CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Imagine this: you’re driving to work, and a letter from your car’s manufacturer is waiting at home. It’s not a routine service reminder—it’s a recall notice. Now what?

Car recalls happen more often than you might think. Millions of vehicles are recalled every year in the U.S. due to safety issues ranging from faulty airbags to stalling engines. Whether you already own the car or you’re thinking about buying one, it’s essential to understand how recalls work and what steps to take.

This guide covers everything you need to know, from checking your car for recalls to handling repairs and protecting yourself when buying a new or used car. Let’s dive in.

A vehicle recall is issued when a manufacturer or the National Highway Traffic Safety Administration (NHTSA) determines that a car has a safety-related defect or doesn’t comply with federal safety standards. These issues can put drivers, passengers, or others on the road at risk.

There are two main types of recall-related actions:

Recalls are typically communicated to owners by mail, email, or phone. But here’s the catch: automakers can’t always reach second or third owners. That’s why it’s so important to check for recalls regularly, especially if you bought a used vehicle.

Checking your vehicle for a recall is fast, free, and only takes a minute.

You can also check on your automaker’s website to monitor recalls over time.

Tip: Set a calendar reminder to check for recalls every 6-12 months. Some recalls are issued years after a car is sold!

If you find out your vehicle has an open recall, don’t panic—but don’t wait either.

Important note: If the recall was just announced, a fix may not be available yet. If this is the case, follow the instructions detailed in the recall for how to proceed until your recall repair is completed. In extreme cases, this may even include not driving the vehicle.

Important: Even if the issue seems minor or your car “feels fine,” safety-related recall repairs should never be ignored.

Yes, but mostly if the issue hasn’t been fixed.

Unrepaired recalls can:

If you’re thinking about selling or trading in your vehicle, take care of any outstanding recalls first. Resolving your car’s recalls is free and improves resale value. That’s a win-win!

Here’s a tip that can save you major headaches: always check for recalls before you buy. This is critical whether the vehicle is new or used. Brand-new vehicles can have recalls, but dealers are responsible for fixing the issue before selling the impacted vehicles.

It might surprise you, but some new cars sitting on dealership lots also have open recalls, especially if the fix isn’t immediately available.

Pro tip: If you’re buying from a private seller, run a full vehicle history report and VIN recall check before committing.

Recalls are serious safety issues that can impact your life, your passengers, and others on the road. The good news? Manufacturers are legally required to fix them for free. All it takes is a few minutes of your time to check and act.

Whether you’re already behind the wheel or shopping for your next car, knowing how to check for recalls and what to do next gives you peace of mind—and possibly saves lives.

Shop smart with CarEdge. Each listing includes NHTSA recall information, with links directly to the latest updates from the agency. CarEdge Car Search even includes any ongoing investigations that may lead to a future recall. We’re simply here to provide the most transparent car buying experience possible, and we hope this information helps. Stay safe out there!

Wondering which SUVs will hold their value best in today’s unpredictable car market? The latest CarEdge Research update reveals the 2025 SUVs with the best resale value, based on total cost of ownership, projected depreciation, and real-world market data. Whether you’re buying new or used, these models are the smart picks for long-term value.

Predicted Depreciation: 25% over 5 years

5-Year Resale Value: $46,648

The Toyota 4Runner continues its reign as one of the top SUVs for resale value. When buying new, the 4Runner is expected to retain 75% of its original value after five years of ownership, assuming typical driving habits. With a market day supply of 71 days, it’s moderately negotiable if you’re buying new.

If you buy a 4Runner that is two years old, you could save $11,361 compared to buying new. When buying a two-year old 4Runner, expect only $4,105 in depreciation over the first three years of ownership. That’s not bad at all.

In 2025, the average price for a three-year-old 4Runner is $41,978.

👉 See the complete Toyota 4Runner resale value and cost of ownership analysis

Predicted Depreciation: 31% over 5 years

5-Year Resale Value: $26,223

The Toyota RAV4 is still one of the most dependable crossovers on the road, something Toyota fans have bragged about for years. In addition to excellent reliability, the RAV4 holds its value surprisingly well. With typical driving habits, the RAV4 is expected to retain 69% of its original value after five years.

