CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Buying a repossessed car carries a lot of stigma. Why was the vehicle repossessed? Did the previous owner maintain it at all? Am I getting a great deal because it was a repo?

Savvy car buyers who are looking for great deals will inevitably find themselves researching repossessed cars. The thought of spending thousands upon thousands of dollars on sheet metal and a gas pedal is concerning for many shoppers, and buying a repossessed car can sometimes appear to be a more cost effective way to get into a used car.

Today we decided to tackle this topic and share our two cents on what you need to know about buying a repo car. As always, if you prefer to watch instead of read, simply click on the video above. Otherwise, let’s dive right in!

It goes without saying that life can be tough. We’ve all experienced it before. There are highs and there are lows, and unfortunately for some, the lows can entail not being able to pay their bills. When that happens, repossession is typically right around the corner. Sadly, this happens to millions of Americans each year.

Based on 2019 data, vehicles are repossessed at a rate of nearly 5,500 per day in the United States. That totals more than 2 million repossessions each year.

There are two types of repossessed car; voluntary and involuntary. As a car buyer you won’t know if the vehicle you’re purchasing was a voluntary surrender repossession, or an involuntary repossession. At the end of the day, both are repo cars, which means their former loan holder could not meet their payment obligations to the owner (the bank that gave them the loan).

Carfax reports have been known to show “repossessed” when applicable, however they aren’t 100% accurate, so knowing you are purchasing a previously repossessed car can be tough.

Repossessed cars come in all sorts of different conditions. As I always like to say, “no two used cars are the same,” and repo cars are no different. The tricky thing about buying a repossessed car is that you have no clue how well the prior owner took care of the vehicle. That being said, getting your hands on the Carfax, and asking the seller (whether it be a dealer or a bank auction) to review the service history is an absolute must.

The more information you can get on the history of the vehicle the better, and without a doubt you need to get a pre-purchase inspection completed before buying any repossessed car. Just like with buying a used car at the dealership, a pre-purchase inspection will provide you with the peace of mind you need to know you are not spending thousands of dollars on a vehicle that is going to cost you thousands more to simply keep it running.

So should you buy a repo car? At the end of the day it is entirely up to you, however you need to be clear on what you are getting yourself into; a crapshoot. The best thing you can do is treat a repossessed car just like you would any other used car, and get all of the information you can about the vehicle before you sign any paperwork.

Sometimes Carfax reports will have an indication that a vehicle has been repossessed, however there is no title designation of “repossessed,” so you’ll never see a title that makes it clear the car was voluntarily or involuntarily repossessed. As well all know, Carfax reports are not 100% accurate, so it’s important to understand that you may never know you are buying a repossessed car, especially if you’re making your purchase at a dealership.

That being said, if you’re purchasing the vehicle directly from your local credit union or bank at a repossessed vehicle auction, then you know what you’re getting into. Websites like RepoFinder exist to help you search free repossessed car listings, however you’ll quickly find that their inventory is limited, and you’ll have better luck researching local options.

Buying a repo car is very similar to buying a normal used car. You should have the same concerns you’d have if the car wasn’t repossessed. Specifically, you need to feel comfortable with the way the car drives and feels. Get a pre-purchase inspection from a trusted mechanic to confirm that the vehicle is in working condition, and that the listed price is fair and reasonable.

Buying a repossessed vehicle presents no different challenges than buying a normal used car. Some people believe that since the vehicle has been repossessed it means the prior driver did not have the means to maintain the vehicle well. There could be some efficacy to this argument, however the opposite also holds some weight: the prior driver probably used it as their daily car, and until financial hardship struck, they most likely took good care of the vehicle, because they needed it to transport them to and from work.

At the end of the day, buying a repossessed vehicle can be a way to get a used car at a slightly cheaper price, however your concerns should still be the same as if you were going directly to the dealer and purchasing a certified pre-owned car.

Typically repossessed vehicles are auctioned off in an attempt to return the greatest amount of capital to the financial institution that issued the loan. That being said, if you buy a repo car from an auction you’ll be paying the highest price, however that “high bid” at an auction is still most likely going to be less than what it would cost to buy a very similar vehicle directly from a dealer.

Connect with us on Facebook: https://www.facebook.com/yourautoadvocates

Access Deal School FOR FREE: https://caredge.com/deal-school

Stay connected with Ray, Zach, and CarEdge here: https://www.instagram.com/shefska/ & https://www.instagram.com/yourautoadvocate/ & https://www.instagram.com/rasisjaz/

Today on the Auto Insider podcast, Zach shares the origin story of CarEdge. What initially started as Ray’s Car Buying Service in 2017 has transformed into CarEdge.

