CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

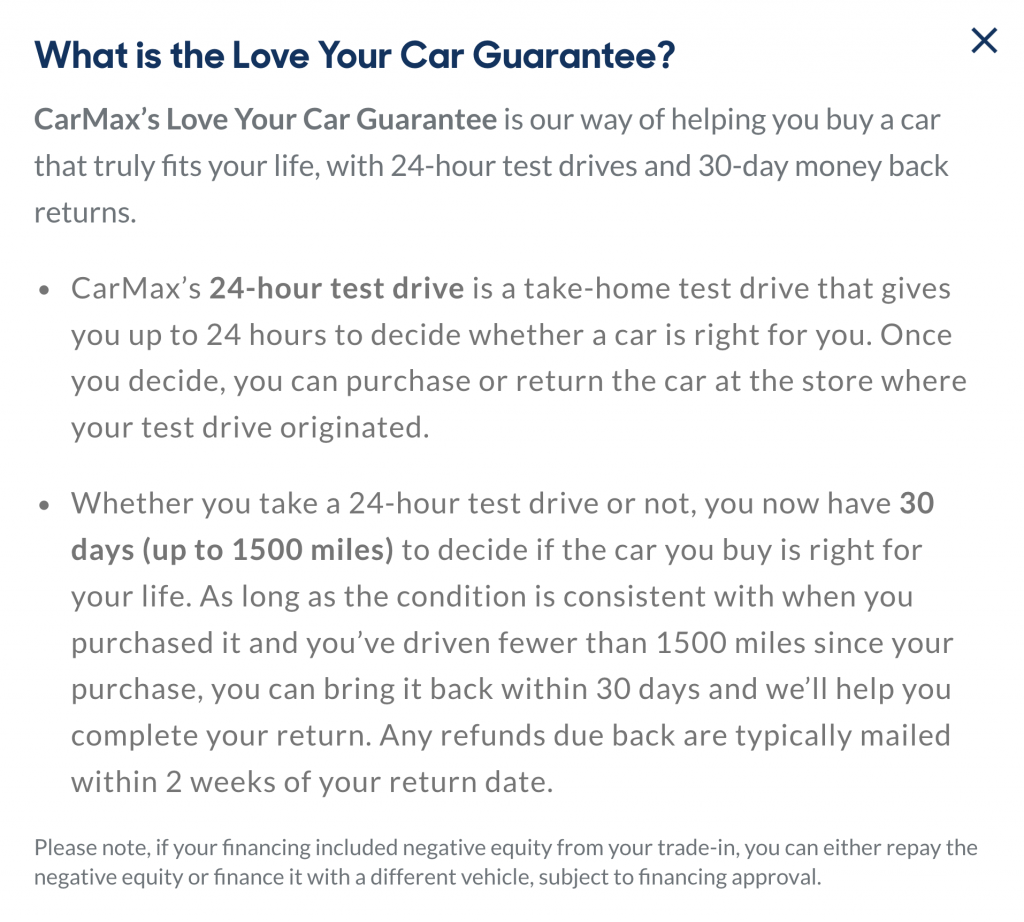

CarMax just announced a new program that is the first of its kind: The CarMax Love Your Car Guarantee. We scoured the Internet for every piece of information we could find on this new guarantee to put this post together for you.

In this CarMax Love Your Car Guarantee review, we’re going to break down exactly what’s in the program. Next, we’ll take it a bit further and compare this new program to their competitors. Lastly, we’ll discuss how you can negotiate with CarMax to get the best price for your car.

Get in…let’s go!

CarMax is the country’s largest retailer of used cars. They changed the game by being one of the first companies to introduce a “no haggle” experience when buying and selling used cars.

Now, the CarMax Love Your Car Guarantee program is set to bring about another change in the world of used cars. This recently announced program has two distinct features that consumers are going to love:

Both of these features are game-changers. Nobody else is offering anything close to these right now. It make buying a car from CarMax more tempting than ever before (someone at CarMax did their consumer research well).

The 24-hour test drive allows prospective car buyers to take a vehicle home, see if it fits into their garage, see how their child’s car seat fits, and get a general feel for the car before deciding if it’s right for them.

