CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

What’s the motivating force that keeps you showing up to work day after day, year after year? Is it your desire to own a home, the need to provide for your family, or simply to cover the bills? In 2022, more Americans are seeing their hard-earned money go straight to their monthly car payment. The latest numbers tell a worrisome tale of the economic reality that seems to be worsening.

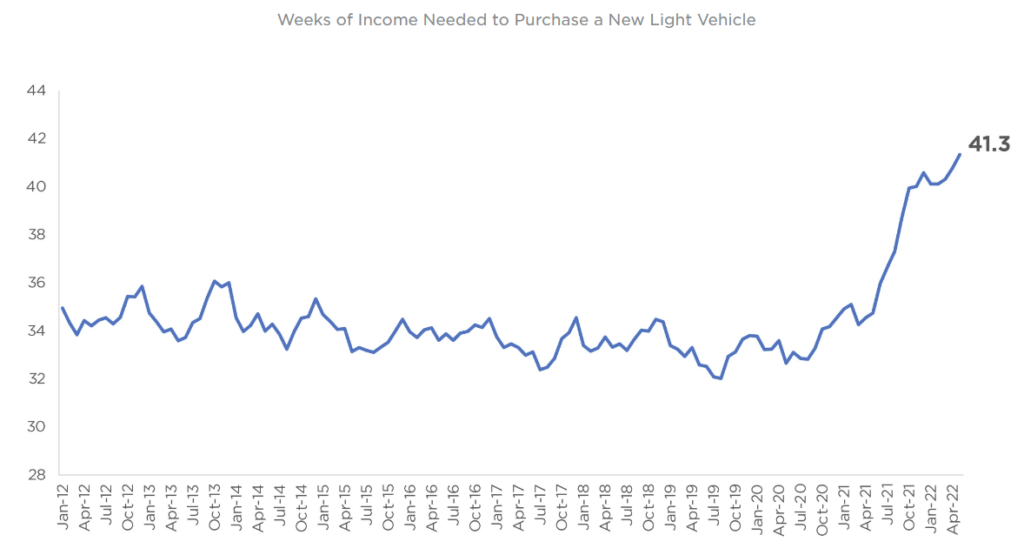

The average transaction price reached a May record of $45,502, according to number crunchers at J.D. Power. Add in the cost of financing, taxes and fees, and the average TOTAL cost of buying a car is ten grand higher at $55,821, according to Cox Automotive and Moody’s Analytics. Considering that the U.S. median household income is $70,284, inflation is at 40-year highs and gas prices mean $100 fill-ups, how much worse can it get?

It now takes 41 weeks of the average American’s household income to purchase a new vehicle

It can get worse, but will it? Rising interest rates mean that an auto loan will cost more over time. The average amount financed on a new car purchase is now $39,721. We’re all friends here, so let’s call it $40,000. The data show that most car buyers opt for a 72 month loan (even I did for my recent electric vehicle purchase), so let’s do the math to see how rising interest rates cost buyers.

In May, the average auto loan interest rate reached 4.07%. The Federal Reserve is openly stating that they plan additional interest rate increases as they flex their muscle in last-ditch efforts to put a damper on inflation. In all likelihood, the average auto loan rate will reach 5% at some point in the next year. Over a 72-month loan term for the average $45,502 transaction, the difference between 4% and 5% auto loan rates totals $1,400 more in interest paid over the life of the loan. At a 5% interest rate, today’s average auto loan will cost $6,813 in interest over 72 months.

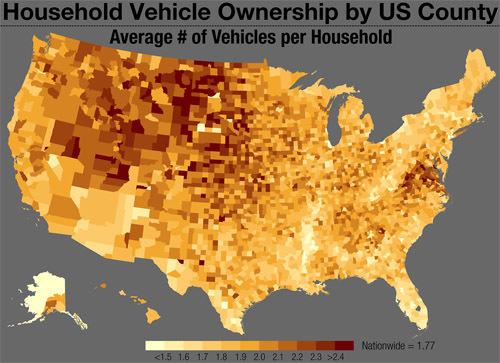

Why are automakers and car dealers keeping prices inflated despite the economic downturn deepening? Simply put, it’s because consumers continue to pay the higher prices. From the perspective of the American consumer, lack of widespread public transportation and our deeply ingrained ‘car culture’ means that for many, a car is a necessity, not a want. Americans are paying higher prices because in many cases they have to. Cars get us to work, to school and to the grocery store.