Zach shares the story of how CarEdge came to be, including the unlikely beginnings, and his dad’s initial lack of interest in supporting the business.

Updated for 2026

When it comes time to say goodbye to your current set of wheels, you have plenty of options. You could sell to Carvana, sell to CarMax, sell to a private party, or perhaps trade in at the dealership. The list goes on and on.

Recently, I went through the process of selling my 2017 Volvo S90 to Carvana, and the process was unlike any other car dealership experience I have ever had before. Selling to Carvana was simple, smooth, and financially, the right choice for me.

We documented the process on our YouTube channel (the video above), and I wanted to go in more detail about the process. Here’s what went well, how it works, and more.

Carvana pays top dollar for their used cars. Why? Because they’re a HUGE publicly traded company that needs to impress investors with constant growth. The only way they can grow is to sell more cars, and the only way they can sell more cars is to buy more inventory. Because of this, Carvana is willing to pay top dollar for used cars.

Obviously Carvana (and all the other digital retailers) buy inventory from wholesale used car auctions, however, when you buy a car from the auction there are a lot of associated fees (buyers fees, transportation, and more). Because of this, companies like Carvana are happy to pay a premium to people like you and me because they don’t have to worry about all of the other costs associated with buying an auction car.

If you’re thinking “should I sell my car to Carvana to get the most amount of money,” the answer may be yes.

Before you do, make sure you compare multiple offers from the growing number of online car buyers. CarEdge has made it easy for you to get all of your offers in one spot, with no annoying phone calls, and no hassle. Check it out below!

Carvana dominated online car buying last year, but the market is quickly changing (check out the video above). There could be better offers out there, and that’s why we recommend comparing offers first.

I recommend you get offers from Carvana, EchoPark, and CarMax before deciding where to sell your car. After we posted our video on YouTube, we received comments from people that told us they received higher offers for their cars from CarMax, EchoPark, and others.

Some commenters even shared stories about selling their cars privately and getting thousands of dollars more than what Carvana offered.

What does all this mean?

If you’re looking for the highest offer possible, you’ll need to do some work to get quotes from each of the various companies (Carvana, CarMax, EchoPark, and others), as well as test the waters of selling privately. Keep in mind that selling privately requires a lot more work, and part of the benefit of selling to Carvana (or a similar company) is to avoid all that hassle and headache.

No! It’s important to understand that your Carvana offer is good for seven days and one thousand miles. I took advantage of both of those parameters when I sold my car to Carvana. I actually sold my car to Carvana five days after my offer “expired,” but this was okay because their online scheduling tool only had availability at that time. That was one of the surprising aspects of my sell to Carvana experience, they were so incredibly flexible.

You communicate via text message with your rep and they’re very accommodating to any changes you need to make. For example, I was originally scheduled to have my car picked up by Carvana in New Jersey, I then realized it would be advantageous for me to drive the car back to Maryland (to move some things), and when I asked Carvana if the offer would change if I drove back to Maryland their answer was simple, “as long as the odometer is within 1,000 miles of the photo you took, you’ll be fine.”

Not only did Carvana not change their offer, they were very accommodating to all of the changes I made during the process.

When you sell to Carvana your offer is good for 7 days or 1,000 miles. This is the most generous policy that I am aware of. CarMax offers a 7 day, 500 mile policy, while Vroom offers a 2 day and 250 mile policy.

Selling a car to Carvana takes less than an hour (and that includes the work you need to do online before you drop your car off, or they pick it up from you). Filling out the online form is quick and easy. Dropping the vehicle off at Carvana takes no more than 20 minutes. Carvana even pays for your Uber/Lyft ride back to a location of your choice.

Sort of, but not really. I was surprised at the fact that Carvana did not inspect my car when I dropped it off. I thought they would do a slightly more in depth inspection upon my arrival, but the reality was they didn’t.

Their staff person walked around my car with an iPad and took some photos, and that was about it.

Text messages you receive from Carvana repeatedly remind you that your car needs to be in running and driving condition, specifically the battery can’t be dead, nor can the tires be in non working condition. Aside from that, there’s no real inspection or requirements for what condition the vehicle needs to be in.

If you owe more on your car than it is worth, you’ll be asked to get a bank check for the amount of the difference between their offer price and the amount remaining on your loan. You’ll upload an image of this check to Carvana and bring it with you when you ultimately sell the vehicle.

