CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

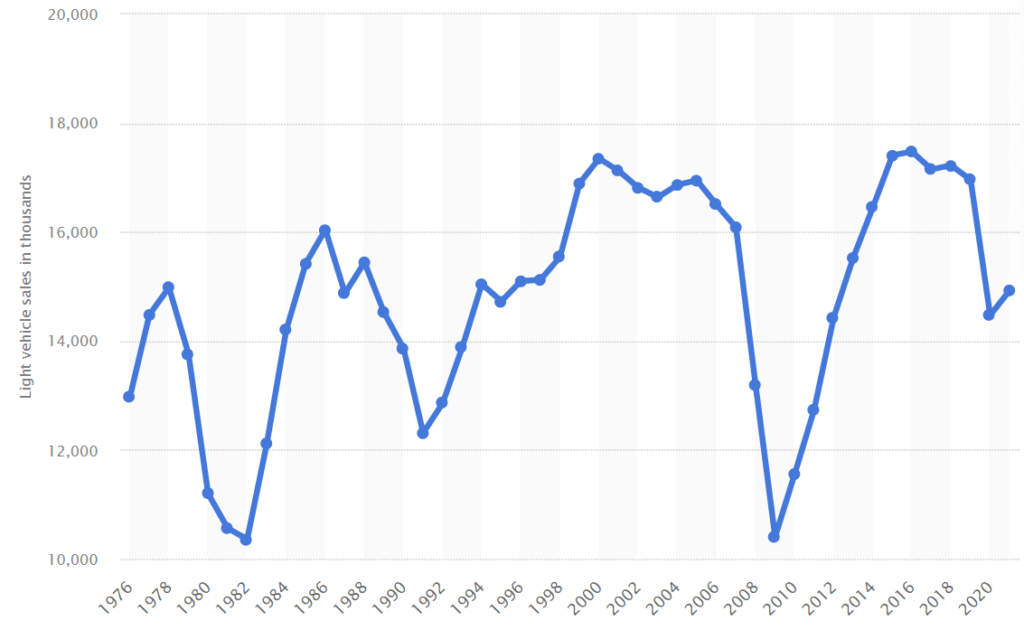

With tariffs, stubborn inflation, and stock market-selloffs, there are many factors that are dampening consumer sentiment in the United States. An economic slowdown impacts everyone, car buyers included. How will a recession impact car sales? How will car buyers be affected by a recession in 2025? Will it be the same as 2008, or are things different this time around? Let’s take a look at what history can teach us.

For most, the mere mention of a recession is cause for cutting back, saving money and spending less. Discretionary spending, essentially spending by choice rather than by need, always plummets in a recession. For some households, discretionary spending includes that shiny new car you’ve had your eye on. For others, a car is essential for work, etc. In a recession, auto sales decline significantly as many buyers back out of the market. However, a recession in 2025 is not going to be the same for car buying as it was in 2008 and 2020.

New vehicle sales in the U.S. fell nearly 40 percent during the ‘Great Recession’ of 2008. Gas-guzzlers were hit the worst, and hybrid powertrains made their big break. 2020’s pandemic-driven recession was the shortest in history, lasting just two months. Even then, auto sales were down 15 percent compared to 2019.

What’s different now? Car prices have climbed for three years straight at a pace never seen before. The result? Reluctant car buyers who are more likely to patiently seek out deals. If an economic recession begins, new car prices will be forced downward by a drop in demand. With high interest rates, car dealers lose money the longer a car sits on the lot due to floorplanning costs. Not selling is never an option, meaning that incentives will mount until buyers see value.

If you’re thinking about selling, you should decide sooner rather than later. We track used car prices weekly, and we’ve seen months of declines in both retail sales and the wholesale markets that determine trade-in values. Used car values are falling, and will continue to decline if a recession is in the cards for 2025.

The average used car listing price has fallen from an all-time high of around $28,000 in 2022 to $25,128 in March 2025. With economic worries lingering, we expect retail used car prices to fall another 3-5% through the end of the year. Those considering selling a vehicle in 2025 should assume that selling sooner will bring a high price versus waiting.

Have you ever heard of a car buying service? These ‘car concierge’ services are growing in popularity as drivers get fed up with the car dealership hassles. CarEdge Concierge is the best way to buy a car today. We’re independent from dealerships and automotive industry groups, meaning that we’re exclusively here to serve you.

After four months of electric vehicle ownership, my perspectives about the mass transition to electric vehicles have evolved. I no longer think that everyone should run out and buy an EV right now (besides, that’s not possible). I have a greater understanding of the skepticism that accompanies the push to EVs. All-in-all, I feel that I now understand the arguments from both sides: electric vehicles are amazing, better for the planet (in the long run) and fun to drive, however EVs are not even close to being ready for mass adoption.