What if you buy used? Buying a two-year-old RAV4 could save you $6,000 versus new. This assumes a selling price of $37,774 when new.

Used three-year-old RAV4s sell for $28,876 on average in 2025. But if you’re eyeing a new one, good luck negotiating—market supply sits at just 31 days.

👉 See the complete Toyota RAV4 resale value and cost of ownership analysis

Predicted Depreciation: 31% over 5 years

5-Year Resale Value: $16,590

The Hyundai Venue might be a budget-friendly SUV, but it still holds value well. When buying a new Venue, you can expect it to retain 69% of its value after five years. With a 98-day supply, there’s room to negotiate if buying new.

If you go used, a two-year-old Venue can save you about $5,000 over buying new, and your depreciation over the next three years is just $2,253—hard to beat. Three-year-old Venues sell for around $17,826 in 2025.

👉 See the complete Hyundai Venue resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $21,218

With Honda’s reputation for reliability, the HR-V is a solid choice for long-term ownership. On average, buying a gently used HR-V saves you $5,655, and depreciation over three years lands just above $4,000.

Used three-year-old HR-Vs sell for about $21,519. New models are not very negotiable, with a 59-day market supply. For comparison, the overall auto market averages 83 days of market supply right now.

👉 See the complete Honda HR-V resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $21,278

The Corolla Cross is a newer addition to Toyota’s SUV lineup, and it’s already proving to be a leader in SUV resale value. It’s popular for many reasons, including affordability, safety, and high fuel economy to name a few. With a tight 33-day supply, you won’t find many bargains on new inventory. The Corolla Cross is manufactured in Alabama, so it’s likely to avoid direct impacts for auto tariffs.

Three-year-old models sell for an average price of $24,024 in 2025. For some, it may be worth it to buy new with such low depreciation.

👉 See the complete Toyota Corolla Cross resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $32,949

A newcomer to the Toyota SUV lineup, the Crown Signia shows early signs of holding its value well. The Crown Signia is the larger sibling to the Toyota Crown, which replaced the Avalon a few years back. Used pricing isn’t widely available yet, but new models are in high demand with a 31-day supply.

👉 See the complete Toyota Crown Signia resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $37,545

One of Toyota’s most family-friendly options, the Grand Highlander blends space, reliability, and excellent resale value. New supply is limited with just 34 days of market supply. It will be tough to negotiate Grand Highlander prices in 2025, but markups are uncommon.

Buying a gently used Grand Highlander (about two years old) should save you nearly $12,000. Over the next three years, depreciation would be about $5,613 when buying used.

👉 See the complete Toyota Grand Highlander resale value and cost of ownership analysis

Predicted Depreciation: 32% over 5 years

5-Year Resale Value: $42,074

Back after a short hiatus, the new Toyota Land Cruiser is already holding value like a champ. The Land Cruiser is forecast to retain 68% of its original value after five years. With a 45-day supply, there’s modest room for negotiation if buying new. It’s not cheap, however. The 2025 Land Cruiser starts at $58,150 with mandatory destination fees. That makes it one of the most expensive Toyota models on sale today.

👉 See the complete Toyota Land Cruiser resale value and cost of ownership analysis

Predicted Depreciation: 33% over 5 years

5-Year Resale Value: $54,387

The Toyota Sequoia is the most expensive SUV on this list—but it still manages to retain value impressively well. Looking to spend less? Buy it two years old and save about $11,000 on average. If you go this route, expect $15,746 in depreciation if you own it for three years.

New models are moderately negotiable with a 49-day supply. That’s far below the industry average of 83 days of supply, but is decently high for a Toyota.

👉 See the complete Toyota Sequoia resale value and cost of ownership analysis

Predicted Depreciation: 33% over 5 years

5-Year Resale Value: $26,527

The Honda CR-V remains one of the best-selling SUVs in America, and for good reason. Its strong resale value reflects consistent reliability, broad appeal, and efficient performance. With just 33% depreciation forecasted over the first five years of ownership, it holds its own in today’s market.