So there you have it. If you’re thinking about selling your car, this is what you need to know about the sell to Carvana experience. Let us know in the comments below where you prefer to sell your vehicles.

If you want the simplest selling experience, I would recommend you consider selling your car to either CarMax, Carvana, or EchoPark. Although Carvana pays a fair amount to sellers, they’re not the only online car buyer these days. Make sure to get online offers from top buyers before making your decision.

Looking for help buying or selling a car? Our team of Car Coaches is changing car buying for the better! From free guides and cheat sheets to premium, personalized car buying help, we’ve got options to suit your needs.

Let us know how we can help!

Connect with us on Facebook: https://www.facebook.com/yourautoadvocates

Access Deal School FOR FREE: https://caredge.com/deal-school

Stay connected with Ray, Zach, and CarEdge here: https://www.instagram.com/shefska/ & https://www.instagram.com/yourautoadvocate/ & https://www.instagram.com/rasisjaz/

Today on the Auto Insider podcast, Ray and Zach discuss the latest trends in the used car market. Wholesale prices have seemingly hit the “peak” and are on their way back down. We’ve seen back to back weeks of decreased wholesale used car prices.

Black Book, one of the industry authorities on used vehicles has reported that the quality of inventory for sale at the auction has deteriorated. Wholesale used car supply is running so low that dealer’s are unable to keep their lots full enough to sell to retail customers.

The New York Times recently published an article titled, “Want to buy a used car? So does everyone else.” Ray and Zach discuss this as well.

Buying a used car in today’s market is like trying to ride a unicycle in grass — difficult. If you’re uninformed, you could easily overpay, fall victim to predatory fees, or even end up with a clunker. There are common car-buying mistakes you can (and should) avoid, and this is especially true when buying a used car, since in most states there are fewer legal protections once you buy a used car “as-is.”

Here at CarEdge we want to make sure you’re an informed car buyer that gets a good car at a fair price, and that’s why we decided to list out our top four tips you can refer to during your car buying process. No one wants to get taken advantage of, and with these four simple tips you can make sure you don’t fall prey to common car-buying mistakes.

Without further ado, let’s jump in!

One of the most common car-buying mistakes you can make is not getting a pre-purchase inspection on a used vehicle. A pre-purchase inspection is a must, even if you’re buying the car out of state.

Some car buyers aren’t aware that you can request a pre-purchase inspection, others don’t think it’s worth spending a few hundred dollars to get one done. Our rule of thumb? Always get a pre-purchase inspection on any used car. This includes certified pre-owned vehicles. Why? Because the peace of mind is worth it.

Every state is different, but generally speaking, the laws protecting used car buyers are pretty unforgiving. In most states the laws surrounding “as-is” purchases don’t provide any recourse for buyers who end up with a clunker. The purchase was made “as-is,” and the seller is in the clear.

With that in mind, it should be obvious that getting a pre-purchase inspection is priority number one when purchasing your next used car. Skipping a pre-purchase inspection can be a costly car-buying mistake that could have been avoided. Plus, you can even leverage the results of the pre-purchase inspection when negotiating the purchase price of the vehicle.

For example, if your mechanic says that the car needs new brake pads and an oil change, then you can negotiate the cost of those repairs into the selling price of the vehicle. If you didn’t conduct the pre-purchase inspection, you would have been stuck footing the bill for those repairs yourself.

How should you go about getting a pre-purchase inspection? I am glad you asked! First and foremost, if you have a trusted mechanic, have them do the inspection. If you don’t have someone on standby (which is most of us), then we recommend a service called Lemon Squad. Lemon Squad is a national network of mechanics, and the reason we recommend their service is because they have been in business for a decade, and they have an “A” rating with the Better Business Bureau.

If the seller of the vehicle won’t let you get a pre-purchase inspection, that’s a sign that this isn’t the right car for you to purchase. If you were selling a car in good faith, wouldn’t you let someone get an inspection done? If they won’t, walk away. It’s not worth making this car-buying mistake only to get stuck with a clunker.

All too often we hear from car shoppers that they purchased a car that had a clean CarFax, only to find out after the fact that the vehicle had been in a minor accident, or had undisclosed repair work done. How and why does this happen so often? It’s simple, CarFax is only as good as the data they receive, and the reality is, CarFax and Autocheck don’t get ALL the information about a vehicle, and when they do, it might not always be that timely.

How can you protect yourself from this reality? Fortunately, there’s a simple workaround!