Automakers have committed well over half a trillion dollars to electric vehicle research and development, marketing and most importantly, charging infrastructure buildout. But the grid isn’t ready, charging providers aren’t ready, and the American public has a LOT to learn before making the switch. EVs could still fail, and bring down the automotive industry with them. We’d hate to see that. These are 5 things that must happen in this decade to prepare the world for electric mobility.

The average price paid for an EV surpassed $66,000, on par with the overall luxury segment.

For years and years, I touted the coming cost parity that would finally make EVs just as affordable as any other car. Industry experts always told us that EV price parity would come when battery costs dropped below $100 per kilowatt-hour. Just as that milestone arrived, the world was turned upside down by the COVID-19 pandemic.

Global factory shutdowns disrupted the supply chains that all automakers rely on, and most notably those related to semiconductor chip production. Without the parts to make the cars, electric vehicle growth was held back just as the public warmed up to them. Raw materials used in both vehicle and battery manufacturing increased in cost by over 100%, and many automakers have passed the premiums on to consumers.

Today, electric vehicles cost more, and inventory is slim. Kelley Blue Book’s June 2022 car price data shows that the average EV transaction was $66,000, $18,000 over the overall car market average of $48,000. One year ago, the average EV transaction was $52,486, or 10.8% less than it was in June of 2020. In short, EV prices are headed in the wrong direction just as automakers are getting serious about making them.

In the age of record smashing, here’s one that will give pause: In June, the estimated average monthly payment increased to $730, which is a new record high. A new car monthly payment now costs as much as rent in many parts of the country. We’re seeing more and more car payments over $1,000 a month. The insane records don’t end there.

More cars are being repossessed as more auto payments are going past-due. With the way things stand today, either EVs will have to become more affordable, or their luxury pricing will soon risk worsening the auto loan crisis.

Earlier this year, Rivian CEO and Founder RJ Scaringe predicted that battery shortages would be the next disruption that the automotive industry would face. In fact, automakers are already rationing the batteries they have, and those they have lined up. Ever wondered why there are so few electric full-sized SUVs? Building those at scale would require a lot more batteries.

The average EV contains $8,255 of raw materials according to CNBC. That’s more than double the amount in combustion-powered counterparts. President Biden has even authorized use of the Defense Production Act to aid the situation by increasing domestic EV production and related supply chains.

For the most part, automakers don’t make their own batteries. They rely on contracts with battery manufacturers like Panasonic, LG Chem, and CATL to supply what their lofty plans for electric vehicles will need. That’s changing little by little. Tesla has started to produce small quantities of its new 4680 battery cells next to Giga Austin.

General Motors just received a $2.5 BILLION dollar loan from the U.S. Department of Energy for manufacturing the Ultium battery in Tennessee. Slowly but surely, some OEMs are taking control of their own battery supply chains. This will be key to avoiding battery shortages.

EV market share SOARS in America. See the latest numbers.

Over 62% of Americans support building out a nationwide charging network, and 39% of American drivers are considering buying an electric vehicle next time they’re in the market for a car. Frugal drivers are welcoming the fuel savings, albeit at a higher upfront cost. At current residential electricity rates, charging up is equivalent to spending about $1.00 per gallon of gas. The most expensive public chargers may approach $2.50 per gallon equivalent.

However, many Americans live in a charging desert. What good is the EV revolution if there’s nowhere to charge? Most EV drivers plug in at home, but not everyone can do that. From apartment dwellers to rural residents, owning an EV simply isn’t viable if there aren’t chargers for road trips, family visits and work transportation needs. When it makes sense for consumers, electric vehicles offer plenty of benefits. Cheaper fuel, less maintenance, sporty performance and no tailpipe emissions to name a few. But EVs risk remaining a symbol of luxury and impracticality if it doesn’t get a lot easier to charge up in America.

2021’s Bipartisan Infrastructure Act included $7.5 billion for the build-out of a national charging network. In summary, federal funding is supposed to get the ball rolling, and the private sector will take it from there. EV charging stations, particularly DC fast chargers, are really expensive to install. On top of upfront costs, America’s electrical grid is not ready for the demand that would be generated by mass adoption of EVs.

The deadline is nearing for states to submit their plans for how they will spend their allocated funding for EV charging. Will they use the funding to install reliable, standardized fast charging stations along major transportation corridors and rural areas alike? We’ll soon find out.

The following are all things I’ve encountered at Electrify America charging stations:

We need to do better to educate EV buyers and prospective EV buyers about how to drive electric without the hassles. We can’t blame the consumer, EVs bring a very different ownership experience. But whose responsibility is it to educate drivers? The dealership? The automaker? The driver themself? Guys like me?

In reality, it will need to be all of the above. General Motors is leaning heavily on the success of what they call affordable EVs to dominate sales by the end of this decade. In the first real sign that OEMs might be taking their newfound responsibility seriously, Chevrolet just launched a great live chat and immersive experience on their website that is entirely devoted to educating the public about their EVs, with an emphasis on the ownership experience. We need more of that, and soon.