However, don’t expect huge discounts on a new CR-V. With 41 days of market supply in 2025, it’s tough to negotiate this popular crossover—unless you find highly negotiable inventory that’s been sitting on the dealership lot for many months.

👉 See the complete Honda CR-V resale value and cost of ownership analysis

If you’re shopping for an SUV in 2025, don’t just consider price—resale value matters more than ever. Every SUV on this list ranks among the top in CarEdge’s total cost of ownership data, helping you to avoid unexpected depreciation. Buying a car is never an investment, but it’s smart to know what to expect.

Explore resale value and cost of ownership comparisons at CarEdge Research

In a move to match Ford’s aggressive April incentives, Stellantis has launched a major new discount program — employee pricing for all. From now through April 30, 2025, buyers can score what amounts to invoice pricing on most new 2024 and 2025 Chrysler, Dodge, Jeep, and Ram vehicles.

Whether you’re eyeing a Jeep SUV or a Ram 1500, you can now take advantage of deep discounts typically reserved for Stellantis employees and their families.

“This week we launched aggressive and consistent incentive and marketing support for April, including an exciting and competitive enhancement that will allow our customers ‘America’s Freedom of Choice’ between employee price or current cash incentives,” said a Stellantis spokesperson on April 4.

How much can you expect to save with employee pricing offers? Here’s how free dealer invoice pricing tools can be used to estimate your savings before you head to the dealership.

The latest Stellantis promotion extends to most 2024 and 2025 models, with just a few exceptions like the high-performance Ram 1500 RHO and Jeep Wrangler Rubicon 392. That means some of the brand’s most popular vehicles now come with discounts that will knock thousands off MSRP.

What makes Stellantis’ offer different from Ford’s employee pricing offer? The nationwide promotion from Stellantis gives buyers the freedom to choose either employee pricing or other cash incentives — whichever results in a better deal at the dealership.

Stellantis has good reason to offer steep discounts. The automaker is struggling with mounting inventory and stagnant sales, with all Stellantis brands seeing above average inventory levels in April. Tariffs are adding further uncertainty for the ‘Big Three’ Detroit automaker.

Here’s a look at what’s included in Stellantis’ employee pricing promotion from April 2025. Eligible vehicles include these top sellers. We’ve included the latest market inventory numbers courtesy of CarEdge Pro. For perspective, the market average is 83 days of supply in early April:

Stellantis brands have some of the highest inventory in the auto industry right now. I bet you could guess another major automaker with a glut of inventory right now. You guessed it: Ford. As tariff impacts spook the car market, we wouldn’t be surprised if Nissan, Mazda, or Hyundai announce employee pricing promotions over the next month.

Employee pricing often means thousands off MSRP, but if you want to know exactly how much you’ll save on the Ram truck or Jeep you’ve got your eye on, we’ve got the perfect tool for you.

👉 Check the Dealer Invoice Price on Any Stellantis Vehicle (Jeep, Ram, Chrysler, Dodge & more)

With the CarEdge Dealer Invoice tool, you can:

Invoice pricing is a great estimation of employee pricing. It’s simply the price of the vehicle, with all dealership profits removed. If you’re looking to estimate how much you could save with Stellantis employee pricing in April, our Dealer Invoice Price tool is what you’re looking for.

With Ford offering A-Plan pricing to all shoppers this month and Stellantis matching with their own employee pricing program, April 2025 is shaping up to be a rare moment of real competition in new car pricing. If you’re in the market for a new truck, SUV, or family hauler, it’s worth comparing both brands while inventory remains strong. If you’re a fan of other OEMs, it may be wise to see if they match Ford and Stellantis with their own employee pricing discounts in the weeks ahead.

We’ll stay on top of the latest announcements on automaker incentives as the industry grapples with economic uncertainty.