The 30-day money-back guarantee, offered as long as the car has 1,500 miles or less driven, provides peace of mind for weary car buyers. If you notice something that you didn’t catch during the 24-hour test drive or you simply change your mind, you can return it within 30 days to the same CarMax location. As far as this CarMax Love Your Car Guarantee review is concerned, this is revolutionary.

CarMax has had a money-back guarantee for years, but it’s only been for a period of seven days. Increasing the number to 30 days is a confidence inspiring move. It shows that they believe you’ll love the car you choose, and even if you don’t it’s not the end of the world.

These features come together to create an entirely different used car buying experience. We’re excited to see how the rest of the used car companies react to the CarMax Love Your Car Guarantee. We’re looking at you Carvana, Vroom, and Shift.

This CarMax Love Your Car Guarantee review wouldn’t be complete without comparing the program to their competitors.

Some automakers, including Cadillac and Buick, have 24-hour test drives available for their new vehicles. However, nobody else in the used car world is offering a 24-hour test drive. CarMax stands alone in letting customers take the vehicle home and try it on for size.

However, CarMax isn’t the only one in town offering a money-back guarantee. Here’s a snapshot of key competitor’s offerings:

As you can see, seven days has been the standard for years. As these app-based used car companies have popped up, they’ve mimicked CarMax’s offering. Now, CarMax has pulled ahead substantially.

We’re excited to see how these newer competitors react to the new CarMax Love Your Car Guarantee program. Will they copy it? Or maybe even surpass it? Only time will tell.

CarMax and all of their competitors promise a “no haggle” car buying process. While this might seem like a relaxing way to buy a vehicle, it can often work against you. We’ve previously talked in-depth about how you can still negotiate with “negotiation-free” car dealers, but it’s worth covering the main points in this CarMax Love Your Car Guarantee review.

There are three things that you can still negotiate with every “no haggle” used car dealer:

The dealership might approve you for a lower interest rate than what they actually offer you, and then pocket the difference if you agree. Negotiate with them to lower your interest rate; they don’t want to lose a car sale over the interest rate.

Did you know that you don’t have to buy an extended warranty when you purchase your car? This is also true for GAP insurance, tire and wheel protection, and anything else they offer you. You can buy them all from a third-party down the road and potentially save money. It might be better to decline their offers and just shop around later, but if you want to buy these extras from the dealership, make sure that you negotiate. The cost of all of these warranties is inflated to provide the dealership with a profit.

If you’re trading a vehicle in, negotiate how much they’ll give you for it. CarMax and other used car giants are always in need of fresh inventory…they want your car. They’d rather buy a car from you than a dealer auction where they don’t really know what they’re going to get. Let them know how much you can get from a private party and use that to drive up your trade-in value.

Keep these three areas in mind if you decide to do business with any of these used car giants that promise a “no haggle” process. You should never simply accept a number they give you…negotiate!

While we’re excited about the new CarMax Love Your Car Guarantee program, you should do your due diligence and read through the fine print for both the 24-hour test drive and the 30-day money-back guarantee. CarMax has not made sample contracts or agreements available online for their new program.

If everything is as good as it seems, this new CarMax program could shake up the world of used cars. We wouldn’t be surprised if Carvana and other competitors start coming out with new policies to try to keep up.

Misdirection is the secret to every magic trick ever created. It’s also the secret to the smoothest tricks performed by car salespeople. One classic old-school dealer close is called the 4-square close. It’s a specific type of close that’s been used for decades and is still employed by salespeople in car dealerships around the country.

Here at CarEdge, our mission is to provide you with the quality education and information that you need to secure a reliable car at a fair price. Today, we’re going to dissect this old-school dealer close and show you how to make it work in your favor.

Let CarEdge help you buy your next car! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

If you prefer to watch instead of read, simply click on the video above.

Imagine you’re at the dealership to buy a new car, and the car salesperson comes back from the sales manager’s office to the cubicle she left you in. She’s holding a folded piece of paper and has a smile on her face. She says something about how the sales manager must be in a good mood, and she unfolds the paper as if it holds the secret to happiness.