The woman I met who arrived at a charging station with 0% state of charge and no A/C should, in my opinion, be upset with her Kia dealer. She loved the car, but no one had explained to her how to plan for interstate travel in an EV. Dealers sell most vehicles in America, but the dealership sales model is under serious threat from the rising popularity of direct-to-consumer sales. Everyone wants to be Tesla. If legacy automakers are to stand a chance in the EV race, more OEMs need to prepare their dealer networks for the public education that comes along with selling EVs.

Does the lack of affordability, charging infrastructure and public awareness mean the electrification of the auto industry is doomed for failure? No, not at all. That’s because there’s still time to right wrongs, and to build out the nation’s charging infrastructure the right way. EVs are still under 6% market share in the U.S. (See the latest EV market share numbers here.) If these same problems persist when we exceed 15%, that will be real cause for concern.

It’s true that the electrical grid isn’t ready for mass adoption of EVs, but it’s getting there. Grid-scale battery megapacks (also pioneered by Tesla) are already being deployed to provide grid stability in times when the supply of electricity is not keeping up with demand. The sun only shines in the day, the wind is intermittent, but grid-scale batteries store and supply power from these renewable sources whenever they are most needed. Now, it’s like the sun is shining at night. These changes take time. Plus, the push for grid-scale battery storage could throw a wrench in EV battery supply chains. Nothing is certain, but things are moving in the right direction.

These are some innovations that have the potential to make electric vehicles more affordable with longer ranges, faster charging and improved safety. These innovations also make EV supply chains less damaging to the environment and less harmful to vulnerable communities worldwide.

How can the nation as a whole get to where it needs to be by, say, 2025? I’ll leave you with my own suggestion for legacy automakers and policymakers: don’t be afraid to learn from Tesla. A seamless, almost hassle-free EV ownership experience already exists in America, from plug-and-charge, reliable fast charging to the peace of mind that comes with the vast Supercharger network. I encourage all policymakers and engineers to learn from Tesla’s successful growth strategies. Will automakers and politicians have the courage to consult Elon Musk’s Tesla, or will they try to figure it all out on their own? What do you think?

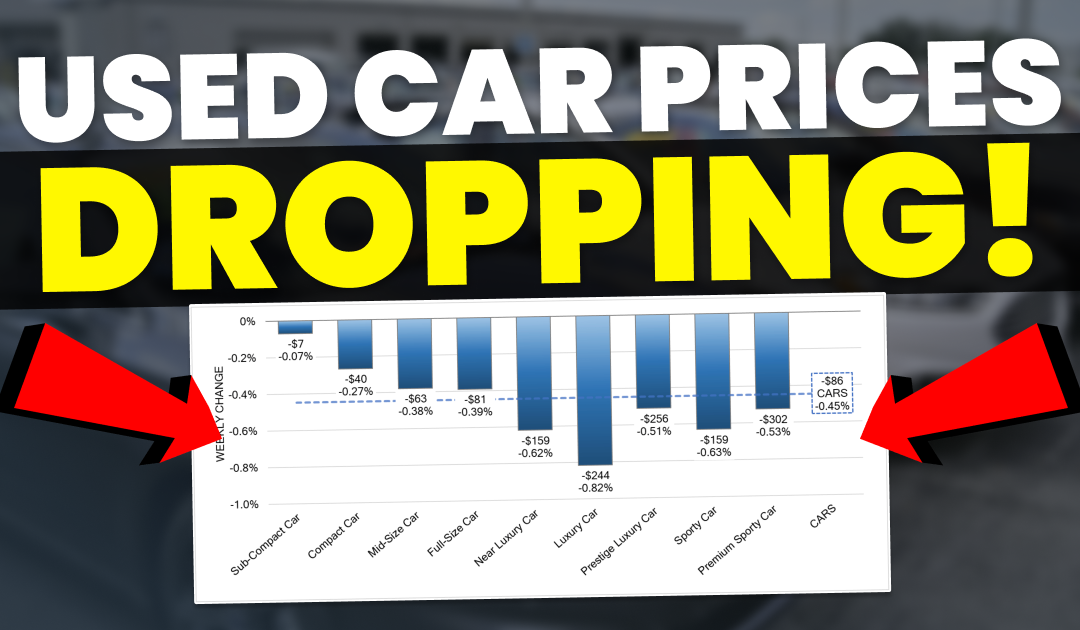

It is officially safe to declare; used car prices are finally going down. Finally, we’re seeing a clear trend emerge in used car prices. Now is the time to sell a car (as we’ve seen five weeks in a row of used car price declines and trade-in values will likely drop over the coming weeks), and patience is still required if you’re looking to buy a used car (wait a few more weeks, we expect prices to decline even more).

Thanks to data from Black Book, Cox Automotive, financial institutions, and the experiences of our community, we now have enough data to feel confident in saying that used car prices are going down, and that they will continue to fall. For car buyers, patience is more important than ever. If you’re in the market to buy a car, wait a few more weeks for a better deal.