Make sure to google the VIN of the vehicle you’re interested in before purchasing. I can’t tell you the number of times a quick Google search has brought up accident photos, auction listings, and more that paint a very different picture than the CarFax or Autocheck did. Also, call your insurance company and tell them you’re thinking about purchasing a vehicle. Give them the VIN, and ask them to run a report on their end (insurance companies have access to more information than CarFax and Autocheck do). By simply calling your insurer, you can get a more clear picture of the history of any vehicle. Neat, eh?

Doing a quick (but through) VIN check before you buy a used car can save you countless headaches down the road.

As a car shopper, you should have no fear of test driving one (or many) vehicles. Taking a car (whether it be new or used) for a test drive is something you absolutely should do.

Although not as effective as a pre-purchase inspection, test driving a car will also shed light on if it is in good working order, and more importantly, it will also help you determine if it’s the right car for you. As my dad used to say to me, “the feel of the wheel can seal the deal,” and I think he is 100% right. It’s hard to commit to such a large purchase without at least first test driving a car.

Even if you’re getting the same car you already have (or have previously owned), it’s still important to take it for a test drive. No two used cars are exactly the same, and for that reason alone, it’s worth taking a test drive.

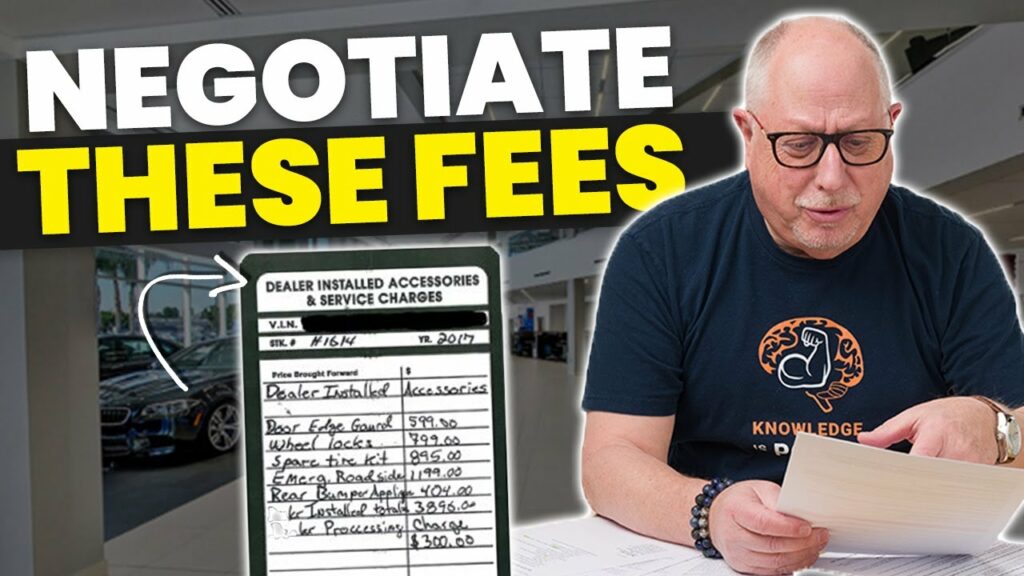

We’ve written extensively about the fees you should and shouldn’t have to pay when purchasing a vehicle. The number of horror stories we’ve heard from shoppers who were charged for nitrogen tires, or a duplicative destination charge is unnerving. However one fee you should never have to pay on a used vehicle is an additional reconditioning fee.

If you are ever asked to pay a reconditioning fee that adds to the price of the car, refuse it! It is absolutely bogus.

Reconditioning is an industry term for the work a used car needs to get it “showroom ready.” This is simply a cost of purchasing inventory and preparing it for sale to a retail customer. With that in mind, if you ever see an additional “recon fee,” recognize that it is B.S., and remind the seller that the reconditioning should already be factored into the selling price of the vehicle.

Dealers have been known to tack on this fee, and it’s a car-buying mistake we’ve seen too many times before. Don’t pay for additional reconditioning!

Car dealership fees: Which are fake, and which are legit?

Don’t overpay.

This may seem obvious, but do your best to not overpay. Cars are a commodity, which means there are A LOT of them.

Be diligent about checking market conditions for the car you’re considering purchasing. Make sure that the dealer you’re working with is not selling the car at a ridiculous markup. With our Market Price Report you can quickly see how negotiable other dealer’s similar vehicles are. Definitely take the time to do that before making your final purchase.

At the end of the day, it’s incredibly important that you get a fair deal. The best way to ensure that happens is to do a bit of research in advance of agreeing to an out-the-door price.