What she shows you are four squares drawn on the paper. You’re about to experience the 4-square — a tried-and-true old school dealer close. Above the four squares you’ll see your name, the vehicle you’re interested in purchasing, and its MSRP. Below are four squares that are the foundation of this close. Those squares are:

She’ll break down each square, saying they’re giving you a great sale by reducing the MSRP. She’ll move on to the trade-in square and say you’re getting a great deal there, too. Then she goes over to the cash down, and say you “only” have to pay that amount. Finally, she then goes over to the payment ranges, there’s typically three of them, and she’ll tell you what they are.

After that, she closes: “Which payment range works best for you?” That’s the conclusion of this old school dealer close. She’s hoping that you simply pick a payment range and you proceed to the next step in the car buying process.

However, you’re probably not going to be happy with every number she presents to you (at least you shouldn’t be!) You’re going to go through the squares, one by one, and say you want better figures (a lower selling price, more for your trade, etc). She might discount the car a little more or up the trade-in value, but the two squares that she really manipulates are the cash down amount and payment ranges. She’ll say something like “it’s just math” as she changes numbers around to suit your requests.

The car salesperson might decrease what you put down, then increase your payment amount, then stretch the payment term. As you negotiate, she’ll keep moving numbers around (probably after multiple trips to the “manager’s office” to get approval) until you are satisfied with your payment amount, the term, and the money down. When that happens, she has successfully closed, and you move on to the next phase.

This entire process is misdirection. The car salesperson is focusing on cash down and payment terms while neglecting the other two boxes, trade-in value and sale price.

It’s a smooth old school dealer close. Unaware buyers fall for it time and time again, which is why it’s still in use. We’d love to see this old school dealer close fade away into obscurity, but that will take a well-educated public.

What can you do to counter this close? Can you avoid it altogether, or perhaps even put it to work for you?

Most car buyers are only interested in how much they are going to pay every month and how much they are going to have to put down. It makes sense since those are the numbers that have a direct impact on their bank account. You hear us talk about it all the time, we shouldn’t be payment shoppers, but naturally, most of us are. It’s okay, you simply need to be informed when you make your buying decisions.

However, focusing on those numbers writes a blank check for dealerships, as they can massage these two numbers to boost their profits. It’s why they use the 4-square close to keep you focused on money down and the payment amount.

Here’s what you do instead: you keep changing the focus to the other two boxes. You keep saying you want more off of MSRP, and you want more for your trade-in. Stand firm in your choice and say that you know they can do better.

Or, we can even take it further.

Take the pen from the car salesperson and add a new box, and label it OTD. That stands for out-the-door, and that’s the real figure you focus on. How much is that car going to cost you, total, to drive off the lot?

You want a grand total that factors in every expense (taxes, title, tags, fees, etc.) and is the absolute final number. You tell them they can keep reducing the sale price and boosting the trade-in value until you both agree on an OTD amount. These will be tough negotiations, but you’ll need to remain firm to secure the OTD price you’re after.

Once you have an agreeable OTD amount, then you can talk about the other boxes. You can discuss how much you need to put down and your monthly payment amount.

It’s vital to understand that these figures are secondary. Many people who focus solely on their monthly payments don’t even know how much the car ends up costing them. You don’t want to be in that situation; you want to walk away knowing you got a fair deal.

You should also make it clear that you want a specific monthly payment, and you only want to put a certain amount of money down. Don’t let them still manipulate these numbers, because they’ll try. Once you’ve agreed on an OTD price, you make sure they match what you want to put down and the payment terms you’re after, especially when you get back into the F&I office.

We’ll be honest; it will be difficult to enact the above plan. Car salespeople are trained to keep the focus on the two squares that make them money. Shifting focus back to the sale price and the trade-in value will be a challenge. Getting them to agree on an OTD amount will be even more difficult. You’ll have to employ every negotiation tactic in your toolbelt, but it’ll be worth it. You’ll avoid getting taken advantage of at the dealership, and like we always say, you can (and should) treat your trade-in as a separate transaction, that way you can focus on getting a fair OTD instead of getting confused between the sale of your vehicle and the purchase of a new one.

Something you must remember is that you are always in control when buying a car. If the salesperson and sales manager won’t work with you on an OTD amount, or you don’t like what they offer you, walk away. You can say something like, “these figures don’t work for me,” and excuse yourself. Anything other than a firm and confident “no” will open the door for overcoming more objections. That’s what they’re trained to do, and you can bet they’ll do it.