Let’s dig into what’s happening in the market, and how you can time your sale or purchase.

In 2021 we witnessed the unthinkable; used car values appreciated more than 40%. During the first quarter of 2022, we saw used car prices drop nearly 5% on the wholesale markets. By the time spring rolled around, we experienced another increase in wholesale used car prices, canceling out those previous declines.

While the wholesale market rose and fell, retail used car prices have remained high during the first half of 2022. Consequently, the average monthly car payment is over $700.

As we settle into summer, we’ve now seen five consecutive weeks of overall market softening. For the first time since the pandemic lows of 2020, used car prices are going down across all market segments.

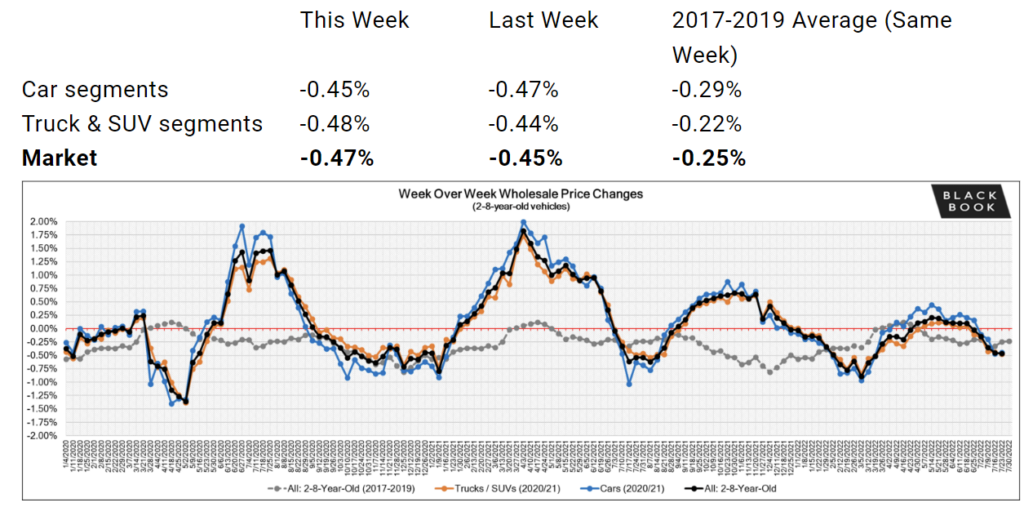

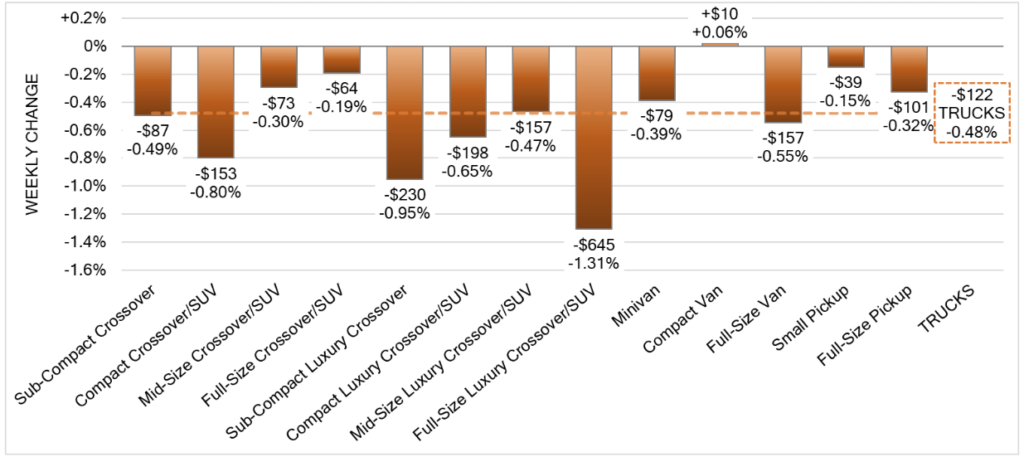

We track weekly wholesale used vehicle prices to provide you with granular market insights that will empower you to make an informed decision if you’re in the market to buy or sell. The past several weeks have brought a much-needed reprieve from month after month of record high used car prices. Notably, wholesale price declines are accelerating. Just last week, used car prices declined by -0.47%. Half of one percent may not cause alarm to some, but remember that this is across just seven days.

When we look at cumulative used car price decreases, the picture becomes more clear. These are the overall used car market price trends from the past five weeks of Black Book’s Market Pro:

-0.02% the week of June 28

-0.15% the week of July 5

-0.35% the week of July 12

-0.45% the week of July 19

-0.47% the week of July 26

That folks, is a trend. Since late June, wholesale used car prices have declined by 1.42% from all-time highs. Now that the trend is clear, our attention turns to how wholesale price declines will translate into lower used car prices for the consumer.

