CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

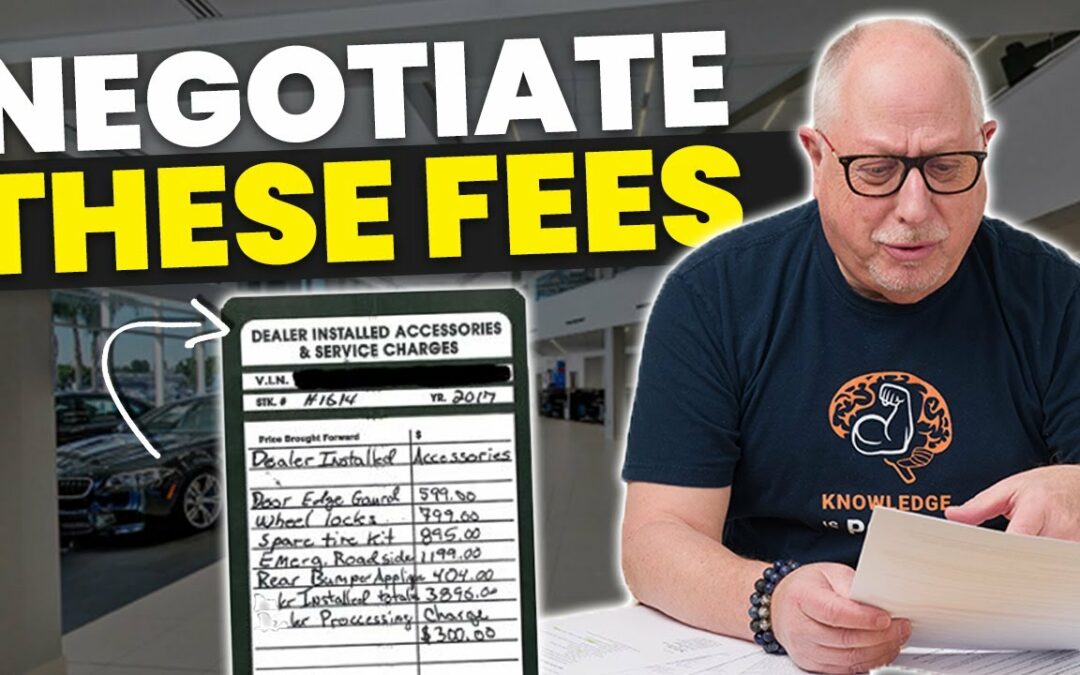

Dealership fees and add-ons can add up to hundreds and even thousands of dollars, but that doesn’t mean you have to pay them. It’s no secret that dealer markups are ruining car buying. This guide to car dealer fees will help you understand common fees, spot hidden or fake charges, and learn how to avoid them.

When purchasing a vehicle, it’s essential to be aware of the legitimate fees and taxes that make up the out-the-door price. These fees are typically imposed by the government and vary by state or local jurisdiction.

Find out how much your next car will REALLY cost with this free out-the-door price calculator.

Here’s a closer look at some of the most common legitimate fees and taxes associated with buying a car.

Buying a car comes with a whole host of taxes. These include city, state, and county sales tax, personal property tax, and often a vehicle license tax, which has to be paid annually. These all vary from state to state, and in the case of sales tax, in even smaller jurisdictions.

In addition to taxes, there are a handful of other legitimate fees that are imposed by your local government. Title, tags, and registration fees are all par for the course when purchasing a vehicle.

The title fee is charged as a cost for the documents required to transfer the title, the cost for this fee can range from $4 up to $150 depending on the state.

Registration fees, charged to cover the cost of registering the vehicle under the buyer’s name, can vary wildly. Some states charge a flat fee, some charge based on weight, while others charge based on how old the car is. Our out-the-door price estimator will help you get a sense for how much your state’s registration fees will be.

Tag fees relate to the physical plates you need to carry on the vehicle. Again, this varies from state to state, but know it is another fee you should be prepared to pay.

Doc fees straddle the line of legitimate and illegitimate. Know that you can and should negotiate the doc fee with a car dealer. Also know that the dealer will never actually remove the fee from your buyer’s order, instead they will reduce the selling price of the vehicle by the same amount as the doc fee.

Doc fees change from state to state and from dealer to dealer. Many states cap doc fees to prevent dealers from exploiting them. For example you’ll never see a doc fee of more than $85 in California, whereas in Florida you’ll frequently find dealers charging upwards of $1,000 for a doc fee. In some states it’s the wild west.

Be Prepared: Car Dealer Doc Fees by State

Read the contract carefully: Make sure to review the sales contract thoroughly and ask the dealer to explain any unfamiliar fees or charges.

Look for inconsistencies: Compare the fees listed in the contract to the fees mentioned during negotiations or in advertising materials. If there are discrepancies, ask the dealer to clarify or remove them.

Research online: Check out resources like CarEdge to get an idea of what fees are typical for your area and vehicle type. This calculator and this guide to doc fees are great places to start.

Need some help? Our Car Coaches are ready to assist today! Learn more about how to get started.