AutoNation CEO Mike Manley said in April that the nation’s largest dealer group had “not seen any reduction in the demand for new vehicles or really any perceivable segment-shifting as a result of current economic conditions.”

“We, frankly, have customers for basically everything that’s coming,” Manley told Automotive News.

Evidence for their bold claims? Kelley Blue Book says that the average vehicle sold went for $1,000 over MSRP. That’s not how it used to be.

We’ve been tracking the volatility of the used car market. The pre-pandemic ups and downs gave way to prices in freefall at the height of the pandemic, followed by an unprecedented turnaround that culminated in skyrocketing used car prices as new car inventory was squeezed by the chip shortage.

What a wild ride it’s been. As of June 2022, overall used car prices have increased more than 30% year-over-year. In some vehicle segments, prices are 60% higher than they were in 2021.

See used car price trends here, updated weekly

More often than not, it makes a lot of financial sense to repair an older vehicle than to shell out record amounts of cash (and financing) for a new car. Only those who drive A LOT (over 15,000 miles per year) might see the benefits of buying a newer, more fuel efficient vehicle. We recently did the math, and the break-even point when purchasing an EV over a combustion-powered competitor can take from four years to sometimes nearly a decade, depending on out-the-door cost, incentives and annual miles driven.

Maintenance isn’t cheap, but with the average monthly car payment over $600/month, more drivers are cornered into picking the lesser of two evils.

You’re one step closer to getting the PlayStation on wheels you’ve always wanted. On June 16, Honda Motor Company and Sony signed an agreement to design and build an electric vehicle. The new joint venture will operate under the name of Sony Honda Mobility Inc.

Sony Honda Mobility will be a 50-50 joint venture with the goal of launching sales in 2025. The two Japanese giants said in a statement that the partnership “will combine Honda’s expertise in engineering and manufacturing vehicles, along with its proficiency in providing after-sales service, with Sony’s strengths in imaging, sensing, telecommunications and entertainment.”

Honda said in April it will invest $37.16 billion USD over the next 10 years in electrification. This investment will culminate in 30 new EV models globally. Honda aims to produce 2 million electric cars annually by 2030. This is ambitious, as there are currently no fully-electric Honda models for sale in North America.

Sony recently unveiled a concept electric crossover dubbed the Sony Vision-S 02. The Sony Honda partnership will likely pick up where Sony left off in research and development of this Sony EV.

Honda is late to the electric vehicle party. Now, Honda is depending on General Motors to get their EV plans off of the drawing board and onto the ground as they prepare for the latter half of the 2020s. The 2024 Honda Prologue is the much anticipated all-electric crossover headed to the American market.

Oddly enough, it’s only Honda in name and exterior design. The 2024 Honda Prologue will be powered by General Motor’s new Ultium Battery platform, which offers fast charging and great range. GM will even build the Prologue in its North American factories. By mid-2023, Honda-branded EVs will be leaving GM plants in Michigan. What a crazy world we live in, when GM-built vehicles become Hondas. Learn more about the Honda-GM partnership.

What if I told you that auto dealerships are one of the largest political forces in the United States? To dealerships both big and small, business is about a lot more than selling cars. There are 17,968 new car dealerships in the United States, a figure that has grown at the same time that vehicle inventory has plummeted, and new car prices have skyrocketed. As the price of a new vehicle rises out of reach for millions more American consumers, many are reporting all-time record profits.

How did dealerships come to exert such a massive influence on the economy and politics of the United States? To find out, we’ll take the backroads of America to bring this fascinating story of power and influence into the spotlight. Nine out of ten American households own a car, and 55% of autos are purchased at a dealership. This is the tale of how we got here.

As the automotive industry was born in the late nineteenth and early twentieth centuries, automakers faced a dilemma. They had figured out how to engineer and produce a transformative product, but how would they deliver and service these first automobiles? Better yet, who would educate the consumer about vehicle ownership?