If they keep pushing, make it clear that the numbers aren’t what you have in mind, so you’re going to leave and find another dealership. You should always have the mindset that you have nothing to lose by walking away. This is why we always say the best time to buy a car is when you don’t need to, since it allows you the comfort of knowing you can walk away.

You might discover that the dealership is actually more willing to work with you if you’re about to leave. Or they won’t, and you’ll leave and move on to the next dealership. Either way, you need to stand up for yourself and don’t let dealers take advantage of you with this classic old-school dealer close.

Over the years I’ve heard (or used) every old-school dealer close in the book. “Closes” range from the salesperson putting “soft” pressure on you while acting as your “friend” to more advanced tactics like the 4 square. There is a certain art to it (as there is in all sales), but it’s not the type of art most people like (especially not when they’re at a car dealership).

Our job at CarEdge is to help you be a more informed and educated car buyer. Today we’ll cover one of the more common “close” tactics called the 3 “m” close. Although it is a bit old-school a lot of dealerships still employ it, and unfortunately new people to the industry are learning it.

The 3 “m” close attempts to overcome the common objections that someone might have when they’re close to signing the dotted line, but aren’t quite ready. Today, I’ll walk you through exactly what’s going on with this close, how to spot it, and what to do about it. As always, if you don’t feel like reading, simply click play on the video above.

Let CarEdge help you buy your next car! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

You need to be ready to walk into the dealership with confidence, and my hope is this article will help. Let’s dive in.

The three “M” close comes into play when a salesperson hears a customer’s first objection, which is often “I need to think about it.” At that point, salespeople are trained to go into a maneuver like the 3 “M” close. You’ll hear something like, “Do we have the right machine picked out for you?”

When you hear this (or some variant of it), recognize what the salesperson is doing, they’re beginning to get into the 3 “M” close, and you just heard the first “M”; is it a problem with the “machine.” You could bet money that the following two M’s are next. This is a dealer favorite old-school close.

The goal of this M is simply to get to you to say that you like the car that’s been picked out and that it’s the right car for you. After all, if you like the car, then there’s some other issue that needs to be addressed. That’s the essence of this old-school dealer close: break down the three common barriers and seal the deal.

If you say it’s not the right car, then they’ll start showing you other vehicle options. If it’s an issue with the machine, your salesperson will act fast to find another vehicle on their lot that meets your needs, wants, and desires.

A decent salesperson will set up this M by saying something like, “Nobody wants to do business with someone that they don’t like, so am I the problem?”

It’s human nature not to want to hurt someone else’s feelings, so it’s almost a guarantee that you’ll say something along the lines of “No, of course you’re not the problem.” People usually want to avoid conflict, so it’s highly unlikely you’re going to say you don’t like your salesperson, even if you can’t stand them.

The car salesperson might even rope in other people that you’ve met from the dealership and say that everyone here would do anything to make sure you got in the right car. Everything said at this step is meant to set themselves up as your best friend who’s just trying to help you get into the right car.

Once they verify that they aren’t the problem, they’ll move on to what probably is the actual problem: the money.

The final M is typically where the actual objection is taking place. You might like the car, you might like the salesperson, but if the numbers don’t add up, you’ll have an objection to signing your vehicle purchase agreement.

At this stage, everyone is on the same page, and the salesperson knows that the money is the issue. Don’t be surprised when they still ask if it is, it’s all part of how they were trained. Once you confirm that the money is the problem, they’ll break down how it’s a good deal or possibly waive some fee that should’ve already been waived.

One tactic that we saw when this topic was brought up on our YouTube channel was pushing to let the customer take the car on an “extended test drive.” This is a bit of a gray area, but can be legitimate. Some dealerships do actually let you bring the car back if you don’t like it after a few days, but you absolutely need to have it in writing. If you don’t get it in writing, then you’re just buying the car. Of course, if you get in a car accident during your extended test drive, you’re the one on the hook, so at the end of the day, I’m not a big fan or proponent of taking a dealer up on this offer.

Another option is that they switch to another closing tactic that’s more specific to the money issue. The purpose of this old-school dealer close is to have you admit where the problem is so that they apply more pressure in that specific place. If it were a game of chess, the 3 “M” close is getting you to move your pawns out of the way so they can strike where it matters.

