If you’ve ever wondered whether it’s better to lease or buy a car, you’re not alone. There’s no one-size-fits-all answer, but with careful considerations, the right choice for you is within reach. One thing is for sure – leasing provides a low-cost path to buying a new car at a time when MSRPs are near record highs. In this guide, we’ll talk to CarEdge’s car buying pros to see what advice they’re giving our customers, and how you can put expert insights to work for your own car deal. Buckle in, because we’ve got quite a bit to cover.

Should You Buy or Lease? Take a Budget-Focused Approach

For those who prioritize their budget, leasing might seem like an attractive option. Rising interest rates and inflated car prices have resulted in hefty monthly payments for new car buyers. Jerry, one of our CarEdge Coaches, points out that “rising prices and interest rates are generating monthly payments never seen before for new car consumers.”

Financing a vehicle, especially without a substantial down payment, can sometimes result in monthly payments that exceed what many people can comfortably afford. In such cases, leasing a vehicle with a more manageable monthly payment may be the only viable solution.

How Long Will You Own the Car?

However, if you’re someone who values long-term ownership and plans to keep a car for 7-10 years, purchasing is often the financially sound choice. Mario, one of our veteran CarEdge Coaches, says that long-term car ownership is always best. “There’s no doubt that keeping a car for 7-10 years is the most financially sound option, surpassing any tempting lease deals, no questions asked.” Owning a car outright offers the advantage of not having to worry about monthly payments once the loan is paid off.

For drivers with different priorities or those who frequently upgrade to a new car, leasing can be an attractive option. Leasing allows you to enjoy a new car every few years without the hassle of selling or trading in your vehicle. It’s particularly advantageous for those who prefer to drive the latest models with updated features.

Leasing is also a good option for electric vehicle adopters. By the time your EV lease is up, range and charging speeds will have improved. Plus, EV resale values are hard to predict, as with any new technology. In this case, Jerry advises, “When considering any EV or plug-in hybrid, you definitely will want to research lease deals. There’s a good chance a lease is the better option.”

See the best EV lease deals this month

If you have relatively stable needs but don’t want to bear the risk of maintaining a car out of warranty, the decision becomes more complex. In these cases, financing often comes out ahead, but you should assess the “opportunity cost” of leasing against the financial gain of building equity for 5 years before upgrading, as Mario suggests. By comparing the total cost of ownership over a 3-6 year period for both leasing and financing, you can make an informed decision.

Compare cost of ownership data here (100% free)

Crunching the Numbers: Leasing vs. Buying?

To make the comparison, calculate your total leasing expenses for the chosen period, including monthly payments, upfront cash, fees upon returning the car, and other expenses such as fuel and insurance. Then, determine your total monthly out-of-pocket cost by dividing this sum by the lease duration. Repeat the process for financing, adding up the total cost, and determining your projected equity position by month 36.

Finally, compare the out-of-pocket costs for both options to decide which suits your needs and budget. This simple exercise should help you determine if leasing is a better option for your financial situation.

Manufacturer Incentives and Resale Value

When deciding between leasing and financing, consider manufacturer incentives and resale value. Our CarEdge Coaches never recommend paying for dealer markups, or anything over MSRP. But when the price is right, buying can certainly become the clear solution.

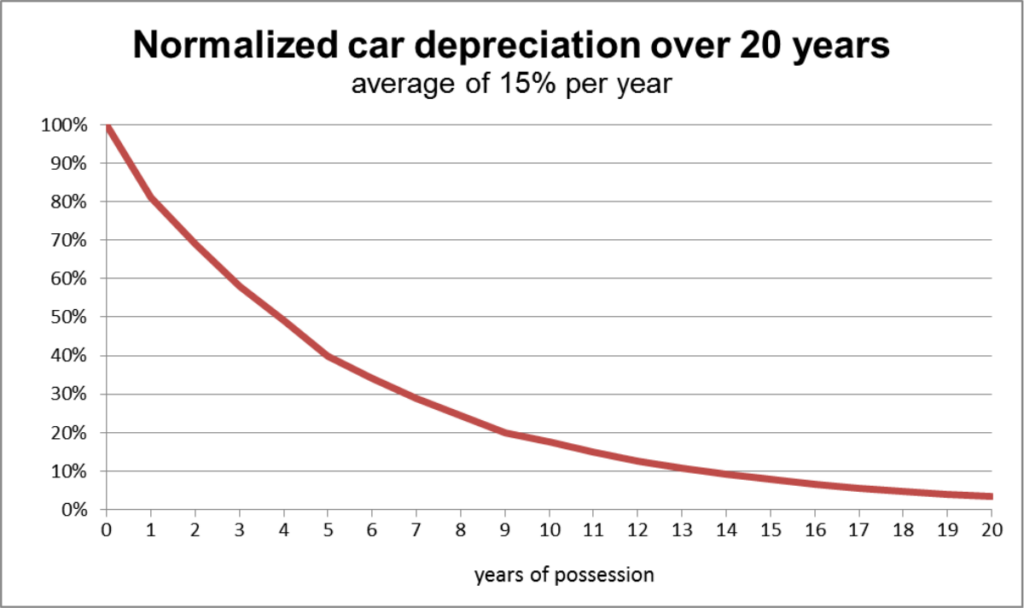

As Mario points out, “Buying becomes a better option for vehicles that offer substantial discounts and incentives from both the manufacturer and the lender.” For vehicles with high resale value, financing may be the better choice, as you can build equity over time. In contrast, for vehicles with significant discounts or depreciation, leasing may be the more economical option.

Free Car Buying Help Is Here!

In the end, the decision to lease or buy a car should align with your specific circumstances and priorities. Budget-conscious drivers might find leasing more accessible, while those planning long-term ownership may prefer financing. Incentives, and resale value also matter. Remember that there’s no one-size-fits-all answer to the leasing vs. buying dilemma. So, whether you opt for a lease or decide to finance, careful research and consideration will lead you to the right decision.

Fortunately, we’ve got dozens of 100% FREE car buying and leasing resources available.

Here are a few CarEdge Community favorites:

See Pre-Negotiated Car Prices With Home Delivery Nationwide

The Best New Car Lease Deals (Updated Monthly)

The Best New Car Incentives in November

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

![10 Cars with the Lowest Cost of Ownership [2026 Data]](https://caredge.com/wp-content/uploads/2026/02/2026-Toyota-Corolla-Hatchback-400x250.png)

Buying vs. leasing is always a tough decision to make. This article helps clarify the pros and cons of both. Thanks!

I would normally purchase a vehicle but due to ALL the “electric junk” that all manufacturers put into their vehicles I’m leaning toward leasing. When do you think the electrical gremlins will appear and show their ugly face?