It’s important to remember that automakers were selling what they called ‘horseless carriages’ to customers at the time. The majority of the population knew nothing of internal combustion engines. In the first and second decades of the twentieth century, automobile adoption picked up pace. How would an ordered vehicle get to a customer’s hands? Who would service these ‘motor carriages’? Would the customer foot the bill for repairs, or would the automaker offer a warranty? These are just a few of the questions up for debate when the car dealer distribution model was conceived.

It took a few decades for the logistics of car distribution to get worked out. Not everyone was on the same page, and some pushed for solutions modeled after other industries. In fact, some early ideas sound ludicrous to us today. Many early auto industry players advocated for a mail order service modeled after the successes of Sears & Roebuck and Montgomery Ward. But that left too many questions unanswered for a young industry that was eager to get it right. Despite the world-changing invention at hand, automakers still feared their own demise. Considering how few of the early automakers have persisted to this day, their fears were not unfounded.

The first dealership in the United States was established in 1898 by William E. Metzger, who sold Oldsmobiles in Detroit. Over the next two decades, the dealership model rose to prominence, slowly overcoming competing automobile sales models. In 1917, the now-famous National Auto Dealers Association (NADA) was established with the goal of giving car dealers a voice in Washington.

Today, the NADA is a nationally-recognized industry and political force that represents over 16,000 auto dealers nationwide. However, one of America’s most powerful lobbies had humble beginnings rooted in the turmoil of a wartime economy.

The NADA was founded in 1917 when a group of dealers set out to change the way Congress viewed the emerging automobile industry. Thirty dealers from state and local associations succeeded in convincing Congress that cars weren’t ‘luxuries’ as they had been classified in the federal tax code. By convincing lawmakers that cars were vital to the economy, the group prevented the conversion of young automobile manufacturing facilities into wartime factories. The so-called ‘luxury tax’ that had been levied on cars was reduced from 5 percent to 3 percent.

In essence, the NADA has been lobbying since the very beginning. And they’re good at it. From 1919 to the present day, the group spearheaded hundreds of legislative priorities that served the interest of the ever-growing number of car dealers in the United States.

In American car culture, cars are central to the economy and most of our day-to-day lives. In 2020, 91% of American households owned at least one car, a figure that continues to grow. Where do the 276 million registered vehicles in the U.S. come from? Tesla and Rivian aside, it’s almost always from a local dealer.

State dealer associations are prominent organizations around the country. The Florida Automobile Dealers Association has over 1,000 dealer members, and dozens of other states have associations of similar size. Political action begins at the grassroots level, and this is where state dealer associations flex their muscle.

State auto dealer associations provide networking opportunities for professionals, a regional dealer support system, and a venue for working out solutions to challenges. There’s also the unified political voice that lobbies at the local, state and nationwide levels. Lobbying costs money, both in the form of employing professional lobbyists, and in lawmaker donations. I’ll scratch your back if you scratch mine? Dealer industry associations have shown time and time again that their lobbyists achieve the desired outcome more often than not.

A recent example of what’s possible at the state level comes in the form of an emerging legislative push that’s troubling for any electric vehicle owner or prospective buyer. In 2022, bills were introduced in both Oklahoma and West Virginia that would ban over-the-air (OTA) updates. Why? Car dealer lobbying groups are doing their best to keep drivers returning to dealer service centers for repairs. Tesla’s pioneering OTA updates have revolutionized everything from performance upgrades via wifi to recall fixes from the comfort of home.

Why would dealership lobbying groups have a bone to pick with OTA updates? Service center visits account for nearly half of total dealership revenue, with some locations relying heavily on service to stay profitable. The electrification of the auto industry is here, and resistance to OTA updates is just a sign of what could be around the corner.

Online car sales have disrupted the industry over the past decade, with the likes of Carvana and Vroom seemingly coming out of nowhere. Their entrance hasn’t been without problems. Carvana is under pressure for repeatedly failing to transfer vehicle titles in a timely manner. The solution? A Florida state senator took the time to hand-craft legislation to simply remove the requirement to provide the title at all. If that’s not motivated by state-level dealer lobbying, I don’t know what is.

