Most car buyers don’t typically think of autumn as a great time to buy a car, but it’s the perfect time if you know where to look. Whether you’re planning to buy, hoping to sell, or are just curious about where the industry is headed, you’ve come to the right place. Buckle up as we steer you through the latest trends, from brand inventories and market conditions to financial forecasts. Let’s roll!

New Car Market Fall Update

The new car market still hasn’t reached so-called ‘normal’. Will it ever? Only a fool would make bold predictions after what we’ve all witnessed this decade. However, let’s talk about what we do know.

This autumn, we’re seeing an increase in cars on the lot, yet a significant disparity persists between automakers in terms of inventory levels. The current industry average hovers just under 60 days in terms of Market Day Supply. Why should you care about Market Day Supply (MDS)? This metric is crucial when understanding how much bargaining power you might have at the dealership. Brands with a high MDS are more eager to shift their inventory, and therefore, more likely to negotiate on price.

The High Inventory Brands

In the present market, Infiniti, Chrysler, Lincoln, Ford, Dodge, Buick, and Jeep have high inventory levels. This makes them prime targets for savvy buyers looking to negotiate a better deal. Here’s a look at nationwide inventory for the most negotiable new car brands:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Infiniti | 119 |

| Chrysler | 179 |

| Lincoln | 128 |

| Ford | 99 |

| Dodge | 190 |

| Buick | 113 |

| Jeep | 179 |

| Market Average | 72 |

As you can see, all of these brands are dealing with a surplus of new car inventory right now. The longer that a new car sits on a dealer’s lot, the more negotiable it becomes for the knowledgeable car buyer. Dealers pay ‘floorplanning costs’ to keep inventory, so every day cuts into their profit margins. Learn how to use this information to your advantage with this 100% free Car Buying Cheat Sheet.

Low Inventory But High Demand

On the flip side, if you’re looking at Kia, Honda, Subaru, Lexus, BMW, and Toyota, be prepared for a bit of a struggle. These brands are facing low inventory levels. In some instances, new arrivals are pre-sold before they even hit the lot!

Here’s nationwide inventory for these new cars:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Kia | 35 |

| Honda | 33 |

| Subaru | 48 |

| Lexus | 50 |

| BMW | 49 |

| Toyota | 40 |

| Market Average | 72 |

See local car market data for every make and model with CarEdge Data.

Surprisingly, Subaru remains a brand that’s willing to negotiate even when their inventory is low. Let’s take a look at some examples of today’s Subaru inventory:

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

Our Coaches frequently empower Subaru lovers with the skills to negotiate even low-inventory new and used Subaru models. Check out these success stories of what is possible!

3 Upcoming Trends in the New Car Market

These are the top trends that our team of Car Coaches are watching this fall season. Each of these variables has the potential to disrupt the new car market in significant ways.

Inventory Surge: The buildup of new car inventory has already begun, but the question remains, will it last into fall? With sky-high interest rates continuing to dominate buyer’s mindsets, we think it will. We predict a buildup of new vehicle inventory as we near the end of 2023, slowly but surely.

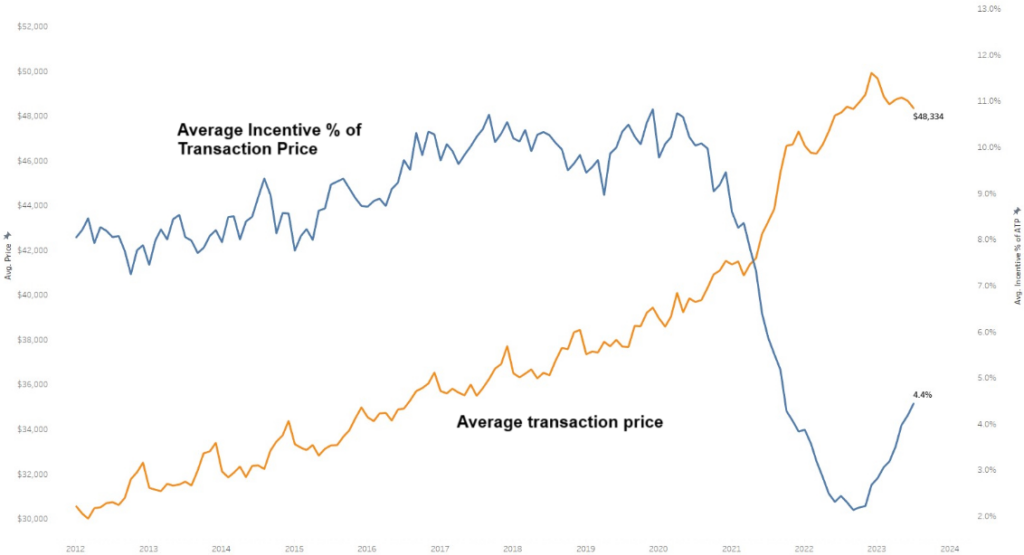

Manufacturer Incentives: Manufacturer incentive spending is at a two-year high, accounting for 4% of the transaction price on average. Brands like Ram and Jeep have recently advertised new models at 10-15% below MSRP. If manufacturers increased their incentives to pre-pandemic historical norms around 7-9%, that would entice more buyers to take action. We don’t expect automakers to raise incentives at such a rapid pace by winter, however.