Ford just dropped a major deal that’s sure to grab attention — and save you thousands if you’re car shopping this spring. As new auto tariffs take effect, Ford is flipping the script with its bold new “From America, For America” campaign. What does that mean for you? Starting now, most new Ford and Lincoln vehicles are available at employee pricing — yes, the same deal Ford workers get.

Ford’s promotion is expected to run through June 2, giving shoppers an extended window to snag steep discounts on nearly every model in the lineup. But Ford isn’t doing this purely out of a good gesture. We’ll take a look at how Ford’s inventory situation is ripe for a clearance sale.

According to CarEdge Pro, Ford is sitting on a mountain of unsold inventory — over 522,000 new vehicles nationwide in early April, which equals a 122-day supply. More than 194,000 of those are leftover 2024 models, which dealers are eager to move before newer shipments arrive.

Ford’s inventory levels have been well above the industry average for months, and with 25% tariffs on imported vehicles kicking in, the pressure is on. Ford’s North American operations are expected to take a hit, and this employee pricing strategy looks like a smart play to clear out excess inventory quickly — before the market gets even more volatile.

Normally reserved for Ford employees, “A Plan” pricing gives you access to the lowest available price on a new vehicle — well below MSRP. Typically, this is referred to as Ford Invoice Pricing. Now, Ford is extending that deal to everyday buyers in an effort to cut through the confusion as tariffs begin to ripple through the market.

Thousands in savings are now on the table, especially on popular models like the F-150, Escape, Explorer, and even foreign-built Fords like the Maverick, Bronco Sport, and Mustang Mach-E.

Here’s a look at what’s included in Ford’s employee pricing promotion from April to June 2025.

Included models:

Excluded models:

This is a retail-focused promotion, so it’s aimed squarely at individual car buyers looking to save on a new Ford this spring.

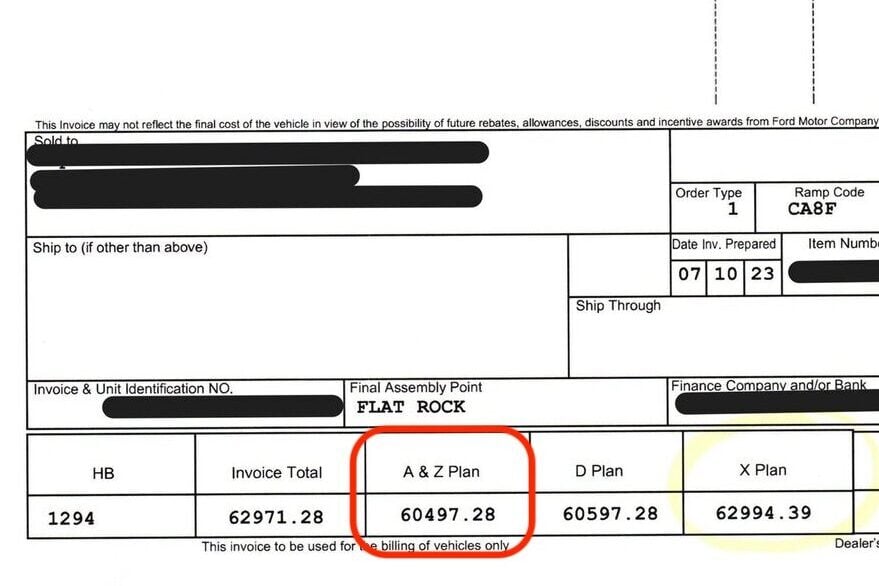

Here’s a real-world example of employee pricing at the dealership, courtesy of one of our CarEdge Car Buying Service customers. The A Plan pricing that Ford is offering is in red:

Ford’s offer is for ‘A Plan’ employee pricing, which you can see above alongside various other incentive levels. Wondering what ‘DB’ is? It’s something the public normally doesn’t see: dealer holdback. Dealer holdback is an amount of money paid to a car dealership from the manufacturer on each new vehicle they sell. As you can see, Ford’s promotion is a great deal, offering rock-bottom prices just as new cars are set to rise due to tariffs.