As we’ve heard from members of our community, used car deals can be had. Negotiating on used cars is more feasible now than before because dealers no longer have the option to simply sell a car at the auction for a profit. With wholesale prices dropping and interest rates rising, dealers are once again negotiating on used car prices.

Consumers can leverage this information (plus the likely increase in used car supply thanks to repossessions, and rising interest rates increasing dealer costs) to negotiate a more fair used car deal. Deal School 2.0 is a great free resource if you’re thinking about buying a used car anytime soon and want to save time and money.

Sadly, we don’t expect retail used car prices to plummet tomorrow. There remains a severe shortage of new cars as automakers continue to grapple with the semiconductor chip shortage, the lingering effects of international COVID shutdowns, and now the war in Ukraine. Still, there’s some good news if you’re looking to buy, and a new sense of urgency if you’re considering selling.

Used car prices are going down on wholesale markets, and now we’re anticipating a decline at the retail level. However, patience will be key. Buyers who are able to wait 60 to 90 days are very likely to save money versus buying today. It would not be out of the question to see used car prices decline 5% to 10% in just a few month’s time. This is because retail prices lag wholesale prices, plus there are a few other factors (covered below) that are impacting our forecast.

The past 18 months have been the exception to the rule. Normally, vehicles are depreciating assets. They lose value over time, and that keeps used car prices more affordable. We think days are numbered for ‘car flippers’ who buy and sell for a profit weeks or months later. Used car prices are on an accelerating downward trend, and this means that your car is likely to be worth less one month into the future.

Trade-in values are going to decline, too. Dealers have been shelling out surplus cash for trade-ins over the past year. More often than not, when you trade in a vehicle, the dealer will sell it at auction. We’re seeing wholesale auction prices decline in real time, therefore dealers will be trying to stay ahead of the downward trend by offering sellers less for their trade-in.

If you’re considering selling a vehicle, our advice would be to sell it as soon as possible. Those who wait are very likely to sell for substantially less given the current market trends.

America’s $1.3 TRILLION in auto loan debt is on the minds of financial institutions. They are aware that they just spent the past year and a half financing vehicles at greatly inflated prices, and that the bottom may fall out at any time. If this indeed is the bubble bursting, the looming threat of auto repossessions will make banks and credit unions very nervous.

If a consumer stops making payments and the repo man pays a visit, the bank will be left with an asset that is depreciating rapidly. Auto loan defaults are increasing, but remain below pre-pandemic levels. As of Q1 2022, about 4% of auto loans were 90 days past due. However, subprime borrowers are more likely to default according to the latest data. In March, 8.5% of subprime borrowers defaulted on their car loans, according to Equifax. We have heard from our community members that upcoming Q2 data from financial institutions will show 10%+ delinquency rates for subprime borrowers. We’re watching this closely.

As more repo vehicles make it to the retail market we expect used car prices to continue to soften.

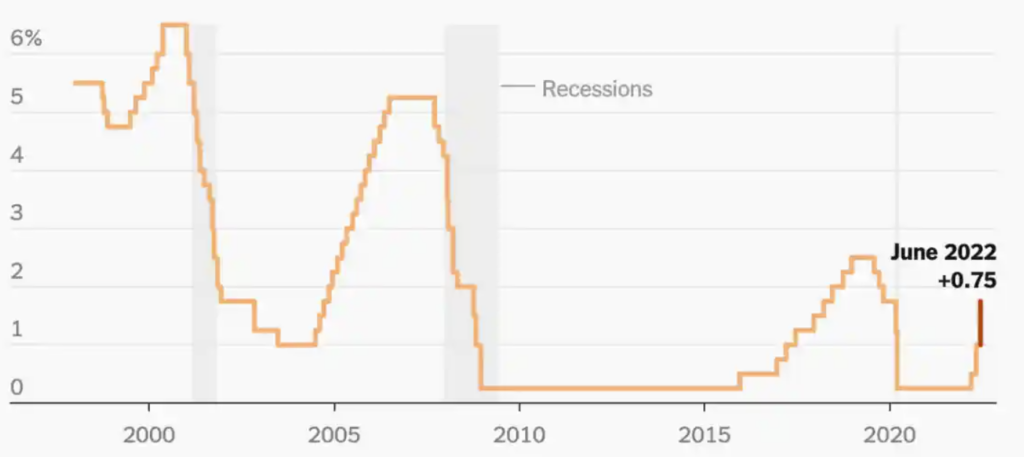

The Federal Reserve has publicly stated that it intends to continue hiking interest rates until inflation is under control. The cost of borrowing money will increase in 2022, and possibly into 2023. Car buyers in the market for higher priced vehicles will feel the effects of higher interest rates most. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term.

Just as consumers are feeling the effects of higher interest rates, dealers are too. The cost to finance dealership inventory (you read that correctly, car dealers don’t pay cash for their cars, they finance them just like you and me) is also going up.