These are the most common hidden fees you shouldn’t feel pressured to pay:

Some dealership fees add no value to your car and should be included with every new and used car at no additional cost. These are essentially fake fees that solely exist to make the dealership more money. Always avoid these fees:

It’s very important to remember that these fees add no value at all to your car, whether new or used. All of these so-called services should be included in the selling price of the vehicle, no ifs, ands or buts. Having trouble negotiating fake fees? Our CarEdge Car Coaches are always here to assist.

These car dealer fees add little value despite potentially costing hundreds or thousands of dollars. If you don’t want the product, these fees or ‘add-ons’ are always negotiable:

👉 Know before you buy! Estimate your future insurance costs with our free car insurance calculator

All of these add-ons and dealership fees are negotiable. Not a single one of them is required, no matter what a salesperson tells you. They’re not like the taxes, title and registration fees that you should expect to pay.

| Fee or Add-on | Category |

|---|---|

| Wheel Locks | Accessory |

| Spash Guards | Accessory |

| Mud Guards | Accessory |

| Exhaust Tip | Accessory |

| Pinstripes | Accessory |

| Sun Shade | Accessory |

| Floor Mats | Accessory |

| Connectivity Kit | Accessory |

| SAVY Driver | Accessory |

| Trunk Tray | Accessory |

| Pro Pack | Accessory Packages |

| KARR Security System | Car Alarm Products |

| Fusion Security System | Car Alarm Products |

| Diamond Ceramic | Paint Protection |

| Zaktek Ultimate | Paint Protection |

| Zurich Shield | Paint Protection |

| Nano Protection | Paint Protection |

| Cilajet | Paint Protection |

| Clearshield | Paint Protection |

| Premium Exterior Finish | Paint Protection |

| Advanced Ceramic Tech | Paint Protection |

| Enviromental Protection Package | Paint Protection |

| Carefree Paint Protection | Paint Protection |

| Ziebart Diamond Gloss | Paint Protection |

| Door Edge Guard | Paint Protection |

| Clear Door Protection | Paint Protection |

| Clear Shield Package | Paint Protection |

| 3M Protection Package | Paint Protection |

| Clear Bra | Paint Protection |

| Paint Pro Film | Paint Protection |

| Invisa Shield | Paint Protection |

| Key Care/Key Replacement | Lost/Stolen Key replacement |

| Vehicle Prep | Dealer Fee |

| Dealer Prep for Delivery | Dealer Fee |

| Pre-Delivery Service | Dealer Fee |

| Pre-Delivery Inspection | Dealer Fee |

| Reconditioning Fee | Dealer Fee |

| VIN Etch | Etch Theft Deterrent |

| VTR | Etch Theft Deterrent |

| Theft Code Protection | Etch Theft Deterrent |

| Courtesy Guard | Etch Theft Deterrent |

| Express Code | Etch Theft Deterrent |

| Phantom Footprint | Etch Theft Deterrent |

| Dent Protection | Exterior Protection |

| Ding Defender | Exterior Protection |

| Appearance Protection | Exterior Protection |

| ELO-GPS | GPS Theft Deterrent |

| Spartan GPS | GPS Theft Deterrent |

| SWAT GPS | GPS Theft Deterrent |

| LoJack | GPS Theft Deterrent |

| Theft Patrol | GPS Theft Deterrent |

| Fabric Defense | Interior Protection Products |

| Interior All Weather Protect | Interior Protection Products |

| NuVinAir | Interior Protection Products |

| Caltex Reistall | Interior/Exterior Protection Products |

| LuxCare | Interior/Exterior Protection Products |

| Autobond Sealant | Interior/Exterior Protection Products |

| Xzilon Paint and Fabric | Interior/Exterior Protection Products |

| PermaPlate | Interior/Exterior Protection Products |

| Paint and Fabric Defense | Interior/Exterior Protection Products |

| Allstate Paint and Fabric | Interior/Exterior Protection Products |

| Nitrogen Fill | Tire Care |

| Solar Guard Tint | Window Tint |

| Tinted Glass | Window Tint |

| Nano-Ceramic Film | Window Tint |

| Smart Auto Windshield | Windshield Protection Coverage |

| Windshield Repair | Windshield Protection Coverage |

| Crystal Fusion | Windshield Protection Coverage |

| Dupont | Paint & Interior protection |

| Simoniz | Paint & Interior protection |

| Diamond Coat | Paint & Interior protection |

| Safe-Guard/Theft | Theft Deterrent |

| US TheftGuard | Theft Deterrent |

| Data Dots/Nano Dots | Theft Deterrent |

| Theft Prevent | Theft Deterrent |

Our CarEdge Car Coaches help thousands of drivers negotiate better deals on their car purchases every month. We’ve seen it all! Here are three examples of ridiculous dealer add-ons and B.S. fees that we’ve helped to negotiate off of the out-the-door price.

Who on Earth would agree to pay $3,000 for a protection package when you could apply those same products for a few hundred dollars elsewhere? Overpriced paint and protection fees are always negotiable.