Over 1.2 million Americans are employed at the nearly 18,000 franchised car dealerships and 60,000 independent dealerships in the United States. The power of dealerships is very much rooted in the economy of the nation. However, this power is not evenly distributed. In many communities, particularly in small-town America, dealerships have an oversized role in the local economy.

Jim Lardner, spokesperson for Americans for Financial Reform, told David Dayen of The Intercept that communities sometimes even rely on the economic powerhouse of locally owned and operated dealerships. “They sponsor Little League teams. Their advertising dollars are crucial to local newspapers and broadcasters. When they talk, lawmakers don’t just listen — they have a hard time hearing anybody else or looking at facts.”

As is often the case, with more economic power comes the appetite for political power. Sure, probably not for the sake of power itself, but to have a say in the rules of the game.

The National Auto Dealers Association has delivered $35 million to members of Congress since 2022. The NADA maintains a large lobbying operation in DC, one that costs $3 million a year to operate. The power of dealers is not limited to the doings of the NADA and state-level associations. In a recent election cycle, 372 of 435 members of the House of Representatives received campaign contributions (money) from auto dealers. 57 out of 100 senators could say the same.

On a national level, the NADA has collaborated with the Alliance of Automobile Manufacturers and even the American Financial Services Association to push favorable legislation. In 2015, a rare bipartisan bill was a textbook example. The bipartisan bill amounted to a stand-down order to the Consumer Financial protection Bureau (CFPB). Shouldn’t lawmakers be standing up for the consumer, not the opposite?

It gets worse. The CFPB was established in 2011 to protect consumers to promote “transparency and consumer choice and prevent abusive and deceptive financial practices. It was partially in response to what we all went through in the 2008 financial crisis. When the CFPB was created, a special provision was added last-minute just for nervous dealers. This provision, which is enshrined in CFPB regulations, says that the agency itself can NOT directly monitor dealerships. As David Daley notes in his wonderful piece in The Intercept, “the CFPB can only fine the lenders who finance car purchases, not the dealers who make the markups”.

This is one of many examples of auto dealers wielding their power to influence laws and regulations in their favor. The secret to their success is something called legislative riders. Riders are provisions or ‘add-ons’ that can be added to a bill last-minute, often with hopes of its controversial aspects being buried in the hundreds or thousands of pages of more newsworthy text. The West Virginia OTA ban that was proposed and later removed is one such example. It was conveniently tucked into a much larger pro-dealer bill.

Record new and used car prices from 2021 to 2023 soured consumer sentiment. Dealer markups regularly reached beyond $10,000, and more car buyers turned to Tesla and other direct-to-consumer automakers to steer clear of the dealership experience. Nine out of ten Tesla buyers cite the no-hassle direct-to-consumer sales model as a major factor in their buying decision. Now, legacy automakers are testing the waters too.

In 2022, Ford made headlines with the announcement that it would split into two new companies under the Ford Motor Company umbrella: Ford Blue for combustion sales, and Ford Model e for electric vehicle sales.

Ford Model e transforms Ford’s electric vehicles sales model to something between direct-to-consumer and the traditional dealership model. There will be no-haggle set pricing, online ordering, but dealers will continue with a role as delivery, test drive and service centers. If you haven’t connected the dots, Ford is taking a few big steps away from the past century of traditional dealership sales. Will other automakers follow?

Mercedes-Benz and BMW are beginning to test what they call agency sales in Europe. Essentially, it’s the same concept as Ford’s Model e business model. Are the floodgates opening in the push to direct-to-consumer sales? We’ll know soon enough.

Car dealerships are powerful economic and political forces in America. The birth of American car culture parallel to the rise of the dealership lobby was no coincidence. However, times are changing. Can dealers lobby their way out of an industry that is evolving at breakneck speed? What will buying a vehicle look like a decade from now? Unknowns abound, but one thing is for sure: the salespeople out front are eagerly awaiting your arrival.

What are the three biggest concerns of drivers pondering the switch to electric mobility? Survey after survey, we find that it’s range, charging and price. And with good reason. Electric vehicles remain $11,000 more expensive than their combustion counterparts on average, and much of America remains a charging desert, unless you can afford the premium for a Tesla. With all of this in mind, is there room for a newcomer to the North American EV space? NIO is on the verge of making it official, as evidenced by their growing presence at their California corporate center. Just what makes NIO stand out from the crowd? It turns out that the Chinese EV startup has some game changers in store.