When floorplan expenses go up, dealers are more incentivized to sell cars that have been sitting on their lot longer. This is why when you search for cars on CarEdge’s car search we show you the days on the lot. The longer a car has been sitting, the more it is costing that dealership in interest payments. As interest rates rise, dealers will be motivated to sell used cars that are sitting on their lot.

Now is the time to sell a car, and better deals are just around the corner for buyers. At the wholesale level, used car prices have dropped by 1.42% month-over-month, and price declines are accelerating. Across all segments, prices paid for used cars were down roughly half a percent in just seven days last week. We now have the confidence (backed by five weeks of data) to call this a downward trend. Sellers are more likely to get more money for their car if they sell sooner rather than later.

We haven’t seen the effects of declining wholesale prices on retail car prices yet, but we will soon. Retail prices won’t fall off an immediate cliff, but declines will be gradual. For those who can wait two to three months, used car prices are very likely going down, and better deals will finally make it to the sales floor.

What have you seen in your area? Share a comment with us below!

Is all the talk of inflation giving car dealers and automakers an excuse to raise car prices even further? While that would be pure speculation, we do know that a new vehicle now costs more than ever before. New data from Cox Automotive/Moody’s Analytics reveals that just a few weeks after a previous record high was reached, new car prices have forced monthly auto payments to new heights. How high will new car prices climb? Is this simply a new normal that we have to accept? Here’s what the data tell us.

The new report from Cox Automotive and Moody’s Analytics is disheartening to say the least. Today’s out-of-control car prices can be summarized by one statistic: In June, the estimated number of weeks of median income needed to purchase the average new vehicle was up 17% from last year. Median incomes have risen slightly, but rising new car prices have far outpaced income.

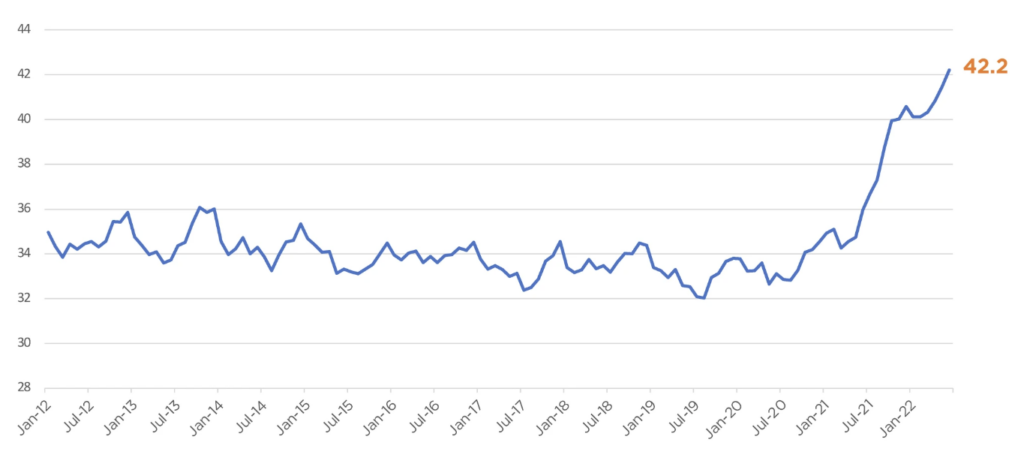

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index is driven by the consumer’s vehicle transaction prices, the income of the consumer, amount financed by the consumer, and the interest rate provided by the lender. The result is a value that represents the number of weeks of the median household income in America that would be needed to buy the average new vehicle.

The number of median weeks of income needed to purchase the average new vehicle in June increased to 42.2 weeks from 41.5 weeks in May. This is an all-time high that reflects the predicament that consumers needing a car find themselves in. From May to June 2022, median income grew 0.3% at the same time that new car transaction prices increased 1.6%.

The estimated average monthly payment increased 2.2% to $730, which is a new record high. A new car monthly payment now costs as much as rent in many parts of the country. We’re seeing more and more car payments over $1,000 a month.

Gone are the days of zero percent financing. As the Federal Reserve continues to raise interest rates to combat inflation, borrowing money becomes more expensive for everyone from the banks to the consumer. From May to June of 2022, the average auto interest rate increased another 8 basis points.

Higher interest rates affect luxury car buyers and those who put little money down the most. A 6% interest rate will result in about $6,000 in total interest paid for a $40,000 loan over 60 months, but just $2,400 for a $15,000 loan over the same term. Interest rates are a big part of car buying, and they remain dynamic as our economy traverses ups and downs.

Why would automakers offer new car incentives when demand far exceeds supply? To be nice to the consumer? We could only hope for such benevolence from OEMs, but we know that’s not how big business works.