Whatever their next step is, you can be sure it’ll involve overcoming your objection about the price. They might pull up vAuto and show you that they’ve got the best price around. They might also break down the financial figures one more time to show that the financing agreement being offered is incredible.

Either way, you don’t want to buy that car. So, what can you do against this close?

One of the things customers say that leads into the 3 “M” close is the classic, “I need to think about it.” Dealers hear that countless times in their careers and the 3 “M” close is used to overcome this objection. Car salespeople are well aware that “I need to think about it” is often an attempt to get out of the dealership, and salespeople are wired to think “How can I close this deal now?”

Unfortunately, your attempt to leave is their attempt to close you. Their job is to help convince you to sign the paperwork today, not tomorrow, not next week, not in a month. That’s where the 3 “M” close comes in. In theory, every objection is dismantled, and you’ll drive away in your new car.

Here’s what you do. Memorize this line because it’s your way to avoid the entire close: “I’m not ready to make that decision.” Short, simple, and conveys all the information they need.

It’s a similar concept to “I need to think about it,” but it leaves less room for pushy sales tactics. If the car salesperson keeps pushing, repeat it. You can always get up and walk away. It’s better to face a temporary awkward situation than sign up for a car payment that’s just a bit too high, and trust me, it won’t be the first time in that salesperson’s career they’ve heard “no!”

Your absolute best weapon against this close is saying “no” at any point. You’re always free to say “no” and walk out of the dealership. Every car salesperson has heard no before, and they’ll hear it again. Don’t be afraid to make them hear it one more time if you’re not ready to sign the dotted line.

We firmly believe that arming you with information is the best way to prepare for the sales tactics that car dealerships employ. Not every dealership is going to roll out this old-school dealer close, but many will. Now that you’re ready for it, you should also be ready to say “no” and walk out.

Here at CarEdge, we get a lot of emails from car buyers like you looking for advice on how to get the best car deal possible. The question “should I pay cash for a car?” Comes into our inbox daily. If you’ve managed to save up enough cash to buy a car, kudos to you. Now, it’s time to be strategic about how you use it to get the best car deal possible.

Most people assume that telling a car dealer that you’re paying in cash is a negotiating tactic and will get you a better price. Here’s the truth: it doesn’t. Saying that you’re paying with cash kills your negotiating power.

If you’re wondering, “should I pay cash for a car?” The answer is complicated. Yes, pay the full amount as soon as possible. But don’t walk in with a briefcase of cash and slam it on the salesperson’s desk.

To understand how to answer this question, we need to begin by looking at how dealerships make their money.

Car dealerships make about a quarter of their profit off car sales, yet vehicle sales make up about half of their revenue. That’s because of the slim front-end margins on most car deals (especially for new cars, used cars are a bit of a different story.)

You’ve heard me say it before, and you’ll hear me say it again—selling cars is merely a means to sell other products like finance options, insurance products, service, and parts.

Car dealerships make most of their money in the service department, but when it comes to vehicle sales, dealerships make their money in the Finance and Insurance (F&I) office. The F&I office is referred to as the “back-end” of a car deal. The “front-end” is what you spend time negotiating with the salesperson. The irony is that dealers are incentivized to sell as many cars as possible (frequently at a loss) simply to make money on the back-end (and from manufacturer incentives).

If you’ve ever bought a car before, you’ve heard a salesperson ask you “do you plan to finance the vehicle?” This is because if they know you plan to finance (and especially if you intend to finance through the dealership) they know the dealership can make money on the back-end of the car deal. Every car dealership out there will ask you to fill out a credit application so they can secure financing options for you. When they do this, they bake profit into the numbers. This practice is a significant source of profit for a car dealership.

So, if you walk in and say you’re paying with cash, you’re telling the salesperson that you’re going to eliminate the dealership’s primary source of profit.

What do you do? You take out a loan.

Let’s say you have all this cash, and you want to buy your car at the best possible price. It should be as simple as buying a meal at a restaurant, right? Unfortunately, that’s not the case.