Let’s cut to the chase. When the conversation turns to NIO, it’s all about battery swaps, affordability and accusations of NIO being Tesla copycats. Controversies aside, NIO has revolutionized what’s possible for EV drivers in China by successfully introducing battery swaps as an alternative to charging. NIO battery swaps are free of charge. Electric vehicle adoption in China has been adopting EVs much quicker than we have in America, with 21% of new vehicle market share being fully-electric in the first months of 2022.

NIO has over 700 stations in China, and it wants to increase that number to 4,000 by 2025. How does a NIO battery swap work? Imagine a fancy car wash-like drive-thru. Instead of slowly pulling in and aligning your car just right to get a wash, you pull in to have a robot remove the battery from the bottom of your car, which is then quickly replaced with a fully-charged battery. Pretty neat, right? NIO says that right now, the cost to build one battery swap station is around half a million dollars. With the next iteration of battery swapping, they plan to halve that cost.

For those who aren’t into the battery swap thing, NIO also offers DC fast chargers for its customers.

Norway is the first European market to become home to NIO’s electric vehicles and unique charging infrastructure. The first battery swap station in Norway opened in January of this year, and 20 more are under construction. By year’s end, NIO will be setting up shop in Germany, Sweden, the Netherlands and Denmark.

What about NIO’s presence in the United States? NIO has established NIO USA, which is now headquartered in a 201,500 square-foot corporate facility in San Jose, California. If you’re not familiar with corporate shenanigans, that’s MASSIVE.

Chinese media recently reported on some eye-catching job announcements from NIO. Specifically, the company is in search of professionals experienced in building a factory in the United States. According to Chinese media outlet Yicai, Nio is also hiring a blueprint planner with experience in “at least one US factory project.” NIO is coming to America! Fellow EV enthusiasts over at InsideEVs covered the details of the rumor.

Looking for affordable EVs? Check out the best EVs under $65,000!

In China and select European countries, NIO offers five all-electric models in 2022. The lineup includes two sedans and three crossover SUVs.

The ET5 is a mid-size electric sedan comparable to the Tesla Model 3. This new model is expected to have a range between 342 and possibly 600 miles, depending on battery pack capacity. It’s fast, too. NIO claims a 0-60 mph time of 4.3 seconds, propelled by dual electric motors that produce 482 horsepower. The NIO ET5 costs roughly $51,000 USD in China. Pricing in America would be pure speculation at this point. See NIO’s product info here.

The ET7 is NIO’s new flagship model. The Chinese automaker announced that the ET7 has achieved the second-best drag coefficient on any production vehicle, at 0.208. That’s tied with the Tesla Model S. Only the Mercedes EQS is more aerodynamic. The Lucid Air is right behind at 0.21.

In addition to battery swapping, NIO is going after recognition for ultimate range. Starting in late 2022, the ET7 sedan will offer a massive 150 kWh battery option, which NIO claims will be good for over 600 miles on a charge. Not even the Lucid Air can claim that in 2022.

In China, the ET7’s price starts at $91,000 USD. This luxury sedan is going after the Tesla Model S. See the full details.

The NIO EC6 is the sportback coupe variant of NIO’s ES6 crossover SUV. The EC6 starts at $52,500 USD in China. Range estimates are from 273 to 381 miles, depending on battery configuration. It’s a quick coupe, with both Sport and Performance Editions available.

The first NIO model sold outside of China is the NIO ES8, a SUV available in six-seat and seven-seat configurations. This is a full-sized SUV, akin to the Tesla Model X in size and interior volume. If the ES8 indeed makes it to America, this will undoubtedly be a hot seller. Oh, and the passenger seat is effectively a business class lounge. The price? In Europe, it starts around $70,000. Learn more.

The ES6 fits snuggly into the most popular vehicle segment in America. Of course, that’s the crossover segment. This five-seater is much-loved by the team at Top Gear. They liken it to some popular competition: theAudi e-Tron, Mercedes-Benz EQC, Jaguar I-Pace and Tesla Model X.

In China, the NIO ES6 starts at $52,000 USD, and is rated for between 300 and 380 miles of range.

