers in the market for higher priced vehicles will feel the effects of higher interest rates most. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term.

Just as consumers are feeling the effects of higher interest rates, dealers are too. The cost to finance dealership inventory (you read that correctly, car dealers don’t pay cash for their cars, they finance them just like you and me) is also going up.

When floorplan expenses go up, dealers are more incentivized to sell cars that have been sitting on their lot longer. This is why when you search for cars on CarEdge’s car search we show you the days on the lot. The longer a car has been sitting, the more it is costing that dealership in interest payments. As interest rates rise, dealers will be motivated to sell used cars that are sitting on their lot.

CarEdge’s Take

Now is the time to sell a car, and better deals are just around the corner for buyers. At the wholesale level, used car prices have dropped by 1.42% month-over-month, and price declines are accelerating. Across all segments, prices paid for used cars were down roughly half a percent in just seven days last week. We now have the confidence (backed by five weeks of data) to call this a downward trend. Sellers are more likely to get more money for their car if they sell sooner rather than later.

We haven’t seen the effects of declining wholesale prices on retail car prices yet, but we will soon. Retail prices won’t fall off an immediate cliff, but declines will be gradual. For those who can wait two to three months, used car prices are very likely going down, and better deals will finally make it to the sales floor.

What have you seen in your area? Share a comment with us below!

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

I’m a U.S. veteran (20yrs uninterrupted service); my f&i expert recently left so I’m a widower now. And for unfortunate circumstances, I cannot collect my Social Security income due me (turned 65yrs last Feb). btw, I own pink slip to my vehicle.. I would like to sell my vehicle so I can purchase another with reliability and endurance.. Mahalo.. ALOHA..