You’ll pay far more for your car if you ask to pay for it all upfront with cash. That’s because the dealership will not be willing to negotiate as much on the front-end of the car deal since you will not become a sales opportunity for the back-end of the deal (aka in the F&I office).

So what should you do? Take out a loan through the dealership and pay it off immediately (or refinance it). Doing this will get you a much lower price than paying with cash at the dealership.

Like we discuss in depth in Deal School, you want to negotiate the out the door price of the vehicle with the salesperson. By informing them of your interest in financing your purchase through the dealership, you’ll find that the salesperson will be more likely to negotiate on the front-end of the deal.

One rule of thumb is that if it’s taxable, it’s negotiable. If a fee is not taxed, you can’t negotiate it down or away. It’s important to know exactly what you can negotiate.

Here’s the essential part of the entire process: make sure the loan does not have a prepayment penalty. If it does, walk away or ask for a different lending option. Fortunately, most loans do not have a prepayment penalty. Typically only exclusive financing options from captive lenders (the manufacturer’s lending institution) have these clauses.

It’s advisable not to tell the dealer that you plan to pay off or refinance the loan immediately. Dealerships incur “chargebacks” when this happens, so let this strategy be our little secret, and not something you blurt out to the F&I manager.

When you’re in the F&I office, decide if you want any of the ancillary products like an extended warranty, and then go through with the rest of the paperwork with the F&I manager. Once you’re happy with all the numbers, pay your down payment, sign the paperwork, and drive away.

You’ve got a brand-new car and a brand-new loan. It typically takes a lender about a week to put a new loan on the books once they receive it from the dealership. Wait about two weeks, then call your lender and ask for the payoff amount. They’ll tell you exactly how much you have to pay to end your loan. Send them a check or wire transfer, and you’re done.

If you don’t have enough cash to pay off your loan immediately, look to refinance the existing loan. However, if you took advantage of a rare zero-APR financing incentive, don’t expect to find anything better out there.

Remember that credit checks within a 30 days period for an auto-loan are grouped into one “hit” on your credit, so you don’t have to be too concerned about getting your credit run once again to find refinance opportunities.

You may have done it by way of a loan, but this is the best way to use your cash to buy a car. If you skip the loan and pay for the car entirely in cash, you’ll end up paying far more than if you take out a loan and pay it off early.

Now that we’ve unveiled our master plan for how to use your cash most effectively to buy a car, we should take a step back and ask if it’s a good idea in the first place.

If you’re asking “should I pay cash for a car,” we’re assuming you have a hefty savings account and financial portfolio. However, if paying cash for a vehicle will drain your savings completely, it might make more sense to finance the loan and put a large amount down for your down payment.

It’s also worth shopping around for different financing offers. No matter what, we always recommend having a pre-approval from an outside financial institution before you go to the dealership so that you have leverage when you are in the F&I office. In some cases, captive lenders offer special financing offers (like 0% APR) that no outside lender can beat. In those cases, financing through the dealership is the only logical option.

Since you now know paying for a car with cash won’t get you a better deal, you might want to reconsider the entire idea. Is this the best use of your cash? If you still think it is, make sure you take out a loan and immediately pay it off instead.

It’s vital that you don’t tell the salesperson, sales manager, or F&I manager that you’re going to pay off the loan immediately. They really don’t want to incur the chargeback.

Instead, go through the motions of taking out a loan and simply pay it off a week later. With this strategy you’ll get the best car deal possible.

Anyone who has ever held a job can tell you a few things that were annoying about it, even if it was their absolute dream job. Selling cars is no different; there are several things customers do that simply annoy car salespeople. It’s almost as if some people are trying to learn how to piss off a car salesperson!

If you want a smooth, pleasant car buying experience, it pays to know what customers do that gets under a car salesperson’s skin. If you want to know how to piss off a car salesperson so you can avoid doing those things, you’re in the right place. It’s time to take a look at five things customers do that frustrate car salespeople.

If you’ve ever held a job that interacts with the public, having a customer come in right before you close is likely pretty high on your list of annoyances. Car salespeople are the same.

Your average car dealership is open from 9 AM to 9 PM, otherwise known as half a day. Most salespeople are scheduled to work for a fair amount of these hours.