Not all of NIO’s customers are thrilled with the battery swapping concept. In response to customer requests, NIO now lets owners buy a battery from the automaker. It will cost an arm and a leg though. For those who do not wish to take advantage of NIO’s unlimited free battery swaps, you can purchase a permanent battery pack for $11,000 to $20,000, depending on the capacity.

Nevertheless, NIO is coming to America with their game-changing charging strategy. I have my doubts that it will be free and unlimited like it is in China, but consumers may be eager to pay for the convenience of battery swapping EVs. What do you think? Is there room for NIO in the North American electric vehicle market? Let us know in the comments, or better yet, head over to the CarEdge Community Forum to discuss with fellow auto enthusiasts and curious car buyers.

Electric vehicle batteries are expensive to replace — often $10,000 to $20,000 for a fully electric car. While battery costs are expected to drop in the coming years, today’s EV drivers need strong warranty coverage to protect their wallet.

By federal law, all EV and hybrid batteries must be covered for at least 8 years or 100,000 miles. In California, that coverage extends to 10 years or 150,000 miles. But not all warranties are created equal. Some go further than others when it comes to battery degradation, replacement criteria, and coverage for second owners.

So, which EV brands offer the most comprehensive battery warranties in 2025? The top spot might surprise you.

Rivian (8 years or 175,000 miles)

Surprise! The best EV warranty is offered by Rivian for the all-new R1T electric truck and R1S electric SUV. Coverage includes all components inside the high-voltage battery and 70% or more of the battery capacity for 8 years or 175,000 miles, whichever comes first.

Drivetrain components are also covered for 8 years or 175,000 miles. It can be unnerving to purchase a vehicle from a startup like Rivian, so at least they’re offering the best battery warranty there is. Learn more about Rivian’s warranty here.

Tesla’s electric powertrain warranty is split into two tiers.

Learn more about Tesla’s battery warranty.

Hyundai and Kia (10 years or 100,000 miles)

When shopping affordable EVs, you can’t beat Hyundai and Kia’s 10 year/100,000 mile EV warranty. The Hyundai EV warranty covers batteries, motors and powertrain components. There’s also the guarantee of at least 70% battery capacity retention. Hyundai lays it out clearly: “While all electric-car batteries will experience degradation over time, ours will not degrade more than 70 percent of the original capacity during the warranty period.”

Learn more about Hyundai’s electric vehicle battery warranty. You can find Kia’s EV warranty details here.

In 2025, it looks like the industry standard for EV manufacturer warranties is 8 years or 100,000 miles, whichever comes first. This manufacturer warranty applies to the following electric vehicles in 2024:

GM electric models like the Chevrolet Equinox EV, Blazer EV, and Cadillac Lyriq have 8 year/100,000 mile battery warranties with a notable catch. The battery retention portion of the warranty will replace the battery if it falls below 60% of the original capacity under coverage. See the full details here.

Q: What do EV battery warranties cover?

A: Most EV battery warranties cover defects in materials and workmanship, as well as capacity loss beyond a certain threshold (usually 70% of the original capacity). If your battery fails or degrades too quickly, it should be repaired or replaced under warranty.

Q: How long are EV battery warranties?

A: Federal law requires at least 8 years or 100,000 miles of coverage. In California and other CARB-aligned states, coverage extends to 10 years or 150,000 miles. Some automakers go above and beyond these minimums.

Q: Who has the best EV battery warranty in 2025?

A: As of 2025, Hyundai and Kia offer some of the most generous EV battery warranties, with 10-year/100,000-mile coverage that includes transferable protection and specific degradation thresholds. Tesla, Ford, and Toyota also offer strong warranties, but terms vary, especially for used EVs.

Q: Do EV battery warranties transfer to new owners?

A: In many cases, yes — but not always. Some automakers offer fully transferable warranties, while others reduce or void coverage after resale. Always confirm the terms before buying a used EV.

Q: Can I get extended protection for my EV battery?

A: Yes. If you plan to keep your EV long-term, an extended warranty can provide added peace of mind. With CarEdge extended warranty plans, you can cover high-cost components like the battery and electric motor after the factory warranty ends.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn more at CarEdge.com.