The numbers are in, and they’re alarming. Subprime auto loan delinquencies have reached their highest level in 32 years — a record stretching all the way back to January 1994. According to data published by Fitch and analyzed by industry expert Bill Ploog, the January 2026 figures mark a 385-month record high for 60-plus-day past-due delinquencies among subprime borrowers.

So what does this mean for everyday car buyers, the auto industry, and the future of car prices? Let’s break it down.

What the Delinquency Data Actually Shows

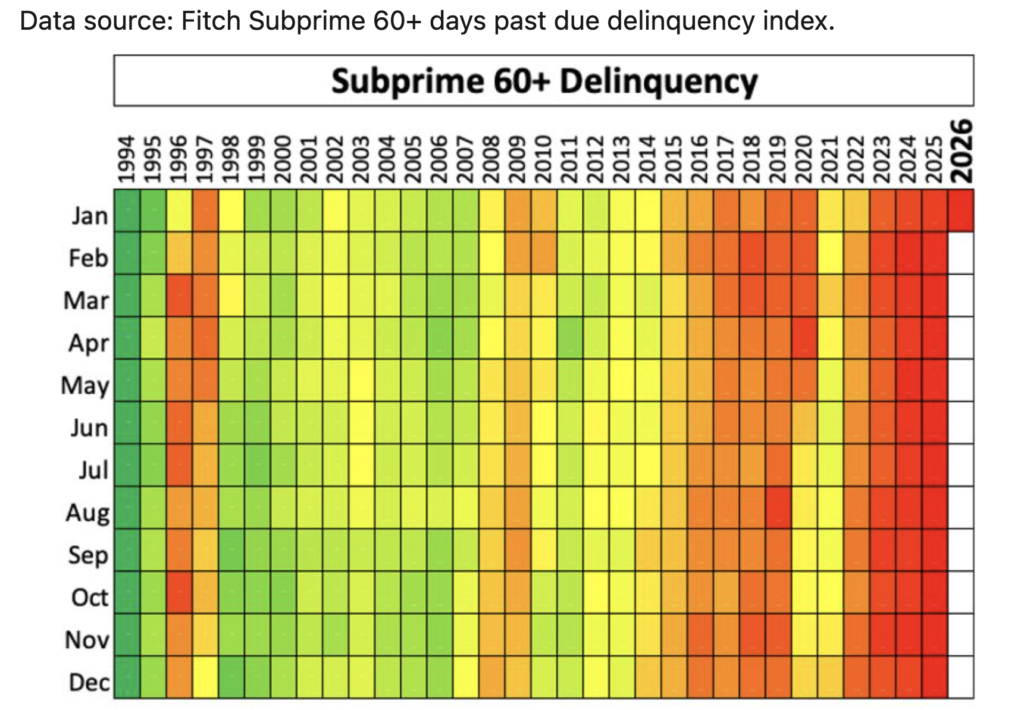

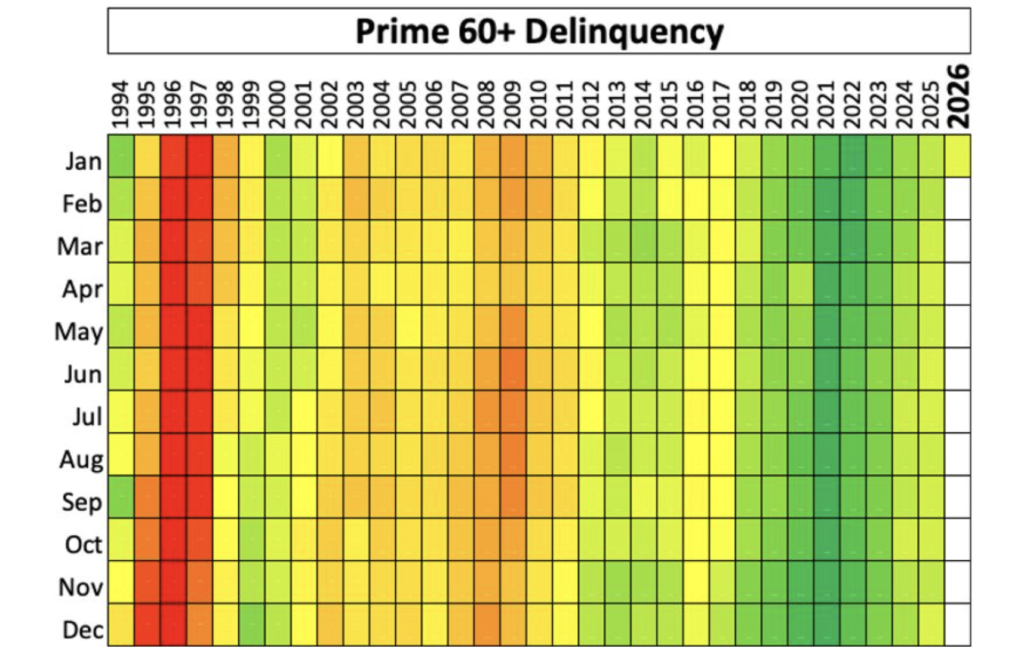

A delinquency heat map shared by Ploog covering 385 months of data paints a stark picture. Green represents the lowest delinquency rates for a given month across multiple years, red represents the highest, and yellow marks the midpoint.

For subprime borrowers — those with lower credit scores — the chart has been deep red for nearly four consecutive years, from 2023 through early 2026. That means the percentage of subprime auto loan holders who are 60 or more days behind on their payments is at the worst levels seen in over three decades.

Meanwhile, prime borrowers — those with good credit — are doing just fine. Their delinquency rates remain healthy and stable. The crisis is concentrated squarely among those who can least afford it.

What Does 60-Day Delinquency Mean?

When a borrower falls 60 or more days behind on their auto loan payment, banks begin seriously considering repossession. The vehicle gets seized, sent to auction, and sold — often for far less than what’s owed on the loan. It’s a lose-lose scenario: the borrower loses their car and likely takes a devastating hit to their credit, while the lender absorbs a loss.

This isn’t just a rearview mirror metric. Because the data reflects accounts that are already 60-plus days past due, it’s showing us the consequences of lending decisions made months or even years ago. The decisions that got us here were baked in long before the numbers showed up on the chart.