So when you come in looking to buy a car at 8:45 PM, the salesperson greeting you will be at least a little annoyed, even if they hide it under a smile. That salesperson was about to leave the dealership and enjoy their free time, but now they might be staying until midnight to sell you a car.

Don’t get us wrong, coming in right before closing and saying you want to buy a car will make a car salesperson and sales manager happy; they’re there to sell cars. They just won’t be as happy about the lack of sleep before the next workday.

If you want to know how to piss off a car salesperson, coming in right before closing is probably the easiest way to do it. If you can, try to go into a car dealership three to four hours before the dealership closes. That gives you time to go through the sales process without making a salesperson stay at work later than they’d prefer.

The car salesperson is there to work with you to sell you a car you love at a great price. They aren’t there to babysit your kids, and they certainly aren’t there to remind you to keep your kids under control.

All too often, parents bring their kids with them into a car dealership to buy cars. There is nothing wrong with that inherently, but once the kids start climbing through showroom cars, honking horns, and spilling drinks in vehicles, it’s time for the parents to step up. Yet, parents often act like there’s nothing wrong with what’s happening.

As a reminder, most car dealerships will have cars ranging from $15,000 to well over $100,000. It’s inconsiderate for parents to let kids use these expensive vehicles for their kid’s entertainment.

Get the information & insights dealers don’t want you to have! It’s like Honey, but for buying cars, trucks, and SUVs. Sign Up For Free

Do you want to know how to piss off a car salesperson? Bring your kids in and let them run wild. In which case, you’ll be forcing the car salesperson to remind you to parent your kids. This could lead to an awkward conversation with you about needing to come back without your kids to continue the deal. Nobody wants that.

If you want to bring your kids with you to buy a car, that’s fine. Just be prepared to parent your children when they get bored.

This annoyance isn’t as prevalent as it used to be, but it still happens.

You see, back in the ’70s and ’80s, people weren’t able to walk into a dealership and drive off the lot with a new car on the same day. Instead, they’d do all their negotiations and then fill out a credit application. The salesperson would call the bank and give them all of the buyer’s information, and then they’d reach a decision about a loan.

To hold the car, the buyer would leave a small deposit, usually around $100.

After the salesperson painstakingly went line by line with the bank rep to get them approved, people simply wouldn’t show up the next day to finalize the sale. That means that the salesperson missed out on a commission, and they wasted their valuable time processing a credit application.

Back then, if the buyer didn’t need a credit application and were going to pay by check, they’d often come back the next day with a check that was $50 cheaper. It seems, they figured they could save a little bit of money right at the end.

Looking to find out how to piss off a car salesperson? Put down a deposit on a vehicle and then never come back. When you put down the deposit, that salesperson cannot sell that car to anyone else. If it’s an expensive car or an in-demand car, they could miss out on other sales while your deposit is holding the vehicle. If you don’t come back to finish the deal, you better believe you’ll have a pissed off car salesperson.

This one is easy to avoid; come back to finish the deal.

This one is simple: you need a driver’s license to test drive a car. The number of people who show up to a car dealership and ask to test drive a car without bringing their driver’s license would astound you. It seems like common sense, yet it still happens all the time.

Wanting to know how to piss off a car salesperson? Get to the point where it’s time for a test drive and then say you don’t have your license with you.

Avoid this annoyance by bringing your driver’s license with you when you go to the dealership.

Honesty is always the best policy, even when dealing with car sales. Being honest with the car salesperson is respectful and persuades them to continue being honest with you.

If you don’t like a car or an offer, confidently say no. Don’t start talking about needing to talk it over with your spouse. Just look the salesperson in the eye and say that the car isn’t the right fit for you or that you don’t like the deal.

Don’t be worried about hurting the car salesperson’s feelings. They hear no all the time. They heard it before you arrived, and they’ll hear it again when you leave. Just be confident and honest with your “no.”

Every car salesperson wants to make a sale, but an annoyed salesperson is less willing to work with you. Learning how to avoid frustrating them will go far in creating a pleasant, straightforward transaction. Plus, it shows you respect the car salesperson even when you’re on opposite sides of the negotiating table.

Now that you know how to piss off a car salesperson, you’re in a good position to start things off on the right foot. Show up well before closing, parent your children if they act up, bring your ID, complete your deals, and be confident if you say no.