New car incentives are down 59% in just 12 months as supply chain problems squeeze new vehicle inventory to record lows that have struggled to climb back. In the second quarter of 2022, incentives averaged $1,228 industry-wide. That’s a 59% drop year-over-year.

| Q2 2022* | Q1 2022 | QoQ change | Q2 2021 | YoY change | |

|---|---|---|---|---|---|

| BMW | $1,206 | $2,358 | -49% | $4,713 | -74% |

| Daimler | $1,257 | $2,012 | -38% | $3,574 | -65% |

| Ford | $1,193 | $1,824 | -35% | $2,567 | -54% |

| General Motors | $1,847 | $1,974 | -6.40% | $4,399 | -58% |

| Honda | $818 | $1,163 | -30% | $2,167 | -62% |

| Hyundai | $620 | $890 | -30% | $2,102 | -71% |

| Kia | $650 | $1,260 | -48% | $2,549 | -75% |

| Nissan | $1,501 | $1,848 | -19% | $3,502 | -57% |

| Stellantis | $1,893 | $2,413 | -22% | $3,522 | -46% |

| Subaru | $753 | $901 | -17% | $1,339 | -44% |

| Toyota | $803 | $1,025 | -22% | $2,219 | -64% |

| Volkswagen Group | $1,169 | $1,769 | -34% | $3,730 | -69% |

| Industry | $1,228 | $1,631 | -25% | $3,003 | -59% |

Until more cars are sitting on dealer lots, there simply won’t be any reason for manufacturers to offer more new car incentives to buyers. Here’s more of our coverage on manufacturer incentives.

In January of 2020, the industry’s average was 82 days’ supply. By early 2021, that figure had fallen to 66, but it would soon plummet as the chip shortage lasted longer than most expected. In July of 2022, new car inventory is slim with just 21 days’ supply.

Subaru, Mazda, Volvo, Kia and Hyundai have had the lowest new car inventory, and therefore have had the least incentives for buyers. See the latest new car inventory numbers.

For three consecutive weeks, used car prices have declined at wholesale auctions. This leading indicator suggests that relief may be on the way for consumers in desperate need of a more affordable option. In fact, only full-size vans appreciated last week. All other vehicle segments have seen prices decline at the used wholesale level.

Will used car prices continue to decline? It all depends on new car inventory. When there are more cars on dealer lots, used cars will lose value, and may ultimately come back down to Earth from record highs. This is something to bear in mind if you’re thinking about buying a used car at today’s inflated prices.

CarEdge tracks used car prices with weekly updates. See used car price updates here.

The U.S. Federal Trade Commission is proposing new regulations that would ban anti-consumer sales tactics notoriously common in the auto industry. These shady practices include..

Car dealer lobbyists are NOT HAPPY about this set of proposed regulations! We the consumers have until September 12, 2022 to leave a comment in support of these common sense regulations. Find out how YOU can make your voice heard here. We must fight back against powerful dealers!