Some dealers seem to think that if you can afford a new truck, you won’t mind paying a thousand dollars extra for unwanted dealer add-ons. Always negotiate these fees.

Two grand for a safety and security package? Nope, nope and nope.

And then you have this… a whole slew of dealership fees and add-ons that are VERY hard to justify.

You should never feel pressured to pay for something that doesn’t add value. Our #1 tip for negotiating car dealer fees is to enter the deal prepared and empowered with knowledge. By being prepared, thoroughly examining contracts, and negotiating wisely, you can minimize surprise fees and secure the best deal possible.

100% FREE Car Buying Help Is Here!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Connect with us on Facebook: https://www.facebook.com/yourautoadvocates

BECOME A BETA TESTER, PLEASE! https://caredge.com/

Stay connected with Ray and Zach here: https://www.instagram.com/shefska/ & https://www.instagram.com/rasisjaz/

You don’t need to look far to realize that used car prices have been incredibly volatile over the past few months. Amidst the ongoing global COVID-19 pandemic, many aspects of life have changed, and the automotive industry has been no exception. Over the past few months we’ve seen supply shortages, once in a lifetime manufacturer incentive deals, and used car prices that defy reality.

It goes without saying that 2020 will certainly be a year we never forget for myriad reasons.

To better understand the true impacts the past few months have had on used car prices, the team over at iSeeCars.com, led by Julie Blackley, conducted a research study on used car price changes. Their findings? Both surprising and telling. A lot of vehicles have seen their values increase, while a select few have actually gone down in price (who would have guessed).

We highly recommend you take a look at the full report here, but in the meantime, we’ve distilled some of our favorite insights for you. Without further ado, let’s dive in.

Connect with us on Facebook: https://www.facebook.com/yourautoadvocates

BECOME A BETA TESTER, PLEASE! https://caredge.com/

Stay connected with Ray and Zach here: https://www.instagram.com/shefska/ & https://www.instagram.com/rasisjaz/

Today Ray and Zach discuss the state of the used and new car market. What effects will the end of government subsidies have on car prices? When should you buy your next new or used car? Is now the right time to buy? Ray and Zach answer these questions and more in today’s episode.

Axios Navigator: https://www.axios.com/newsletters/axios-navigate

Deal School is an entirely free online curriculum that is intended to teach you the bare minimum of what you should know before you buy a car. Taught by Ray and Zach Shefska, Deal School is two and half hours of video content, plus six quizzes to test your knowledge along the way. The goal of Deal School is to help you better understand the car buying process, and how car dealerships operate.

Deal School was born out of frustration. Frustration that buying a car is so challenging. As the CarEdge YouTube channel began to grow, we realized that we could help a lot of people by simply organizing our content into a logical progression. With over 100 videos on YouTube, it can be hard to find the exact topic you are looking for. With Deal School, you can simply glance at the curriculum, find the topic you’re interested in, and jump right there. We created Deal School so that when people ask us “How can I negotiate a car deal?” We can simply link them to Deal School, and know that they are getting a good answer. We hope that if a friend or family member ever asks you about how you bought your car, you’ll tell them about Deal School as well.

There’s no such thing as a free lunch, right? So what’s the catch? If there is a “catch” it’s that you have to sign up with an email address to access Deal School. Otherwise, there is no “catch.” We’ve disabled advertisements on Deal School videos, so you won’t be interrupted by those. Instead, you should be able to click through video to video and focus on learning.

Why do we want your email address? Because in the not too distant future we are going to have products that we are going to sell. Those products will help you navigate the car buying process, and we’ll try to make money from selling them. If you sign up for Deal School with your email address, then we have a way to contact you in the future when we have products to sell (and other free resources too).

How long will Deal School be available?

There is no “expiration date” on Deal School. My dad and I will most likely need to update the course materials in a year or so (as dealership practices change), but aside from that, what you see is what you get, and it will be that way into the future.

Deal School is broken into six core lessons:

Each lesson has a varied number of topics within them. Topics have associated videos and course materials (blog posts, other video, other resources, etc.).

In total there are 50 videos that are a part of the course.

As of right now, Deal School is the only course we have available. We’re very interested in producing more, so if you feel strongly about another topic (for example an entire course dedicated to financing a purchase), then please let us know. How should you let us know? Take a look down below!

Your feedback is invaluable. CarEdge has become what it is today thanks to you. To share feedback with us about Deal School, please complete this short survey: https://caredge.com/deal-school/survey/

Connect with us on Facebook: https://www.facebook.com/yourautoadvocates

BECOME A BETA TESTER, PLEASE! https://caredge.com/

Stay connected with Ray and Zach here: https://www.instagram.com/shefska/ & https://www.instagram.com/rasisjaz/

Today Ray and Zach discuss the current state of the used car market. If you’re thinking about buying or selling your used car, you’ll definitely want to watch this first. New data from Black Book and Manheim provide insights into the current and future state of the used car market.

Black Book report: https://www.blackbook.com/covid-19-market-insights-8-19-20/

Manheim report: https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.html