In a statement to The Detroit News, Ford execs said they want to bring “clarity and certainty” to buyers amid rising prices and economic uncertainty. With plenty of inventory sitting on dealer lots and consumer sentiment cooling, Ford is hoping this price drop will keep buyers engaged — even as tariffs drive up costs behind the scenes.

“Even after a really strong March, our inventory levels are super healthy across our dealer network,” said Robert Kaffl, Director of U.S. Sales and Dealer Relations at Ford. “This employee pricing adds some certainty to what could be an uncertain situation.”

In other words, Ford has an oversupply of new cars and trucks in 2025. With tariffs casting tremendous uncertainty in the broader car market, and Ford looking to bear the brunt of tariff impacts, Ford is looking to get ahead of the situation with what amounts to a clearance sale. We may even see competing OEMs, notably GM and Stellantis, follow suit to remain competitive.

Employee pricing often means thousands off MSRP, but if you want to know exactly how much you’ll save on the Ford you’ve got your eye on, we’ve got the perfect tool for you.

👉 Check the Dealer Invoice Price on Any Ford

With the CarEdge Dealer Invoice tool, you can:

Invoice pricing is a great estimation of Ford’s employee pricing. It’s simply the price of the vehicle, with all dealership profits removed. If you’re looking to estimate how much you could save with Ford employee pricing, our Dealer Invoice Price tool is what you’re looking for.

If you’ve been waiting for the right time to buy a Ford, this might be it. With employee pricing available to all and inventory high, Ford dealers are ready to deal. But don’t wait too long — this promotion ends June 2, and exclusions apply to newly launched models.Want to get the best price? Check the dealer invoice price first, then go in with confidence. Happy spring car shopping! We’ll share the best spring car deals as they arrive. We keep track of all of the best manufacturer offers over at CarEdge Best Deals.

With the arrival of automotive tariffs in 2025, the cost of importing vehicles—and the parts they’re made from—is on the rise. For car buyers looking to dodge the steepest price hikes, shopping for a vehicle assembled in the United States could help soften the blow. In 2025, there are 117 new car and truck models with final assembly in the U.S. From SUVs built in the South to pickups rolling off lines in the Midwest, there are plenty of options for shoppers who want to support domestic manufacturing and potentially avoid the worst of the tariff impacts.

But before you jump to conclusions, there are a few important caveats to understand.

Automotive supply chains are global, and final assembly is just one piece of the puzzle. While the models listed here are all assembled in the United States, many of their parts are sourced from around the world—especially from our North American neighbors in Canada and Mexico. Some of these vehicles are even produced outside the U.S. for other markets, though we’ve focused only on those assembled for sale here at home.

It’s also important to note that the latest round of tariffs applies to imported car parts, not just fully assembled vehicles. That means even models built in American factories may see price increases if key components are subject to tariffs. So while U.S. final assembly offers some insulation from global trade headwinds, it doesn’t make a car completely immune.

Below you will find all 117 cars, trucks, SUVs and EVs with final assembly in the United States of America in 2025. These vehicles are made in facilities around the country, however it’s worth reminding readers that each one of these cars could not be finished without global supply chains.

These are the cars and trucks made in America in 2025:

| Make | Model | Locations of U.S. Final Assembly |

|---|---|---|

| Acura | TLX | Marysville, Ohio, USA |

| Acura | Integra | Marysville, Ohio, USA |

| Acura | MDX | Marysville, Ohio, USA |

| Acura | RDX | Marysville, Ohio, USA |

| Acura | ZDX | Spring Hill, Tennessee, USA |

| BMW | X3 | Spartanburg, South Carolina, USA |

| BMW | X4 | Spartanburg, South Carolina, USA |

| BMW | X5 | Spartanburg, South Carolina, USA |

| BMW | X6 | Spartanburg, South Carolina, USA |

| BMW | X7 | Spartanburg, South Carolina, USA |

| BMW | XM | Spartanburg, South Carolina, USA |

| Buick | Enclave | Lansing, Michigan, USA |

| Cadillac | Celestiq | Warren, Michigan, USA |

| Cadillac | CT4 | Lansing, Michigan, USA |

| Cadillac | CT5 | Lansing, Michigan, USA |

| Cadillac | Escalade | Arlington, Texas, USA |

| Cadillac | Escalade IQ | Detroit, Michigan, USA |

| Cadillac | Lyriq | Spring Hill, Tennessee, USA |

| Cadillac | Vistiq | Spring Hill, Tennessee, USA |

| Cadillac | XT5 | Spring Hill, Tennessee, USA |

| Cadillac | XT6 | Spring Hill, Tennessee, USA |

| Chevrolet | Corvette | Bowling Green, Kentucky, USA |

| Chevrolet | Tahoe | Arlington, Texas, USA |

| Chevrolet | Suburban | Arlington, Texas, USA |

| Chevrolet | Traverse | Lansing, Michigan, USA |

| Chevrolet | Colorado | Wentzville, Missouri, USA |

| Chevrolet | Silverado 1500/2500 | Flint, Michigan, Springfield, Ohio, and Fort Wayne, Indiana, USA |