Why This Is Happening: The Perfect Storm of Easy Credit

Several converging factors have created what many are calling bubble territory in auto lending:

- Extended loan terms: 72-month, 84-month, and even 96-month auto loans have become commonplace. Some credit unions are even offering 120-month (10-year) car loans.

- Sky-high loan-to-value ratios: Wells Fargo was reportedly piloting programs last year at 140-plus percent LTV for borrowers with credit scores in the 500–600 range. That means lending significantly more than the car is actually worth.

- Rock-bottom qualification standards: Carvana, for example, may require as little as $5,000 in annual income to qualify for an auto loan — roughly $100 per week.

- Easier access to credit: Despite declining creditworthiness among borrowers, approval rates have remained high, and loan amounts have grown.

- Record levels of negative equity: More borrowers owe more on their vehicles than the cars are worth.

As Ray Shefska, a 43-year auto industry veteran and co-host of CarEdge Live, put it: “What more clearly do you need to see that suggests there’s a bubble going on?“

The 84-Month Loan Trap: A Short-Term Gain, Long-Term Disaster

Industry voices are increasingly sounding the alarm on ultra-long auto loans. Brian Binstock, a well-known figure in automotive retail, recently posted that 84-month car loans are “a death trap for customers” — and bad for dealers too.

We’ve been warning against 84-month loans for years.

Here’s the logic: when a dealership puts a customer into a 7-year loan, that customer is effectively removed from the market for the better part of a decade. They can’t trade in, they can’t upgrade, and they’re stuck underwater on a depreciating asset.

“Dealers become enamored with short-term profit gains and don’t look at the long-term ramifications,” Ray explained. “When you put people into 84-month and 96-month auto loans, you are essentially taking them out of the market. Two or three years from now, the same dealers are going to be wondering how to get their customers back. You don’t. You can’t.”

