Not all cars are created equal when it comes to insurance costs. While some models are budget-friendly, others will cost drivers thousands more every year in premiums. High repair bills, performance-focused designs, and riskier driver profiles are just some of the factors that push insurance rates higher.

To help you make sense of it, we analyzed insurance data for over 300 models and ranked the most expensive cars to insure in 2025. Our data is based on a 40-year-old driver with good credit, a clean record, and about 13,000 miles driven per year.

At CarEdge, we’ve built our rankings on millions of listings and insurance data points so you can shop smarter, with full transparency on what ownership really costs.

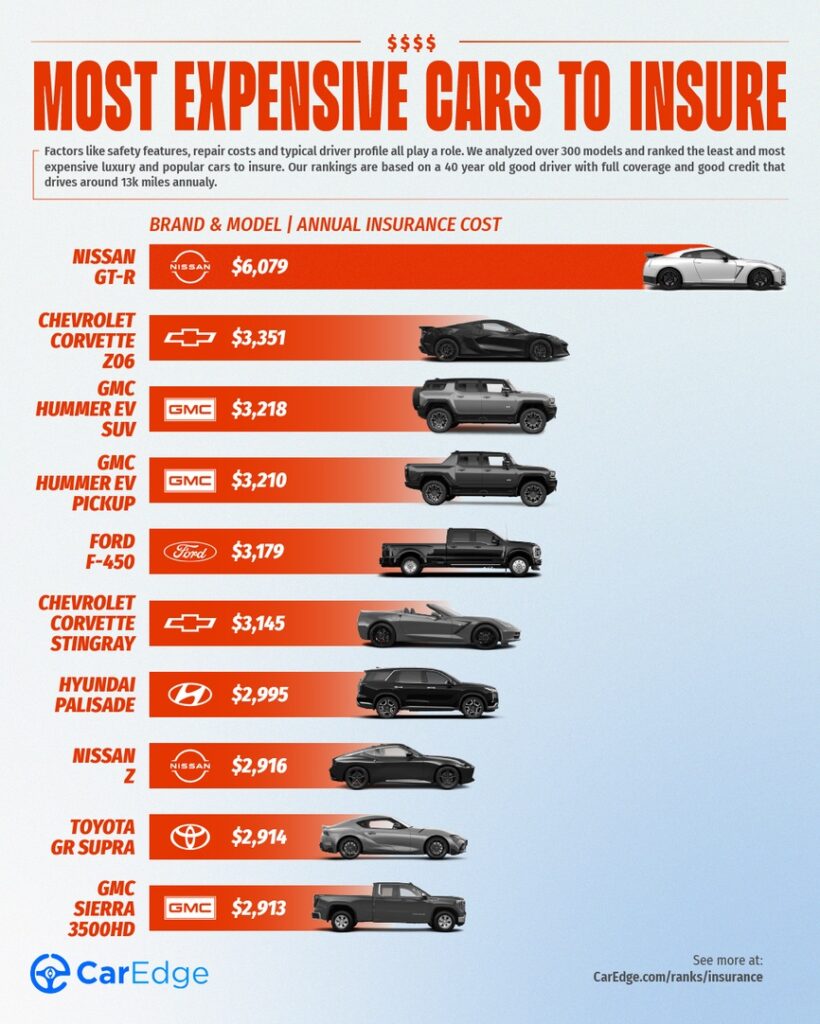

The 10 Most Expensive Cars to Insure

Insurance costs can soar when it comes to sports cars, luxury SUVs, and high-performance trucks. At the very top is the Nissan GT-R, with an average annual premium of $6,079. That’s nearly triple the cost of insuring the cheapest mainstream SUVs.

The Chevrolet Corvette Z06 ($3,351) and both the GMC Hummer EV ($3,218) also ranks among the priciest, thanks to high repair costs and a massive battery. The Ford F-450 ($3,179) shows that heavy-duty trucks can be just as expensive to cover as exotic performance cars.

The Hyundai Palisade is the big surprise on the list. As a popular family hauler, it’s unclear why insurers are charging more for coverage of the Palisade. On average, it costs $2,995 to insure the Palisade for one year.

Other costly models include the Chevrolet Corvette Stingray ($3,145), Nissan Z ($2,916), Toyota GR Supra ($2,914), and GMC Sierra 3500HD ($2,913).

Looking for more insurance rankings? This is just the beginning. See the complete data right here.

Why Are These Cars So Expensive to Insure?

A few key factors make these cars and trucks the most expensive models to insure right now.

- Performance and risk: Sports cars like the Nissan GT-R and Corvette Z06 are built for speed, which insurers associate with higher accident risks.

- Repair and replacement costs: EVs and luxury models, like the Hummer EV and Palisade, require expensive parts and specialized service.

- Size and liability: Large trucks such as the Ford F-450 and GMC Sierra can cause more damage in a collision, raising liability exposure.

What Are the Cheapest Cars to Insure?

Looking for the models with the lowest insurance premiums? We’ve got you covered.

👉 Here are the 10 cheapest cars to insure right now.

Are You Overpaying for Insurance?

Even if your car isn’t on this list, there’s a good chance you’re paying more than you should. Studies have shown that 3 out of 4 drivers qualify for a lower rate when shopping around. Insurance companies often don’t reward loyalty, and drivers can save by comparing quotes.

With CarEdge’s insurance quote comparison tool, you can see if you’re getting the best rate in minutes. It’s free, quick, and could save you hundreds per year.

0 Comments