| Chevrolet | Silverado EV | Detroit, Michigan, USA |

| Dodge | Durango | Detroit, Michigan, USA |

| Ford | Bronco | Wayne, Michigan, USA |

| Ford | Escape | Louisville, Kentucky, USA |

| Ford | Expedition | Louisville, Kentucky, USA |

| Ford | Explorer | Chicago, Illinois, USA |

| Ford | F-150 | Dearborn, Michigan and Kansas City, Missouri, USA |

| Ford | F-150 Lightning | Dearborn, Michigan, USA |

| Ford | Ranger | Wayne, Michigan, USA |

| Ford | Super Duty | Louisville, Kentucky and Avon Lake, Ohio, USA |

| Ford | Mustang | Flat Rock, Michigan, USA |

| Genesis | GV70 | Montgomery, Alabama, USA |

| GMC | Acadia | Delta Township, Michigan, USA |

| GMC | Hummer EV | Detroit, Michigan, USA |

| GMC | Yukon | Arlington, Texas, USA |

| GMC | Canyon | Wentzville, Missouri, USA |

| GMC | Sierra | Roanoke, Indiana, USA |

| GMC | Sierra EV | Detroit, Michigan, USA |

| Honda | Accord | Marysville, Ohio, USA |

| Honda | Civic | Greensburg, Indiana and East Liberty, Ohio, USA |

| Honda | CR-V | Greensburg, Indiana and East Liberty, Ohio, USA |

| Honda | Passport | Lincoln, Alabama, USA |

| Honda | Pilot | Lincoln, Alabama, USA |

| Honda | Ridgeline | Lincoln, Alabama, USA |

| Honda | Odyssey | Lincoln, Alabama, USA |

| Hyundai | Elantra | Montgomery, Alabama, USA |

| Hyundai | Sonata | Montgomery, Alabama, USA |

| Hyundai | Tucson | Montgomery, Alabama, USA |

| Hyundai | IONIQ 5 | Georgia, USA |

| Hyundai | IONIQ 9 | Georgia, USA |

| Hyundai | Santa Cruz | Montgomery, Alabama, USA |

| Hyundai | Santa Fe | Montgomery, Alabama, USA |

| Infiniti | QX60 | Smyrna, Tennessee, USA |

| Jeep | Grand Cherokee | Detroit, Michigan, USA |

| Jeep | Wagoneer | Warren, Michigan, USA |

| Jeep | Grand Wagoneer | Warren, Michigan, USA |

| Jeep | Wrangler | Toledo, Ohio, USA |

| Jeep | Gladiator | Toledo, Ohio, USA |

| Kia | EV6 | West Point, Georgia, USA |

| Kia | EV9 | West Point, Georgia, USA |

| Kia | K5 | West Point, Georgia, USA |

| Kia | Telluride | West Point, Georgia, USA |

| Kia | Sportage | West Point, Georgia, USA |

| Kia | Sorento | West Point, Georgia, USA |

| Lexus | ES | Georgetown, Kentucky, USA |

| Lexus | TX | Princeton, Indiana, USA |

| Lincoln | Aviator | Chicago, Illinois, USA |

| Lincoln | Corsair | Louisville, Kentucky, USA |

| Lincoln | Navigator | Louisville, Kentucky, USA |

| Lucid | Air | Casa Grande, Arizona, USA |

| Lucid | Gravity | Casa Grande, Arizona, USA |

| Mazda | CX-50 | Huntsville, Alabama, USA |

| Mercedes-Benz | GLE | Tuscaloosa, Alabama, USA |

| Mercedes-Benz | GLS | Tuscaloosa, Alabama, USA |

| Mercedes-Benz | EQE SUV | Tuscaloosa, Alabama, USA |

| Mercedes-Benz | EQS SUV | Tuscaloosa, Alabama, USA |

| Nissan | Altima | Smyrna, Tennessee, USA |

| Nissan | Rogue | Smyrna, Tennessee, USA |

| Nissan | LEAF | Smyrna, Tennessee, USA |

| Nissan | Pathfinder | Smyrna, Tennessee, USA |

| Nissan | Frontier | Canton, Mississippi, USA |

| Nissan | Titan | Canton, Mississippi, USA |

| Nissan | Murano | Canton, Mississippi, USA |

| Polestar | Polestar 3 | Ridgeville, South Carolina, USA |

| Ram | Ram 1500 | Sterling Heights, Michigan, USA |

| Rivian | R1T | Normal, Illinois, USA |

| Rivian | R1S | Normal, Illinois, USA |

| Subaru | Crosstrek | Lafayette, Indiana, USA |

| Subaru | Outback | Lafayette, Indiana, USA |

| Subaru | Legacy | Lafayette, Indiana, USA |

| Subaru | Ascent | Lafayette, Indiana, USA |

| Tesla | Model 3 | Fremont, California, USA |

| Tesla | Model Y | Austin, Texas, USA |

| Tesla | Cybertruck | Austin, Texas, USA |

| Tesla | Model S | Fremont, California, USA |

| Tesla | Model X | Fremont, California, USA |

| Toyota | Corolla | Blue Springs, Mississippi, USA |

| Toyota | Camry | Georgetown, Kentucky, USA |

| Toyota | RAV4 | Georgetown, Kentucky, USA |

| Toyota | Highlander | Princeton, Indiana, USA |

| Toyota | Grand Highlander | Princeton, Indiana, USA |

| Toyota | Sequoia | San Antonio, Texas, USA |

| Toyota | Sienna | San Antonio, Texas, USA |

| Toyota | Tundra | San Antonio, Texas, USA |

| Toyota | Corolla Cross | Huntsville, Alabama, USA |

| VinFast | VF8 | North Carolina, USA |

| VinFast | VF9 | North Carolina, USA |

| Volkswagen | Atlas Cross Sport | Chattanooga, Tennessee, USA |

| Volkswagen | Atlas | Chattanooga, Tennessee, USA |

| Volkswagen | ID.4 | Chattanooga, Tennessee, USA |

| Volvo | S60 | Ridgeville, South Carolina, USA |

| Volvo | EX90 | Ridgeville, South Carolina, USA |

As tariffs begin to reshape the auto market, shopping for a model with final assembly in the United States is one way to prepare for potential price hikes. These American-made vehicles may be less exposed to the harshest impacts, but they’re not completely shielded. Global supply chains mean that many parts are still imported and subject to new tariffs.

While it remains true that automakers may absorb some of the added costs from tariffs, it’s undeniable that the longer tariffs stay in place, the more likely price hikes are for 2026 models down the road. We may see sub-$30,000 cars vanish from the market if tariffs stick around for too long.

If you’re in the market for a new car, it’s more important than ever to stay informed. Use our Auto Tariff Checker to see if the car you’re considering could be affected by rising import costs. With the right tools and a little planning, you can stay ahead of the market and make a smarter buying decision.