The UAW Wildcard: There’s speculation of a 10-20 day UAW strike that could cause short-term hiccups. While we don’t expect this to be a game-changer, it’s something to keep an eye on. It would, however, be a bigger deal for automakers like Stellantis and General Motors. Analysts estimate that a 10-day strike would cost them about $5 billion.

CarEdge New Car Market Seasonal Rating: It’s a ‘fine’ time to buy a new car.

Better deals are anticipated this winter, but depending on what vehicle you’re in the market for, this autumn just might be the perfect time to negotiate a great deal.

Used Car Market Fall Update

While used car prices have slightly decreased, they are still far above historical averages. This means you’re unlikely to snag a bargain, especially if you’re gunning for a reliable vehicle with a clean history for under $20,000.

Pro Tip: Never enter the used car market blind. Always get a pre-purchase inspection (PPI) to understand the future maintenance needs and overall condition of the car.

The Trade-In Landscape

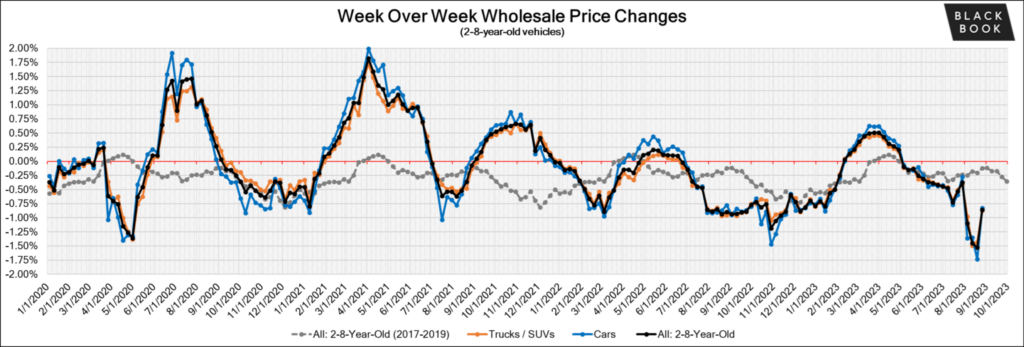

Trade-in values will continue to slowly decline as wholesale auction values are expected to keep falling. Following historically steep declines in wholesale used car prices in July and early August, we expect a more gradual decline in the fall.

Whereas used cars, trucks and SUV values were falling at a rate of -1.00% to -1.5% weekly as of last month, we expect weekly used car values to decline by around -0.5% to -0.3% for most of this season. Why? There’s no indication that a glut of used car inventory will arrive on the market any time soon to drive down values quickly.

The best used car sellers (especially those looking to trade-in) should hope for is slow but steady drops in value in September through November. You’re likely to get more for your trade-in or used car sale today than you will in a few months.

CarEdge Used Car Market Seasonal Rating: very difficult for buyers on a budget.

This is especially true if you’re looking for a vehicle of decent, reliable quality for under $20,000. Interest rates incentivize large down payments and cash buyers, but most of us don’t have the means to put $10,000 or $20,000 down.

No matter what, don’t give up. From free car buying resources to 1:1 expert help with your deal, the CarEdge team is here to help!

Take This Advice With You

If you’re in the market for a new or used car, here’s our most important advice for you: Generally, say NO to market adjustments. A lot has changed since the madness and mayhem of late 2021 and early 2022. The exceptions are true specialty vehicles like Ford Bronco Raptor or Toyota RAV4 Prime, which are so in-demand that markups are almost a given.

For most new and used car models, there’s no way car dealers could justify additional markups in 2023. Staring down a tough deal? Work with a Car Coach to negotiate the BEST deal possible.

We’ll leave you with these reader favorites (100% free). Happy car shopping!

![Ford Models With the Best Resale Value [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Ford-Ranger-400x250.png)

Market demand/supply not end-all deciding factor…it really depends on WHO you buy from and what part of the country you live in. I got lucky in June and got my used fully loaded F-150 for unexpected low out the door price. Didn’t hurt that the other 3 people competing for the truck couldn’t match my credit rating and buy it outright.