This dynamic is compounded by the decline of leasing. During COVID and the chip shortage, manufacturers pulled back on subsidized lease programs. Leasing, which once represented 32–33% of all vehicle sales, dropped to roughly 17–18%. Leasing had the built-in benefit of cycling customers back into the market every three years. Without it, the industry has leaned harder on long-term financing — with devastating consequences.

The Asset-Backed Securities Question

The subprime auto loan crisis also raises serious questions about the investors buying asset-backed securities (ABS) tied to these loans. Companies like Carvana, whose loan portfolios skew heavily subprime, package and sell these loans to investors on Wall Street.

“Why would you look at these stats, look at that chart, and say ‘Yeah, let’s buy that stuff’?” Zach Shefska asked during the show. “What could possibly go wrong? We are at a 32-year high, and yet it doesn’t set off alarm bells on Wall Street.“

The parallels to the 2008 housing crisis are hard to ignore. Back then, lenders were approving mortgages for anyone who could “fog a mirror.” Today, the same dynamic is playing out in auto lending. If you can prove you have a pulse and a minimal income, there’s likely a lender willing to approve you — often at predatory interest rates and on terms designed to maximize lender and dealer profit at the borrower’s expense.

What This Means for Car Prices

Here’s where it gets interesting for anyone shopping for a vehicle. If subprime delinquencies continue to climb and more borrowers are effectively locked out of the market — whether through repossession, negative equity, or simply being trapped in a long-term loan — demand for vehicles should eventually decline.

Basic economics says that when demand drops and supply holds steady, prices come down. That could mean more affordable cars in the future — but it’s a long road to get there.

There’s also a manufacturing angle. If automakers recognize that a growing share of buyers are locked into 6-, 7-, or 8-year loans, they may reduce production to avoid flooding dealerships with inventory that has no buyers. That could temper the price relief somewhat.

As Ray noted: “You take these people out of the market, there’s less demand. When you take out demand and keep supply the same, prices should go down. That should be what happens.“

But he also cautioned that financial engineering — creative lending programs designed to squeeze more buyers into the market — could delay or prevent that correction from ever fully materializing.

The Bigger Picture: A Debt-Dependent Society

The auto loan crisis doesn’t exist in isolation. Consumer debt across the board is at record highs. Credit card balances continue to climb month after month, and most cardholders make only minimum payments — a strategy that can take 30 years to pay off a balance.

“We as a society have created this cycle, and we need to break the cycle,” Ray said. “We need to say it’s okay if you don’t have the latest and the greatest. Just have something that works and works well.“

The data tells a story of a system that incentivizes short-term consumption over long-term financial health. Lenders profit from high-interest, long-term loans. Dealers profit from moving units today. Finance managers profit from maximizing their pay plans. And borrowers — especially subprime borrowers — bear the consequences.

Key Takeaways for Car Buyers

- Know your numbers: Don’t fixate solely on the monthly payment. Understand the total cost of the loan, including interest over the full term, and factor in your down payment.

- Avoid ultra-long loan terms: An 84-month or longer auto loan might make the monthly payment look manageable, but you’ll likely be underwater for years and pay significantly more in total.

- Check your loan-to-value ratio: If a lender is willing to loan you significantly more than the car is worth, that’s a red flag, not a green light.

- Be honest about affordability: If you can only afford a car with a 7-year loan at a high interest rate, you likely can’t afford that car. Consider a less expensive option.

- Educate yourself and your family: Financial literacy around auto loans, credit, and debt management is more important than ever. Resources are widely available — use them.

Conclusion

The 32-year record in subprime auto loan delinquencies is more than a statistic — it’s a warning signal for the entire auto industry and for consumers alike. The combination of extended loan terms, loose lending standards, record negative equity, and declining borrower creditworthiness has created conditions that many industry experts are calling unsustainable.

Whether this leads to a meaningful correction in car prices, a wave of dealership struggles, or a fundamental rethinking of how auto lending works in America remains to be seen. But one thing is clear: the current trajectory isn’t working for the people it’s supposed to serve. Being informed, making disciplined financial decisions, and living within your means isn’t just good advice — in today’s auto market, it’s essential.

0 Comments