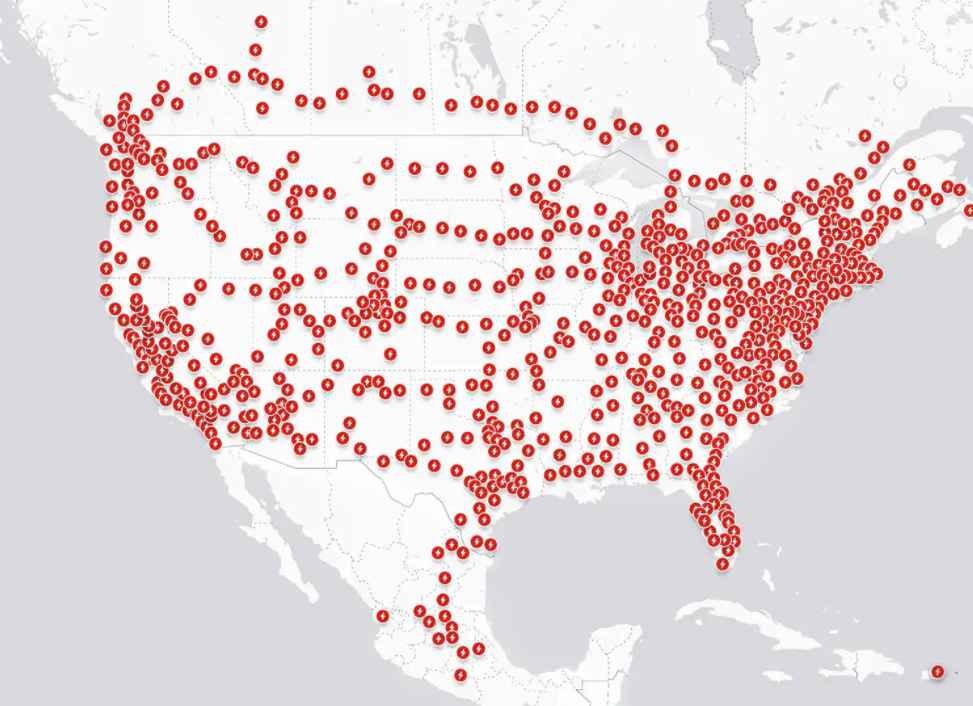

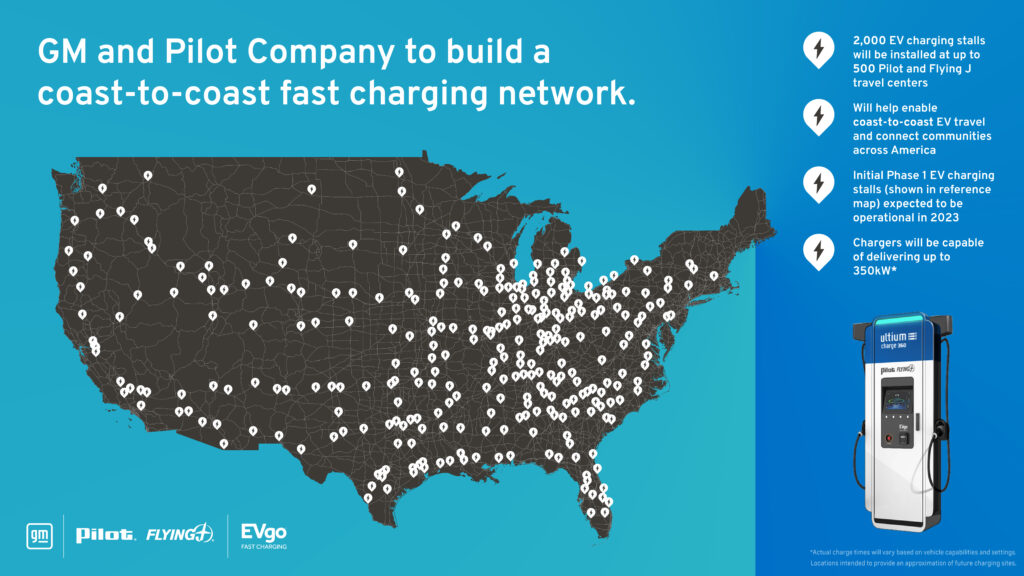

For years, electric vehicle enthusiasts and skeptics alike have said that if electric vehicles were ever to go mainstream, chargers were needed in two places: highway rest areas and truck stops. With today’s announcement from General Motors and the ongoing planning of the national charging network, EV chargers just might end up at both of these high-traffic locations. GM has announced a new partnership with EVgo, America’s third-largest charging network, and Pilot Company to bring EV fast chargers to 500 truck stop locations nationwide.

GM is on the verge of a massive push to EVs, and is counting on its new Ultium battery platform to overcome past issues with America’s most affordable electric car, the Chevrolet Bolt. As long as Tesla’s massive Supercharger network remains exclusively for Tesla owners, GM and other automakers will be faced with the challenge of how to provide adequate fast charging infrastructure for their EV customers.

In a press release, GM said that the new EVgo stations will be accessible to all EV brands. EVgo will install, operate and maintain the new charging stations, and Pilot Company’s Pilot and Flying J travel centers (more commonly known as truck stops) will provide amenities like restrooms and food options.

The latest announcement is separate from the existing collaboration GM has with EVgo to install more than 3,250 fast chargers in American cities and suburbs by the end of 2025. The first charging stations resulting from this new partnership will go live next year.

What exactly is GM’s role in this collaborative effort? From what’s been revealed so far, it appears it’s in the marketing and financing of these charging stations. The EVgo-installed and maintained stations will be co-branded “Pilot Flying J” and “Ultium Charge 360”, according to GM.

With Chevy Bolt sales skyrocketing and the Silverado electric truck almost here, GM’s electric vehicle customers are looking for signs of better charging experiences, and according to the announcement, it sounds like this will go a long way toward a more seamless experience.

“GM customers will receive special benefits like exclusive reservations, discounts on charging, a streamlined charging process through Plug and Charge and integration into GM’s vehicle brand apps providing real-time charger availability and help with route planning.”

Speaking of the Silverado EV and Ultium platform, many of the new EVgo stations will be able to charge at 350 kilowatts, making ultra-fast charging sessions possible in more areas.

One thing that stood out to me was GM’s mention of canopy covers for some of the EVgo charging stations. Plugging in during a thunderstorm fully-exposed to the elements doesn’t make for a fun EV experience, so I welcome this addition to charging stations.

Phase 1 installations (pictured in the map) are supposed to begin operation by the end of 2023. As far as charging infrastructure goes, that’s a quick rollout. Subsequent phases will bring chargers to more locations not announced yet.

Electrify America is currently the charging network of choice for most brands besides Tesla, with over 800 locations in the U.S. Electric vehicle drivers (myself included) are too-often inconvenienced by malfunctioning charging stalls and lines to charge on holiday weekends. With a government-funded national charging network nearing the start of construction, EV drivers are hoping for more reliability, easier access, and less charger downtime. GM’s partnership with EVgo and Pilot could be the pillar that finally brings stability to the EV charging experience. We look forward to this collaboration getting off the ground.